XAUUSD H4 | Reacting off 1st Resistance?

The XAU/USD chart currently has a bullish momentum, indicating a potential upward trend. There's a likelihood of continued bullish movement towards the first resistance. The first support at 1913.49 is significant, aligning with the 61.80% Fibonacci Retracement. The second support at 1901.55 is also noteworthy, aligning with the 78.60% Fibonacci Retracement. On the resistance side, the first resistance at 1931.97 aligns with the 38.20% Fibonacci Retracement, and the second resistance at 1943.88 aligns with the 78.60% Fibonacci Retracement.

Analysis are provided by InstaForex.

Read More

Please visit our sponsors

Results 3,941 to 3,950 of 4086

Thread: InstaForex Wave Analysis

-

08-09-2023, 07:07 AM #3941

-

11-09-2023, 04:09 AM #3942

The selection of a broker should be done carefully, as the broker serves as the bridge that allows traders to engage in Forex trading. That's why I chose Tickmill as my broker, so my trading can be conducted comfortably and safely here.

-

11-09-2023, 06:36 AM #3943

Technical Analysis of Intraday Price Movement of Gold Commodity Asset, Monday, September 11 2023

With the penetration of the three important levels of the CCI indicator on the 4 hour timeframe, the Gold commodity asset indicates that Sellers are dominating this commodity asset, even though there is currently an upward correction to test the Equal High level of 1928.17, but as long as it does not penetrate above the 1935.42 level, Gold still has the potential to continue. The decline is especially supported by the emergence of the Bearish Continuation Ascending Broadening Wedge pattern, so Gold has the potential to go down and try to penetrate below the 1914.79 level and if this level is successfully penetrated, the level of the Daily Bullish Fair Value Gap area in the range of 1903.38-1911.29 will be the next target to be aimed at.

Analysis are provided by InstaForex.

Read More

-

12-09-2023, 05:24 AM #3944

NZDUSD H4 | Falling to 1st support?

The NZD/USD chart currently shows a bullish trend with potential for further upward movement. The 1st resistance at 0.5930, coinciding with the 50.00% Fibonacci retracement, is a key level that may impede bullish progress. Similarly, the 2nd resistance at 0.5992 is also significant for potential resistance.

On the downside, the 1st support at 0.5891 aligns with the 61.80% Fibonacci retracement and serves as a strong support level. The 2nd support at 0.5862, identified as a pullback support, adds to the support zone.

Analysis are provided by InstaForex.

Read More

-

13-09-2023, 06:14 AM #3945

JAPAN PRODUCER PRICES RISE 0.3% ON MONTH IN AUGUST

Producer prices in Japan were up 0.3 percent on month in August, the Bank of Japan said on Wednesday.

That beat forecasts for an increase of 0.1 percent, which would have been unchanged from the July reading.

On a yearly basis, producer prices climbed 3.2 percent - in line with expectations and down from the downwardly revised 3.4 percent increase in the previous month (originally 3.6 percent).

Export prices were up 0.5 percent on month and down 0.8 percent on year, the bank said, while import prices slumped 0.9 percent on month and 15.9 percent on year.

News are provided by

InstaForex.

Read More

-

13-09-2023, 06:23 AM #3946

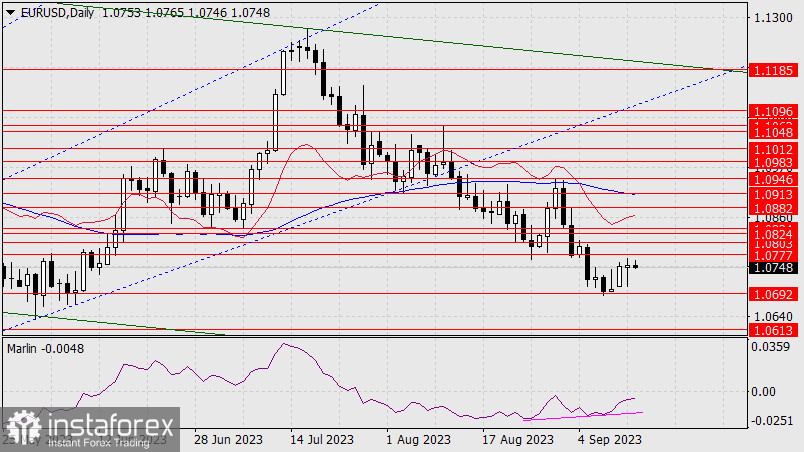

Forex Analysis & Reviews: Forecast for EUR/USD on September 13, 2023

EUR/USD:

Yesterday, the volatile day ended in favor of the bulls. Despite the numerous target levels on the daily chart, which is due to the corrective nature of the growth, the main target is defined by the MACD line around 1.0913. Overcoming the nearest resistance at 1.0777 will open the second target at 1.0803, the low from August 23rd.

Today, the main driving force could be the US inflation data for August. The forecast for the core CPI is 4.3% YoY, compared to 4.7% YoY the previous month, and the forecast for the CPI suggests an increase from 3.2% YoY to 3.6% YoY. If we assume that the data will come out in line with economists' calculations, investors will pay more attention to the decrease in the core CPI, as the Federal Reserve relies more on it. As a result, expectations of a rate hike will decrease, and the euro will rise.

Analysis are provided by InstaForex.

Read More

-

14-09-2023, 05:22 AM #3947

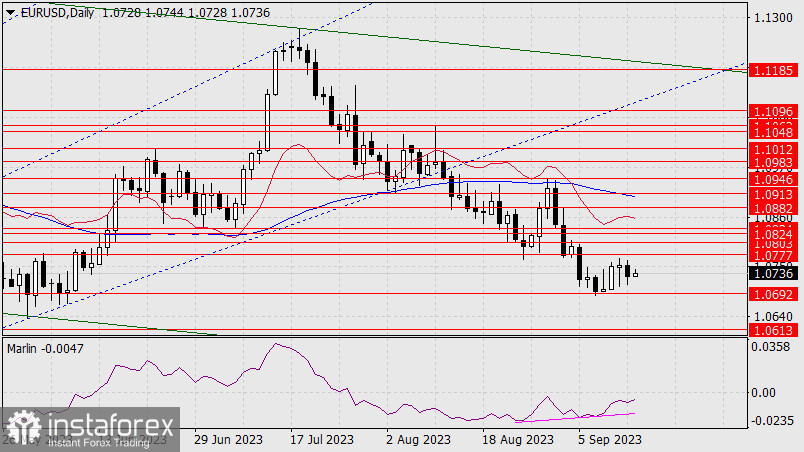

Forex Analysis & Reviews: Forecast for EUR/USD on September 14, 2023

EUR/USD

Yesterday's US CPI data came in around forecast levels. The August Core CPI dropped from 4.7% YoY to 4.3% YoY, while the CPI rose from 3.2% YoY to 3.7% YoY (forecast 3.6% YoY). Considering that industrial production in the eurozone plummeted by 1.1% in July and decreased by 2.2% YoY (forecast -0.3%), the euro's decline could have been greater than the 24 pips that we saw yesterday.

Trading volumes were substantial, indicating that there was market activity, and traders preferred to hold their positions ahead of today's European Central Bank meeting, as the probability of a rate hike stands at 68%. If investors showed an intention not to sell the euro based on US inflation data, they may buy it following the ECB meeting. The bullish target is the 1.0824/32 range. Technical convergence in action. A price above this range will open up the target of 1.0882. The MACD line is approaching this level.

On the 4-hour chart, the price is between the balance and MACD indicator lines. The Marlin oscillator is currently holding an uptrend. A waiting mode is likely until the ECB announces its rate decision.

Analysis are provided by InstaForex.

Read More

-

15-09-2023, 05:31 AM #3948

GBPUSD H4 | Bearish Continuation Expected?

The GBP/USD chart currently shows a bearish momentum due to trading below the bearish Ichimoku cloud. This could lead to a continued bearish movement towards the significant 1st support level at 1.2372, which is marked as an overlap support. Additionally, the 2nd support at 1.2309 is recognized as a swing low support.

On the resistance side, the 1st resistance level at 1.2448 is a pullback resistance, possibly hindering upward movement. The 2nd resistance at 1.2533 is an overlap resistance, suggesting its potential as a point of reversal or resistance.

Analysis are provided by InstaForex.

Read More

-

18-09-2023, 05:16 AM #3949

GBPUSD Day | Bearish Continuation Expected?

The GBP/USD chart displays a dominant bearish trend, emphasized by its position below the bearish Ichimoku cloud and a descending trend line. Key supports stand at 1.2293, backed by the 78.60% Fibonacci Projection, and 1.2182, aligned with the 100% Fibonacci Projection. Resistances are identified at 1.2418 and 1.2632, with the latter being an overlap resistance. The overall outlook remains bearish.

Analysis are provided by InstaForex.

Read More

-

19-09-2023, 05:50 AM #3950

Forecast for GBP/USD on September 19, 2023

The British pound closed Monday at the same level as Friday's closing level. The Marlin oscillator rose, reinforcing the double convergence with the price. We can see that the signal line of the oscillator is converging into a wedge, and an upward exit (most likely) from it will fuel the price growth.

The nearest bullish target is 1.2547, followed by 1.2617. The third target is 1.2684. The MACD indicator line is approaching this level.

On the 4-hour chart, we see a build up in the convergence. A break above 1.2444 will also correspond to Marlin's move into the bullish territory. Such a pattern will support the pound. We await the results of tomorrow's Federal Reserve meeting.

Analysis are provided by InstaForex.

Read More

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote