Forex Analysis & Reviews: Forecast for USD/JPY on March 2, 2022

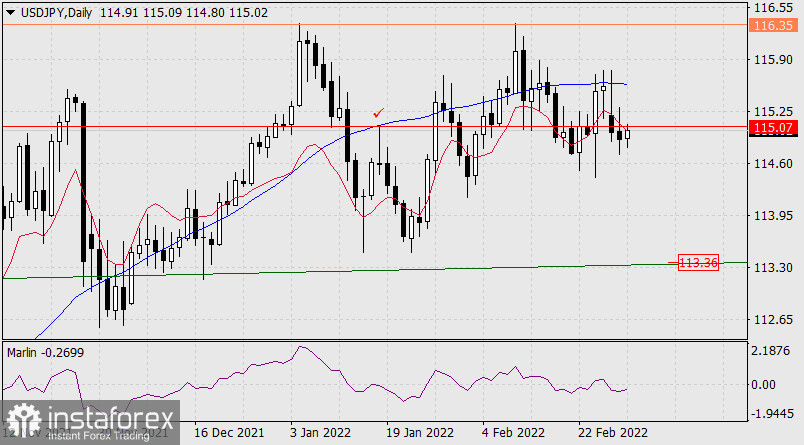

Yesterday, the USD/JPY pair settled below the balance indicator line of the daily scale and below the target level of 115.07 (peak on January 18). The Marlin Oscillator appears to have settled in the area of the downward trend. The US stock index S&P 500 lost 1.55% yesterday. The Japanese Nikkei 225 is down 1.71% in today's Asian session. All these technical circumstances increase the likelihood of a downward movement with the target at 113.36.

On the four-hour chart, the local price growth of the last 3-4 candles occurs below the balance indicator line, which indicates the corrective nature of this growth. The Marlin Oscillator in the negative area. The signal to continue the decline, to accelerate the pace, will be the transition of the price under yesterday's low at 114.71.

Analysis are provided byInstaForex.

Please visit our sponsors

Results 3,491 to 3,500 of 4086

Thread: InstaForex Wave Analysis

-

02-03-2022, 06:06 AM #3491

-

03-03-2022, 07:09 AM #3492

Forex Analysis & Reviews: Trading plan for EURUSD for March 03, 2022

Technical outlook:

EURUSD dropped through 1.1057 lows in the late New York Session on Wednesday before finding support and pulling back. The single currency pair then rallied through 1.1140 levels taking out short term resistance. Prices are retracing a bit at the time of writing trading close to 1.1100-05 levels and bulls are expected to be back in control soon.

EURUSD needs to stay above 1.1057 interim support/low to keep the near term bullish scenario intact. The recent drop between 1.1500 and 1.1057 could be the last leg lower as it has been accompanied by a strong bullsh divergence on the RSI. High probability remains for a bullish reversal from here and push through 1.1500 near term.

EURO bulls are preparing to stage an impressive rally in the next few trading sessions targeting 1.1500 resistance. A break there will confirm that bulls have registered themselves and are here to stay for long. A push through 1.1143 from here will accelerate towards 1.1200 and 1.1300 levels immediately.

Trading plan:

Potential rally through 1.1500 against 1.1000

Good luck!

Analysis are provided byInstaForex.

-

04-03-2022, 08:57 AM #3493

Forex Analysis & Reviews: Forecast for EUR/USD on March 4, 2022

The euro fell by 50 points on Thursday. The lower shadow of the daily candle was the puncture of the target level of 1.1060, this morning the euro is losing about 50 more points, so the road to the nearest target of 1.0910 is open. Breaking the level will open the second target at 1.0825. Things are moving towards the fact that the double gap around the level of 1.1280 (marked with a gray rectangle) will not be closed, as it already accepts a different technical interpretation of the double gap not being closed as a sign of a long-term trend. We suspect that the euro is moving towards below parity in the not too distant future.

The signal line of the Marlin Oscillator went down from its own channel, intending to enter the oversold zone.

The 4-hour chart shows how the price paused at the target level of 1.1060 and accelerated the decline. Marlin's signal line exits the triangle down. We are waiting for a further decline in the euro to the specified goals.

Analysis are provided byInstaForex.

-

07-03-2022, 08:37 AM #3494

Forex Analysis & Reviews: Technical Analysis of ETH/USD for March 7, 2022

Crypto Industry News:

The Korean Digital Asset Industry Committee, made up of South Korea's leading Blockchain experts, has called for a government committee to be formed to help and develop digital asset companies in the country.

The expert group discussed the various ways in which Korea could become a leading marketplace for digital assets and what role the government should play to achieve this. Experts believe Blockchain technology and cryptocurrencies will become key tools of the fourth industrial revolution.

Experts called on the government to support the nascent cryptocurrency industry and other emerging use cases such as decentralized finance, decentralized autonomous organizations, NFT tokens and metaverse.

South Korea's cryptocurrency laws are seen as one of the strictest, considering that nearly 200 small and medium-sized cryptocurrency exchanges had to shut down after regulators issued an injunction for crypto exchanges to create accounts with real usernames.

The Financial Conduct Authority, the country's chief regulator, also banned exchanges from conducting anonymous transactions and banned the use of private wallets. Regulators previously proposed a 20% tax on cryptocurrency profits, but the proposal was postponed due to a lack of clarity on cryptocurrency laws. While regulators have taken a strict stance on the virtual asset market, they seem quite positive about the Metaverse as the country announced $187 million investment for the domestic Metaverse project.

Technical Market Outlook

The ETH/USD pair had broken below all of the Fibonacci retracement levels after the rejection from the technical resistance seen at $3,000 level. The bears are in control of the market and the target for them is located at the swing low seen at $2,302. The momentum is weak and negative, so even despite the extremely oversold market conditions on the H4 time frame the down move might continue for some time. The immediate technical resistance is seen at the level of $2,568. Only a clear and sustained breakout above the trend line resistance located around $3,024 level would change the outlook to bullish in the near time.

Weekly Pivot Points:

WR3 - $3,323

WR2 - $3,179

WR1 - $2,855

Weekly Pivot - $2,718

WS1 - $2,386

WS2 - $2,240

WS3 - $1,190

Trading Outlook:

The market keeps trying to bounce higher after over the 50% retracement made since the ATH at the level of $4,868 was made. The level of $3,192 is the next key Fibonacci retracement for bulls, but the bulls had failed to break through three times already. On the other hand, the next long-term technical support is located at $1,721 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term.

Analysis are provided byInstaForex.

-

08-03-2022, 06:37 AM #3495

Forex Analysis & Reviews: Forecast for GBP/USD on March 8, 2022

GBP/USD is falling very sharply. It declined by three figures over the past three days, with the price hitting 1.3115 on Monday. A further drop will bring the pair to 1.2853-1.2900, which are the November 2020 and December 2019 lows. A rebound seems impossible at the moment because yesterday's trading volumes were close to the yearly high, which is a clear signal for medium-term sell-offs.

The Marlin oscillator also formed a convergence in the four-hour chart, so it is likely that many traders will take a break today and then continue their efforts for a deeper decline.

Analysis are provided byInstaForex.

-

09-03-2022, 06:44 AM #3496

Forex Analysis & Reviews: Elliott wave analysis of Gold for March 9, 2022

Gold is currently testing the former all-time high at 2,074. It should just be a matter of time before this resistance is broken for a continuation higher towards 2,400 and ultimately higher towards our long-term target at 2,700.

Short-term we need to allow for some consolidation either just below the all-time high or just above the all-time high. If the consolidation takes place just below the all-time high at 2,074, we could see a correction towards 1,971 before the next rally higher towards 2,400 and 2,700.

Analysis are provided byInstaForex.

-

10-03-2022, 06:23 AM #3497

Forex Analysis & Reviews: Forecast for EUR/USD on March 10, 2022

EUR/USD gained 175 pips on Wednesday ahead of the meeting between Presidents Zelensky and Putin, the ensuing ceasefire and Ukraine's withdrawn bid for NATO membership. It hit 1.1060, but hesitated on it because the ECB will have a meeting on monetary policy today. Many expect the central bank to confirm its commitment to a soft policy, and if that happens, euro's downtrend will most likely recover, with the first target at 1.0825.

The pair is also bullish in the four-hour chart, signaled by the quote moving above the indicator lines. The Marlin oscillator is in the positive area, but if the pair dips under the MACD line, below 1.1000, then the quote will begin to decline again.

The breakdown of 1.1095 will trigger uncertainty because there are many weak historical levels that may cause increased volatility.

Analysis are provided byInstaForex.

-

11-03-2022, 06:11 AM #3498

Forex Analysis & Reviews: Forecast for GBP/USD on March 11, 2022

GBP/USD was the only currency pair that did not make false movements yesterday following the meeting of the European Central Bank. It fell by 95 points, clearly defining the targets 1.2853-1.2900.

In the four-hour chart, the pair went under 1.3115 this morning, with the Marlin oscillator going into the bearish area.

Most likely, it would continue dipping today as the data on the UK trade balance for January will be released, and many expect it to show a decrease from 12.3 billion to 12.6 billion.

Analysis are provided byInstaForex.

-

14-03-2022, 06:43 AM #3499

Forex Analysis & Reviews: Elliott wave analysis of Silver for March 14, 2022

Silver has activated the double bottom for a rally towards the double bottom target at 29.28 and likely even closer to the extension target at 31.70. Longer-term a break above the former top at 30 should trigger a continuation higher towards the all-time higher near 50.00.

Support remains at 25.40 but even a small break below here,

Analysis are provided byInstaForex.

-

15-03-2022, 07:00 AM #3500

Forex Analysis & Reviews: Forecast for AUD/USD on March 15, 2022

The Australian dollar confirmed our yesterday's thesis about the prospect of a rapid decline as a recovery of balance with other world currencies after its previous four-month growth outstripping the market. The aussie's fall from yesterday was 100 points, the MACD line of the daily scale was reached. This morning, the price continued its decline with overcoming this support line. The Marlin Oscillator is in the downward trend zone. The 0.7065 target is open.

The price is completely in a downward position on the four-hour chart - it is falling below the indicator lines, the MACD line itself has turned to decline. The Marlin Oscillator may soon enter the oversold zone, but under the pressure of fundamental factors, it may end up there for several days.

Analysis are provided byInstaForex.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote