Forecast for USD/JPY on June 26, 2023

USD/JPY:

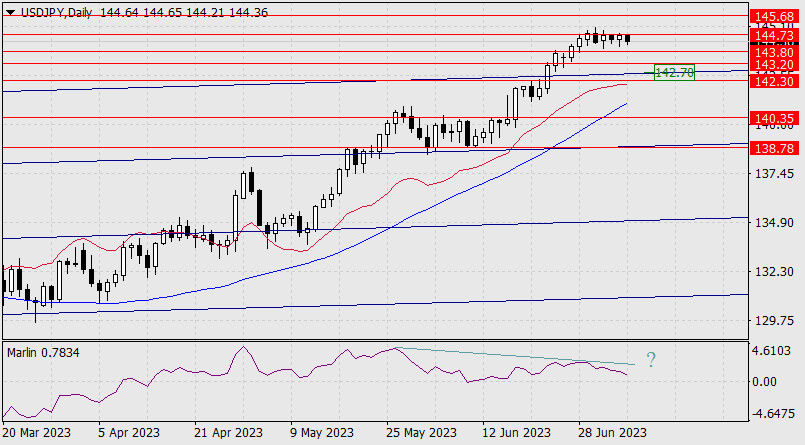

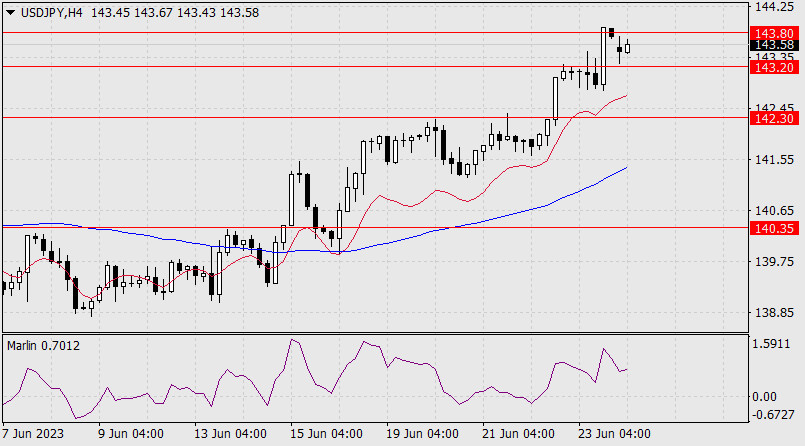

Last Friday, the Japanese yen entered the 143.20/80 range and has been consolidating within it until this morning. On the daily chart, a divergence has not yet formed between the price and the Marlin oscillator. Keeping the price within the current range increases the chances of a subsequent decline. If the dollar continues to rise, then after surpassing 143.80, the 144.73 target will just be within reach.

Falling below 143.20 would indicate that the dollar cannot continue to rise without a corrective pause, and the 142.30 target will open up. Moreover, if the price breaches the support level, it would mean a break below the embedded line of the price channel, potentially leading to sideways movement for a few days before further upward movement.

On the four-hour chart, the pair is accelerating its growth. The Marlin oscillator is not yet in the overbought zone, so there is a good chance for the price to reach 144.73 in the near future before the growth loses momentum. As the probability of further growth and correction is roughly equal, the key levels to watch are 143.20 and 143.80.

Analysis are provided by InstaForex.

Read More

Please visit our sponsors

Results 3,881 to 3,890 of 4086

Thread: InstaForex Wave Analysis

-

26-06-2023, 04:47 AM #3881

-

27-06-2023, 08:42 AM #3882

Technical Analysis of GBP/USD for June 27, 2023

Technical Market Outlook:

The GBP/USD pair has hit the technical support located at the level of 1.2698 and the bulls keeps trying to bounce higher to resume the up trend. The local low was made a few pips lower at 1.2684 and will act as the intraday technical support. The 50 MA will provide the dynamic resistance for bulls around the level of 1.2766 when the up trend is resumed. The weak and negative momentum on the H4 time frame chart support short-term bearish outlook for GBP, but the bulls keep trying to move up. The pull-back might evolve into a full-blown correction if the level of 1.2684 is broken.

Weekly Pivot Points:

WR3 - 1.27656

WR2 - 1.27471

WR1 - 1.27367

Weekly Pivot - 1.27286

WS1 - 1.27182

WS2 - 1.27101

WS3 - 1.26916

Trading Outlook:

The 61% Fibonacci retracement located at the level of 1.2778 has been hit, but it does not indicate the corrective cycle to the upside had been terminated. Any sustained breakout above this level and a weekly candle close above it is needed to change the long-term outlook to bullish. The key long term level of technical support is seen at 1.2444. The next long-term target for bulls is seen at the level of 1.3160.

Analysis are provided by InstaForex.

Read More

-

28-06-2023, 05:31 AM #3883

Forecast for EUR/USD on June 28, 2023

EUR/USD:

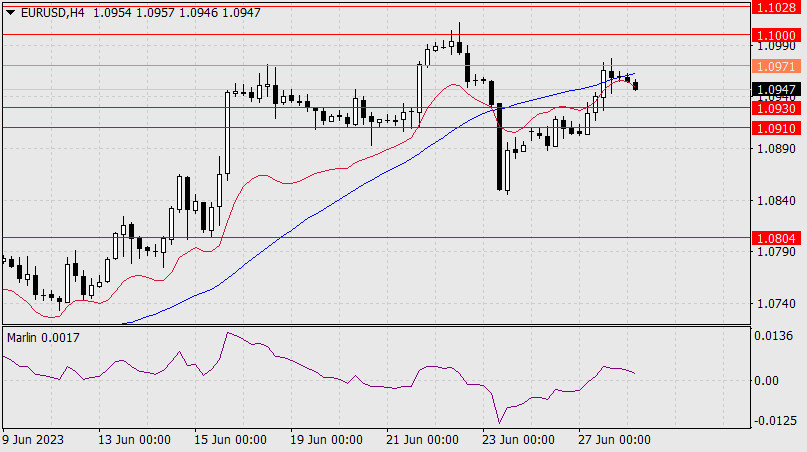

On Tuesday, European Central Bank President Christine Lagarde, at a conference in Portugal, stated with full confidence that the peak rates have been reached, which briefly stimulated the euro's growth. Chinese banks were selling the dollar yesterday, indirectly supporting the euro. The pair rose by 54 points and reached the intermediate level of 1.0971 on the way to 1.1000.

The Marlin oscillator is currently turning downwards, and if the euro does not receive any more external support, the correction may end. Today, Federal Reserve Chair Jerome Powell is also speaking at the same conference in Portugal, and he could say something in favor of the dollar. If not, the price will continue to rise towards the corrective target at 1.1000. If the price surpasses this level, it will continue to rise towards targets at 1.1028 and 1.1085.

On the 4-hour chart, the price is entangled in indicator lines and has not yet fully figured out its relationship with the 1.0971 level. The Marlin oscillator only moved into positive territory yesterday, feeling fresh and ready to assist in further price growth. Falling below the target range of 1.0910/30 will restore the decline in the medium term, which started on June 22. The target is 1.0804.

Analysis are provided by InstaForex.

Read More

-

29-06-2023, 06:32 AM #3884

Forecast for EUR/USD on June 29, 2023

EUR/USD

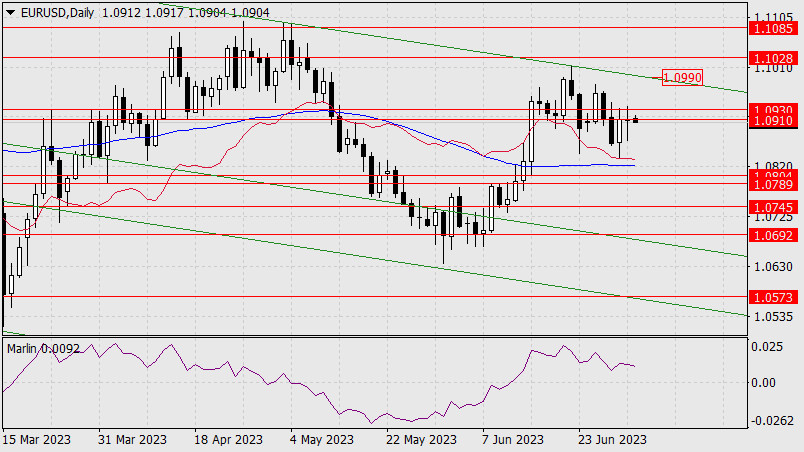

Yesterday, the euro returned to Tuesday's lows, which can be considered as the end of the confrontation amid aggressive rhetoric from central bank officials at the forum in Sintra. Federal Reserve Chairman Jerome Powell confirmed the possibility of rate hikes at consecutive meetings, and investors, comparing economic data that is clearly better in the United States than in Europe, started buying dollars.

The price has already broken below the lower band of the target range of 1.0910/30 and opened the target of 1.0789-1.0804, towards which the MACD indicator line on the daily chart will soon approach. The lower band of the target range is defined by the low of April 3. The Marlin oscillator is declining.

On the four-hour chart, the price has settled below the balance indicator line, and the Marlin oscillator has settled below the zero line. We have a downtrend, and we are waiting for the price to reach the target range.

Analysis are provided by InstaForex.

Read More

-

30-06-2023, 05:02 AM #3885

Forecast for EUR/USD on June 30, 2023

EUR/USD: Yesterday, thanks to the report on the final estimate of US GDP for the first quarter, which turned out to be better than expected, the US dollar strengthened by 0.35%. The euro lost 47 pips. On the daily chart, the price settled below the range of 1.0910/30. Now the price can reach the target range of 1.0789-1.0804.

The MACD line is approaching this range, increasing its importance. Consolidating below this range will be a key indicator of the euro's medium-term uptrend. Around the same time, the Marlin oscillator will move into negative territory.

On the four-hour chart, the Marlin oscillator signal line stayed within the downtrend area yesterday. The price briefly moved above the range and the balance line. We expect further developments within the support range of 1.0789-1.0804.

Analysis are provided by InstaForex.

Read More

-

03-07-2023, 06:32 AM #3886

Forex Analysis & Reviews: Forecast for GBP/USD on July 3, 2023

GBP/USD

On Friday, the GBP/USD pair rose above the target level of 1.2678. The signal line of the Marlin oscillator turned upwards from the zero line. Now, if the pair closes the day above this level, it will continue to rise towards the next resistance level at 1.2785. Closing the day below 1.2678 will extend the period of uncertainty since the US will be celebrating a holiday tomorrow.

According to the main scenario, the price is trading towards the target support level at 1.2520, where the MACD line is currently located. This would automatically lead to a break below the embedded green price channel line (1.2572), which is a sign of medium-term decline. The pair will likely go through light trading today and tomorrow, due to the US holiday, and major events will unfold on Wednesday.

On the four-hour chart, the price is staying above 1.2678, and the first resistance it encounters is the balance indicator line. Marlin is rising in the positive territory. There is a possibility of further growth towards the MACD line (1.2760) and then 1.2785. Currently, time is working in favor of the bears. If the price fails to firmly establish above 1.2678 or reverses downwards, it may lead to a two-day period of uncertainty (range).

Analysis are provided by InstaForex.

Read More

-

04-07-2023, 05:59 AM #3887

Forecast for EUR/USD on July 4, 2023

EUR/USD

Yesterday, the euro showed a range of 60 points, closing the day at the opening level. The upper shadow tested the 1.0930 level, and this morning the price is headed towards this mark again, not giving up hope of reaching the upper band of the green descending price channel around 1.0990. This is possible if the euro follows the stock market and employment data turn out worse than expected. For now, the price needs to consolidate above 1.0930. Surpassing yesterday's low at 1.0871 will be a signal for a decline.

On the 4-hour chart, the price could not consolidate below the balance indicator line and returned to the 1.0910/30 range. Here, it can linger for a while and try to overcome the MACD line around 1.0952. The Marlin oscillator in the positive area is ready to join the growth at any moment.

Given that we accept the bearish scenario for the euro as the main plan, the price may not overcome the MACD line and return below the range. Like yesterday, uncertainty persists in the short-term perspective.

Analysis are provided by InstaForex.

Read More

-

05-07-2023, 05:23 AM #3888

Forecast for EUR/USD on July 5, 2023

EUR/USD

The euro lost more than 30 points yesterday, finding resistance at 1.0910/30 quite strong. The Marlin oscillator is not resisting this decline, it is approaching the border of the downtrend territory. Crossing this border will accelerate the pair's decline. There are two nearby targets: the MACD line (1.0820) and the target range under it at 1.0789-1.0804.

An alternative scenario will unfold with the price breaking above the resistance range of 1.0910/30, making the next target as 1.0984. On the four-hour chart, the price is falling below the balance and MACD indicator lines. The Marlin oscillator is also in decline territory. We are watching the development of the current downtrend.

Today, the eurozone services PMI for May will be published - a decline from 55.1 to 52.4 is forecasted. In the US, the volume of industrial orders for May will be released, with growth of 0.8% expected.

Analysis are provided by InstaForex.

Read More

-

06-07-2023, 04:50 AM #3889

Forecast for USD/JPY on July 6, 2023

USD/JPY

For the sixth session, the yen has done nothing but move to the right. Such consolidation, however, increases the chances of an upward breakout, first to the target of 145.68, then to 147.40. The price's divergence with the Marlin oscillator is gradually losing strength due to inactivity.

Now, even if the price falls to one of the support levels (143.80, 143.20), there will be a quick reversal. If the Marlin oscillator enters negative territory, which will not happen today, the price may fuel the corrective decline to the embedded line of the price channel around the 142.70 mark.

On the four-hour chart, the price fell under the balance and MACD indicator lines during the sideways movement. The price delay under these lines increases the chances of a decline. The Marlin oscillator is consolidating below the zero line – also a sign of a possible decline in the near future. Under the influence of external circumstances, the price may consolidate above 144.73 and this would point to upward movement.

Analysis are provided by InstaForex.

Read More

-

06-07-2023, 07:35 AM #3890

Analytical skills play a crucial role in our success in forex trading. That's why it's essential to continuously develop our analytical abilities to progress and perform better when analyzing the market on a real account with Tickmill as our broker. By honing our analytical skills, we can make more informed decisions and enhance our overall trading performance.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote