Forex Analysis & Reviews: GBPUSD Potential for Bearish Continuation | 11th May 2022

On the H4, with price moving below the Ichimoku cloud, we have a bearish bias that price will drop from our 1st resistance at 1.24080 where the 38.2% Fibonacci retracement and pullback resistance is to our 1st support at 1.22677 in line with the 161.8% Fibonacci extension and horizontal swing low support is. Alternatively, price may break 1st resistance structure and head for 2nd resistance at 1.24802 in line with the 61.8% Fibonacci retracement.

Trading Recommendation

Entry: 1.24080

Reason for Entry:

38.2% Fibonacci retracement and pullback resistance

Take Profit:1.22677

Reason for Take Profit:161.8% Fibonacci extension and horizontal swing low support

Stop Loss: 1.24802

Reason for Stop Loss:

61.8% Fibonacci retracement and horizontal pullback support

Analysis are provided byInstaForex.

Please visit our sponsors

Results 3,541 to 3,550 of 4086

Thread: InstaForex Wave Analysis

-

11-05-2022, 06:20 AM #3541

-

12-05-2022, 05:25 AM #3542

Forex Analysis & Reviews: Forecast for EUR/USD on May 12, 2022

Yesterday, the euro decided neither to actively rise nor to decline. The price continues to consolidate above the support level of 1.0493. The price drop below this level opens the target range of 1.0340/65. The reference point for its lower boundary is the January 2017 low. Yesterday's fall in stock markets (S&P 500 -1.65%), caused by persistently high inflation (monthly CPI growth for April is shown at 0.3%, and the decrease in annual pressure from 8.5% to 8.3%) completely deprives investors of interest to risk. As a result, the probability of the euro falling to the lower border of the price channel with an attempt to overcome it increases.

The price is on the MACD line on the four-hour chart, which so far shows its neutral state, but at the same time, it is below the balance line and the Marlin Oscillator is in the negative area.

Analysis are provided byInstaForex.

-

13-05-2022, 06:05 AM #3543

Forex Analysis & Reviews: Forecast for GBP/USD on May 13, 2022

Yesterday the pound broke through the target level of 1.2250, now it is hardly moving towards the next support at 1.2073 (May 2020 low). The difficulty is created by the convergence with the Marlin Oscillator on the daily scale. However, the convergence is not pronounced, it can be easily broken and lose its already weak appearance.

There is also a slight divergence on the four-hour chart, the signal line of the Marlin Oscillator is consolidating in the range rather than trying to indicate the trend's potential. The most likely development in the current conditions is a gradual decline to the target level of 1.2073 under the MACD line, as it has been for the last week.

Analysis are provided byInstaForex.

-

16-05-2022, 07:59 AM #3544

Forex Analysis & Reviews: Technical Analysis of GBP/USD for May 16, 2022

The GBP/USD pair has been seen bouncing from the swing low located at the level of 1.2155. Despite the oversold market conditions on the H4 and Daily time frame charts there is no indication of trend termination or reversal just yet, so any move up must be seen only as a corrective cycle during the down trend. The bearish pressure continues and the next technical support is seen at the level of 1.2165 and 1.2072. The immediate intraday technical resistance is located at 1.2297 and 1.2325.

Weekly Pivot Points:

WR3 - 1.2621

WR2 - 1.2514

WR1 - 1.2371

Weekly Pivot - 1.2267

WS1 - 1.2119

WS2 - 1.2008

WS3 - 1.1859

Trading Outlook:

The price broke below the level of 1.3000, so the bears enforced and confirmed their control over the market in the long term. The Cable is way below 100 and 200 WMA , so the bearish domination is clear and there is no indication of trend termination or reversal. The next long term target for bears is seen at the level of 1.1989. Please remember: trend is your friend.

Analysis are provided byInstaForex.

-

17-05-2022, 06:46 AM #3545

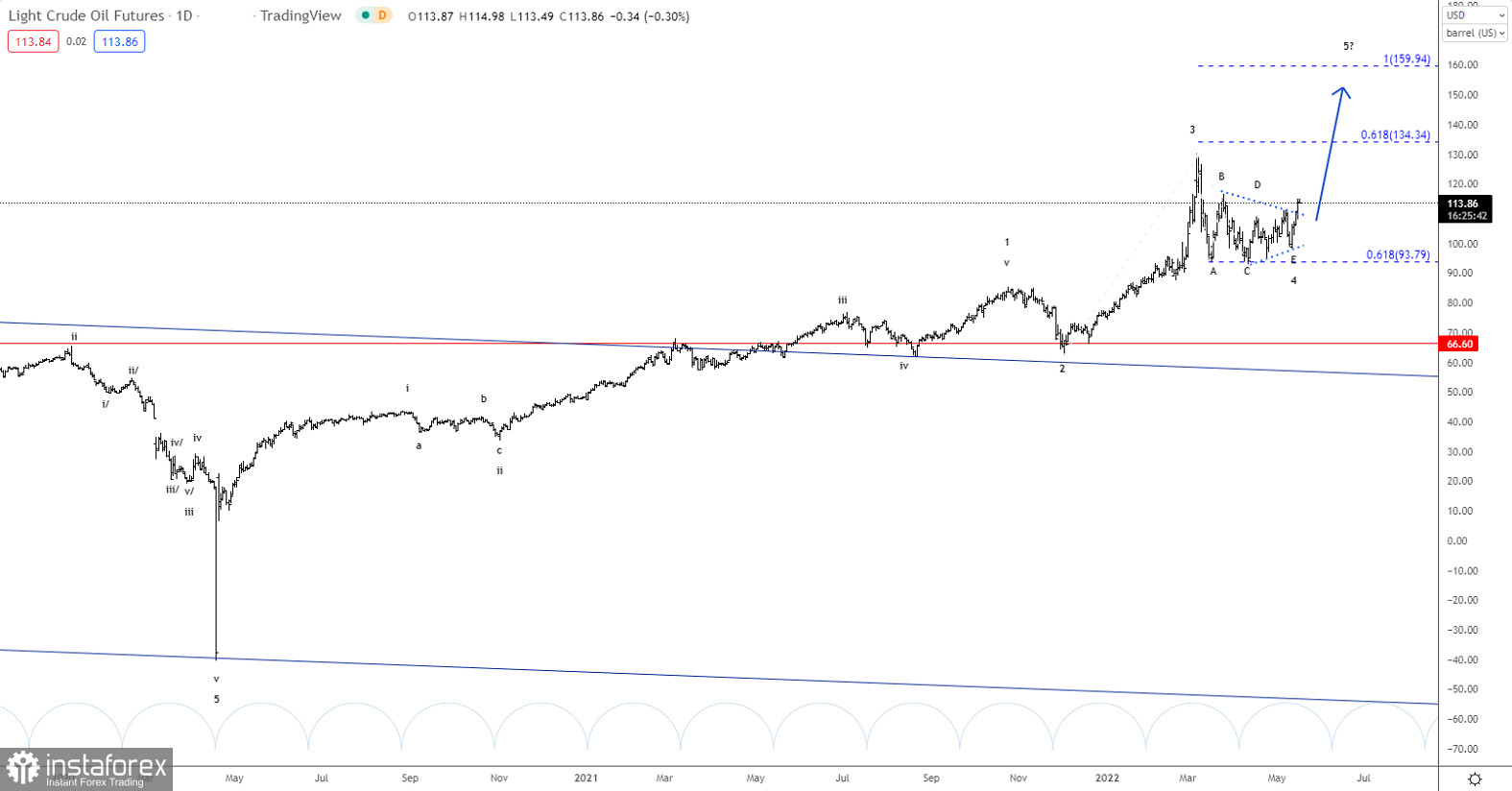

Forex Analysis & Reviews: Elliott wave analysis of Crude Oil for May 17, 2022

Crude oil has just completed a symmetric triangle to the upside which calls for the next impulsive rally towards at least 134.34 and more likely closer to 159.94. If we see a runaway rally in wave 5, we could even see crude oil reach the 200 handle.

Short-term we see minor resistance near 116.64 before running higher for a test of the 134.34 target.

Analysis are provided byInstaForex.

-

18-05-2022, 07:12 AM #3546

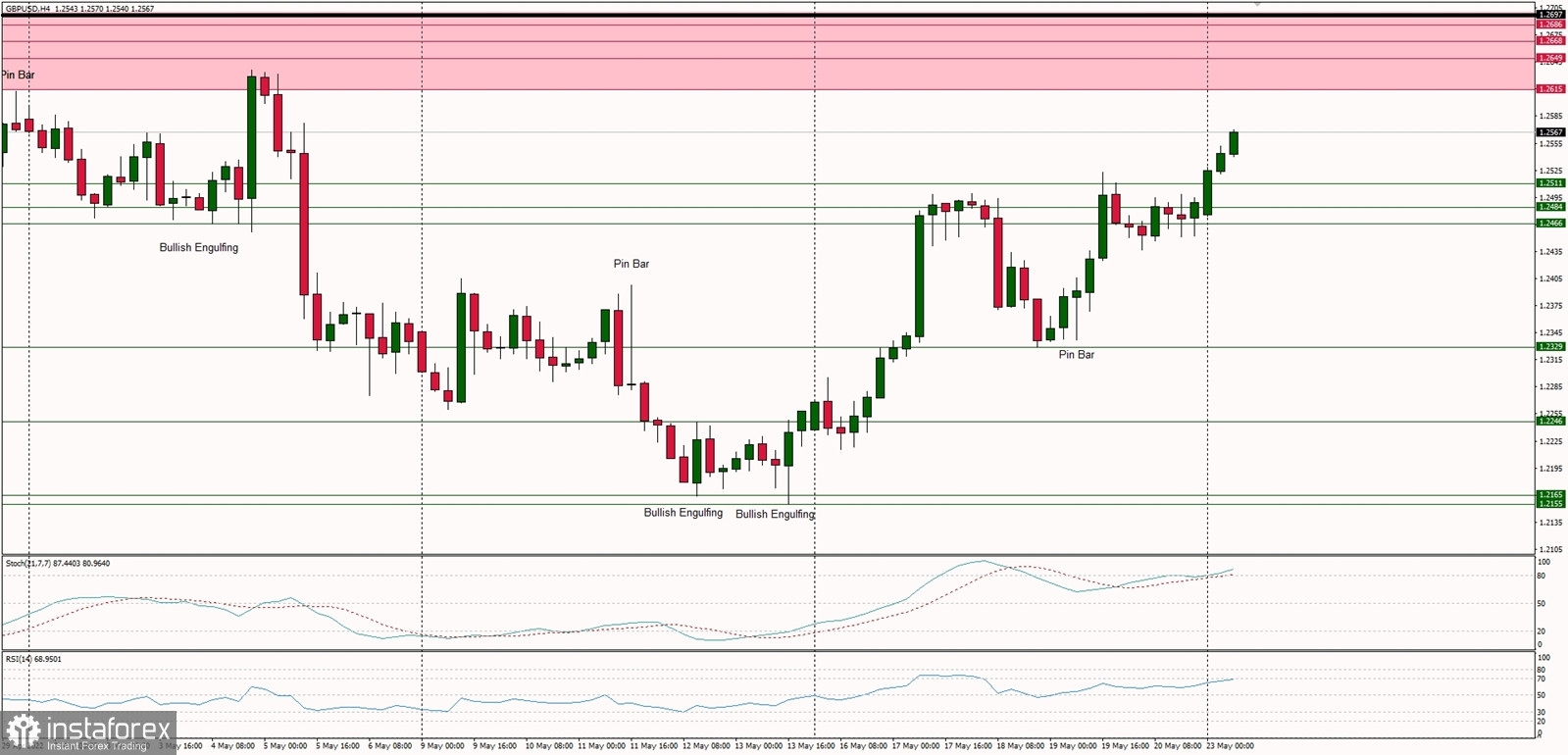

Forex Analysis & Reviews: Technical Analysis of GBP/USD for May 18, 2022

Technical Market Outlook:

The GBP/USD pair has been seen bouncing from the swing low located at the level of 1.2155 and bulls had broken through the immediate intraday technical resistance at 1.2411. The technical resistance located at the level of 1.2484 is being tested currently, so any breakout through this level will open the road towards 1.2615 - 1.2697 zone. Despite the oversold market conditions on the H4 and Daily time frame charts there is no indication of trend termination or reversal just yet, so any move up must be seen only as a corrective cycle during the down trend. The bearish pressure will likely resume soon and the next technical support is seen at the level of 1.2165 and 1.2072.

Weekly Pivot Points:

WR3 - 1.2621

WR2 - 1.2514

WR1 - 1.2371

Weekly Pivot - 1.2267

WS1 - 1.2119

WS2 - 1.2008

WS3 - 1.1859

Trading Outlook:

The price broke below the level of 1.3000, so the bears enforced and confirmed their control over the market in the long term. The Cable is way below 100 and 200 WMA , so the bearish domination is clear and there is no indication of trend termination or reversal. The next long term target for bears is seen at the level of 1.1989. Please remember: trend is your friend.

Analysis are provided byInstaForex.

-

19-05-2022, 07:05 AM #3547

Forex Analysis & Reviews: Technical analysis Apple for May 19, 2022

Apple continues to push lower as expected and should continue lower towards the 38.2% corrective target at 113.08. As we saw it with Target (see our article just before) there is a clear risk, that the Market will be griped by fear and sell-off Apple in a major way.

Yes it's nice to have the newest iPhone, but is it a necessity? No it's not. If the Market starts to think in those terms, then the risk of a major sell-off is increased big time.

No matter, if the Market pushes Apple down in a major sell-off or in a more controlled way, the end result will be the same, a decline towards the 113.08 target and possible even closer to the 50% corrective target at 91.50.

Analysis are provided byInstaForex.

-

20-05-2022, 06:23 AM #3548

Forex Analysis & Reviews: Forecast for EUR/USD on May 20, 2022

Yesterday, the euro defied our main plan, suggesting a decline towards 1.0340, but it failed to break the resistance of the upper limit of the 1.0493-1.0600 range. If the price still manages to settle above the level of 1.0600, then the corrective growth may continue to the MACD line, to the area of 1.0710. Formally, the Marlin Oscillator, which has already moved into the positive area, can help the price, but there is a high risk of its quick return to the zero line, that is, form a false signal.

On the H4 chart, the price reversal from the level of 1.0600 has not yet been expressed. The Marlin Oscillator is not ahead of the price, while it is in the positive area. If the reversal takes place, it will not be fast, it may take two days to exit the range downwards. But this is our main scenario.

Analysis are provided byInstaForex.

Read More

-

23-05-2022, 08:25 AM #3549

Forex Analysis & Reviews: Technical Analysis of GBP/USD for May 23, 2022

Technical Market Outlook:

The GBP/USD pair has bounced from the lows seen at the level of 1.2155 last week and continues to move higher. Currently, bulls has broken above the technical resistance located at 1.2511 (now intraday support) and are heading towards the key supply zone located between the levels of 1.2615 - 1.2697. Any violation of this zone would change the short-term outlook to more bullish as the market could target even the level of 1.3000 again. The strong and positive momentum support the short-term bullish outlook for Cable, however the market conditions look overbought and quick pull-back is welcome.

Weekly Pivot Points:

WR3 - 1.2933

WR2 - 1.2731

WR1 - 1.2632

Weekly Pivot - 1.2626

WS1 - 1.2321

WS2 - 1.2106

WS3 - 1.2001

Trading Outlook:

The price broke below the level of 1.3000 six weeks ago, so the bears enforced and confirmed their control over the market in the long term. The Cable is way below 100 and 200 WMA , so the bearish domination is clear and there is no indication of trend termination or reversal. The bulls are now trying to start the corrective cycle, which is welcome after eight weeks of the down move. The next long term target for bears is seen at the level of 1.1989. Please remember: trend is your friend.

Analysis are provided byInstaForex.

Read More

-

24-05-2022, 07:34 AM #3550

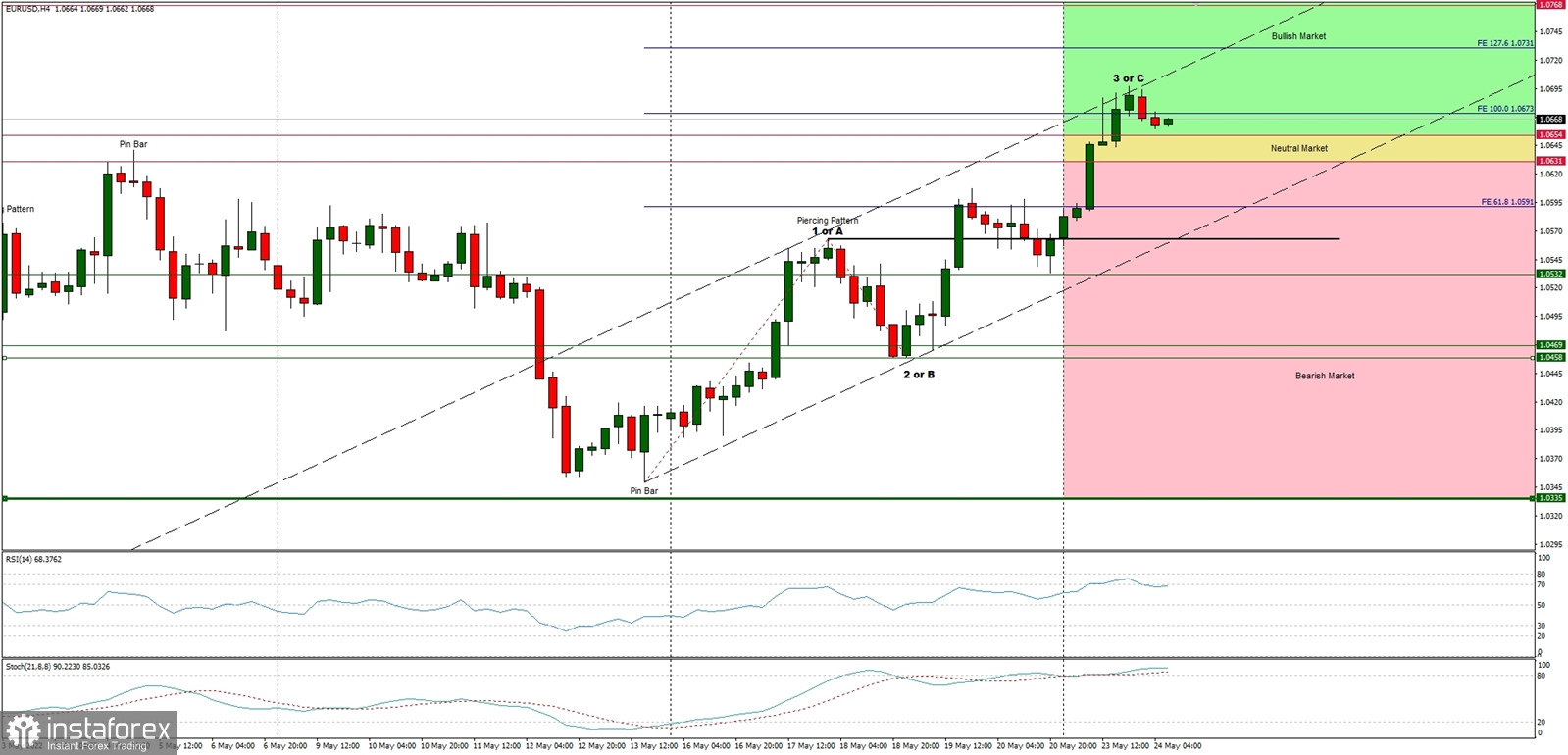

Forex Analysis & Reviews: Technical Analysis of EUR/USD for May 24, 2022

Technical Market Outlook:

The EUR/USD pair has bounced from the lows seen at the level of 1.0349 last week and continues to move higher. Currently, bulls had broken above the neutral market zone located between the levels of 1.0631 - 1.0654 and are trading inside the bullish zone. The strong and positive momentum support the short-term bullish outlook for Euro, however the ABC corrective cycle for bulls looks completed and the level of 1.0673 was the 100% Fibonacci extension for the up wave. If the bulls will continue higher, the next target is seen at 1.0731 (127% Fibonacci extension). The immediate technical support is located at 1.0654 and 1.0631 (the previous resistance).

Weekly Pivot Points:

WR3 - 1.0888

WR2 - 1.0735

WR1 - 1.0635

Weekly Pivot - 1.0526

WS1 - 1.0448

WS2 - 1.0311

WS3 - 1.0227

Trading Outlook:

The market is still in control by bears that pushed the price way below the level of 1.0639, so a breakout above this level is a must for bulls for a long-term trend reversal. The up trend can be continued towards the next long-term target located at the level of 1.1186 only if bullish cycle scenario is confirmed by breakout above the level of 1.0726, otherwise the bears will push the price lower towards the next long-term target at the level of 1.0336 or below.

Analysis are provided byInstaForex.

Read More

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote