Forex Analysis & Reviews: Forecast for EUR/USD on February 7, 2024

EUR/USD

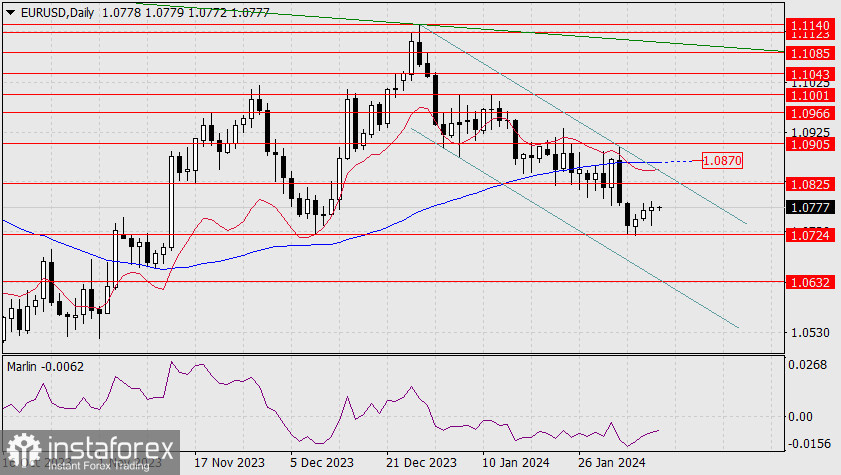

The market started a corrective move on Tuesday. Even the S&P 500, which lost 0.32% on Monday, rebounded by 0.23% yesterday. We do not expect a strong correction since this week's economic calendar does not include any significant economic data. The euro's correction will look like a consolidation above the level of 1.0730, approaching the upper boundary of the short-term downtrend channel on the daily timeframe. If the price settles below 1.0730, it will open the target at 1.0632.

The price needs to do a lot to reverse the entire movement, including breaking above the MACD line, i.e., approaching 1.0905. Therefore, in the current situation, we are simply waiting for the sideways movement to end. The price could rise above 1.0905 if the stock market continues to set new historical records. However, this will eventually stop.

On the 4-hour chart, a small convergence has formed. The bullish target is the MACD line around the 1.0790 mark. Staying above the line will make it possible for the price to rise to 1.0825.

Analysis are provided by InstaForex.

Read More

Please visit our sponsors

Results 4,061 to 4,070 of 4086

Thread: InstaForex Wave Analysis

-

07-02-2024, 06:13 AM #4061

-

08-02-2024, 03:57 AM #4062

Very useful information, that's why I joined forex forums, so I could gain an understanding of the forex market. This way, I can be better prepared and more proficient when trading on a real account with Tickmill broker.

-

08-02-2024, 10:49 AM #4063

USD/CHF H4 | Bearish Drop

For USD/CHF (US Dollar/Swiss Franc), there's a potential bearish reversal scenario indicated by the following key levels:

Resistance Levels:

The 1st resistance level at 0.87435 is identified as "An Overlap resistance," suggesting a significant barrier where selling pressure could intensify, potentially leading to a reversal in the price trend.

The 2nd resistance level at 0.88069 is described as "Multi-swing high resistance," indicating another level where sellers might be active, reinforcing the bearish sentiment.

Support Levels:

The 1st support level at 0.86865 is recognized as "An Overlap support," implying a level where buying interest may emerge, potentially providing a floor for the price decline.

The 2nd support level at 0.86399 is noted as "Pullback support," suggesting another area where buyers could enter the market, potentially limiting further downward movement.

Analysis are provided by InstaForex.

Read More

-

09-02-2024, 04:33 AM #4064Senior Investor

- Join Date

- Jul 2011

- Location

- www.ArmadaMarkets.com

- Posts

- 4,265

- Feedback Score

- 0

- Thanks

- 0

- Thanked 2 Times in 2 Posts

The ability to analyze is a crucial factor in forex trading. Therefore, it is essential to continuously develop analytical skills so that one can analyze the market accurately, especially when trading with Tickmill as the broker.

-

09-02-2024, 07:20 AM #4065

Forex Analysis & Reviews: Forecast for EUR/USD on February 9, 2024

EUR/USD

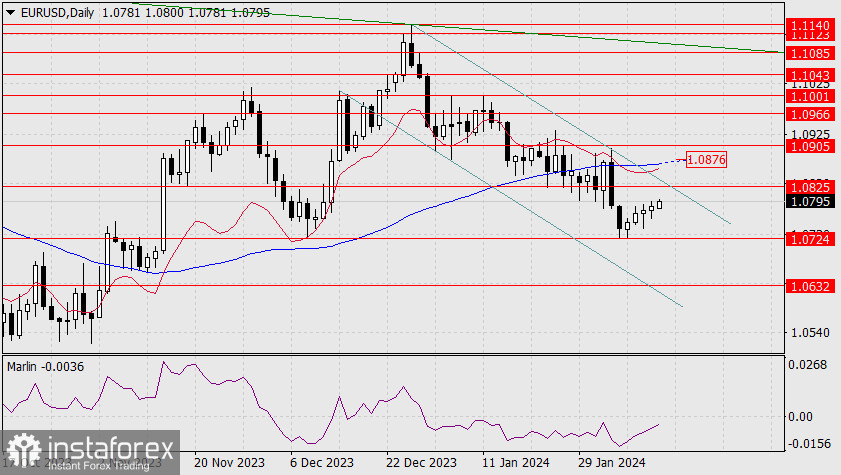

Yesterday, the euro attempted a bearish breakthrough but quickly returned to the initial positions, ending the day with a 5-point gain. We're waiting for progress, probably until the 13th, which is when the US inflation data for January will be released.

Technically, the waiting mode is working in a downward vector, as it brings it closer to the upper boundary of the descending price channel. With the Marlin oscillator in negative territory, there is a higher chance that the price could fall from this level. Overcoming the support at 1.0724 will be a crucial condition for such a decline. The nearest target is 1.0632.

On the 4-hour chart, yesterday's downturn occurred from the MACD line. This line stopped the price from returning. Marlin is currently in the positive territory, but this may not last long. For a bullish breakthrough, the price must consolidate with yesterday's high at 1.0789, which is also slightly above the MACD line. The bulls are aiming for 1.0825.

Analysis are provided by InstaForex.

Read More

-

12-02-2024, 05:19 AM #4066

Forex Analysis & Reviews: Forecast for EUR/USD on February 12, 2024

EUR/USD

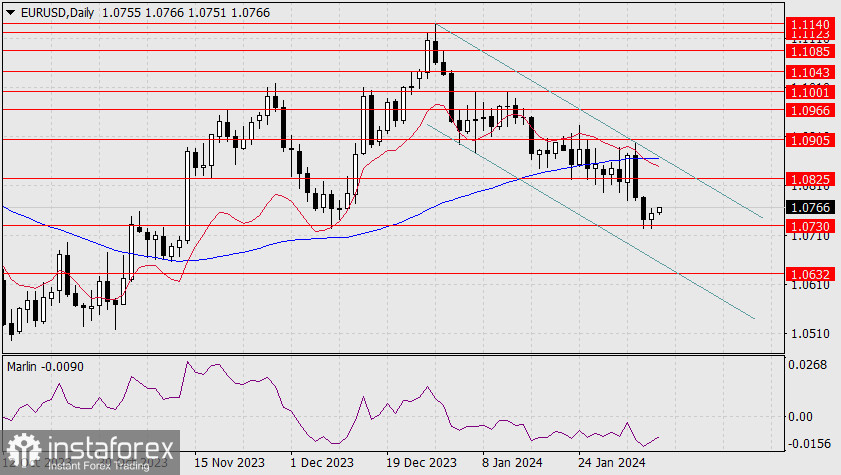

After a reversal from the support at 1.0724, the euro continues to rise for the 5th day towards the target level of 1.0825, which is near the upper band of the local descending channel on the daily scale.

The bodies of the observed white candles are small, indicating an apparent corrective nature of this growth. If the price manages to consolidate above the MACD line (1.0876), the bulls will have a basis to support a stronger rise, for instance, into the range of 1.0966-1.1001. The Marlin oscillator is still developing in negative territory, although its rise is fast.

We are also keeping an eye on the S&P 500 stock index, which reached the target level of 5028 on Friday, and there is a risk of a reversal from this level. If it continues to rise, the next target will be the upper boundary of the global hyperchannel in the target range of 5101.50-5120.00, where the risk of a reversal will increase significantly.

On the 4-hour chart, the price has settled above the MACD line, and Marlin is growing in the uptrend territory. The nearest target of 1.0825 is open.

Analysis are provided by InstaForex.

Read More

-

12-02-2024, 08:23 AM #4067

The selection of a broker should be carefully considered, as the broker serves as a bridge for traders to engage in forex trading. That's why I chose to join Tickmill as my broker, allowing me to trade forex comfortably and securely.

-

13-02-2024, 07:33 AM #4068

Forex Analysis & Reviews: Forecast for EUR/USD on February 13, 2024

EUR/USD

Yesterday, the euro did not reach its target of 1.0825, hindered by investors' flight from risk in the broader market; the S&P 500 lost 0.09% (although overall, stock markets closed mixed), and the yield on US government bonds edged down slightly.

Perhaps the single currency will not rise further, say, to 1.10. Currently, the euro is falling within a medium-term descending channel, staying below the balance and MACD indicator lines with a declining Marlin oscillator. If the price hits the nearest target of 1.0724, consolidates below it, then the euro will continue to fall to the second target of 1.0632 – to the low of September 14, 2023. We expect the pair to continue its downward movement.

On the 4-hour chart, the price has returned below the MACD line but currently feels uncertain there, as the Marlin oscillator has not yet left the growth territory. Perhaps it will do so when the price surpasses yesterday's low of 1.0757.

Today, the US will release figures for its February's Consumer Price Index (CPI). This is the main agenda of the day, as this may influence the Federal Reserve's attitude toward monetary policy.

On the 4-hour chart, the price has settled above the MACD line, and Marlin is growing in the uptrend territory. The nearest target of 1.0825 is open.

Analysis are provided by InstaForex.

Read More

-

13-02-2024, 08:30 AM #4069

Analytical skills are indeed a crucial factor in forex trading. That's why it's essential to consistently develop these skills. This way, one can progress, analyze the market accurately, and potentially profit in collaboration with Tickmill as the broker.

-

14-02-2024, 05:40 AM #4070

Forex Analysis & Reviews: Forecast for EUR/USD on February 14, 2024

EUR/USD

Yesterday there was a strong shift away from risk; the S&P 500 -1.37%, copper -0.52%, but bond yields increased, and oil prices rose. On the one hand, this divergence fully corresponds to investors' expectations of a slowdown in the pace of Federal Reserve rate cuts due to yesterday's US inflation data – the core index held at 3.9% YoY against expectations of a decrease to 3.7% YoY, the US CPI decreased from 3.4% YoY to 3.1% YoY against expectations of 2.9% YoY, and investors' expectations for a rate cut shifted from May to June. On the other hand, earlier in the day, before the data was released, European stock markets and futures on the US stock market were falling, only accelerating with the release of the news. Perhaps the market will not return to the record high that was set by the S&P 500 on Monday, for a long time at that, and this is the beginning of a global crisis. Traditionally, we're waiting for a major company to announce bankruptcy to officially start the crisis. Last year, there were several major bankruptcies, but amid unbridled optimism, they went unnoticed. Now, markets are more attentive.

On the daily chart, the euro has crossed the midline of the descending price channel. The price has breached the support at 1.0724, so now it can aim for 1.0632. Surpassing this target would reveal a significantly lower one at 1.0450, the October 2023 low.

On the 4-hour chart, the price has settled below the target level of 1.0724. The Marlin oscillator has firmly settled in the downtrend territory. It is noteworthy that the decline occurred after a double false breakout above the MACD line (marked by ovals). This is a sign of the medium-term downward movement.

Analysis are provided by InstaForex.

Read More

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote