JAPAN'S HOUSING STARTS FALL AT SLOWER PACE

Japan's housing starts continued to decline in November albeit at a slower pace, data from the Ministry of Land, Infrastructure, Transport and Tourism showed on Friday.

Housing starts were down 3.7 percent on year, following October's 8.3 percent decline. This was also better than the expected decrease of 4.9 percent.

Annualized housing starts rose to 820,000 in November from 802,000 in the previous month.

Further, data showed that construction orders received by the big 50 contractors decreased 4.7 percent on a yearly basis, bigger than the 0.1 percent fall posted in October.

News are provided by

InstaForex.

Please visit our sponsors

Results 3,171 to 3,180 of 4086

Thread: InstaForex Wave Analysis

-

25-12-2020, 06:19 AM #3171

-

25-12-2020, 06:38 AM #3172

Forex Analysis & Reviews: Forecast for USD/JPY on December 25, 2020

USD/JPY

USD/JPY gained 13 points within the trading range of the last three days. Today the Japanese trading floors are open, at the moment the pair is quoted at 103.54, that is, it is already 14 points lower than yesterday's close. Japanese investors seem to be preparing for a negative turn of events from the opening of the new week. We keep our previous forecast that the price will move under the 103.18 level and its successive decline to 102.35.

The four-hour chart shows that the signal line of the Marlin oscillator has already reached the top of its own wedge. Exit from the wedge, respectively, we wait downward, the oscillator will soon leave the negative zone and accelerate the fall.

Analysis are provided byInstaForex.

-

28-12-2020, 07:17 AM #3173

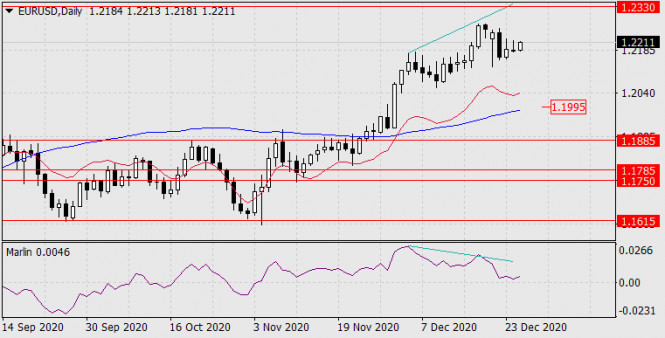

Forex Analysis & Reviews: Forecast for EUR/USD on December 28, 2020

EUR/USD

No significant changes in the market over the past four holidays. The market is thin, and after tense expectations about Brexit, investors want to be compensated for their efforts. Therefore, the price breakdown, which we expected earlier, is possible. If there is no breakout, then we are waiting for calmer movement to the first target of 1.1995 - this is the support of the MACD line on the daily chart. For a more stable decline in price, the transition of the Marlin oscillator to the zone of negative values is not enough. This may happen after the quotes drop below 1.2150.

The four-hour chart shows that the euro's general sentiment is for it to fall, but the signal line of the Marlin oscillator is bent up suspiciously strongly, indicating an intention to enter the positive zone. If this happens, then the price will also surpass the MACD indicator line to the upside, which will entail some more growth in the free roaming area, because the market remains thin. Until it ceases to freely roam around (which will not be long), we are waiting for the downward trend to resume for all indicators.

Analysis are provided byInstaForex.

-

29-12-2020, 07:27 AM #3174

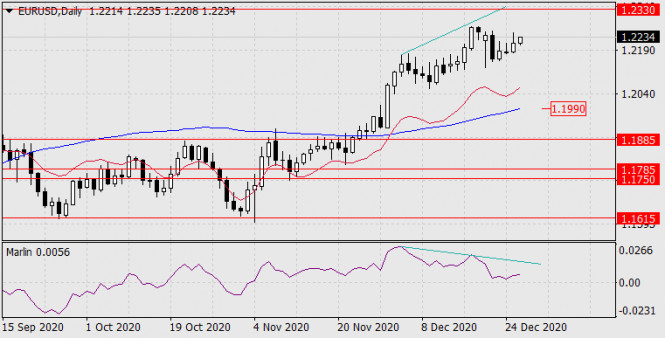

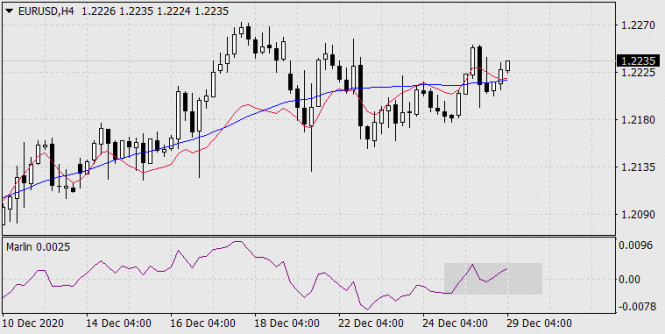

Forex Analysis & Reviews: Forecast for EUR/USD on December 29, 2020

EUR/USD

The euro gained 32 points on Monday, staying in the range of December 22nd. There are fewer signs of a downside breakout. Perhaps there won't be one, the price will spend the final days of 2020 in the range of 18-21. The price divergence with the Marlin oscillator is still present, the first significant target is determined by the MACD line at 1.1990.

The four-hour chart shows that the price winds up on the MACD line, which is also a sign that the price is in the range. The signal line of the Marlin oscillator is similarly curved around the zero neutral line. If the price moves below 1.2180, it will be a sign of the first attempt to break through.

Analysis are provided byInstaForex.

-

30-12-2020, 06:34 AM #3175

Forex Analysis & Reviews: Forecast for AUD/USD on December 30, 2020

AUD/USD

The Australian dollar added 30 points yesterday as the US dollar slightly weakened. Visually, the price shows an intention to reach the target range of 0.7660/75, but the Marlin oscillator is below the lower boundary of its own channel and this factor warns of a high degree of change with this unattainable target.

The four-hour chart shows that there is an increase above the MACD indicator line, which speaks in favor of growth, but the Marlin oscillator has practically fallen into a horizontal trend, which indicates the weakness of the trend, thereby confirming the technical uncertainty of the daily timeframe.

In this situation, it is advisable to wait for clear signs of a trend reversal. Or, to settle above the 0.7675 level when the alternative scenario has been implemented.

Analysis are provided byInstaForex.

-

31-12-2020, 06:17 AM #3176

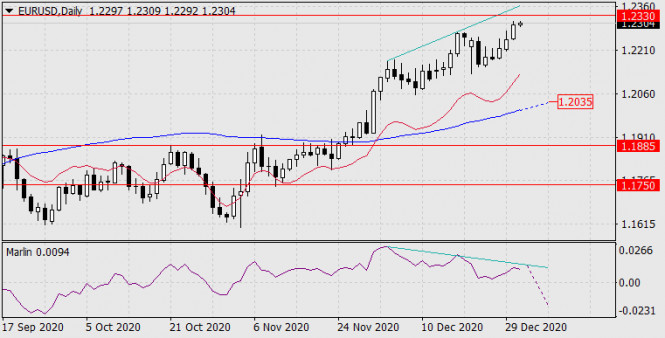

Forex Analysis & Reviews: Forecast for EUR/USD on December 31, 2020

EUR/USD

The euro decided to leave the final days of the outgoing year more beautifully than expected. It continues to grow throughout the week, very little is left to the target level of 1.2330, afterwards a double divergence will be formed on the daily chart and the euro will go into the unknown in 2021.

The first task in the new year is to reach the consolidation range of August-November at 1.1750-1.1885. The first target in order to fall to 1.2035 is the MACD line.

Growth continues on the four-hour chart. There is a possibility of forming a divergence, due to which the signal line of the Marlin oscillator has clearly slowed down its growth and lies a little in the horizon.

Analysis are provided byInstaForex.

-

04-01-2021, 08:17 AM #3177

Forex Analysis & Reviews: Technical Analysis of EUR/USD for January 4, 2021

Technical Market Outlook:

The EUR/USD pair has made new swing high at the level of 1.2309, but the Monday open was below the level of 1.2250 and the price pulled-back towards the trend line support. The Broadening Wedge price pattern is still in progress, so please notice that this particular pattern is a trend reversal pattern, which indicates a possible major correction on the EUR/USD soon. For now, the zone located between the levels of 1.2154 - 1.2177 remains the key demand zone for bulls. The positive momentum supports the short-term bullish outlook as long as the demand zone is not clearly violated. The next target for bulls is seen at the level of 1.2555, but this might be the last push up for EUR/USD before the correction. Any violation of the level of 1.2154 invalidates this scenario.

Weekly Pivot Points:

WR3 - 1.2419

WR2 - 1.2360

WR1 - 1.2290

Weekly Pivot - 1.2236

WS1 - 1.2163

WS2 - 1.2103

WS3 - 1.2035

Trading Recommendations:

Since the middle of March 2020 the main trend is on EUR/USD pair has been up. This means any local corrections should be used to buy the dips until the key technical support seen at the level of 1.1609 is broken. The key long-term technical resistance is seen at the level of 1.2555. The market might be making the Broadening Wedge trend reversal pattern around the levels of 1.2200 - 1.2300. Any violation of the level of 1.2154 supports the trend change/corrective cycle scenario.

Analysis are provided byInstaForex.

-

05-01-2021, 07:22 AM #3178

Forex Analysis & Reviews: Forecast for AUD/USD on January 5, 2021

AUD/USD

The Australian dollar lost around 40 points yesterday, stopping exactly at the December 17 high of 0.7641. We took this level in the last review as a signal to switch to a downward short-term trend with the target of 0.7465. Testing this level confirms its significance.

The signal line of the Marlin oscillator stopped at the lower border of its own downward channel. Obviously, the market did not have enough strength to continue yesterday's trend. Buyers, albeit short-term speculators, still believe in the positive development of risky and commodity currencies, although oil fell by 1.74% (CL) yesterday . We expect the price to drop below the signal level and move towards the target of 0.7465 (December 21 low).

The four-hour chart shows that the price slightly pierced the MACD line and rebounded off the signal level of 0.7641. The Marlin oscillator has entered the downward trend zone and is staying there this morning. We are waiting for the price's second attempt to overcome support at 0.7641.

Analysis are provided byInstaForex.

-

06-01-2021, 07:39 AM #3179

Forex Analysis & Reviews: Forecast for GBP/USD on January 6, 2021

GBP/USD

During yesterday's growth of the British Pound against the background of the general temporary weakening of the Dollar, there was an attempt to get above the target level of 1.3624. The attempt failed and there was only a minor puncture of resistance. Today, in the Asian session, the price played back half of yesterday's growth. The signal line of the Marlin oscillator turned down from the line forming the divergence. The target of the Pound's decline is 1.3325 which is the Kruzenshtern line on the daily chart.

On the H4 chart, the Marlin oscillator is in the negative zone. With the price fixing under the Kruzenshtern line at 1.3578, the road to the marked target of 1.3325 opens to gain more confidence with the departure under the minimum on January 4 (1.3540).

The four-hour chart shows that the price slightly pierced the MACD line and rebounded off the signal level of 0.7641. The Marlin oscillator has entered the downward trend zone and is staying there this morning. We are waiting for the price's second attempt to overcome support at 0.7641.

Analysis are provided byInstaForex.

-

07-01-2021, 07:47 AM #3180

Forex Analysis & Reviews: Forecast for EUR/USD on January 7, 2020

EUR/USD

The euro, as a risk currency, grew yesterday as a response to the information that the Democrats had won a seat in the upper house of the US Congress. At the same time, the latest macroeconomic report from ADP showed disappointing results on new jobs in the private sector - the index showed a decrease by 123,000 in December against expectations of an increase of 60,000 and an increase of 304,000 in November. Some believe that the upcoming data on unemployment will come out even worse; the forecast for Non-Farm Employment Change is 98,000 against 344,000 in November, the unemployment rate is expected to rise to 6.8% from 6.7% in November.

It is difficult to determine where the euro will go with such data, since the January-April 2018 range is very wide (1.2206-1.2555), there are potential reversal levels within it in increments of 40 points. But at the same time, rising by another 70-100 points will not break the divergence with the Marlin oscillator on the daily chart, which will preserve the euro's potential for a reversal. In this section, we will define the 1.2397-1.2414 range as the target, taken at the extremes on April 11 and 17, 2018.

The short-term price decline was stopped by the MACD line on the four-hour chart. The price divergence with the oscillator is held. We are waiting for the euro to rise to the specified target range of 1.2397-1.2414, but we do not recommend opening longs. Getting the price to settle below the MACD line (1.2268) will signal an attack on support at 1.2215.

Analysis are provided byInstaForex.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote