The selection of existing brokers must be able to be considered carefully, this is done so that traders can become more leverage in surviving and can become traders of the month with Tickmill.

Please visit our sponsors

Results 2,991 to 3,000 of 3458

Thread: Forex News from InstaForex

-

08-08-2022, 04:26 AM #2991

-

08-08-2022, 09:26 AM #2992

EUR/USD: dollar maintains momentum, euro difficult to recover

The US currency started the week quite cheerfully, trying to maintain the positive momentum received after the release of the Nonfarm Payrolls data. At the same time, the euro cannot boast of similar dynamics, demonstrating pendulum dynamics.

The euro is once again teetering on the brink of falling, while trying to settle in the positions it has won. However, these actions are not always successful as the USD continues to dominate the market. At the same time, according to reports on the dollar index (USDX), investors are showing bearish sentiment against the US currency. Over the past two weeks, market participants have reduced their positions on USD growth after a long build-up. A continuation of the current trend can lead to a short-term drawdown of the greenback.

Currently, the greenback is trying to gain a foothold in the upward trend, and not without success. Its rise was catalyzed by impressive US employment data. Against this backdrop, markets expect more decisive action from the Federal Reserve in terms of tightening monetary policy. Recall that, according to reports, 528,000 jobs appeared last month in the US economy, and the unemployment rate fell to 3.5%.

According to economists, positive data on US employment revived the hopes of traders and investors about a significant increase in the key rate (by 75 bps) at the Fed's September meeting. Note that strong data on employment growth in America came as a surprise to the markets. Most experts expected opposite results, referring to recent studies on the onset of a recession in the US economy and to a slowdown in economic growth in the country.

For the time being, however, fortune favors the greenback. After the release of Nonfarm Payrolls, the dollar confidently overtook the euro. The EUR/USD was trading near 1.0186 on Monday morning, August 8, trying to return to last week's highs near 1.0200.

Note that after the release of the US employment report, the EUR/USD pair plunged sharply to the critical 1.0170, but later managed to recover. Against this background, some experts are optimistic about the immediate prospects for the euro. According to preliminary calculations, in the coming months, the euro may be in an upward trend, despite the threat of a recession in the European economy. The reason is the increased risk appetite in global markets. Against this background, experts believe that the fair rate of the EUR/USD pair is close to 1.1400. Analysts' conclusions are based on the difference in rates in the US and Germany. At the same time, experts do not exclude another fall of the euro to parity with the dollar.

This week, investors are focusing on US inflation data. The release of the July consumer price index is scheduled (the preliminary forecast provides for an increase of 0.2% in monthly terms) on Wednesday, August 10. The markets will get acquainted with the US producer price index on Thursday, August 11. This indicator is crucial for the further dynamics of the interest rate. Recall that the positive report on employment in the US opened the way for the Fed to aggressively tighten monetary policy.

According to experts, having received confirmation of the strengthening of the US economy, investors will return to long positions on the dollar. This will give an additional impetus to the latter and set up traders for an extreme tightening of monetary policy by the Fed.

News are provided by

InstaForex.

Read More

-

09-08-2022, 06:54 AM #2993

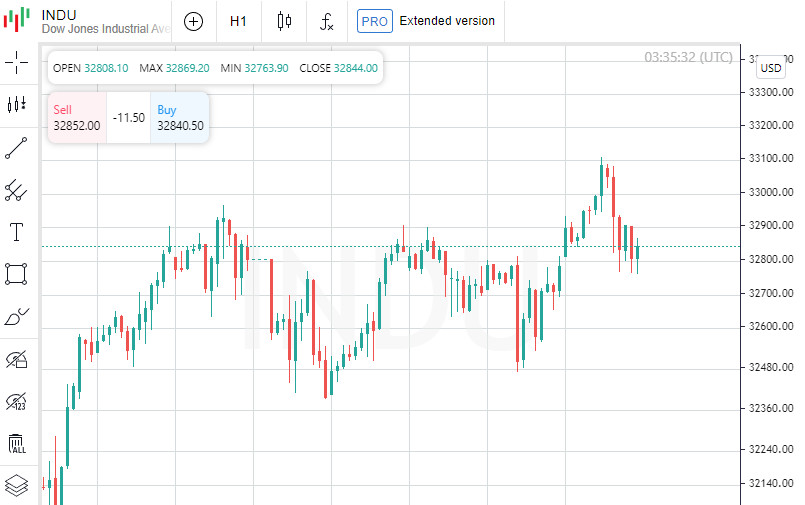

US stock market closed mixed, Dow Jones up 0.09%

At the close of the New York Stock Exchange, the Dow Jones rose 0.09%, the S&P 500 fell 0.12%, and the NASDAQ Composite fell 0.10%.

The leading performer among the components of the Dow Jones index today was Walt Disney Company, which gained 2.48 points or 2.33% to close at 109.11. Quotes Dow Inc rose by 0.66 points (1.28%), ending trading at 52.15. Walgreens Boots Alliance Inc rose 0.49 points or 1.26% to close at 39.48.

The biggest losers were JPMorgan Chase & Co, which shed 1.41 points or 1.22% to end the session at 114.35. Visa Inc Class A was up 2.55 points (1.18%) to close at 213.32, while McDonald's Corporation was down 2.43 points (0.94%) to close at 256. .80.

Leading gainers among the S&P 500 index components in today's trading were Penn National Gaming Inc, which rose 5.56% to hit 36.05, Gap Inc, which gained 5.44% to close at 10.27, and also shares of General Motors Company, which rose 4.16% to close the session at 37.56.

The biggest losers were Tyson Foods Inc, which shed 8.40% to close at 80.10. Shares of NVIDIA Corporation lost 6.30% and ended the session at 177.93. Enphase Energy Inc lost 4.38% to 287.74.

Leading gainers among the components of the NASDAQ Composite in today's trading were Helbiz Inc, which rose 114.64% to 1.61, TOP Financial Group Ltd, which gained 102.66% to close at 20.57, and also shares of Karuna Therapeutics Inc, which rose 71.84% to end the session at 241.19.

Shares of Reata Pharmaceuticals Inc became the leaders of the decline, which decreased in price by 32.61%, closing at 24.06. Shares of Uniqure NV lost 27.02% to end the session at 18.64. Quotes of Nuzee Inc decreased in price by 24.32% to 0.84.

On the New York Stock Exchange, the number of securities that rose in price (2119) exceeded the number of those that closed in the red (1018), while quotes of 123 shares remained virtually unchanged. On the NASDAQ stock exchange, 2399 companies rose in price, 1436 fell, and 229 remained at the level of the previous close.

The CBOE Volatility Index, which is based on S&P 500 options trading, rose 0.66% to 21.29.

Gold futures for December delivery added 0.79%, or 14.15, to $1.00 a troy ounce. In other commodities, WTI September futures rose 1.51%, or 1.34, to $90.35 a barrel. Brent oil futures for October delivery rose 1.37%, or 1.30, to $96.22 a barrel.

Meanwhile, in the Forex market, the EUR/USD pair remained unchanged at 0.13% to 1.02, while USD/JPY advanced 0.05% to hit 135.04.

Futures on the USD index fell 0.20% to 106.28.

News are provided by

InstaForex.

Read More

-

10-08-2022, 11:02 AM #2994

Tailwind: the pound seeks to sail away from the political and economic turmoil

The British currency remains relatively calm this week, expecting, along with the US, a report on the consumer price index in America. An additional factor of pressure for the pound was the thunderclouds on the political horizon of the UK, due to the election of the prime minister.

Markets are focused on the election race in the UK, the favorite of which is Liz Truss, the foreign secretary. She claims the place of Boris Johnson, who was forced by the Conservative Party to resign as prime minister and its leader. The important points of the election program of Truss were the rejection of family benefits and tax cuts for citizens. In addition, the Minister of Foreign Affairs proposed to limit the influence of the Bank of England on the country's economy.

Many analysts assess the current political situation in the UK as a crisis, which is exacerbated by economic turmoil. Recall that last week, the BoE raised interest rates by 50%, but this had little effect on inflation in the country. It should be noted that the central bank began the fight against inflation in December 2021 and since then has systematically raised rates at each of the subsequent six meetings. As a result, by the beginning of the summer, inflation in the UK amounted to 9.4%. According to the BoE's forecasts, it will peak in October, soaring to 13.3%. Against this background, by the end of 2022, the UK economy will enter a recession that will last five quarters.

However, many experts disagree with this view. Currency strategists at Oxford Economics assess the risks of a recession as small, despite the current instability. According to economists, in 2023 the key rate cut by the BoE is more likely. At the same time, the central bank's actions aimed at reducing rates are slowing down economic activity in the UK. Against this backdrop, the GBP is under tremendous pressure, risking to collapse, currency strategists at Societe Generale believe.

At the end of July, the British currency showed growth, waiting for the Federal Reserve to abandon the overly aggressive tightening of the monetary policy. However, this did not happen. On the contrary, the US central bank is quite resolute, and it is supported by the hawkish mood of US officials. Against this background, the pound's recovery was interrupted, releasing the latter into free swimming on the waves of the financial market. The pound has slipped 10% against the dollar since the beginning of this year, placing it in the top three worst currencies among the G-10. The reason is the low pace of rate hikes by the BoE compared to the Fed's anticipatory actions.

According to analysts at Societe Generale, in the near future, the pound will fall to its lowest level since the collapse at the beginning of the COVID-19 pandemic. Additional pressure on the pound is created by the BoE's recent announcement about a possible recession and growing expectations of another rise in interest rates in the US (by 75 bps). In such a situation, the pound may sink to 1.2000 and below. If the bearish trend for the pound continues, the GBP/USD pair will fall to 1.1400-1.2000, according to Societe Generale.

The pair was close to 1.2100 on Tuesday, August 9 and even peaked at 1.2130, but failed to consolidate on these positions. The GBP/USD pair was trading in the range of 1.2069-1.2070 on Wednesday morning, August 10. At the same time, the greenback showed mixed dynamics, as market participants expect July reports on the US consumer price index.

According to updated forecasts for the British currency, in the short term it will maintain support against the US. However, the high likelihood of interest rate cuts by the BoE in 2023 is putting downward pressure on the pound. At the same time, according to analysts at Oxford Economics, in the near future the central bank will raise interest rates amid galloping inflation, thereby contributing to the pound's growth. However, in the long term, the BoE may revise the current monetary strategy, according to Oxford Economics.

UK GDP data for the second quarter of 2022 will be released this Friday, August 12. According to preliminary estimates, this indicator is expected to slow down to 2.8% in annual terms. Against this background, pessimism dominates the markets. In addition, on a quarterly basis, GDP is projected at -0.2%. Earlier, an increase of 0.8% was recorded in the first quarter of 2022. If the current GDP turns out to be weaker than expected, then the pound's decline is inevitable.

The pound may be supported by the dollar's retreat across the entire spectrum of the market. In such a situation, the pound is able to stay afloat. According to preliminary forecasts, in the third quarter of 2022, the GBP/USD pair will remain close to 1.2000 and may reach 1.2200, and by the first quarter of 2023 it will rise to 1.2300.

News are provided by

InstaForex.

Read More

-

11-08-2022, 03:37 AM #2995

the funds and risks that exist must indeed be able to be considered properly, this is done so that traders can be more leverage in getting maximum trading security and comfort like what I got from Tickmill.

-

11-08-2022, 07:17 AM #2996

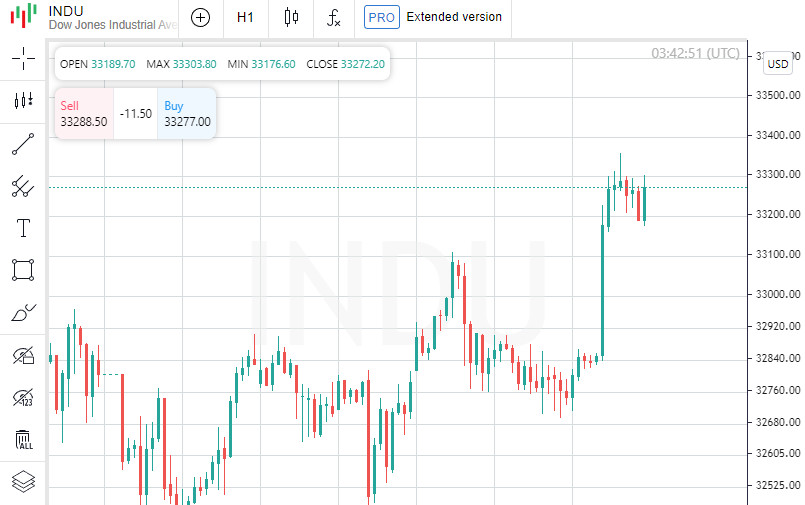

US stock market closes higher, Dow Jones gains 1.63%

At the close of the New York Stock Exchange, the Dow Jones rose 1.63% to a 3-month high, the S&P 500 rose 2.13% and the NASDAQ Composite rose 2.89%.

The leading performer among the components of the Dow Jones index today was Walt Disney Company, which gained 4.30 points or 3.98% to close at 112.43. Salesforce.com Inc rose 6.37 points or 3.50% to close at 188.61. Goldman Sachs Group Inc rose 11.29 points or 3.35% to close at 347.91.

The losers were Merck & Company Inc, which shed 0.33 points (0.37%) to end the session at 89.19. UnitedHealth Group Incorporated was down 0.46 points (0.09%) to close at 537.72, while Walmart Inc was up 0.27 points (0.21%) to close at 129. fourteen.

Among the gainers among the components of the S&P 500 in today's trading were Norwegian Cruise Line Holdings Ltd, which rose 11.82% to 13.53, Royal Caribbean Cruises Ltd, which gained 9.74% to close at 41. 67, as well as shares of Carnival Corporation, which rose 9.19% to end the session at 10.34.

The biggest losers were CME Group Inc, which shed 2.24% to close at 198.40. Shares of Dollar Tree Inc shed 1.76% to end the session at 165.97. Quotes Ralph Lauren Corp Class A fell in price by 1.29% to 95.52.

Leading gainers among the components of the NASDAQ Composite in today's trading were Bioatla Inc, which rose 83.10% to hit 6.61, Amyris Inc, which gained 41.92% to close at 3.25, and Infinity Pharmaceuticals Inc, which rose 39.19% to end the session at 1.03.

The biggest losers were Redbox Entertainment Inc, which shed 52.86% to close at 1.65. Shares of OPTIMIZERx Corp lost 30.02% and ended the session at 15.57. Quotes of IsoPlexis Corp fell in price by 30.00% to 2.10.

On the New York Stock Exchange, the number of securities that rose in price (2685) exceeded the number of those that closed in the red (468), while quotations of 102 shares remained practically unchanged. On the NASDAQ stock exchange, 2934 stocks rose in price, 819 fell, and 241 remained at the level of the previous close.

The CBOE Volatility Index, which is based on S&P 500 options trading, fell 9.32% to 19.74, hitting a new 3-month low.

Gold futures for December delivery lost 0.28%, or 5.15, to hit $1.00 a troy ounce. In other commodities, WTI crude for September delivery rose 1.14%, or 1.03, to $91.53 a barrel. Brent oil futures for October delivery rose 0.74%, or 0.71, to $97.02 a barrel.

Meanwhile, on the Forex market, EUR/USD rose 0.88% to hit 1.03, while USD/JPY shed 1.63% to hit 132.93.

Futures on the USD index fell 1.09% to 105.10.

News are provided by

InstaForex.

Read More

-

12-08-2022, 09:54 AM #2997

The music did not play for long, the yen danced for a short time

The dollar is getting up from its knees after a crushing fall on Wednesday. The yen is currently feeling the greatest pressure from the greenback, which showed the strongest growth on the US inflation data the day before.

The market freaked out

By the end of the week, investors continue to digest the July statistics on US inflation. Recall that the data turned out to be cooler than forecasts, which caused a large-scale sell-off of the dollar.

Last month, annual inflation in the US fell from the previous value of 9.1% to 8.5%, although economists had expected the CPI to fall to 8.7%.

A significant easing of inflationary pressures has increased fears that the Federal Reserve may reduce the degree of its aggressiveness with respect to interest rates already at the September meeting.

The reaction of the market was lightning-fast and very emotional: the yield of US government bonds fell sharply, followed by a plunge in the dollar. The DXY index sank 1.5% to a low of 104.646 on Wednesday.

The dollar's weakness provided support to all major currencies, but the yen gained the most in this situation. The yen soared by more than 1.6% against its US counterpart, to a mark of 135.

The dollar is gaining momentum

After a loud fall on Wednesday, the yield of 10-year US government bonds turned towards growth yesterday. It rose by 3.41% during the day and reached a new high of 2.902%.

The sharp increase in the indicator again widened the gap between the yields of US treasury bonds and their Japanese counterparts.

The yen, which is very sensitive to this difference, could not resist the pressure and moved to decline.

The USD/JPY pair managed to recover by 0.12% to 133.19 on Thursday. It was also supported by the general strengthening of the dollar.

The greenback grew by 0.1% against its main competitors. Its index remained almost unchanged and stayed at 105.2 during the day.

Yesterday's comments by Federal Reserve members contributed to the reversal of the yield of US government bonds and the dollar. Despite the slowdown in inflation in July, the tone of officials still remains hawkish.

Neil Kashkari, president of the Federal Reserve Bank of Minneapolis, said that the latest CPI data did not change his expectations about the Fed's future course.

In addition, he stressed that the central bank is still very far from declaring victory over inflation.

The head of the San Francisco Federal Reserve, Mary Daly, was in solidarity with her colleague. She also does not rule out the continuation of the Fed's hawkish policy, unless, of course, the next portions of macro data will favor such a sharp increase.

Recall that the key Fed's goal is to bring interest rates from the current level of 2.25–2.5% to 4% by the end of the year.

Some analysts believe that the central bank will try to solve this problem as soon as possible, and predict another rate increase of 75 bps at a meeting in September.

Why does the yen have no chance?

This year the dollar index rose by 10%. The greenback received such a solid increase thanks to the aggressive policy of the Fed.

Since March, the US central bank has raised interest rates by 225 bps. This makes it the undisputed leader: none of the major central banks can compete with the Fed in the pace of tightening.

But the biggest divergence in monetary policy right now is between the US and Japan. Despite the global increase in rates, the Bank of Japan is still bending its line and continues to keep the rate at a low level.

The priority for the Japanese central bank is not to fight inflation, but to restore the economy, which has been hit hard by the COVID-19 pandemic.

Unlike the US and EU, which have already managed to get out of the crisis caused by the coronavirus, the Japanese economy is just beginning to show signs of recovery.

According to preliminary estimates, in the second quarter, Japan's annual GDP could show growth of 2.7%, which is in line with pre-pandemic indicators.

Statistics on the gross domestic product will be published on Monday. But even if the data turns out to be positive, it most likely will not affect the policies of BOJ Governor Haruhiko Kuroda in any way.

Many experts are inclined to believe that the head of the BOJ will not give up his commitment to a super-soft monetary rate. The main argument in its favor now will be the low wages remaining in the country.

At this stage, salaries in Japan are far behind the rate of inflation, which undermines the purchasing power of citizens.

Another big reason to keep rates low is the coronavirus statistics. Japan is at the epicenter of a new COVID-19 outbreak, posing a major threat to the world's third largest economy.

According to economists at the Japan Research Institute, the BOJ's position can be changed to hawkish only after Kuroda leaves his post.

Given that he is due to retire no earlier than April 2023, one can estimate how long the downward trend promises to be for the yen.

Analysts at the Finnish bank Nordea predict that the USD/JPY pair will continue to strengthen on the tight policy of the Fed and reach the level of 140 in the foreseeable future.

News are provided by

InstaForex.

Read More

-

15-08-2022, 04:56 AM #2998Senior Investor

- Join Date

- Jul 2011

- Location

- www.ArmadaMarkets.com

- Posts

- 4,135

- Feedback Score

- 0

- Thanks

- 0

- Thanked 2 Times in 2 Posts

Existing analytical skills must be able to be considered properly, this is done so that traders can become more leverage in surviving and can become traders of the month together with Tickmill.

-

15-08-2022, 07:49 AM #2999

Forex Analysis & Reviews: US stocks closed higher, Dow Jones up 1.27%

At the close of the New York Stock Exchange, the Dow Jones rose 1.27% to a 3-month high, the S&P 500 rose 1.73% and the NASDAQ Composite rose 2.09%.

The leading performer among the components of the Dow Jones index today was Walt Disney Company, which gained 3.88 points or 3.30% to close at 121.57. Merck & Company Inc rose 2.09 points or 2.35% to close at 91.02. Apple Inc rose 2.15% or 3.63 points to close at 172.12.

The biggest losers were Johnson & Johnson, which shed 1.84 points or 1.10% to end the session at 165.30. Amgen Inc was down 0.04 points (0.02%) to close at 248.39, while Visa Inc Class A was up 0.25 points (0.12%) to close at 211. .33.

Leading gainers among the S&P 500 index components in today's trading were Broadridge Financial Solutions Inc, which rose 7.93% to hit 183.19, Albemarle Corp, which gained 5.98% to close at 281.60, and also shares of Penn National Gaming Inc, which rose 5.90% to close the session at 37.70.

The biggest losers were Illumina Inc, which shed 8.40% to close at 208.32. Shares of PerkinElmer Inc lost 1.89% to end the session at 157.91. Quotes of Organon & Co decreased in price by 1.34% to 30.99.

Leading gainers among the components of the NASDAQ Composite in today's trading were Embark Technology Inc, which rose 84.80% to hit 1.07, Twin Vee Powercats Co, which gained 77.50% to close at 7.10. as well as AN2 Therapeutics Inc, which rose 64.66% to close the session at 19.38.

The drop leaders were Performance Shipping Inc, which shed 44.88% to close at 0.34. Shares of PLx Pharma Inc shed 36.68% to end the session at 1.64. Quotes of Imac Holdings Inc decreased in price by 33.36% to 0.63.

On the New York Stock Exchange, the number of securities that rose in price (2517) exceeded the number of those that closed in the red (588), while quotes of 123 shares remained virtually unchanged. On the NASDAQ stock exchange, 2,762 companies rose in price, 988 fell, and 200 remained at the level of the previous close.

The CBOE Volatility Index, which is based on S&P 500 options trading, fell 3.32% to 19.53, hitting a new 3-month low.

The consumer sentiment index of the University of Michigan, which reflects the degree of household confidence in the US economy, according to preliminary estimates, rose to 55.1 points in August from 51.5 points in July, with an expected increase to 52.5 points.

Gold futures for December delivery added 0.53%, or 9.55, to hit $1.00 a troy ounce. In other commodities, WTI crude for September delivery fell 2.63%, or 2.48, to $91.86 a barrel. Brent oil futures for October delivery fell 1.69%, or 1.68, to $97.92 a barrel.

Meanwhile, on the Forex market, EUR/USD fell 0.57% to 1.03, while USD/JPY edged up 0.39% to hit 133.52.

Futures on the USD index rose 0.54% to 105.56.

News are provided by

InstaForex.

Read More

-

16-08-2022, 03:50 AM #3000

Existing analytical skills must indeed be able to be considered properly, this is done so that traders can become more leverage in getting the security and comfort of trading with Tickmill.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote