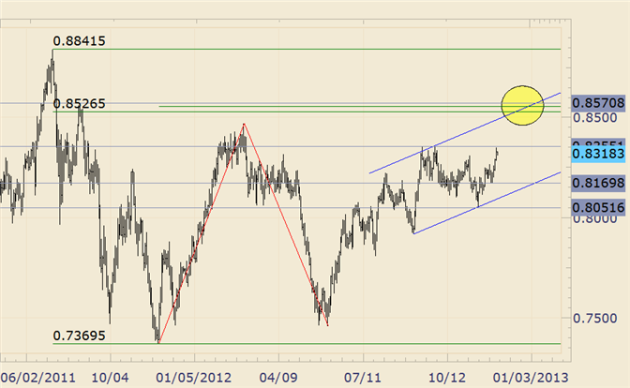

OctaFX.Com - FOREX Technical Analysis: NZD/USD Slams into Short Term Channel and Reverses

Chart Prepared by Jamie Saettele, CMT

FOREXAnalysis: “Bigger picture, the NZDUSD appears quite bullish as the decline from 8355 is in 3 waves (corrective) and the rally from 8052 is in 5 waves. The question at this point is whether the decline from 8267 is complete or simply part of a larger correction that ends below 8170 and closer to the estimated 8125/35 support.”

The NZDUSD has headed straight up since 8170. Given the reaction at channel resistance today, there is the possibility that the advance from 8052 composes wave B of a triangle or flat that began on 9/28. That scenario is not viewed as probable as long as price is above 8170 however. A Fibonacci confluence and August 2011 high intersects with a channel at the end of December.

FOREXTrading Strategy: Weakness into 8240 would be worthy of bullish consideration against 8170.

Dec 7, 2012

OctaFX.Com News Updates

Please visit our sponsors

Results 211 to 220 of 769

-

07-12-2012, 10:51 AM #211Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

-

08-12-2012, 02:12 PM #212Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com -Forex Analysis: British Pound Outlook Supported By BoE Policy- 1.6200 Remains Key

The British Pound continued to retrace the decline from back in September as the Bank of England (BoE) maintained its current policy stance in December, and the short-term rebound in the GBPUSD may gather pace over the remainder of the year as the central bank appears to be slowly moving away from its easing cycle.

Beyond the headline reading for U.K. Jobless Claims, which is expected to increase another 7.0K in November, we’re expecting to see average weekly earnings including bonuses increased for the third month in October, and another uptick in wage growth may become a growing concern for the Monetary Policy Committee (MPC) as inflation is expected to hold above the 2% target over the next two-years.

Indeed, the BoE kept the benchmark interest rate at 0.50% and maintains its asset purchase program at GBP 375B, and we may see the central bank adopt a more hawkish tone for monetary policy as the U.K. emerges from the double-dip recession. Former MPC dove Adam Posen argued that the central bank is ‘going to be on hold indefinitely’ as the central bank turns its attention to the stickiness in inflation, and the BoE may shift gears in the following year as it aims to preserve price stability.

Although the deepening recession in the Euro Zone – the U.K.’s largest trading partner – casts a weakened outlook for growth, we’ve seem consumer price growth hold above target since November 2009, and the committee may look to address the threat for inflation in an effort to preserve its credibility. As a BoE survey shows inflation expectations for the next 12-months increasing an annualized 3.5% following the 3.2% expansion in August, heightening price pressures in the U.K. should continue to prop up the British Pound as it pushes the BoE to scale back its willingness to expand its balance sheet further.

As the relative strength index on the GBPUSD struggles to maintain the upward trend carried over from the previous month, the pound-dollar may continue to consolidate ahead of the BoE Minutes due out on December 19, and the exchange rate may continue to bounce between 1.6000-1.6100 as market participants weigh the outlook for monetary policy.

Nevertheless, as the shift in the policy outlook fosters a bullish forecast for the British Pound, the rebound from 1.5822 may continue to gather pace over the near-term, but we would need a more meaningful move above 1.6200 – the 23.6% Fibonacci retracement from the 2009 low to high – to see the pair breakout of the downward trend carried over from 2011.

Dec 8, 2012

OctaFX.Com News Updates

-

10-12-2012, 07:45 PM #213Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFx - Greece extends buyback offer to reach 30 billion-euro target

ATHENS/BRUSSELS (Reuters) - Greece extended its offer to buy back debt until Tuesday, seeking more bids from bondholders after falling short of a target to retire bonds worth 30 billion euros at a cost of just 10 billion euros.

The buyback is designed to provide for about half of a 40-billion euro debt relief package for Athens agreed last month by the European Union and International Monetary Fund.

Its success is crucial to ensuring Greece's debt is put back on sustainable footing and - more immediately - to unlocking badly-needed aid for the country.

Despite the initial lack of investor interest, the scheme is expected to ultimately hit its targets since Greek banks - whose own fate depends on a successful buyback - are expected to stump up the shortfall.

A total of 26.5 billion euros was tendered at an average price of 33.4 percent of face value when the offer expired on Friday, a senior euro zone official told Reuters.

That would mean Greece would still have 1.15 billion euros left over from the 10 billion euros it was allotted to spend to retire outstanding debt. Assuming the same average price, it could buy an extra 3.5 billion euros worth of bonds.

Greece's debt agency extended the offer to 7 a.m. EDT on Tuesday following Friday's deadline.

"The aim is to reach the 30 billion euro target on the face value of debt to be bought back," said a government official, who declined to be named, adding the aim was to use all of the 10 billion euros given by lenders for the buyback.

Euro zone finance ministers will meet on Thursday in Brussels to review the buyback operation and formally release the next disbursement of loans to Greece under its second international rescue program.

"We are confident that there is still scope for additional tenders by domestic and international investors to ensure a successful debt buyback," European Commission spokesman Simon O'Connor told a regular briefing in Brussels.

"EASILY COVERED"

A senior Greek banker who spoke on condition of anonymity said Athens aimed to use the additional day to get another 3 to 4 billion euros worth of bonds offered for exchange.

"This will be easily covered by Greek banks, if foreign bondholders do not offer more," the banker told Reuters.

Greek banks and insurers had tendered about 10 billion euros of bonds out of their total holdings of about 17 billion euros, the banker said. Nearly 63 billion euros of Greek debt held by private investors was eligible for the buyback.

Shortly before the previous Friday deadline expired, Greek banks got board approvals to offer as much as 100 percent of their bondholdings to make the buyback work.

Athens had offered better-than-expected terms for the buyback to entice investors, with price ranges at a premium over market prices.

But Greek lenders had been reluctant to sell back to the government all of their bondholdings, trying to limit the future profits and interest income on their bonds they will forego.

However, they are expected to step up now to ensure a successful buyback since they depend on the bailout funds that Athens stands to receive once it is completed. A big chunk of the 34.4 billion euros of aid due will be used to recapitalize them.

Athens badly needs the aid to revive its ailing economy, which is on track for a sixth year of recession due to austerity measures including spending cuts and tax hikes.

The EU and the IMF have been withholding rescue payments to Greece for six months because it had failed on pledges to shore up its finances, privatize and make its economy more competitive.

Greece and its international lenders had shied away from setting a binding target for the buyback, apart from saying that Athens would spend a maximum of 10 billion euros on it.

Under the scheme, Greece was expected to spend that amount to repurchase 30 billion euros of debt, shaving it by a net 20 billion euros. That would help slash Greece's debt to 124 percent of GDP by 2020, ensuring that the IMF stays on board in the country's rescue.

Greece set December 18 as the settlement date for offers on the 20 series of outstanding bonds it is buying back.

Athens' debt agency chief urged investors to tender their holdings, warning a similar deal may not come again.

"Future measures may not involve an opportunity to exit investments ... at the levels offered for this buyback," PDMA Chief Stelios Papadopoulos said in a statement.

Dec 10, 2012

OctaFX.Com News Updates

-

12-12-2012, 02:00 PM #214Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFx - Forex Analysis: US Dollar, S&P 500 Charts Warn of Risk Aversion Ahead

THE TAKEAWAY: US Dollar and S&P 500 technical positioning hints the greenback is aiming to reverse higher on the back of haven demand as the equity benchmark turns downward.

US DOLLAR TECHNICAL ANALYSIS– Prices are resting at rising trend line support set from the mid-September bottom, with the outlines of a Flag chart formation hinting at bullish continuation. A Piercing Line candlestick pattern reinforces the case for an upside scenario. A break above Flag resistance at 9976 initially exposes the 23.6% Fibonacci expansion at 9995. Alternatively, a drop below the trend line (now at 9942) targets the Flag bottom at 9895.

Read more

Dec 12, 2012

OctaFX.Com News Updates

-

12-12-2012, 02:22 PM #215Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFx - Forex Analysis: Forex Analysis: US Dollar Classic Technical Report 12.12.2012

Prices are resting at rising trend line support set from the mid-September bottom, with the outlines of a Flag chart formation hinting at bullish continuation. A Piercing Line candlestick pattern reinforces the case for an upside scenario.

A break above Flag resistance at 9976 initially exposes the 23.6% Fibonacci expansion at 9995. Alternatively, a drop below the trend line (now at 9942) targets the Flag bottom at 9895.

Dec 12, 2012

OctaFX.Com News Updates

-

12-12-2012, 02:54 PM #216Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFx - Forex Analysis: Forex Analysis: Is Dollar Weakness After FOMC a Foregone Conclusion?

Forex markets are positioned for a US Dollar selloff as the Federal Reserve expands stimulus efforts but such an outcome is not as assured as it may seem.

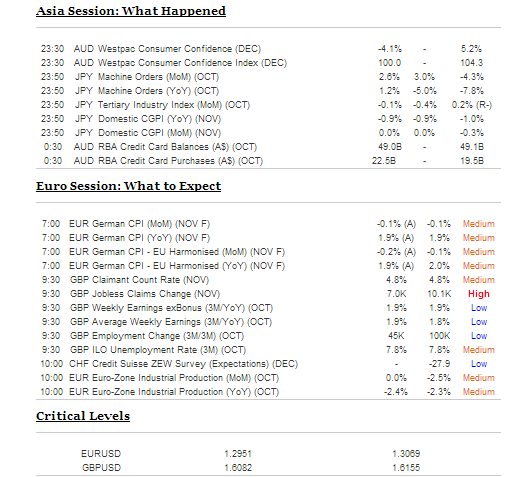

Talking Points

- US Dollar to Rally vs. Majors if Fed Decides Against Unsterilized Bond-Buying

- British Pound to Look Past Jobless Claims Data on Static BOE Outlook, FOMC

- Japanese Yen Sinks as Asian Stocks Soar on Hopes for Fed Stimulus Expansion

Most major currencies were locked in narrow ranges in overnight trade as financial markets look ahead to the Federal Reserve monetary policy announcement to yield direction cues. At the heart of the decision will be the fate of the so-called Operation Twist program designed to re-target stimulus at lowering longer-term borrowing costs. This is done by swapping out short-term securities on the Fed’s balance sheet for long-dated ones at a pace of about $45 billion per month.

Twist is due to expire at year-end and the market consensus appears to be that it will be replaced with an equivalent-sized “unsterilized” bond-buying scheme.

This means that unlike its predecessor, the new effort will not be balance-sheet neutral. Such an outcome is likely to be treated as a meaningful move to the dovish side of the policy spectrum, broadly weighing on the US Dollar against its major counterparts.

Importantly, the recent run of supportive US economic data – most critically the service-sector ISM and NFP data points – as well as an upbeat Beige Book survey suggest the door is open for the FOMC to pursue a less aggressive course. A decision to introduce an unsterilized program smaller than $45 billion or opt for a Twist-like program that does not swell the balance sheet stands weigh heavily on risk appetite and send the greenback higher.

Besides the fate of Operation Twist, traders will likewise look toward revisions in the rate-setting committee’s economic forecasts as well as the tone of Bernanke’s quarterly press conference for additional guidance. Bleak cues on either front may cap US Dollar gains in the event that policymakers take a less dovish path than investors are looking for, opening the door for added easing to be unveiled in 2013. Alternatively, signs of optimism may trim the buck’s losses if the fully unsterilized approach is indeed adopted and aggressively amplify its gains if the committee eschews balance-sheet expansion for now.

On the economic data front, UK Jobless Claims headline the European docket. Expectations call for a 7,000 increase in November, marking a narrow improvement from the 10,100 rise in the prior month. The outcome is unlikely to yield a meaningful reaction from the British Pound, with BOE policy expectations firmly anchored and traders looking ahead to the Fed announcement before committing to a strong directional bias.

The Japanese Yen stood apart from the near-standstill across the FX space in Asian trading hours, sliding as much as 0.6 percent against its leading counterparts as regional stock exchanges pushed higher and dented haven demand. The MSCI Asia Pacific added 0.5 percent amid hopes the Federal Reserve will step up easing efforts.

Dec 12, 2012

OctaFX.Com News Updates

-

13-12-2012, 02:02 PM #217Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

Check out OctaFx-Financial News: CLICK HERE

Dec 13, 2012

OctaFX.Com News Updates

-

14-12-2012, 05:08 PM #218Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com - ECB: 'Tangible easing' of crisis, risks remain

European Central Bank: strains on eurozone banks, markets have eased but much remains to do

FRANKFURT, Germany (AP) -- The European Central Bank says there has been a "tangible easing" of stress on banks and markets from the eurozone debt crisis.

It says risks remain, however, particularly if governments slow down their efforts to cut debt and deficits and improve growth.

The bank is crediting its plan to buy the bonds of heavily indebted countries, which would lower their borrowing costs. European Union efforts to establish stronger banking oversight helped too, the bank said Friday.

The bond purchase plan has seen borrowing rates fall for troubled countries such as Spain and Italy, even though no bonds have been bought.

The ECB warned that the banking system across the 17 countries that use the euro remains fragmented, with borrowing costs higher in troubled countries than in others.

Dec 14, 2012

OctaFX.Com News Updates

-

14-12-2012, 05:45 PM #219Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com - Forex: Euro Struggles On Deepening Recession- ECB Rate Cut On Horizon

Talking Points

- Euro: 3Q Employment Falters, Core Inflation Falls Short Of Expectations

- British Pound: U.K. Core Inflation To Tick Higher, All Eyes On BoE Minutes

- U.S. Dollar: Index Pares Losses As Risk Appetite Subsides, CPI Misses Forecast

Euro: 3Q Employment Falters, Core Inflation Falls Short Of Expectations

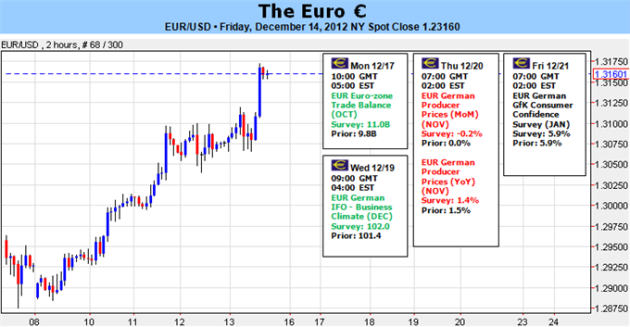

The EURUSD pared the overnight advance to 1.3118 as employment in the euro-area contracted 0.2% in the third-quarter, and the ongoing weakness in the labor market may produce a prolonged recession in Europe as the jobless rate is expected to hit fresh record-highs in 2013.

Although the headline reading for euro-area inflation held steady at 2.2% in November, the core reading for consumer prices increased 1.4% during the same period to mark the slowest pace of growth since August 2011, and easing price pressures certainly raises the scope for another rate from the European Central Bank (ECB)as the economic downturn threatens price stability.

As the ECB preserves a dovish tone for monetary policy, we should see the Governing Council carry its easing cycle into the following year, and the Governing Council looks poised to push the benchmark interest rate to a fresh record-low in an effort to stem the downside risks for growth and inflation.

As the EURUSD continues to carve a lower top around the 38.2% Fibonacci retracement from the 2009 high to the 2010 low (1.3120), we may see a short-term reversal take shape in the week ahead, and we will look for a move back towards the 23.6% retracement around 1.2640-50 as the fundamental outlook for the euro-area remains bleak.

British Pound: U.K. Core Inflation To Tick Higher, All Eyes On BoE Minutes

The British Pound fell back from 1.6142 to trade within the previous day’s range, and the sterling appears to be coiling up for a move higher as the economic docket for the following week is expected to dampen bets for more monetary support.

Although the headline reading for U.K. inflation is expected to hold steady at 2.7%, we’re anticipating a small uptick in the core CPI, and sticky price growth may prop up the sterling ahead of the Bank of England (BoE) Minutes due out on December 19 as the central bank drops its dovish tone for monetary policy.

Indeed, the policy statement may reveal a shift in policy outlook as the BoE looks to address the threat for inflation, and we should see the Monetary Policy Committee (MPC) slowly move away from its easing cycle as price growth is expected to hold above the 2% target over the next two-years. In turn, we should see the MPC endorse a wait-and-see approach in 2013, and a growing number of BoE officials may start to draw up a tentative exit strategy in the year ahead in an effort to balance the risks surrounding the U.K. economy.

As the relative strength index on the GBPUPSD preserves the upward trend from November, we continue to look for another test of the 23.6% Fib from the 2009 low to high around 1.6200, and we may see the British Pound outperform in 2013 as the BoE appears to be bringing its easing cycle to an end.

U.S. Dollar: Index Pares Losses As Risk Appetite Subsides, CPI Misses Forecast

The greenback appears to be regaining its footing going into the North American trade, with the Dow Jones-FXCM U.S. Dollar Index (Ticker: USDOLLAR) bouncing back from a low 9,951, and the reserve currency may track higher throughout the remainder of the day as the rebound in risk sentiment appears to be tapering off.

Nevertheless, we saw U.S. consumer prices slow for the first time since May, led by lower energy costs, and easing price pressures dampens the appeal of the greenback as it increases the Fed’s scope to expand its balance sheet further. As the central bank maintains a highly accommodative policy stance, speculation for more easing will continue to drag on the exchange rate, but we may6 see the 2013 Federal Open Market Committee (FOMC) scale back their dovish tone amid the more broad-based recovery in the world’s largest economy.

Dec 14, 2012

OctaFX.Com News Updates

-

15-12-2012, 12:55 PM #220Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com - Forex: EUR/USD Just Below 1.3200 Without Major Threats…Or Catalysts

EUR/USD Just Below 1.3200 Without Major Threats…Or Catalysts

- Fundamental Forecast for the Euro: Bearish

- European Union approves Greece’s next round of aid after bond buyback program

- Portugal asks for ‘equal treatment’ for bailout terms

- EURUSD’s reversals is showing greater technical strength

The euro’s strength was robust and broadly distributed this past week. A combination of general (though modest) improvement in economic data, the loose adoption of an EU bank supervisor and the long-awaited approval for Greece’s aid distribution generated enough optimism to lift the currency against all of its counterparts.

It’s performance ranged between the barely changed EURCHF (laden by regional capital flows) and the impressive 3.0 percent surge from EURJPY (helped out by an exceptionally weak yen). Helped along by a positive bearing on global investor sentiment, the Euro has leverage fundamentals to remarkable effect. Yet after the aggressive rally to multi-month and multi-year highs, we find that the burden for follow through has risen substantially – just we’ve run out of big-ticket catalysts.

It has taken a tremendous amount of lift to drive the euro to the heights that it scaled last week. Most prominent is the EURUSD which has risen to test the highs set in March along with the 38.2 percent Fibonacci retracement of its 2011-to-2012 bear trend at 1.3150. While the benchmark pair has officially marked its highest intraday level and daily close in over seven months, it hasn’t fully cleared the next stage to extend its bull run into a systemic trend.

This technical view is a fitting reflection of the fundamental and market conditions that the FX market faces moving forward.

To assess our next move, we should first appreciate what it took to wrench the euro to the heights it currently finds itself at. There were a series of economic releases this past week that could at best be described as ‘better-than-expected’. The bulk of the currency’s move was founded on relief. The risk that Greece could either default or exit the Eurozone (or both) tapped into an elemental fear of over the inviolability of the economic collective and its currency. Slowly, however, that threat has abated. The shift began back in July after an EU Summit laid out programs to support struggling members. When the ECB announced a potentially unlimited safety net in its OMT program, the pressure on the euro further eased. This past week, the approval of Greece’s next round of aid was the next step. After an initial short-fall on the bond buyback program, the market saw that the country would meet the target necessary to trigger support as the week wore on. By Thursday, the EU announced an immediate dispersal of €34.3 billion and monthly payouts afterwards.

Delivering aid to Greece removes the euro out of immediate peril, but it is interesting to note that the currency barely advanced after the news.

The market had priced in this outcome well before hand as the alternative would have been politically unpalatable. Yet, now we have found the relief the market had priced in before hand and bought Greece a number of months of calm before another serious shock could show up. Risk has been removed. Shouldn’t the euro be wide open to rally now? Not necessarily. While Greece may no longer be an immediate threat, there really isn’t a convincing argument of strength to be made for bidding the euro. What we have seen from July was in essence a series of relief rallies spurred on by the anticipation of and reaction to stabilizing policy. And, we have run out of catalysts…

In trader parlance, we have ‘reduced the tail risk’ – or as policy officials say, “there is no longer a crisis of confidence in the euro’. Yet, that isn’t a standalone reason to be bullish. Investors are not naïve enough to believe that this one approval will secure Greece or the Eurozone for good. What’s more, neglected concerns may start to come back to the forefront. Spain’s funding issues are national, regional and banking sector-wide; and there has been little genuine progress made beyond a fortunate easing of bond yields. An election in Italy highlights the country’s debt load.

Ireland will release 3Q GDP next week to remind us of the underlying economic issues are. And, perhaps most concerning of all, Portugal has built up a call for ‘equal treatment’ – access to the ‘one-off’ same accommodation as Greece.

Dec 15, 2012

OctaFX.Com News Updates

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote