What is pulling the stocks down?

More at: http://bit.ly/2PjEsih

18.02.2020

The earnings season has come to an end, but that does not stop the news, which moves the stock market. Indeed, coronavirus fears continue to determine the risk sentiment in the markets. The outcome of the quarantine measures is already visible from the recent researches and the fresh announcement by Apple. Below we outlined the main disappointments for the stock market right now.

Disappointment number one: Apple

The big news from Apple seemed to affect everything. The European stock market fell lower with the gap down of DAX 30, the S&P 500 is targeting the levels on the downside, too. The safe-haven currency pairs got stronger and the oil prices fell. The risk trading is held on the pause and soon we will see how the American stocks reacted to that report as well. What is so special about the revenue update by Apple that drives the markets crazy? Of course, it is the figures. Before the outbreak of coronavirus, Apple set the target revenue in the range between $63 billion and $67 billion. Now, according to the guidance by the gadget producer, the company does not expect to meet its revenue target due to the slowdown and lower smartphone demand. The thing is, Apple has great exposure to the Chinese market and has production facilities there. That is why it is not a surprise that the long-lasting Chinese New year “holidays” affect the company’s performance. At the same time, the sales outside China have been quite strong, according to the report.

After the American market’s opening, the stock of Apple gapped down to the $309 support but immediately regained strength towards the $325 level.

Disappointment number two: Walmart

The US retail corporation showed weaker earnings data this quarter. EPS missed estimates with $1.38 (vs. the expected $1.43) and the revenue also disappointed the markets with $141.67 billion (vs. $142.4 billion forecast).

At the moment, on the daily chart of Walmart, the key levels for bears lie at $117 and $115.7, while the upside momentum may be limited by the $119.4 and $120.7 levels.

Disappointment number three: General Motors

The company is reportedly leaving the markets of Australia, New Zealand, and Thailand in order to focus on more productive markets. Among GM’s plans is the selling of the Rayong factory in Thailand and withdraw the Chevrolet brand from there by the end of 2021.

The price of GM opened much lower on the daily chart but managed to recover towards the $35 level.

Please visit our sponsors

Results 291 to 300 of 370

Thread: Forex daily News FBS

-

23-02-2020, 08:20 PM #291Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

-

23-02-2020, 10:42 PM #292Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Coronavirus vs Forex: status update

Check the charts: http://bit.ly/2wHGSkr

20.02.2020

Stats

As of now, the number of deaths due to Coronavirus has exceeded 2000 people and the total number of infections is more than 75000 people across the continents. Most of these, obviously, are in China, where authorities are trying to counter the economic consequences of this disaster through direct financing and control. So far these measures have had limited effect and certain sectors of the Chinese economy were reported to operate at 50% capacity. With most of the countries in the world having China as a top trading partner, that will bring dire consequences.

Gold

Gold left the pulling power of $1,550 which has been holding it since the beginning of the year. Currently, a Troy ounce trades at $1,605, which, first, is above the strategic $1,600 long waited by many to be crossed, and, second, is at a 7-year high. Therefore, from the XAU/USD standpoint, Coronavirus is no little thing. Of course, $1,800 is still too early to be aimed at, but let’s remember: just a couple of months ago, in Autumn-2019 was at $1,450 – almost as far away from the current level as the latter is from the all-time highs. It will be fair to say that gold will have full ground to as high as that if the Coronavirus is not contained in the nearest future.

EUR/USD

In general, the US dollar is as great now against other currencies as EUR is unwell. In summary, the USD has both internal and external factors now supporting it, while EUR has almost all the factors against it. Currently, EUR/USD is traded at 1.0787 – that’s where it has been last in Spring-2017. 3-year low – that’s a serious case. Lower ahead, there are only supports of 1.0560 and 1.0350, left from Autumn-2016. And the facts say these are not far away.

USD/JPY

The Japanese yen finally lost its ground against the USD. That’s due to a notable economic contraction in Japan and the Coronavirus indirect impact on the Japanese economy, while the US dollar rises on strong domestic indicators and increasing flight-to-safety demand for it as a reserve currency. The sluggish uptrend market in the chart has been broken recently by an aggressive leap up. Currently, USD/JPY trades at 111.70, looking at the resistance of 112.40, which is a 1-year high. Very likely, it will be there quite soon.

USD/CNH

Against the Chinese yuan, the US dollar trades at 7.022. That’s above the critical level of 7.000, but since the last week of January that doesn’t alarm anyone more than it has already. If the crisis develops the same manner it has been during this week, do not be surprised to see the resistance of 7.0400 be broken in the nearest future.

Conclusion

The fact that people die because of the Coronavirus is a tragedy. The direct global economic damage because of the production, supply and service shortages in China is an obvious problem. But the tricky part is that the more Coronavirus is raging out there, the larger its long-term impact is going to be. So it is the accumulation effect that is hiding behind the frontlines of quarantined families in Wuhan and canceled flights to China. It will come to light, however, once the crisis is over and the victory over this disaster is announced.

-

23-02-2020, 10:45 PM #293Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Important events on February 24-28

More news: http://bit.ly/39YOFbO

24.02.2020

No way around it

It’s not an event, but a heavy presence out there. And in the absence of loud economic meetings or announcements for the last week of February, this presence becomes even heavier. Coronavirus has been having the global market under pressure for more than a month now. Whatever the dynamic of the counter-measures, the echo of this natural disaster will keep resonating for quite a while. During the week, we will be receiving messages from that front, especially for the Chinese side, both in terms of medical assistance to the population and economic revitalization of the country. As of last week, observers commented that the tip of the crisis has not been reached so far.

US: auxiliary indicators

There will no major indicators released from any side, by some of those released this week are worth checking. From the US, we will have CB Consumer Confidence (Tuesday, 17:00 MT), Durable Goods and Preliminary Quarterly GDP (Thursday, 15:30 MT), Crude Oil Inventories (Wednesday, 17:30 MT), PCE Price Index and Monthly Personal Spending (Friday, 15:30 MT) and Chicago PMI (Friday, 15:30 MT). All these indicators combined provide comprehensive information on the status of the American economy from all sides: production, inflation, retail, and energy. The recent domestic economic achievements of the US have been quite remarkable, so the question is whether this country will be able to keep the pace of expansion on all sides in view of the Coronavirus' indirect impact on it.

USD

As we speak of the US, the media almost unanimously predict that the US dollar has all it needs to keep growing against all its counterparts in Forex. The euro has basically nowhere to go but to lose its positions to the USD. The Japanese yen, although normally regarded as safe-haven, loses value on weak domestic economic indicators in Japan and due to the impact from the suppressed trade activity from the Chinese side. The British pound, despite a slight correction upwards at the end of the week, follows a larger downtrend and also domestically has a lot to worry about.

Gold

There is no event related to gold next week. In fact, there is hardly any event ever that would be concerning specifically gold. But it definitely will be an event if the Coronavirus pushes the price of the precious metal to reach $1,700. While we speak, it trades within the 7-year-highs zone, and a mere $200 separates it from its all-time high. Crossing $1,700 would be a sure sign that the shining metal is on its way there.

-

24-02-2020, 01:38 PM #294Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

The assets wrap: the best, the worst, and the most volatile

Check the charts: http://bit.ly/3c2Uk2y

24.02.2020

Another week was full of coronavirus fears, which moved the markets a lot. Let’s consider the best and the worst-performing assets as Monday’s session kicks in.

The best performers

Among the best-performing currency pairs, we need to highlight the USD/BRL pair. The USD strengthened against the Brazilian real by nearly 950 pips within one week, closing at the all-time-high of 4.3959. The poor Brazilian retail data published on Wednesday and the risk-off sentiment weakened the Brazilian real against the US dollar. If the pair reverses, it’s recommended to pay attention to the 4.3 level.

If you are a trader of major currency pairs, look at USD/JPY. The pair rose from the 109.85 level towards the resistance at 112.1. If the USD continues strengthening this week, bulls will break the 112.1 level and target the next resistance at 112.85. On the downside, there is a strong support level at 109.72.

Among commodities, the safe-haven gold, as well as palladium, was the main gainer. The price for gold rose from $1,582 to $1,584 last week and has opened with a gap up today, moving even higher to the $1,690 level. The next key resistance will be placed at the highs of November 2012 at $1,730. In case of a risk-on sentiment, wait for the reversal to $1,567.5.

As for palladium, the price for this metal jumped by $385.5 and reached an all-time high at $2,829. The key support level for bears lies at $2,247.

The worst performers

Of course, the Australian and the New Zealand dollars faced pressure amid the risk aversion. The AUD/USD pair was going down and tested the levels below the 0.6618. The next support for the pair lies at 0.6443. Bulls need to push the pair above the 0.6618 level in order to reach the 0.68 level faster.

The kiwi was down by 143 pips last week, moving lower t the support at 0.6284. If this level is broken, the next support will lie at 0.6155.

Also, GBP/USD was among the weakest pairs last week. It fell from the opening price of 1.3034 to the lows at 1.2848. The closest support lies at 1.2832. The next one will be placed at 1.2726. The upside momentum will be limited by the 1.3053 level.

The award for the most volatile pairs go also to exotics: USD/MXN and USD/TRY showed some sharp moves last week.

What will be the key movers this week?

Follow the news, check the economic calendar and watch the movement of the assets traded on our platform!

-

02-03-2020, 01:18 PM #295Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Important events on March 2-6

More at: http://bit.ly/2IbPKkO

28.02.2020

Will the pandemic be confirmed?

After the heavy selloff last week amid the coronavirus fears, next week is going to be interesting to look at. As the number of cases around the world continues rising, investors keep selling the risky assets and buying safe-havens such as the Japanese yen. We may expect more news, more cases and, probably, more damage to the markets. In case of lighter data, the risk sentiment will recover.

Reserve bank of Australia will publish the statement

The Reserve bank of Australia will release its rate statement on March 3 at 5:30 MT time. The market expects the bank to keep its interest rate on hold at 0.75%. At the same time, it may acknowledge the risks from the coronavirus, which directly hurt its main trade partner – China, and has been already spread globally. If the bank provides a dovish outlook, the Australian dollar will fall to the lows of the 2008 crisis. In case of an alternative scenario, the AUD will strengthen.

Will we see a rate cut by the Bank of Canada?

The Bank of Canada will be the second major central bank to conduct a meeting next week. The meeting is expected on Wednesday at 17:00 MT time. Coronavirus made the overnight index swaps market pricing in a 61% chance of a rate cut. At the moment, the interest rate is held at 1.75%. The rate cut will make the Canadian dollar vulnerable to a further fall. Let’s not forget that the commodity-linked currency is affected by the coronavirus fears and the weakening of the oil prices. On the other hand, hawkish comments will push the Canadian dollar up.

NFP week

The United States will release the level of non-farm employment change alongside with average hourly earnings and an unemployment rate on Friday at 15:30 MT time. The forecasts are optimistic: analysts anticipate the NFP to advance by 185K, average hourly earnings to increase by 0.3%, and the unemployment change to reach 3.5% - down from the 3.6% previously. Better-than-expected figures will push the US dollar higher.

OPEC urgent meeting

Next Thursday the countries of OPEC will hold an extraordinary meeting in Vienna. They will decide on further cuts of oil output amid the weak oil prices.

-

10-03-2020, 01:13 PM #296Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Analysts: how about $20 for Brent oil?

Check more: http://bit.ly/2TCYy9N

10.03.2020

Oil market crashed after OPEC+ didn’t agree on production cuts. Brent slid as low as to $31.27 a barrel. WTI hit $27.34 a barrel. Both benchmarks haven’t really started to close this week’s bearish gap. What’s next? Let’s see what bank analysts have to say about this.

BNP Paribas

There will be more volatility in oil prices in the next two weeks as that is when the OPEC’s cuts agreement officially ends. The odds are that during this time oil will remain under pressure. What is happening between Saudi Arabia and Russia is a high-stakes poker game.

MUFG

Traders should be ready for prices staying below $30 a barrel in the second quarter of 2020. The commodity’s price has no support on the downside and may fall below $25 a barrel. Models now forecast quarter-end 2020 levels for Q1, Q2, Q3 and Q4 2020 at $28.6 a barrel, $32.3/b, $35.6/b and $46.1/b, respectively.

Bank of America

Brent oil may temporarily fall to $20 a barrel range over the coming weeks as there’s a big shift in Saudi's approach: the country has started giving discounts and will probably allow inventories to build.

Citigroup

There’s a unique combination of demand and supply shocks that could send prices into the $20s.

-

13-03-2020, 03:09 PM #297Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Gold price has dropped

More at: http://bit.ly/2QsESnl

12.03.2020

What happened?

Gold has been falling since the start of the week. Despite the increase of the coronavirus fears, the precious metal – a well-known safe haven – depreciated. XAU/USD reversed down from the $1,700 area and dropped to $1,586 at the moment of writing (March 12, 16:00 MT time).

What are the reasons?

The primary reason of gold’s depreciation is technical correction. Earlier the price has risen to the highest levels since 2012, and that was simply too much too fast, so buyers took profit. The previous candlestick on the monthly chart looks very similar to the one currently forming at that timeframe. February’s candlestick has a big upper wick. This means that the price met resistance and wasn’t able to keep going up.

What’s next?

The natural question now is, “Will gold keep falling?”

The answer is, “Yes, the price may visit lower levels”. On the W1, there’s bearish divergence between the price and the Awesome Oscillator. A weekly close below $1,590 will produce a bearish engulfing pattern on the W1. Support is located at $1,557 (September highs) and 1,535 (100-day MA). The next key level on the downside will be at $1,500. Resistance is at $1,600 and $1,650.

Fundamentally, the reasons for higher gold prices are still here: the coronavirus uncertainty, the easing of monetary policy of large central banks. As a result, watch technical levels. If the signs of reversal to the upside appear at the mentioned support levels, consider bullish positions.

-

16-03-2020, 06:44 PM #298Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

BOE rate cut: what's next for the GBP?

Check more: http://bit.ly/38S9EfG

11.03.2020

What?

Today, the Bank of England made an emergency cut of its interest rate. The regulator shifted the interest rate by 50 basis points to 0.25%. The action was driven by a slowdown of the British GDP growth for January (0% vs. 0.2% expected) and the global uncertainties amid the coronavirus outbreak.

UK GDP growth rate

5756767.png

Source: Trading economics

But there is some optimistic news as well. During the press conference, the BOE governor acknowledged the economic shock caused by the virus, but, at the same time, expressed confidence about its temporary effect. Thus, the weakness of the GBP was short-lived, as bulls took over the market on the Mr. Carney’s beliefs.

345.png

Even though GBP/USD plunged below the 1.2864 level, buyers managed to push it higher and help it to retest the 1.2977 level.

What's next?

If you’re the GBP trader there is no time to relax today. The upcoming UK budget update at 14:30 MT time will contain stimulus measures, which are expected to support the economy and businesses. Follow the updates, as they may have an impact on the GBP.

Time to trade on the GBP?

The market presents a wide range of opportunities today. Besides GBP/USD, take a look at the EUR/GBP. This pair may be a good choice for those who don’t want to deal with the USD volatility expected on the US inflation release at 14:30 MT time.

-

16-03-2020, 09:25 PM #299Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Central banks: all as one

More at: http://bit.ly/38QfQ7O

16.03.2020

With emergency meetings taking place every two days, it is becoming irrelevant to anticipate outcomes of the planned economic events. For this reason, let’s just recap what happened recently and try to have a broader perspective.

Rate-cutting spree

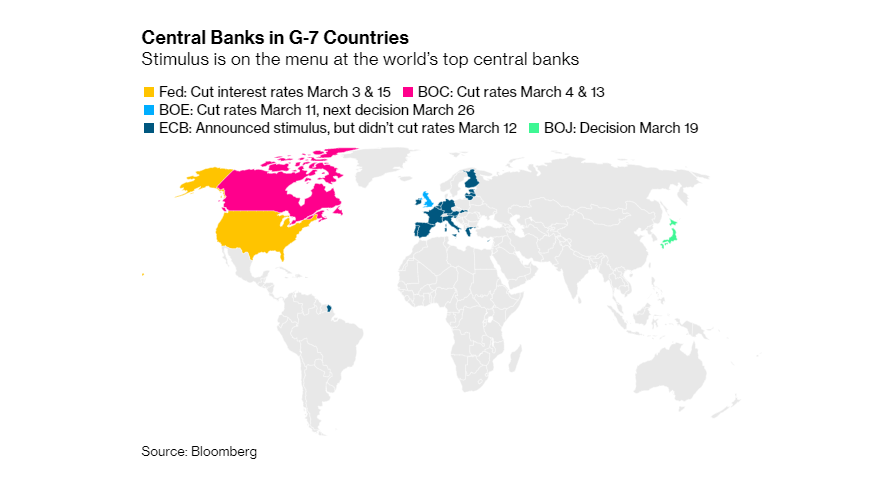

All major central banks have already reacted to the coronavirus fallout by either cutting interest rates or announcing quantitative ease measures – or both. The map below shows what corresponds to the G-7, and note how quickly evolve in the context of the recession fears: this map from Bloomberg’s fresh (this Monday) article only leaves it to the Bank of Japan to take action on March 19 – and the Japanese financial officials have just had an emergency meeting! They left the interest rate unchanged but informed the audience on extensive quantitative ease measures, announcing their full commitment to the G-7 countries to support the level of US dollar liquidity in line with their overseas colleagues.

1.png

Any ace up the sleeve?

Quite controversially, the fact the financial authorities reacted to the coronavirus fallout comes with little consolation. Most of the banks have already fired most of the available artillery at the recession risks. That means, there is very little monetary financial capacity left for the financial authorities of the strongest countries – if any. And that’s while the coronavirus has just started its march into the countries of the most developed and wealthy part of the globe. It appears that the true fight for the global economy will be a test for lengthy economic resilience, and there is normally little chance left for a combatant who fires most available ammunitions at the first strike.

What next?

The US President, a strategic supporter of low domestic interest rate, finally expressed his joy seeing the US Fed cutting the rate to the target range of 0-0.25%. Was Wall Street happy as well? Barely so. Most observers either called for more stimulus or blamed the Fed for panicking and bringing even more run-for-your-life mood into the investors’ circles. Obviously, we are yet to see how the situation around the coronavirus develops, but the currently, financial circles prefer a cautiously modest economic view of the nearest future. Most of the media prefer to view the situation as multi-alternative and restrain from direct predictions. In the meantime, Goldman Sachs sees S&P dropping to 2000 as one of the scenarios. Currently, it is at 2666, which is 21% lower than its recently left all-time high of 3400. So let hope for the best, prepare for the worst, and use the opportunities we have now!

-

17-03-2020, 03:06 PM #300Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Australian job data: the ray of hope for the AUD

More at: http://bit.ly/2WkmvVa

17.03.2020

Australia will publish an update on employment figures on March 19, at 2:30 MT time.

Instruments to trade: AUD/USD, AUD/JPY, AUD/CHF

If you are tired of coronavirus-related news, we recommend you to take a look at the economic calendar. Some of the opportunities may not have as a big effect on the currencies as during the calm times, but traders may still take advantage out of their outcome. One of them is the employment data for Australia, which consists of employment change and the unemployment rate. The previous release was mixed: while employment change advanced by 13.5K, the unemployment rate rose to 5.3%. The reaction of the AUD was limited. What can we expect this time?

If the actual level of employment change is higher and the unemployment rate is lower than the forecasts, the AUD will strengthen;

If the actual level of employment change is lower and the unemployment rate is higher than the forecasts, the AUD will weaken.

Check the economic calendar

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Tags for this Thread

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

6Likes

6Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote