Asia-Pacific stock exchanges fall by 1-3%

The day before, Russian President Vladimir Putin signed decrees recognizing the independence of the Donetsk and Lugansk People's Republics (DNR and LNR). In addition, the president instructed the armed forces of the Russian Federation to carry out peacekeeping functions in the self-proclaimed republics. As eyewitnesses told Interfax, two columns of armored vehicles are on the territory of the DPR and follow to the north and west of the republic.

Western countries called Moscow's actions a violation of international law and announced their intention to impose sanctions, which could be announced as early as Tuesday.

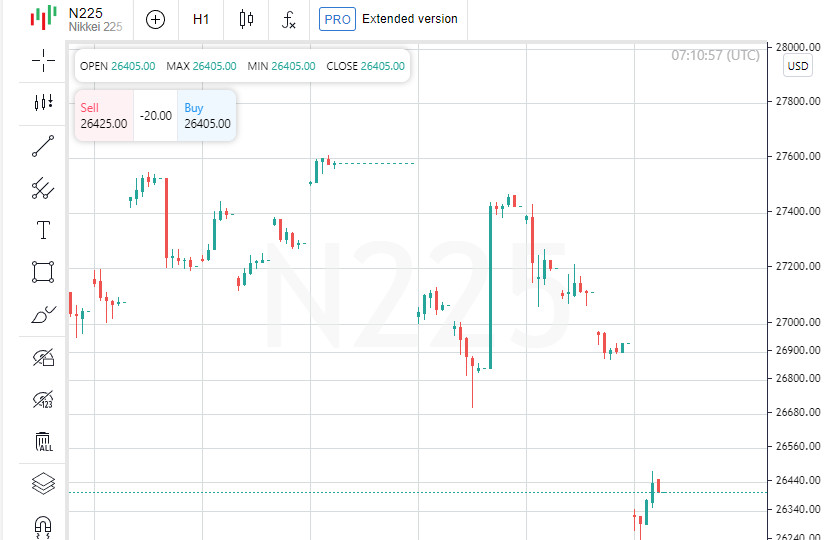

The Japanese Nikkei fell by 1.8% by 8:12 GMT+2.

Shares of consumer electronics manufacturer Sharp Corp. are among the drop leaders among the components of the index. (-7.71%), which continue to fall in price after falling the day before. The company said it plans to buy loss-making display maker Sakai Display Products Corp.

Also, securities of the transport company Kawasaki Kisen Kaisha Ltd. are falling sharply. (-6.7%) and video game developer NEXON Co. Ltd. (-6.2%).

Securities of the investment company SoftBank Group Corp. cheaper by 0.6%, automaker Toyota Motor Corp. - by 2.3%.

The Hong Kong Hang Seng by 8:18 GMT + 2 fell by 3.3%, the Shanghai Shanghai Composite - by 1.4%.

Among the decliners in Hong Kong are shares of gas pipeline operator ENN Energy Holdings Ltd. (-10.9%), Hang Seng Bank Ltd. (-6.6%) and internet giant Meituan (HK:3690) (-6.3%).

Securities of IT companies Alibaba Group Holding Ltd. drop by 3.7%, Tencent Holdings Ltd. - by 2.1%.

South Korean Kospi fell by 1.7% by 8:14 GMT+2.

The consumer confidence index in South Korea fell 1.3 points to 103.1 points in February, the lowest level since last August. A month earlier, the value of the indicator was 104.4 points.

Capitalization of chipmaker Samsung Electronics Co. Ltd. declined by 1.8%, the value of shares of automakers Hyundai Motor Co. Ltd. (KS:005380) and Kia Corp. decreases by 2.2% and 1.9%.

The Australian S&P/ASX 200 fell 1%.

The world's largest mining companies BHP and Rio Tinto lost 0.9% and 1.4%, respectively.

News are provided by

InstaForex.

Please visit our sponsors

Results 2,891 to 2,900 of 3458

Thread: Forex News from InstaForex

-

22-02-2022, 08:38 AM #2891

-

23-02-2022, 09:55 AM #2892

Crypto market update for February 23, 2022

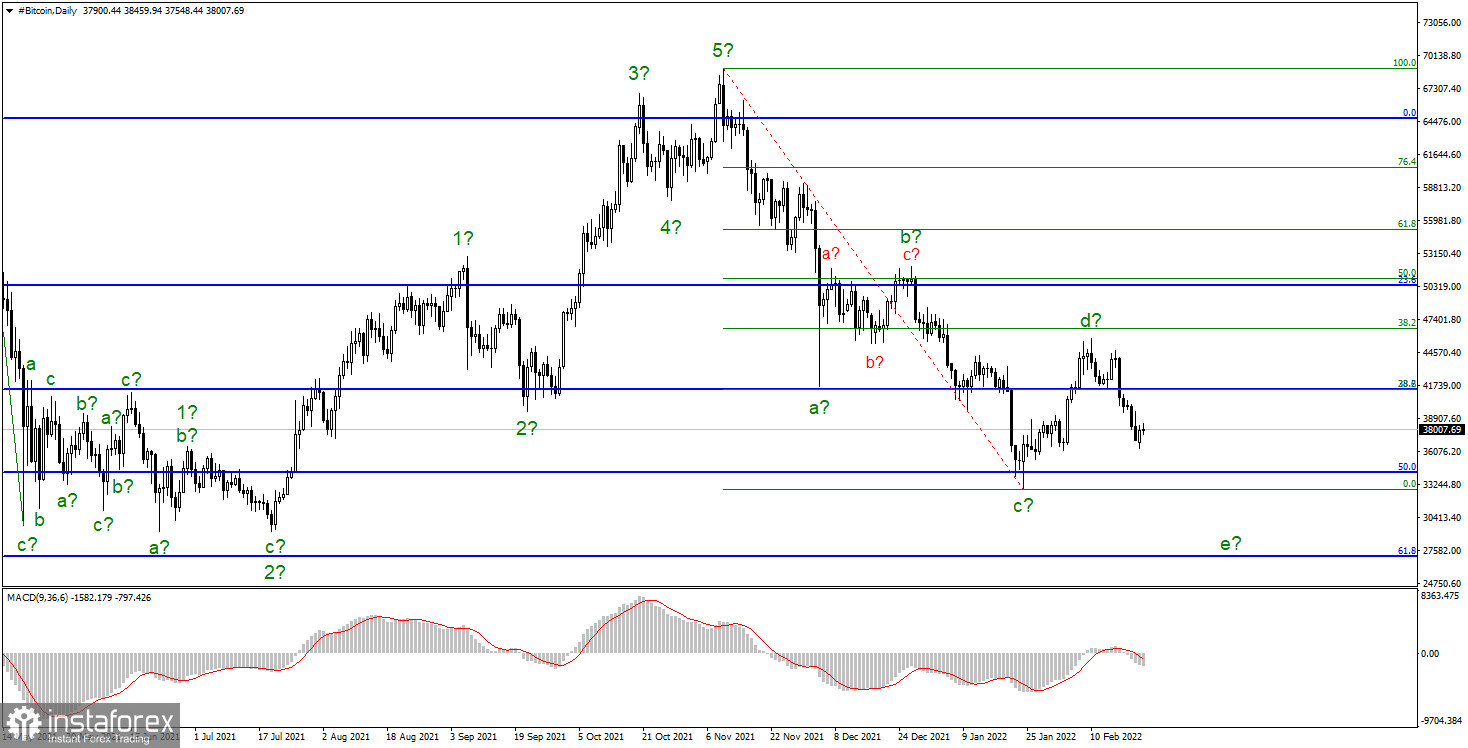

Bitcoin has declined by $7,000 over the past six days. Thus, we have every reason to assume that the formation of the upward wave d is completed. If this assumption is correct, then now the instrument has moved on to building a new downward wave, which is wave e.

No one will deny that the news background sometimes has a strong impact on bitcoin and cryptocurrencies. Usually, this even applies only to negative news background. When all is quiet and calm and central banks are pumping money into their economies while keeping rates low, bitcoin tends to rise. But now it's a completely different matter. Rates are about to begin to rise, and in some places, they have already begun. Central banks no longer intend to print money, and the Fed is going to start reducing its balance sheet, which has ballooned to $9 trillion. Thus, now is an unfavorable time for bitcoin.

I believe that it is on this news and expectations of tightening monetary policy by the market that bitcoin has been declining for several months now. And over the next month, it may drop to $27,000, where wave e can be considered completed. However, geopolitics also intervened, and since bitcoin is a risky asset, it began a new decline along with the stock markets.

And again, geopolitics

So much has been said about geopolitics in recent weeks that I would not like to elaborate on this point. At the same time, this may continue to further reduce the demand for risky assets, which include all cryptocurrencies. Thus, any further escalation of the conflict in Donbass or Ukraine could lead to a wave of new bitcoin sales. In the coming weeks, the danger will be that the troops of the DNR and LNR may go on the offensive in order to capture all the territories of the Luhansk and Donetsk regions. And Russian troops can help them in this, which immediately entered the Donbass as soon as Putin signed a decree recognizing the independence of the LPR and DPR.

The market is negative

Despite the fact that there are still quite a few investors and analysts in the market who continue to believe in bitcoin and its growth in 2022, the mood has changed dramatically to bearish in recent months. More and more experts say that this year there is no reason to expect a renewal of last year's peak. Moreover, some predict a "crypto winter" that will last until 2025.

American economist and writer Nassim Taleb criticized bitcoin, calling it "entertainment for losers." According to Taleb, bitcoin is not really a hedging tool for either inflation or geopolitical risks. Otherwise, why at this time, when inflation is off scale, and the geopolitical situation is at its highest degree, Bitcoin is declining, Taleb wonders. "Actually bitcoin is the exact opposite," said the bestselling author of The Black Swan. Previously, Taleb has repeatedly criticized bitcoin, while noting the positive aspects of blockchain technology.

The construction of the downward trend section continues. At this time, the current wave counting takes on a five-wave form and can continue its construction with targets located near $29,117 and $26,991, which equates to 0.0% and 61.8% Fibonacci within wave e. A successful attempt to break through the $41,470 mark, which corresponds to 38.2% Fibonacci, indicates the market is ready for further sales. Thus, I expect another downward wave to be built. Considering what a difficult news background is now, this wave can be very long.

In many ways, everything will depend on how long the escalation of the conflict in Ukraine will last and how far everything will go. In the coming weeks, everything will really depend on geopolitics, and on March 15-16, the Fed will raise the rate. It's hard to come up with a worse news background for bitcoin.

News are provided by

InstaForex.

-

24-02-2022, 10:18 AM #2893

Things getting worse in Ukraine, so European market trading in red

European stock futures dropped this morning after reports that Russian troops fired missiles at a number of Ukrainian cities and landed troops on its coast. This caused a big wave of risk-off in the global market. Worries about increased inflation and the derailing of the economic recovery after the outbreak of the pandemic affected investors and resulted in German DAX index contracts down more than 5 %, EuroSTOXX futures dropped 5 % and FTSE futures down 2.8 %. While the European market is quite reliant on Russian energy products, the current political situation raised worries in other markets as well. Some Asian stocks, in particular, also fell, and U.S. index futures showed losses of around 2% later on Wall Street. Oil prices are up more than 5% and gold soared 2%.

News are provided by InstaForex

-

25-02-2022, 09:54 AM #2894

EUR/USD: euro explores a new reality without going to extremes, and the dollar, the mainstay of investors, gets a head start

The sparks of the geopolitical conflict simmering around Ukraine have scattered across the global market and burned the euro. At the same time, the US currency got a chance to gain a foothold in the role of a reliable asset of a "safe haven", into which investors once again "dived" into.

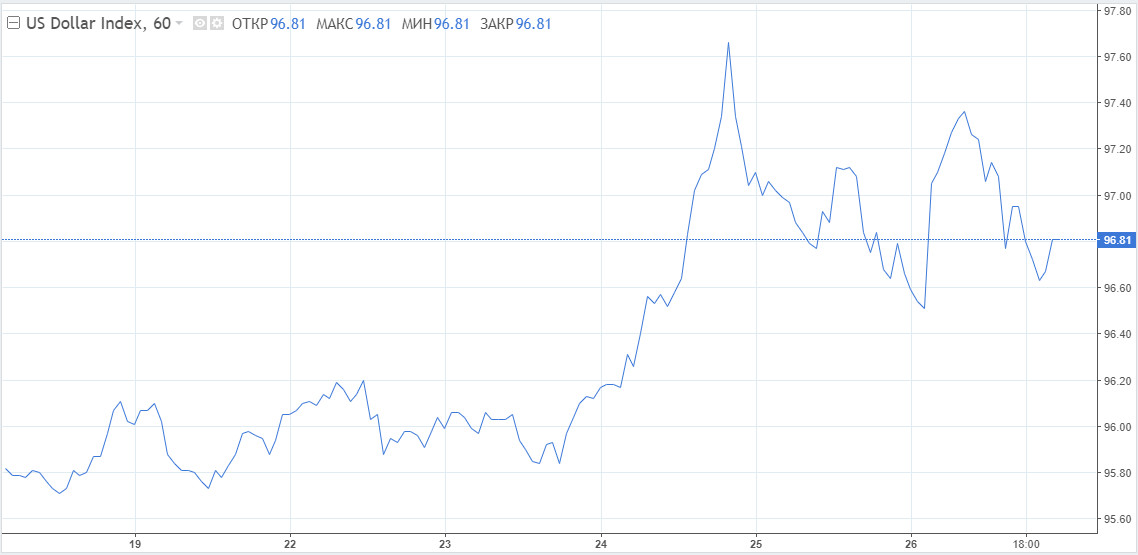

Many European currencies, in particular the Swedish krona, the euro, the Hungarian forint and the Polish zloty, could not withstand the geopolitical tension and sank sharply. Investors rushed to safe currencies, primarily the US, as well as the Swiss franc and the yen. In the course of large-scale risk avoidance and the search for protective assets, the greenback gained 0.9%. According to analysts, risk aversion will dominate the market in the near future. This contributes to the further strengthening of the USD, as well as other safe havens – the yen and the Swiss franc.

The massive "escape" of investors in the dollar was provoked by the intensity of the geopolitical conflict associated with the Ukrainian military operation. Market participants fear negative economic consequences and a significant tightening of sanctions rhetoric against Russian assets. Against this background, currency strategists predict a "well-coordinated movement in USD", which will continue.

The current situation has tripped up the euro, which has fallen under large-scale sales amid risk aversion. On Thursday, the EUR/USD pair was near 1.1250, but then it sank significantly. In the near future, the pair may feel bearish pressure if geopolitical tensions persist.

The euro tried to recover at the end of this week, but acted with varying success. The single currency hardly holds on to the positions it has won. A sharp geopolitical shift provoked the collapse of the EUR/USD pair from the level of 1.1300 to a new low of 1.1106, recorded in May 2020. Later, the pair slightly balanced its dynamics, rising to 1.1200. On the morning of Friday, February 25, the EUR/USD pair was trading near 1.1221, trying to get out of the downward spiral.

An additional pressure factor for the euro may be an increase in energy prices. The implementation of such a scenario will send the EUR/USD pair to the critical level of 1.1100, Danske Bank believes. An increase in the cost of energy carriers is possible in the event of a decrease in the geopolitical intensity, and this is unlikely, the bank notes.

Risk aversion, which prevails in financial markets, gives the dollar a head start. As for the European currency, it seeks to adapt to the new reality and avoid prolonged subsidence. These attempts pass with varying success. According to experts, the fair exchange rate of the euro is 1.2000. Reaching this mark in the EUR/USD pair is possible after the current US government bond placement cycle. Analysts do not rule out EUR growth after the ECB meeting scheduled for March 10.

Geopolitical turmoil has dealt a significant blow to risk appetites, but key currencies have proved resilient. In the short-term planning horizon, experts expect the recovery trend to consolidate.

News are provided by

InstaForex.

-

28-02-2022, 10:22 AM #2895

EUR/USD: the euro is looking for a lifeline, and the dollar is confidently holding the steering wheel

The US currency started the new week on the positive side, continuing the upward trend. Against the background of the steady growth of the greenback, the euro's positions are significantly shaken. The markets are afraid that the EUR will not only dive to the bottom, but will remain there indefinitely.

Earlier, experts considered an early interest rate hike by the European Central Bank to be a lifeline for the euro. The ECB was strongly advised to follow the path of the US one and raise the rate at almost every meeting. However, the escalation of the military conflict around Ukraine has made its own adjustments. At the moment, European leaders are engaged in the implementation of the next sanctions against Russia. Note that the international assets of the Bank of Russia came under attack.

The current situation has become a powerful driver of greenback growth and weakened the euro's position. On the morning of Monday, February 28, the US currency soared against the European one amid the global flight of investors from risk. The reasons are the complication of the geopolitical situation around Ukraine and the introduction of economic restrictions against Russia. The EUR/USD pair was near 1.1162, having significantly sank from the level of 1.1267 recorded at the close of the last session.

According to analysts, the greenback's rally in relation to the euro is due not only to the widespread withdrawal of investors from risk, but also to the collapse of US stock futures. On the last day of February, futures on American securities fell along with the euro, while the safe haven currencies, the dollar and the yen, became market favorites in terms of demand.

The "black swan" of geopolitics has made significant adjustments to the expectations of the Federal Reserve and ECB rate hikes by the markets. At the moment, these measures have receded into the background, although the US central bank does not intend to reconsider the tightening of monetary policy due to the Ukrainian conflict. The changes in the monetary policy should help the growth of the greenback, but the simultaneous fall of the US stock market and the stock market will turn the situation 180 degrees. With the tightening of the monetary policy, investors will massively withdraw from long US debt securities, while the US stock market will stay afloat. Such an ambiguous situation can shake the USD positions.

Currently, the US currency is supported by fears of possible negative consequences of anti-Russian sanctions. Many analysts are alarmed by the potential difficulties for the global economy due to the introduction of restrictions. Bullish sentiment on the US currency prevails among the major market players, and large investment funds are increasing their positions on USD growth for the second consecutive week. Over the past week, funds have increased greenback purchases by 3%. The strengthening of this trend contributes to the further growth of the US currency, analysts believe.

News are provided by

InstaForex.

-

01-03-2022, 07:48 AM #2896

Second round of talks between Russia and Ukraine to be held in coming days. Dollar to stay in demand globally

Demand for safe-haven assets is set to remain strong in the near future. Gold prices are on the rise. Nevertheless, the US dollar briefly retraced down on Monday, while market players were awaiting the outcome of the Russia-Ukraine talks. The talks are unlikely to resolve the conflict, but the willingness of the parties to negotiate has somewhat eased fears in the market. In the coming days, Russia and Ukraine are expected to hold the second round of talks. Officials from both sides returned to their capitals for further consultations.

"We have identified certain points from which we can predict general positions," Vladimir Medinsky, the delegate from Russia, said. A similar announcement was made by Mykhailo Podolyak, Ukraine's presidential advisor.

Meanwhile, the dollar rally is expected to extend. Global demand for the greenback, as well as other safe-have assets, remains strong due to both geopolitical risks and stressed dollar liquidity conditions.

"As such we will keep a close eye on the cross-currency basis swap market for any kinds of stress as well as seeing whether there is any increased demand for dollar liquidity at e.g. the ECB 7-day USD auction," economists at ING said.

DXY is heading back to the high at 97.70 and could break higher still.

"Euro losses have been relatively well contained so far," according to ING. Russia, the United States, and the European Union are now waging an information war. They impose sanctions, threaten, and accuse each other.

Although Europe relies heavily on energy, there have already been some reports of it looking at quotas and limits on Russian energy. Clearly, Europe would have to pay a lot higher price for its energy under such a scenario, and growth forecasts would have to be downgraded.

On Monday, the euro/dollar pair retested the low of 1.1120. Barring any surprise breakthrough in Ukraine-Russia talks, EUR/USD might hit 1.1000 this week.

This week promises to be full of not only political but also macroeconomic events. The eurozone CPI for February is scheduled for Wednesday. In France, the CPI came in higher unexpectedly. But given the events in the east, the ECB is likely to become more hawkish if the eurozone CPI comes in stronger. Bearish bias for EUR/USD continues.

Some analysts anticipate monetary policy tightening in the eurozone. The euro could strengthen on expectations of a rate hike by the ECB, Societe Generale said. The European regulator would raise rates by 25 basis points, experts forecast. The next ECB meeting is scheduled for March 10.

Data on US unemployment could somewhat affect EUR/USD by the close of the week. The figure is estimated to drop to 3.9% versus 4%, while Nonfarm Payrolls are seen to increase by 438K.

News are provided by

InstaForex.

-

02-03-2022, 09:11 AM #2897

EUR/USD: the dollar saves from risks, and the euro needs an energy "crutch"

The current uncertainty of the geopolitical conflict around Ukraine has significantly shaken the EUR/USD pair. The weather vane of its dynamics deviated from the sharp drop caused by the collapse of the euro, but it is far from equilibrium.

On Wednesday, the European currency experienced serious pressure amid the escalation of the Ukrainian conflict. The rise in oil prices added fuel to the fire, increasing investors' worries about an economic blow to the eurozone. The single currency slipped below the support level, reaching a 21-month low of 1.1090, but then recovered. The euro was in the 1.1130-1.1131 range at the beginning of trade. The EUR/USD pair was cruising near 1.1114 on Wednesday morning, March 2, trying to get out of the price hole.

According to analysts, the prospects of the European currency are related to the energy security of Europe. A positive solution to the gas issue and the settlement of LNG supplies will help the euro to rise. If the euro fails, a thorny path is provided, analysts believe. According to analysts at Commonwealth Bank of Australia, the risk for EUR "lies in a steady movement below 1.1106 if market participants lower the economic prospects of the eurozone."

Geopolitical passions are boiling in the markets, but many are confident that they do not threaten the dynamics of the euro. Market participants fear disruptions in energy supplies, which worsen the economic situation of the eurozone. The current stability of the euro is ensured by the balanced approach of European leaders to the introduction of anti-Russian sanctions. According to experts, Europe will not impose restrictions that will block its access to Russian energy carriers. In addition, the "green" strategy of European leaders has seen a 180-degree turn. Many EU countries refuse to use "green" technologies in favor of LNG, and are also not ready to reduce coal consumption. Against this background, the impact of the Ukrainian conflict on the economic growth of the eurozone is minimal, experts believe.

Economists are seriously concerned about the intensification of the global humanitarian crisis. In conditions of economic uncertainty, the dollar comes on the scene. Experts attach key importance to the US currency when protecting investment portfolios. UBS currency strategists believe that the greenback as a safe haven currency has a number of advantages and high stability in times of crisis. At the same time, the greenback shows a tendency to rally at times of increased geopolitical uncertainty or risk-free sentiment in financial markets. UBS is confident that market expectations about a sevenfold rise in US interest rates will support USD in the coming months. The greenback is currently the most attractive tool for currency transactions.

News are provided by

InstaForex.

-

03-03-2022, 08:35 AM #2898

Crypto market rallies as other risk assets plunge

The world's most popular and largest cryptocurrency showed steady growth, trading bullish for the second session. The digital asset tested the February high of $45,000 and then tumbled along with US stock indices in the North American session.

Institutional investors and crypto whales have been recently buying out digital gold, seeking alternative instruments amid the escalating conflict between Russia and Ukraine.

Last week, cryptocurrency funds saw an inflow of assets worth $36 million, up by $239 million, according to CoinShares.

On Tuesday, BTC soared 5.3% to $43,900. Like the flagship cryptocurrency, popular altcoins were also on the rise with ether jumping 4.6%, Binance Coin and Avalanche adding 8%, and XRP rising 2.1%.

The crypto market capitalization has climbed 3.9% to $2.01 trillion over the past 24 hours, CoinGecko, the world's largest cryptocurrency data aggregator, reported.

Meanwhile, BTC dominance increased 0.5% to 41.4% as popular altcoins showed weaker growth. The bitcoin fear and greed index has swelled 31 points to 51 points over the past 24 hours.

New sanctions against Russia targeting the country's financial institutions are named as the main driving force of virtual assets.

On February 28, bitcoin gained more than 15% as the US Treasury imposed sanctions against Russia's Central Bank and froze its assets in the US. Many European states announced similar sanctions as well.

Crypto experts say isolation of Russia's financial system may cause a decrease in the correlation between cryptocurrencies and other risk assets observed since early 2022. Thus, digital gold has recently been bullish despite a fall in other risk assets.

Despite the tense geopolitical situation, this is a good time for the crypto market. To avoid financial losses, investors from Russia and Ukraine began to actively invest in decentralized currencies, in particular, bitcoin.

A fall in fiat currencies became another positive factor for bitcoin. According to Binance, the cryptocurrency exchange, trading volumes between the Russian ruble and BTC and USDT have significantly increased.

At the same time, US officials are increasingly worried Russia might use virtual assets to evade sanctions. They urged the leading cryptocurrency exchanges to block Russian users from their platforms amid concerns digital currencies are being used to mitigate tightening sanctions.

Binance, KuCoin, Kraken, and AAX responded by saying they did not intend to unilaterally block the funds of Russians. Meanwhile, the Kraken online service said that they would be forced to start the blocking process if the regulator said to. The statements by the world's largest crypto exchanges instilled optimism in the crypto market and contributed to the strengthening of BTC.

News are provided by

InstaForex.

-

04-03-2022, 09:44 AM #2899

Apocalypse now: The threat of a second Chernobyl has sharply raised the price of gold

This morning, after a Russian attack, the Zaporizhzhia nuclear power plant, which is the largest in Europe, caught fire. Fear has reached a climax, causing the price of gold to soar again.

On Thursday, Russian troops captured Kherson, located in southern Ukraine, and continued to advance towards Zaporizhzhia. Early on Friday morning, disturbing news came from the region: a local nuclear power plant was on fire.

The fire at the Zaporizhzhia nuclear power plant was caused by shelling by Russian forces who were trying to take control of the facility.

Recall that earlier Russia had already seized the inactive Chernobyl station, located about 100 km north of Kyiv.

Unlike the Chernobyl nuclear power plant, the Zaporizhzhia station is an important strategic facility. It is the largest in Europe and generates approximately 20% of the total volume of all Ukrainian electricity.

The news of the fire at the nuclear power plant raised great concerns about its safety. The threat of a second Chernobyl quickly sowed panic in the stock markets and increased the demand for safe-haven assets.

This morning, gold rose sharply by 0.6% to $1,948.60. However, later, when comments from the Ukrainian authorities about the real situation at the nuclear power plant appeared, the quotes also plummeted.

Ukraine informed the International Atomic Energy Agency that the fire did not affect the main equipment. It was also noted that the radiation background is not disturbed.

The severity of the incident was also assessed by US Secretary of Energy Jennifer Granholm. She assured that all reactors at the Zaporizhzhia NPP are reliably protected and will be safely shut down in an emergency.

Despite the fact that the level of anxiety about the emergency at the nuclear power plant has already decreased, gold still maintains a confident upward trend. Now bullion is aiming to end the current week with an increase.

According to preliminary estimates, since Monday, the yellow asset has risen in price by more than 2%. This is the best weekly increase in the precious metal since May last year.

Geopolitics continues to be the key pricing factor in the gold market. Yesterday, waiting for the outcome of Russian-Ukrainian negotiations, the cost of bullion rose to $1,935.90. The difference with the previous trade, when the quotes fell by 1.1%, amounted to 0.7%.

Investors foresaw that the meeting of the two sides would not lead to a de-escalation of the conflict, and they were right. It seems that there is no point in hoping for a ceasefire anytime soon. The military operation will drag on for a long time, as a result of which the world economy may face a severe crisis.

Markets are already feeling the economic impact of Russia's invasion of Ukraine. Oil prices are rising, fueling fears of accelerating inflation.

Wanting to protect their savings during a period of great uncertainty, many traders get rid of risky financial instruments and buy protective assets.

According to analyst Peter Grosskopf, gold currently has the biggest potential. The expert advises investors to ignore the daily price fluctuations that have been observed in recent days and focus on the larger upward trend of the precious metal.

Grosskopf expects that interest in gold will continue to grow, as there will be a lot of volatility in the stock markets. This is not about a major stock crash. In an environment where both geopolitical and inflationary risks are huge, the usual correction will be enough to scare traders and increase their interest in the precious metal.

News are provided by

InstaForex.

-

08-03-2022, 09:04 AM #2900

Swiss National Bank pledges to stem franc's rise

The euro/franc exchange rate fell to 0.9910 in Asia overnight, as investors sought refuge in the Swiss currency. The valuation is the highest level for the franc since January 2015 when the Swiss central bank scrapped its peg to the euro. "The Swiss franc is currently sought after as a refuge currency, along with the US dollar and the yen," the central bank said in a statement.

"The Swiss franc continues to be highly valued," it added. "The SNB remains prepared to intervene in the foreign exchange market if necessary."

The verbal intervention is an unusual move by the central bank, which last gave a separate statement indicating its concerns about the franc's appreciation after Britain voted to leave the European Union in 2016.

"While the SNB has been rather relaxed about the appreciation of the Swiss franc in the last months ... a drop below parity could change its attitude because parity is also a psychologically important threshold," UBS economist Alessandro Bee said.

The SNB said the increased valuation of the franc, which is a danger for Switzerland's export-dominated economy, also recognized the inflation differentials between Switzerland and other countries.

Consumer price inflation in Switzerland rose to a higher-than-expected 2.2% in February, the highest level since 2008, but well below the 5.8% level in the neighboring eurozone, Switzerland's biggest export market.

The SNB on Monday said it looked at the overall currency situation rather than individual currency pairs.

Sight deposit data, a proxy for the SNB's foreign currency purchases, showed a rise of just 500 million francs last week, indicating a small amount of intervention. Obviously, the bank is hoping with the announcement of its measures to achieve some outflow on the foreign exchange market.

"I expect the SNB to fight this appreciation only moderately – because it cannot change the environment for investors that just seek safety," J. Safra Sarasin economist Karsten Junius said.

Russia's invasion of Ukraine, which it calls a "special operation" has introduced uncertainties as the global economy looks to move towards monetary policy normalization, SNB Governing Board Member Andrea Maechler said in an interview published on Saturday.

Her comments pointed out that the crisis had delayed the SNB's plans to retreat from the negative interest rates and foreign exchange purchases, which had been the basis of its expansive approach.

The Swiss central bank gives its next monetary policy update on March 24. Obviously, if cash inflows continue, the institution will be forced to lower the franc exchange rate, otherwise exports and imports will cost the Swiss too much.

News are provided by

InstaForex.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote