CAD/JPY testing major support, prepare for a bounce!

The price is testing major support at 88.52 (Horizontal swing low support, bullish price action, bullish harmonic formation) and we expect to see a nice bounce above this level to push the price up to at least 88.87 (Fibonacci retracement, horizontal pullback support) before 89.02 (Fibonacci retracement, horizontal overlap resistance).

Stochastic (55,5,3) is seeing major support above 1% where we expect a corresponding bounce from.

Buy above 88.52. Stop loss at 88.24. Take profit at 88.87 and 89.02.

Please visit our sponsors

Results 2,471 to 2,480 of 4086

Thread: InstaForex Wave Analysis

-

22-01-2018, 08:50 AM #2471

-

23-01-2018, 07:22 AM #2472

The trading plan for the US session is EUR/USD and GBP/USD

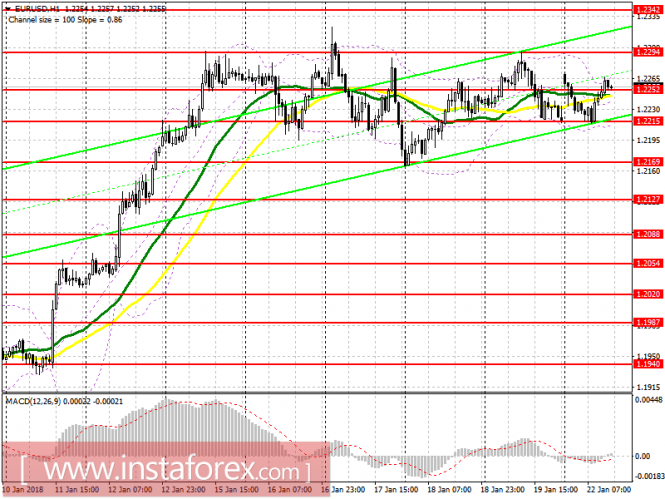

EUR/USD

To open long positions for EURUSD, it is required:

Buyers are trying to get ahold of the level of 1.2252, and while the trade is higher, a chance remains for continued growth of the euro with an update of 1.2294 and the main purpose of a test at 1.2342, where I recommend locking in profits. In the event of a decline below the level of 1.2252 in the afternoon, consider new purchases of the euro after a test at the level of 1.2215, or immediately towards a rebound from 1.2169.

To open short positions for EURUSD, it is required:

A return to the level of 1.2252 would be a good signal to increase short positions on the euro for the purpose of a breakdown and consolidation below the support of 1.2215, which opens a direct road to the area of 1.2169, where I recommend locking in profits. In case the euro further grows, it is possible to look for short positions after the formation of a false breakout at 1.2294 or on a rebound from 1.2342.

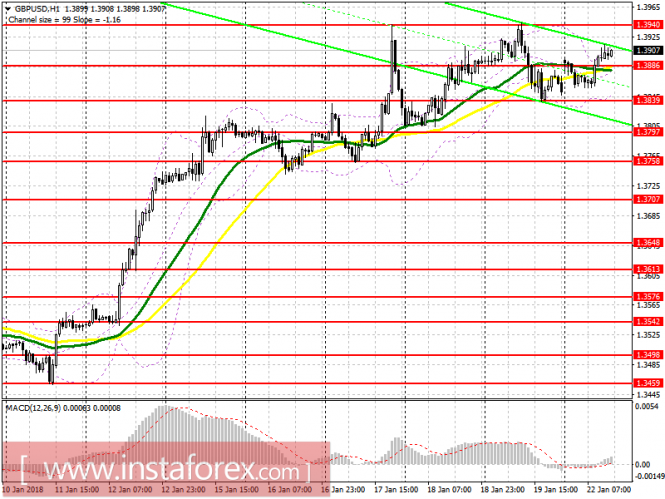

GBP/USD

To open long positions for GBP/USD, it is required: Buyers are trying to work out a scenario in the morning in order to consolidate above 1.3886, and while the trade is at this level, you can count on continuing an upward trend with an exit towards a resistance of 1.3940. The main target remains in the area of 1.4018. In the event of a return below the level of 1.3886, I recommend that you pay attention to long positions on the pound only after a test at 1.3839.

To open short positions for GBP/USD, it is required:

The return at 1.3886 will signal an opening of short positions for the pound, which will lead to the renewal of daily lows in the area of 1.3839 and will likely reach a new support level of 1.3797, where I recommend locking in the profit. In case of continued growth in the pound during the afternoon, short positions can be considered for a rebound from 1.3940.

Indicator description

Moving Average (average sliding) 50 days - yellow

Moving Average (average sliding) 30 days - green

MACD: fast EMA 12, slow EMA 26, SMA Bollinger Bands 20

Analysis are provided byInstaForex.

-

24-01-2018, 07:41 AM #2473

USD/CHF right on major support, prepare for a bounce

The price is now testing major support at 0.9569 (Fibonacci extension, horizontal swing low support) and we expect a bounce above this level to push the price up to at least 0.9699 resistance (Fibonacci retracement, horizontal pullback resistance).

Stochastic (21,5,3) is seeing major support above 3.7% where a corresponding bounce could occur.

Buy above 0.9569. Stop loss at 0.9501.

Take profit at 0.9699.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

25-01-2018, 06:17 AM #2474

Pound updates annual highs on the background of the report on the labor market

The euro managed to strengthen against the US dollar in the morning against the backdrop of data indicating the likely retention of the euro zone's economic growth rates earlier this year. However, a serious breakthrough in important levels of resistance has not occurred, indicating a restrained demand for risky assets.

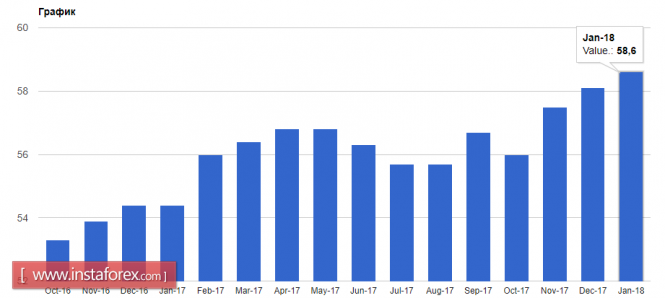

According to the IHS Markit report, Germany's economy continues to show good results in early 2018 due to the growth of activity in the services sector. So, the index of supply managers for the German services sector in January 2018 increased to 57.0 points against 55.8 points in December. Economists, on the contrary, expected a decline in the index. The index for the manufacturing sector in January fell slightly, to 61.2 points.

In the eurozone, there are also signs of stable growth, as evidenced by the data.

According to the IHS Markit report, the preliminary composite index of supply managers of the eurozone in January 2018 increased to 58.6 points against 58.1 points in December. It should be noted that the index values above 50 indicate an increase in activity. This growth in the index corresponds to a quarterly growth of the economy by 1%.

In France, the preliminary index of supply managers for the manufacturing sector in January this year dropped to 58.1 points against the December value of 58.8 points. But the preliminary index of supply managers for the services sector, on the contrary, increased in January to 59.3 points against 59.1 points in December. Economists had expected that the service sector index would drop to a level of 58.9 points.

As for the technical picture of the EURUSD pair, there have been no significant changes. The main objective of euro buyers today will be to keep above the 1.2300 area, which will make it possible to count on continuing the upward trend, with the update of the new significant highs of 1.2390 and 1.2430.

The British pound continued its growth against the US dollar, after it became known that the employment rate in the UK from September to November 2017 reached a record high. Meanwhile, wages in the UK declined, which indicates a worsening of the financial situation of consumers after the referendum on Brexit.

According to a report by the National Bureau of Statistics, the employment rate in the UK was 4.3%, which fully coincided with the forecasts of economists. The average earnings in the UK for the period increased by 2.4%, while real wages fell by 0.5%.

Analysis are provided byInstaForex.

-

26-01-2018, 06:12 AM #2475

NZD/USD right on major support, time to go long

The price is testing major support at 0.7312 (Fibonacci retracement, horizontal overlap support, long-term ascending support, bullish price action) and a bounce could occur at this level to push the price up to at least 0.7436 resistance (major swing high resistance, Fibonacci extension). RSI (55) sees a long-term ascending support line since November 2017 hold up our bullish momentum really well. We're starting to see a possible break of this long-term support line but our major support remains at 51% and only a clean break of that level would be a precursor that a drop is coming. Buy above 0.7312. Stop loss at 0.7256. Take profit at 0.7436.

Analysis are provided byInstaForex.

-

29-01-2018, 05:27 AM #2476

Nobody wants currency wars

Eurozone

Markets continue to assess under the microscope the results of the ECB meeting on Thursday. Mario Draghi's press conference started with a few dovish statements, as Draghi focused on the slowness and austerity, indicating that it is not necessary to wait for surprises and, especially, some severe steps from the ECB.

Draghi called for dividing the expectations for the rate and the regulation of the asset purchase program. Regarding the rate, Draghi spoke directly, he said, the chances of an increase this year are small. With regards to the repurchase of assets, the position is more hawkish, as Draghi had to declare sustainable economic growth, which could mean confirmation of plans to curtail the repurchase program.

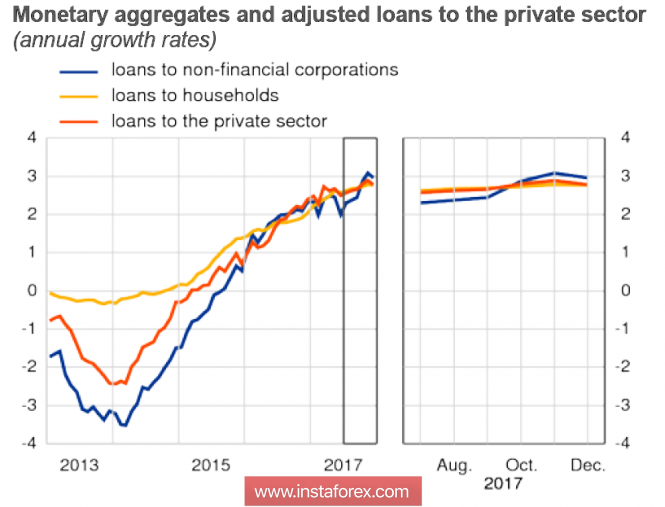

The ECB's lending report released on Friday showed that in December the growth rate of lending to the private sector and non-financial organizations slowed somewhat, but annual rates remain firmly strong, which confirms the conclusion about the sustainability of economic growth in the euro area.

A member of the ECB Executive Board, Benoit Coeure, commented on US Treasury Secretary Munchin's previous statements, saying that attempts to target exchange rates could provoke a currency war, and this is the last thing the world needs. On Thursday, indicating a similar tone, Draghi spoke out, as the issue for the euro is important - excessive strengthening can put downward pressure on inflation, as imports cheapen.

On Tuesday, a preliminary GDP report will be released for the fourth quarter, with a forecast of a 2.6% growth, which is no worse than in the US, which means it will support the euro, all other things being equal. On Wednesday, the report on inflation in January will be released, the forecast is negative, the euro could be under pressure. In general, the reasons for the euro to continue growth without a correction are few, likely a decrease to 1.2323 and consolidation just below the peaks that were reached.

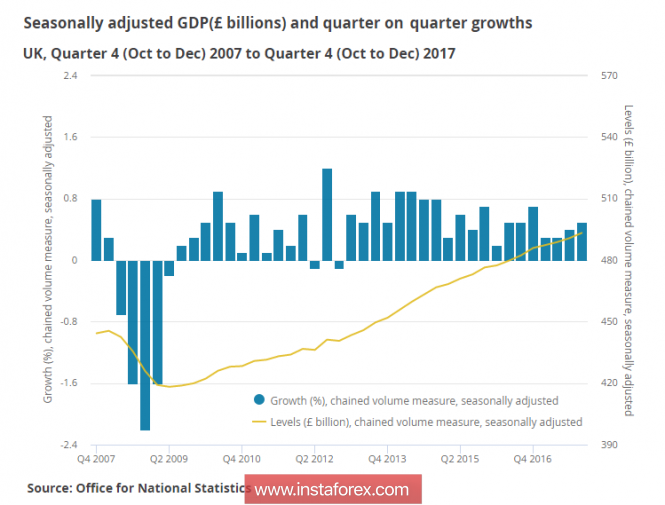

United Kingdom

The UK economy grew slightly stronger in the fourth quarter than forecast, which had a limited support for the pound, which once again renewed its peak after Brexit. However, NIESR forecasted the possibility of growth up to 0.6%, so the market was not very surprised by the result.

The head of the Bank of England, Mark Carney, made an attempt on Friday to knock down a wave of demand for the pound, which, however, proved unsuccessful. Answering a question in an interview with the BBC about quantifying damage from Brexit, Carney said that the country's GDP lost 1% of its growth rate, and by the end of 2018 these losses will grow to 2%. To date, the result of Brexit has been a decline in economic activity of tens of billions of pounds, and it takes time to achieve a higher growth potential.

Carney highlighted the main point - companies are cutting back on investments, as they are waiting for clarity on the UK's trading positions after it leaves the EU.

On Tuesday, the Bank of England will report on consumer and mortgage lending in December. On Wednesday, the Gfk index on consumer confidence will be released. The pound looked very strong last week, and went far into the overbought zone, but the momentum is still strong, and therefore the highs will likely be updated, the nearest support is 1.3995.

Oil

Oil adheres to the most likely scenario, once again the peak is updated, the trends remain the same. Saudi Energy Minister Khaled al-Faleh said in Davos that $25 from its current price is secured by the OPEC + deal, confirming the cartel's position to adhere to the plan to stabilize the market. There is no reason to expect that the OPEC + countries will voluntarily give up the mechanism that fills the scarce state budgets of the oil-producing countries.

Analysis are provided byInstaForex.

-

30-01-2018, 06:11 AM #2477

Gold forming a cup and handle reversal, prepare for a strong drop!

Gold has formed a really strong reversal of a cup and handle formation. We look to sell below major resistance at 1344 (Fibonacci retracement, horizontal overlap resistance, cup and handle breakout level) where a strong drop is expected to push the price down to at least 1325 support (Fibonacci retracement, horizontal overlap support, Fibonacci extension).

Stochastic (34,5,3) is seeing descending resistance hold it down really well which corresponds to the drop we're expecting.

Sell below 1344. Stop loss at 1353. Take profit at 1325.

Analysis are provided byInstaForex.

-

31-01-2018, 09:39 AM #2478

NZD/USD starting to show signs of a bounce, remain bullish

The price continues to test our buying area and ascending channel support. We think that it might be doing a fake breakout now because RSI has not broken below 50% yet. We remain bullish above major support at 0.7312 (Fibonacci retracement, horizontal overlap support, long-term ascending support, bullish price action) for the price to continue its push up to at least 0.7436 resistance (major swing high resistance, Fibonacci extension).

RSI (55) major support remains at 50% and only a clean break of that level would be a precursor that a drop is coming.

Buy above 0.7312. Stop loss at 0.7256. Take profit at 0.7436.

https://forex-images.ifxdb.com/userf...1248a43e81.png

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

31-01-2018, 09:41 AM #2479

NZD/USD starting to show signs of a bounce, remain bullish

The price continues to test our buying area and ascending channel support. We think that it might be doing a fake breakout now because RSI has not broken below 50% yet. We remain bullish above major support at 0.7312 (Fibonacci retracement, horizontal overlap support, long-term ascending support, bullish price action) for the price to continue its push up to at least 0.7436 resistance (major swing high resistance, Fibonacci extension).

RSI (55) major support remains at 50% and only a clean break of that level would be a precursor that a drop is coming.

Buy above 0.7312. Stop loss at 0.7256. Take profit at 0.7436.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

01-02-2018, 05:02 AM #2480

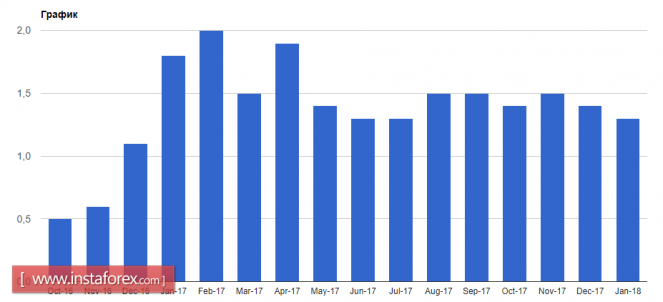

Inflation did not please investors

The European currency managed to strengthen its positions against the US dollar in the first half of the day, but riskier assets did not receive more powerful support from the large players, as the inflation data in the euro zone fully coincided with the forecasts of economists.

The situation in the German labor market is excellent. According to the data, the number of applications for unemployment benefits decreased, and unemployment reached a record low level.

Thus, the number of unemployed in January this year fell by 25,000 compared to December 2017. Economists had expected a reduction of 16,000. In January, the Federal Labor Agency of Germany registered 736,000 vacancies, which is 89,000 more than in January 2017.

The unemployment rate in Germany fell to 5.4%.

Not surprisingly, after such data, and based on past reports, the German Ministry of Economy raised the forecast for GDP growth in 2018 to 2.4% from 1.9% after growing by 2.2% in 2017. It is expected that such a strong growth will be due to good external and internal demand, as well as good labor market conditions.

The inflation data did not cause any serious changes in the market, as investors expected more serious changes in the dynamics.

According to the report, in January this year, compared with the same period of the past, the consumer price index rose by 1.3%, which fully coincided with the forecasts of economists. As you can see, the current level is far from the level set by the European Central Bank, which is slightly below 2%. Core inflation rose to 1% from 0.9%.

As for the euro-zone labor market, according to the statistics agency's report, the unemployment rate in the eurozone in December 2017 remained unchanged at 8.7% against 8.7% in November. Economists also forecast the current level of unemployment.

Data from ADP did not strongly support the US dollar, although they were much higher than economists' forecasts, which indicates the good position of the US labor market.

According to the report, the number of jobs in the private sector in the US increased by 234,000 in January this year, while economists forecast an increase of 193,000. The ADP noted that there was a strong hiring of medium and large companies.

A serious breakthrough of the level of 1.2450 did not happen. Most likely, traders took a wait-and-see attitude before the Fed decision on interest rates, and the publication of the accompanying statement. Only a real breakthrough of the range 1.2445-1.2455 will lead to continued growth in risk assets with an update of 1.2500 and a new high at 1.2560.

Analysis are provided byInstaForex.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 3 users browsing this thread. (0 members and 3 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote