The ability to analyze is a highly crucial factor in forex trading. Therefore, it's essential to consistently develop analytical skills. This is done so that traders can analyze the market accurately and profitably, particularly when trading with Tickmill as their broker.

Please visit our sponsors

Results 4,041 to 4,050 of 4086

Thread: InstaForex Wave Analysis

-

12-01-2024, 08:35 AM #4041

-

15-01-2024, 06:10 AM #4042

Forex Analysis & Reviews: Forecast for GBP/USD on January 15, 2024

GBP/USD

Pound, consolidating above the level of 1.2745, closed the day 2 points higher. However, looking at the fluctuations, this may not be the case, especially since today the pair opened 5 points lower.

The signal line of the Marlin oscillator turned downward, and if the pair overcomes the January 11 low of 1.2689, the balance line could be broken. In this case, GBP/USD will head towards the support level of 1.2610. Overcoming this will push the pair to 1.2524. The MACD line may also head towards this level. After that, pound may bounce from 1.2524 to new yearly highs.

Important economic data for the UK will be released on Wednesday (CPI for December). Until then, do not expect strong movements in the pair.

On the four-hour chart, the pair broke through the MACD line, while the Marlin oscillator fell downward, signaling a short-term decline. Further movement could be towards 1.2689, 1.2657 and 1.2610.

Analysis are provided by InstaForex.

Read More

-

16-01-2024, 07:24 AM #4043

XAU/USD H4 | Falling to support

The XAU/USD (Gold/US Dollar) chart suggests a potential bearish scenario with a focus on continuing towards the support levels. Here are the key support and resistance levels:

Resistance Levels:

The 1st resistance level at 2058.27 is identified as "An Overlap resistance." This level may act as a significant barrier to further upward movement in the price of gold.

The 2nd resistance level at 2077.23 is also labeled as "An Overlap resistance." It represents another level where selling pressure could potentially emerge and limit any bullish momentum.

Support Levels:

The 1st support level at 2038.74 is marked as "Pullback support." This level could attract buying interest and serve as a potential area of price reversal or consolidation.

The 2nd support level at 2016.85 is identified as "An Overlap support." It represents another important support zone where traders might consider entering long positions.

Analysis are provided by InstaForex.

Read More

-

17-01-2024, 04:06 AM #4044

Forex Analysis & Reviews: Forecast for AUD/USD on January 17, 2024

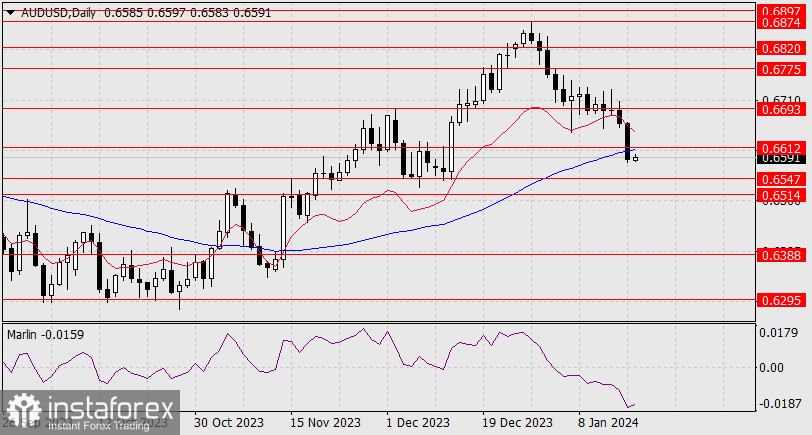

AUD/USD

The pair lost 75 pips yesterday and broke the support levels of the target level of 0.6612 and the MACD line. The next target will be 0.6547. However, risk appetite may surge after the release of inflation data from the eurozone, and retail sales and industrial production reports from the US.

The dip below the supports may turn out to be false, and growth may continue above 0.6693. If upcoming data also turns out weaker than expected, AUD/USD will head towards 0.6514/47.

On the four-hour chart, no clear signs could be seen of either a continuation of the decline or a reversal. Usually, the pair would continue to fall, but market sentiment appears to be changing. Commodities and stock indices may also grow.

Analysis are provided by InstaForex.

Read More

-

18-01-2024, 05:37 AM #4045

Forex Analysis & Reviews: Forecast for USD/JPY on January 18, 2024

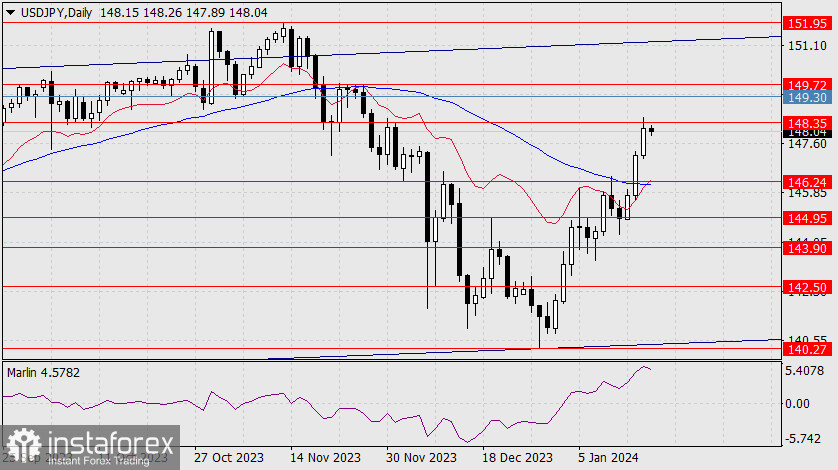

USD/JPY

The pair demonstrated strong growth in the past three days and even reached the target level of 148.35 yesterday. At this point, the Marlin oscillator on the daily chart indicated a reversal.

It remains uncertain whether the pair will fall into a correction or a medium-term decline. Nevertheless, growth will halt at 149.30 (price channel line on the weekly chart) and 149.72 (target level determined by the peaks of November 22-24). In the case of a correction, the pair will find support at the MACD line and the level of 146.24. Consolidation below this level will lead to a decline towards the target levels indicated on the chart.

On the four-hour chart, the Marlin oscillator shows the beginning of a reversal, while the MACD line, which the price must overcome to confirm its intention, remains downward. The decline of the pair will not be rapid (in the form of a triangle), and this will allow the MACD line to approach the price.

Analysis are provided by InstaForex.

Read More

-

19-01-2024, 06:51 AM #4046

Forex Analysis & Reviews: Forecast for GBP/USD on January 19, 2024

GBP/USD

Yesterday, on the daily chart, the British pound opened and closed the day above the balance indicator line (red). This indicates that the balance of power has shifted towards buying, and the price has settled above this line.

The Marlin oscillator is still in the downtrend territory, but it is getting weaker, and the price still needs to overcome the resistance level at 1.2745 to decisively defeat the bears. It is likely that a break above 1.2745 and the oscillator transitioning into the positive territory will occur simultaneously. Exchange Rates 19.01.2024 analysis

On the 4-hour chart, Marlin has already entered the growth territory. It is important for the price to break above the resistance of the MACD line (1.2715), which is currently being held back by the balance line. Considering these factors, the price may be able to overcome visible obstacles and continue to rise. The target is 1.2826, which is the high from December 28th.

Analysis are provided by InstaForex.

Read More

-

22-01-2024, 05:59 AM #4047

Forex Analysis & Reviews: Forecast for EUR/USD on January 22, 2024

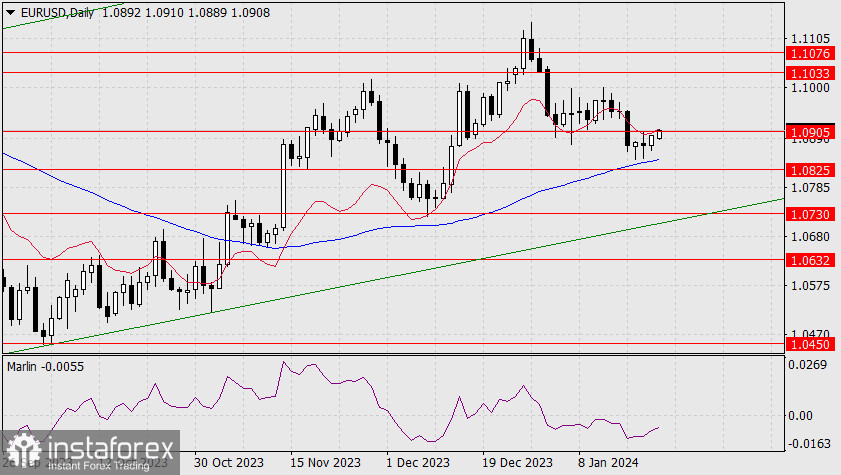

EUR/USD

The markets reaffirmed their commitment to risk-taking on Friday, with the S&P 500 setting a new all-time high, a level not seen since January 2022. The US dollar index fell by 0.24%, while the euro gained a modest 22 pips. However, we do not expect risk appetite to persist, primarily due to geopolitical tensions in the Middle East and Taiwan. A market downturn could occur suddenly and significantly at that.

At the moment, the euro is trying to break through the resistance at 1.0905 and along with it the balance indicator line, which would open the way for the price to reach the target levels of 1.1033 and 1.1076 (the high from April 14, 2023). The Marlin oscillator has gained strength on the daily timeframe, moving towards the border of the uptrend territory.

On the 4-hour chart, the Marlin oscillator has moved into the bullish territory. The only thing left to do is for the price to settle above 1.0905, which would also be a move above the MACD indicator line, and then the price could continue to rise.

Analysis are provided by InstaForex.

Read More

-

23-01-2024, 05:59 AM #4048

Forex Analysis & Reviews: Forecast for EUR/USD on January 23, 2024

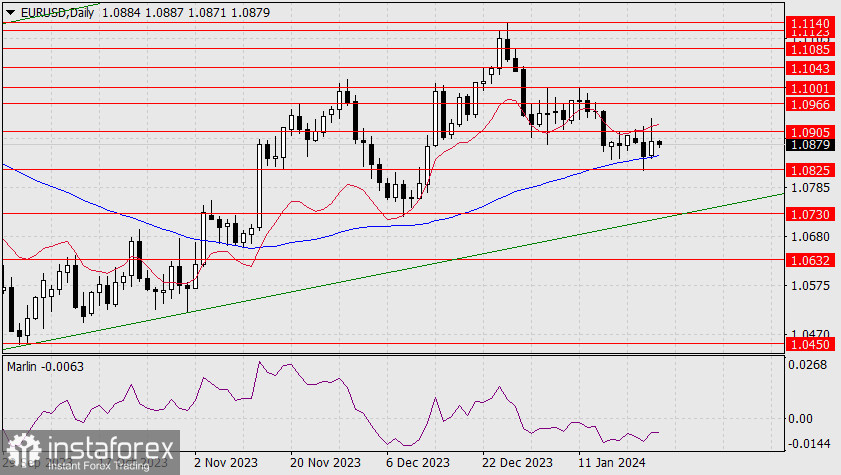

EUR/USD

Yesterday, the main event was that traders saw a higher probability of the Federal Reserve keeping the current interest rate at the March meeting to 58.4%. The speeches of FOMC representatives finally had an effect. As a result, the dollar index increased by 0.08%, and the euro fell by 15 points.

The price rebound occurred at the intersection point of the balance indicator line on the daily timeframe with the target level of 1.0905. The local decline is supported by the MACD line around the level of 1.0853 on the daily timeframe. A consolidation below this level will allow the price to move towards 1.0825 and even 1.0730, which is the embedded price channel line and the target level.

A consolidation above 1.0905 will open the way towards the target of 1.1033. This is the main scenario. The signal line of the Marlin oscillator is in a sideways neutral movement. Tomorrow, the eurozone will publish the Manufacturing PMI for January, with a forecast of 44.8 compared to December's 44.4. The US Manufacturing PMI is also expected to rise, reaching 48.0 compared to 47.9 in December. This likely indicates a recovery in risk appetite.

Analysis are provided by InstaForex.

Read More

-

24-01-2024, 08:01 AM #4049

Forex Analysis & Reviews: Forecast for EUR/USD on January 24, 2024

EUR/USD

Yesterday was a volatile day for all major currencies. The euro traded within the range of 1.0825-1.0905 with a slight overlap. The Marlin oscillator is currently recovering, and the price is moving above the MACD indicator line on the daily chart, which it has yet to surpass. So we are still aiming for a breakthrough of 1.0905 and have the price rise to 1.1033 or even higher.

Today, the eurozone will publish the Manufacturing PMI for January, with a forecast of 44.8, compared to December's 44.4. The U.S. Manufacturing PMI is also expected to rise to 48.0 from December's 47.9. We expect a recovery in risk appetite, especially considering that U.S. stock markets closed mixed yesterday.

Tomorrow, the European Central Bank will announce its vision on monetary policy, and there are already rumors that the ECB may adopt a stricter stance than the Federal Reserve in its meeting next week.

On the 4-hour chart, the price and the oscillator have formed a convergence. We can confirm the price's intention to turn upward when it moves above the MACD line and beyond the 1.0877 level. After that, the price may aim for the 1.0905 level.

Analysis are provided by InstaForex.

Read More

-

25-01-2024, 06:21 AM #4050

Forex Analysis & Reviews: Forecast for EUR/USD on January 25, 2024

EUR/USD:

Yesterday's data on business activity in Europe and the United States worked in favor of the US, as manufacturing activity increased from 44.4 to 46.6, while services fell from 48.8 to 48.4. At the same time, US stock markets closed the day mixed, reaching strong technical resistance.

As a result, the euro did not receive significant technical support for its growth. However, the price could also rise due to unjustifiable optimism ahead of today's European Central Bank meeting. If the stance of the ECB officials has not changed in recent days, we can expect a moderately hawkish tone in the final statement, which could support the euro.

The euro will find support if it breaks above the resistance at 1.0905, preferably surpassing yesterday's high at 1.0933. Currently, the price is above the MACD line on the daily timeframe, which maintains a positive bias.

On the 4-hour chart, the price has settled above the MACD indicator line, and the Marlin oscillator has entered the growth territory. Although visually, the price and the oscillator may "dip" below their supports, yesterday's bullish breakout makes more sense if we look at the reports. We are waiting for the ECB's decision on monetary policy.

Considering the upcoming Federal Reserve meeting, the euro is unlikely to experience a significant decline if today's central bank meeting turns out to be dovish. Target levels on the charts have been adjusted due to new technical conditions.

Analysis are provided by InstaForex.

Read More

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote