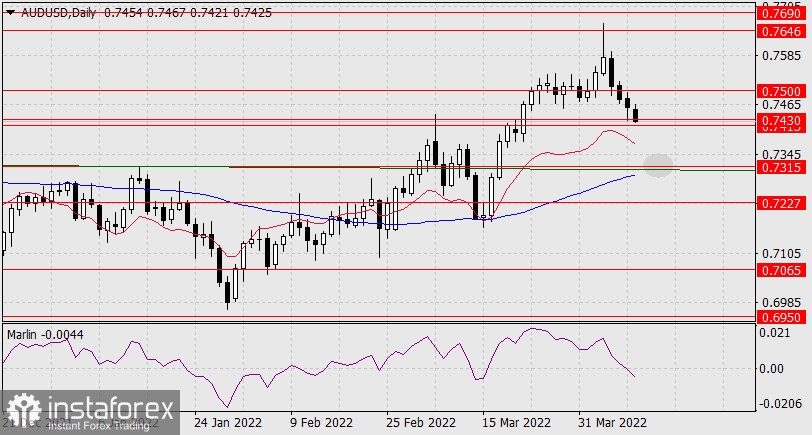

Forex Analysis & Reviews: Forecast for AUD/USD on March 30, 2022

The Australian dollar's decline, which had begun yesterday, stopped and turned into the US dollar's growth, which weakened by 0.72%. The Australian dollar managed to return above the target level of 0.7500 in one day and is now ready to rise to the next bullish target of 0.7600. The aussie's readiness is still not complete, as the Marlin Oscillator has not turned up yet. Perhaps the upward price movement will be in the form of a saw.

On the H4 chart, the price has settled above the target level of 0.7500 and is developing above the balance indicator line. The Marlin Oscillator is close to the transition to the positive area. We are waiting for the price at the level of 0.7600.

Analysis are provided byInstaForex.

Please visit our sponsors

Results 3,511 to 3,520 of 4086

Thread: InstaForex Wave Analysis

-

30-03-2022, 06:01 AM #3511

-

31-03-2022, 07:12 AM #3512

Forex Analysis & Reviews: ETHUSD, Bullish Pressure | 31st March 2022

On the H4, with price moving above the Ichimoku indicator, we have a bias that price will rise to our 1st resistance at 3589 in line with the horizontal pullback resistance and 127.2% Fibonacci extension from our 1st support at 3240 in line with the horizontal pullback support and 23.6% Fibonacci retracement. Alternatively, price may break 1st support structure and head for 2nd support at 3034 in line with the horizontal pullback support and 38.2% Fibonacci retracement.

Trading Recommendation

Entry: 3240

Reason for Entry:

Horizontal pullback support and 23.6% Fibonacci retracement

Take Profit: 3589

Reason for Take Profit:Horizontal pullback resistance and 127.2% Fibonacci extension

Stop Loss: 3034

Reason for Stop Loss:Horizontal pullback support and 38.2% Fibonacci retracement

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided byInstaForex.

-

01-04-2022, 06:42 AM #3513

Forex Analysis & Reviews: Forecast for USD/JPY on April 1, 2022

So, yesterday's daily candle of the USD/JPY pair formed a small body with medium-length shadows, and this morning there is an increased growth of the pair. Taking into account the large black candle of the environment, we see the formation of a reversal combination. Our scenario involves the formation of a triangle here. If the triangle is horizontal, then this will be a sign of further price growth, if the triangle is formed upwards, and for this it has a target level of 125.85, then this will be a reversal pattern in the medium and long-term decline. At the moment, we are waiting for growth to the area of the upper hypothetical line of the triangle at 124.60.

On the four-hour chart, the price is trying to go above the balance and MACD indicator lines, the price has formed a convergence with the oscillator. The exit of the price above the MACD line (122.80), most likely, will coincide with the transition of Marlin to the positive area and this will be a signal for the continuation of the price growth.

Analysis are provided byInstaForex.

-

04-04-2022, 07:38 AM #3514

Forex Analysis & Reviews: GBPUSD Bullish Bounce | 4th Apr 2022

On the H4, prices are abiding by an ascending trendline support. We see the potential for a dip from our 1st resistance 1.31152 at 23.6% Fibonacci retracement towards our ascending trendline support. Breaking our ascending trendline support will find prices dipping towards our 1st support at 1.30558 in line with 61.8% Fibonacci retracement. Our bearish bias is further supported by prices trading below our Ichimoku cloud resistance. Alternatively, prices may climb towards our 2nd resistance at 1.31622 in line with our graphical swing high.

Trading Recommendation

Entry: 1.31152

Reason for Entry:

23.6% Fibonacci retracement

Take Profit: 1.30558

Reason for Take Profit:61.8% FIbonacci retracement

Stop Loss: 1.31622

Reason for Stop Loss:

Graphical swing high

Analysis are provided byInstaForex.

-

05-04-2022, 10:37 AM #3515

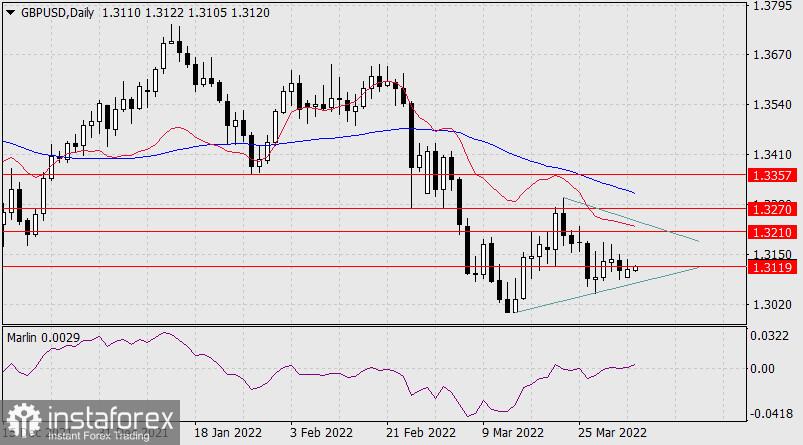

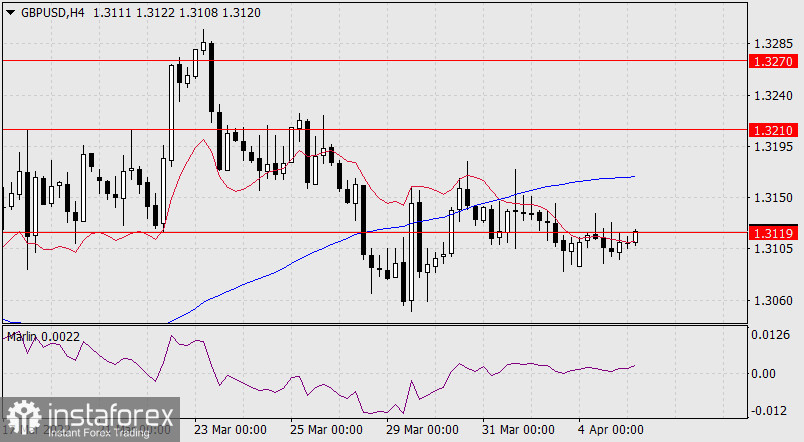

Forex Analysis & Reviews: Forecast for GBP/USD on April 5, 2022

The British pound begins to form a pennant-shaped formation on the daily scale. From the ideological point of view, this is quite consistent with investors' expectations for the Bank of England meeting, which will take place exactly one month later, and the European Central Bank, which will take place in nine days. On the technical side, after the formation of the lower line of the pennant, the price now tends to rise, to the upper line of the supposed pennant, to the target level of 1.3210. The signal line of the Marlin Oscillator fixed in the positive area.

On the H4 chart, the price has not yet consolidated above the target level of 1.3119, and the signal line of the oscillator, although it is above the zero line, is still moving sideways. Today's trading day may be similar to yesterday's.

Analysis are provided byInstaForex.

-

06-04-2022, 06:18 AM #3516

Forex Analysis & Reviews: Forecast for EUR/USD on April 6, 2022

The euro is falling evenly - yesterday's fall was about the same as on Monday. On the daily chart, the signal line of the Marlin Oscillator settled below the zero line. The trend is completely down, the target 1.0820 is open. Going under the level will be an early sign that we will see the euro at parity with the dollar. Consolidating below 1.0636 (March 2020 low) will confirm this signal.

The decline continues for all indicators on the four-hour chart. The Marlin Oscillator slowed down a bit, but it is not in the oversold zone yet. We are waiting for further development of the downward movement.

Analysis are provided byInstaForex.

-

07-04-2022, 07:08 AM #3517

Forex Analysis & Reviews: Forecast for GBP/USD on April 7, 2022

The British pound has settled under the target level of 1.3119 on a daily scale, now it acts as a resistance for it. The signal line of the Marlin Oscillator is moving sideways along its own zero line. The prevailing trend is downward. We are waiting for its qualitative breakdown with the development of the target level of 1.2900.

The trend remains bearish on the lower working chart of H4. The price is below the indicator lines, the Marlin Oscillator has moved below the zero line and is already moving sideways in the negative area. We are waiting for the price at the target level of 1.2900. This is the December 2019 low.

Analysis are provided byInstaForex.

-

08-04-2022, 07:01 AM #3518

Forex Analysis & Reviews: Forecast for EUR/USD on April 8, 2022

The euro continues to decline, although it has slowed down. It has a technically and ideologically important support at 1.0820 ahead of it, overcoming which opens the target of 1.0636 – the low of March 2020, therefore, in order to overcome such an important support, you need to gather your strength. Today is Friday, no important news is planned, and investors, if they have planned a breakthrough, will organize it not today. The Marlin Oscillator of a daily scale is moving exactly horizontally, which hints at the preliminary closing of short positions of players before an assault with fresh forces.

On the four-hour chart, the Marlin Oscillator is growing in the downtrend zone, this can be interpreted in two ways: the oscillator rarefaction before further decline into the oversold area and a slight convergence with the price, indicating the expected closing of positions.

Thus, two scenarios of one action appear: price correction from current levels (correction limit at 1.0945) and a subsequent powerful attack on the target level of 1.0820, and support at 1.0820 working off with a subsequent bounce from the level and only then going under it with a further decline.

Analysis are provided byInstaForex.

-

11-04-2022, 06:51 AM #3519

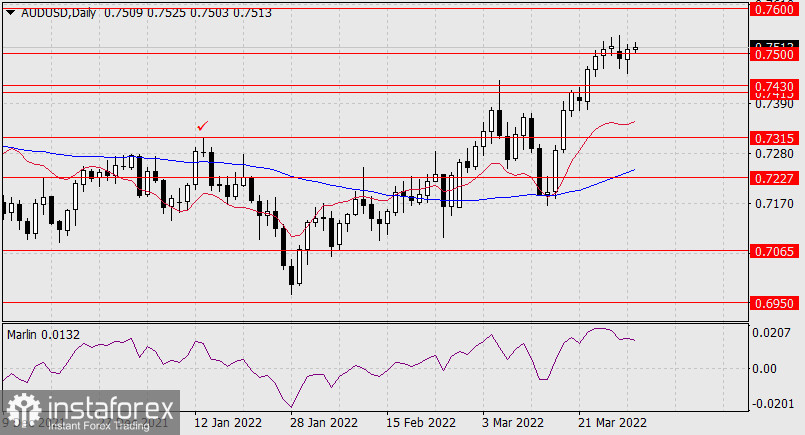

Forex Analysis & Reviews: Forecast for AUD/USD on April 11, 2022

On Friday, the Australian dollar marked the lower shadow of the daily candle in the target range of 0.7415/30, then went back out of it. The signal line of the Marlin Oscillator has gone into the negative area, so we do not expect a strong correction from the range reached. Until the US dollar index strengthens again, the aussie is likely to move sideways. The price going under the lower border of the range opens a new target 0.7315 (high on January 13).

On the four-hour chart, the price is in no hurry to go into a correction. The Marlin Oscillator is also in no hurry to move either down or turn up. This circumstance confirms the aussie's reluctance to develop corrective growth.

Analysis are provided byInstaForex.

-

12-04-2022, 08:49 AM #3520

Forex Analysis & Reviews: Elliott wave analysis of Silver for April 12, 2022

Silver turned higher as the cycle bottomed. We are looking for a break above minor resistance at 25.85 for a continuation higher towards 30.00 and ultimately a rally towards the all-time high at 50.00.

Support is now seen at 24.59 that ideally will be able to protect the downside for the expected break above minor resistance at 25.85. Only a break below support at 24.13 will shift the tide towards the downside and a decline towards 23.38, but the odds for this outcome are very low.

Analysis are provided byInstaForex.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote