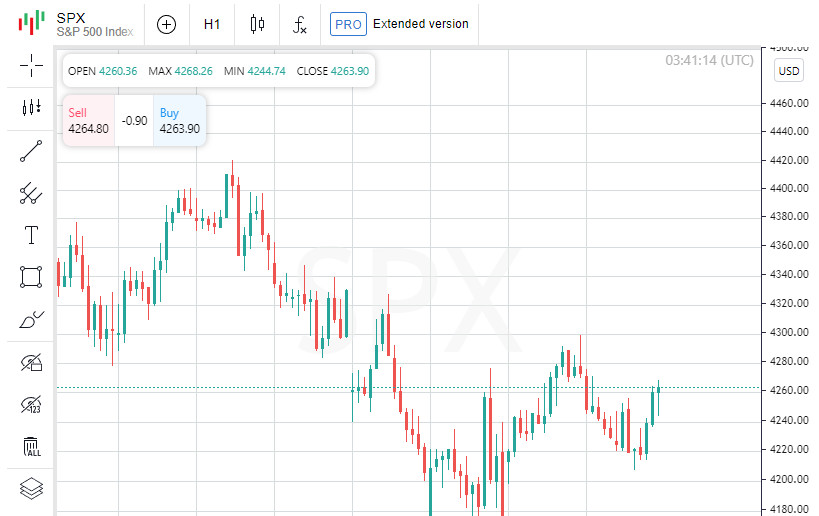

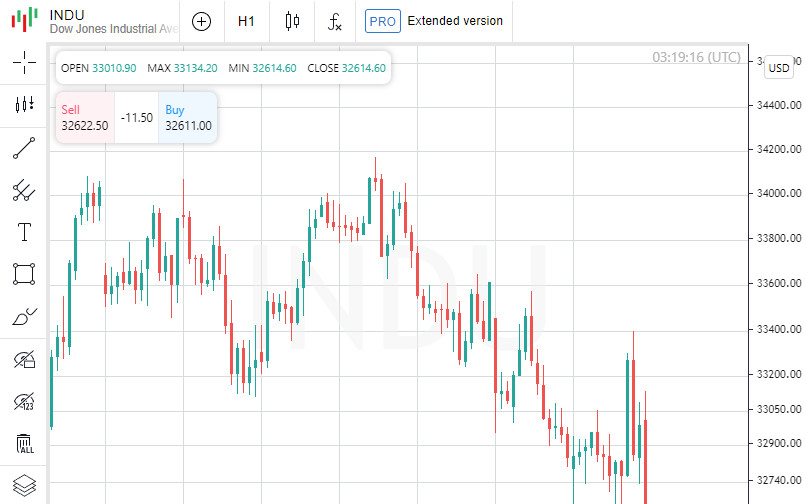

US stocks closed lower, Dow Jones down 0.56%

At the close on the New York Stock Exchange, the Dow Jones fell 0.56% to a 6-month low, the S&P 500 index fell 0.73%, and the NASDAQ Composite index fell 0.28%.

Caterpillar Inc was the top performer among the components of the Dow Jones index today, up 13.30 points or 6.76% to close at 210.00. Chevron Corp rose 8.49 points or 5.24% to close at 170.53. Boeing Co rose 4.63 points or 2.74% to close at 173.80.

Shares of Coca-Cola Co were the leaders of the fall, the price of which fell by 2.42 points (3.96%), ending the session at 58.66. Procter & Gamble Company rose 3.96% or 6.05 points to close at 146.79 while UnitedHealth Group Incorporated shed 2.75% or 13.41 points to close at 473.46.

Leading gainers among the S&P 500 index components in today's trading were Enphase Energy Inc, which rose 10.82% to 175.99, SolarEdge Technologies Inc, which gained 10.41% to close at 328.91, and also shares of Quanta Services Inc, which rose 8.17% to close the session at 116.83.

The biggest losers were Seagate Technology PLC, which shed 9.51% to close at 90.57. Shares of ConAgra Foods Inc shed 8.22% to end the session at 30.93. Quotes of Intuitive Surgical Inc decreased in price by 7.98% to 269.32.

Leading gainers among the components of the NASDAQ Composite in today's trading were Hycroft Mining Holding Corporation, which rose 203.31% to 1.00, Kala Pharmaceuticals Inc, which gained 88.49% to close at 1.15. as well as shares of Westport Fuel Systems Inc, which rose 52.63% to end the session at 2.03.

The drop leaders were shares of Imperial Petroleum Inc, which fell 43.33% to close at 4.25. Shares of Inspirato Inc lost 42.78% to end the session at 15.25. Quotes of Digital Brands Group Inc decreased in price by 30.61% to 1.36.

On the New York Stock Exchange, the number of securities that rose in price (1694) exceeded the number of those that closed in the red (1502), while quotes of 147 shares remained virtually unchanged. On the NASDAQ stock exchange, 2069 companies rose in price, 1727 fell, and 265 remained at the level of the previous close.

The CBOE Volatility Index, which is based on S&P 500 options trading, fell 3.62% to 35.13.

Gold futures for April delivery added 3.12%, or 62.35, to $2.00 a troy ounce. In other commodities, WTI crude for April delivery rose 4.44%, or 5.30, to $124.70 a barrel. Futures for Brent crude for May delivery rose 0.06%, or 0.08, to $129.27 a barrel.

Meanwhile, in the Forex market, the EUR/USD pair remained unchanged at 0.00% to 1.09, while USD/JPY edged up 0.01% to hit 115.67.

Futures on the USD index fell 0.17% to 99.12.

News are provided by

InstaForex.

Please visit our sponsors

Results 2,901 to 2,910 of 3458

Thread: Forex News from InstaForex

-

09-03-2022, 06:52 AM #2901

-

10-03-2022, 11:47 AM #2902

Reviews: European stock markets rise sharply ahead of the big day

In Wednesday's trading, key European indices showed strong gains. The German DAX is up by 5.32% after a permanent four-day decline. By the way, the DAX fell by more than 8% over the past week.

The STOXX Europe 600 index of Europe's leading companies rose by 2.5% to 425.66 points. The British FTSE 100 gained 2.1% to settle at 7,112.6 points, while the French CAC 40 jumped by 5.01% to 6,283.33 points.

The main reason for the spectacular rise in key European indices was the strong rally in the banking sector on the back of a stronger euro against the dollar. On Wednesday, UniCredit, BNP Paribas, Deutsche Bank shares soared by 8.3%, 7.97%, and 5.56% respectively.

In Wednesday's trading, key European indices showed strong gains. The German DAX is up by 5.32% after a permanent four-day decline. By the way, the DAX fell by more than 8% over the past week.

The STOXX Europe 600 index of Europe's leading companies rose by 2.5% to 425.66 points. The British FTSE 100 gained 2.1% to settle at 7,112.6 points, while the French CAC 40 jumped by 5.01% to 6,283.33 points.

The main reason for the spectacular rise in key European indices was the strong rally in the banking sector on the back of a stronger euro against the dollar. On Wednesday, UniCredit, BNP Paribas, Deutsche Bank shares soared by 8.3%, 7.97%, and 5.56% respectively.

The securities of the German sportswear manufacturer Adidas climbed by more than 8%. The company's revenues rose by 15.2% to 21.23bn euros in the year to date. In addition, management of Adidas announced a 10% increase in dividend payments to €3.3 per share and projected sales growth of 11-13% in 2022.

Shares in German tyre and automotive components maker Continental jumped 4% following the release of the company's financial report. According to the latest figures, Continental posted a net profit last year and resumed paying dividends to shareholders.

The UK's Prudential Plc gained 6.8%. The insurance company increased its operating profit by 16% year-on-year in 2021. The main driver behind Prudential Plc's spectacular results was the strengthening of its business in the Asian region.

The capitalization of Russian miner Polymetal soared by 33%. The company's management reported smooth production processes in Russia and Kazakhstan despite Western countries' sanctions.

Shares in German postal and logistics company Deutsche Post AG rose 5.7% on a report of a 14% increase in net profit in the fourth quarter last year. In addition, the day before, the company announced the launch of a new €2bn buyback programme.

Another important upside factor for Europe's leading indicators was the steadily rising oil prices, which exceeded $130 a barrel on Wednesday morning. The day before US President Joe Biden announced that the White House had banned energy imports from the Russian Federation. The UK authorities have also announced their intention to move away from Russian oil by the end of 2022. In the meantime, the European Union plans to reduce the bloc's energy dependence on energy supplies from the Russian Federation.

On this news, the price of black gold instantly hit its highest levels since July 2008. In addition, decisive measures by Western countries carry the risks of further increases in the global cost of oil and a deterioration of the industry's supply chains.

At the same time, Fatih Birol, head of the International Energy Agency, said the IEA was ready to bring more oil to market by releasing additional stocks.

In recent days, the increase in world oil prices has been partly held back by news that US black gold inventories rose by 2.8 million barrels over the week. At the same time, market analysts predicted a steady decline in the indicator. Experts believe that this state of affairs was the result of consumers' negative reaction to higher prices at petrol stations and, as a consequence, a refusal to travel.

This week's investor focus is on the upcoming European Central Bank (ECB) meeting scheduled for Thursday. Market participants will be keeping a close eye on how the ECB will deal with the persistently rising inflation rate and the multiple difficulties caused by the military conflict in Ukraine.

In addition, the Russian and Ukrainian foreign ministers are scheduled to meet on March 10 in Turkey, which the world markets are expecting with great positivity and hope.

News are provided by

InstaForex.

-

11-03-2022, 06:24 AM #2903

US stocks closed lower, Dow Jones down 0.34%

At the close on the New York Stock Exchange, the Dow Jones fell 0.34%, the S&P 500 index fell 0.43%, the NASDAQ Composite index fell 0.95%.

Chevron Corp was the top gainer among the components of the Dow Jones index today, up 4.55 points or 2.74% to close at 170.82. Walmart Inc rose 3.17 points (2.27%) to close at 142.63. Dow Inc rose 0.83 points or 1.39% to close at 60.63.

Shares of Apple Inc became the leaders of the fall, the price of which fell by 4.43 points (2.72%), ending the session at 158.52. Procter & Gamble Company was up 2.57% or 3.83 points to close at 144.94, while Cisco Systems Inc was down 2.16% or 1.21 points to close at 54.71.

Leading gainers among the S&P 500 index components in today's trading were Halliburton Company, which rose 8.93% to hit 37.95, Baker Hughes Co, which gained 8.67% to close at 36.74, and Mosaic Co, which rose 7.74% to end the session at 62.19.

Etsy Inc was the biggest loser, shedding 5.35% to close at 136.98. Shares of EPAM Systems Inc lost 4.86% to end the session at 188.76. Quotes of MSCI Inc decreased in price by 4.69% to 465.26.

Leading gainers among the components of the NASDAQ Composite in today's trading were Hycroft Mining Holding Corporation, which rose 138.10% to hit 1.50, AgriFORCE Growing Systems Ltd, which gained 102.37% to close at 3.42 , as well as shares of Hoth Therapeutics Inc, which rose 38.79% to close the session at 0.80.

The biggest losers were Trean Insurance Group Inc, which shed 51.70% to close at 3.40. Shares of Fossil Group Inc lost 37.51% and ended the session at 9.08. Quotes TherapeuticsMD Inc fell in price by 27.50% to 0.29.

On the New York Stock Exchange, the number of securities that fell in price (1836) exceeded the number of those that closed in positive territory (1367), and quotes of 128 shares remained virtually unchanged. On the NASDAQ stock exchange, 2,282 companies fell in price, 1,463 rose, and 253 remained at the level of the previous close.

The CBOE Volatility Index, which is based on S&P 500 options trading, fell 6.84% to 30.23.

Gold futures for April delivery added 0.68% or 13.60 to hit $2.00 a troy ounce. In other commodities, WTI April futures fell 2.64%, or 2.87, to $105.83 a barrel. Futures for Brent oil for May delivery fell 0.04%, or 0.04, to $109.15 a barrel.

Meanwhile, in the Forex market, the EUR/USD pair remained unchanged 0.05% to 1.10, while USD/JPY rallied 0.00% to hit 116.14.

Futures on the USD index rose by 0.58% to 98.53.

News are provided by

InstaForex.

-

14-03-2022, 06:54 AM #2904

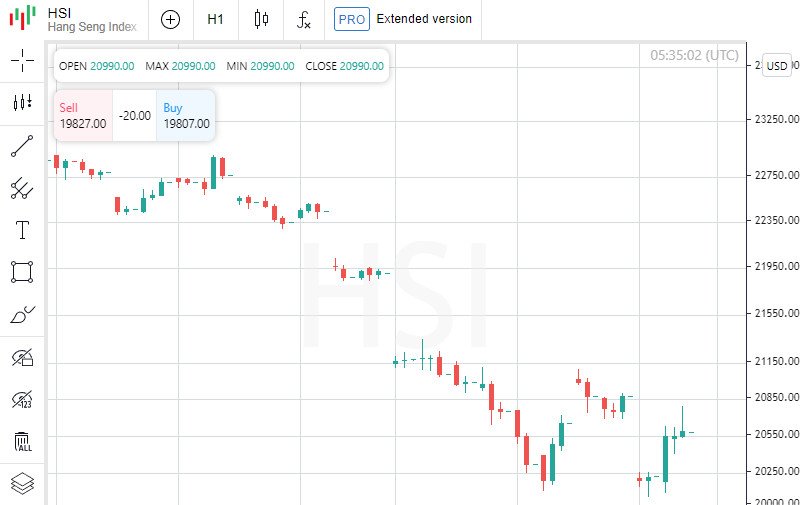

Asia-Pacific stocks are generally down

As of 07:28 GMT+2, the Shanghai Composite Index is down 1.3% to 3266.73 points, the Shenzhen Composite Exchange is down 1.47% to 2141.27 points, the Hong Kong Hang Seng Index is by 3.75%, up to 19783.61 points. The Australian S&P/ASX 200 is up 1.12% to 7142.4 points, while the Japanese Nikkei 225 is up 1.09% to 25429.5 points. South Korean KOSPI is down 0.73% to 2641.85 points.

Asian stock markets are mostly negative on Monday as investors watch the developments around Chinese companies listed in the US. Earlier, the US Securities and Exchange Commission presented a list of five companies that may be delisted.

According to Daily FX analysts quoted by the Wall Street Journal, the quotes of Chinese technology giants listed on US stock exchanges have been falling for the second day in a row due to fears of delisting them.

News are provided by

InstaForex.

-

15-03-2022, 06:40 AM #2905

AUSTRALIA HOUSE PRICES JUMP 4.7% ON QUARTER IN Q4

House prices in Australia were up 4.7 percent on quarter in the fourth quarter of 2021, the Australian Bureau of Statistics said on Tuesday.

That exceeded expectations for a gain of 3.9 percent and was down from the 5.0 percent increase in the third quarter.

On a yearly basis, house prices jumped 23.7 percent, up from 21.7 percent.

The total value of residential dwellings in Australia rose A$512.6 billion to A$9,901.6 billion in Q4, and the mean price of residential dwellings rose A$44,000 to A$920,100.

News are provided by

InstaForex.

-

16-03-2022, 07:02 AM #2906

SOUTH KOREA JOBLESS RATE FALLS IN FEBRUARY

South Korea's unemployment rate declined in February, data from Statistics Korea showed on Wednesday.

The jobless rate fell to a seasonally adjusted 2.7 percent in February from 3.6 percent in January. In the same month last year, the unemployment rate was 3.9 percent.

On an unadjusted basis, the unemployment rate declined to 3.4 percent in February from 4.1 percent in the previous month.

The number of unemployed decreased to 954,000 in February from 1.143 million in the preceding month. Compared to a year ago, the figure decreased by 399,000 persons.

The number of employed persons increased by 1.037 million year-on-year to 27.402 million in February.

News are provided by

InstaForex.

-

17-03-2022, 06:51 AM #2907

SINGAPORE NON-OIL DOMESTIC EXPORTS SINK 2.8% IN FEBRUARY

The value of non-oil domestic exports in Singapore was down a seasonally adjusted 2.8 percent on month in February, Statistics Singapore said on Thursday/

That missed expectations for a decline of 0.3 percent following the 5.0 percent increase in January.

On a yearly basis, non-oil domestic exports climbed 9.5 percent - again missing forecasts for an increase or 15.7 percent and down from 17.6 percent in the previous month.

News are provided by

InstaForex.

-

18-03-2022, 06:13 AM #2908

JAPAN CONSUMER PRICES JUMP 0.9% ON YEAR IN FEBRUARY

Consumer prices in Japan were up 0.9 percent on year in February, the Ministry of Internal Affairs and Communications said on Friday.

That exceeded forecasts for an increase of 0.7 percent and accelerated from 0.5 percent in January.

On a monthly basis, inflation added 0.4 percent following the flat reading in the previous month.

Core CPI, which excludes volatile food prices, rose 0.6 percent on year after gaining 0.2 percent a month earlier.

News are provided by

InstaForex.

-

21-03-2022, 06:17 AM #2909

NEW ZEALAND HAS NZ$385 MILLION TRADE SHORTFALL IN FEBRUARY

Japan posted a seasonally adjusted merchandise trade deficit of NZ$385 million in February, Statistics New Zealand said on Monday. That follows the downwardly revised NZ$1,126 million deficit in January (originally a trade deficit of NZ$1.082 billion).

Exports were worth NZ$5.49 billion last month, up from the downwardly revised NZ$4.8 billion a month earlier (originally NZ$4.86 billion).

Imports were at NZ$5.88 billion, down from the downwardly revised NZ$5.92 billion in the previous month (originally NZ$5.94 billion).

News are provided by

InstaForex.

-

22-03-2022, 01:25 AM #2910

JAPAN LEADING INDEX DATA DUE ON TUESDAY

Japan will on Tuesday release final January figures for its leading and coincident indexes, highlighting a light day for Asia-Pacific economic activity.

In December, the leading index had a score of 104.7, while the coincident was at 92.7.

News are provided by

InstaForex.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote