OctaFX.com- Forex: Dollar So Close to a Bullish Surge, What Does it Take?

- Dollar So Close to a Bullish Surge, What Does it Take?

- Euro Finds Little Bounce From Greece Hole Plug, Spain Rescue Rumors

- British Pound Rallies Briefly After CPI Data, Right Back Towards 1.5850

- Japanese Yen: Risk Aversion May have Wavered but the Yen Hasn’t

- Swiss Franc at Two Month High Versus Euro, 1.2000 in Sight

- Australian Dollar Losing Steam on Rate Outlook, Bullishness Deflating

- Gold Makes a Bearish Turn but Commitment Lacking Without Dollar

New to FX? Watch thisVideo; For live market updates, visitDailyFX’s Real Time News Feed

Dollar So Close to a Bullish Surge, What Does it Take?

The Dow Jones FXCM Dollar Index (ticker = USDollar) has held just below critical resistance and fresh two month lows since risk-trends were rejected despite the otherwise ‘better-than-expected’ October payrolls. Taking a look at the chart of the Dollar Index, we find the big-ticket 10,000 figure is complimented by the 100 and 200-day moving averages – considerable weight to any technical trader. However, the most remarkable technical read on the greenback is also a very telling fundamental consideration: the average true range (ATR). Measuring the average of the currency’s daily range (on a rolling 10-day basis), we find that the dollar has carved out the smallest rate of activity since high and low data have been recorded – so since at least January 2011. Altogether, that tells us a significant swell of volatility is soon at hand.

These measures of activity on the technical level are mirrored with what we have seen fundamentally. As the US benchmark equities have led a questionable march higher for riskier assets over the past months and years, we have also seen the FX Volatility Index slide to lows not seen since before the financial crisis in 2008 (the index is currently at 7.41 percent). The standard volatility indicators are both measures of insurance costs against adverse price movements and more elementally ‘fear’ gauges. Therefore, when these measures of risk rise, it is generally in response to a more active move towards risk aversion. That is a strong factor for the greenback – if and when it happens. Yet, we have seen the volatility measures continuously trend lower against a trend of more obvious troubles in growth trends, financial crises and fiscal imbalances.

Though it doesn’t necessarily have to jump start a watershed event in speculative positioning, a sudden return of volatility through the immediate future is a particularly credible threat. That being said, this may be a pickup in activity that defies the common convention that a big swing in price action necessarily translates into risk aversion (a disconnect that would most likely bypass the traditional volatility readings). Markets are currently positions such that they reflect the ‘tail risk’ (low probability, but high impact potential) that the Euro-area crisis will hit critical mass and / or the US will hit the wall that is its Fiscal Cliff. Recently, however, EU officials have managed to by Greece a few more weeks and lawmakers on both sides of the US political spectrum have voiced confidence in a budget resolution. Winding down those factors could boost risk trends – and likely will. The critical question is how much is the market weighing this possible short-term relief against the obviously, long-term problems…

Euro Finds Little Bounce from Greece Hole Plug, Spain Rescue Rumors

European officials are struggling to put out fires as the flames come progressively closer with each swell. The newswires have been crowded by headlines that are clearly aimed at provoking fear in a rapidly deteriorating financial situation in the Eurozone. Yet, through all the countdowns to Greece running out of money, the questions over whether the Spain will ask for an official rescue and other (lesser) concerns that have intensified this past week; the euro has posted limited – though consistent – downside progress. In contrast, recent positive developments / speculation have yielded just as little return in the Euro’s favor. Between a bill auction yesterday and allowance of Asset Backed Securities use as collateral, Greece looks like it will be able to cover the bond maturity that happens on Friday. On another front, rumors were running in the speculative circles that Spain would soon seek a bailout. Neither risk (EURUSD) nor anti-risk (EURAUD) pair closed in the green for the euro. Perhaps the market is awaiting today’s event risk: Greek and Portuguese 3Q GDP. There is no misinterpret ting these reports.

British Pound Rallies Briefly After CPI Data, Right Back Towards 1.5850

In quiet trading conditions, traditional fundamental releases – that would otherwise struggle for face time in market influence against larger themes like risk trends – can have a bigger impact on price action. That was the case with the pound and CPI data this past session. The headline CPI reading for October rose 2.7 percent on a year-over-year basis – a pickup from the lowest reading since November 2009. GBPUSD and other pound pairs responded with a brief bounce, but it wouldn’t hold. The BoE will not be hiking rates anytime soon.

Japanese Yen: Risk Aversion May have Wavered but the Yen Hasn’t

We have seen a strong risk aversion move this past week – though it may have been uneven across the markets – and the yen has certainly benefit the safe haven seeking. The only problem is that policy officials are trying to push the currency lower to offer some relief to the economy through exports. It is likely doubly frustrating that with recent hints over the past 24 hours at a possible bounce in risk trends that the yen has continued to gain ground against all of its counterparts. We have to wonder at what point, Japanese authorities will mimic the SNB.

Swiss Franc at Two Month High Versus Euro, 1.2000 in Sight

SNB President Jordan must not be happy. Two months ago, the EURCHF exchange rate finally picked up from the central bank’s force-imposed 1.2000-floor without the express influence of policy authority. Tail risk on the Euro-crisis seemed to ease and the safe haven flows reversed. Today, however, we are only 35 pips off that floor once again. After this brief jaunt, the market may realize the SNB will have to push it higher.

Australian Dollar Losing Steam on Rate Outlook, Bullishness Deflating

The Australian dollar seems to be relentless. The currency has climbed against the dollar and yen despite risk aversion moves from US equities this past week. And, despite the even footing, it has also advanced against fellow safe haven – the New Zealand dollar. The market hasn’t fully committed to risk aversion, but the Aussie’s true strength is the reduction of expected rate cuts. Well, that rebound seems to be fizzling out…

Gold Makes a Bearish Turn but Commitment Lacking Without Dollar

Gold has put in for three consecutive bearish days through Tuesday’s close. Though we haven’t moved very far on this retreat, it is still the worst trend for the metal in over a month. Until the dollar commits to a clear run – the anti-fiat / anti-inflation appeal of gold is put into the spotlight. Meanwhile, ETF holdings are at record highs and the CBOE’s gold volatility index has plunged back to multi-year lows (14.5 percent).

Nov 14, 2012

OctaFX.Com News Updates

Please visit our sponsors

Results 181 to 190 of 769

-

14-11-2012, 05:31 PM #181Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

-

15-11-2012, 02:49 PM #182Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.com- Dollar soars to 6-month high versus Japanese yen

FRANKFURT (MarketWatch) -- The U.S. dollar soared to its highest level versus the Japanese yen in more than six months Thursday, rising as the leader of Japan's main opposition party continued to push for a further loosening of monetary policy by the Bank of Japan. The dollar soared as high as 81.25 yen and changed hands in recent action at 81.15 yen, up from 80.20 yen in North American trade late Wednesday.

The yen last traded above 81 yen in late April. News reports said Shinzo Abe, leader of the main opposition Liberal Democratic Party, urged the Bank of Japan to push official interest rates below zero. Abe is seen as likely to become Japan's next prime minister in elections expected next month.

Nov 15, 2012

OctaFX.Com News Updates

-

16-11-2012, 03:49 PM #183Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com - Euro rises but vulnerable to Greece uncertainty

Prices took out resistance at the top of a rising channel established from mid-September, exposing the 61.8% Fibonacci retracement at 10038. A push above that targets the 76.4% retracement at 10109. The channel top – now at 10021 – has been recast as support, with a push back below that aiming for the 50% level at 9982.

Nov 16, 2012

-

16-11-2012, 04:26 PM #184Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com - Forex Analysis: NZD/USD Classic Technical Report 11.16.2012

ASIA/EUROPE FOREX NEWS WRAP

Prices are testing support in the 0.8064-0.8101 area, with a break lower exposing the 0.80 figure and the 50% Fibonacci retracement at 0.7962. Near-term resistance is at 0.8222, the underside of a previously broken rising channel set from late May, with a push above that targeting the 0.83 mark.

Nov 13, 2012

OctaFX.Com News Updates

-

17-11-2012, 05:31 PM #185Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com -Forex Analysis: Canadian Dollar At Risk For Further Losses On Slowing Inflation

The Canadian dollar weakened against its U.S. counterpart, with the USD/CAD pushing back above parity, and the Loonie may face additional headwinds in the week ahead as the economic docket dampens market expectations for higher borrowing costs. Although Canada retail sales are projected to increase another 0.5% in September, the consumer price report may dampen the Bank of Canada’s (BoC) scope to normalize monetary policy as price pressures diminish.

As the headline and core reading for consumer prices are expected to slow in October, BoC Deputy Governor Agathe Cote anticipates inflation to hold below the 2% target until the end of 2013, and we may see the central bank continue to endorse a neutral policy stance over the near to medium-term as the fundamental outlook for the region remains clouded with high uncertainty. After pushing back plans to balance the federal budget, Finance Minister Jim Flaherty held a cautious outlook for the region amid the ‘economic shocks that ripple outwards from other nations,’ and warned that Canada ‘is not immune to global forces’ amid the tepid recovery in the United States – Canada’s largest trading partner.

Given the historical ties between the two economies, BoC Governor Mark Carney many not want to get too ahead of the Federal Reserve as Chairman Ben Bernanke keeps the door open to conduct more quantitative easing, and we should see Mr. Carney preserve the 1.00% benchmark interest rate for most of 2013 in an effort to encourage a sustainable recovery. According to Credit Suisse overnight index swaps, market participants see the BoC keeping borrowing costs on hold over the next 12-months, and easing bets for a rate hike may continue to dampen the appeal of the Loonie as investors weigh the prospects for future policy.

As the rebound from 0.9632 gathers pace, the USD/CAD appears to be carving out an bullish trend, and we may see the pair continue to retrace the decline from June as the developments coming out of Canada curb bets for a rate hike. However, as the relative strength index on the USD/CAD remains capped by the 67 figure, the divergence in the oscillator certainly foreshadows a short-term correction in the index, and the pair may track sideways during the holiday trade before we see another bullish move in the exchange.

Nov 17, 2012

OctaFX.Com News Updates

-

19-11-2012, 04:03 PM #186Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com -Forex Analysis: US Dollar Classic Technical Report 11.19.2012

Prices edged through resistance at 10038, the 61.8% Fibonacci retracement, with buyers now aiming to challenge the 76.4% level at 10109.

The first layer of significant support lines up at 10020, the top of a formerly broken rising channel set from mid-September, with a drop below that targeting the 50% retracement at 9982.

Nov 19, 2012

OctaFX.Com News Updates

-

19-11-2012, 04:57 PM #187Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com -FOREX Technical Analysis: British Pound Slips in Early Week Trading

FOREX Trading and Technical Analysis Observations

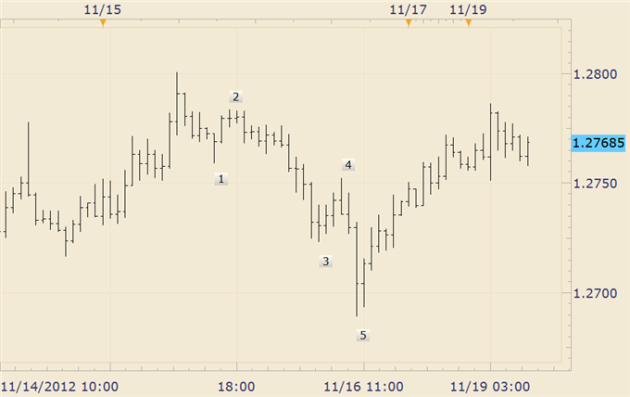

EUR/USD-As focused in FX Technical Weekly, the EUR/USD decline from Thursday’s high (12801) is impulsive which suggests that the larger downtrend has resumed. I am short as of this morning with a 12805 stop. Exceeding 12801 would shift focus to former supports at 12824 and 12882.

AUD/USD-is nearing resistance from the 61.8% retracement of the decline from 10480 at 10406. I’m on the lookout for a top and reversal but understand that RBA minutes are due tonight. Exceeding 10480 would shift focus to 10550 (again).

USD/JPY-is showing signs (JS Spike bars on multiple time frames) of topping. The rally from 9/13 may be complete in 5 waves. Wave 5, from the 11/9 low, is also in 5 waves. Considering the 61.8% retracement of the decline from March at 8148, risk is to the downside.

AUD/JPY-is approaching a potentially HUGE pivot near 8500.

EUR/USD – 60 Minute Bars

READ MORE

Nov 19, 2012

OctaFX.Com News Updates

-

21-11-2012, 03:46 PM #188Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com - Dollar Rebounds after Greece Decision Delayed, EUR/USD Ranges

- Dollar Rebounds after Greece Decision Delayed, EUR/USD Ranges

- Euro Rally Halted in its Tracks after Officials Fail to Advance Crisis Fight

- Australian Dollar: Reserve Currency Status vs Risk Sensitivities

- Japanese Yen Can Drop Slow or Drop Fast Depending on Vote

- British Pound: Traders Await BoE Minutes to Gauge QE Appetite

- US Oil Tumbles on Expectations of Gaza Strip Cease Fire

- Gold Trading Lower after EU Delays Rescue, Dollar Guiding

Dollar Reboundsafter Greece Decision Delayed, EUR/USD Ranges

The dollar spent Tuesday slowly drifting higher as the sharp risk aversion move over the open 24 hours of trading this week consolidated. That slow drift found a considerable accelerant early this morning, however, as the market learned that European policy officials had once again deferred making a decisive call on how to proceed with Greece’s financial aid – the linchpin to one of the financial market’s greatest fundamental threats. Without a solution on hand to a market-wide threat, the comfort of dollar liquidity looks considerably more appealing. From a risk assessment, we find S&P 500 futures have taken a quick turn lower having held the well-worn resistance at 1,390/88. On the FX side, EURUSD collapsed 80 pips while the AUDUSD dropped 40 pips. For the safe haven dollar itself, the Dow Jones FXCM Dollar (ticker = USDollar) has extended its climb from Tuesday’s 10,000-mark test. A turn in risk is one thing. A sustained trend is something else completely though…

News that Eurozone officials have prolonged the uncertainty surrounding their weakest link is a clear bearish weight on speculators shoulders. The longer this situation continues unsolved (or more appropriately, unprogressed), the less likely it is that global investors will be satiated by a lackluster solution. The underlying reality is that the long-term situation in Europe, Asia and the United States is murky and not being met with clear and lasting reform (instead, officials seem to be betting on a ‘general improvement’ in market conditions or other external development like exports or stimulus). Yet, traders are willing to overlook the lack of a long-term solution so long as they see the opportunity to speculate for short-term gain in the interim. With each temporary effort to buy time and subsequent return to critical structural issues, we find the market less willing to play along with the short-lived risk rally. That speaks to a fundamental shift where deleveraging and dollar advance grow more permanent.

A lack of confidence in genuine improvement for growth, yields and financial operation is a critical concern for traders heading forward. That said, such concerns may be muted the rest of this week. Active risk aversion – the necessary ingredient for dollar strength – requires an active catalyst. However, we have seen the Euro-area crisis put on ice and the Fiscal Cliff has grown scarce amongst the financial headlines. Furthermore, the liquidity drain and disruption in risk transmission with the US Thanksgiving holiday is fast approaching.

Euro Rally Halted in its Tracks after Officials Fail to Advance Crisis Fight

In the lead up to what was arguably this week’s most prominent event risk – the EU Finance Ministers’ funding decision on Greece – euro activity collapsed. In fact, the average hourly range just before the announcement was an incredible 10 pips. Why was this event so influential? Greece has had to return to the funding well numerous times, but this particular iteration has seen greater reticence and a many more delays than what we have seen in the past. Yet another postponement was announced early this morning.

After more than 11 hours of debate over the next steps for the Eurozone’s most troubled member, officials reneged on their vow to offer a definitive resolution. Officials offered hollow remarks about progress in discussions and idea sharing, but these comments offer little reassurance. The statement that was released has set the next meeting on November 26 as the firm date for a verdict on Greece’s aid needs. Looking ahead, the situation is tense with some EU members troubled about offering more support and the IMF wavering on further participation with the debt-to-GDP forecasts for 2020 projected well above the level deemed ‘sustainable’. One thing is certain: Monday’s risk trend bearing has been significantly altered. Rather than return to a clear sentiment bearing, we will have another wait-and-see Monday.

Australian Dollar: Reserve Currency Status vs Risk Sensitivities

The IMF’s announcement that it was considering adding the Australian (and Canadian) dollar to the official list of reserve currencies offers a substantive change in fundamental bearing for the currency. A high-yielding, safe haven would be the Holy Grail for FX traders. Yet, the Aussie dollar doesn’t fit that ideal. The fund’s label wouldn’t represent an official change for traders – rather it’s a reaction to central banks already buying. This ‘reserve’ status is flimsy. With enough momentum, the carry currency would quickly fall back into line in with a risk aversion move.

Japanese Yen Can Drop Slow or Drop Fast Depending on Vote

Heading into the December 16 Parliamentary vote in Japan, growth and a high yen will be a centerpiece of both the LDP and DPJ’s campaign. As such, stimulus and proactive currency devaluation will be a shared objective. However, there is a different rate of attrition for the yen. Under Noda (DPJ), the BoJ’s independence looks more secure. With Abe (LDP), unlimited stimulus and foreign bond buying is on the table.

British Pound: Traders Await BoE Minutes to Gauge QE Appetite

Bank of England Governor Mervyn King is very concerned about the state of the English economy if his statements are to be believed. And yet, his efforts to bolster growth (and offset government austerity measures) have fallen well short of what his counterparts in the US, Eurozone and Japan have pursued. Is the MPC ready to augment its efforts? We will have another update from the upcoming BoE minutes.

US Oil Tumbles on Expectations of Gaza Strip Cease Fire

US oil prices collapsed Tuesday on early news that a cease fire would be called in the active engagement in the Gaza Strip. Such a move would help curb supply fears in the oil-rich Middle East. However, that calm never seemed to fully materialize. Crude prices began to rebound from 85.50 as that realization dawned. However, more general risk trends are a major factor here as well. With Greece, risk aversion is a weight.

Gold Trading Lower after EU Delays Rescue, Dollar Guiding

Under a purely academic interpretation of how fundamental roles play out, gold should have rallied after news that EU officials were delaying a decision on Greece. That maintains a sense of uncertainty and is a considerable threat to financial market stability. And yet, the metal dropped after the news. Why? With the euro under pressure, the world’s most liquid currency receives a boost. And gold is priced primary in dollars.

Nov 21, 2012

News Updates

-

21-11-2012, 05:53 PM #189Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com - Forex: Euro Relief Rally At Risk, Sterling Looks Higher On BoE Policy

Talking Points

- Euro: EU Fails To Deliver Greek Deal, IMF Says More Needs To Be Done

- British Pound: BoE Votes 8-1 on QE, Curbs Bets For Lower Borrowing Costs

- U.S. Dollar: Continues To Gain Ground Ahead Of Thanksgiving Holiday

Euro: EU Fails To Deliver Greek Deal, IMF Says More Needs To Be Done

The Euro pared the overnight decline to 1.2735 as European policy makers floated different options to save Greece, but the reactionary approach held by the EU continues to encourage a bearish outlook for the EURUSD as the debt crisis dampens the fundamental outlook for the region.

Indeed, the EU unveiled a EUR 10B bond-buyback plan for Greece, which would be financed through the European Financial Stability Facility, while the group is also looking to suspend Greece’s interest payment on the bailout program through 2020 in an effort to keep the periphery country within the monetary union.

As the EU prepares a bundled aid package to avert a Greek default, International Monetary Fund Managing Director Christine Lagarde argued that ‘a bit more’ needs to be done to find a credible solution for Greece, and the ongoing rift within the troika – the EU, ECB, and IMF – may produce further weakness in the EURUSD as European policy makers struggle to restore investor confidence.

As European policy makers increase their pledge to avoid a credit event in Greece, headlines coming out of the region may keep the single currency afloat over the coming days, but we may see the EURUSD struggle to hold above the 23.6% Fibonacci retracement from the 2009 high to the 2010 low around 1.2640-50 as the fundamental outlook for the euro-area turns increasingly bleak.

As the short-term rebound in the EURUSD fails to keep the exchange rate above the 20-Day SMA (1.2820), the pair may consolidate going into the holiday trade, and we will maintain our bearish forecast for the euro-dollar as the weakening outlook for the region is expected to put additional pressure on the European Central Bank to ease monetary policy further.

British Pound: BoE Votes 8-1 on QE, Curbs Bets For Lower Borrowing Costs

The British Pound climbed to a fresh weekly high of 1.5948 as the Bank of England (BoE) Minutes sapped bets for additional monetary support, and the rebound from 1.5822 may continue to gather pace over the near to medium-term as the central bank appears to be slowly moving away from its easing cycle.

Although the Monetary Policy Committee voted 8-1 to keep its asset purchase program at GBP 375B, the board argued against a further reduction in the benchmark interest rate, while a growing number of central bank officials turned their attention to the stickiness in price growth as the central bank warned that ‘above-target inflation in the near term increased the chance that any pick-up in productivity would result in higher wage demands.’

As the BoE strikes a more neutral tone for monetary policy, we’re seeing the relatives strength index on the GBPUSD breakout of the downward trend carried over from September, and the technical development encourages a bullish outlook for the GBPUSD as the pair appears to be carving out a higher low in November.

U.S. Dollar: Continues To Gain Ground Ahead Of Thanksgiving Holiday

The greenback continued to gain ground on Wednesday, with the Dow Jones-FXCM U.S. Dollar Index (Ticker: USDOLLAR) advancing to a high of 10,059, and the reserve currency may track higher ahead of the holiday trade as the developments coming out of the EU meeting fails to generate an improved landscape for risk-taking behavior.

As U.S. traders go offline ahead of the Thanksgiving holiday, the drop in market participation may produce choppy price action over the next 24-hours of trading, but the bullish sentiment surrounding the reserve currency looks poised to gather pace over the remainder of the year as the Federal Reserve adopts an improved outlook for the world’s largest economy.

Nov 21, 2012

News Updates

-

23-11-2012, 02:45 PM #190Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com - Euro, global shares gain as Greek deal seen closer

LONDON (Reuters) - The euro hit a three-week high on Friday after an unexpected rise in German business sentiment for November and on signs of progress in efforts to help Greece secure fresh funding.

Companies in Europe's powerhouse economy have turned slightly more optimistic about the outlook despite the euro zone crisis, breaking a six-month run of worsening sentiment, the Munich-based Ifo think-tank said.

"The unexpected rise in November's German Ifo survey provides some relief, but doesn't alter the big picture of near stagnation in the euro zone's growth engine," said Jonathan Loynes, chief European economist at Capital Economics.

The euro climbed to $1.2913 following the data and is on track to gain 1.2 percent against the dollar this week.

European equity markets showed less reaction as many investors chose to end one of the best weeks of 2012 so far by booking some of their profits.

The pan-European FTSEurofirst 300 index (.FTEU3) edged up 0.1 percent at 1,102.35 points, on course for its best week since May and the second biggest weekly gain of the year.

London's FTSE 100 (.FTSE), Paris's CAC-40 (.FCHI) and Frankfurt's DAX (.GDAXI) were between flat and 0.2 percent higher. (.EU) (.L)

GREEK OPTIMISM

The gains across European markets were supported by optimism that Greece will get the money needed to avoid bankruptcy when euro zone finance ministers, the International Monetary Fund and the European Central Bank meet again on Monday.

A Greek government official told Reuters the IMF and the European Union have narrowed their differences over the target for Greek debt reduction by 2020.

Agreement on a new debt target and how it can be reached is a key stumbling bock in agreeing the release of 44 billion euros ($57 billion) of funds from the bailout package Greece desperately needs to avoid bankruptcy.

"The market is getting a bit confident that a Greek deal will be struck. This will remove one of the near-term uncertainties in the euro zone," said Paul Robson, currency strategist at RBS.

Greek government bond yields, however, were 5 basis points higher at 16.49 percent, but a relatively small move for the volatile paper and still close to its lowest level since the country's debt was restructured in March.

"It's not the first time we have this type of news. The market knows there is a disagreement," said ING rate strategist Alessandro Giansanti. "Until there is an official statement, detailing what they want to do, especially in terms of a debt restructuring, we're not going to see so much of a reaction."

Ten-year German government bonds, a barometer of investor sentiment on the euro zone crisis were 2 basis points lower at 1.42 percent.

YEAR END OUTLOOK

The potential for a Greek deal and signs lawmakers in the United States will eventually agree steps to avoid a fiscal crisis there have been behind a strong rally in share markets around the world this week and have supported commodities.

"These two positive drivers should make for a strong month of December, which traditionally is a fairly good month anyway," said Philippe Gijsels, head of research at BNP Paribas Fortis Global Markets.

MSCI's world equity index <.MIWD00000PUS> was up 0.15 percent on Friday at 326.75 points, on course for a gain of nearly 3 percent this week. That will be its best weekly performance since mid-September.

U.S. stock index futures also point to modest gains when Wall Street trading resumes for a short post-Thanksgiving trading day. (.L)(.EU) (.N)

Earlier, MSCI's broadest index of Asia Pacific shares outside Japan <.MIAPJ0000PUS> rose 0.7 percent for a weekly gain of 2.6 percent, its best week for two months.

Gold edged up 0.1 percent to $1,731.36 an ounce and looks set to post its second weekly rise in three, while three-month copper on the London Metal Exchange was up 0.18 percent a tonne at $7,729.

On the other hand Brent crude slipped towards $110 a barrel as the fragile ceasefire between Israel and Gaza eased supply concerns.

On Thursday Israel began withdrawing its army, which had been poised to invade the Gaza Strip in pursuit of militants firing rockets into Israel.

"Oil prices will probably be under pressure as long as the ceasefire holds," said Filip Petersson, a commodity strategist at SEB Commodity Research.

Nov 23, 2012

OctaFX.Com News Updates

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote