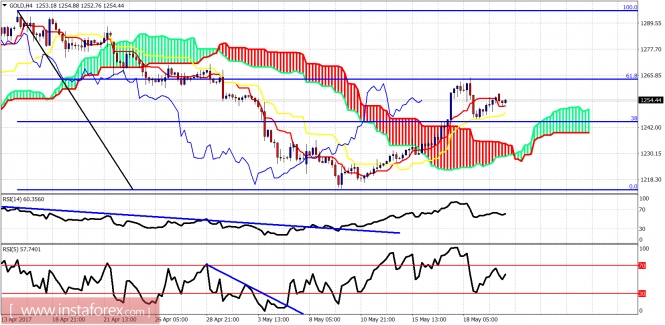

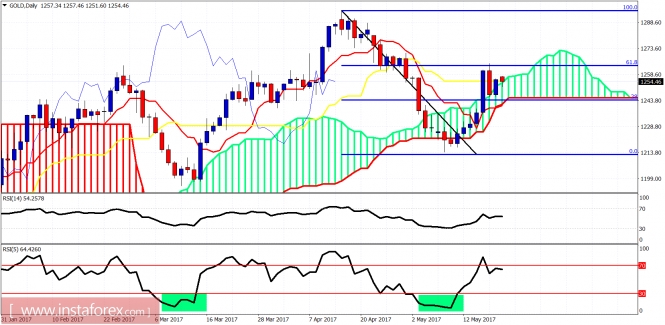

Ichimoku indicator analysis of gold for May 22, 2017

Gold price is overbought in the short-term and justifies a pullback towards $1,240. It is important for Gold bulls to hold above $1,230 and create a new short-term base of a higher low in order to move above $1,280-$1,300 which is the long-term resistance.

Gold price is trading above the Ichimoku cloud support. Price got rejected at the resistance of the 61.8% Fibonacci retracement. Short-term support is at $1,247 and next at $1,230. Price is expected to move lower before higher.

Gold daily chart shows price above daily cloud but below the 61.8% Fibo level resistance. I expect a pullback and a higher low to be created over this week. As long as price is above $1,213 we target $1,230-40 and next $1,280-$1,300. If the $1,213 low is broken, expect a move towards $1,150-60.

InstaForex analytical reviews will make you fully aware of market trends!

Being an InstaForex client, you are provided with a large number of free services for efficient trading.

More analysis - at instaforex.com

Please visit our sponsors

Results 2,311 to 2,320 of 4086

Thread: InstaForex Wave Analysis

-

22-05-2017, 08:50 AM #2311

-

25-05-2017, 08:55 AM #2312

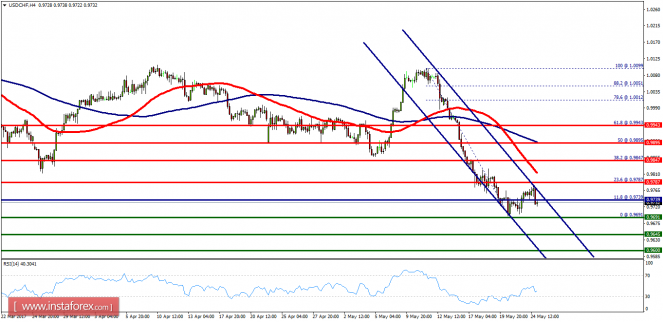

Technical analysis of USD/CHF for May 25, 2017

Overview:

The USD/CHF pair. The first resistance level is seen at 0.9787 followed by 0.9847, while daily support 1 is seen at 0.9691. The USD/CHF pair broke support which turned to strong resistance at 0.9787. The market is still set to trade around the daily pivot point of 0.9739. This week, it continued to move downwards from the level of 0.9787 to the bottom around 0.9739. The pair is trading below this level. It is likely to trade in a lower range as long as it remains below the resistance of 0.9787 which is expected to act as major resistance. Amid the previous events, the USD/CHF pair is still moving between the levels of 0.9787 and 0.9691. For that reason, the major resistance can be found at 0.9787 providing a clear signal to sell with a target seen at 0.9691. If the trend breaks the minor support at 0.9691, the pair will move downwards continuing the bearish trend development to the level of 0.9645 and 0.9600 in order to test the daily support 3. Overall, we still prefer the bearish scenario which suggests that the pair will stay below the area of 0.9787 (resistance).

InstaForex analytical reviews will make you fully aware of market trends!

Being an InstaForex client, you are provided with a large number of free services for efficient trading.

More analysis - at instaforex.com

-

26-05-2017, 09:25 AM #2313

Elliott wave analysis of EUR/JPY for May 26, 2017

Wave summary:

We continue to look for a corrective decline into the 123.78 - 124.17 area before the next impulsive rally towards 134.30 and 138.52 should be expected. Short-term resistance is now seen at 125.16 and again at 125.43, Only a break above the later will indicate that the correction is complete and more upside towards 134.30 is developing.

R3: 125.81

R2: 125.43

R1: 125.16

Pivot: 125.00

S1: 124.86

S2: 124.17

S3: 123.78

Trading recommendation:

We will re-buy EUR at 124.20 or upon a break above 125.43.

InstaForex analytical reviews will make you fully aware of market trends!

Being an InstaForex client, you are provided with a large number of free services for efficient trading.

More analysis - at instaforex.com

-

29-05-2017, 08:01 AM #2314

Technical analysis of EUR/USD for May 29, 2017

When the European market opens, some Economic Data will be released, such as Private Loans y/y and M3 Money Supply y/y. Today, the US will not release any Economic Data, so, amid the reports, EUR/USD will move in a low to medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.1226.

Strong Resistance:1.1220.

Original Resistance: 1.1209.

Inner Sell Area: 1.1198.

Target Inner Area: 1.1172.

Inner Buy Area: 1.1147.

Original Support: 1.1136.

Strong Support: 1.1125.

Breakout SELL Level: 1.1119.

Analysis are provided byInstaForex.

-

30-05-2017, 06:06 AM #2315

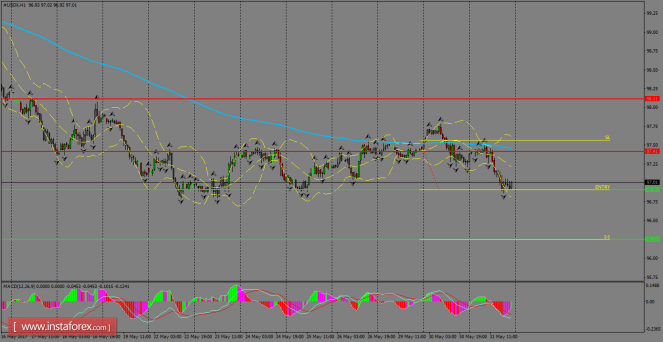

Daily analysis of USDX for May 30, 2017

The index remained in sideways during the Memorial Day in the United States, capped by the 200 SMA at H1 chart. The bears are still strong across the greenback and we can expect some declines towards 96.90. However, if USDX manages to break above the 200 SMA, it's expected to see a rally that tests the resistance area of 98.11.

H1 chart's resistance levels: 97.41 / 98.11

H1 chart's support levels: 96.90 / 96.25

Trading recommendations for today: Based on the H1 chart, place sell (short) orders only if the USD Index breaks with a bearish candlestick; the support level is at 96.90, take profit is at 96.25 and stop loss is at 97.56.

Analysis are provided byInstaForex.

-

31-05-2017, 07:07 AM #2316

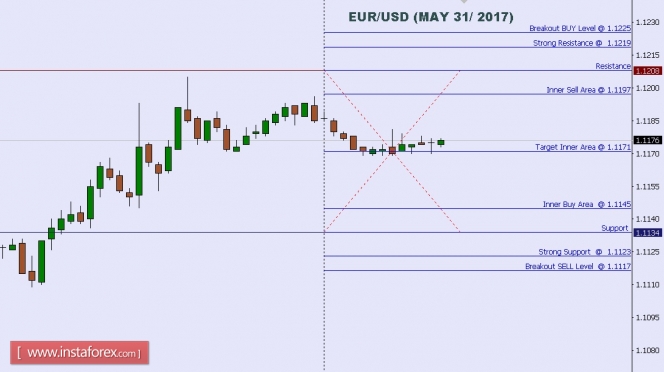

Technical analysis of EUR/USD for May 31, 2017

When the European market opens, some Economic Data will be released, such as Unemployment Rate, Italian Prelim CPI m/m, Core CPI Flash Estimate y/y, CPI Flash Estimate y/y, Italian Monthly Unemployment Rate, German Unemployment Change, French Prelim CPI m/m, and German Retail Sales m/m. The US will release the Economic Data, too, such as Beige Book, Pending Home Sales m/m, and Chicago PMI, so, amid the reports, EUR/USD will move in a low to medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.1225.

Strong Resistance:1.1219.

Original Resistance: 1.1208.

Inner Sell Area: 1.1197.

Target Inner Area: 1.1171.

Inner Buy Area: 1.1145.

Original Support: 1.1134.

Strong Support: 1.1123.

Breakout SELL Level: 1.1117.

Analysis are provided byInstaForex.

-

01-06-2017, 06:35 AM #2317

Daily analysis of USDX for June 01, 2017

The index is finding support around 96.00, as the bears continue to keep pressure the greenback in the short-term. Once it manages to break below the 96.90 level, then we might see some declines to take place towards 96.25. However, if USDX does a consolidation above the 200 SMA at H1 chart, it can look for the 98.11 level.

H1 chart's resistance levels: 97.41 / 98.11

H1 chart's support levels: 96.90 / 96.25

Trading recommendations for today: Based on the H1 chart, place sell (short) orders only if the USD Index breaks with a bearish candlestick; the support level is at 96.90, take profit is at 96.25 and stop loss is at 97.56.

Analysis are provided byInstaForex.

-

02-06-2017, 06:22 AM #2318

Fundamental Analysis of USD/CHF for June 2, 2017

USD/CHF has been recently in a corrective structure between 0.9700-0.9750 area. Recently CHF had negative economic reports like KOF Economic Barometer which was released with a worse figure at 101.6 which was expected to be at 106.2, GDP was released with a worse figure at 0.3% which was expected to rise to 0.5% from the previous figure of 0.2% and Retail Sales report was released with much worst figure at -1.2% which was expected to rise to 2.4% from previous 2.1%. Despite CHF having a good number of important economic events, the currency has managed to gain some strength over USD recently after the correction but failed to continue yesterday as of the positive USD ADP non-farm Employment Change report which showed a rise to 253k which was expected to rise to 181k from 174k previously. Today on the USD side, we have a number of high impact economic events like Average Hourly Earnings report is expected to show a fall to 0.2% from 0.3% previously, Unemployment Rate is expected to be unchanged at 4.4% and Non-Farm Employment Change is expected to decline to 181k from the previous figure of 211k. Though the Non-Farm Employment Change is expected to decline today as of ADP reports Non-Farm Employment Change has higher chances of release with a positive figure which will strengthen the growth of USD against CHF in the coming days.

Now let us look at the technical view, the price has shown a false break downwards after breaking below corrective structure support level at 0.9700. Currently, the price is residing between the corrective structure and a daily close above 0.9750 and daily close below 0.9700 will only enclose the upcoming move in this pair. As of the positive reports on the USD side evolving recently, it is expected that the price has higher chances of breaking upward above 0.9750 level with an upper target towards 0.9960 resistance area but if the price rejects off the corrective structure resistance 0.9750 or breaks below 0.9700 with a daily close below it then we will be looking forward to selling with a target towards 0.9550 support area.

Analysis are provided byInstaForex.

-

05-06-2017, 07:01 AM #2319

Technical analysis of EUR/USD for June 05, 2017

When the European market opens, some Economic Data will be released, such as Final Services PMI, German Final Services PMI, French Final Services PMI, Italian Services PMI, and Spanish Services PMI. The US will release the Economic Data, too, such as Labor Market Conditions Index m/m, Factory Orders m/m, ISM Non-Manufacturing PMI, Final Services PMI, Revised Unit Labor Costs q/q, and Revised Nonfarm Productivity q/q, so, amid the reports, EUR/USD will move in a low to medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.1333.

Strong Resistance:1.1326.

Original Resistance: 1.1315.

Inner Sell Area: 1.1304.

Target Inner Area: 1.1277.

Inner Buy Area: 1.1250.

Original Support: 1.1239.

Strong Support: 1.1228.

Breakout SELL Level: 1.1221.

Analysis are provided byInstaForex.

-

06-06-2017, 06:34 AM #2320

Elliott wave analysis of EUR/JPY for June 6, 2017

Wave summary:

The failure to rally has shifted the short-term count in favor of a triangle consolidation unfolding for wave B. If this is the case, then support seen at 123.11 should be able to protect the downside for a rally above resistance seen at 123.31 that confirms wave C is developing for a rally towards 134.54 as the ideal upside target.

R3: 124.70

R2: 124.43

R1: 124.13

Pivot: 123.80

S1: 123.68

S2: 123.53

S3: 123.11

Trading recommendation:

Our stop at 124.10 was hit for a loss of 55 pips. We bought EUR again at 123.85 and will place our stop at 123.05.

Analysis are provided byInstaForex.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote