OctaFX.Com - Forex: Euro Looks Lower Amid Bets For Further Greek Aid- Eyes 1.2650

Talking Points

- Euro: Germany To Vote On Greek Deal, Schaeuble Sees Further Assistance

- British Pound: BoE Keeps Door Open For More QE Amid Ongoing Slack

- U.S. Dollar: Benefits From Risk Aversion, Fed’s Beige Book In Focus

Euro: Germany To Vote On Greek Deal, Schaeuble Sees Further Assistance

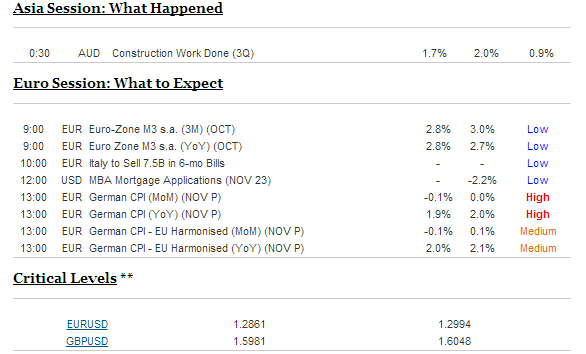

The EURUSD weakened to an overnight low of 1.2880 as German Finance Minister Wolfgang Schaeuble kept the door open to provide further support for Greece, but the reactionary approach in dealing with the debt crisis may continue to dampen the appeal of the single currency as the governments operating under the monetary union become increasingly reliant on external assistance.

As the Bundestag, Germany’s lower house, prepares to vote on the new aid package for Greece, Mr. Schaeuble showed a greater willingness to shore up the periphery country as long as the coalition government continues to meet all of its obligations, but we may see the EU put increased pressure on the European Central Bank (ECB) to ease monetary policy further as the debt crisis drags on the real economy.

The Bank of Spain warned that the extraordinary efforts taken by the ECB ‘has started to show some symptoms of wearing out’ as the periphery countries struggle to get their house in order, and we should see the Governing Council carry its easing cycle into the following year in order to tackle the deepening recession. As the ECB stands ready to implement the Outright Monetary Transactions (OMT), the weakening outlook for growth and inflation may prompt the central bank to target the benchmark interest rate in 2013, and we may get some hints for a rate cut at the December 6 meeting as the economic downturn threatens the outlook for price stability.

As the EURUSD carves out a lower top ahead of December, the reversal from 1.3007 should gather pace in the days ahead, and the pair looks poised to fall back towards the 23.6% Fibonacci retracement from the 2009 high to the 2010 low around 1.2640-50 as it searches for support.

British Pound: BoE Keeps Door Open For More QE Amid Ongoing Slack

The British Pound extended the decline from earlier this week, with the GBPUSD slipping to a low of 1.5961, but the recent weakness in the sterling may be short lived as the Bank of England (BoE) looks to carry its wait-and-see approach into the following year.

Although the BoE expects inflation to hold above the 2% target over the next two-years, board member Charles Bean argued that the Monetary Policy Committee (MPC) should keep the door open to expand its balance sheet further amid the persistent slack in the real economy. However, above-target inflation may become a pressing concern for the central bank as price growth has held above 2% since 2008, and we may see a growing number of MPC change their tune in 2013 as the U.K. emerges from the double-dip recession.

As the GBPUSD appears to be carves out a higher low in November, the rebound from 1.5822 may gather pace going into December, and we are still looking for a run at the 23.6% Fib from the 2009 low to high around 1.6190-1.6200 as the relative strength index breaks out of the bearish trend.

U.S. Dollar: Benefits From Risk Aversion, Fed’s Beige Book In Focus

The greenback extended the advance from the previous day, with the Dow Jones-FXCM U.S. Dollar Index (Ticker: USDOLLAR) climbing to a high of 9,998, and the reserve currency may track higher throughout the North American trade as market participants scale back their appetite for risk.

As new home sales are expected to increase another 0.3% in October, the budding recovery in the housing market may spark a bullish reaction in the USDOLLAR, but we may see market volatility taper off ahead of the Fed’s Beige Book as market participants weigh the outlook for monetary policy. Indeed, the district banks should continue to highlight a more broad-based recovery in the world’s largest economy, and the report may sap bets for more easing as the recovery gradually gathers pace.

Nov 28, 2012

OctaFX.Com News Updates

Please visit our sponsors

Results 201 to 210 of 769

-

28-11-2012, 08:01 PM #201Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

-

29-11-2012, 04:27 PM #202Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com -Forex Analysis: US Dollar Classic Technical Report 11.29.2012

Prices are stalling at the bottom of a rising channel set from mid-September (now at 9971). A break below this boundary initially exposes the 38.2% level at 9945. Near-term resistance lines up at 9993, the 23.6% Fibonacci retracement, with a push above that aiming to challenge the November 16 high at 10071.

Daily Chart - Created Using FXCM Marketscope 2.0

Nov 29, 2012

OctaFX.Com News Updates

-

29-11-2012, 05:32 PM #203Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com - FOREX Technical Analysis: British Pound Slips in Early Week Trading

A EURJPY short was taken last night at 10640 (released via Twitter @JamieSaettele). 10642 is the 61.8% of the decline from 10712 at 10640. Price has extended slightly beyond this level but the stop is above the 11/26 high. Once (if) the market turns lower again, objectives are 10458 and 10375 (former is former resistance and 38.2% of rally from 10031 and latter is middle of former congestion and 50% level).

The USDJPY is little changed from yesterday. Near term structure has evolved to the point that the rally into 8221 may compose wave B within the A-B-C corrective decline from 8283. I remain of the mind that the 4th wave of one less degree at 8088-8158 will produce the next low. 8113/16, which the 4th wave terminus (triangle) and 11/15 JS Thrust close, is of specific interest.

The AUDJPY is the weakest of the Yen crosses today, although losses are minimal. Risk remains to the downside in the near term as long as the Sunday night high is in place. Levels of interest as eventual support are 8485 and 8414.

EURJPY – 240 Minute

Read More

Nov 29, 2012

OctaFX.Com News Updates

-

29-11-2012, 05:39 PM #204Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com - FOREX Technical Analysis: British Pound Slips in Early Week Trading

A EURJPY short was taken last night at 10640 (released via Twitter @JamieSaettele). 10642 is the 61.8% of the decline from 10712 at 10640. Price has extended slightly beyond this level but the stop is above the 11/26 high. Once (if) the market turns lower again, objectives are 10458 and 10375 (former is former resistance and 38.2% of rally from 10031 and latter is middle of former congestion and 50% level).

The USDJPY is little changed from yesterday. Near term structure has evolved to the point that the rally into 8221 may compose wave B within the A-B-C corrective decline from 8283. I remain of the mind that the 4th wave of one less degree at 8088-8158 will produce the next low. 8113/16, which the 4th wave terminus (triangle) and 11/15 JS Thrust close, is of specific interest.

The AUDJPY is the weakest of the Yen crosses today, although losses are minimal. Risk remains to the downside in the near term as long as the Sunday night high is in place. Levels of interest as eventual support are 8485 and 8414.

EURJPY – 240 Minute

Read More

Nov 29, 2012

OctaFX.Com News Updates

-

29-11-2012, 05:41 PM #205Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com - FOREX Technical Analysis: British Pound Slips in Early Week Trading

A EURJPY short was taken last night at 10640 (released via Twitter @JamieSaettele). 10642 is the 61.8% of the decline from 10712 at 10640. Price has extended slightly beyond this level but the stop is above the 11/26 high. Once (if) the market turns lower again, objectives are 10458 and 10375 (former is former resistance and 38.2% of rally from 10031 and latter is middle of former congestion and 50% level).

The USDJPY is little changed from yesterday. Near term structure has evolved to the point that the rally into 8221 may compose wave B within the A-B-C corrective decline from 8283. I remain of the mind that the 4th wave of one less degree at 8088-8158 will produce the next low. 8113/16, which the 4th wave terminus (triangle) and 11/15 JS Thrust close, is of specific interest.

The AUDJPY is the weakest of the Yen crosses today, although losses are minimal. Risk remains to the downside in the near term as long as the Sunday night high is in place. Levels of interest as eventual support are 8485 and 8414.

EURJPY – 240 Minute

Read More

Nov 29, 2012

OctaFX.Com News Updates

-

01-12-2012, 12:14 PM #206Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFx - Forex Analysis: New Zealand Dollar To Threaten Range As RBNZ Softens Dovish Tone

The New Zealand dollar pared the rebound from earlier this month after tagging a fresh high of 0.8266, but the recent weakness in the higher-yielding is likely to be short-lived as the Reserve Bank of New Zealand (RBNZ) preserves a neutral policy stance. Indeed, the economic data on tap for the following week may push the kiwi higher ahead of the interest rate decision as we’re expecting to see a small improvement in the terms of trade along with a marked increase in building activity, and a slew of positive developments may lead the NZDUSD to threaten the November high (0.8307) as it dampens speculation for a rate cut.

According to a Bloomberg News survey, all of the 16 economists polled see the RBNZ keeping the benchmark interest rate at 2.50%, and central bank Governor Graeme Wheeler may continue to tame expectations for additional monetary support amid the expansion in private sector credit. Although the central bank head continues to highlight the ongoing slack within the real economy, the rebuilding efforts from the Christchurch earthquake may start to fan fears of an asset bubble amid record-low borrowing costs, and Governor Wheeler may signal a need to raise the cash rate in 2013 amid rising home prices.

As the slowdown in global growth hampers the near-term outlook for the export-driven economy, the RBNZ remains poised to carry its wait-and-see approach into the following year, but we will be keeping a close eye on the policy statement as Mr. Wheeler warns of impending risks to the region. In turn, the fresh batch of central bank rhetoric may encourage a bullish forecast for the New Zealand dollar, and we may see the kiwi outperform against its major counterparts over the coming months amid the shift in the policy outlook.

As the 10, 20, 50, and 100 day moving averages continue to converge with one another, the formation suggests that the NZDUSD may continue to face range-bound prices over the near-term, but a less dovish statement from the RBNZ may trigger a move above 0.8300 – the 23.6% Fibonacci retracement from 2010 low to the 2001 high – as market participants curb bets for lower borrowing costs.

Dec 1, 2012

OctaFX.Com News Updates

-

02-12-2012, 04:09 PM #207Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com - Analysis: Greek deal puts euro zone in slow recovery room

PARIS (Reuters) - The euro zone is in the recovery room now the danger of a Greek default has been averted for a couple of years, but it is not yet safe from a Japanese-style "lost decade".

The currency area's escape route hinges more on the pace of expansion in the United States and China, lifting the world economy, than on the policy mix in Europe, which will continue to favour austerity over growth in 2013.

At best, Ireland and Portugal could emerge slimmed down from their bailout programmes and regain capital market access by the end of the year, demonstrating that adherence to a tough fiscal adjustment plan can work.

But question marks hang over both. And Greece, like miracles, will take a little longer. And another debt writedown.

Gloomy forecasts from the OECD and private economists suggest the 17-nation euro currency area may stay in recession all next year, swelling the armies of unemployed and pushing efforts to reduce public deficits and debt mountains off track.

Political risks abound; possible social revolt against austerity policies in Greece, Spain or Portugal; a messy, inconclusive election outcome in Italy; and perhaps labor unrest against more modest structural reforms being mooted in France.

Monday's EU-IMF agreement to keep Greece afloat inside the euro zone, by reducing its debt now and hinting at official debt relief to come later, has removed the biggest risk of a financial shock that could re-ignite market panic and send the euro back into the emergency ward.

Market relief over the Greek deal, coupled with European Central Bank promises to do what it takes to preserve the euro, helped Italy sell its last 10-year bonds of 2012 on Thursday at the lowest yield for nearly two years.

French Finance Minister Pierre Moscovici called it "a turning point for the euro zone because it helps recreate stability and confidence. Greece's fate will no longer be a daily issue".

European Internal Market Commissioner Michel Barnier, using a soccer metaphor, said the peak of the debt crisis was over and "we are now at the start of the second half".

Some analysts are less convinced.

Mujtaba Rahman of Eurasia Group said the Greek fix "keeps the show on the road, but is no game changer".

GERMAN DELAY

The campaign for Germany's general election in September means that bolder steps towards writing off debt or sharing liabilities will have to wait until at least the end of next year. Public opposition to a "transfer union" in the euro zone's biggest economy and main paymaster remains high.

Yet no Eurosceptical party has emerged to capitalize on that mood, and the next Berlin government, whether a "grand coalition" of centre-right and centre-left, which seems the most likely, or another permutation, may be more open to such solutions.

The European Commission set out ambitious proposals for closer economic, fiscal and banking union last week, including a common euro zone fund to reward structural reforms, but most big changes will be on hold until after the German vote.

In the meantime, modest progress is likely on creating a single European banking supervisor, the first step towards a euro zone banking union, but without a joint deposit guarantee to deter capital flight and bank runs.

IMF Managing Director Christine Lagarde says swift implementation of a banking union with powers to supervise all banks in the euro area is now the top priority.

Germany will continue to press for stricter European control over budgets in euro zone states, but that will involve trade-offs with greater mutualisation of risk and treaty changes that might only come after the 2014 European Parliament elections.

Many EU officials and analysts expect that Spain, which has so far avoided a sovereign bailout, will have to request euro zone assistance early in the new year, when it needs to raise at least 230 billion euros ($300 billion) on capital markets.

That would trigger European Central Bank buying of its bonds, which might reassure investors and further reduce borrowing costs for Madrid and Italy initially.

But it would raise hackles in Germany, given the Bundesbank's continued opposition, prompting market speculation about the ECB's will and ability to sustain bond purchases.

Markus Huber, senior trader at ETXCapital, reckons that even though economic reforms and ECB reassurance have cut Italy's borrowing costs, an indecisive outcome of a general election due in April could send yields soaring again.

Rome is also at risk of contagion if Spanish Prime Minister Mariano Rajoy continues to dither and delay a euro zone credit line for Madrid, he said.

FRANCE RISK?

A more remote but much-talked-about risk is the possibility that financial markets could turn against France if President Francois Hollande's labor market and welfare financing reforms disappoint or meet militant street resistance.

France's borrowing costs are hovering close to historic lows despite its loss of the coveted AAA credit rating from Moody's this month after Standard & Poor's downgraded Paris in January.

Fitch Ratings, the only credit watchdog still to have France on AAA, said last week it could lower that grade if the country fails to meets its deficit reduction targets and its economy performs worse than forecast.

Yet many investors believe France, with a deep, liquid debt market, enjoys an implicit German guarantee and so buy French bonds as a proxy for the strong northern euro zone states that have less debt to issue.

French economist Jacques Delpla, co-author of a proposal for a limited issuance of common euro zone bonds, argues that euro states' debt will become more attractive in the next few years as other major economies try to inflate away their problems.

"The whole of the world except Europe is going to inflate away its debt - the United States, Britain, Japan," he told a conference of the European Council on Foreign Relations.

"Only euro zone debt will remain strong blue debt because the great German legacy is that we won't inflate. So part of our debt is going to default, and the rest will become the crown jewels of world debt."

In economic terms, the euro zone's adjustment should advance further next year, with German wages rising above inflation while "internal devaluations" in peripheral euro zone countries make their exports more competitive and narrow current account imbalances.

ECB President Mario Draghi, who expects most of the euro zone to start recovering in the second half of 2013, cautioned on Friday that the crisis was far from over and governments must consolidate their budgets and reduce current account imbalances.

Optimists such as the Lisbon Council, a Brussels-based pro-market think-tank, and Berenberg Bank say the euro zone is turning into a more balanced and potentially more dynamic economy thanks to market pressure and constant demand for structural reforms.

But the longer and deeper the recession in Spain, Italy and Portugal, the greater the risk of them being sucked into a vicious circle of falling revenues outpacing spending cuts which in turn depress demand and output, causing lower revenues.

At the gloomy end of the scale, economists from Citi said last week they expected continued recession in the euro area in 2013 and 2014 and prolonged weakness thereafter — with ongoing financial strains and, over the next few years, a Greek exit and a series of sovereign debt restructurings.

The euro's survival may no longer be in much doubt after the ECB stepped in and the Germans decided to keep Greece inside the currency area, but the euro zone faces at best a slow grind back up the hill.

Dec 2, 2012

OctaFX.Com News Updates

-

05-12-2012, 02:45 PM #208Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com - Eurozone retail sales slump in October

Eurozone retail sales in unexpectedly big slump in October as investors await ECB meeting

LONDON (AP) -- Retail sales across the 17 European Union countries that use the euro slumped far more than anticipated in October, largely due to a huge drop in Germany, in a development that will put more pressure on the European Central Bank to cut borrowing rates soon.

Euro stat, the EU's statistics office, said Wednesday that euro-zone retail sales fell 1.2 percent in October from the previous month, double September's decline and substantially more than the 0.2 percent drop expected in the markets

The figures provide further evidence that households across the euro-zone remain gloomy over the economy and are reluctant to spend more than they have to — non-food sales were particularly weak during October.

The euro-zone is back in recession, officially defined as two straight quarters of falling output, and unemployment is up at a record high of 11.7 percent with 18.7 million people out of work.

"The prospects for consumer spending in the euro-zone look troubling in the near term at least given very low consumer confidence, high and rising unemployment, generally muted wage growth and tightening fiscal policy in many countries," said Howard Archer, chief European economist at IHS Global Insight.

While five of the countries at the epicenter of Europe's debt crisis — Greece, Cyprus, Spain, Portugal and Italy — are in recession, other economies, such as powerhouse Germany, are also now seeing demand wane. German retail sales fell a staggering monthly 2.8 percent, according to Eurostat.

Wednesday's figures come a day before the ECB meets to decide on whether to cut its main interest rate from the record low of 0.75 percent. Most economists think the ECB will wait before backing another cut, though the dire economic indicators recently have created some uncertainty over its decision. The euro fell on the latest figures, trading 0.1 percent lower on the day at $1.3093.

As well as announcing its latest interest rate decision, the ECB is also due to unveil its latest quarterly economic projections. They're not expected to show a recovery in the euro-zone economy before the second half of next year at the earliest as many governments continue to enact spending cuts and tax increases to lower debt.

A separate survey reinforced market expectations that the recession in the eurozone has continued into the fourth quarter. Though the monthly purchasing managers' index — a broad gauge of business activity — from financial information company Markit was revised up to 46.5 in November from the previous estimate of 45.8, the survey still points to recession — any reading below 50 points to a contraction in activity.

Dec 5, 2012

OctaFX.Com News Updates

-

05-12-2012, 03:15 PM #209Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com - Forex News: Euro Fails to Hold 1.31 As Spanish Bond Auction Misses Target

Despite the failure to reach a final agreement on a joint banking supervisor in yesterday’s meeting of European finance ministers, the Euro still climbed higher in yesterday’s session and rose above 1.3100 in the first part of today’s trading. Risk sentiment seems to be higher as the move was mimicked by other risk-correlated currencies, and European equities opened higher in today’s trading. Part of the optimism may come from Asian markets, where the Shanghai Composite index climbed nearly 3% in today’s trading, following an announcement that economic policies will be kept stable in China.

There were only a few economic releases in today’s European session. The 10th straight decline in Euro-zone composite output was not as bad as initially estimated, and the rise in UK services activity disappointed expectations.

The bigger decline came when sales of Spanish 3, 7, and 10-year bonds disappointed a maximum target of 4.5 billion Euros by only raising 4.25 billion in the auction. Then, Euro-zone retail sales were reported to have declined 1.2% in October, the disappointing number kept EURUSD below 1.3100.

The Euro is currently trading at about 1.3085 against the US Dollar in forex markets. Resistance could be provided by a 2-month high at 1.3139, and support could be provided at 1.3026, by the 76.4% retracement of the drop from October’s high to November’s low.

Tomorrow could see a lot of movement in Euro trading. The ECB will announce the interest rate at 12:45 GMT, expectations are for the rate to be left at 0.75%. Also, an updated estimate of the Euro-zone GDP for Q3 will be released, the previous estimate saw a 0.1% decline.

EURUSD Daily: December 5, 2012

Dec 5, 2012

OctaFX.Com News Updates

-

06-12-2012, 06:12 PM #210Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFx -ECB cuts growth outlook for eurozone, holds rates

European Central Bank cuts growth outlook for eurozone, leaves interest rates unchanged

FRANKFURT, Germany (AP) -- The European Central Bank underlined the gloomy prospects for the economy of the 17 European Union countries that use the euro, cutting its forecast for growth next year to minus 0.3 percent from plus 0.5 percent.

Even so, the bank left rates unchanged at its meeting Thursday, and ECB head Mario Draghi gave little sign the bank was willing to add more stimulus. He said the bank had already done much to lower borrowing costs in heavily indebted countries that are struggling to grow.

The bank's 22-member governing council kept the refinancing rate unchanged at 0.75 percent. The rate determines what private-sector banks are charged for borrowing from the ECB, and through that what rate the banks set for their businesses and consumer clients.

Draghi said current rates were "very accomodative" — meaning they are low enough to encourage growth. He also said that the ECB had already effectively lowered some interest rates with its plan announced in September to buy the bonds of indebted countries.

That plan — which would drive down borrowing costs for indebted governments that ask for help — had already led to drop of as much as 2 or 2 ½ percentage points in some countries borrowing costs, just on anticipation by bond investors.

"That is much more than you can achieve by a cut in the policy rate," Draghi said.

The eurozone's economy is in recession, having shrunk 0.1 percent in the third quarter after a 0.2 percent fall in the previous three months. A recession is often defined as two quarters of negative growth in a row. It is expected to contract again in the last three months of the year.

Draghi said the slump would continue into next year, with a gradual recovery later in 2013. The bank's minus 0.3 percent outlook is the midpoint of the forecast rate of between minus 0.9 percent and plus 0.3 percent.

Growth is being held back across the eurozone as governments slash spending and raise taxes to try to reduce levels of debt piled up from overspending in the case of Greece or real estate bubbles and banking crises in Spain and Ireland. Greece, Portugal, Ireland and tiny Cyprus have already needed bailouts, while Italy and Spain, the eurozone's third- and fourth-largest economies, teetered on the edge of needing help this summer.

A rate reduction in theory could stimulate the eurozone's economy by making it easier to borrow, spend and invest. But rates are already low, and borrowing remains weak. There are only a few early signs that previous rate cuts and stimulus measures are finally trickling through to the wider economy.

Draghi said that there had been a "wide discussion" on interest rates but that "in the end the consensus was to leave rates unchanged." Use of the term "consensus" suggests the council was not unanimous, but many analysts think the ECB could leave rates alone well into next year and might be done cutting.

Some analysts think the bank may now consider it has done enough to help the economy after a year of drastic measures. The most important was an offer in September to buy unlimited amounts of bonds issued by of Europe's heavily indebted countries. It also made €1 trillion ($1.3 trillion) in cheap, long-term loans to stabilize shaky banks last December and February, and cut rates a quarter point in July.

The bond purchase plan announced in September has helped stabilize the eurozone debt crisis. The purchases would aim to drive down bond interest rates, which would lower borrowing costs for indebted countries such as Spain and Italy and make it easier for them to manage their debt loads.

Although no bonds have been bought, the mere possibility has influenced the bond market. The interest yield on Spanish 10-year bonds is down to around 5.4 percent now, from 7.6 percent in July. Italy's costs to borrow for 10 years are now down to 4.4 percent, down from over 7 percent at the start of the year and close to the country's average for the past decade, But while governments are breathing easier, that hasn't restarted growth.

The ECB has tried to make sure that its crisis efforts are making it through to the eurozone's wider economy — but it is taking time to be felt and fear and reluctance remain. While some business confidence indicators are beginning to rise and the supply of money in the economy is increasing, consumer spending sagged 1.2 percent in October.

Dec 6, 2012

OctaFX.Com News Updates

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote