Forex Analysis & Reviews: Forecast for EUR/USD on April 27, 2022

The euro was ahead of our bold forecasts. We expected an attack on the target level of 1.0636 at the Federal Reserve meeting, but the price reached it last night, and at the point of intersection of the level with the lower border of the Fibonacci channel, marked in green on the daily chart. Consolidating below 1.0636 (March 2020 low) opens the way for the euro to parity. The first target is 1.0493 (February 2017 low).

On the four-hour chart, the price lingers at the reached level with a slight upturn of the Marlin Oscillator. Here, however, there may still be at least a slight correction in depth, in the form of consolidation, to give the oscillator a little rise before further decline. But if it does not exist, then after settling under 1.0636, we are waiting for further movement to 1.0493.

Analysis are provided byInstaForex.

Please visit our sponsors

Results 3,531 to 3,540 of 4086

Thread: InstaForex Wave Analysis

-

27-04-2022, 06:39 AM #3531

-

28-04-2022, 07:06 AM #3532

Forex Analysis & Reviews: Technical Analysis of EUR/USD for April 28, 2022

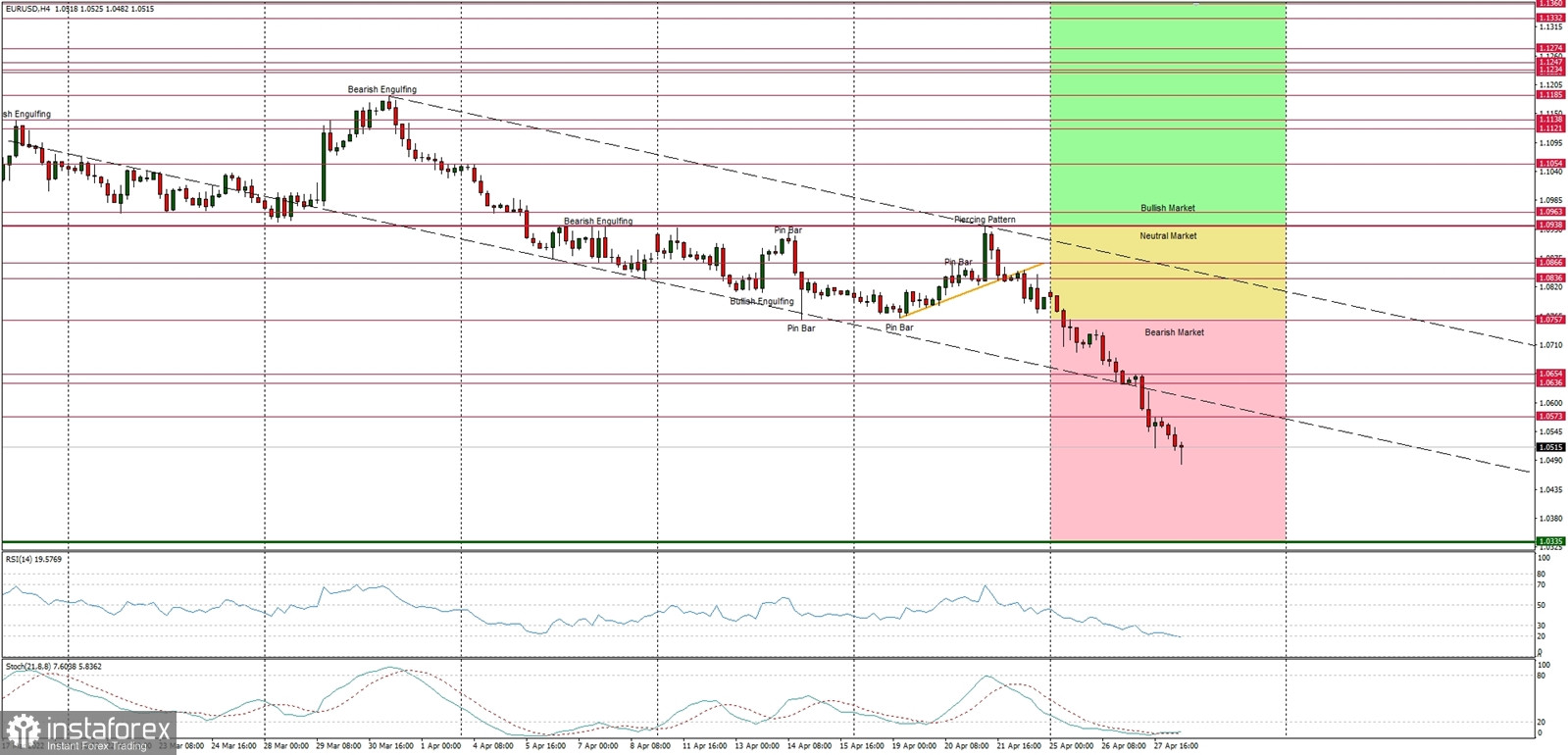

Technical Market Outlook

The EUR/USD pair had broken below the last week low seen at the level of 1.0757 and made a new swing low at the level of of 1.0481, however, in a case of the down move continuation, the next target for bears is seen at the level of 1.0336. This level is the key long-term technical support from 2020, so please keep an eye on the market behaviour around this level. The nearest technical resistance is located at 1.0654. Despite the oversold market conditions on the H4 and Daily time frame charts, the down trend continues and there is no indication of trend termination or reversal just yet. Weak and negative momentum supports the short-term bearish outlook.

Weekly Pivot Points:

WR3 - 1.1064

WR2 - 1.0994

WR1 - 1.0884

Weekly Pivot - 1.0825

WS1 - 1.0717

WS2 - 1.0643

WS3 - 1.0535

Trading Outlook:

The market is still in control by bears that pushed the price way below the level of 1.1185, so a breakout above this level is a must for bulls for a trend reversal. The next long-term technical support is located at 1.0639. The up trend can be continued towards the next long-term target located at the level of 1.1494 (high from 06.02.2022) only if bullish cycle scenario is confirmed by breakout above the level of 1.1186 and 1.1245, otherwise the bears will push the price lower towards the next long-term target at the level of 1.0639 or below.

Analysis are provided byInstaForex.

-

29-04-2022, 07:11 AM #3533

Forex Analysis & Reviews: Elliott wave analysis of GBP/JPY for April 29, 2022

GBP/JPY is correcting nicely from the 168.43 peak and we should see more downside force being added in the near-term towards our first downside target at 158.15, but this support will likely break after a short while for a continuation towards support at 154.41 and possibly closer to 150.04.

So continue to look for more downside pressure near term.

Analysis are provided byInstaForex.

-

02-05-2022, 07:20 AM #3534

Forex Analysis & Reviews: Technical Analysis of EUR/USD for May 2, 2022

Technical Market Outlook

The EUR/USD pair had made a new swing low at the level of 1.047 and in the meantime, the bulls are trying to bounce towards the lower channel line located around the level of 1.0573, which is the nearest technical resistance as well. So far they failed to move back into the descending channel, so in a case of the down move continuation, the next target for bears is seen at the level of 1.0336. This level is the key long-term technical support from 2020, so please keep an eye on the market behavior around this level. Despite the oversold market conditions on the H4 and Daily time frame charts, the down trend continues and there is no indication of trend termination or reversal just yet. Weak and negative momentum supports the short-term bearish outlook.

Weekly Pivot Points:

WR3 - 1.1064

WR2 - 1.0933

WR1 - 1.0710

Weekly Pivot - 1.0591

WS1 - 1.0363

WS2 - 1.0252

WS3 - 1.0032

Trading Outlook:

The market is still in control by bears that pushed the price way below the level of 1.1185, so a breakout above this level is a must for bulls for a long-term trend reversal. The up trend can be continued towards the next long-term target located at the level of 1.1494 (high from 06.02.2022) only if bullish cycle scenario is confirmed by breakout above the level of 1.1186 and 1.1245, otherwise the bears will push the price lower towards the next long-term target at the level of 1.0336 or below.

Analysis are provided byInstaForex.

-

03-05-2022, 07:08 AM #3535

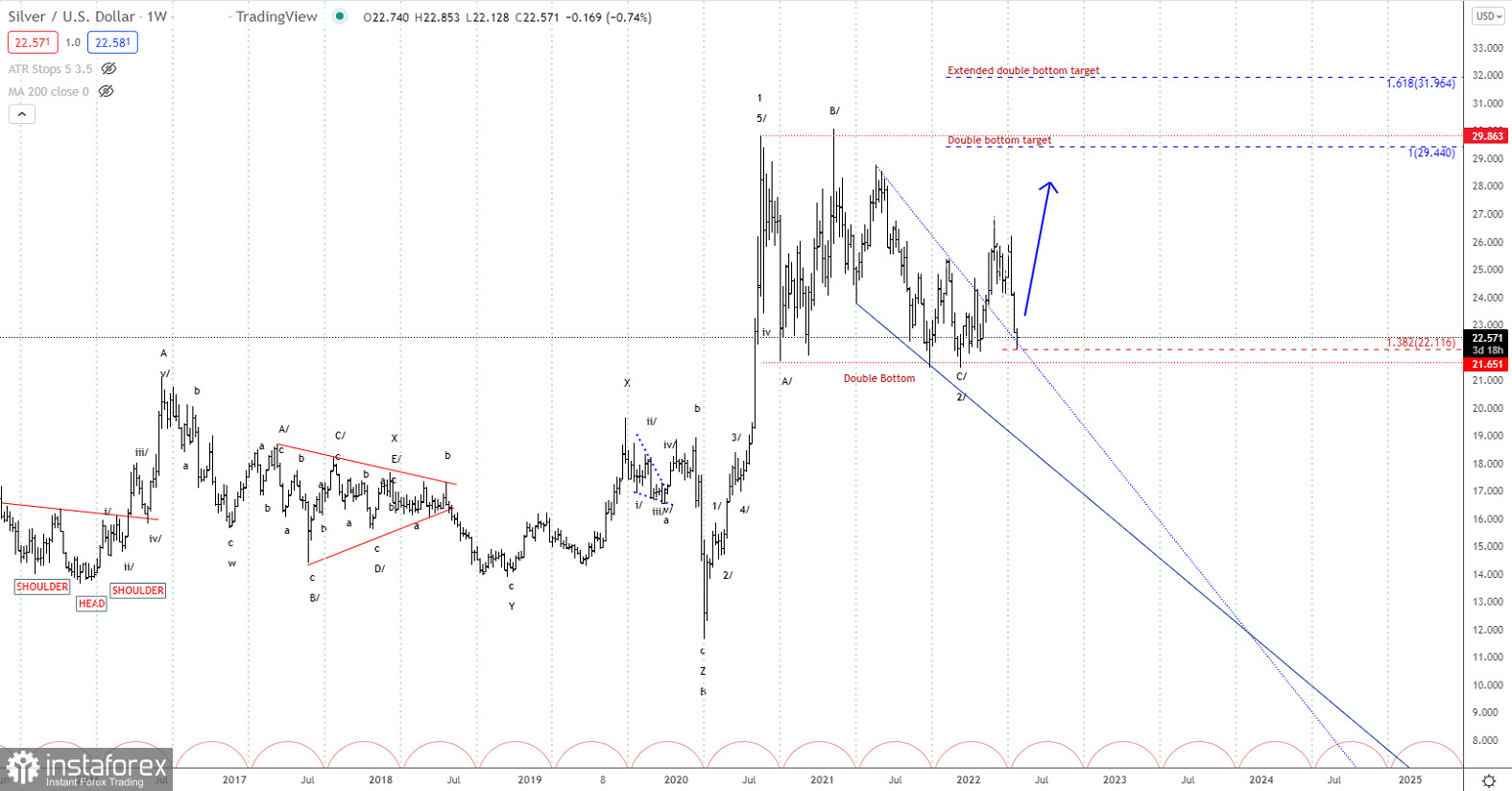

Forex Analysis & Reviews: Elliott wave analysis of Silver for May 3, 2022

Silver is testing support at 22.16 and could be ready for the next impulsive rally towards resistance at 30.00 and a break above here will release the energy for a continuation higher to the all-time high at 50.00. That said, if minor resistance at 23.56 is able to cap the upside, then silver could move closer to strong support near 21.65 before being ready to rally in the next impulsive move higher.

So for now we need to stay flexible and observe the market behavior near 22.16 and more importantly near minor resistance at 23.56 as a break will indicate the correction is complete and the next rally towards 30.00 is in motion.

Analysis are provided byInstaForex.

-

04-05-2022, 06:35 AM #3536

Forex Analysis & Reviews: USDJPY, Potential for Bullish Continuation | 4th May 2022

On the H4, with price moving above the Ichimoku cloud, we have a bullish bias that price will rise to our 1st resistance at 131.240 where the swing high resistance is from our 1st support at 129.374 in line with the horizontal pullback support and 50% and 78.6 Fibonacci retracement. Alternatively, price may break 1st support structure and head for 2nd support at 127.240 where the horizontal swing low support is.

Trading Recommendation

Entry: 129.374

Reason for Entry:

Horizontal pullback support and 50% and 78.6 Fibonacci retracement

Take Profit:131.240

Reason for Take Profit: Horizontal swing high resistance

Stop Loss: 127.240

Reason for Stop Loss:

Horizontal swing low support

Analysis are provided byInstaForex.

-

05-05-2022, 06:58 AM #3537

Forex Analysis & Reviews: Forecast for EUR/USD on May 5, 2022

As a result of yesterday's Federal Reserve meeting, investors decided to postpone a large-scale attack on counter-dollar assets. The reason for this decision was a slight slowdown by the Fed in the pace of balance sheet reduction: the markets expected that the central bank would immediately reduce the balance sheet at a rate of $95 billion per month, but it was decided to start with $47.5 billion per month, bringing the forecast rate to $95 billion. billion in three months. The rate, as expected, was increased by 0.50%. An increase of 0.50% was also announced for the next meeting in June.

The euro rose by 103 points, but we do not expect this momentum to develop. On Friday, the data on employment in the US is expected to reduce unemployment from 3.6% to 3.5%. As before, the euro has little cause for optimism, we just have to wait for the technical signs of a recovery in the strengthening of the dollar.

The price is in a downward trend on the daily chart – the Marlin Oscillator is in the negative area. If there are no new surprises, then Marlin will not enter the zone of positive values.

The situation is growing on the four-hour scale. To change the trend, at least one condition must be fulfilled: the price should fall under the MACD line (1.0556), the transition of the Marlin Oscillator to the negative area. Apparently, this will happen tomorrow.

Analysis are provided byInstaForex.

-

06-05-2022, 07:30 AM #3538

Forex Analysis & Reviews: Technical Analysis of EUR/USD for May 6, 2022

Technical Market Outlook

The EUR/USD pair bounce had been capped at the level of 1.0636 after the Pin Bar candlestick pattern was made at the H4 time frame chart. The oversold market conditions on the Daily time frame chart, indicate the down trend continues and there is no indication of trend termination or reversal just yet. The nearest technical support is located at 1.0469. The bearish market border is located at 1.0755, so there is still a room for bears to try to resume the down trend.

Weekly Pivot Points:

WR3 - 1.1064

WR2 - 1.0933

WR1 - 1.0710

Weekly Pivot - 1.0591

WS1 - 1.0363

WS2 - 1.0252

WS3 - 1.0032

Trading Outlook:

The market is still in control by bears that pushed the price way below the level of 1.1185, so a breakout above this level is a must for bulls for a long-term trend reversal. The up trend can be continued towards the next long-term target located at the level of 1.1494 (high from 06.02.2022) only if bullish cycle scenario is confirmed by breakout above the level of 1.1186 and 1.1245, otherwise the bears will push the price lower towards the next long-term target at the level of 1.0336 or below.

Analysis are provided byInstaForex.

-

09-05-2022, 07:15 AM #3539

Forex Analysis & Reviews: Elliott wave analysis of GBP/JPY for May 9, 2022

We see a should/Head/Should top building and the neckline support currently sitting near 159.63 a clear break below the neckline support will call for a continuation lower towards support at 157.96 and 154.14 as the next downside targets.

The neckline support should not be to difficult to break confirming the top and the continuation of wave C lower towards support near 134.14 and possibly even lower towards the 50% target at 150.09.

Analysis are provided byInstaForex.

-

10-05-2022, 06:51 AM #3540

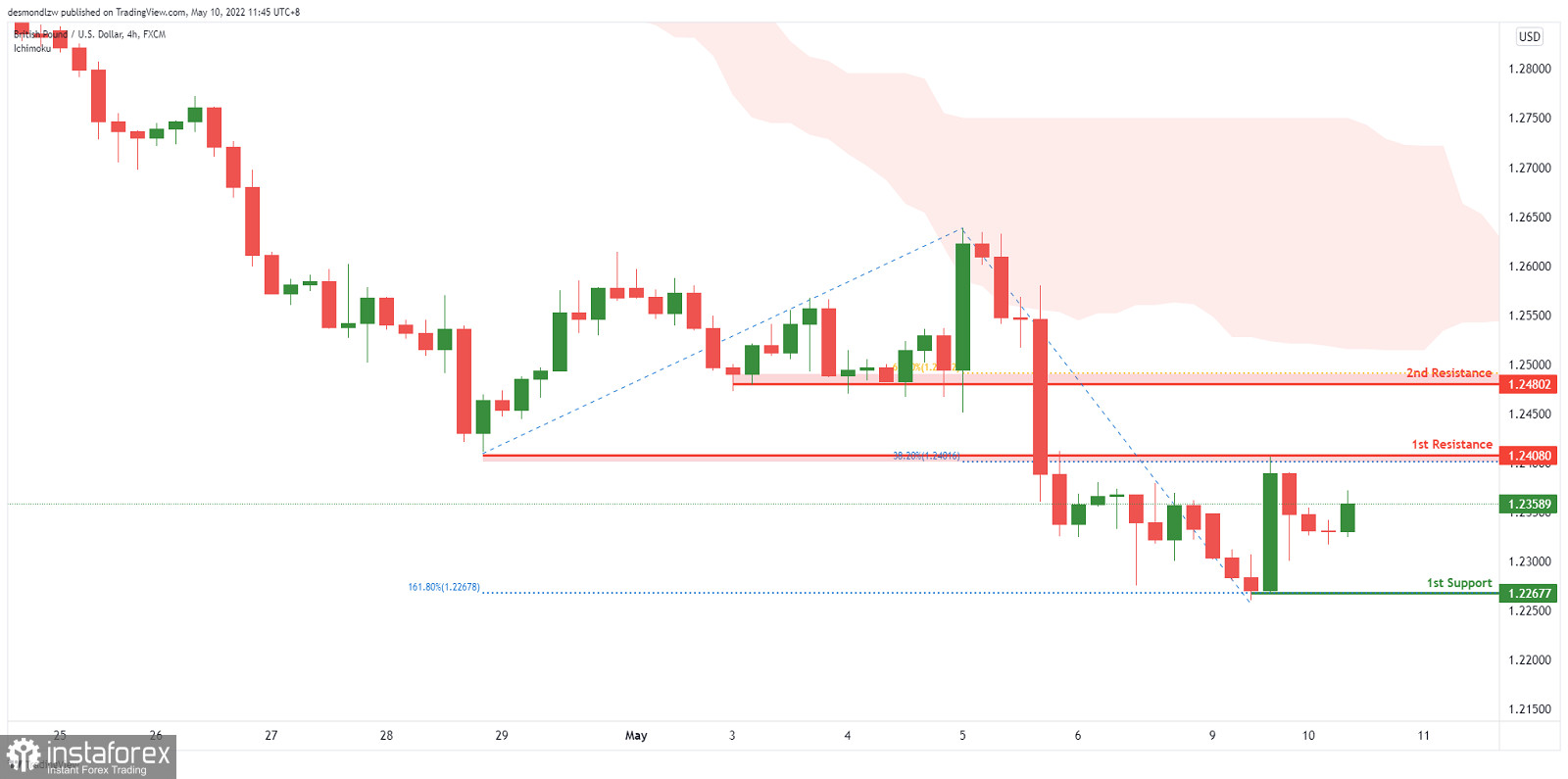

Forex Analysis & Reviews: GBPUSD Potential for Bearish Continuation | 10th May 2022

On the H4, with price moving below the Ichimoku cloud, we have a bearish bias that price will drop from our 1st resistance at 1.24080 where the 38.2% Fibonacci retracement and pullback resistance is to our 1st support at 1.22677 in line with the 161.8% Fibonacci extension and horizontal swing low support is. Alternatively, price may break 1st resistance structure and head for 2nd resistance at 1.24802 in line with the 61.8% Fibonacci retracement.

Trading Recommendation

Entry: 1.24080

Reason for Entry:

38.2% Fibonacci retracement and pullback resistance

Take Profit:1.22677

Reason for Take Profit:161.8% Fibonacci extension and horizontal swing low support

Stop Loss: 1.24802

Reason for Stop Loss:

61.8% Fibonacci retracement and horizontal pullback support

Analysis are provided byInstaForex.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 2 users browsing this thread. (0 members and 2 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote