Forex Analysis & Reviews: Forecast for EUR/USD on January 26, 2024

EUR/USD

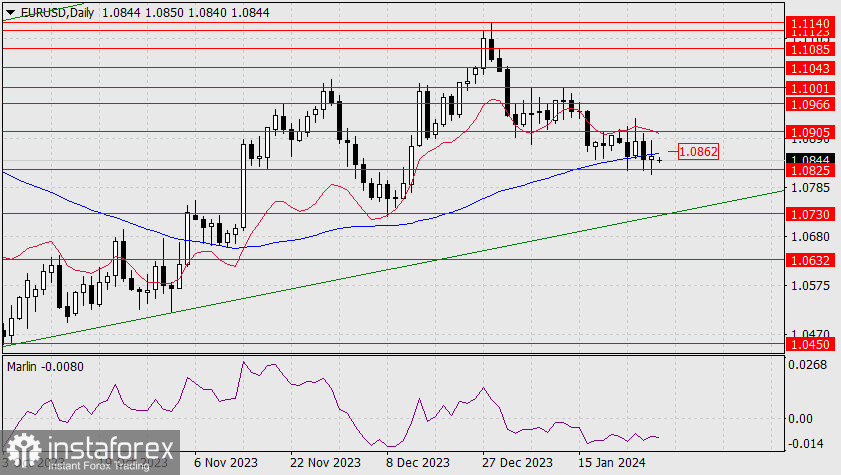

Yesterday, the price repeated Tuesday's scenario – the daily candle tested the boundaries of the range between 1.0825 and 1.0905 with candles, and the day closed with a long black body. However, the price closed the day below the MACD indicator line, and it opened today below this line. The European Central Bank meeting and ECB President Christine Lagarde's subsequent speech were neutral.

There are currently more technical prerequisites for breaking through support, but overall, market interest in risk has increased significantly – almost all financial market instruments rose yesterday, from stock markets to bonds and gold. This increase in risk appetite was driven by strong US GDP data – 3.3% growth in the fourth quarter, exceeding the forecast of 2.0%.

Investors may be expecting a dovish tone from the Federal Reserve at its January 31 meeting. Now, any of the euro's movements could turn out to be a false move. We are waiting for the key event of the upcoming week. We believe that the Federal Reserve will be the first to start the rate-cut cycle, so the Fed may also start to show verbal signals.

Today, the US will release data on income and spending for December, with expectations being positive, and they could strengthen the rise of riskier assets, including the euro.

On the 4-hour chart, the price and oscillator have formed a semblance of a double or even triple convergence. We can confirm this once the price settles above the MACD line (1.0855). Take note that the MACD line coincides in price level with the daily MACD line (1.0857), and overcoming such significant resistance could push the euro upward.

Analysis are provided by InstaForex.

Read More

Please visit our sponsors

Results 4,051 to 4,060 of 4086

Thread: InstaForex Wave Analysis

-

26-01-2024, 05:20 AM #4051

-

29-01-2024, 05:41 AM #4052

Forex Analysis & Reviews: Forecast for EUR/USD on January 29, 2024

EUR/USD

At the end of the past week, during which the central banks of Japan, Canada, and the eurozone held meetings, the euro fell by only 44 pips. This indicates that investors are waiting for the outcomes of the Federal Reserve's decisions, and until then, significant market movements are not expected. Although the price settled below the MACD line on the daily chart, there is a small chance that the price will settle below the support level of 1.9825 since the bearish gap from the opening of the session has not yet been closed, and settling below the MACD line ahead of the Fed meeting may turn out to be a false signal.

Overcoming the MACD line (1.0862)will certainly eliminate the existing danger of a significant drop below 1.0825. However, this will not be a sign of a rise above 1.0905. Of course, we are waiting for the Fed's decision on monetary policy and the market's reaction to it. We expect the euro to fall below 1.0450 if the US stock market falls. Perhaps this will happen in February for political reasons.

On the 4-hour chart, an unclosed gap is clearly visible. The price adheres to the MACD line. The downtrend is restrained by a double convergence with the Marlin oscillator. We await the Fed meeting on Wednesday.

Analysis are provided by InstaForex.

Read More

-

30-01-2024, 05:24 AM #4053

Forex Analysis & Reviews: Forecast for USD/JPY on January 30, 2024

USD/JPY

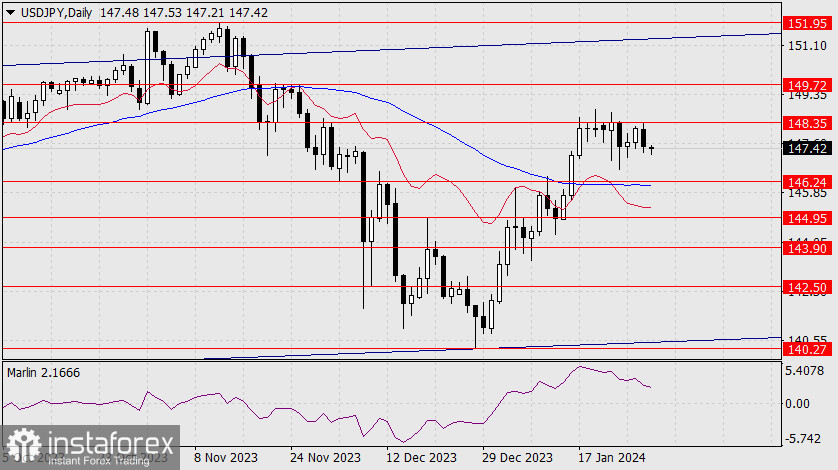

The USD/JPY pair once again tested the resistance level at 148.35 and forcefully moved downwards toward the support level at 146.24, just below which lies the MACD indicator line. The Marlin oscillator is decreasing. If the price consolidates below 146.24, it will signal the start of a medium-term decline in the pair, possibly below 140.27.

US government bond yields turned lower on Monday.

On the 4-hour chart, the price has settled below the balance indicator line, and the MACD line is turning downwards.

We are seeing signs of a new downward trend being formed. The Marlin oscillator made a false breakout into the positive territory (marked by a rectangle), afterwards it returned to the downtrend territory. We are awaiting the price at the first target level of 146.24.

Analysis are provided by InstaForex.

Read More

-

31-01-2024, 06:00 AM #4054

Forex Analysis & Reviews: Forecast for EUR/USD on January 31, 2024

EUR/USD

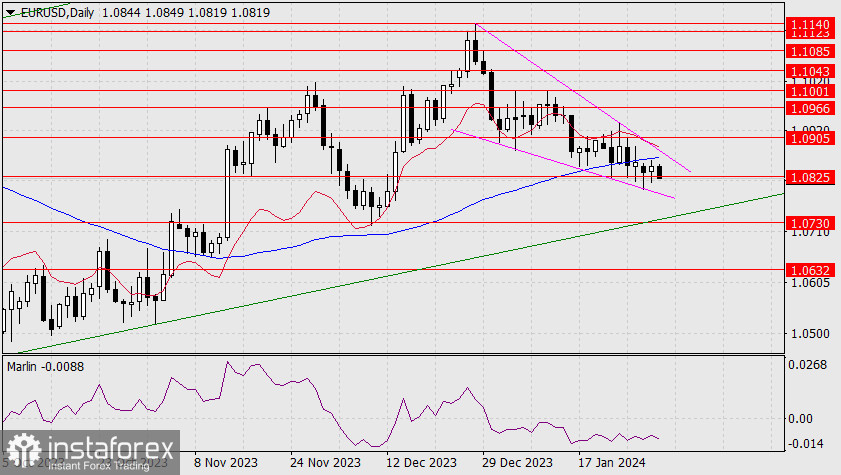

The euro completed a small task set before yesterday – it worked out the resistance of the MACD indicator line on the daily timeframe, closing the day with a white candle. Meanwhile, the Marlin oscillator strengthened its bullish momentum, which shows that the euro is ready to rise ahead of the FOMC meeting. From a technical standpoint, this will look like the price breaking out of the descending corrective wedge. This is our main scenario. The first bullish target is 1.0905, and the second is 1.0966 – the peak of November 21, 2023.

If events develop according to an alternative scenario, the price may attack the lower embedded line of the price channel with a target level of 1.0730.

On the 4-hour chart, the price pierced the price support of 1.0825 and the MACD line. The Marlin oscillator turned down from the zero line. The gap from the opening of the week was closed yesterday evening.

Earlier, we mentioned that of all the major central banks, the Federal Reserve would be the first to signal a rate cut. Assuming that the Fed will not lower the rate in March but only in May, even in this case, today is a very convenient time to send the corresponding signal. Recent statements by officials from these central banks illustrate this assumption well: Fed official James Bullard mentioned the possibility of a rate cut in March, and European Central Bank President Christine Lagarde said yesterday that we still need to wait for employment and wage data.

Analysis are provided by InstaForex.

Read More https://ifxpr.com/3HDmjqD

-

31-01-2024, 07:40 AM #4055

The ability to analyze is a crucial and influential factor in forex. Therefore, I have developed my analytical skills. This is done to ensure personal growth and the capability to analyze the market accurately in collaboration with Tickmill as the broker.

-

01-02-2024, 05:31 AM #4056

Forex Analysis & Reviews: Forecast for GBP/USD on February 1, 2024

GBP/USD

Following the outcome of yesterday's Federal Reserve meeting, the British pound became stable below the balance indicator line on the daily chart. The target level of 1.2745 was tested with the upper shadow. The Marlin oscillator continues its sideways movement. Today, it started the day by trading higher. The main signal that the pound received from the Fed is the Bank of England's commitment to a hawkish stance at today's meeting, following the Fed's example.

Most likely, this stance will be revealed through the voting division among the committee members. As a result, the probability of the pound's growth is quite high. After surpassing 1.2745, the first target is 1.2826. Next, we expect the upper boundary of the price channel to be tested around 1.2876. This is the main scenario.

On the 4-hour chart, the price is returning above the MACD line as a continuation of the sideways trend. The Marlin oscillator provides an even greater sign of growth, which entered the growth territory yesterday. We are waiting for the BoE meeting.

Analysis are provided by InstaForex.

Read More https://ifxpr.com/4bdQnGV

-

02-02-2024, 08:53 AM #4057

Forex Analysis & Reviews: Forecast for EUR/USD on February 2, 2024

EUR/USD

Yesterday, the euro, which was losing momentum, received support from the stock market, which gained 1.25% (S&P 500) and lifted the euro by 54 pips. On the daily chart, the price broke out of the descending wedge and is attempting to settle above the MACD line. The Marlin oscillator is also ready to rise; soon, it will move into the growth territory.

Today, the market expects the U.S. employment data to show minor weakness. In the non-farm sector for January, 187,000 new jobs are forecasted compared to 216,000 in December, and an increase in the unemployment rate from 3.7% to 3.8%. However, the stock market, along with other instruments, often developed a risk-on sentiment against labor data, for instance, on November 3rd, when non-farm payrolls for October were 150,000 against an expectation of 180,000.

On the 4-hour chart, the price has already settled into the uptrend territory – it is currently moving above both indicator lines, and Marlin has been stable in the bullish territory. We expect the euro to rise towards the target levels of 1.0966, 1.1001 (the peak of January 11th), and 1.1043, while keeping a close eye on the stock market.

Analysis are provided by InstaForex.

Read More

-

05-02-2024, 04:56 AM #4058

Forex Analysis & Reviews: Forecast for EUR/USD on February 5, 2024

EUR/USD

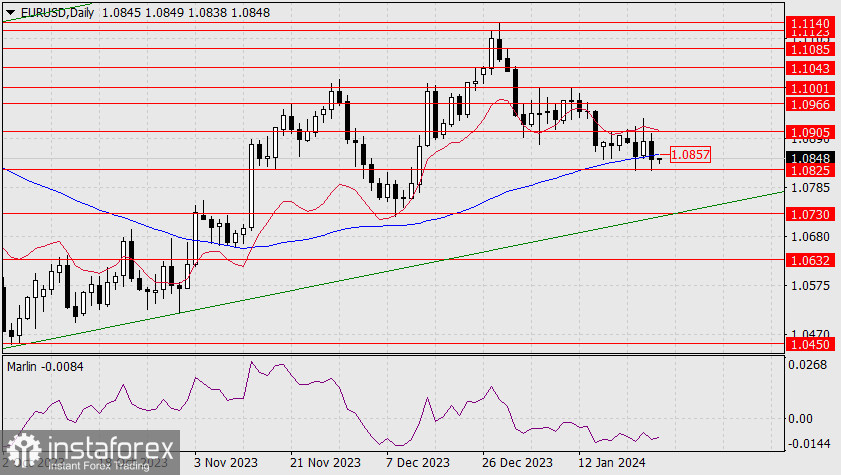

Last Friday, the US employment data from the US Bureau of Labor Statistics surprised the currency market. US nonfarm payroll employment far exceeded expectations of 157,000, with an increase of 353,000 in January. Not only that, but December's figures were revised upward by 117,000. According to federal funds rates, the market probability of maintaining the current Federal Reserve rate at 5.50% in the March meeting has increased from 62% to 80%, and the likelihood of a rate cut in May rose from 58% to 60%. The yield on 5-year US government bonds rose from 3.82% to 3.98%. The S&P 500 stock index jumped by 1.07%, but the euro lacked the decisiveness to follow suit, dropping by 85 pips. Oil and gold also fell.

The euro still has a chance to turn higher, but it needs to rebound from the support level. The nearest support is the price channel line on the daily chart at 1.0748. Just below it is the level of 1.0730. If the price does not turn from there, the price could aim for 1.0632. There is also support at the lower boundary of the wedge, which has already been tested this morning but appears weak.

On the 4-hour chart, the price has settled below the balance and MACD indicator lines. The Marlin oscillator has settled in the downtrend territory. Probably a short-term continuation of the downward movement.

Analysis are provided by InstaForex.

Read More

-

06-02-2024, 05:20 AM #4059Senior Investor

- Join Date

- Jul 2011

- Location

- www.ArmadaMarkets.com

- Posts

- 4,135

- Feedback Score

- 0

- Thanks

- 0

- Thanked 2 Times in 2 Posts

Analytical skills are a crucial and highly influential factor in forex trading. That's why developing analytical abilities is essential. This is done so that traders can analyze the market accurately and benefit from it with Tickmill as their broker.

-

06-02-2024, 07:41 AM #4060

Forex Analysis & Reviews: Forecast for EUR/USD on February 6, 2024

EUR/USD

On Monday, the euro fell by 44 pips, reaching the target level of 1.0730 with the lower shadow of the daily candle. The price surpassed the lower border of the green price channel, and the channel is no longer relevant.

Now, after overcoming the level of 1.0730, which the price has reached, the euro may continue to fall to the next target at 1.0632. The signal line of the Marlin oscillator slightly bent upwards, which may indicate a minor correction from the support it reached before it falls further.

On the 4-hour chart, the price consolidates above the support level. Marlin is discharging before a possible new wave of decline. We are waiting for the price to consolidate below 1.0730 and move towards the designated level of 1.0632 – the low of September 14, 2023, and the low of May 31.

Analysis are provided by InstaForex.

Read More

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 2 users browsing this thread. (0 members and 2 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote