Global challenges: rising oil prices in response to the Gaza crisis and data from the United States

On Thursday, oil prices surged more than 3% due to concerns about the potential expansion of conflict in the Middle East after Israel rejected a ceasefire offer from HAMAS.

The price of Brent crude oil increased by $2.42 to $81.36 per barrel, while West Texas Intermediate crude rose by $2.36 to $76.22 per barrel. As a result, the cost of Brent surpassed the $80 mark, and WTI exceeded $75 per barrel for the first time in February.

The escalation of the situation affects the rise in oil prices, with Brent and WTI prices expected to increase by more than 5% over the week.

"We are watching further developments, assessing potential consequences," said John Kilduff from Again Capital LLC, highlighting the impact of attacks by Houthi rebels supported by Iran on global oil trade.

For peace agreement discussions, HAMAS representatives arrived in Cairo, where they met with Egyptian and Qatari mediators.

A stronger-than-expected decrease in US gasoline and distillate inventories also supported oil prices.

Aker BP reported that production at the Johan Sverdrup field, the largest in the North Sea, would be maintained at 755,000 barrels per day until the end of the year, exceeding the initially planned 660,000 barrels per day.

According to UBS analyst Giovanni Staunovo, the demand for oil remains high among the largest consumers, including India and the US.

The US Department of Labor reported a decrease in unemployment claims, indicating the labor market's underlying strength.

IG analyst Tony Sycamore expressed that deflation risks in China, the world's largest crude oil importer, are pressuring global oil prices.

"The decline in oil prices in Asia is largely related to recent challenges in the Chinese stock markets and the unexpected consumer price index figure, undermining confidence ahead of the Lunar New Year," he added.

News are provided by

InstaForex.

Read More

Please visit our sponsors

Results 3,441 to 3,450 of 3458

Thread: Forex News from InstaForex

-

09-02-2024, 10:37 AM #3441

-

12-02-2024, 05:45 AM #3442

US yield data raises stakes: global equities back on top

The global stock index MSCI All Country (.MIWD00000PUS) increased by 0.4%, marking its third consecutive weekly gain.

The S&P 500 index closed above 5000 for the first time on Friday, and Nasdaq briefly traded above 16,000, thanks to growth from large corporations and chip manufacturers, including Nvidia, as investors focused on artificial intelligence technologies and expected high profits.

Shares of Nvidia (NVDA.O) jumped 3.6%, reaching a record high after Reuters reported the creation of a new business unit focused on developing specialized chips for cloud computing companies and others, including advanced AI processors.

This followed a Wall Street Journal report that OpenAI CEO Sam Altman was negotiating with investors to fund a technology initiative aimed, among other things, at increasing chip production for powerful artificial intelligence.

"So far, the AI story has been about building infrastructure, chips, and data centers," said David Lefkowitz, head of US equities at UBS Global Wealth Management, adding that it "highlights potentially huge demand for AI infrastructure in the future."

Besides the 1.99% increase in the Philadelphia Semiconductor Index, contributions were also made by technology giants, including Microsoft (MSFT.O), Amazon.com (AMZN.O), and Alphabet (GOOGL.O), to index profit.

According to LSEG data, with results from about two-thirds of S&P 500 companies, Wall Street's earnings growth expectations for the fourth quarter are now 9.0% compared to 4.7% at the start of January, with 81% of companies exceeding estimates compared to an average of 76% over the last four reporting periods.

Strong corporate earnings, positive employment data, GDP, and decreasing inflation create a favorable backdrop for further stock market development.

Consumer prices in the US for December rose less than initially expected, but core inflation remained somewhat high, as data released on Friday showed. The data revision changed little in the expectations for changes in the Federal Reserve's rates.

Inflation data for the US in January is expected next week.

The Dow Jones Industrial Average (.DJI) fell by 54.64 points, or 0.14%, to 38,671.69, the S&P 500 (.SPX) added 28.70 points, or 0.57%, to 5,026.61, and the Nasdaq Composite (.IXIC) grew by 196.95 points, or 1.25%, to 15,990.66.

Positive earnings and optimism regarding artificial intelligence helped the S&P 500 index achieve ten intra-day record highs this year.

Nasdaq closed just 0.4% below its record closing high of 16,057.44, registered in November 2021.

Over the week, all three indices recorded their fifth consecutive weekly gain: S&P rose by 1.4%, Nasdaq by 2.3%, and Dow by 0.04%.

Earlier data showed that consumer prices in the US for December rose less than initially expected, but core inflation remained somewhat high - a mixed picture that clouded expectations regarding the timing of the Federal Reserve's interest rate cuts.

Strong economic data and recent comments from Federal Reserve officials dispelled hopes that the central bank would start cutting interest rates in March.

Market participants are waiting for consumer price data for January next week to get more clues about when the Fed will reduce borrowing costs.

It's also worth noting that shares of Cloudflare (NET.N) rose by 19.5%, as optimistic revenue and profit forecasts for the first quarter were expected. However, shares of PepsiCo (PEP.O) fell by 3.6% after its fourth-quarter revenue fell short of estimates, as multiple price increases reduced demand for its juices and Lay's chips.

Shares of Pinterest (PINS.N) fell by 9.5% after the company forecasted first-quarter revenue significantly below Wall Street estimates.

The yield on benchmark 10-year US Treasury notes rose by 0.7 basis points to 4.177% from 4.17% late on Thursday.

The yield on 2-year notes, which typically moves in step with interest rate expectations, increased by 3.2 basis points to 4.4883% from 4.456%.

Gold prices were pressured by higher yields: spot gold fell by 0.44% to $2024.16 per ounce. Futures on American gold decreased by 0.4% to $2038.7.

Futures on Brent crude oil increased by 0.7% to $82.19 per barrel, while futures on American oil rose by 0.8% to $76.84.

European stocks closed slightly lower under the influence of rising yields and falling shares of L'Oreal.

The pan-European STOXX 600 index closed down by 0.1%, but still showed a weekly gain of 0.2%.

Shares of L'Oreal fell by 7.6% after the French cosmetics company reported unsatisfactory sales growth in the last quarter.

Inflation in Germany, Europe's largest economy, fell in January to 3.1%, fueling bets on when the European Central Bank will start cutting interest rates.

However, the yield on eurozone bonds reached a multi-week high after several ECB rate-setters warned against prematurely easing monetary policy.

"Indeed, it now seems entirely evident that the ECB will wait for wage statistics in Europe at the end of April before likely cutting rates in June," said ING.

Japanese stocks reached a 34-year high. The yen recovered after falling to a 10-week low as traders reassessed their bets on how quickly the Bank of Japan might raise rates.

In China, mainland markets were closed, and in Hong Kong, trading was sluggish and ended early, with the Hang Seng index falling by 0.8% amid concerns that authorities might not fulfill promises to support.

News are provided by

InstaForex.

Read More

-

13-02-2024, 04:29 AM #3443Senior Investor

- Join Date

- Jul 2011

- Location

- www.ArmadaMarkets.com

- Posts

- 4,127

- Feedback Score

- 0

- Thanks

- 0

- Thanked 2 Times in 2 Posts

The selection of a broker should be carefully considered, as the broker serves as a bridge for traders to engage in forex trading. Therefore, I chose to join Tickmill as my broker. This way, I can comfortably and safely participate in forex trading here.

-

13-02-2024, 10:23 AM #3444

Stocks and the dollar: stability vs. growth ahead of key consumer price index

At the start of the week, global market indices remained virtually unchanged, while the US currency slightly strengthened ahead of Tuesday's consumer price index report in the US, which could hint at when the Federal Reserve might begin cutting interest rates.

In the realm of cryptocurrencies, Bitcoin reached $50,000, a level not seen in over two years, with its value increasing by 5.6% to $50,207. Cryptocurrency stocks also saw gains: Coinbase Global (COIN.O) increased by 3.7%.

The S&P 500 index slightly fell after reaching a new intraday record high. Last week, the S&P 500 index surpassed 5,000 points for the first time in history. The MSCI global stock index remained unchanged after reaching its highest level since January 2022.

The January report on the consumer price index is expected on Tuesday, with the US producer price report to follow later in the week. Investors are also eagerly awaiting the January US retail sales report, set for release on Thursday.

Initial expectations of a Fed rate cut at the upcoming meeting were not met due to data indicating the economy remains stable.

Market estimates put the likelihood of rates staying unchanged in March at 84.5%. According to CME FedWatch Tool data, the chance of a rate cut of at least 25 basis points in May dropped to 61% from over 95% at the start of 2024.

"Moderate consumer price index data and soft retail sales should reinforce the Fed's confidence that inflation is returning to its target," said Mark Chandler, chief market strategist at Bannockburn Global Forex in New York.

The Dow Jones Industrial Index (.DJI) rose by 125.69 points, or 0.33%, to 38,797.38, the S&P 500 (.SPX) lost 4.77 points, or 0.09%, to 5,021.84, and the Nasdaq Composite (.IXIC) dropped 48.12 points, or 0.30%, to 15,942.55.

Among the Dow Jones index components, Nike Inc (NYSE:NKE) shares increased by 2.71 points (2.59%) and closed at 107.21. Shares of Goldman Sachs Group Inc (NYSE:GS) went up by 8.63 points (2.25%), finishing at 392.89. Shares of 3M Company (NYSE:MMM) rose by 1.76 points (1.89%), closing at 94.66.

Shares of Salesforce Inc (NYSE:CRM) fell by 3.76 points (1.29%), ending the session at 287.54. Shares of Microsoft Corporation (NASDAQ:MSFT) rose by 5.29 points (1.26%), closing at 415.26, while shares of Apple Inc (NASDAQ:AAPL) dropped in price by 1.70 points (0.90%), finishing trading at 187.15.

Among the S&P 500 index components, shares of VF Corporation (NYSE:VFC) appreciated by 13.92% to 17.43, Diamondback Energy Inc (NASDAQ:FANG) gained 9.38%, closing at 165.98, and shares of Mohawk Industries Inc (NYSE:MHK) increased by 6.61%, ending the session at 117.28. Shares of Motorola Solutions Inc (NYSE:MSI) decreased in price by 3.20%, closing at 320.30.

Shares of ServiceNow Inc (NYSE:NOW) lost 3.19%, ending trading at 786.98. Quotes of Monolithic Power Systems Inc (NASDAQ:MPWR) dropped by 2.98% to 729.87.

Among the NASDAQ Composite index components, shares of Beamr Imaging Ltd (NASDAQ:BMR) surged by 371.56% to 9.95, Renalytix Ai Plc (NASDAQ:RNLX) increased by 228.00%, closing at 1.25, and shares of Millennium Group International Holdings Ltd (NASDAQ:MGIH) rose by 201.94%, ending the session at 3.11.

Shares of AN2 Therapeutics Inc (NASDAQ:ANTX) decreased in price by 74.50%, closing at 5.10. Shares of Medavail Holdings Inc (NASDAQ:MDVL) lost 43.22%, ending trading at 1.80. Quotes of TOP Financial Group Ltd (NASDAQ:TOP) dropped by 40.63% to 3.20.

Shares of Goldman Sachs Group Inc (NYSE:GS) reached a 52-week high, increasing by 2.25%, 8.63 points, and finished trading at 392.89. Shares of Beamr Imaging Ltd (NASDAQ:BMR) reached a historical high, rising by 371.56%, 7.84 points, and ended trading at 9.95. Shares of Medavail Holdings Inc (NASDAQ:MDVL) fell to a 3-year low, losing 43.22%, 1.37 points, and closed at 1.80.

The global stock index MSCI (.MIWD00000PUS), tracking stocks in 49 countries, dropped by 0.01%. European stocks (.STOXX) increased by 0.5%.

Markets in China, Hong Kong, Japan, South Korea, Singapore, Taiwan, Vietnam, and Malaysia were closed for holidays.

Financial markets in mainland China were closed for the Lunar New Year holiday and will resume trading on Monday, February 19. Trading in Hong Kong will resume on February 14.

Investors also tempered their expectations for a European Central Bank rate cut after two policy makers stated last week that the ECB needs more evidence of inflation falling before it can reduce rates.

On Monday, the Federal Reserve Bank of New York published its January survey of consumer expectations, which showed that inflation expectations for one year and five years remained unchanged at 3% and 2.5%, respectively. The predicted inflation growth over three years fell to 2.4%, the lowest level since March 2020, from December's 2.6%.

The dollar index, which tracks the dollar's performance against a basket of other major trading partners' currencies, increased by 0.1% to 104.13.

The dollar rose by 0.03% against the yen to 149.35, while the euro dropped by 0.1% for the day to $1.0769.

The yield on US Treasury bonds fell, with the rates on benchmark 10-year bonds decreasing after three consecutive periods of growth.

The yield on the benchmark 10-year US Treasury bonds decreased by 1.9 basis points to 4.168% from 4.187% late on Friday.

Oil futures closed mixed, almost unchanged. Concerns over interest rates and global demand caused the market to pause after prices jumped by about 6% last week.

US oil increased by 8 cents and settled at $76.92 per barrel. Brent crude oil decreased by 19 cents and settled at $82.

Spot gold prices fell by 0.3%.

News are provided by

InstaForex.

Read More

-

14-02-2024, 10:22 AM #3445

Inflationary explosion in the US: how do the dollar and bonds react?

The consequences of high inflation are felt across the financial market. Specifically, the main Wall Street indices reacted to this news with a decrease after the publication of data indicating a higher than expected rise in consumer prices. This event pressured the expectations regarding the imminent lowering of interest rates, which in turn led to an increase in the yield of US Treasury bonds.

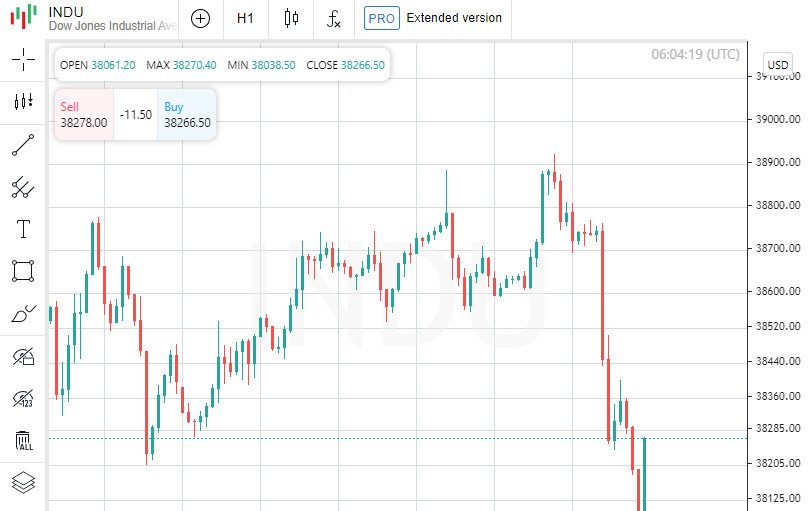

Among other things, the Dow Jones Industrial Average recorded its most significant drop in almost 11 months after the US Department of Labor's report showed an unexpected increase in consumer prices in January, especially due to the rise in housing costs.

Against this backdrop, market indices, which were on the rise in anticipation that the Federal Reserve System (FRS) would begin to lower rates as early as May, showed negative dynamics. The S&P 500 index, for example, closed above the 5000 point mark for the first time, and the Dow Jones index traded near record-high values. However, the publication of inflation data revised expectations regarding the FRS's policy, increasing the likelihood that rate cuts may not occur until June.

Mega-cap companies sensitive to rates, such as Microsoft, Alphabet, Amazon.com, and Meta Platforms, showed a decrease in stock prices amid the rise in yields of US Treasury bonds to a two-month high. A similar situation was observed among chip manufacturers, including Micron Technology, Qualcomm, and Broadcom, which led to a 2% drop in the Philadelphia SE Semiconductor index.

The real estate, consumer discretionary, and utilities sectors faced the most significant losses among the 11 major industry indices of the S&P 500, especially real estate, which reached its lowest values in more than two months.

Small-cap companies also felt the pressure, with the Russell 2000 index showing the most significant daily drop since June 2022.

"Various statements by Federal Reserve System officials in recent weeks have indicated that the market-anticipated rate cuts in the first half of the year might have been premature. The latest consumer price index data certainly confirms this trend," commented Bob Elliott from Unlimited Funds.

The consumer inflation data followed a modest revision of inflation figures for the last quarter of 2023, giving investors temporary relief regarding inflation expectations.

The Cboe Volatility Index reached its highest level since November, highlighting the growing market concern. The S&P 500 and Nasdaq Composite indices lost 1.37% and 1.79% respectively, while the Dow Jones Industrial Average fell by 1.36%, marking its most significant decline since March 2023.

Among other developments, JetBlue Airways shares surged by 21.6% after Carl Icahn disclosed his stake in the company, calling the shares "undervalued." Arista Networks' shares declined by 5.5% following a gross profit forecast below expectations, and Marriott International lost value after forecasting annual earnings below analyst expectations.

Cadence Design Systems and toy manufacturer Hasbro also faced a drop in share value after publishing gloomy forecasts. Meanwhile, Tripadvisor shares jumped by 13.8% following the announcement of the creation of a special committee to review deal proposals.

The total trading volume on US exchanges reached 12.9 billion shares, comparable to the average of the last 20 sessions at 11.71 billion shares.

The US stock market continues to demonstrate record levels, supported by leading technology companies and expectations of Federal Reserve rate cuts. The global stock index MSCI and the Stoxx 600 European index also showed a decline amid current events.

The dollar index reached a three-month high, and bitcoin set a new record since December 2021, despite subsequent declines.

Data on US retail sales and the producer price report are expected shortly, which may further influence market sentiments.

The rise in oil prices continues amid tensions in the Middle East and Eastern Europe, with Brent crude futures and West Texas Intermediate showing significant increases. Meanwhile, gold prices fell below the key level of $2000 per ounce after the CPI data was released, reaching a two-month low.

News are provided by

InstaForex.

Read More

-

16-02-2024, 09:24 AM #3446

Intraday Price Movement of Litecoin Cryptocurrency, Friday February 16 2024

If we look at the 4-hour chart of the Litecoin cryptocurrency, we can see a Bearish 123 pattern followed by the apperance of a Bearish Ross Hook (RH) pattern and a Rising Wedge pattern, all of which confirms that in the near future Litecoin has the potential to weaken down to level 68.16. If this level is successfully broken downwards then Litecoin will have the potential to continue weakening to level 66.45, but if on its way down there suddenly occurs an upward correction which breaks above level 72.93 then all the decline scenarios that have been described previously will automatically cancel themselves.

News are provided by InstaForex

Read More

-

21-02-2024, 08:21 AM #3447

The ability to analyze is a crucial factor in forex trading. Therefore, developing analytical skills is essential. This is done to ensure that one can analyze the market accurately and benefit alongside Tickmill as the broker.

-

22-02-2024, 01:51 AM #3448

Gold and oil raise rates

In Asian markets on Tuesday, gold prices remained within a narrow range amid fears of long-term interest rate hikes. The absence of trading signals was also due to a holiday in the American market.

Gold demonstrated some strengthening, reaching the $2000 per ounce mark after recovering from a two-month low over the last two trading sessions. However, current fluctuations in gold prices are still occurring within the range of $2,000-$2,050, which was established for the majority of 2024.

Spot gold prices increased slightly by 0.1% to $2,019.17 per ounce, while the price of gold futures expiring in April settled at $2,030.20 per ounce as of 23:34 Eastern Time.

Analysts from Citibank highlight three main catalysts that could push gold prices to $3000 per ounce and oil to $100 per barrel in the next 12-18 months. Among them are a sharp increase in gold purchases by central banks, stagflation, and a deep global recession. Currently, gold is trading around the $2016 mark and could rise by approximately 50% in the event of any of these scenarios materializing.

Analysts point to dedollarization in central banks of developing countries as the most likely path to reaching $3000 per ounce of gold. This would lead to a doubling of gold purchases by central banks and shift the focus of demand from jewelry to gold as the main driver. Central bank gold purchases have reached record levels in recent years, aiming to diversify their reserves and reduce credit risk. Leading this trend are the central banks of China and Russia, as well as India, Turkey, and Brazil, actively increasing their gold bullion purchases. According to the World Gold Council, global central banks have maintained a level of net gold purchases exceeding 1000 tons for two consecutive years.

In the context of a global recession, a deep economic downturn could force the United States Federal Reserve to drastically cut rates, which, in turn, could be the reason for gold prices to rise to $3000. Gold traditionally exhibits an inverse correlation with interest rates, becoming a more attractive asset compared to fixed income in a low-rate environment.

Stagflation, combining high inflation with economic slowdown and rising unemployment, could also trigger a rise in gold prices, despite the low likelihood of such a scenario. Gold is perceived as a safe haven in periods of economic instability, attracting investors looking to avoid risks. In addition to the above factors, Citi suggests that the baseline scenario for gold involves reaching a price of $2150 per ounce in the second half of 2024, with an expected average price just over $2000 per ounce in the first half of the year. Record prices may be achieved by the end of 2024.

Although geopolitical tensions in the Middle East provide support for gold prices, a more significant price increase is restrained by the prospect of long-term interest rate hikes in the US.

Traders are lowering expectations regarding the Federal Reserve's imminent rate cuts following reports of high inflation in the US, and statements from Fed officials reinforce assumptions about maintaining high interest rates over a longer period.

The outlook for gold in the near future remains uncertain, similar to the situation in the market for other precious metals. Prices for platinum and silver show a decline, and copper experiences a slight drop in price, despite a reduction in the base interest rate in China, the largest importer of the metal.

In the context of the oil market, analysts consider a scenario where oil prices could once again reach $100 per barrel, considering risks associated with geopolitical tensions, actions by OPEC+, and possible supply disruptions from key oil-producing regions. Tensions in the Middle East, particularly the conflict between Israel and Hamas, and increasing tension on the border between Israel and Lebanon highlight potential risks for oil suppliers in the OPEC+ region.

News are provided by

InstaForex.

Read More

-

22-02-2024, 05:01 AM #3449Senior Investor

- Join Date

- Jul 2011

- Location

- www.ArmadaMarkets.com

- Posts

- 4,127

- Feedback Score

- 0

- Thanks

- 0

- Thanked 2 Times in 2 Posts

The ability to analyze is a crucial factor in forex trading. That's why I consistently work on developing my analytical skills. This is done to ensure that I can analyze the market accurately and benefit from it with Tickmill as my broker.

-

22-02-2024, 09:56 AM #3450

Nikkei Hits New Highs: How Nvidia Became the Driving Force Behind the Semiconductor Industry's Growth

A landmark milestone was recorded in the Japanese stock market on Thursday: the Nikkei average breached the threshold set in December 1989, thanks to a significant rise in the share prices of companies operating in the microelectronics sector. This leap was driven by the superior earnings forecasts of American chip giant Nvidia, surpassing market expectations.

The Nikkei index reached 39,029.00, updating the historical high of 38,957.44 set on the last trading day of 1989, when the Japanese economy was at the peak of the "bubble." This was made possible by low asset valuations and corporate reforms, which attracted the attention of foreign investors looking for alternatives to weakening Chinese markets. Since January 2023, the index has jumped by 52%, showing impressive growth.

It took 34 years to recover from the downturn, a record period for a major market, surpassing Wall Street's recovery from the Great Depression by ten years.

To date, the index has shown a growth of almost 17% after a 28% increase in 2023, leading among major Asian exchanges. While the Nasdaq technology index grew by 43% last year and by 6% this year.

The Nikkei rally successfully resists recession in Japan, military conflicts in Europe and the Middle East, global inflationary pressure, and rising interest rates worldwide. Trading activity and a weak national currency contributed to increased exporter revenues, protecting the market from a decline in domestic demand.

The implementation of corporate reforms in Japan, including share buybacks and reduction of cross-shareholdings, as well as foreign investments such as Warren Buffet's significant investments in 2020, highlighted the attractiveness of valuations and contributed to the rally. Last year, the Japanese stock market received 6.3 trillion yen ($42 billion) in foreign investments, and in January of this year, 1.16 trillion yen.

The success of the Japanese market at the beginning of 2024 was also due to a strong earnings season, a drop in the yen's value, and expectations that the Bank of Japan will continue its ultra-loose monetary policy. Analysts raised their year-end forecasts from 35,000 to 39,000, noting the potential for further growth.

Comparing the current market situation to the boom of the 1980s and the subsequent crash, which led to a prolonged period of deflation, there is no fear of a new crisis today, as inflation is controlled at just over 2%, and company incomes continue to grow.

Companies like Fast Retailing Co (owner of Uniqlo), chipmakers Advantest Corp and Tokyo Electron have become the backbone of the current rally, unlike past decades when bank and real estate stocks were in focus.

The growth of the Japanese market is also supported by robust corporate reforms and opportune timing for growth amidst a downturn in China. While the Nikkei index is on the rise, indexes in Hong Kong and China are experiencing a downturn, attracting investments to Japan.

Corporate cash reserves and household savings in Japan also have the potential to stimulate stock price growth, encouraging their entry into the market.

A 6% increase in Nvidia shares after a revenue forecast exceeding expectations highlighted the company's steady demand for chips, becoming a key factor for the market. Shares of Tokyo Electron and Advantest, along with other companies in the microelectronics sector, showed significant growth, contributing to the overall success of the Nikkei index and demonstrating a healthy dynamic in the industry.

News are provided by

InstaForex.

Read More

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 3 users browsing this thread. (0 members and 3 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote