OctaFX.Com -Canadian Dollar Forecast Turns Bullish on USD Weakness

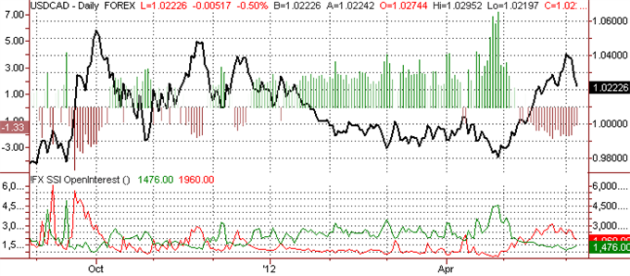

Forex retail trading crowds are now their least short US Dollar (ticker: USDOLLAR) versus the Canadian Dollar since the USDCAD first crossed above the CS$1.00 mark. We unabashedly called for important USDCAD gains as crowds sold into rallies. Yet short positions are down 22 percent since last week while longs have risen 19 percent.

As with other US Dollar pairs, we believe that the Canadian Dollar stands to benefit as the USD itself looks likely to correct lower through short-term trading. (USDCAD losses)].

Jun 07, 2012 14:43

OctaFX.Com News Updates

Please visit our sponsors

Results 91 to 100 of 769

-

07-06-2012, 09:55 PM #91Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

-

14-06-2012, 09:56 AM #92Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com - Merkel firmly behind euro, but will she act?

Germany's Merkel stresses commitment to saving euro, but will she act?

BERLIN (AP) -- Germany's Chancellor Angela Merkel has insisted repeatedly that "if the euro fails, Europe fails."

Now the crisis in the 17 countries that use the euro is coming back to the boil, with Spain admitting it needs help to rescue its banks and voters in Greece deciding whether to back a party that could pull out of the single currency. And all eyes are on economic powerhouse Germany to see what it will do to save Europe's union from collapse.

There's no denying Merkel's commitment to keeping the common currency together. But that doesn't mean she's ready to take the politically difficult measures many say are needed to save the day. She appears torn between freeing funds to rescue a wider European dream and pressures from her narrower power base at home.

Which way she turns will be critical to Europe's future — and the fate of the global economy.

The two sides of the leader who can make or break the common currency have been on prominent display at crucial moments of the crisis.

— As Europe's No. 1 budgetary hawk, Merkel was the architect last year with former French President Nicolas Sarkozy of a strict set of fiscal rules designed to put a lid on the chaos of too many governments holding too much debt.

— But she also has a pragmatic side. Notably, she has shown flexibility in signing up to rescue packages she initially resisted — starting with the initial bailout deal for Greece in mid-2010.

It's certainly in Germany's economic interests to ensure the euro has a future. Of Germany's €276 billion ($346 billion) in exports in this year's first quarter, nearly €110 billion went to other eurozone countries. The full 27-nation EU accounted for more than half of its exports. So Germany desperately needs a stable market close to home.

It's also clear that Europe needs Germany: The nation's GDP of €2.6 trillion is 30 percent larger than that of France, the second biggest eurozone economy, meaning Germany alone has the funds to bail out the struggling bloc.

Still, absent a threat of immediate disaster, Merkel has shown little sign of budging from her insistence that help comes with strings attached, that thrift is a fundamental virtue and that there's no magic wand to save the euro. At the recent G8 summit of leading economic nations at Camp David, Merkel cut a lonely figure fending off pressure from fellow leaders to ditch austerity and jump-start growth.

When the global financial crisis first flared in 2008, Merkel famously invoked the "Swabian housewife" — the traditional personification of Germany's prudent housekeeping named after a region in the southwest of the country.

"She would have told us a piece of worldly wisdom," Merkel said: "You cannot live above your means in the long term." The image stuck.

Polls consistently show Merkel at or near the top of the list of Germany's most popular politicians. Her hard line on the crisis has a great deal to do with that popularity.

Merkel led calls to saddle Greece with tough austerity measures, such as cuts in public sector pay and pensions, as part of its two multibillion-euro rescue packages. Germans see it as just desserts for years of profligate spending, while they kept their finances in order.

But the spending cuts have left the Greek economy mired in a deep recession. Angered by the seemingly endless pain, Greeks have turned away from the two traditional parties in elections last month. They voted instead for more radical parties that have vowed to pull the country out of its bailout and austerity agreements. This weekend Greece faces another election. And if it backs a radical left party that promises to ditch its bailout terms, it's hard to see Merkel allowing Greek aid payments to keep flowing.

That could lead Greece to default and force it out of the euro, a move into uncharted territory that could undermine the entire global financial system.

The threat has held little sway in Germany. A poll by the Forsa agency released last week found that 62 percent of Germans want Merkel to stick to her tough line on Greece. And they favor — by 49 percent against 39 — a Greek exit from the common currency.

"I think her commitment to keep the euro alive is very strong, but I think it's not that strong to keep Greece within (it)," said Carsten Brzeski, senior economist at ING in Brussels. "They would like to keep Greece in but ... if Greece wants to go out as a result of the elections, then so be it."

The fact is, the direct effect of a Greek exit on the German economy would be small. Germany's €1.2 billion of first quarter exports to Greece amount to only a tiny fraction of what it sold to Europe as a whole. But Brzeski argues that there are broader risks: there would be a probability of losing billions of euros in German-guaranteed loans for Greece and the heightened danger of bailouts to other troubled countries such as Spain and Italy if Greece pulled out, neither likely to go down well with Germans.

And Merkel faces increasing criticism abroad for over-emphasizing austerity, notably from her longtime partner in fighting the economic crisis: France, which has a new Socialist president. Francois Hollande has rapidly become one of the strongest voices among European leaders pushing measures to boost growth.

One of these measures has been "eurobonds"— jointly issued debt that could be used to fund anything and could eventually replace an individual country's debt. Eurobonds would protect weaker countries by insulating them from the high interest rates they now face when they raise money on bond markets. Those high interest rates are ground zero of the crisis: They forced Greece, Ireland and Portugal to seek bailouts.

In the face of such pressure, Merkel has already shown signs of her other notable trait: pragmatism. She has started to soften her tone lately on promoting growth, hinting she'd be willing to do more as long as it means deeper European integration in the long run.

And there is a possibility that she will make further concessions. Ahead of elections due in Germany next year, the center-left opposition — from which Merkel needs support for her cherished European fiscal pact to be approved by Parliament — has begun demanding pro-growth measures.

Merkel's coalition recently proposed fostering growth by increasing the capital of the European Investment Bank, a development bank that lends money for public projects, using existing EU funds more efficiently and implementing structural reforms — but no more stimulus money.

Concessions aren't likely to include Eurobonds any time soon. They're politically toxic to Merkel's center-right coalition, unloved by other prosperous countries and could run into trouble with Germany's highest court, which has guarded parliament's control over the German budget.

More feasible may be a so-called debt redemption fund along lines proposed last November by the German government's panel of independent economic advisers. That would see a country's debts above 60 percent of GDP transferred to a common redemption fund with joint liability. They would be obliged to pay them off over 20-25 years and would have to pledge part of their foreign exchange or gold reserves as security.

Germany's opposition backs the idea. Merkel's spokesman, Steffen Seibert, said last week that "significant constitutional and legal concerns" need to be discussed.

Merkel herself cautioned last week against expecting a revolutionary "big design" to emerge from an EU leaders' summit at the end of this month. She made clear that she is still playing a long-term game to strengthen the eurozone through more centralized control of how governments run their economies. That will provide little comfort to Greeks hoping for a quick resolution as they head to the polls.

"We need not just a currency union; we also need a so-called fiscal union, more common budget policies. And we need above all a political union," she said. "That means that we must, step by step as things go forward, give up powers to Europe as well."

Jun 14, 2012 06:42

OctaFX.Com News Updates

-

14-06-2012, 10:25 AM #93Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com -Spain banks borrowed 324.6 billion euros from ECB in May

MADRID (Reuters) - Spanish banks borrowed a new record high of 324.6 billion euros from the European Central Bank in May, up from 316.9 billion euros in April, data from the Bank of Spain showed on Thursday.

The data reflected that banks remain largely shut of the interbank funding market as banks shy away from lending to each other in a worsening euro zone debt crisis.

Total net borrowing was 287.8 billion euros in May compared with 263.5 billion euros in April.

The data chime with figures from Portugal, where borrowing in May also hit a new record high of 58.7 billion euros.

Jun 14, 2012 08:13

OctaFX.Com News Updates

-

06-07-2012, 03:03 PM #94Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com -Finance chiefs confront Europe's unfinished business

BRUSSELS (Reuters) - Euro zone officials are cautioning against expecting any quick action from the currency bloc's finance ministers when they meet on Monday to sort out the tangle of loose ends and disagreements left by last month's EU debt-crisis summit.

Banking supervision, the use of European Union bailout money, aid to Spain and Cyprus and how to deal with Greece -- together it could take months to finalize, despite pressure from financial markets for clarity on the details.

Leaders from the 17 nations sharing the euro reached a deal in the early hours of last Friday to give the European Central Bank greater oversight of the bloc's banks and to use the euro zone's rescue funds to reduce countries' borrowing costs.

But after going beyond what many diplomats, finance officials and investors had expected, critical elements were left vague. Time-frames may already be slipping and opposition is building in euro zone hardliners the Netherlands and Finland.

"You have a Finnish problem. You have a Dutch problem. You have a German problem too," said one euro zone diplomat, pointing to the reservations of those countries about what was announced at the summit and German Chancellor Angela Merkel's reluctance to help its partners without strict conditions.

"I don't see a package done by Monday. They will work until the end of July or the beginning of August on these things," said the diplomat, who is involved in preparations for the Eurogroup meeting of euro zone finance ministers.

The meeting's crowded agenda may hamper progress. Discussing an aid package for Spain's banks, dealing with a request from Cyprus for emergency help, and whether to ease the conditions of Greece's second bailout are also on the table.

Euro zone leaders have committed to ECB-led supervision for banks, which would then allow the permanent rescue fund - the European Stability Mechanism - to recapitalize banks directly, rather than having to lend to governments.

That is seen as a major concession to Spain, which has requested a bailout of up to 100 billion euros ($125 billion) for its banks, but does not want to see that money added to its national debt and possibly push it towards a sovereign rescue.

Leaders agreed to remove the ESM's preferred creditor status when it lends to Spain, to calm investors who were worried they would not be repaid the money they had already lent.

They also decided that the ESM and the euro zone's temporary bailout fund, the EFSF, can buy euro zone bonds at auction and in the open market to lower borrowing costs, with some conditions attached but without a full program.

POLITICAL PROBLEMS

In their summit statement on June 29, leaders told the Eurogroup of finance minister "to implement these decisions by July 9". That now looks optimistic and delays could test market patience.

Ministers will look at the mechanics of how it will work in practice on Monday, but much depends on the ECB's crucial role as supervisor, which will need to be grounded in European law.

It now falls to the European Commission to propose such legislation, which is not expected until at least September.

"It will take at least until the first half of next year to be implemented," said Douglas Renwick, a director responsible for government credit ratings at Fitch Ratings.

"This could run into political problems. The major banks are often national champions and governments have been quite protective of them in the past. The idea of ceding oversight to a European level is a politically painful step to take."

Despite the obstacles to the broad package outlined by leaders, the range of measures agreed allow some short-term action, and vocal opposition to euro zone bond buying in the Netherlands and Finland is unlikely to ruin those plans.

Finland has said it opposes bond-buying in secondary markets, because it considers such purchases to be ineffective.

In emergency cases, the ESM's treaty allows for decisions to be taken with an 85 percent majority, and the Netherlands and Finland only account for 8 percent combined.

"The ESM discussion is being complicated by politicians talking to their electorates, but I think there is a consensus to move ahead with what was decided at the summit," said another euro zone official, briefed ahead of the Eurogroup.

TOUGH TROIKA

If only things were so straight forward for southern Europe.

Greece's new Finance Minister Yannis Stournaras said on Thursday he had been warned to expect a tough time at the Eurogroup, having acknowledged Athens was off course on its pledges linked to a 130-billion-euro rescue.

Ministers will discuss the findings of the "troika" of the European Union, the European Central Bank and International Monetary Fund from their first mission to Greece since the June 17 election. Another mission is due to return later in July.

Greece's Prime Minister Antonis Samaras wants to ease the terms of the bailout, but that would mean more money for Athens.

"Even if the second program as it stands were fully implemented, it is not clear that market access could resume (in 2015)," said David Mackie, an economist at JP Morgan. "A third program seems likely in any event."

For Spain, ministers are unlikely to sign off formally on an aid package for its banks as they are still awaiting an expert report on the situation, despite expectations of a July 9 deal.

"If the euro zone is to survive it has to be more integrated," said Fitch's Renwick. "Further difficult political concessions will have to be made over the coming years."

Jul 06, 2012 09:35

OctaFX.Com News Updates

-

06-07-2012, 03:19 PM #95Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com -US Dollar Inches Higher Ahead of NFPs; Japanese Yen Steady, Gold Lower

High beta currencies and risk-correlated assets have traded slightly lower against the world’s reserve currency, the US Dollar, ahead of the most important data release this week: the US Nonfarm Payrolls report for June. A significantly disappointing figure in May stoked expectations of a third round of quantitative easing from the Federal Reserve; and even though the Federal Reserve did not deliver on those hopes, as expected, there is speculation that another bombshell could reignite the conversation.

Meanwhile, some discouraging developments out of Europe have stunted any rebound in the Euro after the EURUSD broke out of its Symmetrical Channel to the downside in the wake of yesterday’s European Central Bank rate decision. As noted earlier this week, the performance of Italian and Spanish bond yields, especially on the shorter-end of the yield curve (in light of the two longer-term refinancing operations (LTRO), yields within the three-year umbrella are the most accurate gauge of funding stresses in the Euro-zone) have disappointed. The Italian 2-year note yield has risen to 3.733% (+10.3-bps) while the Spanish 2-year note yield has risen to 4.838% (+39.7-bps). The Italian 10-year note yield has risen to 6.015% (+6.3-bps) while the Spanish 10-year note yield has risen to 6.936% (+23.8-bps); higher yields imply lower prices.

RELATIVE PERFORMANCE (versus USD): 10:54 GMT

GBP: +0.12%

JPY: +0.05%

CHF: -0.10%

EUR: -0.12%

CAD: -0.14%

AUD:-0.28%

NZD: -0.29%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): +0.05%See More

Jul 06, 2012 10:58

OctaFX.Com News Updates

-

06-07-2012, 03:34 PM #96Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com -Stocks, euro slide on worries over U.S. jobs

NEW YORK (Reuters) - Stocks on major exchanges extended their losses on Friday and the euro hit 5-week lows after U.S. jobs data for June came in weaker than expected, fueling concerns that Europe's debt crisis is pushing the world's largest economy into low gear.

Prices of oil and copper fell along with those gold as the dollar surged amid a broad flight from risk.

U.S. and German government bond prices leapt, with investors seeking safe havens in U.S. Treasuries and German bunds.

The Labor Department said U.S. non-farm payrolls expanded by just 80,000 jobs in June, falling short of forecasts. A Reuters poll showed the market expecting a growth of 90,000 jobs.

The data raised pressure on the Federal Reserve to do more to boost the economy, and imperiled President Barack Obama's chances of reelection in November.

The 80,000 jobs added in June was "a poor number and a very political number and it will not sit well with the market," said Jeff Savage, regional chief investment officer for Wells Fargo Private Bank in the Northwest in Portland, Oregon.

"There is no question that the QE3 conversation becomes very alive in the coming days and weeks," he said, referring to a third round of quantitative easing since 2008 that markets were expecting from the Fed. The first two rounds of QE involved large-scale Treasuries buying, aimed at lowering long-term interest rates.

Futures traders added to bets that the Fed will keep short-term interest rates near zero until the end of 2014.

Fed fund futures, tied to the overnight lending rate between banks, ticked up after the jobs report, signaling traders see the Fed first hiking rates in the fourth quarter of 2014, either at its October or its December meeting of that year.

The Dow Jones industrial average (^DJI) was down 126.32 points, or 0.98 percent, at 12,770.35. The Standard & Poor's 500 Index (^GSPC) was down 13.36 points, or 0.98 percent, at 1,354.22. The Nasdaq Composite Index (^IXIC) was down 29.03 points, or 0.98 percent, at 2,947.09.

European shares fell further after the jobs data (.FTEU3), down nearly 0.8 percent on the day, having been 0.2 percent lower befo*****d. World stocks <.MIWD00000PUS> fell 1 percent.

The euro extended losses to fall to a fresh five-week low against the dollar, sliding nearly 0.5 percent to $1.2332 after falling as low as $1.2317 earlier.

Monetary policy loosening by a trio of major central banks failed to impress investors on Friday, pushing Spanish borrowing costs back up to unsustainable levels reached before last week's EU summit took measures designed to ease pressure on them.

China, the euro zone and Britain all loosened monetary policy on Thursday, signaling growing alarm about the world economy. But to little avail.

The 19-commodity Thomson Reuters-Jefferies CRB index was headed for its sharpest loss in a week as oil and copper prices fell about 2 percent each.

Gold slid more than 1 percent in choppy trade as investors turned to the perceived safety of the dollar. The spot price of gold, which tracks trades in bullion, was at $1,588.19 from $1,604.33 at Thursday's close.

U.S. Treasuries' benchmark 10-year note yields were at 1.5559 percent, their lowest levels in four days. Safe haven German Bund futures hit a session high.

Jul 06, 2012 12:47

OctaFX.Com News Updates

-

07-07-2012, 04:28 PM #97Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFx -Japanese Yen To Appreciate Further As BoJ Maintains Current Policy

Fundamental Forecast for Japanese Yen: Bullish

- USDJPY Pop above 80 Lacks Conviction

- USDJPY: Candles Point to Bullish Resumption

- Japanese Yen Outlook Clouded as USD Surges

The Japanese Yen continued to appreciate against its U.S. counterparts as positive real interest rates in Japan increases the appeal of the low-yielding currency, and we may see the USDJPY track lower in the week ahead should the Bank of Japan preserve its current policy in July. Indeed, the BoJ is widely expected to uphold its zero interest rate policy, and there’s speculation that the central bank will continue to carry out its current asset purchase program as the board raises its outlook for the region.

Indeed, the BoJ raise its fundamental assessment of all the nine regions for the first time since October 2009 while presenting the quarterly Sakura Report and it seems as though the central bank will stick to its wait-and-see approach as economic activity starts picking up. Although Governor Masaaki Shirakawa maintained his pledge to purse ‘powerful monetary easing,’ it seems as though the central bank is becoming more upbeat towards the economy as the recent developments coming out of the world’s third-largest economy raises the prospects for future growth. Meanwhile, the Nikkei newspaper said that the BoJ may scale back on its 6-month operation and expand its shorter-term programs, but the central bank may see scope to inject additional liquidity into the system as the ongoing turmoil in Europe dampens the outlook for the world economy. BoJ Deputy Governor Hirohide Yamaguchi held a cautious tone while speaking in Tokyo earlier this week and said that excessive gains in the local currency would dampen private sector activity, and we may see the central bank try to talk down the Yen as it lowers the scope for an export-led recovery.

As the USDJPY threatens the ascending channel carried over from June, a close below the 20-Day SMA (79.56) would instill a bearish outlook for the pair, and the dollar-yen may continue to give back the rebound from 77.65 as the relative strength index fails to maintain the upward trend from the previous month. However, we may see the dollar-yen face sideways price action ahead of the rate decision as market participants weigh the outlook for monetary policy, and the outcome of the rate decision should generate a clearer picture for the USDJPY amid the mixed views surrounding the BoJ

Jul 07, 2012 02:02

OctaFX.Com News Updates

-

07-07-2012, 04:45 PM #98Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com -British Pound Looks to FOMC Minutes, EU FinMin Summit for Direction

Fundamental Forecast for British Pound: Neutral

- Soft PPI Figures Underscore Case for Additional Easing

- Pound Counter-intuitively Rallies as BOE Expands QE

- UK Services PMI Shows Deeper Slump Than Expected

- Speculative Sentiment Points to More Pound Weakness

The British Pound remains sensitive to risk sentiment trends, with GBPUSD showing a firm correlation with the MSCI World Stock Index. In the aftermath of last week’s disappointing US jobs report and underwhelming stimulus efforts from the ECB and the BOE, this puts the spotlight on minutes from June’s FOMC outing amid hopes the Fed will deliver some relief. Although Ben Bernanke and company opted not to introduce QE3 last month, traders will be keen to gauge the degree to which such an option entered into the conversation to guide expectations for a possible expansion of the balance sheet to be unveiled in the coming months.

On balance, the utility of another QE program seems highly suspect. Indeed, with US Treasury yields already so low that after adjusting for inflation, real rates are in negative territory out to the 10-year maturity, it seems unlikely that a further push lower will materially encourage those not borrowing to do so. The Fed is surely not oblivious to the limitations of more QE, but it is equally sensitive to the fact that a strong signal against stimulus may trigger pandemonium across financial markets. That means the door to further easing is likely to be kept open, at least rhetorically. With that in mind, language perceived as increasing the likelihood of added accommodation is likely to boost risk appetite and with it the Pound. Needless to say, the inverse scenario is likewise the case.

Besides investors’ yearning for looser monetary conditions, the Eurozone debt crisis is set to return to the forefront as the currency bloc’s finance ministers convene for a meeting on Monday. The sit-down is expected see officials begin implementation of June’s EU leaders’ summit framework. While little is likely to be achieved on longer-term issues like joint bank governance and the expansion of EFSF/ESM bailout fund powers, the Spanish bank rescue is likely to figure prominently into the proceedings.

Details of the effort are expected to be ratified at the sit-down. The British Pound continues to be a beneficiary of regional haven flows at times of rising concern about the Euro area, meaning an outcome perceived as disappointing by investors may boost the UK currency.

Jul 07, 2012 07:10

OctaFX.Com News Updates

-

10-07-2012, 12:49 PM #99Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.ComSpanish deal lifts shares, euro stays weak

LONDON (Reuters) - European shares inched up on Tuesday after the region's finance ministers made limited progress on measures to help embattled Spain, but the euro and commodities fell as signs of a sharp slowdown in China fuelled anxiety about the global economy.

The FTSE Eurofirst (.FTEU3) index of top European shares edged up 0.6 percent to 1036.40, after the euro area finance chiefs agreed a deal which will release 30 billion euros of bailout funds for Spain's troubled lenders by the end of July.

The euro zone ministers also decided to grant Spain an extra year until 2014 to reach its deficit reduction targets but made no apparent progress on how the bloc's new rescue fund, the ESM, will be used to help lower Madrid's elevated borrowing costs.

The euro fell 0.3 percent to $1.2280, slipping back in the direction of a two-year low of $1.2225 hit on Monday.

The euro's struggles saw the dollar index (.DXY), which measures the greenback against a basket of major currencies, climb 0.1 percent at 83.219, near a one-month high.

"With the (euro zone) finance ministers' meeting out of the way without proving to be a source of inspiration for risk assets, the focus of the market now turns to the German constitutional court," said Chris Weston, an institutional dealer with IG Markets.

The German court is due to give its preliminary ruling on complaints against the European Stability Mechanism (ESM) and the euro zone's fiscal compact, which could ultimately lead to a further implementation delay.

Spanish 10-year bond yields eased about 14 basis points on news of the deal to just under the crucial seven percent level widely seen as unsustainable.

The euro finance chiefs plan to reconvene in Brussels on July 20 to finalize the agreement, having first obtained the approval of their governments or parliaments.

"I think we have a long ways to go before we reach the stage at which policymakers will be ready to act, particularly as it relates to potential bond purchases in the secondary market," said Todd Elmer, currency strategist for Citi.

CHINA WORRIES

Meanwhile the world's second largest economy China sharply curtailed its levels of imports in June in further evidence that Europe's three-year debt crisis is dragging down economic activity around the world.

Demand for Chinese goods in June was also below its usual pace in part because the U.S. economy has also not fully recovered, a top Chinese customs official said.

Annual import growth was 6.3 percent in June, far short of the 12.7 percent forecast by economists and the 12.7 percent achieved in May. China's crude oil imports for June plunged to their lowest levels of the year from a record high in May.

The lackluster trade numbers came a day after data showed inflation in China eased further in June, giving room to the central bank to loosen its monetary policy to stimulate growth without stoking upward price pressures.

This is a busy week for Chinese economic data releases which culminates on Friday with second-quarter gross domestic product figures, which are expected to show the lowest growth in at least three years.

The latest batch of numbers sent share markets lower across Asia but left the MSCI world equity index <.MIWD00000PUS> largely unchanged at 309.50 after three days of losses.

Brent crude oil was down 1.7 percent at $98.60 a barrel after the data with worries over supply disruptions also easing as a labor strike in Norway's oil industry ended.

Gold prices edged down as the nervousness about global economic growth saw investors turn towards the dollar for safety.

Spot gold dipped $1.50 to $1,585.15 an ounce while the U.S. gold futures contract for August delivery edged down 0.2 percent to $1,585.30.

"The market is being a little pessimistic and cautious about the global economy, and investors are choosing the dollar as the top safety haven," said Li Ning, an analyst at Shanghai CIFCO Futures.

Jul 10, 2012 07:27

OctaFX.Com News Updates

-

10-07-2012, 01:04 PM #100Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com -Euro Approaches 2-Year Low on French, Italian Production Concern

The euro declined to within 0.4 percent of its lowest level in two years versus the dollar as industrial production shrank in France and was forecast to fall in Italy as Europe's debt crisis undermined growth.

Europe's 17-nation currency weakened most against the yen among its 16 major peers after European Union Economic and Monetary Affairs Commissioner Olli Rehn said Spain will soon have to take additional measures soon to meet budget targets. The dollar strengthened versus most of its most traded counterparts as Asian stocks declined. Australia and New Zealand's currencies dropped after data showed growth in exports and imports slowed in China.

"The euro is going to stay quite weak, particularly against the U.S. dollar and the yen," said Joseph Capurso, a strategist in Sydney at Commonwealth Bank of Australia (CBA), the nation's biggest lender. "The euro zone is still in recession and it's probably getting even deeper."

The euro lost 0.1 percent to $1.2297 at 8:15 a.m. London time after sliding to as low as $1.2251 yesterday, the weakest since July 2010. The shared currency fell 0.3 percent to 97.62 yen. It touched 97.43 yesterday, the least since June 5.

French output fell 1.9 percent from a month earlier, Insee, the Paris-based statistics office, said today. April's production increase was revised down to 1.4 percent. Economists had forecast a decline of 1 percent in May, according to the median estimate of 21 forecasts in a Bloomberg News survey.

Jul 10, 2012 07:35

OctaFX.Com News Updates

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote