The US Fed: salvation cometh

More at: https://bit.ly/2J9011t

24.03.2020

Economy bailout

Until recently, observers were complaining that the US Fed’s financial aid was not enough to keep the American economy going at acceptable pace. Well, it seems their prayers were heard: the Fed is opening its unlimited power to the market now. Its’ aid will be literally unlimited: Jerome Powell’s team promised to buy as many government-backed bonds and mortgage-backed securities as its required to ensure the virus hit doesn’t inflict too much damage. “Aggressive efforts must be taken across the public and private sectors to limit the losses to jobs and incomes and to promote a swift recovery once the disruptions abate”, the Fed stated on Monday.

Essentially, that means, while the congress keeps discussing a $2trln stimulus, the Fed steps in to finance businesses and individuals directly, extending their support much beyond critical parts of the economy. That’s about time: observers predict the inevitable recession to the US economy and job losses in the rage of 1mln due to the coronavirus.

Forex

The US dollar responded immediately, as it was supposed to just like in any other case of such a large currency influx: it eased its grip on the market. Even the weak currencies such as MXN, TRY and RUB got an opportunity to relax a bit after an unstoppable onslaught of the USD. Gold surged as well, taking back its privileges as a safe-haven commodity.

Stocks

S&P dropped to 2175 – its lowest market since 2016. But the Fed’s actions made it get back up to 2320. Observers comment that although there still is certain bearish potential, there are reasons to expect recovery over the pass. For this reason, it is a good moment to watch for the pick-up signs for a possible buy in the nearest future.

Please visit our sponsors

Results 301 to 310 of 370

Thread: Forex daily News FBS

-

24-03-2020, 12:51 PM #301Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

-

27-03-2020, 01:04 AM #302Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Euro zone suffers loss of economic activity

Check more: https://bit.ly/2xowjDl

26.03.2020

What is happening?

Economic activity in service sector in the Euro zone and the UK is on its lowest rates since 2009.

How do we now that?

On Tuesday leading indicators of economic health in France, Germany and UK were released – French, German and UK Flash Services PMI. The numbers are disappointing as they came out below the expected level. At the same time, manufacturing industries were actually doing better than economists had predicted.

These indicators show how purchasing managers assess business conditions today. With people in France, Spain and Italy confined to their homes, travel plans being abandoned, with restaurants and other entertainment places being shut down, there is no surprise that service sector is struggling today.

What does it mean?

These indicators gave a first signal that euro zone economy is tilting to recession. Governments have started to guarantee loans for small companies, help those who lose their jobs, and boost spending. However, the European lockdowns will leave a 350 billion-euro hole in household incomes and company profits.

The threat is that if the containment measures are needed a long time, the euro area will collapse. The UK economy will contract by at least 10% in the first half of the year, according to Bloomberg Economics’ estimates. The economy in euro area is forecast to shrink 3.1% in first quarter, with another blow of 2.4% in the second.

The future of euro-area economy mostly depends on the measures that governments will take. That is why right now it is quite necessary to get updated not to miss fresh news that might influence the market.

The ECB and the EUR

The European Central Bank makes all efforts to cope with the extraordinary shock that stunned the market. For this reason, it scrapped most of the bond-buying limits in its 750 billion-euro ($819 billion) pandemic emergency program.

This program will continue all this year and will also allow the ECB to buy bonds with shorter maturities.

The long-term perspective of euro will depend on its effectiveness of every member of euro zone. We will monitor the situation closely and keep you updated as always.

-

30-03-2020, 03:18 PM #303Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Forex market update on March 30

More at: https://bit.ly/3dzC8hP

30.03.2020

To start the week, let’s throw a quick glance on the market disposition this Monday.

Forex

No big movement so far, with USD and JPY being moderately strong against their counterparts. In general, the overall mood of the market is very cautious. Very possibly, currency investors are not yet sure how to interpret Donald Trump’s recent stepping back from his previous call to resume normal activity by Easter. Now, the virus state is extended until April 30 in the US. So the audience is watching for more fundamentals on the USD to factor it into this week’s movements.

USD/JPY: support 107.00, resistance 108.50

Gold

The precious metal has lost its momentum for the upside. Currently, it trades at $1,615 per ounce and is likely to continue the consolidation at this level. As there is no certainty on the market about the nearest perspectives, and the positivity is hardly outweighing the pessimism of what’s going on, so is the gold – hanging there at the ranges of $1,610-1,620.

XAU/USD: support $1,600, resistance $1,645

Oil

The oil market is now in a “prepare for the ride” state. Most media reiterate the truth that Donald Trump lost the opportunity to lead the global oil market anywhere, and even if he wanted it now, it is too late. Saudi Arabia and Russia show no more sympathy to each other nor any more concern by the global consequences of the oil price war. These last days of March will end the current period of output limitations following the December agreements of the OPEC+, now obsolete. Hence, Wednesday will be the first day of the truly free oil market. Probably, that is going to be an example that freedom without limitations is no good for anyone. In the meantime, the oil price is at decade-long bottom levels.

WTI: support $20, resistance $28

-

31-03-2020, 02:55 PM #304Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Is Chinese economy rebounding?

More at: https://bit.ly/2w2wfsp

31.03.2020

It seems that China may have defeated the pandemic as the coronavirus cases has dramatically fallen there. The country has come through the worst and is recovering now.

Today China Manufacturing PMI (purchasing managers’ index ) was released and it went beyond all expectations as the index was 52.0 with forecast of 44.9 while previous one was 35.7!

What does it mean for China?

It’s excellent for the Chinese yuan. Indexes above 50.0 indicate industry expansion as it’s widely assumed, but nowadays it doesn’t mean that Chinese economic activity has fully resumed. The country might avoid a recession but, anyway, will undergo a steep slowdown because of the virus shocks on production and demand. World Bank downgraded China’s 2020 GDP forecast to 2.3% versus 6.1% reported for 2019.

What does it mean for the world?

The whole world is suffering from the virus now and this shock will affect greatly almost every country as economies are all intertwined. As Michael Howell from London’s CrossBorder Capital Ltd. said, we should be ready for the turnaround of the lead economy. Who knows, maybe US dollar will cede its place to the Chinese yuan. However, this is an assumption, which may not hold up.

Technical analysis of USD/CNH

Let’s look at the USD/CNH chart. It’s now on 7.1060 mark crossing Moving Average of 50. The rebound of the Chinese PMI should strengthen the Chinese yuan. Despite that fact, we see the upward trend and the pennant, so, we can assume that, the graph should surge after it.

Chinese PMI affects Australian dollar

Moreover, the Australian dollar bounced back substantially from the Chinese PMI data. Often the Australian dollar acts as a Chinese-economy proxy bet. Moreover, 2.2 trillion dollar US stimulus package improved the global risk sentiment, what was beneficial for riskier currencies, including the aussie. However, worries about the financial downturn from the coronavirus support the US dollar's perceived safe-haven status.

We see the AUD/USD pair on 0.6090 mark now. It almost reached 61.8% Fibonacci retracement level with 0.62300 mark and then turned back to 50%. It’s the decisive moment, will it go down breaking through 50% Fibonacci retracement level or continue its growth.

-

06-04-2020, 12:30 AM #305Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

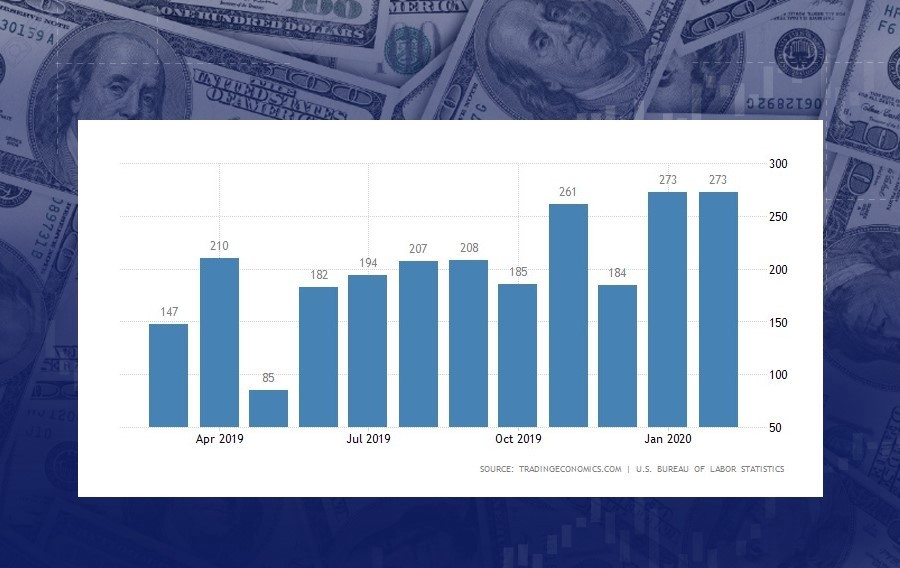

Employment data may make the USD volatile

Check at: https://bit.ly/34dLtHA

01.04.2020

The US Non-farm payrolls, also known as NFP, will be published on April 3, at 15:30 MT time.

Instruments to trade: EUR/USD, USD/JPY, USD/CHF

The indicator represents the change in the number of employed people during the previous month excluding the farming industry. Traders pay huge attention to it, as it makes the US dollar highly volatile after the release. It’s worth mentioning that it comes out at the same time with the level of average hourly earnings and the unemployment rate. In March, the level of non-farm payrolls greatly outperformed the forecasts with 273K (vs. 175K). The average hourly earnings came out in line with expectations of 0.3% and the unemployment rate fell to 3.5%. Despite such a positive release, the reaction of the USD was limited. The currency was already struggling with coronavirus fears. This time the situation may be completely different after the record-high unemployment claims last week. It increased the risks of this employment data coming out significantly lower than in the previous release. On the other hand, if non-farm employment change and average hourly earnings are higher and the unemployment rate is lower than the forecasts, the USD will rise.

• If the actual levels of employment change and average hourly earnings are higher and the unemployment rate is lower than the forecasts, the USD will rise;

• If the actual levels of employment change and average hourly earnings are lower and the unemployment rate is higher than the forecasts, the USD will fall.

Check the economic calendar

-

06-04-2020, 12:33 AM #306Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

OIL: it started

More at: https://bit.ly/2wgHLRb

02.04.2020

Very short: WTI oil trades above $25 just after $20 in the morning!

Why? Two things: China's recovering economy is demanding oil, and Donald Trump is calling on Saudi Arabia and Russia to cut supply by 10mln bpd (no surprise Saudi Arabia calls for an emergency OPEC+ meeting now). Be careful and use the situation!

WTI.png

-

06-04-2020, 12:36 AM #307Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Oil industry: Donald Trump’s 2 tweets boost the price

Check it at: https://bit.ly/3bSV0GJ

03.04.2020

Yesterday we saw how WTI oil prices jumped up after Donald Trump’s 2 tweets and reached the 25.30 mark. Today the WTI price went even higher and now it’s 27.32 dollars per barrel. There is definitely an upward trend, breaking through 23.6 Fibonacci level at the 26.85 mark and two lines of Moving Average, 50 and 100, respectively.

How did the oil war get started?

The Organization of Petroleum Exporting Countries met in early March and failed to agree on the amount of oil supply cut amid the coronavirus outbreak. It meant that starting April 1 all the members could pump as much oil as they want. As a result, both unlimited supply and reduced demand (because of lockdowns for many economies around the world) cause oil prices to fall dramatically.

What is the forecast for the oil market?

The OPEC+ meeting will be hold on April 6. It’s expected that Russia and Saudi Arabia will negotiate and cut oil production to raise the WTI price to nearly 30 dollars per barrel. The United States has traditionally not been a part of these kinds of meetings, but its new status as the world’s largest oil producer, coupled with its particularly expensive method of extracting oil, means that things could be about to change.

-

07-04-2020, 03:01 PM #308Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Trading bootcamp for free

There's going to be a virtual trading bootcamp starting from tomorrow from this broker (FBS). May be a good opportunity to learn or practice

https://www.facebook.com/financefreedomsuccess/

-

07-04-2020, 03:45 PM #309Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Can you win with the AUD?

More at: https://bit.ly/39LJxqZ

06.04.2020

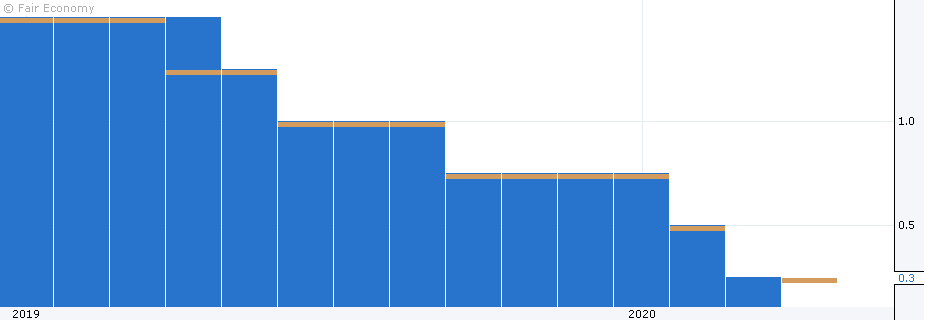

RBA Rate Statement is released on Tuesday at 07:30 MT time.

Instruments to trade: EUR/AUD, AUD/USD, GBP/AUD, AUD/JPY

Australian monetary policymakers already slashed the interest rate twice in March. By reducing it to the current level of 0.25%, they tried to enhance the domestic economic environment and give it the maximum possibility to recover from the coronavirus. Given the fact that the Chinese economy – the main trade partner of Australia – is already gaining back its powers, Australia should have an improved economic outlook by the time the new rate is released. The Reserve Bank of Australia (RBA) explained that there will be no intention to raise back the rate until inflation gets to 2-3% channel and full employment is reached.

If the rate is held steady at the current level, the AUD will rise.

Otherwise, it will fall.

Check the economic calendar

-

07-04-2020, 03:48 PM #310Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Emergency in Japan as coronavirus spreads

https://bit.ly/39Qd6Yv

07.04.2020

Instruments to trade: USD/JPY, CAD/JPY, AUD/JPY

Coronavirus pushes to recession countries one by one. This time it gets to Japan, known as one of the world’s hardest working nation.

Soft lockdown in Japan

As coronavirus cases surged in the country, Prime Minister Shinzo Abe declared the state of emergency in the largest population centers that make up almost 50% of GDP, according to Bloomberg.

In fact, the lockdown isn’t as strict in Japan as in other countries today, it’s just a request to stay at home and close businesses, not an order. So, perhaps the downturn of economic activity won’t be so extreme. However, according to Japan economists, people will take it seriously this time.

Government measures

Moreover, Japan Prime Minister will rescue the country’s economy by almost 1 trillion US dollars stimulus package equal to 20% of Japan's economic output. It’s more than double the amount Japan spent following the crisis in 2008.

Forecast

Many economists believe that Japan has already fallen into recession because of export declines, supply-chain disruptions and travel bans. There are fears that economy is going to shrink close to 20% in a lockdown.

As we could notice, if coronavirus cases rise, the stock market volatility rises too. As a result, Japanese yen may lose its safe-heaven status.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Tags for this Thread

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

6Likes

6Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote