Forecast for AUD/USD on December 8, 2023

Yesterday, the Australian dollar, with overlaps, covered the entire range of levels 0.6547-0.6612. It sharply grew when the Marlin oscillator's signal line turned from the zero line.

According to technical rules, the pair can rise further by surpassing the previous day's high (0.6623), but since the US will release important data today, there may be a false breakout above 0.6623.

According to technical rules, the pair can rise further by surpassing the previous day's high (0.6623), but since the US will release important data today, there may be a false breakout above 0.6623.

On the 4-hour chart, the price is consolidating just before the resistance level of 0.6612. The MACD line is slightly above it, precisely at yesterday's high. Consolidating above it will signal further growth. The Marlin oscillator is already in the uptrend territory. We are waiting for the resolution of the situation with the release of the US data.

Read more: https://www.instaforex.com/forex_analysis/362643

Analysis are provided byInstaForex.

Read More

Please visit our sponsors

Results 4,011 to 4,020 of 4086

Thread: InstaForex Wave Analysis

-

08-12-2023, 01:47 PM #4011

-

11-12-2023, 05:09 AM #4012

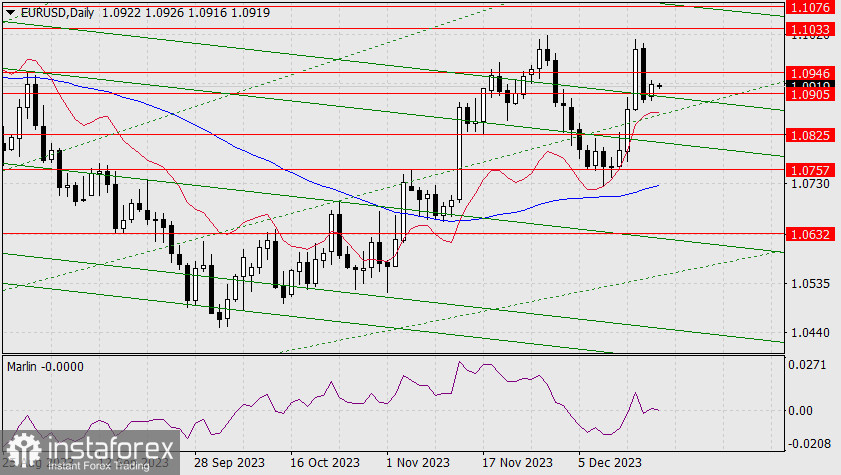

Forex Analysis & Reviews: Forecast for EUR/USD on December 11, 2023

EUR/USD

Friday's U.S. labor data turned out better than expected. The result was reflected in a decrease in the unemployment rate from 3.9% to 3.7%. The balance indicator line stopped the initial downward movement in response to the news. This was evidently influenced by the risk appetite, as the S&P 500 stock index grew by 0.41%. It is very close to continuing its growth in the medium-term, and to achieve this, the quote needs to surpass the year's high of 4612 (July 27), paving the way for the pair to reach the record target of 4816 (January 2022).

From this perspective, the euro's growth is limited to the time when the S&P 500 continues to rise. Synchronization with this timeframe gives the first serious target level of 1.1076 – the upper band of the descending price hyperchannel, coinciding with the peak on April 14 (December 21-22).

On the 4-hour chart, a double convergence has formed, which could provide the initial momentum in order for the price to rise further so it can consolidate above 1.0825. This would mean settling above the nearest embedded line of the price channel, marked on the daily chart. Subsequent consolidation above the MACD line (1.0850) would mean overcoming the Fibonacci ray on the daily chart and pave the way for the pair to reach the target level of 1.0905. Considering the upcoming Federal Reserve meeting, the euro's growth could be quite strong.

Analysis are provided by InstaForex.

Read More

-

12-12-2023, 05:22 AM #4013

Forex Analysis & Reviews: Forecast for EUR/USD on December 12, 2023

EUR/USD

In the previous review, we tied the rise of counter-dollar currencies to the development of risk sentiment in the broader market. Yesterday, the S&P 500 stock index surpassed the nearest peak from July 27 (4612), and now it has a good target at the level of 4818, which is a record high (January 2022). Oil has risen slightly. Yields on US government bonds have not changed for the third day in anticipation of tomorrow's Federal Reserve meeting.

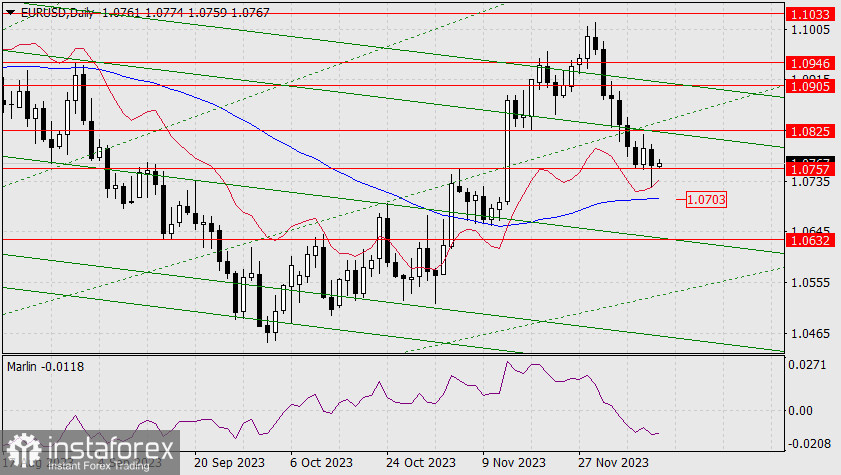

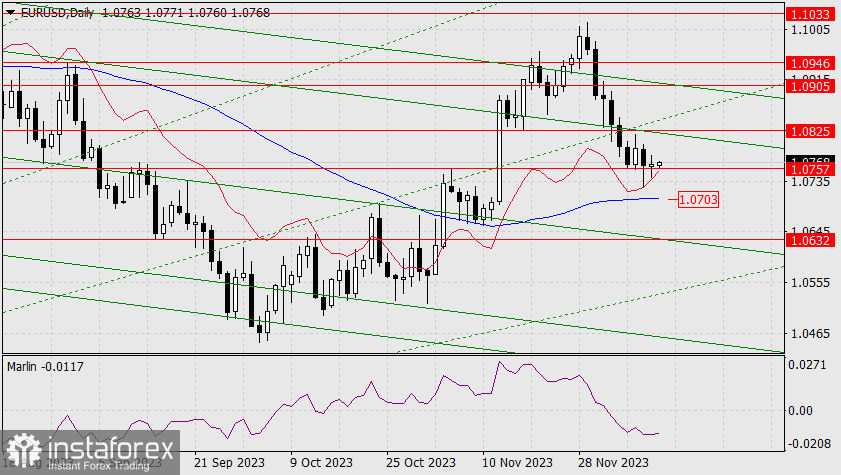

On the daily chart, the price has consolidated above the level of 1.0757. The Marlin oscillator is slowly turning upward. If there are no significant events that will hinder the euro's way, the price will continue to rise towards the target level of 1.0825.

A potential bullish breakout, in continuation of the decline from November 29, will take place if the price surpasses the support of the MACD line in the area of 1.0703. The first bearish target will be 1.0632. Exchange Rates 12.12.2023 analysis

On the 4-hour chart, the price is consolidating symbolically above the support of 1.0757. The signal line of the Marlin oscillator, after the previous convergence, entered the uptrend territory. Overcoming the level of 1.0825 will support the uptrend, as resistance is strengthened by the approaching MACD line.

Analysis are provided by InstaForex.

Read More

-

13-12-2023, 08:28 AM #4014

Forecast for EUR/USD on December 13, 2023

EUR/USD

So, yesterday's US inflation data turned out to be positive for the euro. The core CPI for November remained at the previous 4.0% YoY, while the CPI decreased from 3.2% YoY to 3.1% YoY. Such an optimistic trend of decreasing inflation could be reflected in today's dot plot projections on interest rates by FOMC members.

Today, the euro may surpass yesterday's high and continue to rise.

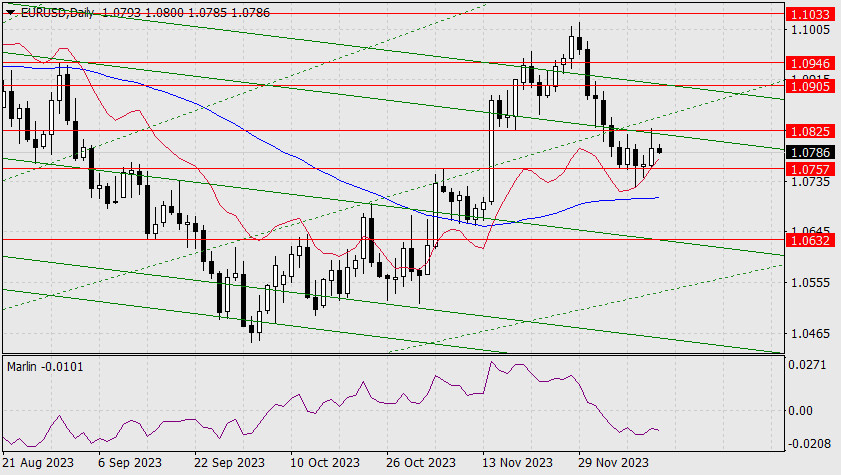

Yesterday, the upper shadow reached the target level of 1.0825. According to the main scenario, we expect a breakout and the euro to rise towards 1.0905. The second target is 1.0946.

On the 4-hour chart, the price reached the MACD indicator line and retraced slightly downwards. The price settled above the balance line indicator, and the Marlin oscillator settled in the uptrend territory. If the price consolidates above 1.0825, it will mean consolidation above the MACD line. We expect the euro to continue rising according to the main plan.

Analysis are provided by InstaForex.

Read More

-

14-12-2023, 06:42 AM #4015

Forex Analysis & Reviews: Forecast for AUD/USD on December 14, 2023

AUD/USD

The Australian dollar sharply strengthened after yesterday's Federal Reserve meeting – up 100 pips compared to the euro's 80-pip rise. In today's Asian session, the pair continued to rise at an even greater speed, and has already surpassed the target level of 0.6693. With that said, we now expect the uptrend to move forward towards the target levels of 0.6775 and 0.6815 (the average value of the peaks in April and May).

A slight move of the Marlin oscillator's signal line into negative territory (red arrow) is now considered a false move, afterwards we witnessed movement into the overbought territory.

On the 4-hour chart, the price is trying to consolidate above the level of 0.6693. If it successfully manages to consolidate, this would automatically support the pair's rise to 0.6775.

Analysis are provided by InstaForex.

Read More

-

15-12-2023, 05:13 AM #4016

Forex Analysis & Reviews: Forecast for USD/JPY on December 15, 2023

USD/JPY

The USD/JPY pair continues to support the dollar's broad weakness. Yesterday, the yen strengthened by 97 pips, and the lower shadow of the daily candle tested the target support at 141.23. During the correction, the price approached the resistance level at 142.70 by this morning.

This level is strong, so we do not believe that there is a reason for the price to overcome it. After completing the correction, a consolidation could form before the level for 1-2 days. After that, we expect a new test of support at 141.23 and further down to 140.35, coinciding with the embedded line of the price channel.

On the 4-hour chart, the price and the Marlin oscillator formed a weak convergence. However, the oscillator quickly moved upward, so it may briefly linger at elevated values before turning downward.

Analysis are provided by InstaForex.

Read More

-

18-12-2023, 06:34 AM #4017

Forex Analysis & Reviews: Forecast for EUR/USD on December 18, 2023

EUR/USD

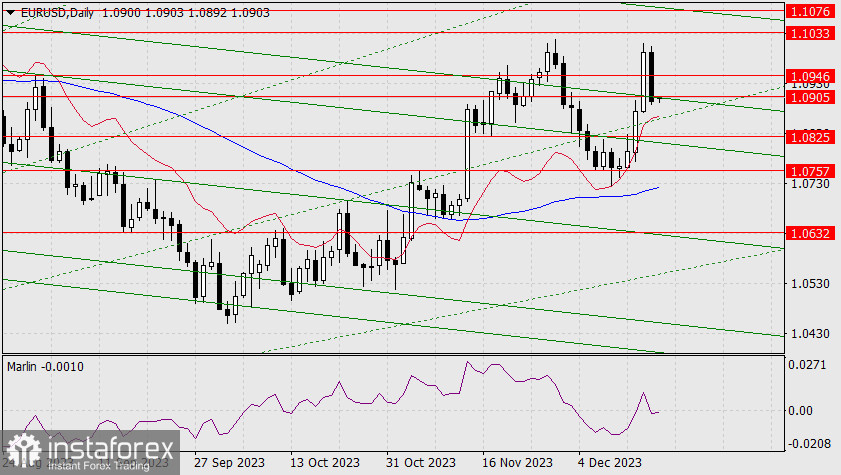

Friday's correction turned out to be quite intense and balancing on the verge of a trend change, as the price managed to overcome the strong support at 1.0905, and the Marlin oscillator returned to negative territory. Now, if the current day closes below the price channel line, below the level of 1.0905, the price could attack the lower Fibonacci ray and support at 1.0825.

However, the euro still has a chance to rise. In order to do so, the current daily candle should stay above the level of 1.0905, which will lead the Marlin oscillator to rise in the positive territory. Surpassing the 1.0946 mark will reopen the target of 1.1033 and then 1.1076.

On the 4-hour chart, we can see that the corrective phase was just over 38.2%. The Marlin oscillator has not left the growth territory. There is a good chance that the price will turn from these levels. The uptrend remains intact, and in order to change it, the price needs to consolidate below 1.0825 and below the MACD line.

Such a deep correction only occurred with the euro. The Canadian dollar strengthened on Friday, Asia-Pacific currencies spent the day in consolidation, and this morning, the New Zealand dollar continues to rise. This means that on Friday, the euro qualitatively reacted to the weak eurozone PMI data. But today, the IFO indices for Germany for December will be released, and they are expected to increase. In particular, the value is expected to rise from 89.4 to 89.5. This supports the main scenario.

Analysis are provided by InstaForex.

Read More

-

18-12-2023, 07:34 AM #4018Senior Investor

- Join Date

- Jul 2011

- Location

- www.ArmadaMarkets.com

- Posts

- 4,148

- Feedback Score

- 0

- Thanks

- 0

- Thanked 2 Times in 2 Posts

The ability to analyze is an incredibly crucial factor in forex trading. That's why developing analytical skills is essential, enabling one to analyze the market accurately and potentially benefit alongside Tickmill as the broker.

-

19-12-2023, 06:46 AM #4019

Forex Analysis & Reviews: Forecast for EUR/USD on December 19, 2023

EUR/USD

Yesterday, the euro closed with a white candle above the level of 1.0905, and the signal line of the Marlin oscillator quickly returned to the bullish territory. Although this isn't a signal that the pair will rise to the level of 1.1033, it removes the risk of a decline to 1.0825.

Perhaps the bulls still do not have enough long positions to overcome 1.0946, then we will see the price consolidating in the range of 1.0905/46. On the 4-hour chart, the price has settled above the level of 1.0905 and above the 38.2% Fibonacci correction level.

The Marlin oscillator is misleading the bulls, showing an intention to move below the neutral zero line. At the same time, this is a sign of an upcoming correction in the range of 1.0905/46. A consolidation below the lower band of the range will sharply increase the risks of a decline.

Analysis are provided by InstaForex.

Read More

-

20-12-2023, 04:36 AM #4020Senior Investor

- Join Date

- Jul 2011

- Location

- www.ArmadaMarkets.com

- Posts

- 4,148

- Feedback Score

- 0

- Thanks

- 0

- Thanked 2 Times in 2 Posts

The ability to analyze is an incredibly crucial factor in forex trading. Therefore, as a trader, it's essential to consistently develop your analytical skills. This is done so that traders can analyze the market accurately and benefit together with Tickmill as their broker.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 6 users browsing this thread. (0 members and 6 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote