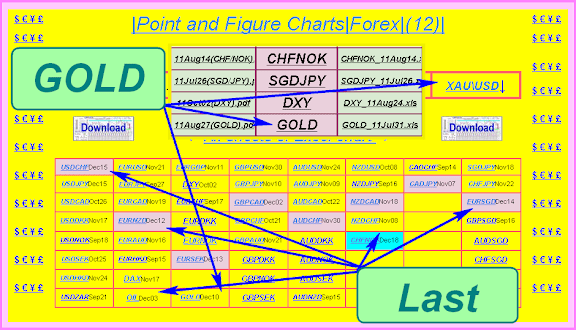

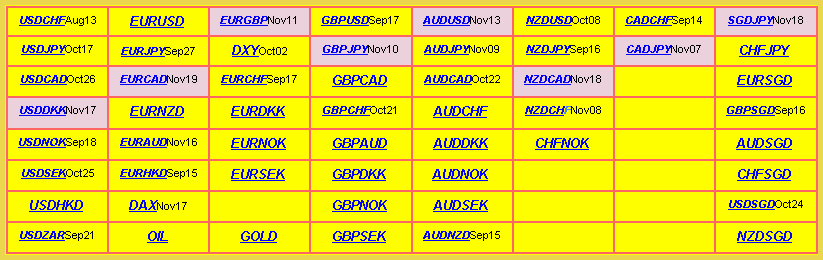

Графики P&F по различным валютным парам и некоторым другим инструментам. Ячейка помеченная другим цветом, последние варианты графиков по указанному финансовому инструменту. Файл Excel самого графика можно скачать переходя по ссылкам.

==================================

Code:https://docs.google.com/document/pub?id=1k-LK7SJO6d2Ep1R9z2ln5_GA5rSGeqp6dp2xIgiZ-1c

Please visit our sponsors

Results 121 to 130 of 161

-

21-11-2011, 07:58 AM #121

-

27-11-2011, 09:08 AM #122

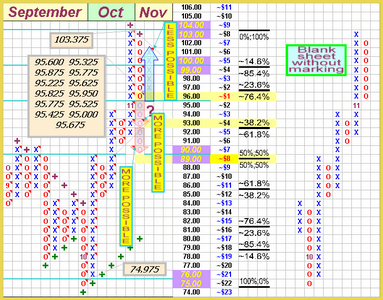

Нефть, как известно, основное сырьё в мире. Поэтому независимо от торговли другими инструментами на нефтяные цены нужно периодически посматривать. :) Не читая ничьи обзоры склоняюсь к мысли, что будет некоторое коррекционное падение. Как и раньше за основу взят фьючерс (NYMEX: QM) из-за удобства добычи котировок.

Обзор с большими картинками здесь. ~~~>docs.google.com/leaf?id=0BxxKzvQ2GlM8MjZhMjY4ZjAtZTA3Yi00MTZmLWJhZ TQtN2ExODI3NGUxYzQz&sort=name&layout=list&num=50 Это документ GOOGLE он обновляющийся, там можно найти и прошлые версии есть в настройках. Вообще хорошая штука документы GOOGLE, рекомендую, а главное бесплатно. Это же на "ЖАБЕ", тот же PDF file. ~~~>img38.imageshack.us/img38/6217/11nov26.pdf Почему я пришёл к такому выводу? Было три мощных движения вверх , как правило четвёртого не бывает. Значит должен быть откат вниз. Промежуточную линию фибо 23,8% пробило. Значит как минимум будет движение к 38,2% и даже к отметке 50,0% Вот такой взгляд на нефть на ближайшее время.

Обзор с большими картинками здесь. ~~~>docs.google.com/leaf?id=0BxxKzvQ2GlM8MjZhMjY4ZjAtZTA3Yi00MTZmLWJhZ TQtN2ExODI3NGUxYzQz&sort=name&layout=list&num=50 Это документ GOOGLE он обновляющийся, там можно найти и прошлые версии есть в настройках. Вообще хорошая штука документы GOOGLE, рекомендую, а главное бесплатно. Это же на "ЖАБЕ", тот же PDF file. ~~~>img38.imageshack.us/img38/6217/11nov26.pdf Почему я пришёл к такому выводу? Было три мощных движения вверх , как правило четвёртого не бывает. Значит должен быть откат вниз. Промежуточную линию фибо 23,8% пробило. Значит как минимум будет движение к 38,2% и даже к отметке 50,0% Вот такой взгляд на нефть на ближайшее время.

-

28-11-2011, 08:54 AM #123

*Our overall outlook for crude oil prices is bearish, as the outlook for global growth is worsening due to mounting concerns from Europe and the fact that major economies around the globe are still weak, and that should put negative pressure on crude oil prices.

*Traders will be awaiting the infamous jobs report from the United States on Friday, and a strong figure could boost optimism and push crude oil prices higher. [Topcommodities Net]

Learn more :

~~~>http://mdunleavy.byethost7.com/11Nov26.html

^^^ORvvv

~~~>http://iticsoftware.com/postimages2/...9/11Nov26.html

^^^ORvvv

A t t a c h m e n t (1) <~~OR~~> A t t a c h m e n t (2)

-

04-12-2011, 02:42 PM #124

CL had a positive day for the Friday session as traders continue to buy commodities in general. The market looks like it wants to attempt a breakout above the recent highs of $103 and if it does – this could be the beginning of the next massive leg up in the market. However, we expect the area to actually be more resistance than the market is ready to go up against at the moment. We are buyers, but will need to see a pullback first.

[meta4forexbroker]

https://docs.google.com/document/pub...d.6dku2saylq6t

-

11-12-2011, 10:46 AM #125

...In the bigger picture, there is still no clear sign of long term trend reversal yet and price actions from 1923.7 would still be finally unfolded as correction/consolidation only. Though, the consolidation pattern would likely extend below 1923.7 for a while and rally attempt should face strong resistance near to this level. We'd anticipate another falling leg before such consolidation completes. And in such case, downside should be contained by 1478.3/1577.4 support zone...[by oilngold]

Learn more :

~~~>http://iticsoftware.com/postimages2/...9/11Dec10.html

^^^ORvvv

~~~>http://img690.imageshack.us/img690/4721/11dec10.pdf

^^^ORvvv

A t t a c h m e n t

-

18-12-2011, 08:35 PM #126

Gold dropped to as low as 1562.5 last week before forming a temporary low there and recovered. Initial bias is neutral this week for some consolidations. But recovery should be limited below 1667.1 support turned resistance and bring another fall. Below 1562.5 will target 1535 key support and below...[by oilngold]

Learn more: (>1<); (>2<)

-

26-12-2011, 08:35 AM #127

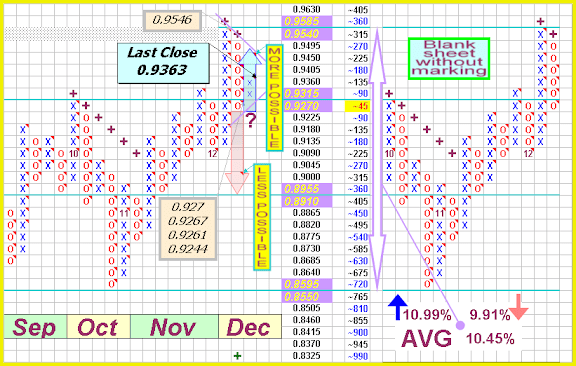

USD/CHF rose a bit during the Friday session as the pair continues to grind higher. The 0.93 level that was broken above recently has been very supportive over the last week, and we think this is a possible sign of things to come. The pair is being supported by the fact that the Swiss National Bank is working against the value of the Franc and this should continue to push this pair higher. Also, the Dollar is the safe haven everyone wants. Because of this, we are buying this pair overall, and especially on dips.[by forextv]

Learn more :

~~~>http://iticsoftware.com/postimages2/...9/11Dec25.html

^^^ORvvv

~~~>http://img521.imageshack.us/img521/929/11dec25.pdf

^^^ORvvv

A t t a c h m e n t

-

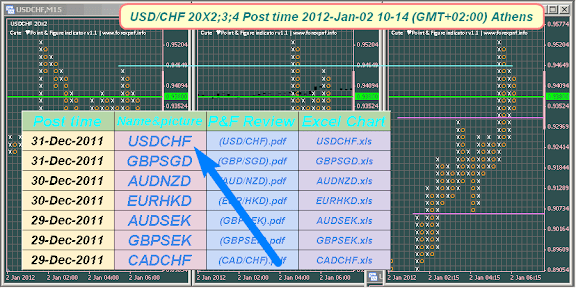

02-01-2012, 10:34 AM #128

*Forexpros – The U.S. dollar dipped against the Swiss franc in subdued trade on Friday, trimming some of the week’s gains as sustained concerns over the debt crisis in the euro zone supported safe haven demand.

*USD/CHF hit 0.9469 on Thursday, the pair’s highest since December 15; the pair subsequently consolidated at 0.9384 by close of trade on Friday, shedding 0.19% over the week.

*The pair is likely to find support at 0.9266, the low of December 20 and resistance at 0.9477, the high of December 13.

*Trading volumes remained low seeing as many traders closed books to lock in profit before the end of the year, reducing liquidity in the market and increasing volatility

CLICK HERE for detail information...

-

09-01-2012, 08:02 AM #129

Forexpros - The Euro was lower against the U.S. Dollar on Sunday. EUR/USD was trading at 1.2677, down 0.33% at time of writing. The pair was likely to find support at 1.2667, today's low, and resistance at 1.3077, Tuesday's high. Meanwhile, the Euro was down against the British Pound and the Japanese Yen, with EUR/GBP shedding 0.26% to hit 0.8224 and EUR/JPY falling 0.42% to hit 97.47.

Learn more :

~~~>http://iticsoftware.com/postimages2/...9/12Jan08.html

^^^ORvvv

~~~>http://img819.imageshack.us/img819/3411/12jan09.pdf

^^^ORvvv

A t t a c h m e n t

-

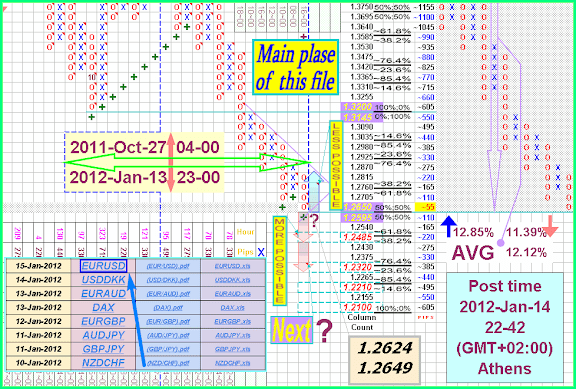

15-01-2012, 08:39 AM #130

EUR/USD rose during the Thursday session as traders celebrated successful bond auctions in both Italy and Spain. However, the recent downtrend is certainly intact, and it is hard to think that it suddenly will give way based upon these two sales. The 1.30 level above is the start of significant resistance, and we are looking to sell weakness in that area if it appears. The candle does suggest some possible follow through over the next day or two, but we aren’t willing to won the Euro in general and there are simply far too many problems in that part of the world right now. We are selling rallies going forward.[by forex-download]

Learn more :(>1<);(>2<)

^^^ORvvv

A t t a c h m e n t (1) <~~OR~~> A t t a c h m e n t (2)

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Tags for this Thread

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Chart in Forex

Chart in Forex

Reply With Quote

Reply With Quote