Technical analysis of EUR/USD for Dec 21, 2016

When the European market opens, some economic data will be released such as consumer confidence index and Belgian NBB business climate index. The US will also publish some reports such as crude oil inventories and existing home sales. Therefore, amid the reports EUR/USD will move with low to medium volatility during this day.

TODAY'S TECHNICAL LEVELS:

Breakout BUY Level: 1.0439.

Strong Resistance:1.0433.

Original Resistance: 1.0423.

Inner Sell Area: 1.0413.

Target Inner Area: 1.0389.

Inner Buy Area: 1.0365.

Original Support: 1.0355.

Strong Support: 1.0345.

Breakout SELL Level: 1.0339.

Disclaimer: Trading Forex (foreign exchange) on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

InstaForex analytical reviews will make you fully aware of market trends!

Being an InstaForex client, you are provided with a large number of free services for efficient trading.

More analysis - at instaforex.com

Please visit our sponsors

Results 2,211 to 2,220 of 4086

Thread: InstaForex Wave Analysis

-

21-12-2016, 08:56 AM #2211

-

22-12-2016, 08:17 AM #2212

Technical analysis of USD/JPY for Dec 22, 2016

In Asia, Japan will not release any economic data today but the US will reveal such reports as Natural Gas Storage, Personal Income m/m, CB Leading Index m/m, Personal Spending m/m, Core PCE Price Index m/m, HPI m/m, Final GDP Price Index q/q, Durable Goods Orders m/m, Unemployment Claims, Final GDP q/q, Core Durable Goods Orders m/m .So there is a probability the USD/JPY will move with low to medium volatility during this day.

TODAY'S TECHNICAL LEVELS:

Resistance. 3: 118.15.

Resistance. 2: 117.92.

Resistance. 1: 117.69.

Support. 1: 117.41.

Support. 2: 117.18.

Support. 3: 116.95.

More analysis - at instaforex.com

-

27-12-2016, 08:22 AM #2213

Technical analysis of GBP/JPY for December 27, 2016

GBP/JPY is under pressure.

The pair has been capped by both 20-period and 50-period moving averages, while the relative strength index stays below 50.The pair holds below 144.50 and remains capped by a negative trend line. Meanwhile, the relative strength index lacks upward momentum. As long as 144.50 is not broken above, a break below 143.20 is likely.

The pair is trading above its pivot point. It is likely to trade in a wider range as long as it remains above its pivot point. Therefore, long positions are recommended with the first target at 143.20 and the second one at 142.80. In the alternative scenario, short positions are recommended with the first target at 144.95 if the price moves below its pivot point. A break of this target is likely to push the pair further downwards, and one may expect the second target at 145.30. The pivot point lies at 144.50.

Resistance levels: 144.95, 145.30, 145.50

Support levels: 143.20, 142.80, 140.15

More analysis - at instaforex.com

-

28-12-2016, 07:42 AM #2214

Elliott wave analysis of EUR/JPY for December 28, 2016

Wave summary:

The failure to break below support at 122.01 and the following break above resistance at 122.78 shifted the count in favor of the running triangle. This triangle consolidation is now complete and wave (v) higher toward 126.54 is now unfolding.

Short-term support is seen at 122.99 and then at 122.63, but we doubt that the later will be tested before the next rally higher to 124.09 and then to 126.54.

Trading recommendation:

Our stop+revers at 122.85 was hit and we are now long EUR from 122.85. Stop will be placed at 122.10 and take profit+revers will be placed at 126.25.

InstaForex analytical reviews will make you fully aware of market trends!

Being an InstaForex client, you are provided with a large number of free services for efficient trading.

More analysis - at instaforex.com

-

29-12-2016, 07:49 AM #2215

Technical analysis of USD/JPY for Dec 29, 2016

In Asia, Japan will release the BOJ Summary of Opinions data and the US will release some Economic Data, such as Crude Oil Inventories, Natural Gas Storage, Prelim Wholesale Inventories m/m, Goods Trade Balance, and Unemployment Claims. So, there is a probability the USD/JPY will move with low to medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Resistance. 3: 117.38.

Resistance. 2: 117.15.

Resistance. 1: 116.92.

Support. 1: 116.64.

Support. 2: 116.41.

Support. 3: 116.10

More analysis - at instaforex.com

-

03-01-2017, 08:29 AM #2216

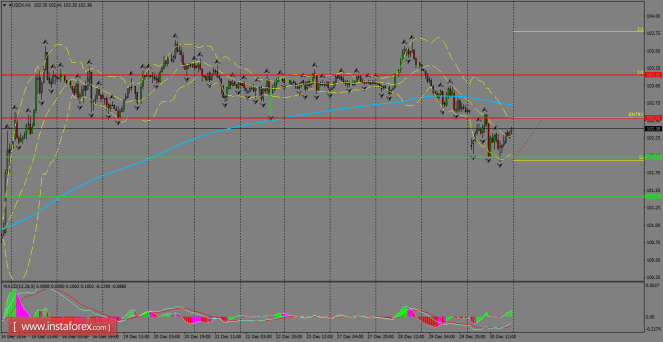

Daily analysis of USDX for January 03, 2017

USDX stayed above the demand zone of 101.97 as it is awaiting further momentum in order to establish a clear path in the short term. It seems that the bears are favored in the current scenario because the index is consolidated below the 200 SMA on H1 chart and a breakout below that zone should help to extend the decline towards the 101.40 level.

H1 chart's resistance levels: 102.53 / 103.15

H1 chart's support levels: 101.97 / 101.40

Trading recommendations for today: Based on the H1 chart, place buy (long) orders only if the USD Index breaks with a bullish candlestick; the resistance level is at 102.53, take profit is at 103.15 and stop loss is at 101.92.

More analysis - at instaforex.com

-

04-01-2017, 08:22 AM #2217

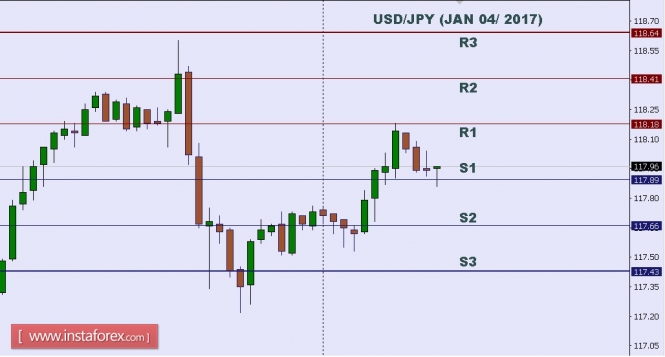

Technical analysis of USD/JPY for Jan 04, 2017

In Asia, Japan will release the Final Manufacturing PMI. The US will release some economic data such as FOMC Meeting Minutes and Total Vehicle Sales. So there is a probability the USD/JPY pair will move with low to medium volatility during this day.

TODAY'S TECHNICAL LEVELS:

Resistance 3: 118.64.

Resistance 2: 118.41.

Resistance 1: 118.18.

Support 1: 117.89.

Support 3: 117.43.

More analysis - at instaforex.com

-

05-01-2017, 08:26 AM #2218

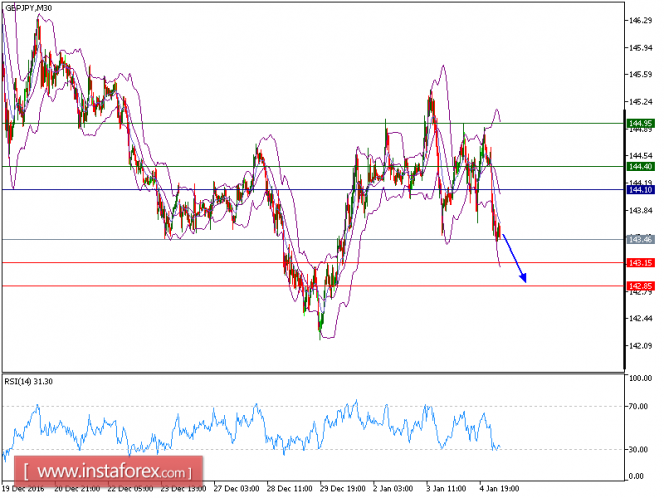

Technical analysis of GBP/JPY for January 05, 2017

GBP/JPY is expected to trade with a bearish bias as the key resistance is at 144.10. The pair remains capped by its descending 20-period moving average and remains on the downside. Meanwhile, the relative strength index is below 50 and lacks upward momentum. As long as 144.10 is not broken above, a break below 143.15 seems likely.

The pair is trading below its pivot point. It is likely to trade in a lower range as long as it remains below the pivot point. Short positions are recommended with the first target at 143.15. A break below this target will move the pair further downwards to 142.85. The pivot point stands at 144.10. If the price moves in the opposite direction and bounces back from the support level, it will move above its pivot point. It is likely to move further to the upside. According to that scenario, long positions are recommended with the first target at 144.40 and the second one at 144.95.

Resistance levels: 144.40, 144.95, 145.40

Support levels: 143.15, 142.85, 142.00

More analysis - at instaforex.com

-

05-01-2017, 08:34 AM #2219

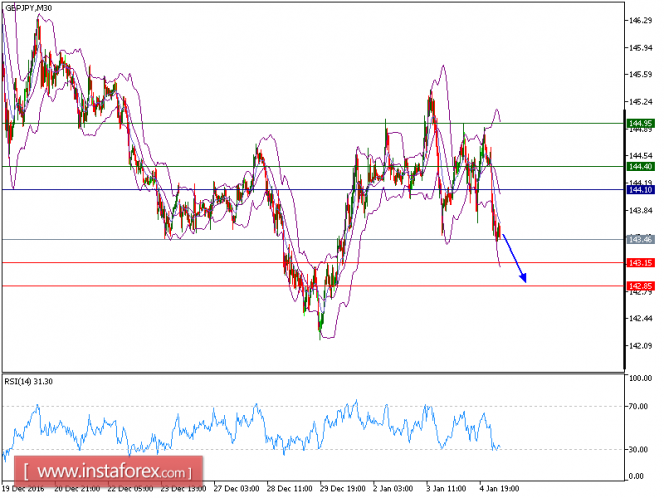

Technical analysis of GBP/JPY for January 05, 2017

GBP/JPY is expected to trade with a bearish bias as the key resistance is at 144.10. The pair remains capped by its descending 20-period moving average and remains on the downside. Meanwhile, the relative strength index is below 50 and lacks upward momentum. As long as 144.10 is not broken above, a break below 143.15 seems likely.

The pair is trading below its pivot point. It is likely to trade in a lower range as long as it remains below the pivot point. Short positions are recommended with the first target at 143.15. A break below this target will move the pair further downwards to 142.85. The pivot point stands at 144.10. If the price moves in the opposite direction and bounces back from the support level, it will move above its pivot point. It is likely to move further to the upside. According to that scenario, long positions are recommended with the first target at 144.40 and the second one at 144.95.

Resistance levels: 144.40, 144.95, 145.40

Support levels: 143.15, 142.85, 142.00

More analysis - at instaforex.com

-

06-01-2017, 08:27 AM #2220

Technical analysis of USD/JPY for Jan 06, 2017

In Asia, Japan will release the Average Cash Earnings y/y. The US will release some economic data such as Factory Orders m/m, Trade Balance, Unemployment Rate, Non-Farm Employment Change, and Average Hourly Earnings m/m. So there is a probability the USD/JPY pair will move with medium to high volatility during this day.

TODAY'S TECHNICAL LEVELS:

Resistance 3: 116.43.

Resistance 2: 116.21.

Resistance 1: 115.98.

Support 1: 115.70.

Support 2: 115.48.

Support 3: 115.25.

More analysis - at instaforex.com

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 2 users browsing this thread. (0 members and 2 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote