Euro has proven everything to everyone

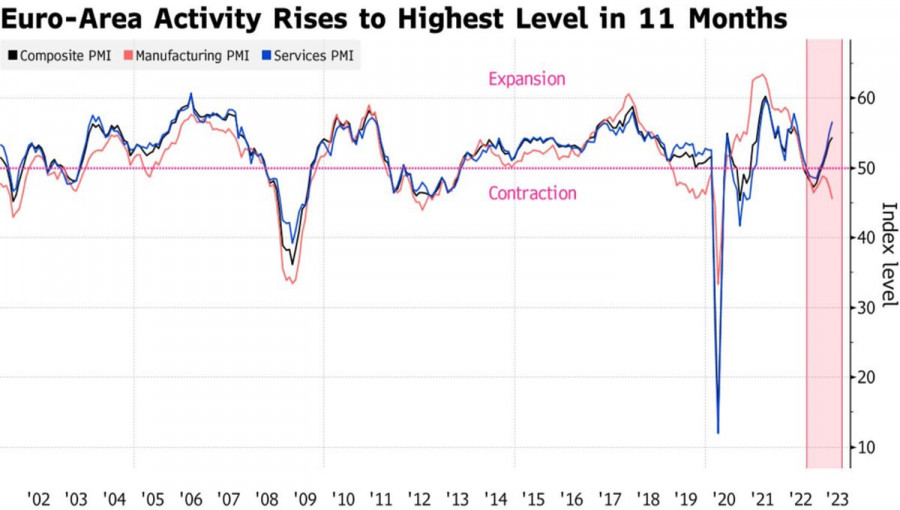

A strong economy means a strong currency. The soar of the composite business activity index in the Eurozone in April to an 11-month high has become further proof of the accelerating economy of the currency bloc. It doesn't matter that it entirely relies on the service sector, with the gap between its PMI and the manufacturing sector becoming the largest since 2009. What's important is that the region will avoid a recession, and its resilience opens the door for the ECB to further raise interest rates, which positively reflects on EURUSD.

Dynamics of European business activity

Germany is once again becoming the locomotive of European economic growth: the Purchasing Managers' Indices for both Germany and France have exceeded forecasts. At the same time, ECB Vice President Luis de Guindos noted that core inflation in the Eurozone turned out to be persistently high, even more persistent than the market expected. For the European Central Bank not to lose confidence, the indicator should decrease. Such rhetoric implies that the regulator does not intend to rest on its laurels. Most likely, market forecasts about raising borrowing costs to 3.75% are accurate or slightly underestimated.

Bank of Ireland Governor Gabriel Makhlouf also argued that it was too early for the ECB to pause the monetary policy tightening process. He referred to the data available to the European Central Bank, based on which the pause seems premature. It seems that Christine Lagarde's opinion that the European Central Bank has little way ahead is at odds with the views of the Governing Council members. The ECB will undoubtedly raise the deposit rate at the May meeting. The question is by how much, 25 or 50 basis points?

Meanwhile, in the US, the situation is unfolding like a textbook: after rapid GDP growth, the Fed's monetary policy tightens, and then the American economy starts to wobble. Disappointing statistics on existing home sales, manufacturing activity from the Philadelphia Fed, and unemployment benefit claims suggest that a recession is near. If the US faces a downturn and the Eurozone avoids it, why sell EURUSD?

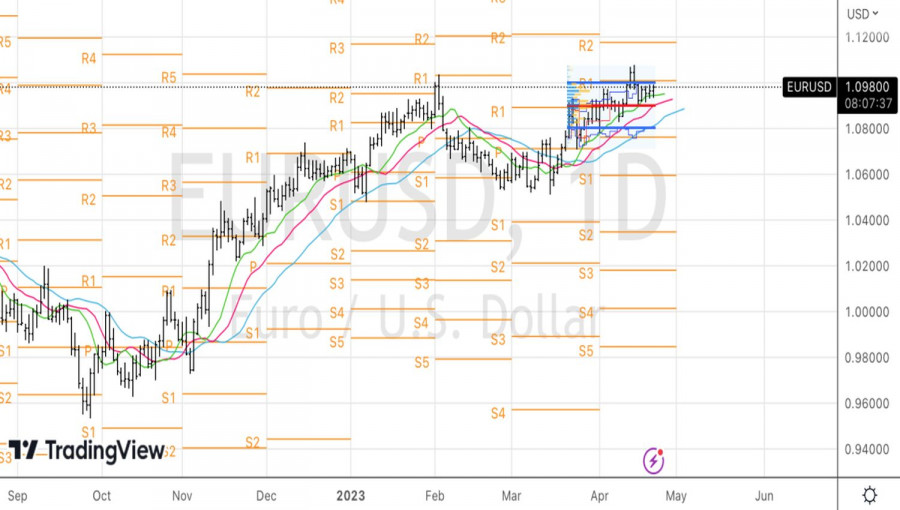

For the week leading up to April 21, the economic calendar will present investors with another puzzle. The key events will be the releases of German and European GDP data for the first quarter, the flash estimate of April inflation in Germany, and statistics on the Personal Consumption Expenditures Index – the Fed's preferred inflation indicator. Almost all important figures will be released at the end of the five-day period, so most of it will involve buying on the facts. The question is, what will be purchased: the US dollar or the euro? Technically, the EURUSD pair has approached the upper limit of the fair value range of 1.08-1.101 at arm's length. A successful assault will open the way for the "bulls" to restore the upward trend towards 1.12 and will form the basis for establishing long positions.

Analysis are provided by InstaForex.

Read More

Please visit our sponsors

Results 3,831 to 3,840 of 4086

Thread: InstaForex Wave Analysis

-

24-04-2023, 06:12 AM #3831

-

25-04-2023, 04:57 AM #3832

EUR/USD. IFO report, weakening of the greenback, strengthening of the euro

The euro-dollar pair returned to the area of the 10th figure today, after a brief southern correction. At the beginning of last week, sellers tried to launch a counteroffensive but stopped at the base of the 9th figure. Then, buyers regained the initiative but failed to overcome the psychologically important price barrier of 1.1000. At the start of the new trading week, the EUR/USD bulls are once again entering the battle, despite an almost empty economic calendar.

However, the only significant release on Monday (the IFO index) turned out to be on the side of the euro - almost all components of the release were in the "green zone", reflecting an improvement in the situation. But overall, the northern trend of the EUR/USD is primarily due to the weakening of the US currency: the US dollar index is under pressure today, amid increased interest in risk assets.

The "green hue" of the IFO report

According to data published today, the German IFO Business Climate Index in April slightly improved - to 93.6 points with a forecast of growth to 93.4. On the one hand, the indicator has grown minimally compared to the March values. On the other hand, the index demonstrates a consistent upward trend for the seventh month in a row. For comparison, it is worth noting that in September last year, it was at the level of 84.4 points. Another component of the release also came out in the "green zone": the IFO Economic Expectations indicator, which has also been consistently growing for seven months in a row.

Commenting on the published report, IFO Institute economist Klaus Wohlrabe said that, on the one hand, the German economy is far from a significant recovery. On the other hand, there are positive trends - for example, Wohlrabe noted that recent shocks in the banking sector (SVB, Credit Suisse) did not have a strong impact on the sentiment of German companies. He also pointed out that the economies of China and the United States are supporting German industry: manufacturers' expectations regarding exports have "noticeably increased." In addition, the IFO representative reported that the share of German companies that want to increase prices "has declined again."

The euro received additional support from the Bundesbank report published today, according to which the German economy in the first quarter of this year "turned out to be stronger than expected", and business activity has grown again. However, the prospects for further recovery "remain ambiguous" – due to inflation, which is still putting pressure on consumption.

Nevertheless, today's growth of the EUR/USD pair is primarily due to the weakening of the US currency. The euro received minor support from the IFO Institute, but this release only complemented the already established fundamental picture.

The dollar is losing its grip

Recall that last week the dollar strengthened its position due to two factors: an increase in hawkish expectations regarding the further actions of the Federal Reserve (against the background of statements by Waller and Bullard) and an increase in risk-averse sentiment. This week, these fundamental factors have weakened their influence. The market has crystallized the opinion that the Federal Reserve will raise the rate by 25 basis points at the May meeting, while further steps will depend on the incoming data (in the field of inflation). Waller's statement about "several increases" is rather hypothetical: at present, traders are confident only in the May increase. According to the data from the CME FedWatch Tool, the probability of implementing a 25-point scenario in May is now almost 90%. At the same time, the probability of maintaining the status quo at the June meeting is almost 70%.

At the same time, hawkish expectations regarding the further actions of the European Central Bank continue to strengthen. For example, according to experts from the investment bank Brown Brothers Harriman, there is currently about a 30% probability of a 50 basis point rate hike at the May meeting. Further in the prices, another 25-point increase is expected in June and another 25-point increase in July.

Moving forward, the ECB may take a break, but the probability of a "final chord" – another rate hike in the fall (at the September or October meeting) – is currently almost 50%. Consequently, the final rate level is now considered in the range of 3.75%-4.0%. For comparison, it is worth noting that at the beginning of last week, BBH's expectations for the peak rate were at 3.75%, and the week before that – 3.50%. Hawkish expectations have increased due to corresponding statements from ECB representatives, who, in the majority, continue to insist on maintaining a hawkish course.

Conclusions

The euro-dollar pair has resumed its upward trend after a brief pause and a southern correction. Looking at the weekly chart of EUR/USD, we can see that the pair has been within an upward trend since the end of February. The southern price pullback that we observed last week was a correction against the temporary strengthening of the greenback.

At the end of this week, crucial macroeconomic reports for EUR/USD will be published: US GDP, core PCE index, and German CPI. These releases can "redraw" the fundamental picture for the pair. But for today, the established information background contributes to the strengthening of the upward movement.

From a technical point of view, the pair on the daily chart is between the middle and upper lines of the Bollinger Bands indicator, as well as above all the lines of the Ichimoku indicator, which has formed a bullish signal "Parade of Lines". The first intermediate target is 1.1050 (the upper line of the Bollinger Bands indicator on the D1 timeframe). After overcoming it, the next target of the upward trend will be the 1.1100 mark.

Analysis are provided by InstaForex.

Read More

-

26-04-2023, 05:29 AM #3833

Forecast for EUR/USD on April 26, 2023

EUR/USD

The euro did not take the chance to overcome the nearest peak of April 14 at 1.1076, and so its high was 1.1068. Thus, there will be no divergence. In this case, the growth of the last five days takes on the role of correction from the fall of April 14-17. The price clearly shows the intention to reach the support of the MACD line, coinciding with the low of April 17 at 1.0910. When the price reaches this target, the Marlin oscillator will already be in negative territory, which will help in overcoming this level to attack the lower support of 1.0872 - on the embedded line of the green downtrend channel.

The First Republic Bank reported a loss of 102 billion in client funds. The bank's shares collapsed by 49.38%, pulling the S&P 500 down by 1.58%. Yields on US government bonds fell, and the market probability of the Federal Reserve raising the rate by 0.25% next week also decreased (76.2% vs. 88.1% the day before), but markets are already preparing for a new wave of crisis (in the US), which is expected to start this summer. The dollar will strengthen in this crisis, as demonstrated yesterday, in the role of a protective asset.

On the four-hour chart, the price has consolidated below the MACD indicator line, and the Marlin oscillator has moved towards the decline. I expect the price to fall to the nearest target of 1.0910. However, market participants are waiting for comments from the Fed representatives regarding the current situation, so despite the technical prerequisites, we do not expect a significant decline until May 3rd.

Analysis are provided by InstaForex.

Read More

-

27-04-2023, 06:19 AM #3834

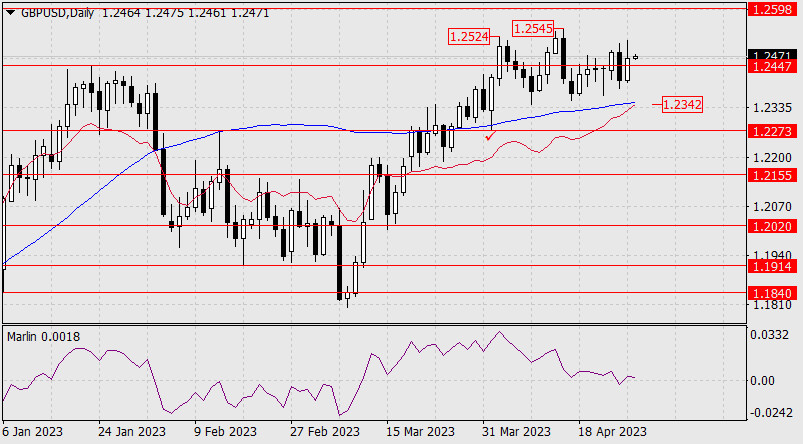

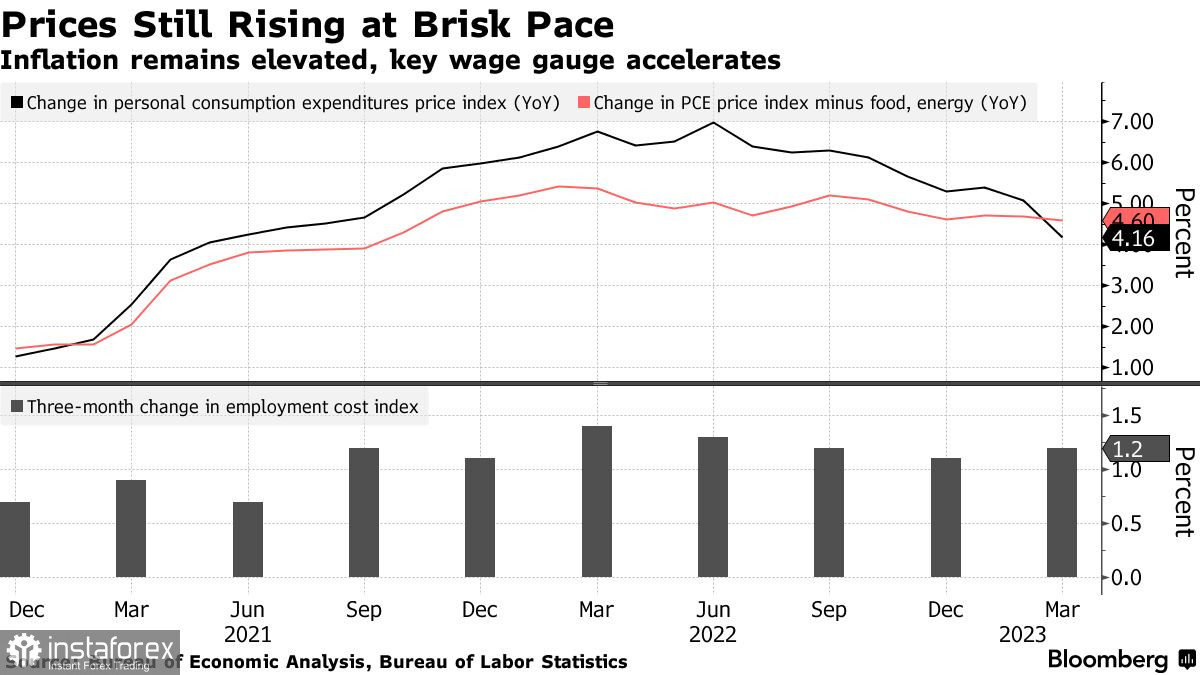

Forecast for GBP/USD on April 27, 2023

GBP/USD

The British pound continues its sideways movement in anticipation of the FOMC meeting next week. The upper limit of the range is the April 14th peak at 1.2545. Breaking through it will extend growth to 1.2598. Slightly higher is the second target level of 1.2666 – the peak of May 2022.

A sign of further price growth is the Marlin oscillator, turning upwards from the zero line – from the limit of the area of the downtrend.

If the price falls, the range will end with overcoming the MACD line (1.2342).

On the four-hour chart, the price has consolidated above the indicator lines, and the signal line of the Marlin oscillator is in the positive area. The pound has a good chance of surpassing yesterday's peak. Especially if today's US GDP data turns out to be lower than forecasted.

Analysis are provided by InstaForex.

Read More

-

28-04-2023, 04:29 AM #3835

EUR/USD. "The specter of stagflation": the US economy weakens, inflation grows

The American economy in the first quarter disappointed, but the dollar is strengthening its positions across the market, including the euro pair. After impulsive growth to the middle of the 10th figure, the EUR/USD pair turned 180 degrees and headed south. At the moment, bears are testing the nearest support level of 1.1000, corresponding to the Tenkan-sen line on the daily chart. Such an anomalous, at first glance, reaction of the greenback is due primarily to the strengthening of hawkish expectations regarding the Fed's further actions. The dollar is growing amid the threat of stagflation in the US, as today's release shows that consumer spending is still strong, and inflationary pressure remains at an unacceptably high level.

In the language of dry numbers

US GDP growth in the first quarter of this year was almost twice as bad as expected. According to forecasts, the US economy was supposed to grow by 2.0%, reflecting a downward trend (in the fourth quarter of 2022, growth was recorded at 2.6%). However, GDP volume increased by only 1.1%, which is much lower than economists' expectations.

Notably, after the publication, the likelihood of a 25-point increase in the Fed's interest rate at the May meeting rose to 82%. That is, the market is virtually confident that the regulator will increase the rate to 5.25% next week, despite the "red hue" of the headline indicator in today's report.

As they say, the devil is in the details. The release structure shows that the US economy is slowing down amid high inflation. For example, the GDP price deflator in the first quarter increased by 4.0% YoY, while economists expected this component to grow by 3.7% YoY (I recall that in the fourth quarter, the indicator grew by 3.9% YoY). The core GDP price deflator in the first quarter was also in the "green zone," rising by 4.9% YoY, with a forecast of 4.7% YoY growth (fourth quarter result – 4.4% YoY). That is, consumer spending, which accounts for a large part of GDP, grew at the highest rate since the second quarter of 2021; the volume of government spending increased at the highest rate since the beginning of the year before last.

What the release says

It should be recalled that the core consumer price index excluding food and energy prices in March started to gain momentum again. In annual terms, the indicator rose to 5.6% in March. Over the previous five months, the core CPI had been declining – from 6.6% (in September 2022) to 5.5% (in February 2023). For the first time in the last six months, the growth rates of the core index accelerated. At the same time, overall inflation, the producer price index, the import price index – all these inflation indicators came out in the "red zone," reflecting active downward dynamics.

In other words, all conditions for another round of the Fed's interest rate hike have been met today. The "last puzzle" will be the publication of core PCE inflation indicators (the release is scheduled for tomorrow, April 28). If Friday's numbers also come out in the green zone, the results of the May meeting will be virtually predetermined.

Indirect support for the greenback was provided by the US labor market data released today. It turned out that the number of initial jobless claims increased by 230,000 last week. The indicator showed an upward trend for two weeks in a row (+240, +246 thousand), but a decline was recorded today.

However, the US housing market continues to disappoint dollar bulls. It became known today that the volume of pending home sales in the US in March fell by 5.2% (in monthly terms), with a forecast of 0.8% growth. In annual terms, transactions fell by 23.2%, compared to analysts' forecast of a 22.8% decline. I recall that earlier released reports in this area also reflected negative dynamics. In particular, the volume of home sales in the secondary market in March decreased by 2.4% (the weakest result since November 2022). The indicator of building permits issued in the States in March fell by 8.8%, indicating that the high cost of borrowing is putting pressure on this sector of the economy.

Conclusions

The GDP growth report published today reflects the threat of stagflation in the US: the country's economy is growing at a weak pace, while inflationary components are gaining momentum. Therefore, today's release de facto ended up on the side of the dollar, as it strengthened investors' confidence that the Federal Reserve will indeed decide on another rate hike.

At the same time, this fact is already largely priced in, so the current strengthening of the greenback is likely to be temporary.

It should also be recalled that on the eve of the May meeting, another bank in the US (with a market capitalization of $1.06 billion) was on the verge of collapse. First Republic, whose securities fell by almost 50%, risks repeating the fate of Silicon Valley, Signature Bank, and Silvergate. The bank reported that clients withdrew $100 billion from accounts, and deposits decreased by more than 40%. In light of such news, the Federal Reserve is unlikely to be aggressive next week, so as a result of the May meeting, the dollar may come under strong pressure, even despite the fact of a 25 basis point rate hike.

Thus, in my opinion, it is advisable to use southern price pullbacks on the EUR/USD pair to open long positions with the first target at 1.1050 (upper Bollinger Bands line on the daily chart) and the main target at 1.1100.

Analysis are provided by InstaForex.

Read More

-

01-05-2023, 03:56 AM #3836

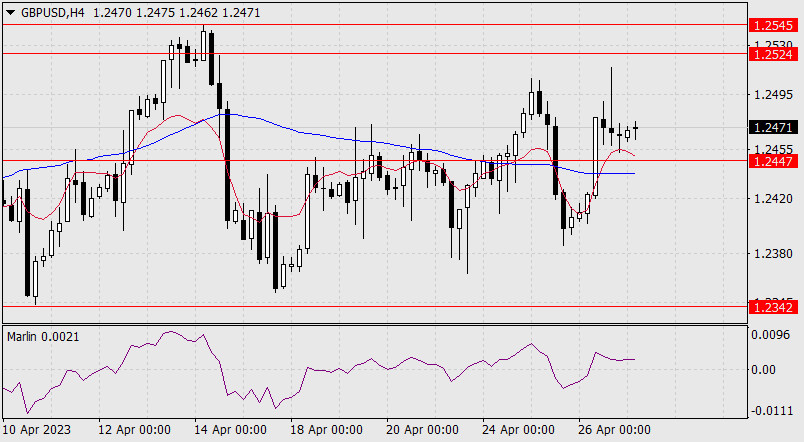

Forex Analysis & Reviews: High inflationary pressure forces the Fed to continue raising rates

Euro and pound decline on news that two key inflation indicators showed sustained pressure in the US in recent months, supporting the case for a new interest rate hike by the Federal Reserve System next week.

The Personal Consumption Expenditures (PCE) price index, excluding food and energy, the Fed's preferred core inflation measure, rose 0.3% in March compared to the previous month and 4.6% compared to a year earlier. The Commerce Department report also said that the employment cost index, which the Fed also closely monitors, rose 1.2% in the first quarter compared to the previous period, exceeding economists' forecasts.

I would like to remind you that the main goal of the Fed is a 2% level, which is measured by a broader indicator, but the regulator considers the core indicator as a better indicator of the trend.

Price data, especially in combination with rising labor costs, confirm expectations that Fed policymakers will continue to raise interest rates, raising them by another quarter of a percentage point at next week's meeting.

A positive aspect in the PCE report was the slowdown in the growth of service costs. Thus, service prices, excluding housing, rose only 0.2% in March. However, in annual terms, the indicator remains elevated at 4.5%.

Despite this, there are concerns that persistent inflation in the service sector, partly driven by strong wage growth in these industries, risks keeping price growth above the Fed's target indicator in the foreseeable future.

As for further benchmarks, since it is obvious that the Fed will raise rates at the May 2-3 meeting, many expect the regulator to then take a long pause, but the latest data allow for a more aggressive approach that the committee could use as early as next week.

Personal consumption expenditures, adjusted for prices, remained unchanged last month, reflecting reduced spending on goods and moderate spending on services after a revised 0.2% decrease in February. The decline in consumer spending indicates that households are becoming more cautious and cutting purchases.

As for income, it grew by 0.3%. Real wages also grew by 0.3% for the month. The saving rate jumped to 5.1% - the highest level since the end of 2021. Regarding the technical picture of EURUSD, the bulls still have a chance to continue the growth. To do this, they need to stay above 1.1000 and take control of 1.1030. This will allow them to move beyond 1.1060. From this level, it is possible to climb to 1.1100. In case of a decline in the trading instrument, only around 1.1000 do I expect any actions from major buyers. If there is no one there, it would be good to wait for the minimum of 1.0960 to be updated, or to open long positions from 1.0940.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.95% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Analysis are provided by InstaForex.

Read More https://ifxpr.com/44a7ENH

-

02-05-2023, 05:19 AM #3837

Forex Analysis & Reviews: Forecast for AUD/USD on May 2, 2023

AUD/USD

On Monday, the Australian dollar tested the resistance level of 0.6670, and under pressure due to the US dollar (#USDX 0.43%), returned to the support of 0.6628. On the daily chart, the Marlin oscillator did not react to the asset's growth. Marlin remains in the area of the downtrend.

[IMG][https://forex-images.ifxdb.com/userf...urce!.jpg/IMG]

At the moment, the price is trying to overcome this support; in a few hours, the Reserve Bank of Australia will make a decision on monetary policy, with the rate expected to be at 3.60%. Such a decision is unlikely to contribute to the strengthening of the Australian currency, even if the rhetoric is moderately aggressive, as tomorrow, the Federal Reserve Is almost guaranteed to raise the rate by at least 0.25%. The nearest target is 0.6567 – the low of March 8, then we expect movement to 0.6450.

On the four-hour chart , yesterday's movement above the MACD indicator line (blue) and a quick return below it indicates the falsity of yesterday's surge. The price has already consolidated below the line. We are waiting for the RBA's decision and expect the price to fall further.

If the price climbs above 0.6670 and consolidates, it will open an alternative scenario with growth to 0.6730.

Analysis are provided by InstaForex.

Read More https://ifxpr.com/44hwcnZ

-

02-05-2023, 05:20 AM #3838

Forex Analysis & Reviews: Forecast for AUD/USD on May 2, 2023

AUD/USD

On Monday, the Australian dollar tested the resistance level of 0.6670, and under pressure due to the US dollar (#USDX 0.43%), returned to the support of 0.6628. On the daily chart, the Marlin oscillator did not react to the asset's growth. Marlin remains in the area of the downtrend.

[IMG][https://forex-images.ifxdb.com/userfiles/20230502/analytics645073e2b5d67_source!.jpg[/IMG]

At the moment, the price is trying to overcome this support; in a few hours, the Reserve Bank of Australia will make a decision on monetary policy, with the rate expected to be at 3.60%. Such a decision is unlikely to contribute to the strengthening of the Australian currency, even if the rhetoric is moderately aggressive, as tomorrow, the Federal Reserve Is almost guaranteed to raise the rate by at least 0.25%. The nearest target is 0.6567 – the low of March 8, then we expect movement to 0.6450.

On the four-hour chart , yesterday's movement above the MACD indicator line (blue) and a quick return below it indicates the falsity of yesterday's surge. The price has already consolidated below the line. We are waiting for the RBA's decision and expect the price to fall further.

If the price climbs above 0.6670 and consolidates, it will open an alternative scenario with growth to 0.6730.

Analysis are provided by InstaForex.

Read More https://ifxpr.com/44hwcnZ

-

03-05-2023, 05:14 AM #3839

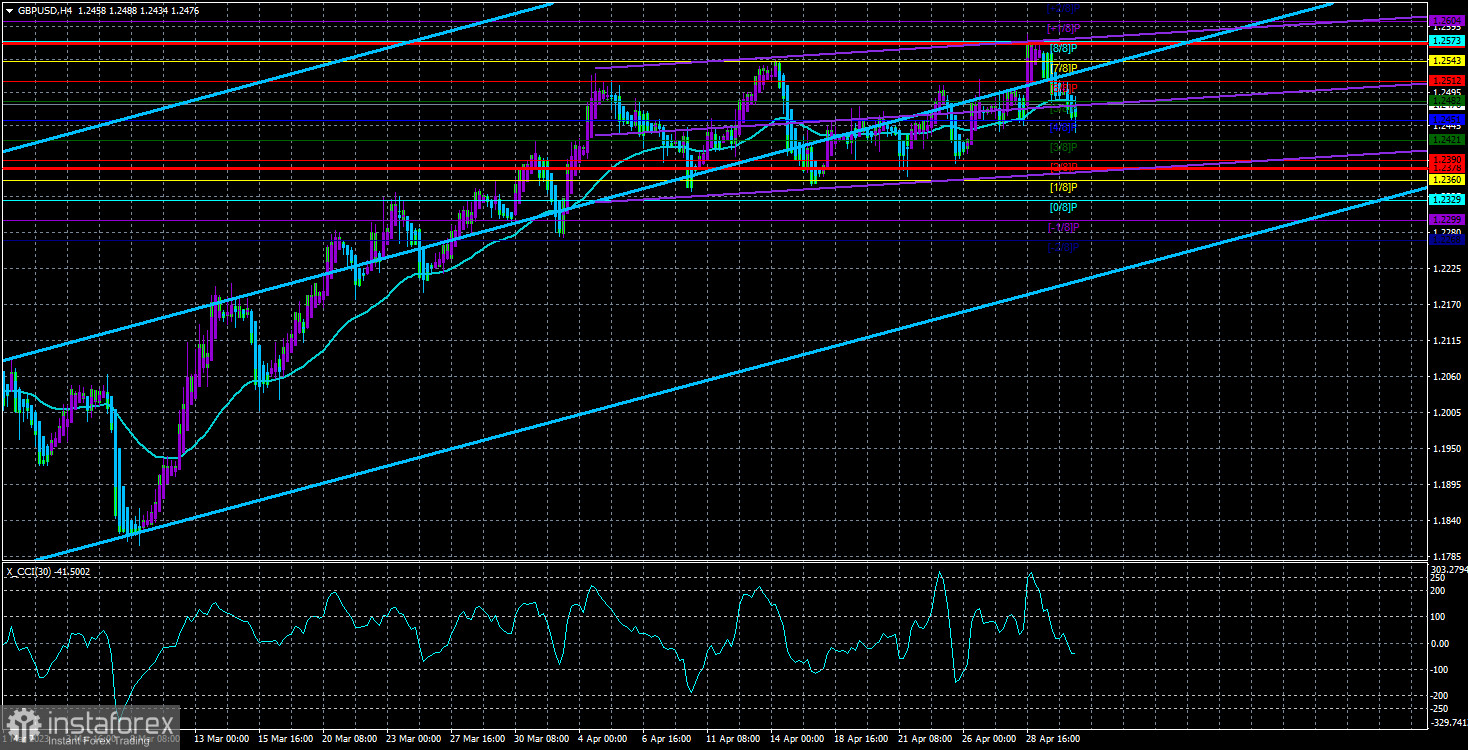

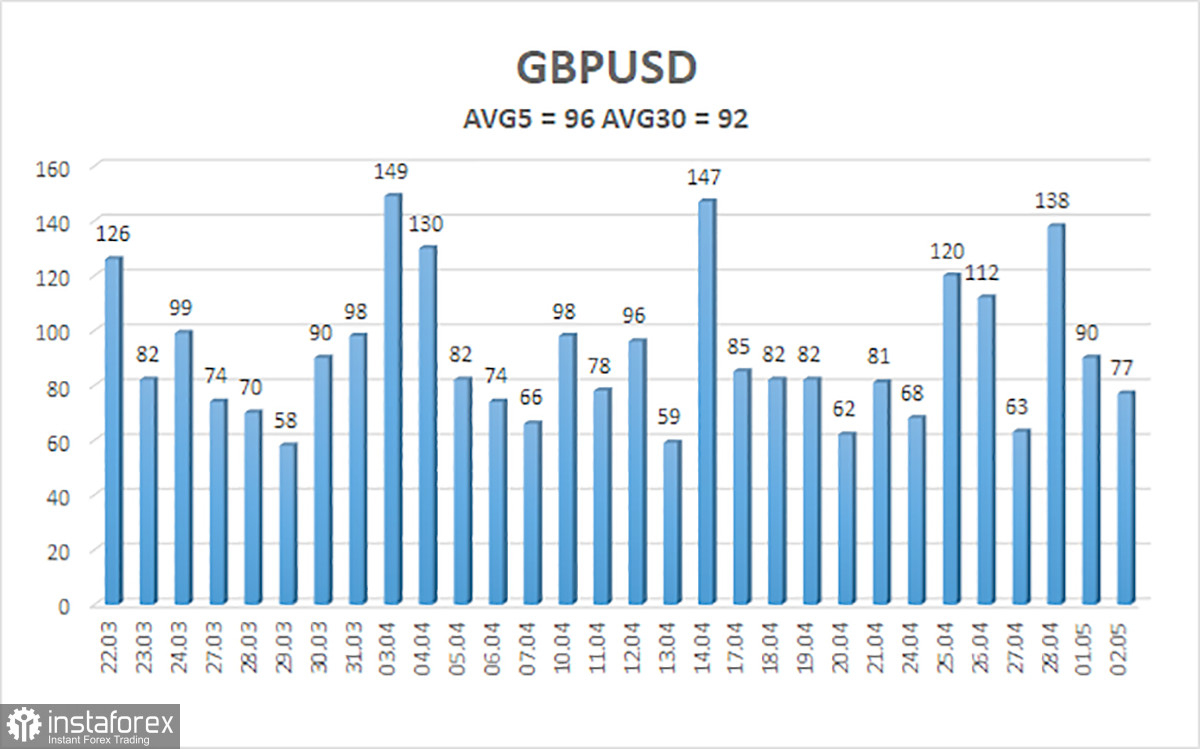

Forex Analysis & Reviews: GBP/USD. Overview for May 3. Market sentiment is changing to "bearish"

The GBP/USD currency pair continued its not-too-strong decline for most of the day on Tuesday. All the week's most important events are still ahead, so the market is in no hurry to rush into opening trading deals. Moreover, the ECB and FRS decisions, likely to be announced on Wednesday and Thursday, have already been factored into the market. This means we may see sharp spikes in activity these days without significant changes in currency pair rates. In the case of the British pound, there has been uncorrected growth for two months. Uncorrected, not unstoppable, as the upward trend has weakened in recent weeks. The pound moved up with its last strength. The pain of the bulls, who desperately wanted to maintain the upward trend and interpreted almost every report favoring the pound, was visible. Still, at the same time, they received an extremely small number of real factors supporting the British currency. In any case, the pound has grown by 700 points in 2 months, and almost everything shows that a strong correction should begin in the 4-hour timeframe.

On the 24-hour timeframe, it should also begin and be stronger than on the 4-hour. On the daily chart, about 2200 points were passed upward, implying a significant correction. Of course, making such conclusions on the eve of three central bank meetings is presumptuous, but if we see unprovoked growth in both pairs again at the end of this and next week, it will be too much. The market cannot be forbidden to trade in any direction, even if there are no reasons for it. But in this case, you can close your eyes to fundamental and macroeconomic analysis. What's the point if the market doesn't pay attention to it? The price has once again consolidated below the moving average line, which we have observed for the last two months at least seven times. No decline started after any of these overcomes. The CCI indicator has already entered the overbought area twice, which is a strong sell signal, so we continue to expect a powerful drop in the British pound.

The US labor market continues to shrink.

We would like to note one significant moment from yesterday, which may mean a change in market sentiment to "bearish." In the second half of the day, the JOLTs report on the number of job openings in the US labor market was released, which again turned out to be worse than the forecast value - 9.59 million against 9.775 million. The number of job openings has been falling for three months, which means a deterioration in the atmosphere of the labor market. We may see weaker reports on nonfarm payrolls and unemployment on Friday than currently expected. But that's not important. The US dollar practically did not fall immediately after the publication of this report. Earlier, traders would have had enough for the American currency to lose 60–80 points. On Tuesday, it lost 50 but quickly tried to return to its original path - to the south.

This moment indicates that the market is refusing further purchases, regardless of the decisions made by the FRS and ECB. Of course, this conclusion is quite risky, but simultaneously, the pair cannot constantly move in one direction. Sooner or later, a turning point must come. Why not a day before the FRS meeting and a week before the Bank of England meeting? After all, surprises are unlikely, and in the case of the BoE, we may see a refusal to tighten policy for the first time in a long time. We believe that the rate will be raised once again, as inflation is still above 10%, but at the same time, we believe that one or two more increases - and this cycle will be completed regardless of the current inflation rate. The pound, like the euro, is losing one of its main support factors, of which there have been few recently.

The average volatility of the GBP/USD pair over the last five trading days is 96 points. For the pound/dollar pair, this value is considered "average." On Wednesday, May 3, we thus expect the movement within the channel to be limited by levels 1.2378 and 1.2572. A reversal of the Heiken Ashi indicator upward will signal a new round of upward movement.

Nearest support levels:

S1 – 1.2451

S2 – 1.2421

S3 – 1.2390

Nearest resistance levels:

R1 – 1.2482

R2 – 1.2512

R3 – 1.2543

Trading recommendations:

The GBP/USD pair in the 4-hour timeframe has corrected to the moving average. Sideway movement may resume again, as in recent weeks, we often observe flat rather than a trend. Trading can be done again only by reversing the Heiken Ashi indicator or on younger timeframes. Explanations of illustrations:

Linear regression channels - help determine the current trend. If both are directed in one direction, the trend is currently strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which it is now advisable to trade.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) means that a trend reversal is approaching in the opposite direction.

Analysis are provided by InstaForex.

Read More https://ifxpr.com/3oTloMs

-

04-05-2023, 08:05 AM #3840

Forex Analysis & Reviews: USD/JPY analysis for May 04, 2023 - Potential for the further downside movement

USD/JPY has been trading downside as I expected and the first upside objective has been reached at 135.00. Anyway, I see potential for the lower prices towards 133.35.

Due to the strong downside momentum and no signs for the reversal, I see potential for the further downside movement towards lower reference.

Next major downside objective is set at the price of 133.35

MACD is showing negative reading, which is sign that sellers are still in control.

Intraday resistance is set at the price of 135.00

Analysis are provided by InstaForex.

Read More https://ifxpr.com/3VwljKY

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote