Forecast for AUD / USD on December 20, 2019

AUD / USD

Yesterday, the Australian dollar grew 32 points on good employment data which makes the unemployment rate fell from 5.3% to 5.2%. In general, the correctional growth from the fall of the "Aussie" from December 13 to 17 was 61.8% which is 38.2% on the chart. Due to this, the growth may stop since a double divergence has already been formed on the Marlin oscillator, and the probability of triple divergence is historically small. The first goal of the new wave of decline is the nested price channel line at 0.6860. Overcoming this level opens up prospects for a medium-term decrease in the Australian dollar which is at 0.6820 according to the MACD line near the Fibonacci level of 123.6%, and at 0.6778 which is the reaction level of 161.8%. This continues on to the underlying embedded price channel line which is at 0.6678.

On the four-hour chart, the price is currently above the balance lines (indicator red) and MACD, and the Marlin oscillator is also in the growth zone. The departure of the price for these lines, below 0.6885, will reveal the main lowering scenario. The observed price above the indicator lines will be interpreted as false.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided byInstaForex.

Please visit our sponsors

Results 2,921 to 2,930 of 4086

Thread: InstaForex Wave Analysis

-

20-12-2019, 04:36 AM #2921

-

23-12-2019, 04:44 AM #2922

EUR/USD approaching support, potential bounce!

Trading Recommendation Entry: 1.10533

Reason for Entry: 61.8% Fibonacci retracement, 127.2% fibonacci extension, horizontal swing low support

Take Profit : 1.11418 Reason for Take Profit: horizontal swing high resistance, 61.8% fibonacci retracement

Stop Loss: 1.10253 Reason for Stop loss:78.6% Fibonacci retracement, Horizontal pullback support

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

26-12-2019, 09:07 AM #2923

GBP/USD approaching resistance, potential drop!

Trading RecommendationEntry: 1.31158Reason for Entry: 38.2% Fibonacci retracement, horizontal pullback resistance

Take Profit : 1.27253Reason for Take Profit:50% fibonacci retracementStop Loss: 1.35194Reason for Stop loss:

Horizontal swing high resistance

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

27-12-2019, 07:44 AM #2924

EUR/USD approaching resistance, potential drop!

Trading Recommendation Entry: 1.11104 Reason for Entry:

Horizontal overlap resistance, 38.2% Fibonacci retracement, 78.6% Fibonacci extension Take Profit : 1.10667

Reason for Take Profit: horizontal swing low support, 61.8% Fibonacci retracement Stop Loss: 1.11541

Reason for Stop loss:Horizontal swing high resistance, 61.8% Fibonacci retracement

[B]*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.[B]

-

06-01-2020, 04:49 AM #2925

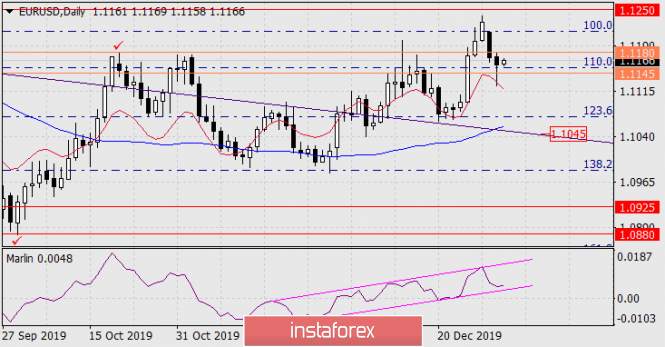

Forecast for EUR/USD on January 6, 2019

EUR/USD

Last Friday, the euro made an attempt to push the technical level of 110.0% Fibonacci on the daily chart, but it failed on its first attempt. On Saturday, US President Trump threatened to attack 52 Iran's targets in the event of Iran's military response to a US missile strike, leading to the assassination of General Soleimani. Trump was indirectly supported by Britain, Germany and France, once again urging Tehran to comply with the nuclear deal. We doubt the development of the conflict before the hot phase of the war with Iran, but the current situation can help the dollar in getting out of consolidation (of course, in the direction of strengthening), stretching from July last year.

On the daily chart, the signal line of the Marlin oscillator approached the lower boundary of its own channel, the exit from which down will strengthen the fall of the euro. The purpose of the movement is the embedded line of the global downward price channel in the region of 1.1045.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided byInstaForex.

-

07-01-2020, 03:47 AM #2926

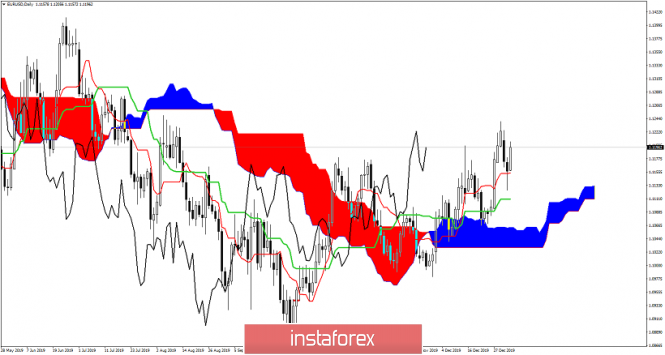

Ichimoku cloud indicator Daily analysis of EURUSD for January 7, 2020

EURUSD remains in a bullish trend continuing to make higher highs and higher lows. Price so far has respected the key Cloud support area of 1.1040-1.1050. Thus we continue to see more upside potential over the coming days.

Price has broken above the Kumo (cloud) and has so far successfully back tested support. Price bounced off the Cloud and this was another bullish signal. EURUSD is now trading above the tenkan-sen (red line indicator) while the kijun-sen is trending below tenkan-sen with a positive slope. With the tenkan-sen above the kijun-sen we have supporting evidence of a bullish trend. We continue to expect this next leg higher to move closer to 1.1280.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided byInstaForex.

-

08-01-2020, 04:55 AM #2927

Australian network through franc

Good evening, dear traders. Congratulations to all Orthodox Christians on Christmas! I wish you well and financial well-being!

As you have probably already noticed, I often trade certain cross-courses using the grid method. And today, as an example of one of them, I will show how you can spread the correct network of limit purchases on the highly oversold AUD/CHF instrument.

Please note that such counter-trend sets should be carried out only after fairly strong passes and an understanding of the average rollback for the pair. You can see some part of these numbers on the screen on the left with a 5-digit dimension.

Now, if you use the lot increase coefficient, you can calculate it according to the trader's calculator.

Good luck in trading and control the risks!

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided byInstaForex.

-

09-01-2020, 04:17 AM #2928

The collapse of the Boeing after another 737 crash

Good evening, dear traders. I present to you the trading idea for Boeing's Stock CFD.

So, yesterday, there was a terrible catastrophe of the Ukrainian Boeing 737 in Iran. Boeing fell shortly after takeoff and all 170 passengers died. Now, for the preliminary version: technical - engine fire. This is not the first crash with a Boeing in recent times. Thus, we recommended selling the shares that were mentioned back in December.

Boeing has a very interesting level of $ 318 from the point of view of hunting for stops. In fact, this is a platform with the feet of buyers of this asset for the entire last year. 737 was discontinued in December, but accidents continued with it. Against this background, we recommend holding short positions in order to break through the level of 319 with a further pull to historical 292:

Since the opening, the shares have lost $ 4. Therefore, we recommend developing the reduction to the above levels if you are not yet on sale.

Good luck in trading and control the risks!

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided byInstaForex.

-

10-01-2020, 05:09 AM #2929

Forecast for GBP/USD on January 10, 2020

GBP/USD

The British pound lost 30 points on Thursday. The price consolidated below the MACD line on the daily chart. The signal line of the Marlin oscillator is falling in the negative trend zone, but not due to the strong dynamics of the pound's decline, the balance indicator line (red) continues to hold the price, further slowing its decline. The continuation of such a tendency - a decrease in the British pound will lead to an increase in bullish sentiment, the market can take advantage of such confusion.

Data on US employment will be published today, the forecast for new jobs in the non-agricultural sector for December is 162 thousand, this may be an incentive to further pull down the pound to the Fibonacci level of 161.8% at the price of 1.2968. But even in this case, the pound's decline rate may not be enough to overcome the balance indicator line. If it also remains below the price by the opening of Monday, then the correction of the British pound is possible next week. The 1.2968 level is technically strong.

On the four-hour chart, the price consolidated below the MACD line yesterday - one candle with the whole body was under this line, but at the moment the price is already above the MACD line. Such a false signal is also a sign of a short downward movement, if any (to our target 1.2968). The Marlin oscillator is moving after the price, it is not providing signals. Another price consolidation below the MACD line, as well as under the correction level of 23.6%, will open the nearest target at 1.2968. To move the price to lower targets (1.2820, 1.2730), which are marked on the daily scale, you need a rapid movement of the price down today.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided byInstaForex.

-

13-01-2020, 07:34 AM #2930

Forecast for GBP/USD on January 13, 2020

Quotes of the British pound are held for two days on the indicator line of the balance of the daily scale in red. Overcoming it will allow the price to consistently take the three immediate goals at the Fibonacci levels: 1.2968, 1.2820, 1.2730. The Marlin oscillator is in the decline zone.

On the four-hour chart, the price overcame the support of the MACD line, but did so with a gap. In this case, with a general declining trend and in the absence of warning reversal signals, the "window" serves as a harbinger of a further fall in prices, but it is not advisable for it to remain open for a long time.

We are waiting for the closure of this gap and a further decline in the British pound. The Marlin oscillator is developing in a declining trend zone.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote