TESLA: up to $500 per share or not so fast?

More at: http://bit.ly/39NUtpx

06.01.2020

What happened

On December 30, Tesla celebrated its first Model-3 vehicle moving off the company’s first overseas plant in Shanghai, China.

What does it mean

Tesla is trying to conquer the Chinese market, being an electric vehicle production pioneer. This goal is pursued because the company sees the strategic importance and vast potential of the Chinese consumer demand. Reaching a success here would mean that Tesla is truly going global.

However, there are various factors against that: a general drop in the Chinese domestic consumer demand as a trade war echo, a mid-term drop in the electric vehicles demand among the population, the vehicles may be affordable for a narrower market segment than what the company expects, the company’s own financial bumps, competitors and others.

Where are we now

The company stock price broke through the previous all-time high of $390 in the middle of December. On the daily chart, $435 per share was reached in one leap, followed by a brief correction down to $403. However, the mentioned first Model-3 appearing from the Tesla Shanghai factory gates pushed the price up again. Consequently, it is now at the current all-time high of $443 per share.

Where is it going

Now, all eyes will be on Tesla’s Chinese sales dynamics. If these go well, eventually, that will prove that the company’s strategic decision to tap into China’s market was the right one. If it happens, the company stock will indeed has all it takes to reach $500 per share as analysts forecast. If not, we will see what else Elon Musk has up his sleeve.

Before you go

You can trade Tesla stock in line with other stocks FBS offers.

To do that, you need to:

Open MT5 account in your FBS personal area.

Make a deposit.

Download MT5.

Log in and start trading.

Please visit our sponsors

Results 281 to 290 of 370

Thread: Forex daily News FBS

-

07-01-2020, 03:23 PM #281Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

-

08-01-2020, 02:03 PM #282Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

GOLD: bullish move on US-Iran conflict escalation

Follow the markets: http://bit.ly/39LUxWR

08.01.2020

Missiles landing, plane crashing

Missiles have landed today at US airbases in Iraq. This was Iranian retaliation for the killing of elite Quds Force commander Qassem Soleimani by American forces. Another piece of news was that a plane bound to Ukraine crashed in Iran with all passengers and staff dying. No surprise, gold rose to $1,600 as investors seek refuge and hedge their risks against market drawdowns.

Broader consequences

$1,600 may not be the end of it. Analysts at Goldman Sachs say that gold may reach $1,625 this quarter if the Middle East crisis persists. Notice though that even this forecast may be too modest: if the price fixes above the Fibonacci level at $1,585, the next one will be as high as at $1,730 – that’s $145 above the current price!

What's next

The US President Donald Trump did not specify the losses of the US bases. On the contrary, he tweeted “so far, so good!” and promised to give a speech today. Hence, this seems to be the major event to look forward to. At this moment, gold is correcting to the downside a bit, but the situation has all the prerequisites to put further pressure down on the USD and keep pushing the precious metal higher. The medium-term outlook for gold will remain positive as along as the price remains above the 2019 high at $1,557. Therefore, it’s a good moment to buy the precious metal and look forward to what the US president says.

-

10-01-2020, 04:40 PM #283Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Main currency pairs: closing the week

Check the charts: http://bit.ly/35G982H

10.01.2020

Friday rolls in, closing the first market week of the year 2020. Below, we briefly go through the opportunities this day offers for some key currency pairs in view of important events of the previous and coming days.

USD: all set for the NFP

Of course, markets wait for the Non-Farm Payrolls (out at 15:30 MT time). The overall situation for the US dollar looks positive for various reasons. First, the fears of the conflict escalation with Iran have subsided, losing the focus of the audience and letting the risk appetite get back from safe-havens. Second, the US-China deal is on the way, with the Chinese officials planned to visit Washington DC next week and finally sign the deal on January 15. Third, the recent economic indicators released by the US authorities give a good impression, not to mention surprisingly strong data on the previous NFP.

Hence, let’s see if USD manages to break some of the local barriers after the obstacles get removed from its way up. Against the JPY, 109.70 has been the resistance level capping the bullish moods since May 2019. Last, two months show that the currency pair has been testing this line again and again. Will today be the breakthrough?

Against the EUR, the price is testing the support of the 200-period Moving Average. Also, that is where the bottom line of the December uptrend is located – EUR/USD went into consolidation there at 1.1106. Will this trend be broken as well, leading to the reversal upwards? Let’s see what the NFP brings.

EUR/GBP: dotting the “I’s” for Brexit

The future is finally decided. Boris Johnson’s EU Withdrawal Agreement has been approved in the House of Commons and passed to the House of Lords. 31Jan confirming the end of the relationship is now merely a formality. Now, all eyes will be on the course of negotiations between the UK and the EU. The European Commission President Ursula von der Leyen said it will be almost impossible to have all the points negotiated until the end of 2020, so the fears of a bad Brexit are amassing. On the other side, the Eurozone’s own economic indicators are not that good, although there are signing of the European economy picking up the pace. That’s why we see EUR/GBP struggling to decide where to go, right in the crossing area of the Moving Averages at the level of 0.8500. Which direction it will choose? So far, the table is tilted towards the EUR more.

AUD: lands on fire, currency rising

Against all odds, the AUD is rising. While the bushfires keep damaging the Australian economy and the rumors of the RBA going dovish in February are voiced out among the observers, the AUD/NZD grows to 1.038 to test the 50-period Moving Average. If that resistance is broken and the currency manages to climb above 1.0400 to challenge the 100-MA, it will move into the upper part of the downtrend prevailing during the last month and possibly challenging it later on.

-

13-01-2020, 12:31 PM #284Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Important events this week will bring us

More at: http://bit.ly/2tclgeB

13.01.2020

American and British consumer prices

The market awaits the US consumer prices on Tuesday at 15:30 MT time (12:30 GMT) and the British CPI on Wednesday at 11:30 MT time (9:30 GMT). No major surprises are expected by analysts: while the American headline and core CPIs are anticipated to advance by 0.2%, the British consumer price index may reach the same level as during the previous release, showing the increase by 1.5%. As usual, higher-than-expected figures will bring positive momentum to the USD.

In the end, it needs a sign

Donald Trump plans to meet with the Chinese side on Wednesday, where he is going to sign the “phase one trade deal”. Despite the optimism on the agreement, the details of the document have still not been announced and reportedly remain under review. We expect the comments by both sides and the final details of the deal. As it may fail to meet the market’s expectations, Wednesday’s trade will largely depend on the risk sentiment.

The risk may also be affected by the US-Iran tensions after the latter admitted it shot down a Ukrainian airliner by mistake.

Retail sales of the US

The week will be highlighted by yet another important indicators for the United States, which are retail sales and core retail sales. The indicators will be published on Thursday at 15:30 MT (12:30 GMT). Analysts are optimistic in their forecasts; both headline and core indicators are anticipated to rise by 0.5% and 0.3% accordingly.

Earning reports by the US banks

This will be the first earnings week of 2020 with Citigroup and JPMorgan releasing their financial results on Tuesday and Alcoa with the Bank of America on Wednesday. While JP Morgan is forecast to release the revenue of $27.96 billion and EPS equaled 2.37, experts suggest Citigroup posting EPS of 1.86 and the revenue of $73.9 billion. At the same time, the earnings of Alcoa are expected to decline, with a revenue of $2.48 billion and EPS of -0.21.

Exotic currencies are under the spotlight

The Bank of Turkey and the South African Reserve banks will hold their meetings on Thursday. The decisions by the regulators may affect the TRY and the ZAR.

-

20-01-2020, 12:24 PM #285Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Important events this week will bring us

More at: http://bit.ly/2tCanmp

20.01.2020

How does the year begin for Australian consumers?

Westpac Consumer Sentiment will be announced at 01:30 MT time on Wednesday (Tuesday, 23:30 GMT). This indicator shows the overall economic activity status in the country through polling more than 1000 households and obtaining their feedback on past and future economic conditions. The December release was at -1.9; if this week’s indicator comes higher than forecast, it will mean an improved economic outlook.

Jobs data will be released at 02:30 MT time (00:30 GMT) on Thursday. Almost 40K jobs added referring to November were much more than what the market expected, for December analysts look for 11.2K new jobs. If the actual figure outperforms the forecast again, the AUD will be supported.

BOC takes the word

The Canadian interest rate will be announced at 17:00 MT (15:00 GMT) on Wednesday. No change is expected to the current level of 1.75%, so the main focus will be at the BOC’s press conference following at 18:15 MT (16:15 GMT). If there are dovish notes, CAD may be under pressure down.

How long quantitative easing will continue?

ECB’s press conference will be at 15:30 MT time (13:30 GMT) on Thursday, after the interest rate announcement at 14:45 MT time (12:45 GMT) the same day. Also, a separate speech by the ECB president Christine Lagarde is scheduled at 11:30 MT time (09:30 GMT) on Friday. As there is no change foreseen for the rate itself, the audience will wait for the hints in the speech of the ECB President, particularly to outline the quantitative easing that the policymakers have been pressing on. Continuation of this line drives the EUR down.

The Brexit year begins for the British economy

The British PMI will be released at 11:30 MT time (09:30 GMT) on Friday. While the ECB President is unveiling the economic outlook for the Eurozone, the GBP will receive something to move on. The forecast referring to the month of December is slightly higher than the figures of the previous release for both the manufacturing and service sectors. If the results outperform what the market expects on Friday, the GBP will receive a boost.

Lastly

Using these events, you may trade AUD/USD and USD/CAD, referring to the Australian and Canadian indicators, and EUR/GBP within the context of the announcements from the UK and European economic authorities. However, other pairs with the mentioned currencies will be affected as well. That's why we welcome you to follow the news with FBS and see particular trade ideas offered daily.

-

22-01-2020, 02:44 PM #286Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Retail data may shake the loonie

More at: http://bit.ly/2TOVQP0

22.01.2020

Canada will publish the headline and core retail sales on January 24 at 15:30 MT time.

Retail indicators show the change in the total value of sales at the retail level. The main difference between the headline and core indicators lies in the fact, that the latter excludes automobile sales due to their volatility. Last time both indicators came out much lower than the projections. While the forecasts were quite optimistic, the actual figures showed a decline. The retail sales fell by 1.2%, and core retail sales - by 0.5%. As a result, the Canadian dollar moved down. Will we see a different outcome this time?

• If the indicators are greater than the forecast, the loonie will rise;

• If the indicators are lower than the forecasts, the loonie will fall.

Check the economic calendar

-

27-01-2020, 12:36 PM #287Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

The sell-off across the markets

More at: http://bit.ly/3aOfFfg

27.01.2020

The week has started with a cautious note, as the news surrounding coronavirus combined with the attack of the US embassy in Baghdad increased the risk-off sentiment in the markets.

Coronavirus is spreading

What is a coronavirus and how it affects the markets? You can read more about it in our recent article. Long story short, it is a deadly pneumonia-like disease that started in the food markets of middle China. China has already reported more than 2,700 cases of coronavirus. The country even extended the Lunar New year holiday after the reports of 80 confirmed deaths. And while the doctors are looking for a cure, the spread of the virus continues.

The attack of the US embassy

Five rockets crashed near the US embassy in Iraq amid the wide protests in the country. The demonstrators have been demanding the removal of the ruling elite and an end to foreign interference in Iraqi politics.

The market reaction

The risk-weighted assets reacted immediately to the news. Of course, the initial reaction has been visible on the USD/CNH chart. The pair gapped up towards the crossover of the 200- and 50- day SMA at 6.9795. At the moment, bulls are targeting the next key resistance at 7.014. The key level on the downside will be placed at 6.9525. The next one is 6.92.

Against the USD, the Australian dollar gapped down towards the 0.6770 level on the daily chart. Strong bearish pressure may pull the pair lower to the 0.6750 level. The upside momentum will be limited by the 0.6820 and 0.6855 levels.

USD/JPY has been showing a mixed performance. After the opening below the 50-day SMA and the 109 level, bulls have been trying to take back their positions. On the other hand, bears are still trying to pull the pair as low as the 200-day SMA at 108.47. The next key support will lie at 108.25.

Gold has retested the highs of early January around the $1,585 level. Increased risk-off sentiment may push it higher towards $1,600. On the downside, there is support at $1,538.

Oil prices opened much weaker, too. The price of Brent fell to the lows of last October, looking forward the support at $58.2. The next key level for bears will lie at $57.3. Bulls need to push the price above the $60 level to get back their positions.

WTI inched lower, too. Right now the price is moving down towards $51.85. The next support in focus will be placed at $51. The key level for bulls is placed at $54.

-

28-01-2020, 12:02 PM #288Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

PFIZER: will it repeat the jump?

Check the charts: http://bit.ly/2U2ZC7r

28.01.2020

What?

The famous pharma giant Pfizer is going to release its earnings report on January 28 at 17:00 MT time. According to analysts, the company will post a revenue of $12.61 billion and EPS of $0.57.

Why is it important?

The current release will show whether the merger of Pfizer’s off-patent drug unit Upjohn with drug-producing company Mylan brings any positive results. While some analysts anticipate the deal to be powerful enough for a company to stay strong in the challenging pharmaceutical market, others are being more skeptical. They expect to see any significant effect only in 2023. Of course, the optimistic comments on this topic during the conference call on January 28 will be appreciated by bulls.

The previous release

During the previous release, the revenue reached $12.68 billion, while EPS came out at $0.75. The figures were greater than analysts’ expectations. Also, the company raised its 2019 forecasts. According to it, the revenue will reach $51.2 to $52.2 billion (vs. $50.5 to $52.5 previously) and EPS $2.94 to $3 (previously $2.76 to $2.86).

As we can see in the picture below, the price of Pfizer stock jumped on the release from $37.27 to $38 and managed to rise as high as $38.75 within a day.

If the actual figures outperform the forecasts this time, we may see a similar scenario.

Key levels for Pfizer stock

On the daily chart, the price of Pfizer is trying to stick above the 200-day SMA. The positive earnings report will push the stock above the $40.86 level towards the next resistance at $41.8. The downward momentum will be limited by the $38.67 level.

What should you do now?

Get ready for the release at 17:00 MT time and follow these easy steps

Open the MT5 account in your FBS personal area

Make a deposit

Download MT5

-

31-01-2020, 12:14 PM #289Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Friday: closing January 2020

Check the charts: http://bit.ly/37L7zSW

31.01.2020

Not only humans

From a “planetary” perspective, an event such as a new virus outbreak is supposed to happen every now and then. The evolution still goes on, and the fact that humans are the most successful and advanced species does not mean that other species have stopped their development in the background. In fact, there are particular beings in the organic world that keep competing with the human race since ages – the viruses. Now, it is Coronavirus. “Came” fast, stroke hard, and reigning already cross-continent in a matter of two weeks.

Source: Bloomberg

As of now, there are almost 10,000 confirmed Coronavirus cases across the world, with the majority registered in China as the initial territorial source. Out of these, more than 200 are deaths and 1500 severe.

As a result, flights were halted, borders were closed, production was stalled, markets were suppressed. Obviously, the Chinese economy has to endure the strongest impact. However, other countries suffer also, proportionately to their ties with China and involvement in the global economic process.

The World Health Organization declared the virus outbreak as a global emergency recognizing the gravity of the situation and the rising toll of the infected. Hence, the crisis is still on, and it is far from being dealt with, but the tone of the announcement by the WHO was more confident than what it could have been. The impression is therefore heavy, but not yet the panic mode. Based on this, we can assume that the flight to safety will keep guiding the stock and Forex markets, but we need to be cautious when predicting the exact levels to which safe-haven currencies can rise and stock fall. In any case, USD, JPY, and CHF are expected to be in the focus of the Forex market investors.

In the parallel universe

Like there are no concerns, Amazon announced its breakthrough sales during the holidays, to the joy of investors and amusement of the market. The stock is on the rising curve now, trading at the level of $1,871 per share and aiming at the resistance of $1,888. If it crosses that level and climbs to $1,900, we may well interpret it as a mid-term trend reversal. Supports of $1,865 and $1,835 will be there to check the opposite potential.

The British Isles

A very interesting combination of news is keeping the focus around the UK. Yesterday, the EU Council has adopted the Brexit document, which was the last formality concluding the process. Today, at midnight MT time the transition period comes into force. The UK PM will give a speech over Brexit and the UK economy, probably encouraging the population to unite around the country’s advancement in this period (and with this, trying to solidify his political positions as well). Lastly, the Bank of England announced the interest rate unchanged at 0.75% as voted 7-2. However, it pointed out serious economic weakness points – we will see how Boris Johnson will address that.

Amidst all this, the GBP has been growing stronger against the Euro. Currently, the currency pair is trading at 0.8400. The closest support lies at 0.8280, the December low. It seems unlikely for EUR/GBP to go straight to there even with the good information layout, but that will be a mid-term aim for the currency pair. If the GBP loses its positions, the local resistance levels will be at 0.8450, 0.8470 and 0.8510.

Safe like Canada?

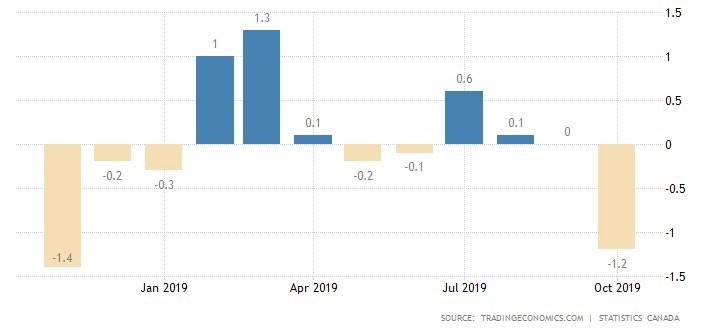

Today, Canada announces its monthly GDP growth rate at 15:30 MT time. The tendency over the year was a decline in this indicator. Hence, it would be inspirational for the CAD to see a better-than-expected performance of the Canadian economy.

Since the very beginning of the year, the USD/CAD has been showing nothing but appreciation of the US dollar against the CAD. If there is no good news for the Canadian dollar, there are December high of 1.3265 and November high of 1.3325 before the currency pair as resistance levels.

-

20-02-2020, 02:13 AM #290Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

The USD is awaiting the flash manufacturing PMI

More at: http://bit.ly/2V6w2Pd

19.02.2020

The United States will publish its flash manufacturing PMI at 16:45 MT time on February 21.

Instruments to trade: EUR/USD, USD/JPY, GBP/USD

This indicator reflects the economic situation of a country. While it’s just a survey of purchasing managers in the manufacturing industry, their answers tend to show the overall views on the current business conditions within a country. If the indicator is above 50, it demonstrates the expansion of an industry, while an indicator below 50 signals a contraction. Last time an indicator came out at a lower-than-expected level. As a result, the USD fell. What awaits the currency this time?

• If the actual level of indicator is higher than the forecasts, the USD will go up;

• If the actual level of indicator is lower than the forecasts, the USD will go down.

Check the economic calendar

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Tags for this Thread

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

6Likes

6Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote