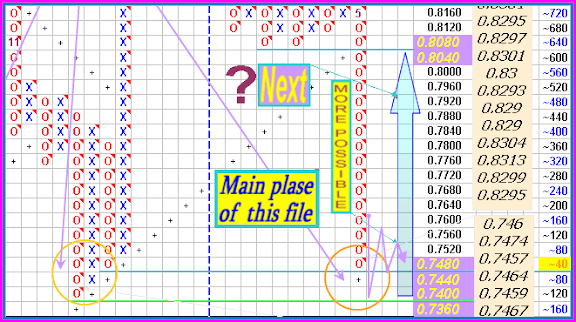

NZD/USD continued its free fall, but at least escaped the very steep channel. Has it found a bottom after diving so deep? NBNZ Business Confidence is the highlight of this week.

--Steep Channel Broken

--As the graph shows, the pair managed to break out of a steep downtrend channel since that accompanied it since the beginning of May. Does this signal a stabilization?

--I remain bearish on NZD/USD

--The kiwi proved to be quite vulnerable, as the worsening European mess joins another drop in Chinese manufacturing PMI. 0.7370 is the next target.[By forexcrunch]

Learn more :

~~~>https://docs.google.com/spreadsheet/...Gc&output=html

^^^ORvvv

~~~>http://img834.imageshack.us/img834/669/12may27.pdf

^^^ORvvv

A t t a c h m e n t

Please visit our sponsors

Results 141 to 150 of 161

-

27-05-2012, 10:26 AM #141

-

04-06-2012, 08:14 AM #142

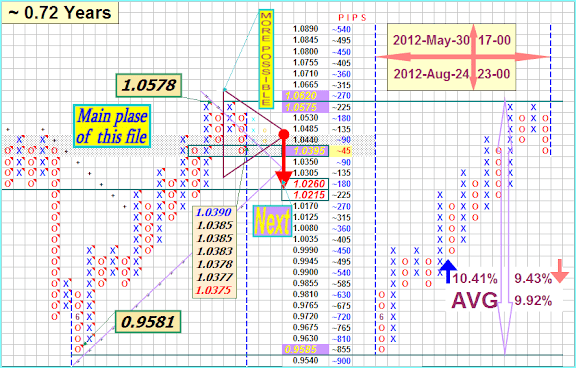

--USDCHF's upward movement from 0.9043 extends to as high as 0.9769. Further rise is still possible next week, and next target would be at 0.9900 area.

--Support is at 0.9500, only break below this level could signal completion of the uptrend.

--For long term analysis, USDCHF has formed a cycle bottom at 0.8931 on weekly chart. Further rise towards 1.0000 would likely be seen over next several weeks.[Written by ForexCycle]

> > Learn more! < <

See also:

~~~>https://docs.google.com/open?id=0B9c...Gx6dktXRl8tTm8

^^^ORvvv

~~~>http://img213.imageshack.us/img213/5037/12jun03.pdf

-

11-06-2012, 09:55 AM #143

--The Loonie rose after the Canadian economy created a modest but better-than-expected 7,700 jobs in May, against the market expectation of 5,000 jobs. However, unemployment rate in the nation stood unchanged at 7.3% in May. Separately, international merchandise trade deficit in Canada widened to C$0.37 billion in April, against the market expectation of C$0.18 billion trade surplus.

--In the Asian session, at GMT0300, the pair is trading at 1.0216, with the USD trading 0.54% lower from Friday’s close, as risk appetite increased following news that Spanish banking sector would be given a capital injection of up to €100 billion.

--The pair is expected to find support at 1.0163, and a fall through could take it to the next support level of 1.0110. The pair is expected to find its first resistance at 1.0312, and a rise through could take it to the next resistance level of 1.0408.

--The currency pair is trading below its 20 Hr and 50 Hr moving averages.[by gcitrading]

> > Learn more! < < || > > Learn more! < <

See also:

>>https://docs.google.com/open?id=0B9cvIxidsTjva1YyMWJfZ1dMa1k<<

>>http://img35.imageshack.us/img35/6121/12jun11.pdf<<

-

18-06-2012, 01:49 PM #144

--Думаю не выбрала ещё нефть до конца своего падения и возможно опустится ещё ниже где-то в район 74-75 долларов ...

--События развивались классически цена достигла линии поддержки и преодолела её, опустившись до 81 доллара. Сейчас формирует треугольник, который может быть реализован последующим движением вниз в указанный выше диапазон 74-75 долларов....

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~`

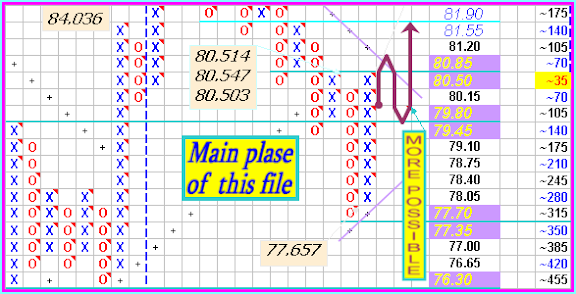

---Crude Oil Weekly P&F Technical Outlook.

...Crude Oil Maintains The Upside Bias.OPEC decision was so helpful for crude pushing it up to the top of the range that is expected to remain among it $80-$85, as the commodity is trading now around $84.66. But how long the upside momentum will last as the Greek elections at the door and no one knows how results will come. In fact, central bankers seem to be more mature than the market speculated before, as they stand ready to stabilize financial markets in a coordinated action to provide liquidity if the Greek elections on Sunday cause a mess in the market....[by oilngold]

> > Learn more! < <

See also:

~~~>https://docs.google.com/open?id=0B9c...2VmWU5xUk96alE

^^^ORvvv

~~~>http://img717.imageshack.us/img717/6808/12jun17.pdf

^^^ORvvv

A d d i t i o n a l l y ↑↑↑

-

24-06-2012, 07:57 PM #145

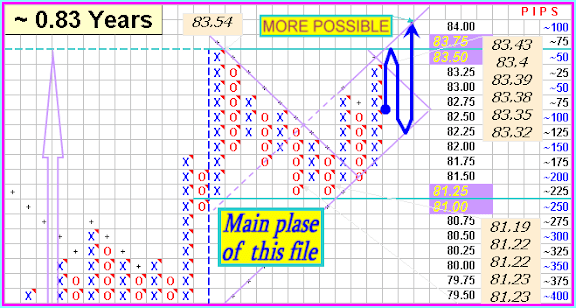

--The USD/JPY pair shot straight up during the week as the dollar found its footing against most currencies for the week.

--The 80 handle continues to be the epicenter of resistance for our money, and has still price down.

--The level won’t be considered broken out of it until we cross and close above the 80.50 level.

--This area is a clear top to the resistance area on the daily charts.

--Because of this, we are not ready to go along yet but believe that a break of the top of this week’s candle would be an excellent buy signal.

--As for selling, we are looking to do that now. [By FX Empire Analyst]

> > Click to learn more! < <

See also ↓↓↓

~~~>https://docs.google.com/open?id=0B9c...ktmX0NlcnJWMHM

^^^ORvvv

~~~>http://img401.imageshack.us/img401/9310/12jun24.pdf

^^^ORvvv

A d d i t i o n a l l y ↑↑↑

-

08-07-2012, 03:16 PM #146

The Dollar Index (DXY), which Intercontinental Exchange Inc. uses to track the greenback against the currencies of six major U.S. trade partners including the euro and the yen, advanced 2 percent, the most since December, to 83.285. It touched 83.431, the highest level since June 1.

==================================

Dollar Index [DXY]: This forum had the conviction to be a $ bull for the last 1 year or so when all expert commentary was bearish on the currency. The buck hasn’t disappointed by its performance either, having rallied from 73.26 in May 2011 to a close of 82.9420 last week, just under its previous high at 83.6700. Can the $ rally higher?

> > Click to learn more! < <

See also ↓↓↓

~~~>https://docs.google.com/open?id=0B9c...VFhZzFydUxfa3M

^^^ORvvv

~~~>http://img195.imageshack.us/img195/2825/12jul07.pdf

^^^ORvvv

A d d i t i o n a l l y ↑↑↑

-

16-07-2012, 09:38 AM #147

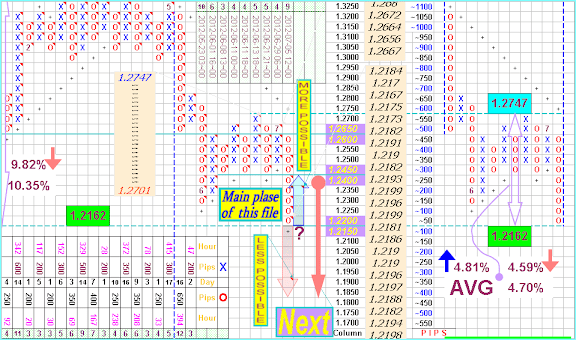

--EUR/USD Weekly Outlook and Trading Idea Outlook:

--As expected EUR/USD continued lower and almost reached the 1.2145 Fibonacci level (the low recorded last week was 1.2163).

--Now, despite the Friday's bounce, the daily chart remains very negative and I expect further weakness.

--We may see some choppy sideways action first (most likely between 1.2145 and 1.2345) because the market has become quite oversold.

--Only a rise abv 1.2430/40 will negate the immediate bearish outlook and will risk larger recovery twd 1.2670 before the downtrend from the May 2011 top resumes....

--Strategy: Holding short from 1.2600 is favored. Stop=1.2450. [By ibtimes]

> > Click to learn more! < <

See also ↓↓↓

~~~>https://docs.google.com/open?id=0B9c...TVST0hIWGVmVkk

^^^ORvvv

~~~>http://img694.imageshack.us/img694/7990/12jul15.pdf

^^^ORvvv

A d d i t i o n a l l y ↑↑↑

-

23-07-2012, 08:29 AM #148

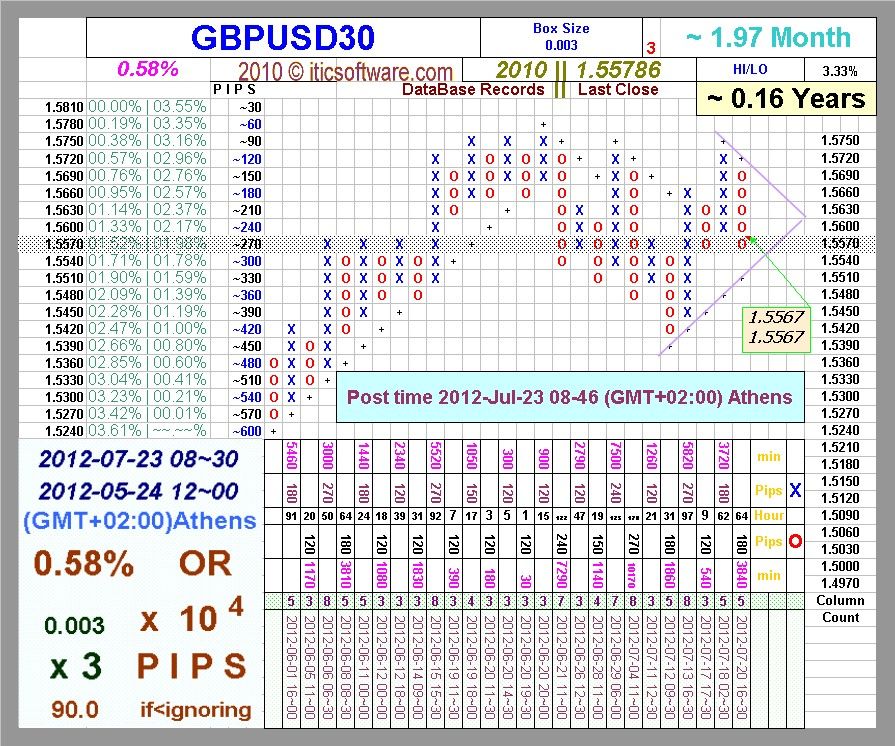

–Please note that overall GBP/USD has been in a very volatile sideways mode since January 2009.

–A break below 1.5269 and then the low of January 13th i.e.

–1.5233 may indicate a break below the lower support line.

–Please check this weekly chart of GBP/USD.

–Strategies for Trading GBP/USD (British Pound-Dollar): s mentioned above, our overall outlook for GBP/USD stays bearish but initially we stay neutral to expect some volatile sideway moves and even the possibilities of some further upward consolidation can’t be ignored.

–We are avoiding longs for GBP/USD right now, considering the overall bearish outlook.

–As mentioned above, initially we will be watching for the breaks of mentioned resistance and supports for the next week's trade decisions.

– [By forexabode.]

> > Click to learn more! < <

See also ↓↓↓

~~~>http://img16.imageshack.us/img16/6202/12jul21.pdf

^^^ORvvv

~~~>https://docs.google.com/open?id=0B9c...lFOalNHS3c3bnM

^^^ORvvv

A d d i t i o n a l l y ↑↑↑

-

31-07-2012, 08:01 AM #149

-GOLD: Although GOLD rallied sharply to close higher the past week, it remains trapped in a range between the 1,544.35 and the 1,640.45 levels.

-In order for the commodity to extend its upside it will have to break and hold above the 1,640.45 level, its range top.

-This if seen will open up further upside towards the 1,670.70 level and then the 1,700.00 level.

-Its weekly RSI is bullish and pointing higher suggesting further strength.

-The alternative scenario will be for the commodity to return to the 1,546.95 level on price failure where a violation will aim at the 1,527.05 level where a breach will resume its broader medium term weakness and then pave the way for further declines towards the 1,500.00 level.

-Price hesitation could occur here but if that level gives way, expect the commodity to decline further towards 1,478.05 level.

-All in all, GOLD continues to hold on to its broader medium term downside though trading in a range[Written by FXTechStrategy]

> > Click to learn more! < <

See also ↓↓↓

~~~>https://docs.google.com/open?id=0B9c...zdYMzY1eGpWbXM

^^^ORvvv

~~~>http://img819.imageshack.us/img819/7263/12jul30.pdf

A d d i t i o n a l l y ↑↑↑

-

27-08-2012, 09:00 AM #150

—The Australian dollar showed some movement in both directions but was almost unchanged over the week, as AUD/USD closed at 1.0399.

—Highlights of the upcoming week include Building Approvals and Private Capital Expenditure.

—The pair continues to trade in a narrow range following mixed economic releases in both the US and Australia, as the pair showed some fluctuation but was unable to sustain any breakout.

—I am neutral on AUD/USD.

—After impressive gains this summer, the aussie has been in a holding pattern for the past few weeks.

—Given the turmoil in Europe and mixed data out of the US and Australia, the choppiness could continue.

—However, if the US economy produces more weak data and there is further talk of QE intervention, look for the Australian dollar to make some gains.[Written by forexcrunch]

> > Click to learn more! < <

See also ↓↓↓

~~~>https://docs.google.com/open?id=0Bxx...IyZjg0NjFhMmJj

^^^ORvvv

~~~>http://img99.imageshack.us/img99/5194/12aug27.pdf

A d d i t i o n a l l y ↑↑↑

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Tags for this Thread

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Chart in Forex

Chart in Forex

Reply With Quote

Reply With Quote