The buyers of the euro are ready

Despite weak performance in the manufacturing sector, the European currency continues to make attempts to grow against the US dollar. It is maintaining an upward price channel.

It was only in Italy where there was an increase in the index of production while in France and Germany, the similar index slowed slightly.

According to the report of the statics agency, the index of supply managers for the manufacturing sector in Italy for the month of January this year rose to 59.0 points, compared to 57.4 points in December last year. Economists predicted the index at the level of 57.3 points.

In France, there is a marked decrease in activity in the manufacturing sector. According to the report, the index of supply managers for the manufacturing sector in January fell to 58.4 points against the December index of 58.8 points. Economists and market participants did expect a decline to the level of 58.1 points.

In Germany, the index of supply managers also slowed its growth. According to the data, PMI for Germany's manufacturing sector in January fell to 61.1 points against 63.3 points in December 2017. Economists had expected the index to fall to the level of 61.2 points.

If we talk about the euro area as a whole, then there is also a slight decline. According to the statistics agency, the index of supply managers PMI for the production area of the eurozone in January dropped to 59.6 points, compared to 60.6 points in December. The data fully coincided with the forecasts of economists.

It is important to note that finding the index above the level of 50 points indicates an increase in activity.

The current data that's at a rather slight decline in indicators at the beginning of this year will not likely affect the data on GDP seriously in the first quarter of 2018, which is confirmed by the market reaction to the data.

As for the technical picture of the EURUSD pair, so far the situation is developing in favor of buyers as it managed to keep the trade in an upward price channel. The lower limit of this level is at the January 30 low. The breakthrough of resistance at the level of 1.2470 opens up good prospects for the EURUSD pair for further growth of the trading instrument in the area of annual maximums at 1.2540.

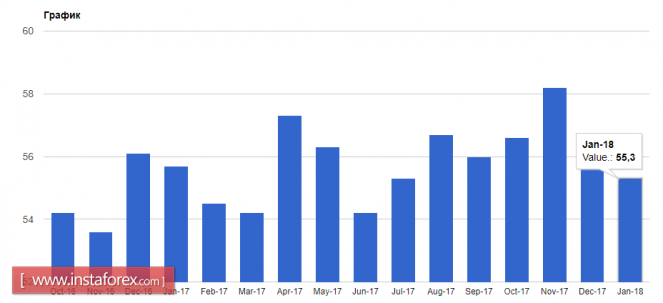

A similar index that's already in the UK, also did not put pressure on the British pound, even despite its slowdown to a 6-month low.

According to a report by research company IHS Markit Ltd., the index of supply managers for the UK manufacturing sector in January was 55.3 points compared to 56.2 points in December. The value of the index above 50 indicates an increase in activity. Economists had expected the index to be 56.5 points.

Analysis are provided byInstaForex.

Please visit our sponsors

Results 2,481 to 2,490 of 4086

Thread: InstaForex Wave Analysis

-

02-02-2018, 04:03 AM #2481

-

05-02-2018, 05:52 AM #2482

Daily analysis of GBP/USD for February 05, 2018

The pair is struggling to consolidate the price action above the resistance level of 1.4280 and it seems that the 200 SMA could act, once again, as a dynamic support. If that happens, GBP/USD could resume the overall bullish bias and can skyrocket towards the 1.4393 level. MACD indicator remains in the negative territory, calling for a leg lower.

H1 chart's resistance levels: 1.4280 / 1.4393

H1 chart's support levels: 1.4060 / 1.3937

Trading recommendations for today:

Based on the H1 chart, buy (long) orders only if the GBP/USD pair breaks a bullish candlestick; the resistance level is at 1.4280, take profit is at 1.4393 and stop loss is at 1.4168.

Analysis are provided byInstaForex.

-

06-02-2018, 05:58 AM #2483

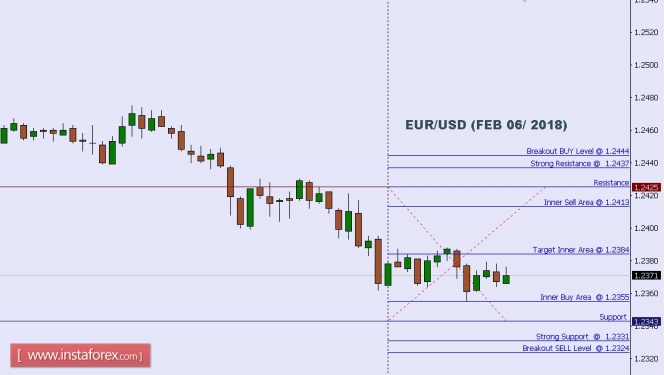

Technical analysis of EUR/USD for Feb 06, 2018

When the European market opens, some Economic Data will be released such as Retail PMI, French Gov Budget Balance, and German Factory Orders m/m. The US will release the Economic Data too, such as IBD/TIPP Economic Optimism, JOLTS Job Openings, and Trade Balance, so, amid the reports, EUR/USD will move in a low to medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.2444.

Strong Resistance:1.2437.

Original Resistance: 1.2425.

Inner Sell Area: 1.2413.

Target Inner Area: 1.2384.

Inner Buy Area: 1.2355.

Original Support: 1.2343.

Strong Support: 1.2331.

Breakout SELL Level: 1.2324.

Analysis are provided byInstaForex.

-

07-02-2018, 05:54 AM #2484

The deficit of foreign trade in the US at record highs

Despite the good data for Germany, which came out in the morning, demand for the US dollar remained.

According to the report of the German Ministry of Economics, orders in the manufacturing sector of Germany in December last year grew due to strong demand from abroad. Thus, the total volume of production orders in December 2017 increased by 3.8% compared with the previous month, while economists expected that the growth in December will be 0.6%.

As I noted above, the leaders were export orders, which grew by 5.9%, while internal orders increased by only 0.7% compared to the previous month.

The US dollar has ignored the data on the next wave of growth of foreign trade deficit in the US, which peaked in nine years. This happened as a result of growth in imports due to strong consumer demand.

According to the report of the US Department of Commerce, the foreign trade deficit in December 2017 increased by 5.3% compared to the previous month and amounted to 53.12 billion US dollars. Economists had expected a deficit of $52.0 billion.

Import to the US grew by 2.5% to $ 256.5 billion. The increase in imports of goods during the holiday season had a negative impact on the indicator. There was also an increase in imports of cars and capital goods. Export grew by only 1.8% to $ 203.4 billion.

Speech by Fed official Bullard was generally ignored by the market.

Fed President St. Louis James Bullard said today that the relationship between the employment market and inflation has disrupted, and inflation expectations have risen. First of all, he was referring to the latest report of the US Department of Labor, which pointed to a serious increase in labor forces and an increase in wages, which would definitely spur inflation in early 2018, giving it a serious upward momentum along with economic growth.

Bullard also noted that the tax bill will promote investment growth, but the monetary policy is currently close to neutral and does not need to be adjusted.

It is worth paying attention to the fact that his opinion is at odds with the recent statements of his colleagues, in which it was clearly indicated that the Federal Reserve will raise interest rates this year.

The deficit of Canada's foreign trade in December grew due to the fact that imports prevailed over exports, which slowed significantly compared to the previous month.

According to the Bureau of Statistics of Canada, the foreign trade deficit in December 2018 increased by 3.19 billion Canadian dollars. Economists forecast a deficit of C$ 2.25 billion in December. Imports in December rose by 1.5%, to a record level of 49.70 billion Canadian dollars, while exports increased by 0.6%, to 46.51 billion Canadian dollars.

Analysis are provided byInstaForex.

-

08-02-2018, 05:58 AM #2485

Daily analysis of USDX for February 08, 2018

The index managed to do a rebound above the 200 SMA and gathered momentum towards the 90.30 level. A higher continuation is expected once USDX does a break above 90.63. To the downside, the 200 SMA continues to provide dynamic support but if it gives up, the bearish side could get again another breath.

H1 chart's resistance levels: 90.63 / 91.75 H1

chart's support levels: 89.36 / 87.88

Trading recommendations for today: Based on the H1 chart, place sell (short) orders only if the USD Index breaks with a bearish candlestick; the support level is at 89.36, take profit is at 87.88 and stop loss is at 90.81.

Analysis are provided byInstaForex.

-

09-02-2018, 05:47 AM #2486

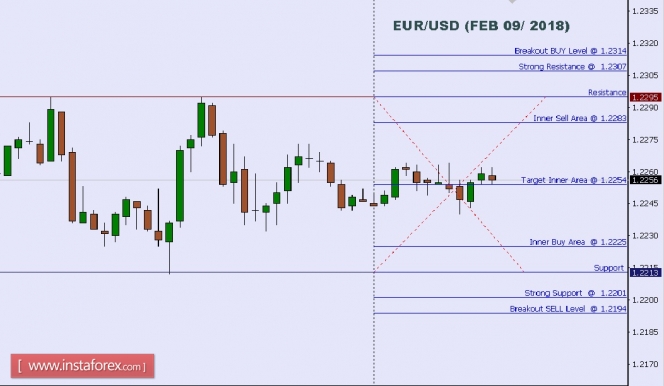

Technical analysis of EUR/USD for Feb 09, 2018

When the European market opens, some Economic Data will be released such as Italian Industrial Production m/m and French Industrial Production m/m. The US will release the Economic Data too, such as Final Wholesale Inventories m/m, so, amid the reports, EUR/USD will move in a low to medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.2314.

Strong Resistance:1.2307.

Original Resistance: 1.2295.

Inner Sell Area: 1.2283.

Target Inner Area: 1.2254.

Inner Buy Area: 1.2225.

Original Support: 1.2213.

Strong Support: 1.2201.

Breakout SELL Level: 1.2194.

Analysis are provided byInstaForex.

-

12-02-2018, 04:09 AM #2487

Euro and Pound Test Key Support

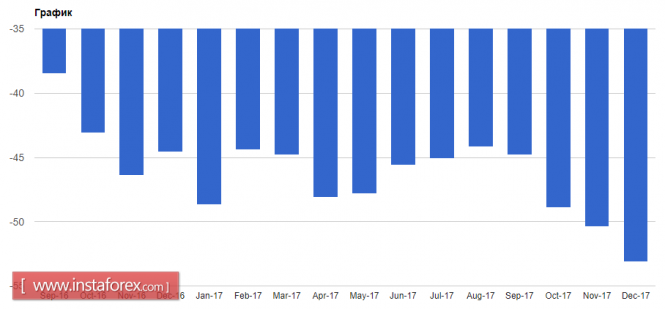

Eurozone

The euro makes weak attempts to stay above 1.22, but success is possible only if the wave of panic in the stock and debt markets goes down, taking the form of correction, although deeper.

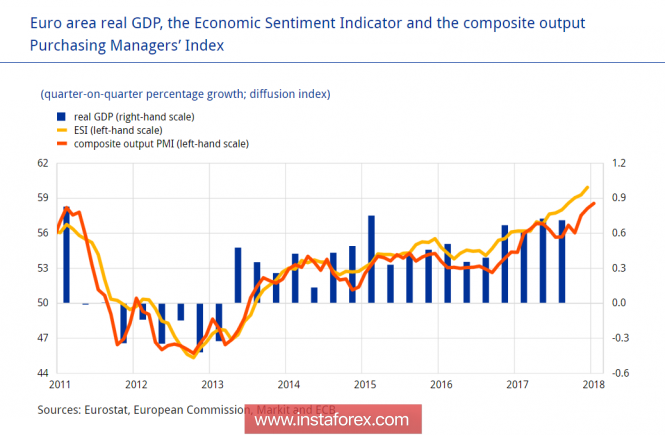

On Wednesday, the consumer inflation index will be published in Germany in January. It is expected to show a decline from 1.6% to 1.4% relative to December, but according to the forecast, the HICP index should remain unchanged at 1.4%. Also on Wednesday, Eurostat will publish an estimate of the eurozone's GDP in the fourth quarter, and there are no reasons for concern either - the PMI Markit and ESI economic activity indicators calculated by the European Commission are growing at a record pace, which, given the high correlation between PMI and GDP, which makes it possible to look at economic growth with optimism.

The problem for the eurozone is something different - the growing surplus of foreign trade leads to the need to seek the use of surplus capital. At the same time, the growth of inflation in the eurozone is not sufficient to force the ECB to begin the unwinding of its monetary policy. The spread between the yields of European and American securities is growing, and the capital from the eurozone will be in demand by investors in the US if rates in US banks continue to grow, especially since the threat of four rate hikes in the current year suddenly became real.

Monetary authorities of the eurozone will not prevent the outflow of excess capital, since this process will allow the euro to be controlled, but if the panic in the markets continues and it comes to a serious crisis, the euro may significantly weaken. Correction of the EUR USD pair is not yet completed, it is possible to decrease to 1.21, but the chances to stay above this support are still high. On Monday, the euro could return to zone 1.2305 / 20, further dynamics will be determined by whether a wave of panic that has covered the markets will develop.

United Kingdom

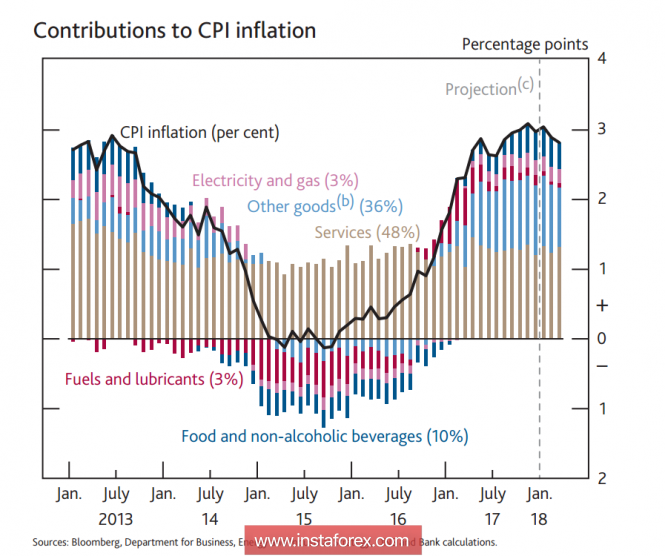

The pound last week has undergone multidirectional pressure. On Wednesday, the Bank of England supported the pound, leaving the rate unchanged and at the same time hinting that it could accelerate the process of raising rates due to higher economic growth rates.

Updated forecasts suggest GDP growth in 2018 at 1.8%, which, however, is below the growth rates in the US and the euro area, the equilibrium unemployment rate is reduced from 4.5% to 4.25%, and inflation by 2020 will be 2.2%, which is higher than the target 2%, which means an increase in the rate is required.

At the same time, as can be seen from the report, the growth of inflation occurred due to other goods, that is, most likely due to imports. The strengthening of the pound eliminates this factor in the coming months.

However, on Friday, the pound's declined resumed after the EU negotiator Michel Barnier stated that the Brexit agreement might not be reached. It is obvious that Brexit still remains the main factor of influence on the pound rate.

On Tuesday, data for January on retail sales and consumer inflation will be published. The forecasts are neutral and meet the expectations of the Bank of England. Determining the dynamics of the pound will continue to be based statements on Brexit, as well as the development of the situation with sales in the stock and debt markets. At the level of 1.3700/30 is the key support level, the pound has a chance to stay higher, the breakdown will worsen the technical picture and will contribute to a rapid decline on the background of flight from risk.

Oil

The weakening of oil looks like a rout, which is expected, based on the development of the situation in the markets. Oil reacts to the threat of slowing the growth of global GDP and the development of a full-scale crisis, and this is the main driver of decline.

Another factor contributing to the decline is the production growth in the US. In addition, Baker Hughes reported a sharp increase in the number of drilling last week by 29 pcs, which indicates an increase in investment in the industry.

Support for Brent resisted until 60.98, the channel is still up, so growth attempts after the formation of the bottom are not ruled out.

Analysis are provided byInstaForex.

-

13-02-2018, 06:42 AM #2488

Elliott wave analysis of EUR/NZD for February 13, 2018

Wave summary:

The rally from 1.6854 is not yet convincing, but if support at 1.6897 is able to protect the downside for a new rally above minor resistance at 1.7023 the correction in wave ii should be complete and wave iii developing for a rally to and above resistance at 1.7479 on the way higher to 1.7777.

A break below 1.6897 will risk a new decline to 1.6853 and maybe even closer to 1.6830 before wave ii is complete.

R3: 1.7045

R2: 1.7023

R1: 1.6966

Pivot: 1.6897

S1: 1.6878

S2: 1.6853

S3: 1.6830

Trading recommendation:

We are long EUR from 1.6977 with our stop placed at 1.6845.

Analysis are provided byInstaForex.

-

15-02-2018, 04:33 AM #2489

Good data on inflation led to the growth of the US dollar

The euro slumped in relation to the US dollar in the morning, before the release of important data on inflation in the US. The main reason for the pressure on the euro could be data on the slowdown in economic activity in Germany at the end of last year.

According to the report, Germany's GDP in the fourth quarter of 2017, compared with the previous quarter, increased by 0.6%. In annual terms, growth was 2.3%. These data fully coincided with the forecast of economists.

As noted in the statistics agency, the good growth rates are maintained due to the high external demand for premium goods. The acceleration of exports was also indicated.

Inflation in Germany slowed at the beginning of this year, which is an alarming call for the ECB. According to the data, the consumer price index fell by 0.7% in January of this year compared with December 2017, which fully coincided with the forecasts of economists. Core inflation fell by 1.0%.

Italy's GDP showed the fastest growth in the last seven years. According to the National Bureau of Statistics Istat, Italy's economy in 2017 grew by 1.6% compared with 2016.

As for the growth of the eurozone's GDP, the growth in the 4th quarter compared to the 3rd quarter was 0.6%, and compared to the same period in 2016, GDP increased by 2.7%. These data also fully coincided with the forecasts of economists.

The good economic indicators of the Eurozone at the end of 2017 have repeatedly led the European Central Bank to pay attention to the current situation in monetary policy, as well as the volume of the bond repurchase program, the reduction of which could lead to further euro growth in the medium term.

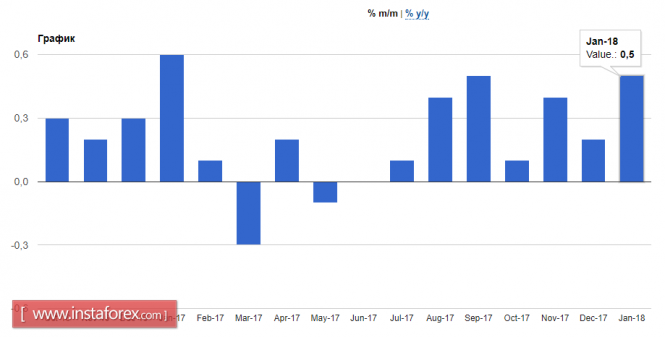

Data on the growth of inflation in the second half of Wednesday increased demand for the US dollar, which managed to regain even more positions lost at the beginning of the week against the euro and the British pound.

According to the report, the consumer price index in the US in January 2018 increased by 0.5%, exceeding the forecast of economists, who expected an increase in inflation of only 0.3%. Compared to the same period in 2017, inflation increased by 2.1%.

The base index, which does not take into account volatile prices, increased by 0.3% in January, with a growth forecast of 0.2%. Compared to the same period in 2017, the index grew by 1.8%.

Given such good performance, the short-term growth of the US dollar against the euro and the pound may continue, as it is possible that a good inflation rate in the US could seriously affect the Federal Reserve's decision on interest rates, which could again be hiked this spring.

Analysis are provided byInstaForex.

-

19-02-2018, 05:31 AM #2490

The dollar takes the initiative

Positive macroeconomic data allowed the dollar to finally recoup from a prolonged fall caused by panic sell-offs in stock markets.

Against the euro, the dollar fell below the psychological level of 1.24, the reason was the increased demand for the dollar after unexpectedly positive data on the housing market for January. The number of new buildings grew by 9.7%, experts expected growth of only 3.4%, and also by 7.4% the number of building permits increased with a forecast of 3.5%. Growth in activity in the construction sector may lead to a slowdown in housing prices.

The University of Michigan's report on consumer confidence turned positive, the sentiment index rose to 99.9 against 95.7 in December, apparently, the mood of the taxation was positively influenced by the start of the tax reform, with a deterioration in sentiment rather than growth. The peak that was formed - the second since 2004 - indicates that in the American society, the perception of reforms is assessed positively.

In addition, the rise in prices for imports and exports were above forecasts, which will affect inflation, and we will get quite a confident growth in the dollar, even despite the recent turmoil in the stock market.

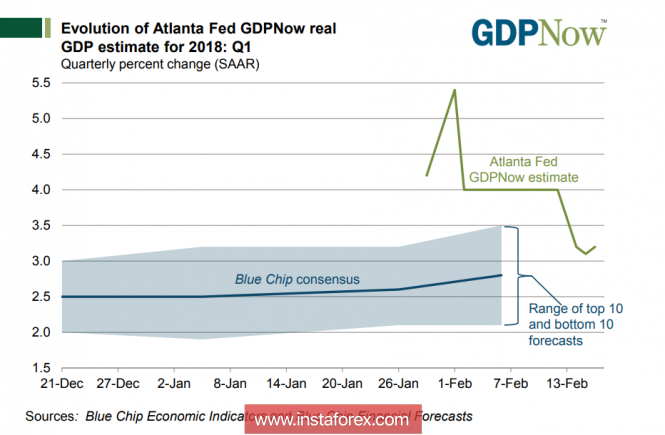

The forecast for GDP growth in the first quarter from the Federal Reserve Bank of Atlanta improved slightly and amounts to 3.2% on Monday evening. The negative from the weak data on retail sales and consumer inflation is somewhat stable, the threat to the selling of the dollar has decreased significantly.

Markets can not yet understand how the tax reform will affect the US economy. In pre-election promises, Trump focused on the fact that he would begin to reduce the budget deficit and the huge debt, but in reality so far everything is developing in the opposite scenario. The budget deficit will significantly increase this year, as well as the level of public debt. As for the corporate sector, there is still no desire to reduce borrowing, on the contrary, the benefits of tax cuts can cause not a decrease in debt, but its growth - companies intend to issue more bonds this year than in 2017. This trend , if it is implemented, can completely reverse the intent of the tax reform on its head.

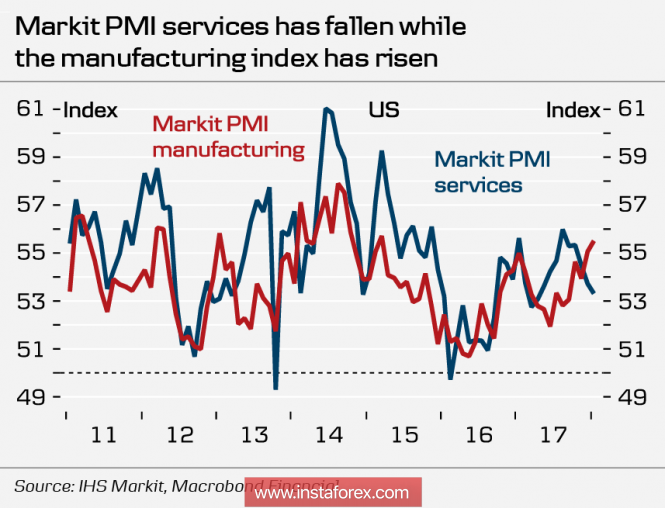

The key event of the upcoming week is the publication of the minutes of the FOMC meeting on January 31. The test of the statement slightly changed in regards to the meeting in December, but it was impossible to understand what estimate the members of the Cabinet gave to the launched tax reform. A detailed alignment can again lead to an increase in volatility, since the forecast for the number of rate hikes this year will directly depend on it. While the markets are confident of two increases in March and June, further opinions vary, and the protocol can greatly affect market sentiment. Business activity indexes from Markit will also be released on Wednesday.

At the moment, the dynamics of the indices is opposite, the production PMI rose in January to 55.5p compared to 55.1p in December, which indicates the strongest growth in the manufacturing industry since March 2015. Regional data show continued growth, the ISM index rose more than expected , so on Wednesday, most likely, there will be a confirmation of growth in business activity.

At the same time, in the service sector, activity slowed for several months in a row, which quite distorted the overall picture. It is expected that against the backdrop of growing consumer confidence and confident labor market data, the PMI index in the services sector will also show growth, which will provide additional support to the dollar.

Thus, by the end of the week, the dollar managed to survive the blow and has good chances to stay on the achieved levels.

Monday is a holiday in the US, so strong movements due to lack of objective data are not expected. The likelihood against commodity currencies appears to be at its highest, however, the yen will not enjoy less demand, the growth of usdjpy is unlikely. It is also possible to resume demand for gold and the Swiss franc.

Analysis are provided byInstaForex.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote