TForecast for GBP / USD pair on August 28, 2019

GBP / USD pair

Yesterday, the growth of the pound negates the fall of Monday. However, on the daily chart, it met insurmountable resistance of the indicator line of the balance line (red), which is currently slightly below the indicator line of the MACD trend line (blue).

A double divergence has already formed on the four-hour chart. The reversal signal of the Marlin oscillator has amplified while the market is still "hot". The signal line of the oscillator is still in the growth zone and in fact, the price is higher than all indicator lines. On the daily chart, the price can gather strength and go on the assault to the second target of 1.2350/81. To fix the primary reversal signals, it is necessary to fix the price below the minimum of yesterday, which will also correspond to the price drift under the embedded line of the price channel on the daily chart. The MACD line of four-hour scale also tends to be at this level. Probably, a key level is being formed here. In case of a breakout, you should wait before sales.

Analysis are provided byInstaForex.

Please visit our sponsors

Results 2,841 to 2,850 of 4086

Thread: InstaForex Wave Analysis

-

28-08-2019, 05:44 AM #2841

-

29-08-2019, 04:53 AM #2842

Britain on the verge of a constitutional crisis

The pound fell sharply by 100 points on the news that Boris Johnson could try to interrupt parliament for a month - from September 11 to October 14 - so that Parliament could not stop Johnson from withdrawing Britain out of the EU without an agreement.

This is a constitutional crisis. The queen has such a right to suspend the work of the parliament, at the proposal of the prime minister. However, such an action on this occasion is a clear crisis. Given the minimal majority of conservatives in parliament - it is very likely - to have a political crisis and new elections.

Analysis are provided byInstaForex.

-

02-09-2019, 03:57 AM #2843

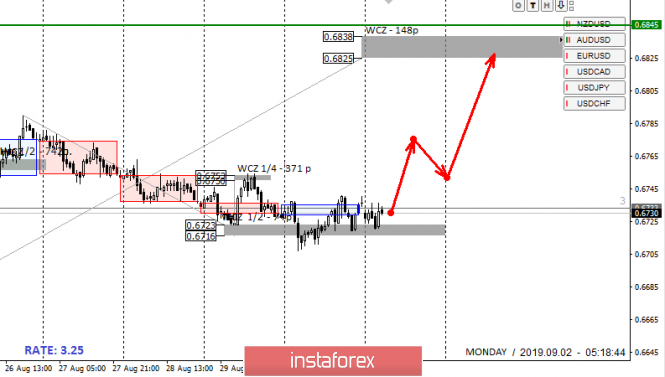

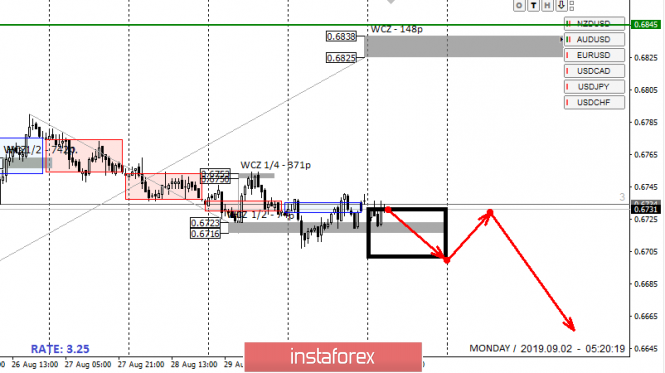

Control zones AUDUSD 09/02/19

The August movement is a complex impulse structure. At the beginning of last week, there was consolidation above WCZ 1/2, which indicates an upward priority. Today, the WCZ 1/2 0.6723-0.6716 test is taking place again. Purchases from this zone are profitable, since the growth target continues to be the weekly control zone 0.6838-0.6825.

The flat movement of August implies the continuation of work from monthly extremes, so they should be taken into account in trading plans. To break the ascending structure, it will be necessary to close today's trading below 0.6716. This will make it possible to resume work in a downward direction. The first goal of the fall will be the low of August.

Daily CZ - daily control zone. The area formed by important data from the futures market, which change several times a year.

Weekly CZ - weekly control zone. The zone formed by important marks of the futures market, which change several times a year.

Monthly CZ - monthly control zone. The zone, which is a reflection of the average volatility over the past year.

Analysis are provided byInstaForex.

-

03-09-2019, 01:59 AM #2844

Weekly market review

Greetings, dear traders! Congratulations to everyone on the beginning of autumn and, hopefully, on the increase in volatility associated with the end of the holiday period, including the bank traders, and the Forex market, as you know, is the interbank market, and the private traders who are here – random people.

The first week of autumn is an important trading period associated with a change in order placements in anticipation of non-farm payrolls, and after them. Often, it is the "nanoc" that one ends and other tendencies of instruments related to the American dollar begin. Today, Monday, according to most professional traders, is the worst time to open new trading positions and decide on a change in trading trends. Moreover, it is also today, September 2, 2019 - is a holiday in the USA and Canada - Labor Day. Therefore, let us congratulate the United States labor teams on this holiday!

For us, this means that trading during this evening will take place in narrow ranges and it is not worth waiting for super-movements from the markets today. Only "Donald Trump" can break the "trade silence" with his Twitter. Sometimes, it seems to me that Donald is an avid trader who "rules" his unprofitable positions with his own, often diametrically opposite, statements on the network.

Today, the main trading idea related to the American dollar for me is to strengthen the dollar in USD/JPY and GBP/USD, which gave last week. I also have very interesting ideas on certain crosses, which will be published soon.

What to do for traders in a period of low volatility? Of course, developing trading skills in the "strategy tester", as well as working on the analysis of profitable / unprofitable positions of the last week, in order to understand - how you earn and how much you lose and at what volumes and at what time you have it is obtained most efficiently. Good luck in trading! And see you at the evening reviews of cross-courses!

Analysis are provided byInstaForex.

-

04-09-2019, 07:51 AM #2845

Technical analysis of EUR/USD for 04/09/2019

Technical Market Overview:

The EUR/USD pair has bounced from the low at the level of 1.0926, broke above the technical resistance at the level of 1.0964 and made a local high at the level of 1.0979. The momentum is off the negative area and the stochastic is off the oversold territory. The next target for the local pull-back or correction is seen at the level of 1.0997. Nevertheless, if bears continue to make pressure on the market, the next target for them is seen at the level of 1.0908, which is technical support at the weekly time frame.

Weekly Pivot Points:

WR3 - 1.1285

WR2 - 1.1224

WR1 - 1.1084

Weekly Pivot Point - 1.1025

WS1 - 1.0886

WS2 - 1.0818

WS3 - 1.0681

Trading Recommendations:

The best strategy for current market conditions is to trade with the larger timeframe trend, which is down. All upward moves will be treated as local corrections in the downtrend. The downtrend is valid as long as it is terminated or the level of 1.1445 clearly violated. There is an Ending Diagonal price pattern visible on the larget timeframes that indicate a possible downtrend termination soon. The key short-term levels are technical support at the level of 1.0814 and the technical resistance at the level of 1.1250.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

05-09-2019, 04:41 AM #2846

Golden cosmos

Good evening, dear traders. As promised, here's the evening forecast for gold. Sorry, was not able to publish it in the morning, because it has already started to work.

The trade wars drove gold to an incredible $ 1,550 per troy ounce. This is the largest gold trend. for many years! Over the past year, gold has passed a record of 36,000p and continues to storm the high, knocking out the stops of medium-term sellers. And just yesterday, according to perhaps the most effective Price Action trading strategy, a pattern called "daily absorption in the trend" has appeared - which speaks of an ongoing trend and after which it is recommended to buy. Today, to the American session, there was a magnificent rollback, allowing you to go into longs at the best price.

On the other hand, sellers who have been selling gold from highs for two weeks now have to hide their risks only for one single extreme - this year's high - quotation 1554. Although, gold has not yet risen above. This is a trap that will be slammed in the near future and trap sellers.

I propose to take a closer look from the rollbacks to the longs - with a take on updating 1554 and higher. Often breakdowns of weekly extremes for gold are very volatile - and give a positive slippage, on which you can earn good profit. This is the first part of the plan.

The second part is for those traders who are buying in a large amount (scalpers). The idea is very simple and is to work after the breakdown of 1554, which for example to 1560-1570, and then to return to the broken level of 1554. This is an old scalping technique in the overbought market to work on the consolidations of large buyers after the breakdown of key extremes. It is due to this that the price decline to a broken level, which becomes support.

Be that as it may, you can earn in both cases.

I wish you success in trading and follow the policy of money management!

News are provided by

InstaForex.

-

06-09-2019, 03:11 AM #2847

Taking profit on USD/JPY and GOLD

This is not a random number, because the method of "hunting for stops" involves work tied to the mistakes of bank traders. The average amount of stops which makes these 100p. And you can easily check it by looking at the open positions of banks online right now. Thus, we still have positions in crosses - which are also all in the "plus".

In addition, fix part of the profit from the position on gold left overnight + 430p, and hold the last part at the level of 1500:

Tomorrow is an important day for currency traders. I have noticed many times that if you give out before non-game plus - you have to leave, because the news is extremely unpredictable. Therefore, I prefer to trade after news trends, and for this, you need to have patience. The best choice for traders to trade on the USD news (if you are not a stop hunter) is to sit them in crosses. And fortunately, our diversification tactics make this easy to do. We continue to hold positive positions on AUD/CHF or NZD/CHF according to the recommendations given earlier.

Good luck in the trading and see you at the next reviews!

Analysis are provided byInstaForex.

-

10-09-2019, 06:22 AM #2848

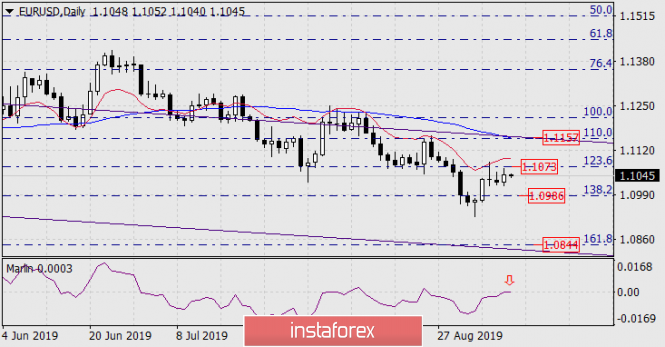

Forecast for EUR/USD on September 10, 2019

EUR/USD

On Monday, the euro made another attempt to work out the target level of 1.1073 - the Fibonacci level of 123.6%, but this time stopped short of positive news about the growth of Germany's trade balance in July from 18.0 billion euros to 20.2 billion and ideas of Germany to establish a parallel state structure for attracting investment through increased public debt, which turned out to be insufficient.

On the daily chart, the signal line of the Marlin Oscillator shows the intention of a reversal down from the boundary with the growth territory. This is the first, but weak and the only sign of a possible price reversal down, there are no others even on the four-hour chart.

On H4, the price develops above the indicator lines of balance and MACD. Marlin is also in the upward trend zone. If the price consolidates above the level of 1.1073, growth to the Fibonacci level of 110.0% is possible at the price of 1.1157. The development of the downward trend is possible after the price goes below the MACD line on H4 (1.1006) and under the Fibonacci level of 138.2% at the price of 1.0986. In this case, the target level is the Fibonacci level of 161.8% at the price of 1.0844.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

-

11-09-2019, 05:26 AM #2849

Forecast for AUD / USD pair on September 11, 2019

AUD / USD pair

In the last two days, the Australian dollar has fixed above both lines of the price channels (red and blue) for the weekly and monthly scales. The price is also higher than the balance lines and MACD daily chart. The nearest target is open to July 10 minimum at 0.691. Subsequent consolidation above a new level opens the second target of 0.6962, which is the upper border of the blue (weekly) price channel.

For the development of a falling scenario, the price should fall below the support of the MACD line on the four-hour chart at 0.6815. Under this condition, the downward target below opens to 0.6685, which is the embedded line of the red (monthly) price channel.

Analysis are provided byInstaForex.

-

12-09-2019, 05:10 AM #2850

Gold: a great opportunity to buy at the level of $1480-50

According to Bart Melek, the head of TD Securities, the strengthening of the dollar, the growth of the value of US stocks and bond yields reflected on the prospects for gold and long positions in the asset. "The yellow metal fell to just below $1,500 an ounce at the beginning of the week, and we think that the price could move to the support level between $1,480–50 if the Fed doesn't weaken the policy at the next meeting," Meleka said. At this stage, the gold market believes that the US central bank will keep rates at the current level without any unconditional commitments to aggressively lower rates in the future. "In our opinion, no matter what central banks do over the next few months, the global economy will decline due to weaker trading activity amid a trade war between the US and China."

The largest world markets are under attack. Germany is showing weakness, China continues to disappoint with its performance, and there are signs that the US economy is also slowing. Given these facts and that monetary policy is not very productive, the projected decline in the price of gold should be considered as an excellent buying opportunity, since central banks need to be aggressive in their actions in order to avoid a sharp drop in global activity next year.

Analysis are provided byInstaForex.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 2 users browsing this thread. (0 members and 2 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote