Technical analysis of EUR/USD for Oct 03, 2017

When the European market opens, some Economic Data will be released, such as PPI m/m and Spanish Unemployment Change. The US will release the Economic Data, too, such as Total Vehicle Sale, so, amid the reports, EUR/USD will move in a low to medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.1789.

Strong Resistance:1.1782.

Original Resistance: 1.1771.

Inner Sell Area: 1.1760.

Target Inner Area: 1.1732.

Inner Buy Area: 1.1704.

Original Support: 1.1693.

Strong Support: 1.1682.

Breakout SELL Level: 1.1675.

Analysis are provided byInstaForex.

Please visit our sponsors

Results 2,401 to 2,410 of 4086

Thread: InstaForex Wave Analysis

-

03-10-2017, 06:31 AM #2401

-

04-10-2017, 06:30 AM #2402

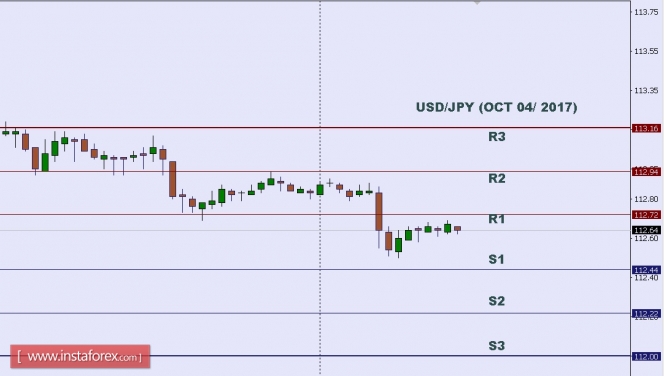

Technical analysis of USD/JPY for Oct 04, 2017

In Asia, Japan today will not release any Economic Data, but the US will release some Economic Data, such as Crude Oil Inventories, ISM Non-Manufacturing PMI, Final Services PMI, and ADP Non-Farm Employment Change. So, there is a probability the USD/JPY will move with medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Resistance. 3: 113.16.

Resistance. 2: 112.94.

Resistance. 1: 112.72.

Support. 1: 112.44.

Support. 2: 112.22.

Support. 3: 112.00.

Analysis are provided byInstaForex.

-

06-10-2017, 07:11 AM #2403

Technical analysis of EUR/USD for Oct 06, 2017

When the European market opens, some Economic Data will be released, such as Italian Retail Sales m/m, French Trade Balance, French Gov Budget Balance, and German Factory Orders m/m. The US will release the Economic Data, too, such as Consumer Credit m/m, Unemployment Rate, Non-Farm Employment Change, and Average Hourly Earnings m/m, so, amid the reports, EUR/USD will move in a medium to high volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.1769.

Strong Resistance:1.1762.

Original Resistance: 1.1751.

Inner Sell Area: 1.1740.

Target Inner Area: 1.1712.

Inner Buy Area: 1.1684.

Original Support: 1.1673.

Strong Support: 1.1662.

Breakout SELL Level: 1.1655.

Analysis are provided byInstaForex.

-

09-10-2017, 06:06 AM #2404

EUR/USD testing strong resistance, prepare to sell

The price has bounced up perfectly from our buying area previously and is fast approaching our profit target. We turn bearish today looking to sell below 1.11744 resistance (Fibonacci retracement, horizontal pullback resistance) for a push down to at least 1.1653 support (Fibonacci extension).

Stochastic (21,5,3) is seeing major resistance below 95% and we expect a corresponding reaction from this level.

Sell below 1.1744. Stop loss is at 1.1793. Take profit is at 1.1653.

Analysis are provided byInstaForex.

-

10-10-2017, 05:56 AM #2405

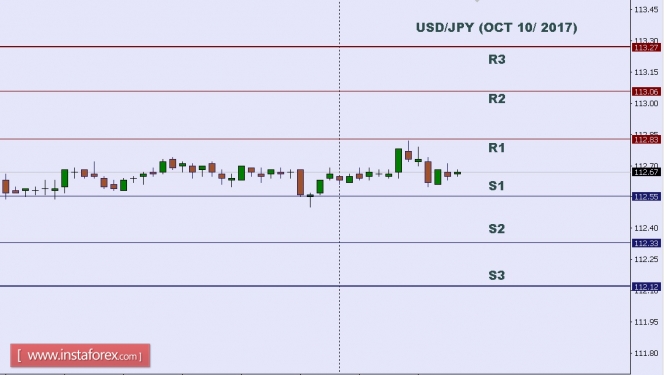

Technical analysis of USD/JPY for Oct 10, 2017

In Asia, Japan will release the Economy Watchers Sentiment and Current Account data, and the US will release some Economic Data, such as IBD/TIPP Economic Optimism and NFIB Small Business Index. So, there is a probability the USD/JPY will move with ... volatility during this day.

TODAY'S TECHNICAL LEVEL:

Resistance. 3: 113.27.

Resistance. 2: 113.06.

Resistance. 1: 112.83.

Support. 1: 112.55.

Support. 2: 112.33.

Support. 3: 112.12.

Analysis are provided byInstaForex.

-

10-10-2017, 01:25 PM #2406

Rely on us to in-depth Technical Analysis that will save you time and give you accurate forecasts prepared by expert technical analysts. If you do not have the skills or experience to analyze technical indicators, support and resistance levels, Fibonacci or other technical analysis instruments, let us do the hard work for you.

To gain exclusive and free access to our technical analysis, sign up by joining FXB Trading

-

11-10-2017, 06:44 AM #2407

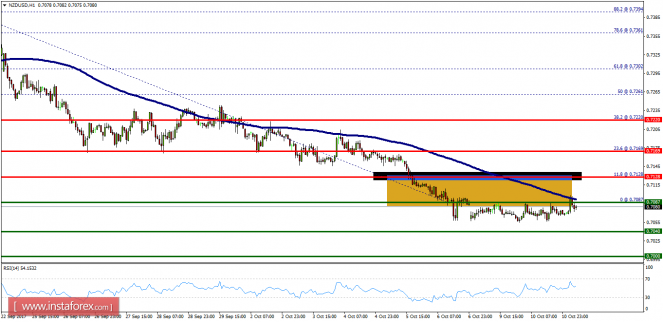

Technical analysis of NZD/USD for October 11, 2017

Overview:

The NZD/USD didn't make significant movement yesterday. There are no changes in my technical outlook. The bias remains bearish in the nearest term testing 0.7000 or higher. Immediate support is seen around 0.7087. The NZD/USD pair fell from the level of 0.7128 towards 0.7087. Now, the price is set at 0.7069 to act as a minor support. It should be noted that volatility is very high for that the NZD/USD pair is still moving between 0.7128 and 0.7040 in coming hours. Furthermore, the price has been set below the strong resistance at the levels of 0.7169 and 0.7220, which coincides with the 23.6% and 38.2% Fibonacci retracement level respectively. Additionally, the price is in a bearish channel now. Amid the previous events, the pair is still in a downtrend. From this point, the NZD/USD pair is continuing in a bearish trend from the new resistance of 0.7128. Thereupon, the price spot of 0.7128/0.7087 remains a significant resistance zone. Therefore, a possibility that the NZD/USD pair will have downside momentum is rather convincing and the structure of a fall does not look corrective. In order to indicate a bearish opportunity below 1.0020, sell below 0.7128 or 0.7087 with the first targets at 0.7040 and 0.7000 (support 3). However, the stop loss should be located above the level of 0.7169.

Analysis are provided byInstaForex.

-

12-10-2017, 06:50 AM #2408

The political crisis in Spain does not put pressure on the euro

Despite the continuing tension between Spain and Catalonia, the European currency continues to strengthen its positions against the US dollar. The expected publication of the report of the Federal Reserve System since the last meeting also does not put pressure on euro buyers.

Today, the Prime Minister of Spain has demanded that the leader of Catalonia Carles Puigdemont gave a clearer assessment of his position and answer the question whether he declared the independence of the region or not.

If the Catalan leader takes this step, the Prime Minister of Spain will be fully entitled to deprive the rights of Catalonia some autonomy, which will lead to greater confrontation. This will be done with an based on article 155 of the Spanish Constitution, which allows the government to deprive the regions of certain rights of autonomy in the event of a threat to the interests of Spain.

Statements by the representatives of the Federal Reserve did not affect the prices of the US dollar. Today, the president of the Federal Reserve Bank of Chicago, Charles Evans, draw the focus towards the fundamental indicators of the US economy. In his view, the current situation is good enough to start a discussion about the need to raise interest rates later this year. Evans also noted the improvement in the situation with wages, and expects that the unemployment rate in the US may drop even lower.

As for the technical picture of the EURUSD pair, going beyond resistance 1.1830 had a positive impact on new buyers of risky assets, which led to the further increase of the trading instrument already in the 1.1860 area with the main purpose of reaching 1.1870.

The growth potential of the euro may be limited by the Fed's minutes, which will be published tonight.

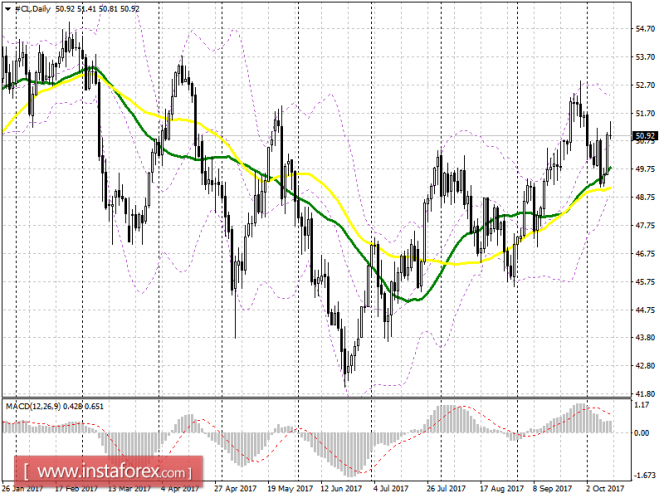

Prices of oil fell after the release of the OPEC report, which noted an increase in production levels.

According to the data, the cartel's production in September this year increased to 32.75 million barrels per day. OPEC expects oil demand to grow by 1.5 million barrels per day by 2017 fiscal year, as well as 1.4 million barrels a day in 2018.

The cartel also increased the estimate of the world supply of oil in September to 96.5 million barrels per day. Total oil reserves in OECD countries in August 2017 were 171 million barrels, above the five-year average level.

As for the technical picture of oil, only a breakthrough of the level of 51.30 on the WTI mark can lead to a larger upward movement with a test of the monthly highs around 52.80. If buyers can not get hold of the level of 51 US dollars, a downward correction may lead to the updating of the lower limit of 49.40.

Analysis are provided byInstaForex.

-

13-10-2017, 06:53 AM #2409

Technical analysis of EUR/USD for Oct 13, 2017

When the European market opens, some Economic Data will be released, such as German Final CPI m/m. The US will release the Economic Data, too, such as Prelim UoM Inflation Expectations, Business Inventories m/m, Prelim UoM Consumer Sentiment, Retail Sales m/m, Core Retail Sales m/m, Core CPI m/m, and CPI m/m, so, amid the reports, EUR/USD will move in a low to medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.1886.

Strong Resistance:1.1879.

Original Resistance: 1.1868.

Inner Sell Area: 1.1857.

Target Inner Area: 1.1829.

Inner Buy Area: 1.1801.

Original Support: 1.1790.

Strong Support: 1.1779.

Breakout SELL Level: 1.1772.

Analysis are provided byInstaForex.

-

16-10-2017, 05:46 AM #2410

Technical analysis of EUR/USD for Oct 16, 2017

When the European market opens, some Economic Data will be released, such as Trade Balance and German WPI m/m. The US will release the Economic Data, too, such as Federal Budget Balance and Empire State Manufacturing Index, so, amid the reports, EUR/USD will move in a low to medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.1870.

Strong Resistance:1.1863.

Original Resistance: 1.1852.

Inner Sell Area: 1.1841.

Target Inner Area: 1.1813.

Inner Buy Area: 1.1785.

Original Support: 1.1774.

Strong Support: 1.1763.

Breakout SELL Level: 1.1756.

Analysis are provided byInstaForex.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote