The selection of the existing broker must be able to be considered properly, this is done so that traders can be more leverage in getting maximum trading security and comfort like what I got from Tickmill.

Please visit our sponsors

Results 3,671 to 3,680 of 4086

Thread: InstaForex Wave Analysis

-

12-10-2022, 02:38 AM #3671

-

12-10-2022, 06:30 AM #3672

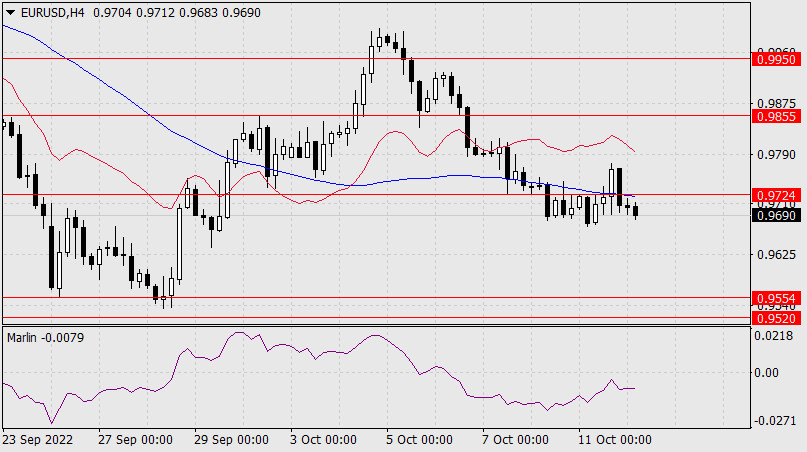

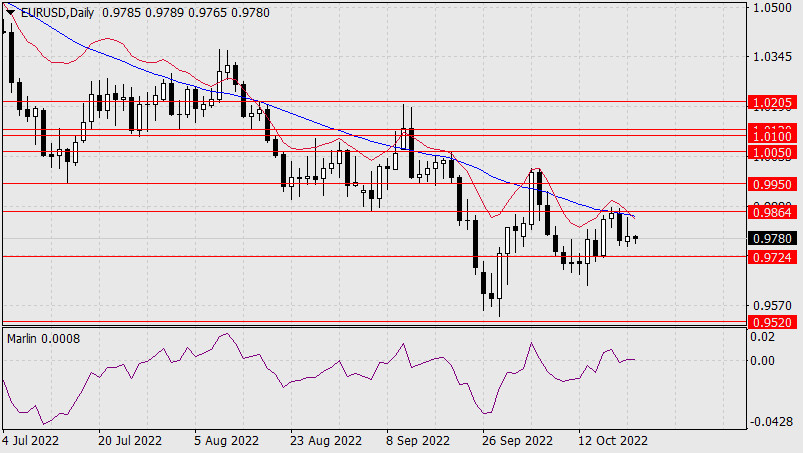

Forex Analysis & Reviews: Forecast for EUR/USD on October 12, 2022

Yesterday, the euro traded in a solid range of 103 points, but the closing of the day was almost at the opening level and in fact the price settled on the daily chart, under the key level of 0.9724. As a result, now we are waiting for a more confident price decline to the level of 0.9520.

Eurozone industrial production data for August will be released today. An increase of 0.6% and an improvement in the annual rate from -2.4% to 1.2% y/y are expected. Market participants will be drawn to today's release of the FOMC minutes from the last meeting - investors need to find out if their federal funds rates are justified in the 78% probability of a 0.75% rate hike at the Federal Reserve meeting on November 2.

On the four-hour chart, the price consolidated under the MACD line and under the level of 0.9724 now after a false exit above these lines. We look forward to continuing the chosen course. Not far from the target level of 0.9520 is an intermediate target of 0.9554 – the low of September 26th. The level is strong, so the target of the movement can be defined as a range of 0.9520/54.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex.

Read More

-

13-10-2022, 06:42 AM #3673

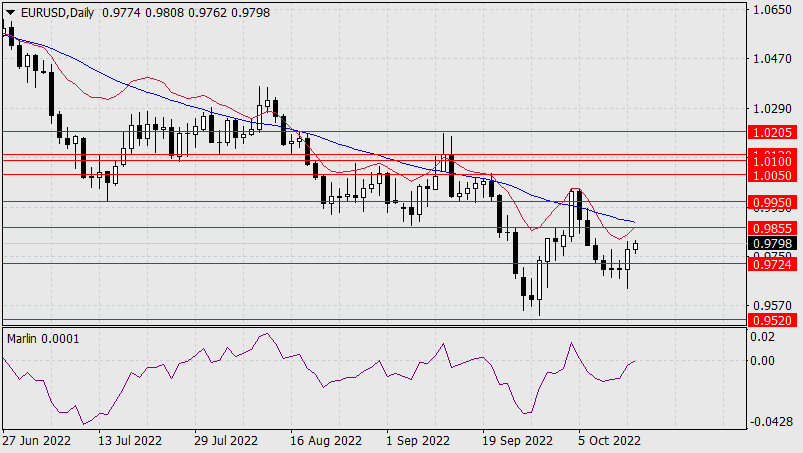

Forex Analysis & Reviews: Forecast for EUR/USD on October 13, 2022

Yesterday's publication of the minutes from the last Federal Reserve meeting showed a rather hawkish mood of the members of the monetary policy committee, but the markets practically did not react to it, if we do not take into account a brief revival at the time of the immediate release.

Today the focus will be on US inflation data for September. Core CPI is projected to rise from 6.3% y/y to 6.5% y/y, headline CPI is expected to decline to 8.1% y/y from 8.3% y/y in August. If we add to these mixed forecasts the expected increase in initial jobless claims, which is expected to increase from 219,000 to 225,000, that is, with a jump above the one and a half month data, then preferences for long positions on the dollar will prevail. The price is still consolidating below the 0.9724 level on the daily chart. The Marlin Oscillator is growing, so it is undesirable for the bears to delay pushing through the euro, as the bulls can become more active and consolidate above the specified key level. And the 0.9855 target opens above it. The main scenario assumes a decline to support 0.9520.

On the four-hour chart, the price is generally consolidating under the MACD indicator line. The Marlin Oscillator shows the intention to reverse down from the zero line. We are waiting for the price in the target range of 0.9520/54.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex.

Read More

-

14-10-2022, 06:44 AM #3674

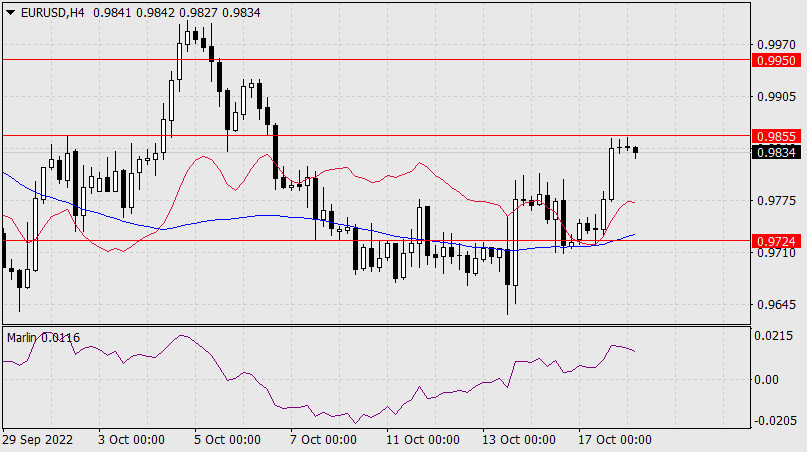

Forex Analysis & Reviews: Forecast for EUR/USD on October 14, 2022

Yesterday was another day of high volatility. The euro traded in the range of 176 points, closing the day with an increase of 74 points. The price has moved above the resistance level of 0.9724, now the 0.9855 target is just ahead. The daily-scale MACD indicator line is approaching the level.

According to the first version of the correction, the growth may end in this area. According to the second option, the growth may continue to the level of 0.9955 - to the low of July 14, which will create a false exit of the price above the MACD line. If later the price returns and settles under the MACD line, then the subsequent decline may be below 0.9520.

The media cite arguments for the euro's growth: the market has fully priced in the Federal Reserve's November rate hike of 0.75% and even the "ceiling" of the rate of 4.85% in March next year. We allow such an interpretation and quote the euro at current levels at a rate of 4.85%, but then political factors should be removed from the components, including the latest event - sabotage at the Druzhba oil pipeline in Poland. Oil rose by 2.44% yesterday, the stock index S&P 500 by 2.60%. That is, there is a short-term return of market players to risk. At the same time, yields on US government bonds are not declining. So far, we are seeing a "shake-up" of the market on US inflation data. Yesterday, the core CPI for September showed an increase from 6.3% y/y to 6.6% y/y, while the overall CPI fell from 8.3% y/y to 8.2% y/y.

On the four-hour chart, the price settled above the level of 0.9724 and MACD line. Growth stopped at the balance line, which shows the consolidation of the "bulls" for a short-term turning point in their favor. Marlin Oscillator is in the growth zone. We are waiting for the end of the correction either at the nearest level of 0.9855 or at 0.9950, which is more likely due to the nature of yesterday's reversal.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex.

Read More

-

17-10-2022, 05:27 AM #3675

Analytische Bewertungen Forex: Forecast for GBP/USD on October 17, 2022

The pound returned to the support of 1.1170 on Friday after British Prime Minister Liz Truss sacked Treasury Secretary Kwasi Kwarteng, who had been in office for just 38 days.

And since the sell-off of the pound was emotional (-148 points), today's opening was with a rising gap. The gap tells us that the market will try to close it, which will mean that the price will go under the support level of 1.1170, and then it may continue to decline to the support of 1.0815 - to the green price channel line.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided byInstaForex.

Read More

-

18-10-2022, 07:33 AM #3676

Forex Analysis & Reviews: Forecast for EUR/USD on October 18, 2022

The main drivers of yesterday's growth in almost all market assets were the British pound and the US stock market. The new Minister of Finance, Jeremy Hunt, canceled the so-called "mini-budget" of his predecessor Kwarteng, on which the currency and debt markets of Great Britain went up. The pound rose by 1.05%, S&P 500 by 2.65%, also growing under the impression of good corporate reports, and the euro by 1.08% (117 points).

[IMG]https://forex-images.ifxdb.com/userfiles/20221018/analytics634e125a0371a.jpg/IMG]

In its growth, the price almost reached the magnetic point of intersection of two lines - the target level of 0.9855 and the MACD line of the daily scale. Now the price has two actions to choose from: consolidate above this level and continue to rise to 0.9950, and turn down to the starting point of yesterday - to the level of 0.9724. The Marlin Oscillator is in the positive area, it tends to continue growing. The difficulty in choosing a direction is also that there are now two opposing investment ideas on the market: to continue buying risk on a positive background of corporate reports and to be careful in this, slowly getting rid of the euro, as amid continuing negative statistics on the euro area, the European Central Bank may raise the rate not by 0.75% but by 0.50% at a meeting on October 27, which, of course, will send the euro unambiguously down.

US industrial production data for September is released today. Forecast 0.1% vs. -0.2% in August. And if the data helps the euro to overcome the current resistance of 0.9855, then this will become an indicator of the mood of investors in the coming days (growth in risk appetite).

The situation is generally on the rise on a four-hour timescale. But in order to stay in the growing trend, the price must consolidate above the resistance. Otherwise, a quick return to 0.9724 may follow. This can happen in the event of sharply negative news.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex.

Read More

-

19-10-2022, 03:15 AM #3677Senior Investor

- Join Date

- Jul 2011

- Location

- www.ArmadaMarkets.com

- Posts

- 4,127

- Feedback Score

- 0

- Thanks

- 0

- Thanked 2 Times in 2 Posts

Each broker has its own advantages and disadvantages. Choose a broker that you think is suitable and in accordance with his trading style. I myself chose the Tickmill broker, in addition to safe capital I can also trade comfortably and safely.

-

19-10-2022, 06:44 AM #3678

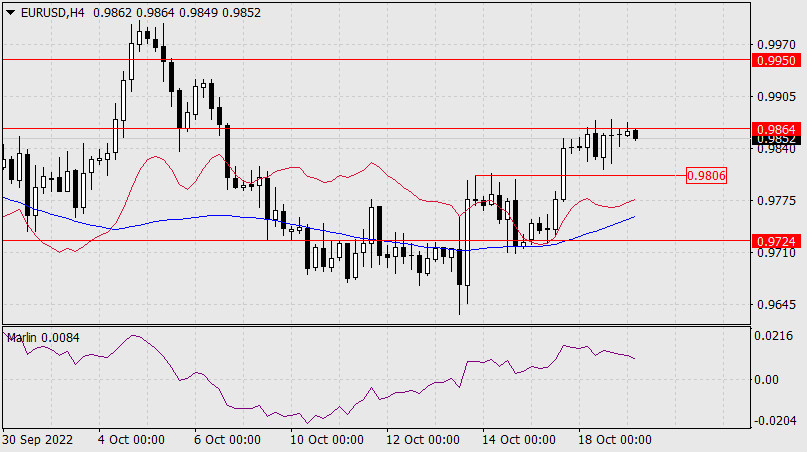

Forex Analysis & Reviews: Forecast for EUR/USD on October 19, 2022

The euro stalled on the strong price level resistance at 0.9864 (September 6 low) in line with the daily MACD indicator line.

The Marlin Oscillator is growing in the positive area, which means that the price is preparing to exit above the resistance. If this attempt turns out to be successful, then the increase may last up to 0.9950/52, the low of July 14th. In order for the price to turn towards 0.9724, it needs to overcome the cluster of peaks on October 13-14 near the level of 0.9806.

The situation is similar on the lower timeframe; consolidating above 0.9864 will allow the euro to rise to the target level of 0.9950, consolidating under 0.9806 will again direct the quote in a downward direction to the target level of 0.9724.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex.

Read More

-

20-10-2022, 09:42 AM #3679

Forex Analysis & Reviews: Forecast for USD/JPY on October 20, 2022

The yen hit an important target at 150.00 (this morning's actual high of 149.96). In addition to being a round number, the target is defined by an embedded monthly timeframe price channel line. Above it are levels with increased frequency, approximately every 80 points.

There were rumors again on the market that the Bank of Japan is preparing another intervention. The technical component also indicates to us a high probability of a price reversal during the formation of a divergence with the Marlin Oscillator. We believe that this is the main scenario for further developments. The nearest target in this case will be the price channel line in the area of 147.40.

A divergence is also preparing to form on the four-hour chart. We will find out later this evening whether the reversal will take place or not.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex.

Read More

-

21-10-2022, 05:14 AM #3680

Forecast for EUR/USD on October 21, 2022

The euro bulls did not want to give up easily yesterday - the trading range was 92 points and the day closed with a white candle of 15 points. On the technical side, the price took advantage of the confusion of the Marlin Oscillator at the zero neutral line.

But already in the Pacific session, yesterday's growth was blocked, the price again rushed to the nearest support of 0.9724, the Marlin Oscillator is pushing through the support of this zero line. A decline below 0.9724 opens the next target at 0.9520.

On the four-hour chart, the price makes a second attack on the support of the MACD line. The price also moved under the balance indicator line, which shows us the shift in the players' mood to sell. The Marlin Oscillator is moving deeper into the downward trend.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex.

Read More https://ifxpr.com/3EWQqJh

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote