Inflation data reflected on the euro

Today's inflation data released in the first half of the day was not very encouraging for the European Central Bank. The regulator expects to achieve a target inflation rate just below 2.0%, which is still significantly out of its reach.

Producer prices fell in June, which goes against the ECB's plans to wind down monetary stimulus measures in the form of bond purchases.

According to the European Union's statistics agency, the producer price index of the eurozone in June this year fell by 0.1% compared with May. It should be noted that the last increase of this index was recorded in January this year. The only consolation is that, compared with June last year, the index rose by 2.5%.

As seen from the recent data, the acceleration of economic growth has little effect on inflation.

Yesterday, data was released, which indicated that the euro area's GDP grew by 0.6% in the second quarter of 2017 compared to the previous quarter and by 2.1% compared to the same period of the previous year.

The current exchange rate of the euro against a number of other currencies also creates a number of setbacks to exports and could adversely affect the rate of economic growth by the fourth quarter of this year.

Today it also became known that the Purchasing Managers Index for the manufacturing sector in Switzerland increased by 0.8 points in July, to 60.9 points. Such indicators indicate very serious signs of further acceleration of activity in the manufacturing industry in Switzerland.

Nevertheless, the Swiss franc still remains under pressure against the euro and the US dollar. The USD/CHF pair rose sharply, having reached the level of 0.9700, the breakthrough of which will open the opportunity to update the July highs to around 0.9730.

Data in the second half of the day on the labor market in the US did not make have any significant impact to the market.

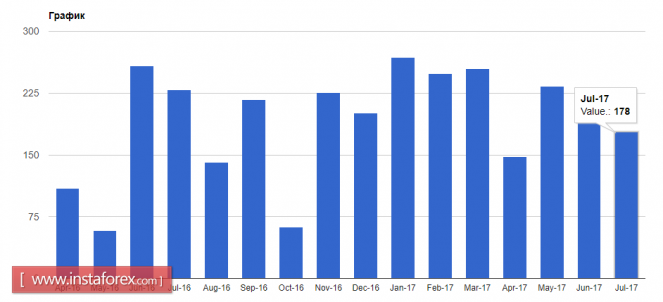

According to the report by Automatic Data Processing Inc. and Moody's Analytics, the number of jobs in the private sector increased by 178, 000 in July this year, while economists forecast a bigger job increase of 180,000. The June data were revised. So, the number of new jobs for the month was 191,000, not 158,000, as previously reported.

Analysis are provided byInstaForex.

Please visit our sponsors

Results 2,361 to 2,370 of 4086

Thread: InstaForex Wave Analysis

-

03-08-2017, 05:43 AM #2361

-

04-08-2017, 06:52 AM #2362

Technical analysis of USD/JPY for Aug 04, 2017

In Asia, Japan will release the Average Cash Earnings y/y data, and the US will release some Economic Data, such as Trade Balance, Unemployment Rate, Non-Farm Employment Change, and Average Hourly Earnings m/m. So, there is a probability the USD/JPY will move with medium to high volatility during this day.

TODAY'S TECHNICAL LEVEL:

Resistance. 3: 110.63.

Resistance. 2: 110.41.

Resistance. 1: 110.20.

Support. 1: 109.93.

Support. 2: 109.72.

Support. 3: 109.50.

Analysis are provided byInstaForex.

-

07-08-2017, 06:43 AM #2363

EUR/JPY prepare to buy on major support

The price is now testing major support at 130.19 (Fibonacci retracement, Fibonacci extension, bullish divergence) and we expect to see a strong bounce above this level for a push up to 131.03 resistance (Fibonacci retracement, horizontal swing high resistance).

Stochastic (34,5,3) is seeing strong support above 7.8% and also sees bullish divergence signaling that a bounce is impending.

Correlation analysis: We are seeing JPY weakness across the board with bounces expected on EUR/JPY, AUD/JPY, and USD/JPY.

Buy above 130.19. Stop loss is at 129.76. Take profit is at 131.03.

Analysis are provided byInstaForex.

-

08-08-2017, 05:52 AM #2364

Technical analysis of EUR/USD for Aug 08, 2017

When the European market opens, some Economic Data will be released, such as French Trade Balance, French Gov Budget Balance, and German Trade Balance. The US will release the Economic Data, too, such as IBD/TIPP Economic Optimism, Mortgage Delinquencies, JOLTS Job Openings, and NFIB Small Business Index, so, amid the reports, EUR/USD will move in a low to medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.1855.

Strong Resistance:1.1848.

Original Resistance: 1.1837.

Inner Sell Area: 1.1826.

Target Inner Area: 1.1798.

Inner Buy Area: 1.1770.

Original Support: 1.1759.

Strong Support: 1.1748.

Breakout SELL Level: 1.1741.

Analysis are provided byInstaForex.

-

09-08-2017, 05:41 AM #2365

Germany shows its poor performance

Data for France and Germany, which came out in the morning, were completely ignored by the market. The low intraday volatility, which did not exceed 20 points in the EURUSD pair, indicates that many investors and traders prefer to take some pause, since the US dollar's rally since Friday is no longer supported by large players, and many market participants are in a bit of a confusion and are unsure how to proceed.

According to the statistics agency, there is a decline in German imports and exports. However, this has not yet affected the foreign trade balance.

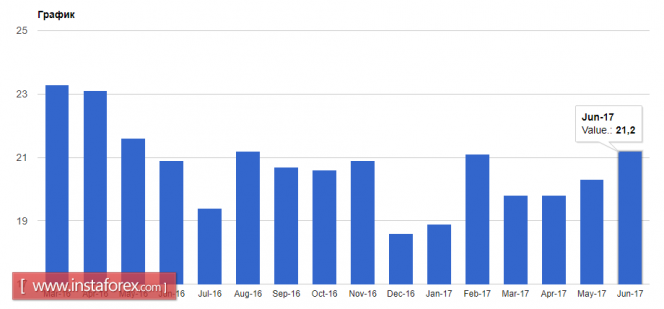

As indicated in the report, Germany's exports in June this year compared with May decreased by 2.8%, while the reduction in imports was 4.5%. Germany's foreign trade surplus in June amounted to 21.2 billion euros, while economists predicted the trade balance at the level of 21.4 billion euros. It should be noted that as early as May of this year, the surplus passed the 20 billion euros mark for the first time.

The reduction in industrial production in Germany, which was reported yesterday, along with today's data, is the first alarm bell that the economic growth rate of the first-largest euro-zone economy is gradually slowing down, which will undoubtedly affect the indicators for the second quarter of this year.

According to the statistics agency, the current deficit in France's balance of payments increased. This happened due to the sharper than expected decline in exports.

According to the report, in June this year the negative balance of the current account the balance of payments totaled to 2.1 billion euros against 1.9 billion euros in May. The trade deficit rose to 4.7 billion euros. The deficit of the state budget of France in June rose to 62.3 billion euros from 61.8 billion euros in May. Since the inauguration of the new president of France, very little time has passed, but, as we recall, Macron promised to give a lot of effort to combat the budget deficit.

In the afternoon, data came from The Retail Economist and Goldman Sachs, according to which retail sales increased during the reporting week. So, the index of sales in US retail chains increased by 2.4% for the week from July 30 to August 5, while in comparison with the same period last year the index grew by 1.1%.

As for the technical picture of the EURUSD pair, it remained unchanged compared to the morning review.

A further downward trend will be entirely fixed at yesterday's support level of 1.1790, to gain a foothold below which it has not yet been possible. Selling is recommended after the return of the trading instrument under the level of 1.1790, with the main goal of reducing the support area to 1.1740. A breakthrough in this area will open up the possibility of the euro falling to new weekly lows of around 1.1670.

Analysis are provided byInstaForex.

-

10-08-2017, 05:46 AM #2366

Elliott wave analysis of EUR/NZD for August 10, 2017

Wave summary:

EUR/NZD continues to work its way higher towards the expected target at 1.6236. This resistance should only be able to provide temporary resistance, before the next swing higher towards 1.6969.

Short-term support is now seen at 1.6005 and again at 1.5920.

R3: 1.6236

R2: 1.6196

R1: 1.6081

Pivot: 1.6050

S1: 1.6005

S2: 1.5959

S3: 1.5920

Trading recommendation:

We are long EUR from 1.5510 with stop placed at 1.5825. If you are not long EUR yet, then buy near 1.6005 and use the same stop at 1.5825.

Analysis are provided byInstaForex.

-

11-08-2017, 05:58 AM #2367

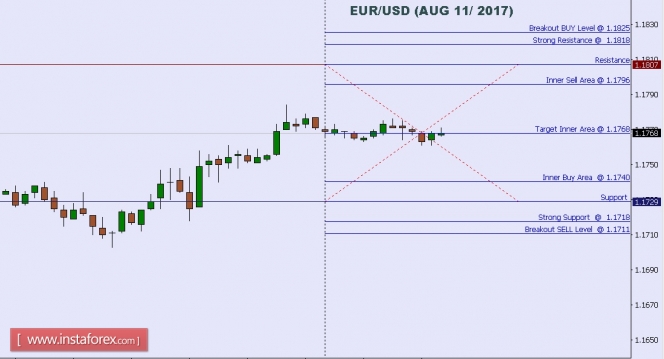

Technical analysis of EUR/USD for Aug 11, 2017

When the European market opens, some Economic Data will be released, such as French Prelim Non-Farm Payrolls q/q, French Final CPI m/m, German WPI m/m, and German Final CPI m/m. The US will release the Economic Data, too, such as Core CPI m/m and CPI m/m, so, amid the reports, EUR/USD will move in a low to medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.1825.

Strong Resistance:1.1818.

Original Resistance: 1.1807.

Inner Sell Area: 1.1796.

Target Inner Area: 1.1768.

Inner Buy Area: 1.1740.

Original Support: 1.1729.

Strong Support: 1.1718.

Breakout SELL Level: 1.1711.

Analysis are provided byInstaForex.

-

14-08-2017, 06:55 AM #2368

US dollar: a massive reassessment of risk is coming

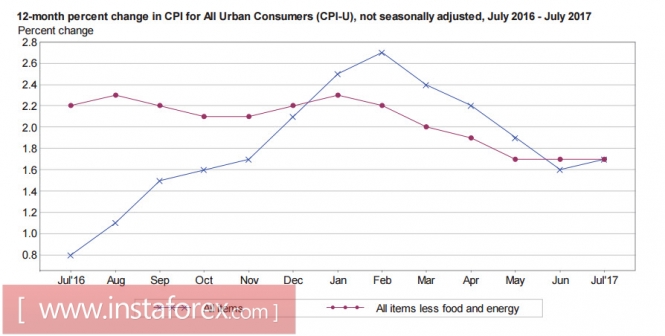

The US dollar, which briskly started the week, lost all of its trump cards and was again sold out on Friday amid muffled data on inflation.

Consumer prices rose by 0.1% in July, an annual increase of 1.7%. Both indicators are better than a month ago, but worse than expected. Experts forecasted prices to rise by 0.2% in the monthly data and 1.8% in the annual data.

Yesterday, the producer prices report was published. It also turned out to be worse than expected. The annual price index rose by 1.9% which is worse than the 2.0% results from the previous month. It is even much worse than the expectation of 2.2%. Compared to the results from June, prices have dropped by 0.1%. The worse-than-expected data indicates that there is still a significant imbalance in the market between estimates of the state of the US economy and real macroeconomic indicators.

The head of the Federal Reserve Bank of Minneapolis, Neel Kashkari, said on Friday that the US Federal Reserve can wait in increasing interest rates until inflation approaches the target of 2%. Kashkari drew attention the fact that the wage growth remains slow and a premature rate increase may lead to a slowdown in economic growth.

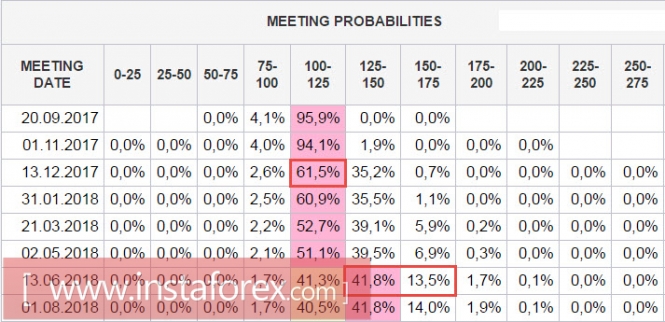

In fact, over the past week, the probability of a rate hike in December, according to the CME, fell from 48% to 35.9%. The expectations of this next step by the Fed moved to June 2018. The shift of expectations for six months is a lot. In fact, bulls in dollars are deprived reasons to go on the offensive in the foreseeable future.

Another factor of the weakness of the dollar was the geopolitical tensions on the Korean peninsula. US President Donald Trump warned Pyongyang against attacks on Guam, where the US military base is located or on US allies. The markets began to respond to the verbal war, but the probability of a military solution to the issue at the moment is extremely small. The probability of a strike against North Korea will cause Russia to be extremely displeased with China and will promote an even closer rapprochement which clearly does not meet the long-term interests of the United States.

A noticeable increase in the degree of tension is not accidental and quite possibly intended to hide something more substantial than Pyongyang's nuclear program. On Thursday, the Treasury report on the budget was published despite the annual dynamics for 17 months. Revenue growth cannot compensate for the decline of the previous period and ensure the fulfillment of government obligations. Perhaps Trump's formidable rhetoric about North Korea is of an intra-American nature. Trump tries to score points before a large-scale battle with the Congress on a number of crucial issues. Hour X is approaching, the government must submit a draft budget for the 2018 financial year. In any case, it is impossible to balance falling incomes with expenditures without raising the ceiling of borrowing. Moreover, the formation of budget is meaningless without the approval of a tax reform, the project of which has not yet been submitted to the Congress. Perhaps Trump's administration will try to combine these two issues into one. The markets expect active government action in the near future.

On Tuesday, data on retail sales and import and export prices will be published in July. Forecasts are moderately positive. If the released data is no worse than expectations, it can stop the decline in the dollar. On Wednesday, the market's attention will be focused on the publication of the protocol of the July FOMC meeting. Players will assess the likelihood of the start of a quantitative tightening program in September.

In any case, there are more questions than answers. The dollar cannot rely on either economic growth or geopolitical stability. While there is advantage over defensive assets, primarily for yen and gold, there is a high probability that this mood will continue for the upcoming week.

Analysis are provided byInstaForex.

-

15-08-2017, 06:02 AM #2369

AUD/JPY reversing nicely below our selling area, remain bearish

The price dropped really nicely from our selling area yesterday. We remain bearish looking to sell below strong resistance at 86.57 (Fibonacci retracement, Fibonacci extension) for a corrective drop towards 85.42 support (Fibonacci extension, horizontal swing low support).

Stochastic (34,5,3) is seeing major resistance at 91% and also intermediate resistance at 64%.

Correlation analysis: We're seeing JPY strength with drops on AUD/JPY, EUR/JPY, and USD/JPY.

Sell below 86.57. Stop loss is at 85.42. Take profit is at 87.17.

Analysis are provided byInstaForex.

-

16-08-2017, 06:06 AM #2370

Technical analysis of EUR/USD for Aug 16, 2017

When the European market opens, some Economic Data will be released, such as Flash GDP q/q and Italian Prelim GDP q/q. The US will release the Economic Data, too, such as FOMC Meeting Minutes, Crude Oil Inventories, Housing Starts, and Building Permits, so, amid the reports, EUR/USD will move in a low to medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.1796.

Strong Resistance:1.1789.

Original Resistance: 1.1778.

Inner Sell Area: 1.1767.

Target Inner Area: 1.1739.

Inner Buy Area: 1.1711.

Original Support: 1.1700.

Strong Support: 1.1689.

Breakout SELL Level: 1.1682.

Analysis are provided byInstaForex.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote