Forecast for EUR/USD on June 12, 2023

EUR/USD

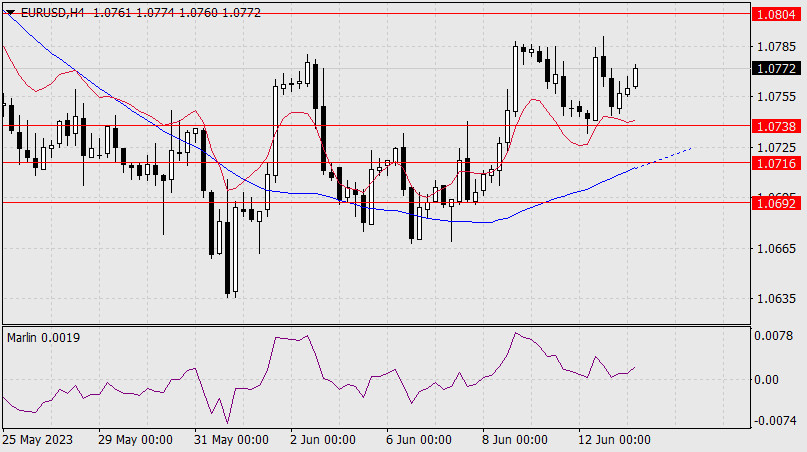

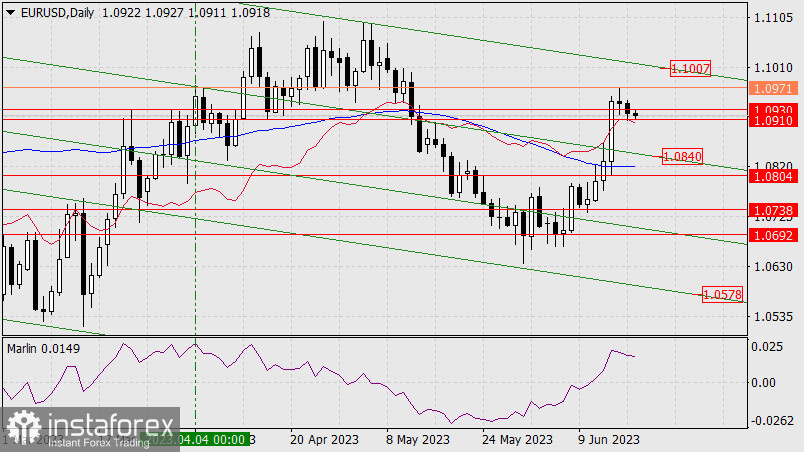

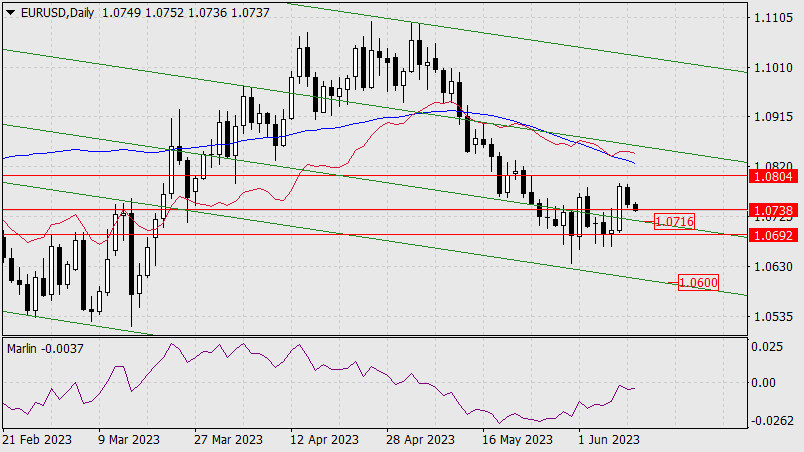

The euro is approaching the support level at 1.0738. The Marlin oscillator has backed off from attacking the zero line and has turned around as it approaches it. On the euro's path towards the target at 1.0600, there are at least three strong support levels: the nearest ones are at 1.0738, 1.0716, and 1.0692. There are no major macroeconomic news today, but tomorrow's important event will be the release of the May CPI in the US, and forecasts already suggest a slowdown in inflation (4.9-5.0% YoY compared to April's 4.9% YoY, although the range of forecasts varies depending on the analytical agency and individual groups of economists).

The yield on US government bonds is not decreasing and remains at the peaks of June 7-9, technically leaning towards growth. This sentiment is also felt in gold, which has declined in value for the second consecutive day. The market probability of a rate hike on Wednesday has slightly increased from 25.3% to 29.9%. If tomorrow's CPI data does exhibit growth, investors will significantly raise this probability, and the markets will psychologically be prepared for an actual rate hike. Today, the volatility is likely to be low, and the day's close will be slightly lower.

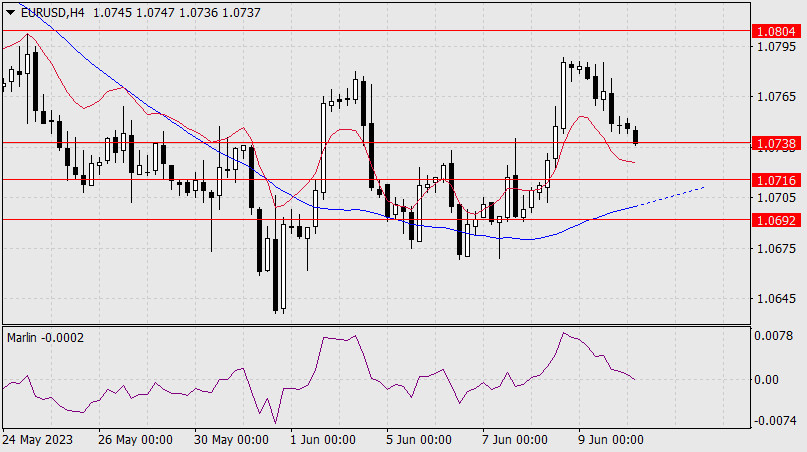

On the four-hour chart, the signal line of the Marlin oscillator is approaching the zero line and may meet it when the price touches 1.0738. Afterwards, we expect the price to move sideways.

Analysis are provided by InstaForex.

Read More

Please visit our sponsors

Results 3,871 to 3,880 of 4086

Thread: InstaForex Wave Analysis

-

12-06-2023, 05:46 AM #3871

-

13-06-2023, 05:44 AM #3872

Forecast for EUR/USD on June 13, 2023

EUR/USD

The euro chose to wait within the range of 1.0738-1.0804 ahead of the Federal Reserve meeting, rather than the previously anticipated range of 1.0692-1.0738. Technical indicators in the new range feel more at ease, with the Marlin oscillator approaching the neutral zero line.

However, this calmness is likely to be disrupted. The ZEW Economic Sentiment Index for the eurozone is projected to worsen from -9.4 to -11.9 in June. The evening will bring the main event of the day - the release of US CPI data. The consensus forecast suggests a decline in the overall index from 4.9% YoY to 4.1% YoY, and a decrease in the core index from 5.5% YoY to 5.3% YoY. The projected decline in inflation is optimistic, but at the moment, we consider it a secondary factor. If the Fed intends to raise interest rates, then weak data will be released, as inflation, like employment, are heavily manipulated fundamental indicators in the US.

We see a slight discrepancy between market expectations and the Fed's stance on interest rates, which is quite understandable, as rate hikes strongly impact businesses, and the market needs a confirmation of the rate hike, as it has been ignoring verbal signals from FOMC members given previously, as well as rate hikes by other central banks. Yesterday, investors increased the probability of a 0.25% rate hike to 30%. However, this is not enough, so the signal must be more specific, which is expected to be provided by today's inflation data published by the US Bureau of Labor Statistics. If CPI data does not come out poorly, uncertainty about the interest rate will become particularly high.

The situation is neutral on the four-hour chart. The price is developing above the balance and MACD indicator lines, but the Marlin oscillator is attempting to move into negative territory. We await further developments. Target levels are marked on the chart.

Analysis are provided by InstaForex.

Read More

-

14-06-2023, 06:11 AM #3873

Technical Analysis of Intraday Price Movement of Crude Oil Commodity Asset, Wednesday June 14, 2023

With the appearance of deviations between price movements and the MACD indicator on the 4-hour chart - Crude Oil commodity assets, in the near future #CL has the potential to appreciate corrected rally upwards to test the Bearish Orderblock level at 70.62 as the main target and if the momentum and volatility are sufficiently supportive, it is not impossible that the 200 EMA will be the next target to aim for provided that on the way to these targets it does not occur #CL returns to its initial bias again especially not to break below the 67.92 level because if this level is successfully broken then the scenario of an upward correction above that has been described will become invalid and cancel by itself.

Analysis are provided by InstaForex.

Read More

-

15-06-2023, 05:08 AM #3874

Forecast for AUD/USD on June 15, 2023

AUD/USD So, the US inflation data on Tuesday and yesterday's Federal Reserve meeting pushed the locally overbought Australian dollar above the target level of 0.6810. Since this level is strong, yesterday's growth corresponds to the overall market movement, and this morning we can see that the price has slightly fallen from the resistance level.

The Marlin oscillator is turning downwards on the daily chart, but clearly, the price needs external support. We are waiting for the market's reaction to the results of the European Central Bank meeting today. We will learn about further growth if the price consolidates above 0.6810 (target 0.6873), and a break of the ascending trend will be indicated by the price breaking below the support level of 0.6730.

On the 4-hour chart, the Marlin oscillator is moving sideways in a narrow range, which is a sign of a downward breakout of this range. The price needs to overcome yesterday's low at 0.6759. After that, we can expect the price to attack 0.6730, where the MACD indicator line is approaching and strengthening it.

Analysis are provided by InstaForex.

Read More

-

16-06-2023, 05:03 AM #3875

Forecast for GBP/USD on June 16, 2023

GBP/USD:

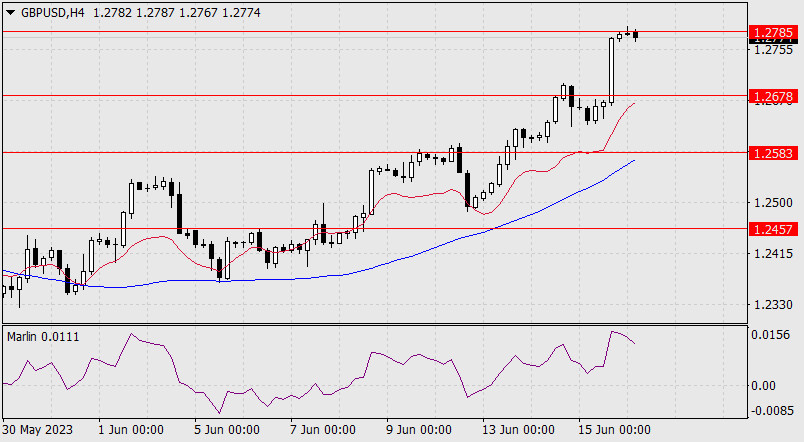

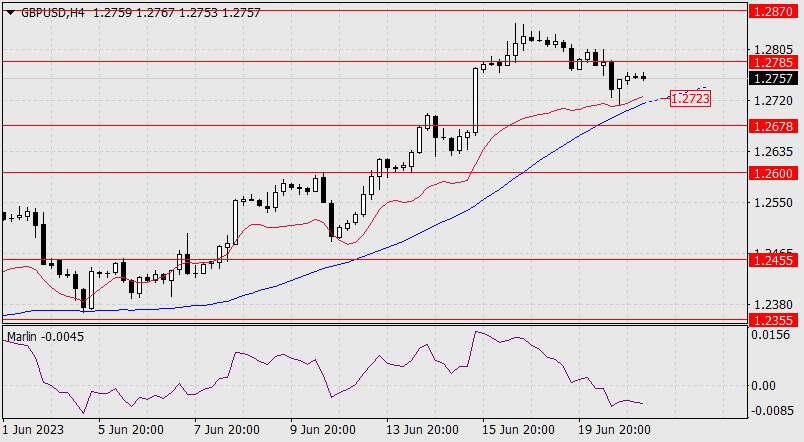

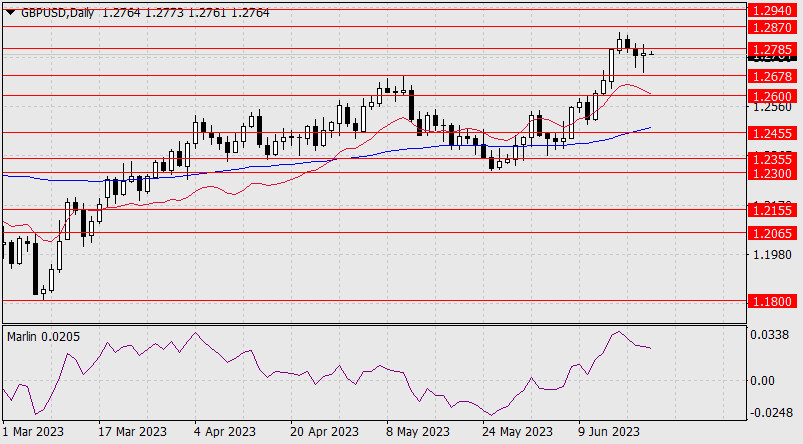

On Thursday, the pound rose by 120 pips, reaching the target level of 1.2785. Consolidation above this level will make it possible for the pair to reach the next target at 1.2870. The subsequent targets are at 1.2980/90, and so on, every hundred pips. Yesterday, the pair surpassed the peak of May 10, which marked the highest point of growth since September 2022. As a result, the market has started a trend, and the decline observed from May 10 to May 25 was merely a correction within this annual uptrend.

Considering the fundamental factors and the disbelief in the pound's long-term growth, the current year-long growth can be interpreted as a correction from a more significant decline between May 2021 and September 2022 (69 weeks). Currently, this is the 37th week of growth. It may continue for another three weeks and the pound can reach the level of 1.3160, the December 2021 low.

We are extremely cautious about the prospect of such growth. Right now the Marlin oscillator is already showing signs of a reversal from the overbought territory.

On the 4-hour chart, there are no clear reversal signals, although the oscillator is in the overbought territory. The pound has a good chance of surpassing the 1.2785 level, and it will try to reach the 1.2870 target.

Analysis are provided by InstaForex.

Read More

-

19-06-2023, 05:21 AM #3876

Forecast for EUR/USD on June 19, 2023

EUR/USD:

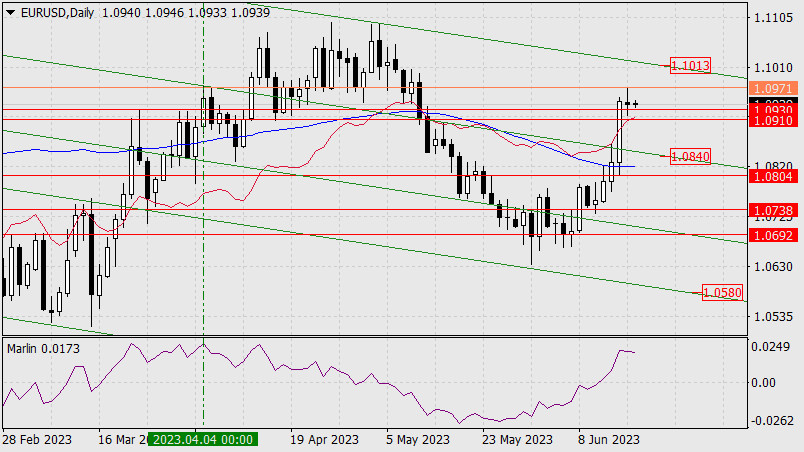

On Friday, the euro fell by 5 pips, reaching the upper shadow of the April 4th peak. This level is not very strong, but after testing the stronger target range of 1.0910/30, a reversal could occur from a weaker level. If the price surpasses Friday's high (1.0971), the price will try to test the upper limit of the price channel around 1.1013. The daily Marlin oscillator is turning downward, indicating that the euro will likely try to return below the range of 1.0910/30. Consolidation below this range would allow for a bearish push towards the lower embedded line of the price channel around 1.0840.

On the four-hour chart, there is a price consolidation above the target range of 1.0910/30, indicating a desire for further upward movement. The Marlin oscillator will also turn upward, easing the oversold condition. However, if the euro has no intention of rising, once the price falls below the mentioned range, it will consolidate below the zero line along with the oscillator, as its decline is quite rapid. The support level at 1.0840 approximately corresponds to the MACD line on the four-hour chart. The same indicator line on the daily chart is also approaching this area.

The support is becoming stronger, and its significance is increasing day by day. Therefore, breaking below this level would be a definitive signal for the development of medium-term downward movement (1.0580).

Analysis are provided by InstaForex.

Read More

-

20-06-2023, 06:01 AM #3877

Forex Analysis & Reviews: Forecast for EUR/USD on June 20, 2023

EUR/USD

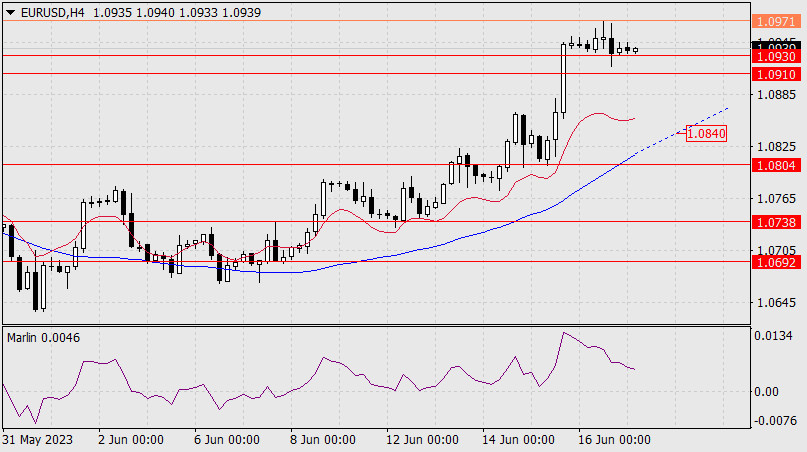

Yesterday, the euro fell by 18 pips, marking the lower limit of the target range at 1.0910/30 with its lower shadow. Consolidation below the range will allow for an advance towards the lower line of the price channel around the 1.0840 mark. However, the signal line of the Marlin oscillator is falling sluggishly, indicating that the euro still has a potential to rise. At the same time, the price is above the balance indicator line (which also halted its decline yesterday), indicating a maintained upward potential along with Marlin.

The situation could be reversed by a strong downward movement surpassing yesterday's level. This is possible if the US construction data turns out to be good and today's speeches by James Bullard and John Williams demonstrate firmness, hinting at Federal Reserve Chairman Jerome Powell's stance in his key speech in the House of Representatives tomorrow.

On the four-hour chart, the signal line of the Marlin oscillator sharply declines in a straight line. This often indicates a reversal of the price upwards. If the price finds the strength to break below the MACD line, the upward reversal is either postponed until the completion of a deep correction or canceled. The price is about 65 pips away from the MACD line, and an additional 15-20 pips would be needed for confirmation below it, which may prove to be an unattainable task for today. Powell's speech will take place in 9 four-hour candles (green vertical line). If the price does not deviate from its plan, it will only need to cover 50 pips since the MACD line is rising and approaching the price. The ultimate signal level is the peak on June 14 at 1.0865. The task is achievable, but the first impulse is necessary. The main plan will be canceled if the price breaks above the peak on June 16, allowing the price to continue rising towards 1.1007.

Analysis are provided by InstaForex.

Read More

-

21-06-2023, 05:12 AM #3878

Forecast for GBP/USD on June 21, 2023

GBP/USD

Yesterday, the British pound settled below the linear resistance at 1.2785. The Marlin oscillator's signal line is declining, inspiring the British pound not to hesitate in reaching the target support level at 1.2678. However, the price needs a good reason - a slowdown in the inflation report from the National Statistics Office. The forecast for the CPI is expected to be 8.5% YoY, compared to April's 8.7% YoY. If the data shows that inflation is getting stronger, the price may try to reach the target level of 1.2870.

On the 4-hour chart, the price found support from the balance line (red indicator). This hints at investors' desire to maintain an upward situation, as the Bank of England is expected to raise the interest rate by 0.25% tomorrow, with its planned four more rate hikes by the end of the year, totaling 5.75%. This would align with the Federal Reserve's interest rate by the end of the year (assuming two rate hikes by the Fed by year-end).

From a technical perspective, the price should settle below the MACD line, below 1.2723, if it intends to make at least a false downward movement. For a more confident decline, the price should establish itself below 1.2678.

Analysis are provided by InstaForex.

Read More

-

22-06-2023, 05:27 AM #3879

Forecast for GBP/USD on June 22, 2023

GBP/USD:

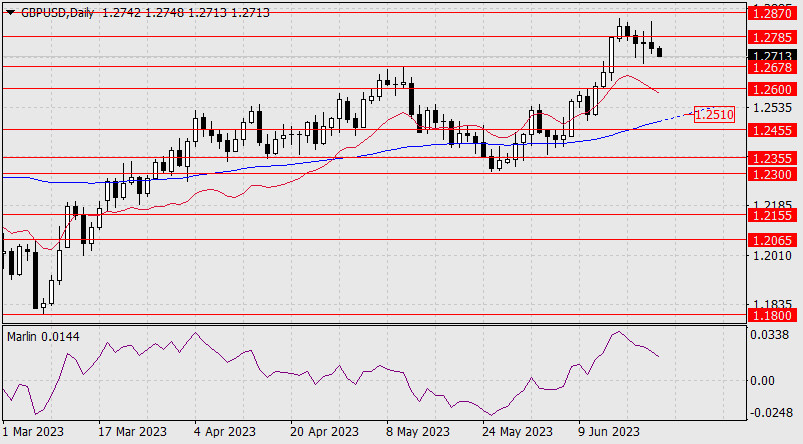

Yesterday, the British pound traded within a range of 110 pips, closing the day with a 5-pip increase. Such volatility allowed the price to hold below the resistance level of 1.2785 and the Marlin oscillator to stay in a downward direction. Today, the price has a chance to retest the support level of 1.2678 and, if successful, it may fall towards 1.2600.

Consolidation above 1.2785 would allow the price to continue rising according to an alternative scenario towards the level of 1.2870. The next target is 1.2940. On the four-hour chart, we can see that the price's failure to consolidate below the MACD indicator line has brought the price back above this line, but now with consolidation. The Marlin oscillator is in negative territory, so there is a possibility of another attempt to break downward.

Today, the Bank of England will make a decision on monetary policy, and a 0.25% rate hike is expected. However, consulting agencies suggest that this increase is already priced in, so investors will focus on the central bank's further plans.

Analysis are provided by InstaForex.

Read More

-

23-06-2023, 05:47 AM #3880

Forecast for GBP/USD on June 23, 2023

GBP/USD

Despite the Bank of England's decision to raise the base rate by 0.50% instead of the expected 0.25%, the British pound closed the day down by 22 pips. The unexpected decision sparked UK recession concerns. With inflation remaining at 8.7% YoY and the rate increased to 5.00%, the economy is experiencing a situation of economic contraction and reduced consumer demand (and inflationary pressure!). The UK finds itself in this trap for the second time, with the first time being during the global crisis of 2008/2009, when the rate was also raised to 5.00% and inflation was at 5.0% YoY.

Today, retail sales data for May in the UK will be released, with a forecast of -0.2%. The forecast for core retail sales is -0.3%. The decline in retail sales to -3.0% YoY currently corresponds to the contraction seen during the 2008 crisis, and the March figure of -3.9% is even worse than those years.

So, the price failed to extend yesterday's rally, and the breakthrough above the resistance at 1.2785 turned out to be false for the third consecutive session. Now, the price is declining towards the nearest support at 1.2678. Breaking this level will open up the next target at 1.2600.

On the 4-hour chart, the price has consolidated below the balance and MACD indicator lines, and the Marlin oscillator is in negative territory. The short-term trend is bearish. To confirm a medium-term decline, the price needs to consolidate below the MACD line on the daily chart (1.2510).

Analysis are provided by InstaForex.

Read More

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote