OctaFX.Com - Forex: US Dollar Weakest on Friday; Euro Up After German Data, ECB Speak

ASIA/EUROPE FOREX NEWS WRAP

The final day of the three day liquidity drawdown has arrived, and price action on Friday has been moderately bullish for high beta currencies and risk-correlated assets. There’s been decent follow-through on yesterday’s advances by the Australian and New Zealand Dollars, as well as the Japanese Yen and the Euro, as the US Dollar is the worst performing currency across the board.

Mainly, there’s been some positive news flow out of Europe allowing for the continued rebound in risk-appetite, as any such headlines out of the United States are absent amid the Thanksgiving holiday.

On the data front, a German business confidence reading outperformed expectations, helping ease concerns that the Euro-zone’s largest economy was starting to slide towards recession; perhaps this pace has been stalled.

On the European news side, there have been a few more reports that Spain is inching towards a bailout agreement, which is bullish for the EUR/USD has it means the European Central Bank’s OMTs would be active, essentially placing a cap on short-term Spanish yields. ECB President Mario Draghi reminded market participants of this today, saying ‘if and when’ (paraphrasing) the OMTs need to be implemented, the ECB stands ready to go.

Furthermore, the developments on Greece have been frustrating yet hopeful, with another Euro-zone finance ministers’ meeting on November 26. Round the clock negotiations this week fell short of any major compromise, although it was agreed upon that Greece would receive another two years to fulfill its obligations; another round of elections resulting from brinksmanship could be a major setback.

Taking a look at European credit, peripheral bond yields are mostly higher, preventing the Euro from rallying further. The Italian 2-year note yield has decreased to 1.977% (-3.3-bps) while the Spanish 2-year note yield has increased to 2.983% (+1.0-bps). Similarly, the Italian 10-year note yield is unchanged at 4.771% while the Spanish 10-year note yield has increased to 5.648% (+2.3-bps); higher yields imply lower prices.

READ MORE

Nov 23, 2012

OctaFX.Com News Updates

Please visit our sponsors

Results 191 to 200 of 769

-

23-11-2012, 03:31 PM #191Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

-

26-11-2012, 07:36 PM #192Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com -FOREX Trading: US Dollar Support Probably at Slightly Lower Levels

As focused in FX Technical Weekly on Friday, the confluence of technical levels across multiple markets suggests that recent moves may extend for one or two days before markets reverse yet again.

The mid 1420s should produce a top in the S&P. The 61.8% retracement of the decline from the top comes in at 1424.20. The 100% extension of the rally from the low (1342.10-1390.90 from 1379.10) is at 1427.80. More importantly, 1424.90 is the April high and within the vicinity of pivots since August (circled). Weakness below 1388.90 would suggest that top is in place.

I’m on the lookout for a low and opportunity to turn bullish again near 9945 in the USDOLLAR.

The EURUSD has responded to the 61.8% retracement of the decline from 13172, trading sideways to open the week. Near term pattern suggests slightly higher prices in stair step fashion (4th and 5th waves) before exhaustion. Resistance extends to 13070.

The AUDUSD is little changed to begin the week. Expect the current move to extend slightly higher. 10550, the 9/14 reversal day close and 161.8% extension of 10287-10424, is a level that may produce the next top. I remain long from last week (10340 entry) but am looking to reverse the position near 10550.percent at 106.12 yen.[/B]

Nov 26, 2012

OctaFX.Com News Updates

-

26-11-2012, 08:11 PM #193Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com -Forex Strategy: US Dollar and Japanese Yen Weakness Likely

The US Dollar has traded to fresh monthly lows against the Euro and other key currencies, while the Japanese Yen trades beyond major support levels. Extremely low forex options market volatility expectations support the case for further JPY and USD weakness.

DailyFX PLUS System Trading Signals –The US Dollar (ticker: USDOLLAR) trades at fresh monthly lows against all except the similarly weak Japanese Yen – we see scope for further USD and JPY lows.

Pronounced downtrends in the US Dollar and Japanese Yen have made for powerful trend trading through recent price action, and we see scope for continued outperformance in several trend trading strategies. The Euro trades at fresh monthly highs against the US Dollar and 7-month peaks against the Japanese Yen.

The trend is up until it isn’t, and we won’t go against the recent EURUSD and EURJPY uptrends unless (USD and JPY downtrends) until there are real signs of capitulation. In the meantime our trend-based “Tidal Shift/Momentum2” trading system remains our preferred strategy across a range of USD and JPY pairs.

The probabilities of an important USD and JPY reversal have clearly grown as both currency have fallen sharply from recent peaks; further bets on continued weakness are clearly risky. Yet we see few important signs of capitulation, and indeed we would argue that buying into US Dollar and Japanese Yen weakness seems far more risky.

Seasonal trends show that the end of the month/beginning of the new trading month can often bring changes in trend. But we’ll need to see real signs of reversal before advocating a shift in general trading bias.

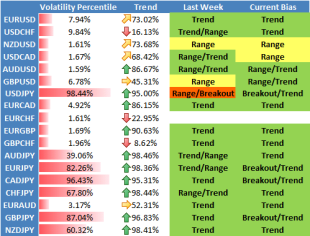

DailyFX Individual Currency Pair Conditions and Trading Strategy Bias

Market Conditions: The US Dollar has traded to fresh monthly lows amidst exceedingly low FX market volatility.

Any important reversals for the safe-haven US currency may need to wait for a similarly significant shift in market conditions. FX options continue to show the lowest volatility expectations since 2007—arguably supporting further USD and JPY weakness.

Nov 26, 2012

OctaFX.Com News Updates

-

27-11-2012, 03:01 PM #194Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com - Forex Analysis: S&P 500 Chart Setup Hints US Dollar Support to Hold

THE TAKEAWAY: S&P 500 technical positioning warns of a turn lower ahead, hinting the safe-haven US Dollar may manage to hold up at support and position for recovery.

US DOLLAR TECHNICAL ANALYSIS– Prices broke below the 23.6% Fibonacci retracement at 9993 to challenge the bottom of a rising channel set from mid-September (now at 9970). A break below this boundary initially exposes the 38.2% level at 9945. Alternatively, a break back above 9993 aims for the November 16 high at 10071.

Daily Chart - Created Using FXCM Marketscope 2.0

S&P 500 TECHNICAL ANALYSIS – Prices are showing a Hanging Man candlestick below resistance at 1408.50, the 50% Fibonacci retracement. This barrier is reinforced by a falling trend line set from mid-October. A turn lower sees initial support at 1392.80, the 38.2% retracement, with a break below that aiming to challenge the 23.6% level at 1373.40. Alternatively, a push above resistance exposes the 1424.90-30.90 area.

READ MORE

Nov 27, 2012

OctaFX.Com News Updates

-

27-11-2012, 03:25 PM #195Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com - Forex News: Euro Fails to Maintain Greece Deal Gains

The Europe we saw at the beginning of today’s session was very different than the Europe of yesterday, at least from a trader’s perspective.

Per the overnight announcement in forex news sources, Euro-zone leaders came to an agreement on Greece that lowered interest rates, returned some of the money made off of previous loans, and setup the release of the next 34.4 billion Euro aid tranche in December. What we heard from European officials following the announcement was overwhelmingly positive. German Economy Minister Roesler said the Greek Deal is a positive sign for the Euro. EU’s Barroso welcomed the deal, while German FM Westerwelle said the aid plan is a good result that is based on reforms. German lawmakers will vote on the Greek plan on November 29.

However, the Euro rally following the news of the Greece deal couldn’t even sustain 1.3000 against the USD, as the key level quickly returned to providing resistance after being briefly broken. To see some of the criticisms of the deal, please look at DailyFX Currency Strategist Ilya Spivak’s Euro Open.

The other major piece of news was the appointment of Bank of Canada Governor Mark Carney as the new governor of the Bank of England starting in July. Current BoE Governor King said the UK chose a really outstanding candidate, and Carney is the first foreigner to be chosen for the position. Sterling rallied thirty points higher from 1.6000 following the announcement.

Current BoE Governor King was speaking today at an inflation report to the UK parliament. He said that the BoE outlook is for a slow economic recovery, and UK inflation to remain above target for some time. The UK GDP grew 1% in Q3 according to a second estimate released today. The BoE has previously said that the sudden growth was due to one time factors and the economy may slip back into negative growth during Q4.

Also today, the US Dollar rose a bit when Fed member Fisher said during a speech in Berlin that he advocates setting limits to QE as soon as the next meeting. Fisher said that the US’s biggest problem is unemployment and that inflation is under control in the US. He also said that he was never in favor of operation twist.

The Euro has now erased all of the gains following the Greece announcement and is trading slight above 1.2950 against the US Dollar in currency markets. Resistance could now be provided by the key 1.3000 line, and support could be provided at the recent support level of 1.2824.

EURUSD Daily: November 27, 2012

Nov 27, 2012

OctaFX.Com News Updates

-

27-11-2012, 03:49 PM #196Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com - Forex Analysis: US Dollar Classic Technical Report 11.27.2012

Prices broke below the 23.6% Fibonacci retracement at 9993 to challenge the bottom of a rising channel set from mid-September (now at 9970). A break below this boundary initially exposes the 38.2% level at 9945.

Alternatively, a break back above 9993 aims for the November 16 high at 10071.

Nov 27, 2012

OctaFX.Com News Updates

-

27-11-2012, 04:15 PM #197Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com - Forex Analysis: NZD/USD Classic Technical Report 11.27.2012

Prices are testing resistance at the underside of a previously broken rising channel set from late May (0.8264).A push above that targets a falling trend line at 0.8292. Initial support lines up in the 0.8051-82 area, with a drop below that exposing the 0.80 figure and the 50% Fibonacci retracement at 0.7962.

Daily Chart - Created Using FXCM Marketscope 2.0

Nov 27, 2012

OctaFX.Com News Updates

-

28-11-2012, 02:45 PM #198Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

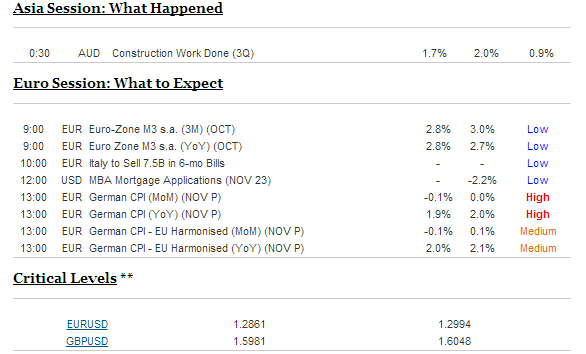

OctaFX.Com -Forex Analysis: Euro May Fall as Soft German CPI Drives ECB Easing Bets

The Euro may face further selling pressure as German inflation slows to the weakest in four months, driving ECB monetary easing expectations.

Talking Points

- Japanese Yen Gains as Asian Stocks Drop on Greece Deal Rethink, “Fiscal Cliff” Jitters

- Euro May See Selling Pressure as German CPI Drop Drives ECB Easing Expectations

- US Home Sales, Beige Book May Buoy Dollar vs. Yen, Drive Weakness vs. Comm Bloc

The Japanese Yen outperformed in overnight trade as a drop in Asian stocks drove demand for the regional safe-haven currency. The MSCI Asia Pacific benchmark index lost 0.5 percent, with the newswires citing ominous comments from the OECD warning a global recession could follow a failure to avert the US fiscal cliff as the catalyst.

A reconsideration of yesterday’s Eurogroup summit outcome likely added to negative cues. A knee-jerk reaction to the headline claiming a deal on Greece had been reached buoyed risk appetite yesterday but sentiment was quick to unravel as markets digested the details of the arrangement, as expected. Indeed, the Euro lagged its top counterparts in Asian hours.

Looking ahead, the preliminary set of November’s German CPI figures headlines the calendar. Expectations call for the headline inflation rate to drop to 1.9 percent, the lowest in four months. The outcome may weigh on the Euro as forex traders take softening price pressure to mean the ECB has added room for further easing amid signs of deepening recessionin the wake of deteriorating economic data (particularly the recent run of region-wide PMI figures).

Later in the day, the spotlight turns to the Federal Reserve Beige Book survey of regional economic conditions. Separately, US New Home Sales are expected to hit 390,000 in October, marking the highest reading since April 2010. Signs of firming recovery in the US may prove supportive yields and boost the US Dollar against the Japanese Yen while weighing on the greenback against the growth-geared commodity bloc currencies (Australian, Canadian and New Zealand Dollars).

Nov 28, 2012

OctaFX.Com News Updates

-

28-11-2012, 03:17 PM #199Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com - Forex News: Euro Trading Steady Above 1.2900 Ahead of German Inflation

Now that more than 24 hours have passed since the Greece bailout agreement, most of the responding chatter has already been exhausted, and we have been left in today’s European session without a major fundamental story to guide trading. The major story currently affecting asset markets is the impending US fiscal cliff, and Harry Reid’s comments, that not much progress on a deal has been made, sent US equities lower in yesterday’s session.

Furthermore, despite the lack of an upcoming major market moving event, a lot of analysts are calling for a reversal of recent Euro gains, as EURUSD trading showed a false break of 1.3000 in yesterday’s session. DailyFX Currency Strategist Ilya Spivak said he continues to hold the pair short, and Chief Strategist John Kicklighter said in his daily market wrap-up that he initiated a EURJPY short.

The only European data release that could possibly affect trading is the German inflation for November; the average expectation among Bloomberg surveyed analysts is for a 1.9% annual rise in consumer prices.

Also, there has been some small amounts of chatter in today’s session about the Greece deal. ECB member Nowotny said that the agreement was the best of all alternative solutions. Nowotny said that there are no ideal solutions for Greece and that a debt cut is not on the table anymore. He also remarked that Greece has implemented massive reforms, but it is still not enough.

Additionally we heard a prediction from the Bank of Spain that data indicates that the Spanish GDP will continue to fall in Q4, and that ECB measures are starting to wear out. France Finance Minister Moscovici said that the French GDP will rise by 0.8% in 2013. In England, MPC member Bean said the Bank of England hasn’t shut the door on further quantitative easing and that uncertainty is limiting stimulus effectiveness.

The Euro is currently trading above 1.2900 against the US Dollar in forex markets. Resistance might continue to be provided by the key 1.3000 line, and support could be provided by a previous support line around 1.2824.

EURUSD Daily: November 28, 2012

Nov 28, 2012

OctaFX.Com News Updates

-

28-11-2012, 03:46 PM #200Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com - Banks see decline in profits from currency trading, WSJ reports

The banking industry is seeing a significant decline in profits from currency trading, as once-lucrative businesses are eroded by electronic trading and the proliferation of new platforms, reports the Wall Street Journal.

Nov 28, 2012

OctaFX.Com News Updates

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote