–Euro/dollar had a positive week, riding on the determination of the ECB in using its firepower to counter the Spanish crisis.

–The upcoming week is even more important, with the German constitutional court’s ruling needed to enable the bailouts.

–There are quite a few additional regular indicators and special events.

–Will the rally continue?.

–I am neutral on EUR/USD.

–After the huge rally that sent the pair to the highest levels since May, there is room for some correction.

–The rise came on a better than expected ECB decision, and high hopes for QE3 in the US.

–These hopes could lead to a disappointment, countering the big steps that Europe is taking to counter the crisis.

–Written by Forexcrunch.

> > Click to learn more! < <

See also ↓↓↓

~~~>http://img684.imageshack.us/img684/9896/12sep08.pdf

^^^ORvvv

~~~>https://docs.google.com/file/d/0B9cv...2dYQ1k/preview

A d d i t i o n a l l y ↑↑↑

Please visit our sponsors

Results 151 to 160 of 161

-

09-09-2012, 10:21 AM #151

-

23-09-2012, 09:14 PM #152

–The GBP/USD pair rose during the session on Friday and even managed to break through the 1.63 level at one point.

–However, by the end of the day we saw a pullback that formed a shooting star.

–This pair has been overbought for a while, and as such a pullback would be welcomed by many of the buyers at this point.

–We still see the 1.60 level was massively supportive at this point time, and hope that a pullback is a chance to start buying this market somewhere closer to that level.

–However, we managed to break the top of the shooting star from Friday, then of course is a massively bullish signal as well.

–Even if we do see a breakdown of price over the next day or two, we are not interested in selling as the central bank equation of this currency pair is pretty straightforward: the Federal Reserve is looking to expand its quantitative easing, and the Bank of England is looking to sit still with its rates.

–Because of this, there is a positive swapped going long this pair. [Written by fxempire]

> > Click to learn more! < <

See also

~~~> https://docs.google.com/file/d/0B9cv...DY5LTQ/preview

↑↑↑ OR ↓↓↓

~~~> http://img525.imageshack.us/img525/354/12sep23.pdf

A d d i t i o n a l l y

-

07-10-2012, 07:16 PM #153

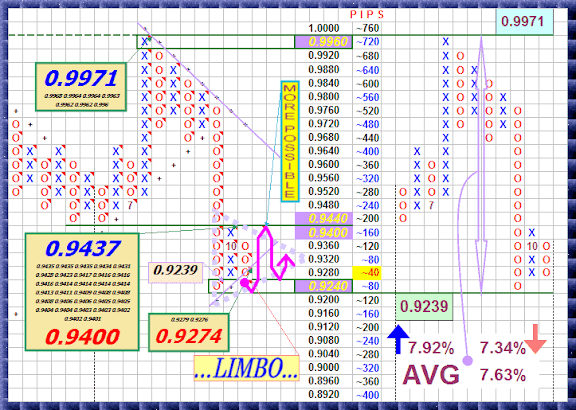

–USDCHF: With USDCHF reversing almost all of its corrective recovery gains the past week, the big risk is for it to return to the 0.9238 level.

–If this occurs in the new week, further declines will shape up towards the 0.9193 level, its May 07’2012 low with breach targeting the 0.9100 level and ultimately the 0.9000 level, its big psycho level.

–Its weekly RSI is bearish and pointing lower supporting this view.

–On the upside, it will have to return above the 0.

–9424 level to annul its current weakness and resume its bullish offensive towards its Sept 10'2012 high at 0.9482.

–A breach will open up further upside gain towards the 0.9606 level.

On the whole, the pair remains biased to the downside in the short term.

[Written by traderslaboratory]

> > Click to learn more! < <

See also

~~~> https://docs.google.com/open?id=0B9c...zZvZ1pFS1N1ZGs

↓↓↓ ORvvv ↑↑↑

~~~> http://img15.imageshack.us/img15/8383/12oct06.pdf

A d d i t i o n a l l y

-

21-10-2012, 09:06 PM #154

–Gold Prices Range bound till New Effective Triggers are seen:

–Gold traders now look ahead to next week and movements in gold prices will be taking cues from the FOMC interest rate decision on Wednesday and Q3 GDP data on Friday.

–It is highly unlikely for the Fed to change its QE3 decision in the October 2 day FOMC meeting, which concludes Wednesday.

–Although the central bank is not expected to alter its policy stance, investors will be closely eyeing the accompanying statement for an updated assessment of the domestic economy.

–If the Fed adds concerns about inflation and rising prices, gold prices will remain well supported as investors flock into gold bullion as a traditional hedge against inflationary pressures.

–The Fed may also keep focus on what to do when Operation Twist ends in December.

[Written forexpros]

~~~~~~~~~~~~~~~~~~~~~~~~~~~~

> > Click to learn more! < <

See also

~~~> https://docs.google.com/file/d/0BxxK...XlpSms/preview

↑↑↑ OR ↓↓↓

~~~> http://img443.imageshack.us/img443/8240/12oct21.pdf

A d d i t i o n a l l y

-

27-10-2012, 05:44 PM #155

–The AUD/USD pair initially fell during the week, but found a bit of a bid later on and formed a hammer.

–This is right after to shooting stars, and is in the middle of a massive consolidation area.

–We figure that this pair will be very difficult to trade, although it does look bullish at the moment.

–As for a longer-term point of view, the Reserve Bank of Australia is slated to cut rates at least once if not twice.

–This should weigh upon the Australian dollar going forward, as well as all the global risks out there.

–However, it appears that as far as longer-term trader concerned, we need to break above the 1.06 level to have complete clarity higher.

–If we managed to break down below the 1.0150 level however, we figure that this pair will absolutely crumble.

[Written by fxempire]

> > Click to learn more! < <

See also

~~~> https://docs.google.com/file/d/0B9cv...jJ3ZXM/preview

↑↑↑ OR ↓↓↓

~~~> http://img827.imageshack.us/img827/7477/12oct27.pdf

A d d i t i o n a l l y

-

10-11-2012, 09:04 PM #156

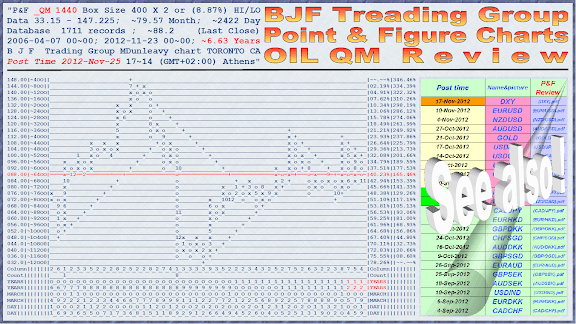

EURUSD Analysis 10th November 2012 – P&F Update...

> > Click to learn more! < <

See also

~~~> https://docs.google.com/file/d/0BxxK...g5YzQ5/preview

↑↑↑ OR ↓↓↓

~~~> http://img7.imageshack.us/img7/3057/12nov10.pdf

A d d i t i o n a l l y

||BJF Trading Group||Expert Advisor||MT Indicator||Forex Software||MQL4 Coding||

-

18-11-2012, 04:52 PM #157

•The dollar index continues to remain firmly bullish on the daily chart, moving higher and breaking above the 81 region, as the currency of first reserve continues to strengthen following the U.S. election.

•This firm move higher for the U.S. dollar has been accompanied by sustained buying volume on both the daily and the three day chart, which have both provided additional momentum to the move higher, following the key breakout from the sideways congestion created during September and October, which saw the index trade in a narrow range.

•This platform of support is now providing the necessary springboard, and with the Hawkeye Heatmap now firmly green, the U.S. dollar looks set to continue higher in the short to medium term.

•Should the three day trend also transition through to bullish in due course, then we can expect to see the index climb to test the 83.00 region and beyond with consequent weakness across the major currency pairs, along with commodities. [Written by forexpros]

↓↓↓ Click to learn more! ↓↓↓

https://docs.google.com/spreadsheet/...Gc&output=html

See also

~~~> https://docs.google.com/file/d/0B9cv...25oVlk/preview

↑↑↑ OR ↓↓↓

~~~> http://img822.imageshack.us/img822/5085/12nov18.pdf

A d d i t i o n a l l y

||BJF Trading Group||Expert Advisor||MT Indicator||Forex Software||MQL4 Coding||

-

26-11-2012, 10:30 AM #158

Crude Oil Weekly Technical Outlook

•Sat Nov 24 12 09:51 ET Crude Oil Weekly Technical Outlook Nymex Crude Oil (CL)Crude oil edged higher to 89.98 last week but failed to take out 90 psychological level and retreated again.

•Nonetheless, note that firstly, it's has taken out near term falling channel.

•Secondly, it seems to be well supported by 4 hours 55 EMA.

•Thirdly, daily MACD is staying well above signal line.

•The development argues that fall from 100.42 might be completed at 84.05 already.

•Further rise will be mildly in favor as long as 86.17 minor support holds.

•Strong rally would be seen to 93.66 resistance to confirm the bullish case.

•Though, below 86.17 will flip bias back to the downside for another low below 84.05.

[Written by oilngold]

> > Click to learn more! < <

See also

~~~> https://docs.google.com/file/d/0BxxK...UxYzQz/preview

↑↑↑ OR ↓↓↓

~~~> http://img547.imageshack.us/img547/2082/12nov26.pdf

A d d i t i o n a l l y

||BJF Trading Group||Expert Advisor||MT Indicator||Forex Software||MQL4 Coding||

-

09-12-2012, 07:45 AM #159

—The GBP/USD fell friday to trade at 1.6010 after the Bank of England yesterday held rates and policy.

—Today, industrial production and manufacturing production both disappointed markets reporting well below forecast, casting a greater doubt on the UK economy.

—Just a few days ago, the UK downgraded growth for 2013 and Chancellor Osborne, presented the Autumn statement with a negative forecast. [Written by forextv]

~~~> Click to learn more!

See also

~~~> http://goo.gl/acRBE

↑↑↑ OR ↓↓↓

~~~> http://img402.imageshack.us/img402/2061/12dec08.pdf

A d d i t i o n a l l y

||BJF Trading Group||Expert Advisor||MT Indicator||Forex Software||MQL4 Coding||

-

16-12-2012, 06:17 PM #160

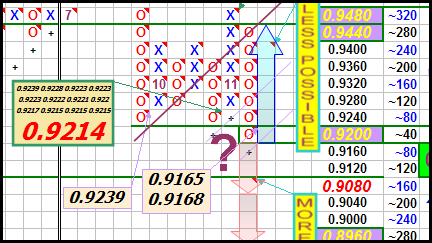

—USDCHF Analysis - December 15, 2012

—USDCHF breaks below 0.9214 support, suggesting that the downtrend from 0.9971 has resumed.

—Further decline could be expected next week, and next target would be at 0.9000 area.

—Resistance levels are at 0.9300 and 0.9400, as long as these levels hold, the downtrend from 0.9511 will continue.

—For long term analysis, USDCHF had formed a cycle top at 0.9971 on weekly chart.

—Further decline to 0.8500 area would likely be seen over the next several months.[Written by ForexCycle]

~~~> Click to learn more!

See also

~~~> http://goo.gl/EMVCX

^^^ OR vvv

~~~> http://img35.imageshack.us/img35/9255/12dec16.pdf

A d d i t i o n a l l y

||BJF Trading Group||Expert Advisor||MT Indicator||Forex Software||MQL4 Coding||

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Tags for this Thread

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Chart in Forex

Chart in Forex

Reply With Quote

Reply With Quote