EUR/USD pair's new target is the level of 1.1500

The American and European currencies are trying to reverse the previous trend in the EUR/USD pair, which mainly showed a downward trend. The new target of this classic pair was the level of 1.1500, which can be achieved with massive strength.

For several days, the EUR/USD pair has been trying to break through the upper border, but the level of 1.1500 was mesmerizing. When the situation develops favorably and there is the confidence that the desired level is about to be reached, luck slips away. The pair returns to the starting point, disappointing the markets.

The situation is repeating itself. The EUR/USD pair is marking time, although there are plenty of chances to increase. Among them, experts include the "hawkish" actions of the ECB and the Fed. The pair's growth is hampered by the euro's confusion, which cannot decide on the direction.

The multi-directional dynamics of the euro are confusing the market. It showed a steady rise on Monday, which was replaced by a gradual decline. The upward trend of the single currency slowed down amid expectations of US inflation data. According to analysts, positive macro-statistical reports will provoke an increase in the US dollar's price. Currently, the bulls are defending the level of 1.1400, not letting the bears to the level of 1.1500. On this wave, the pair retains temporary growth potential. On Tuesday morning, the EUR/USD pair was trading at the level of 1.1423, which is a noticeable decline from the previous day.

There are not too many new reasons for the EUR/USD pair to grow soon. It may remain in the current range, waiting for a favorable moment. On a positive background, the pair can surge to the level of 1.1580, and then adjust again to 1.1400. If such a scenario is implemented, the EUR/USD pair will stabilize in the range of 1.1400 - 1.1600 by the end of February.

Positive reports on annual US inflation will be one of the catalysts for the growth of the US currency and, as a result, the classic pair. According to preliminary estimates, inflation accelerated to 7.3% in January compared to 7% in December. This is the highest level recorded since February 1982.

Information on US inflation is mainly important for the dynamics of the US currency since the Fed's further strategy depends on them. Summing up the results of the January meeting, the regulator drew attention to suitable conditions for an early increase in rates. This is due to the rapid growth of inflation and the strengthening of the labor market in the United States. The majority said that the decision to increase the rate will be made next month.

Currently, the euro looks restless, having difficulty choosing a further direction. The specialists believe that its short-term increase was not only due to changes in the ECB's policy but also due to the US dollar being overbought. The overvaluation of the USD played into the hands of the EUR. According to analysts' calculations, the fair exchange rate of the euro is 1.2200 based on the difference between two-year rates in the US and Germany. The revaluation in favor of the US dollar occurred amid a sharp increase in 2-year US government bonds.

Assessing the prospects of the European currency, experts believe that it will not stop when it reaches the level of 1.2200. Experts pay attention to the "overlap" effect recorded in its dynamics, due to which it can surge over 10 figures. The implementation of such a scenario in 2022 will lead the EUR/USD pair to the level of 1.3000.

Markets are focusing on US inflation and the results of the Fed's January meeting. According to Credit Agricole's analysts, another round of inflation or "hawkish" signals from the Fed is needed to resume the dollar rally in the near future and sharp rise in the EUR/USD pair. The current attempts of the dollar to beat the euro are quite successful, but they lead to distortions in the pair or slow down the dynamics of the EUR/USD pair.

News are provided by

InstaForex.

Please visit our sponsors

Results 2,881 to 2,890 of 3458

Thread: Forex News from InstaForex

-

08-02-2022, 09:33 AM #2881

-

09-02-2022, 06:49 AM #2882

Clash of the Titans: The dollar king goes backstage, shining gold on the main stage. Bull trap or sustainable trend?

The markets are finding it difficult to decide due to the lack of a strong catalyst, the major currency pairs continue to trade within recent levels. The dollar never managed to regain its status as the king of growth, despite strong data on the labor market, the expected record inflation, the hawkish position of the Federal Reserve and the growth in the yield of treasuries. It would seem, well, what else is needed to return to the upward dynamics?

At the end of last week, the dollar index lost 1.8% of its value, now it continues to trade around the 95.60 mark.

Nevertheless, economists and traders do not lose hope for the growth of the dollar, believing that it will still manifest itself. The current decline is just a correction that will be short-lived, market players comment on the situation.

At least the US currency has fundamental reasons for growth. Judging by the rhetoric, the Fed plans to overtake other major world central banks in tightening monetary policy. Moreover, the divergence of the curves reflecting the dynamics of monetary policies will begin to increase over time. This is one of the biggest factors in favor of further strengthening of the dollar, but with a caveat. As a result of these actions, the Fed needs to quickly cope with rising inflation.

There is another scenario. First, the Fed may eventually lag behind in the process of curbing accelerating inflation. Secondly, the central bank may set itself the task of not harming the recovery process of the US economy. The balance between economic growth and the cycle of monetary policy tightening will be disrupted, and the dollar will be under pressure again.

The USD/JPY pair feels quite comfortable now, climbing and staying above the 115.00 mark. The prospects for further short-term increases are supported by the fundamental background. Investors are considering the possibility of a 50bp rate hike in March. The pair's growth was also supported by the fact that there was demand for the dollar and a rally in the yield of treasuries.

Meanwhile, traders are reluctant to make trading decisions ahead of the publication of US inflation data on Thursday, and this affects the dynamics of the USD/JPY pair as well. So far, this is the only factor that can really limit the growth potential of the quote.

Analysts of Societe Generale demonstrate a confident bullish attitude towards USD/JPY, expecting a sharp increase in the quote in the coming weeks. The yield of 10-year Treasury bonds is about to exceed 2%, which means that the pair will quickly approach the 116.00 mark. Then the path to 120.00 will be opened. However, such volatility is likely to be temporary.

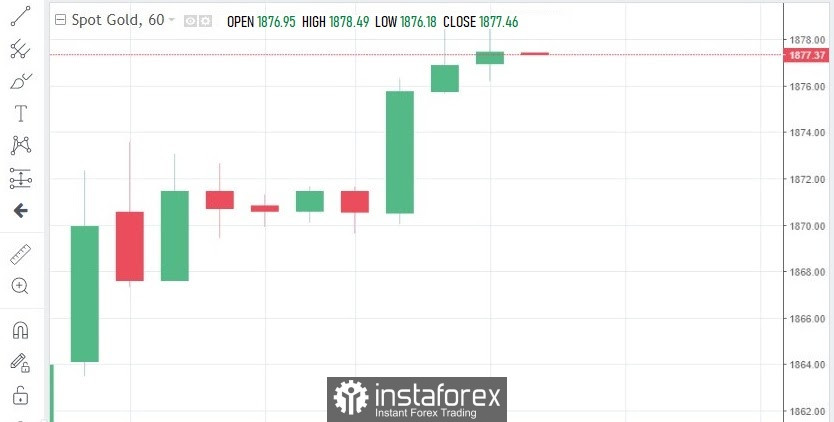

If not the dollar, then what? In which direction is it most profitable for the investor to direct their gaze? Experts advise to take a closer look at gold. Although the precious metal does not bring investment income, it is a popular protective asset, especially in conditions of record inflation.

Yes, gold is sensitive to the tightening of monetary policy, this puts pressure on prices. Much will depend on whether the inflation situation worsens and whether interest rates will rise faster. Here we also need to take into account the technical component. Judging by the charts, gold is not going to fall. At the moment, long positions on the XAU/USD pair look preferable. At the same time, the approach of the Fed's March meeting, at which a rate hike is expected, will increase fluctuations in gold and the dollar.

The crucial area is $1,810 per ounce. Its penetration will send the price to $1825, and then to the area of $1830-$1832. A decisive breakdown of this barrier will be seen as a new trigger for bulls. The XAU/USD pair may accelerate growth towards the January peak of $1853.

A convincing breakdown below the $1810 mark will make gold vulnerable to further sales below $1800 dollars, testing support at $ 1790.

News are provided by

InstaForex.

-

10-02-2022, 10:28 AM #2883

EUR/USD: USD bears will take the lead if the US dollar fails to rise

Many analysts believe that the expected US macro statistics will only slightly change the dynamics of the US dollar. There is growing confidence in the markets that the price of US currency will decline. In such a situation, USD "bears" will benefit.

This week, the US dollar resisted pressure from risk appetite and expectations of the upcoming Fed rate hike. On Wednesday evening, it entered a downward spiral. Its decline against the euro took place amid a reduction in the yield of US government bonds. At present, the 10-year US Treasury yield has fallen to 1.94% (from the previous 1.95%), while remaining at a high level for the last two years.

Currency markets are waiting for new reports on US annual inflation. According to preliminary forecasts, the inflationary spiral in January 2022 unwound to its maximum values (7.3%). It is worth noting that this has not been recorded since February 1982. Experts believe that the confirmation of these data will force the Fed to reconsider the current monetary policy. It is possible that the regulator will speed up the process of raising the key rate.

The current situation turned out to be in the hands of the dollar bears. According to experts, they may take the lead as the markets are not sure about the strengthening of the US dollar. Moreover, strengthening risk sentiment and instability in the Treasury bond market amid falling energy prices hinder the growth of the US dollar. Such a decline is facilitated by "marking time" on the Fed's part, as the market won back the upcoming rate hike. Further action by the Fed will determine US consumer price reports.

The current situation contributes to the slowdown in the dynamics of the EUR/USD pair. The pair is trading in the same range, stagnating while expecting the US macro statistics. On Thursday morning, the EUR/USD pair was near the level of 1.1425.

Analysts said that the EUR/USD pair has hardly moved since the beginning of this week, remaining in a narrow range. At the same time, it corrected below the level of 1.1400, reaching 1.1397, and then returned to 1.1420-1.1425. This was facilitated by the US dollar's weakening, which experts believe will last for some time.

In addition to the Fed's intervention, the dynamics of the EUR/USD pair are influenced by the comments of the European regulator. ECB's "hawkish" statements may send the pair to the range of 1.1460-1.1480.

Many analysts expect the US dollar to further plunge against the euro and other world currencies this year. Specialists believe that the USD is overbought, so its price turned out to be "inflated" at the end of 2021. However, some market participants do not agree with this position and are waiting for the US dollar to grow amid the tightening of the Fed's monetary policy, but a fourfold rate hike is unlikely to strengthen the US currency. The regulator will not increase the number of rate hikes (up to seven times, as previously reported) in 2022, as this will lead to a collapse in the US stock market.

The majority of analysts are betting on the euro's appreciation this year. However, there are pitfalls here. Economists predict the euro to decline by the end of 2022, although it is currently strengthening against the US dollar. An interest rate increase by the ECB does not cancel out the negative scenario for the euro, the further growth of which remains in question. The difference in approaches to the monetary policy of the ECB and the Fed also adds pressure. Experts concluded that the current situation is in favor of the US dollar.

News are provided by

InstaForex.

-

11-02-2022, 09:48 AM #2884

USD soars following inflation data

Many analysts note the strange behavior of the US dollar. After a sharp rise, it has slid into a short-term decline. Yet, the greenback will have to pick up a trajectory soon. '

There are two possible scenarios. It may resume a steady rise and enter a narrow range. At the same time, flat trading is unlikely to undermine the Us dollar's bullish bias. A short-term downward movement will also hardly last long. Currently, the greenback is trading without a clear-cut trend. Before that, it incurred significant losses. Economists assumed that the US currency would climb higher after the publication of US macro statistics.

The US dollar performed a dizzying rise after the release of the Consumer Price Index (CPI) and NFP reports. Annual inflation accelerated to 7.5% from the previous figure of 7%, notching the highest reading in four decades. As for the weekly number of initial jobless claims, the reading decreased by 16,000, amounting to 223,000. Analysts had expected the indicator to drop to 230,000.

So, it is not surprising that the US dollar has soared. However, it ran out of steam quite fast. As a result, it retreated. Some forex strategists believe that the greenback may resume a downward movement. Following the publication of the report, the euro was supposed to assert strength against the US currency, rising to 1.1100. However, it did not happen. Before the release of inflation data, the EUR/USD pair sank by 0.2% to 1.1406. Shortly after, it managed to stabilize. On Friday morning, February 11, the EUR/USD pair was trading in the range of 1.1386-1.1387. It rolled back from the target levels after the publication of inflation data.

Analysts reckon that the euro failed to rally due to the aggressive behavior of large market players who increased their long positions on USD futures. Last week, the volume of long positions de3clined slightly. The price was hovering near two-year highs. The greenback is unable to advance now although it has made attempts to rise.

The US inflation report boosted the growth of the US dollar. At the same time, it triggered a drop in futures on the main stock indices. The Fed is sure to take notice of a new increase in inflation figures when making a monetary policy decision. US Treasury yields increased significantly. The Germany 2 Years / United States 2 Years Government Bond spread grew to 1.87%. This indicator tracks the short-term trend of the EUR/USD pair.

Apparently, it is getting really difficult for the central bank to curb soaring inflation. It was expected to slow down. However, those predictions turned out to be incorrect. So, the Fed is likely to resort to additional tools to cap inflation. The regulator plans to hike the key rate in March. According to Bank of America (BofA) analysts, the Federal Reserve may raise the interest rate 7 times this year thanks to steady wage growth. BofA also expects 4 rate hikes by 0.25% in 2023.

The revised inflation report could also facilitate the US's dollar rally. It is likely to gain momentum provided that inflation figures are high. It may also enable the Fed to raise the key rate immediately by 50 percentage points (pp). The current situation requires the regulator to take decisive action on monetary policy.

News are provided by

InstaForex.

-

14-02-2022, 09:00 AM #2885

If there is war tomorrow? Fear of an attack on Ukraine drove up the price of gold

Every day the Russian-Ukrainian conflict flares up with greater force.

On Friday, the White House statement added fuel to the fire that Moscow could attack Ukraine any day On the evening of February 11, American officials recommended that US citizens urgently leave the territory of Ukraine. According to the West, there is now a high probability of Russia's invasion of the Black Sea Republic at any moment.

The alarming comment immediately raised the quotes of protective assets, including gold. Late on Friday evening, precious metal prices soared sharply, ramming through the key resistance at $1,850.

Bullion also met the new working week with steady growth. At the time of preparation of the material, gold futures were trading at $1,859. They rose 0.9% compared to Friday's close, when they rose 0.26%.

In general, over the past week, the value of the precious metal has risen by 1.9%. Expectations of January inflation data in the United States contributed to the positive dynamics.

As for the beginning of the current seven-day period, the main price-forming factor in the gold market remains geopolitical risks.

On Sunday, the United States said that Russia could create an unexpected pretext for invading Ukraine. In turn, the Kremlin denied this possibility and accused the American side of hysteria.

Nevertheless, another escalation of the conflict led to strong volatility on the Asian stock market on Monday morning. The drop in demand for risky assets caused an increase in appetite for gold.

At the beginning of the day, the yellow asset approached the highest value for three months. Analyst Philip Nova believes that its further dynamics depends on two upcoming meetings.

Today, German Chancellor Olaf Scholz will discuss the situation with Ukrainian President Vladimir Zelensky, and his talks with Russian President Vladimir Putin are scheduled for tomorrow.

If, following the results of the meetings, the German politician does not signal a reduction in tension, this will serve as another impetus for the growth of prices for precious metals. According to the expert, in the near future, the quotes may jump to $1,900.

News are provided by

InstaForex.

-

15-02-2022, 10:13 AM #2886

Protected Gold protects. Investors are greedily buying gold in search of protection from geopolitical risks

Gold rose sharply in price on Monday. This was facilitated by increased geopolitical tensions. The whole world is watching how the protracted conflict between Russia and Ukraine will be resolved.

Last week, some Western media reported insider information that Moscow could launch an attack on February 16.

In response, yesterday the President of Ukraine Volodymyr Zelensky declared this date a day of unity. He called on Ukrainians to hang the country's flags on buildings on Wednesday and sing the national anthem together.

Many interpreted his statement as a bold hint. It seems that the head of Ukraine has been officially informed that February 16 will be the day of the invasion.

Also on Monday, a comment by British Prime Minister Boris Johnson added fuel to the fire. He called the situation in Ukraine "very, very dangerous."

All these factors led to panic and a major sell-off on the world stock markets. Yesterday, the shares of many companies fell sharply.

Now investors are moving away from risky instruments to protective assets. One of the best shelters is considered to be gold.

At the beginning of the new working week, bullion showed impressive dynamics. During the day, they rose by 1.5% (for comparison: over the past seven days, the quotes rose by 1.9%).

In monetary terms, the difference from the previous close was more than $27. Gold finished trading on Monday at the highest mark in three months at $1,869.40, and $1,872.80 became the daily high.

Analyst David Russell believes that a close above $1,870 will stimulate gold bulls to reach a new goal faster. The next psychologically important mark for a yellow asset is $1,900.

The expert warns that in the near future, the movement of quotes will strongly depend on the news background. Even a slight heating up of the conflict and the growing uncertainty around the situation in Ukraine will contribute to an increase in prices for the precious metal.

At the same time, any sign of a thaw in relations between Russia and the West could trigger a fall in the yellow asset.

Yesterday, by the way, UN Secretary-General Antonio Guterres called on world leaders to step up diplomacy in order to calm the situation as soon as possible. He said he was deeply concerned about the "growing speculation" regarding the military conflict.

Another negative factor for gold now is the hawkish rate of the US Federal Reserve. On Monday, the central bank held an unscheduled meeting at which officials continued to argue about how aggressively to approach an interest rate hike in March.

The president of the Federal Reserve Bank of St. Louis, James Bullard, who is entitled to vote at FOMC meetings this year, advocates speeding up the process. He intends to convince his colleagues to raise rates by 100 bps by the beginning of July.

Meanwhile, Commerzbank analysts consider this unrealistic. In their opinion, further escalation of the Russian-Ukrainian conflict will keep the Fed from raising interest rates by 50 bps in March, as this may cause excessive turmoil in financial markets.

News are provided by

InstaForex.

-

16-02-2022, 09:53 AM #2887

Wall Street trades draw US SEC attention

On Monday, the Wall Street Journal reported that the US Securities and Exchange Commission (SEC) is conducting an investigation into Morgan Stanley and Goldman Sachs launched by the US Department of Justice. The main issue is whether financial executives might have warned hedge funds about large stock sales ("block trades"), which violates the regulations.

The participants of the investigation give no comments.

Broker-dealers tend to act on behalf of clients or using a hedging strategy (a method of insuring assets against negative market trends). They buy and sell large blocks of shares, and this can affect the company's stock prices. This process is especially active during periods of volatility, when portfolios are being rebalanced.

If such valuable information is obtained in advance, it may have a great impact on the market. Companies should adjust processes preventing the misuse of nonpublic information. Otherwise, it could violate U.S. laws.

As the WSJ reports, the SEC has sent subpoenas to some hedge funds and banks requesting information about investors' interaction with bankers. It is also mentioned that investigations into block trades irregularities began in 2019.

It is being investigated if bankers revealed non-public information to some privileged clients. If such incidents become known, they will find out how this information may have affected some funds that are " liquidity providers" for Wall Street companies.

News are provided by InstaForex

-

17-02-2022, 09:47 AM #2888

Three main factors for USD growth: geopolitics, risk appetite, and macro statistics

The US dollar's steady growth, observed from time to time, is due to the interaction of three main factors – a decrease in risk appetite, inspiring US macro statistics, and the easing of geopolitical conflict. At the moment, the key "pillar" supporting the US dollar is American statistics.

Today, the US currency found it difficult to choose a direction, as markets assessed several factors affecting it. Its growth was facilitated by positive macroeconomic statistics from the US, which turned out to be better than forecasts. In particular, US retail sales soared 3.8% m/m in January 2022 against an expected rise of 2.1%. At the same time, the volume of industrial production in the country increased by 1.4%, while a growth rate of 0.4% was forecasted. Both indicators indicate favorable conditions for further tightening of the Fed's monetary policy.

The decline in risk appetite is also another factor stimulating the growth of the US dollar. In such a situation, investors go to protective assets, primarily gold and the US dollar. However, risk appetite has returned amid certainty over the Fed's new minutes, which is less hawkish than expected. This situation provoked the USD's temporary decline. At the same time, retail sales and the strengthening of the US labor market can improve global risk appetite.

Moreover, some weakening of the US dollar was facilitated by geopolitical tensions, namely, the alleged ceased of the military conflict around Ukraine. This provoked significant price dynamics for key trading instruments. As a result, the US currency turned to the downside. It was followed by gold and oil.

On Thursday morning, the EUR/USD pair was near the level of 1.1354. It is worth noting that the euro rose to the level of 1.1363 against the US dollar yesterday and managed to consolidate at this level a little later.

The growing inflation continues to put pressure on the US dollar. The current situation requires the Fed to take decisive action – to raise rates as soon as possible. The regulator cannot afford dovish rhetoric, otherwise, it will provoke serious economic shifts. ECB also made "hawkish" statements, which allows the key rate to be raised by the end of the year.

The US dollar is supported by the growth of retail sales in the country. The strong indicator neutralizes concerns about a possible recession in the American economy. Earlier, investors were worried that the upcoming Fed rate hike would negatively affect the US economy. It should be noted that the high probability of a recession poses a threat to further USD growth. However, experts believe that there are now no reasons to implement an unfavorable scenario.

News are provided by

InstaForex.

-

18-02-2022, 09:26 AM #2889

Is the pound's growth temporary?

Many analysts are asking questions: how long will the pound's growth last? Or will it decline soon? Specialists are worried about sharp changes in the dynamics of the British currency, which can undermine its position.

The pound was growing steadily this week, impressing the markets. It is rising due to impressive UK macro statistics and expectations of positive changes in the interest rate. Experts assume that the Bank of England will raise the key rate following its leading counterparts, such as the Fed and the ECB.

A strong impulse for the pound's growth was the sudden acceleration of annual inflation in the UK. According to the reports of the Bureau for National Statistics, British inflation reached 5.5% last month, from the previous 5.4%. In the first month of 2022, consumer prices in the country fell by 0.1% after rising by 0.5% in December. Economists said that UK's inflation reached a 30-year high, slightly behind another world record – US inflation, which spiraled to a 40-year increase.

A significant increase in UK consumer prices contributed to the strengthening of the national currency. Against this background, expectations of an early rate hike by the Bank of England have increased. The overall positive mood contributed to the rise of the pound, although experts fear that the upward trend will end soon.

The current situation helped the GBP/USD pair to rise. The pound took the opportunity and tried to consolidate its gained positions. According to UOB currency strategists, the pair needs to break through the resistance of 1.3645 for further growth. The probability of the pound rising above the level of 1.3645 is still insignificant, but the chances will increase if the pound does not go beyond the level of 1.3520 in the coming days. The UOB notes that the next resistance level for the GBP/USD pair is set around 1.3680.

Analysts' comments are right – the pound is far from the indicated level of 1.3645. On Friday morning, the GBP/USD pair was trading at 1.3610, trying to rise higher, but with mixed success. A day earlier, the pound increased by 0.25%, reporting to the level of 1.3616. Analysts say the pair will remain in the wide range of 1.3550-1.3650 in the near term, in which it is located after a significant deviation from the "bearish" trend in December 2021.

The future economic prospects of the UK are as vague as the weather in the country, especially given the possible fiscal increase. The pound will remain in a fighting mood in the coming weeks, as market participants are confident in the upcoming tightening of the monetary policy by the Bank of England. It can be recalled that the regulator has raised interest rates twice since December 2021 (to 0.5% from the previous 0.1%). Now, the markets expect a further rise in the key rate in March up to 0.75% or immediately up to 1%.

Many analysts consider the pound undervalued by 10% relative to the US dollar. According to experts, this situation developed after the Brexit referendum in 2016 and continues to this day. Experts believe that this undervaluation hinders economic growth in the country. At the same time, the short-term prospects for the pound are quite optimistic and set investors in a positive mood.

News are provided by

InstaForex.

-

21-02-2022, 09:35 AM #2890

Dollar: a new rival and a "feedback loop"

Experts positively assess the potential of the US currency. At the same time, the relative lull in the dynamics of USD worries the markets. Growing concerns are reinforced by geopolitical instability and the expectation of an early rise in the Fed's interest rate.

The escalation of the geopolitical situation at the end of last week put significant pressure on the greenback and the EUR/USD pair, which collapsed from a high near 1.1375 to 1.1320, but then recovered. Currently, the pair runs in a wide range of 1.1300-1.1400, which will remain in the near future.

The new week began for the dollar with a slight decline against the euro. The reason is a small respite in the difficult geopolitical situation around Ukraine. On the morning of Monday, February 21, the EUR/USD pair was trading at 1.1363. The European currency strengthened its position against the US one, taking advantage of the pause in the geopolitical confrontation.

Many analysts are set to increase the price of the greenback, despite the tense external background. After a month-long reduction in positions for USD growth, investors and traders set a course to increase them. Over the past week, large investment funds have raised long positions on the greenback by 5%. The continuation of this trend contributes to the further growth of the US currency.

However, in the medium and long term prospects for the USD, not everything is as rosy as it seems at first glance. The dollar has a serious rival, experts warn. This is not the euro, but the British currency, which can compete with the US one.

Optimism about the pound is promoted by its slow but steady growth compared to the volatility of the greenback and the euro. Against the background of the upcoming tightening of the PREP by the leading central banks, the Federal Reserve and the European Central Bank, the Bank of England found itself in a more advantageous situation. The British central bank took care of the normalization of monetary policy in advance, increasing the interest rate twice: the first time - from 0.125% to 0.25%, and two weeks ago - from 0.25% to 0.5%. According to analysts, this has not happened since 2004.

Experts believe that against the background of galloping inflation in the United Kingdom, the central bank will increase the rate again. To this decision, the Bank of England is pushing another round of inflation (up to 5.5%), which has not been recorded since 1992. As a result, the pound, with the monetary support of the central bank, can compete with the dollar.

Experts consider the upcoming increase in the Fed's interest rate to be another factor of pressure on the greenback. Many analysts are arguing about the tightening of the PREP by the Federal Reserve, weighing the pros and cons for the dollar. At the same time, analysts find it difficult to give an unambiguous assessment of what is happening. They are afraid of the so-called "feedback loop" that keeps inflation at a high level. According to JPMorgan experts, a similar "loop" in the economy is formed between strong growth, price pressure and household actions. The effect of the "feedback loop" generates a colossal financial burden, characteristic of off-scale inflation. Currently, a similar situation is observed.

Against this background, the Fed is able to raise the interest rate nine times, according to JPMorgan. Currency strategists consider this a necessary measure to curb inflation in the US: "This year, the Fed will raise the rate by 25 basis points at each of the nine meetings." It is expected that such steps will support the greenback, which will retain its status as a global protective asset. The power of the US currency allows it to stay afloat and strengthen its position in times of crisis.

News are provided by

InstaForex.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote