Oil Loses Altitude: How the Economic Downturn Affects the Market

Brent crude oil futures dropped by 14 cents, or 0.2%, to $79.92 per barrel by 01:25 GMT, while West Texas Intermediate (WTI) crude oil futures last declined by 10 cents, or 0.1%, to $74.66 per barrel.

Both contracts had risen by approximately 2% on Monday as a Ukrainian drone strike on Novatek's fuel terminal in Ust-Luga raised supply concerns and led to a price surge. Analysts suggest that Novatek is likely to resume full-scale operations within a few weeks.

While the damage to loading docks at the Ust-Luga terminal only "briefly impacted exports," this move increases the likelihood of the Russian-Ukrainian conflict "shifting into a new phase, with both sides targeting key energy infrastructure," stated analysts at ANZ Research in their report.

Geopolitical tensions were overshadowed by ongoing concerns about the slowdown in China's economic recovery, raising worries about global oil demand, given that the Asian giant is the world's largest crude oil importer.

China has implemented measures to support its economy, but domestic consumption remains sluggish, making oil traders nervous about demand prospects.

In the Middle East, the United States urged Israel to protect innocent people in hospitals, medical staff, and patients as Israeli forces assaulted one hospital and besieged another, advancing into the western Khan Yunis sector in Gaza.

American and British forces also conducted a new round of strikes on the Houthi rebels' underground storage and missile and reconnaissance capabilities linked to Iran.

Houthi attacks on ships in the Red Sea region have disrupted global navigation and heightened concerns about inflation. The group claims their attacks are in solidarity with Palestinians when Israel strikes Gaza.

Additionally, crude oil inventories in the United States are expected to decrease by approximately 3 million barrels by January 19. Distillate stocks were anticipated to decrease last week, while gasoline stocks are expected to increase.

Managers seem to conclude that ongoing economic growth in the United States will continue to exert pressure on prices, while the conflict in the Middle East will provide some support to prices in Europe and Asia.

Funds appear to be betting on contrasting economic outlooks between the ongoing U.S. economic growth and a protracted recession in Europe.

News are provided by

InstaForex.

Read More

Please visit our sponsors

Results 3,431 to 3,440 of 3458

Thread: Forex News from InstaForex

-

23-01-2024, 06:09 AM #3431

-

25-01-2024, 06:46 AM #3432

Global oil game: new rounds in light of events in the USA and China

This trend was reflected in the increase in the March Brent crude oil contract price by 0.3%, reaching $80.24 per barrel. A similar dynamic was observed with West Texas Intermediate crude, which appreciated by 0.3% to $75.31 per barrel.

Toshitaka Tadzawa, an analyst at Fujitomi Securities, emphasized the role of the decrease in U.S. oil reserves and expectations regarding China's economic upswing as the main factors fuelling oil price growth. He also noted that political instability in the Middle East is encouraging investors to buy oil.

According to the U.S. Energy Information Administration, crude oil inventories decreased by 9.2 million barrels, far exceeding the analysts' forecast of 2.2 million barrels. This decrease was due to a reduction in imports and the closure of refineries due to bad weather, which restricted vehicle movement.

The Chinese economy also impacted the oil market. The People's Bank of China announced a significant reduction in the bank reserve requirement ratio, suggesting an injection of about $140 billion into the economy, potentially a strong boost for economic growth.

An important aspect was the decrease in U.S. domestic oil production. Bob Yager, Director of Energy Futures at Mizuho, notes that production in Bakken was particularly affected, experiencing a significant drop.

Amid Arctic freezes, U.S. oil production fell to a five-month low of just 12.3 million barrels per day. Officials from North Dakota stated that restoring oil production in the state, a key player in shale extraction, might take about a month following severe damage caused by extreme weather conditions.

Thus, events in both the U.S. and China are shaping new trends in the global oil market, demonstrating the interplay of economic strategies and natural phenomena in today's global economy.

News are provided by

InstaForex.

Read More

-

26-01-2024, 06:29 AM #3433

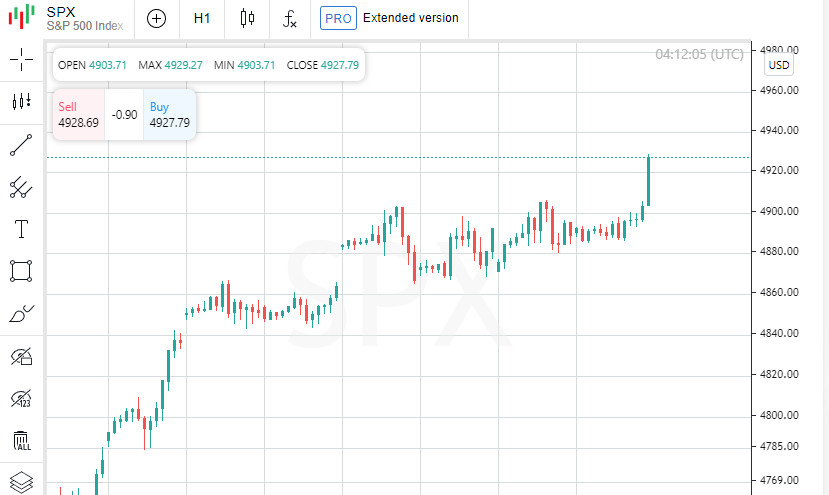

Two sides of the market: record growth of the S&P 500 and the Tesla crisis

U.S. Economic Strength: Surpassing Expectations

The U.S. economy demonstrated remarkable growth, surpassing all forecasts in the fourth quarter. This rise was a surprise to experts, highlighting the resilience of the country's economic dynamics.

Comcast and American Airlines: Symbols of Growth

Comcast reported revenues exceeding expectations, contributing to the rise in their stocks. Meanwhile, American Airlines also pleases investors with an optimistic profit forecast, demonstrating the health of the aviation industry.

S&P 500 Index: At the Peak of Success

The S&P 500, reflecting the overall market trend, grew by 0.53%, reaching a historical high for the fifth session in a row. This record growth is backed by investors' confidence in the U.S. economic potential.

Global Market in the Rhythm of the American Economy

Global stocks rise on the wave of American economic growth. At the same time, the euro loses positions, reflecting the European Central Bank's decision to keep interest rates unchanged.

U.S. Economy: Impressive GDP Growth

The U.S. Gross Domestic Product in the fourth quarter showed an impressive 3.3% annual growth. This significantly exceeds forecasts, disproving fears of a possible recession in 2023.

Tesla: Challenges Amidst Overall Growth

In contrast to the general market optimism, Tesla faces problems. After the publication of a disappointing sales forecast, the company's stocks fell, standing out against the general market upswing.

S&P 500: New Horizons of Growth

The rally of the S&P 500 index continues, marking a new record high reached for the first time in two years. This indicates investors' optimism regarding the future of the American economy and reduced interest rates, as well as growing interest in artificial intelligence.

GDP a Pleasant Surprise for the Market

Rob Haworth from U.S. Bank Asset Management Group emphasized that the U.S. GDP growth is a pleasant surprise for the market. The absence of inflation issues and active consumer spending create a favorable environment. This circumstance strengthens confidence that companies' revenues and sales will grow in the future.

Unemployment Level: A Slight Increase in Claims

Recent data indicate a slight increase in the number of unemployment benefit claims, reaching 214,000, slightly exceeding the forecast of 200,000. This points to minor fluctuations in the labor market.

Tech Giants: Awaiting Quarterly Reports

The upcoming quarterly reports from Apple, Microsoft, Amazon, Alphabet, and Meta Platforms will provide investors valuable insight. This will help assess whether the high valuations of these companies are justified after their stock growth since the crisis on Wall Street in 2022.

Dow Jones, S&P 500, and Nasdaq: The Rise Continues

The Dow Jones Industrial Index showed significant growth, adding 242.74 points. S&P 500 and Nasdaq also increased, indicating the continuing rise in the market.

Global Market: Steady Growth

At 16:14 Eastern European Time (214 GMT), the global MSCI stock index, reflecting dynamics in 49 countries, rose by 0.32%. The European STOXX 600 index also closed with a 0.3% increase, confirming a stable positive trend in the global economy.

Electric Vehicles: Stock Fall After Tesla's Report

Following the publication of Tesla's quarterly report, shares of other electric vehicle manufacturers also suffered. Rivian Automotive and Lucid Group recorded a decrease in their shares by 2.2% and 6.7% respectively, reflecting overall concern in the sector.

Healthcare Sector: Drop in Humana's Shares

Humana's shares sharply fell by 11.7%, following the forecast of modest annual profits, which impacted the S&P 500 healthcare sector index, decreasing it by 0.2%. This reflects current challenges in the health insurance sector.

UnitedHealth and Cigna:

Falling Following Humana Following Humana, shares of other health insurers also incurred losses. UnitedHealth and Cigna showed a decrease of 3.9% and 2% respectively, highlighting instability in this market segment."

IBM and Comcast: Stock Growth Following Positive Forecasts

IBM shows impressive stock growth of 9.5%, thanks to a revenue forecast that exceeds expectations. Comcast's shares also rose by 3.4% after the company surpassed quarterly revenue forecasts.

American Airlines: Sharp Rise in Shares

Shares of American Airlines sharply increased by 10.3%, thanks to a very optimistic annual revenue forecast, which is a good sign for the aviation industry.

S&P 500: Earnings Surpass Expectations

According to the latest data, 82% of the companies in the S&P 500 index that have reported their earnings have exceeded expectations. This is significantly higher than the long-term average of 67%, indicating an overall positive sentiment in the market.

Boeing: Stock Decline Due to FAA Ban

Boeing's shares noticeably fell by 5.7%, following the decision of the U.S. Federal Aviation Administration to prohibit the company from expanding the production of 737 MAX models due to technical issues.

S&P 500 Index: Predominance of Growth Over Decline

The S&P 500 index exhibited a positive ratio of rising to falling stocks, at 4 to 1, indicating a prevailing upbeat trend in the market.

Indices Hitting New Highs and Lows

The S&P 500 recorded 50 new highs and only two new lows, while Nasdaq registered 97 new highs and 119 new lows, reflecting the current market's volatility.

Trading Volume:

Market Stability The trading volume on U.S. exchanges remained consistent, reaching 11.5 billion shares, in line with the average level of the last 20 sessions.

The U.S. Dollar Strengthens, Euro Weakens

The U.S. dollar showed an increase, signaling the Federal Reserve's reluctance to lower interest rates. Concurrently, the euro hit a six-week low against the dollar following the European Central Bank's statement about maintaining high interest rates.

Oil and Gold: Price Increase

U.S. oil prices reached their highest since late November, with futures for West Texas Intermediate and Brent crude oil rising by 3% and 2.99% respectively. Gold prices also saw an increase, with a 0.32% rise in spot prices.

News are provided by

InstaForex.

Read More

-

29-01-2024, 04:36 AM #3434Senior Investor

- Join Date

- Jul 2011

- Location

- www.ArmadaMarkets.com

- Posts

- 4,127

- Feedback Score

- 0

- Thanks

- 0

- Thanked 2 Times in 2 Posts

The selection of a broker should be done carefully, as the broker serves as a bridge for traders to engage in forex trading. That's why I chose to go with Tickmill as my broker; here, I can trade forex comfortably and securely.

-

30-01-2024, 09:54 AM #3435

S&P 500 peaks: hopes for upcoming Fed meeting and tech profits

U.S. stock indices showed growth on Monday. Investors prepared for a busy week, expecting a large number of financial reports from high-market-cap companies, new economic data, and a Fed meeting dedicated to monetary policy. All three major U.S. stock indices showed growth, with the high-tech Nasdaq (.IXIC) index growing the most. The S&P 500 index (.SPX) reached a new record closing level. After the main index rose by 3.3% in the first month of 2024, BlackRock revised its assessment of U.S. stocks, raising it.

In anticipation of upcoming reports, investors' attention is focused on high-profile companies in technology and related sectors. A number of key companies, including Alphabet Inc (GOOGL.O), Microsoft Corp (MSFT.O), and Qualcomm Inc (QCOM.O), are preparing to publish their financial results, starting from Tuesday and peaking on Thursday with reports from giants such as Apple Inc (AAPL.O), Amazon.com (AMZN.O), and Meta Platforms Inc (META.O). Also of interest are the results of other significant companies: General Motors Inc (GM.N) on Tuesday, Boeing Co (BA.N) on Thursday, as well as leading oil corporations Exxon Mobil Corp (XOM.N) and Chevron Corp (CVX.N), which will present their reports on Friday.

The main event of the week for investors is the press conference of the chairman of the Federal Reserve (Fed) Jerome Powell and the results of the two-day meeting of the U.S. central bank, scheduled for Wednesday. Additionally, the publication of U.S. unemployment data is expected on Friday. There is speculation that the Fed will maintain its key interest rate at 5.25%-5.50%. However, some investors do not rule out that the central bank may deviate from its plans to raise rates.

Fed Chairman Jerome Powell and other members of the policy leadership have already stated that a reduction in interest rates should not be expected until inflation falls to the annual target level of 2%. They also emphasized their readiness to take a flexible approach in response to changing economic data. The list of economic reports this week includes labor market data, including job vacancies and workforce turnover research, the ADP report, fourth-quarter employment cost data, productivity metrics, layoff plans, and the January employment report, to be published on Friday.

In addition to the aforementioned reports, this week will also see the release of the Case-Shiller home price index, consumer confidence indicators, the Purchasing Managers' Index from the Institute for Supply Management, construction spending statistics, and information on manufacturing orders. Recent positive economic data, including impressive gross domestic product and personal consumer expenditure figures released last week, have, on one hand, alleviated concerns about a possible recession, and on the other hand, reduced the likelihood of the Federal Reserve cutting interest rates soon, possibly as early as March.

The industrial Dow Jones index (.DJI) increased by 224.02 points (0.59%) to 38,333.45. The S&P 500 index (.SPX) gained 36.96 points (0.76%) to 4,927.93, and the Nasdaq Composite index (.IXIC) rose 172.68 points (1.12%) to 15,628.04. Out of the 11 sector indices of the S&P 500, ten showed growth. The largest increase was in the consumer discretionary index (.SPLRCD), which grew by 1.37%, followed by a 0.97% increase in the information technology sector (.SPLRCT). The energy sector (.SPNY) was the only one to show a decline. Microsoft (MSFT.O), a company that drew market attention to the field of artificial intelligence thanks to its partnership with Open AI in 2023, is expected to report a 15.8% increase in quarterly revenue. Its shares closed up by 1.4%.

Tesla Inc (TSLA.O) shares rose by 4.2% following the electric car manufacturer's announcement of capital investment plans. Shares of robot vacuum maker iRobot (IRBT.O) fell by 8.8% as the company and Amazon abandoned merger plans due to opposition from EU antitrust authorities. Meta Platforms (META.O) shares increased by 1.7% after brokerage firm Jefferies raised its target price from $425 to $455.

Shares of Warner Bros Discovery (WBD.O) lost 1.2%, as brokerage firm Wells Fargo downgraded the streaming platform's rating to 'equal weight'. Financial technology company SoFi Technologies (SOFI.O) shares jumped by 20.2% following the announcement of profits in the fourth quarter. On the NYSE, there were 397 new highs and 50 new lows.

On the Nasdaq, 2975 stocks rose and 1314 fell, as the number of rising stocks outnumbered falling ones by approximately a 2.3 to 1 ratio. The S&P 500 index set 45 new 52-week highs and did not find any new lows, while the Nasdaq recorded 226 new highs and 101 new lows. The trading volume on U.S. exchanges was relatively small, with 10.3 billion shares traded compared to the average of 11.5 billion shares over the previous 20 sessions.

Investors were also sensitive to geopolitical risks related to the rise in oil prices following a missile attack in Kauta, which caused a fire on a fuel tanker in the Red Sea, and a drone attack in Jordan.

News are provided by

InstaForex.

Read More

-

05-02-2024, 08:05 AM #3436

The ability to analyze is a crucial and significant factor in forex trading. That's why I consistently develop my analytical skills to ensure continuous improvement. By doing so, I aim to enhance my ability to analyze the market accurately, especially when trading on a real account with Tickmill as my broker.

-

05-02-2024, 09:59 AM #3437

Wall Street is on the verge of change: how the US economy ignores the Fed

The current version was alarmed by evidence suggesting that the economy might be too heated for the Federal Reserve to cut rates without risking an inflation rebound. Friday's U.S. employment data served as the latest indicator of stronger-than-expected growth after Federal Reserve Chairman Jerome Powell, a few days earlier, quashed hopes that the central bank would begin to lower rates in March.

"Looking back at the fourth quarter and the recent stock rally, it can largely be attributed to the anticipation of a Fed pivot, and we are witnessing this pivot evaporate before our eyes," said Matthew Miskin, one of the chief investment strategists at John Hancock Investment Management.

The Friday employment report revealed that non-farm payroll employment increased by 353,000 last month, significantly surpassing the 180,000 growth anticipated by economists. Additionally, the economy added 126,000 more jobs in November and December than previously reported.

Many investors consider strong growth a positive sign for stocks, especially if it is accompanied by higher-than-expected corporate earnings. The S&P 500 index reached a new high on Friday following the employment data release, spurred by a sharp rise in shares of Facebook's parent company Meta Platforms (META.O) and Amazon (AMZN.O), which surged by 20% and 8% respectively after their corporate results.

In 2024, S&P 500 earnings are expected to grow by almost 10% following a 3.6% increase in 2023. These expectations will be tested in the upcoming week with another significant batch of reports, including from Eli Lilly (LLY.N), Walt Disney (DIS.N), and ConocoPhillips (COP.N).

Analysts predict a remarkable year for U.S. stocks: 2024 will end more than 10% higher at 5500 points. They attribute this growth to optimism about the business potential of artificial intelligence, which helped stocks like Nvidia (NVDA.O) last year, likely contributing to this growth.

However, sustained growth above trend poses another problem – concerns about inflation rebound.

A longer period of high interest rates could also exacerbate stress in sectors of the economy that are already suffering, such as commercial real estate.

Shares of New York Community Bancorp (NYCB.N), a major CRE lender in New York, fell in recent days, sparking broader regional banking issues after the company cut dividends and announced unexpected losses.

As the fourth-quarter earnings season continues, 230 companies in the S&P 500 index have reported. Of these, 80% exceeded Wall Street's expectations. Overall, analysts forecast a 7.8% year-over-year increase in S&P 500 earnings for the October-December period, a significant improvement from the 4.7% estimate as of January 1.

Meta Platforms shares rose 20.3% to a record level after announcing the payout of its first dividends on the eve of Facebook's 20th anniversary.

Amazon.com (AMZN.O) shares jumped 7.9% following a revenue increase in the fourth quarter as new generative artificial intelligence features in cloud computing and e-commerce spurred solid growth during the holiday season.

Regional bank shares stabilized after two days of sharp sell-offs triggered by disappointing earnings from New York Community Bancorp (NYCB.N). The bank's shares rose 5.0% on Friday, and the KBW regional banking operations index (KRX) increased by 0.2%.

The S&P 500 index rose 1.07% and closed at 4958.61 points. The Nasdaq index gained 1.74% to 15628.95 points, and the Dow Jones industrial index increased by 0.35% to 38654.42 points.

Of the S&P 500's 11 sector indexes, six rose, led by the communication services index (.SPLRCL), which gained 4.69%, followed by a 2.49% increase in the consumer services index (.SPLRCD).

Cigna (CI.N) shares increased by 5.4% after the health insurance provider raised its annual profit forecast.

Microchip Technology (MCHP.O) shares fell by 1.6% following a disappointing sales forecast from the chipmaker.

Skechers USA, a footwear manufacturer, also provided a gloomy forecast, resulting in a 10.3% drop in its shares. Shares of the largest oil company, Chevron Corp (CVX.N), increased by 2.9% after exceeding analysts' estimates.

In the S&P 500 index (.AD.SPX), declining shares outnumbered advancing ones at a ratio of 1.2 to one.

The S&P 500 set 68 new highs and four new lows; Nasdaq recorded 75 new highs and 144 new lows. Trading volume on U.S. exchanges was relatively low: 11.2 billion shares were sold compared to an average of 11.6 billion shares over the previous 20 sessions.

Accelerated growth and expectations that rates will remain at their current level for an extended period could lead to an increase in the yield on treasury bonds. Higher yields may pressure stocks as they compete with bonds for investors, and higher rates increase the cost of capital in the economy.

The yield on 10-year treasury bonds, which moves inversely to bond prices, reached 4.05% on Friday.

Investors continue to anticipate the Federal Reserve cutting rates by about 125 basis points this year. This is less than the approximately 150 basis points estimated earlier this week but still significantly more than the 75 basis points forecasted by the Fed.

News are provided by

InstaForex.

Read More

-

06-02-2024, 05:18 AM #3438Senior Investor

- Join Date

- Jul 2011

- Location

- www.ArmadaMarkets.com

- Posts

- 4,127

- Feedback Score

- 0

- Thanks

- 0

- Thanked 2 Times in 2 Posts

The selection of a broker should be done carefully, as the broker serves as the bridge for traders to engage in forex trading. That's why I chose to join Tickmill as my broker. This way, I can conduct forex trading comfortably and safely.

-

07-02-2024, 09:16 AM #3439

S&P 500 on the finish line: the impact of US earnings and interest rates

S&P 500: Slow gains amid expectations of interest rate changes

Tuesday brought modest gains in the S&P 500, where investors were scrupulously analyzing mixed reports from U.S. giants and evaluating statements from Fed officials looking at hints of an upcoming interest rate cut.

Minneapolis FRB head Neel Kashkari emphasized that the fight against inflation is not over, but noted its accelerating decline, pointing to data that has been largely in line with the Fed's 2% target over the past three and six months.

FRB Cleveland Chairman Loretta Mester expressed the view that a rate cut is possible under favorable developments, although she did not go into details of possible policy easing due to uncertainty around inflation.

Dynamics of shares and sectoral changes of the market

Equity dynamics were erratic throughout the day but recorded gains towards the close.

The Dow Jones Index (.DJI) jumped 141.24 points, or 0.37%, to 38,521.36. The S&P 500 (.SPX) strengthened 11.42 points, or 0.23%, to 4,954.23, while the Nasdaq Composite (.IXIC) rose 11.32 points, or 0.07%, to close at 15,609.00.

On Tuesday, U.S. Treasury Secretary Janet Yellen expressed concern about tensions in the banking sector and among commercial real estate owners, but emphasized that with the help of regulators, the situation remains under control.

The KBW Regional Banks Index (.KRX) ended the day down 1.4%, marking a 12.6% decline over the past six trading sessions. Shares of New York Community Bancorp (NYCB.N) collapsed 22.2% after the bank reported an unexpected quarterly loss due to real estate debt forgiveness for some customers, losing about 60% of its value for the week.

Meanwhile, airline stocks pushed the Dow Jones Transportation Average (.DJT) index up 2.1%, pointing to the demand for air travel. Frontier Group Holdings (ULCC.O) delighted the market by jumping 20.8% thanks to reporting reaching breakeven.

According to LSEG, more than half of the companies in the S&P 500 have already reported earnings that beat expectations 81.2% of the time. Total S&P 500 fourth-quarter earnings are projected to be up 8.1% from a year ago.

GE HealthCare Technologies (GEHC.O) rose 11.6% after posting quarterly earnings that beat expectations, fueling record gains in the healthcare sector of the S&P 500 Index (.SPXHC).

The materials sector (.SPLRCM) posted the best performance of any S&P 500 sector.

The MSCI Global Index (.MIWD00000PUS), which reflects stocks in 49 countries, rose 0.51%.

Shares of chemical giant DuPont de Nemours (DD.N) jumped 1.7%, up 7.4% after the company beat quarterly profit forecasts and also announced a $1 billion share repurchase program and a dividend hike.

Palantir Technologies (PLTR.N) soared 30.8% in anticipation of an upbeat full-year earnings forecast.

Meanwhile, shares of Eli Lilly (LLY.N) are down 0.2% despite a 2024 earnings forecast that exceeds expectations.

Shares in the semiconductor segment added to the tension on the Nasdaq Technology Market, with the Philadelphia SE Semiconductor index (.SOX) down 1%. Rambus Inc (RMBS.O) was at the epicenter of the decline, losing 19.2% after posting quarterly results.

On NYSE actively growing stocks outperformed falling ones, demonstrating a ratio of 2.6 to 1. There were 190 new highs versus 64 new lows on this floor.

The Nasdaq showed 2,721 stocks went up and 1,476 went down, with rising issues outnumbering falling ones by a ratio of 1.8 to 1. The S&P 500 marked 27 new 52-week highs versus 8 new lows, while the Nasdaq recorded 110 new highs and 122 new lows.

Total trading volume on U.S. exchanges reached 11.21 billion shares, compared with the usual average of 11.54 billion over the past 20 sessions.

Strengthening Chinese stocks and the international market

In China, authorities have taken to strengthening its stock market, leading Chinese blue chip stocks (.CSI300) to climb more than 3%. In New York, the iShares China Large-Cap ETF (FXI.P) rose 5.7% and the Golden Dragon China Index (.HXC) jumped 5.9%.

A series of statements from China's financial markets regulator and President Xi Jinping's upcoming meeting with regulators indicated Beijing's determination to combat losses in the domestic market.

State-owned investment fund Central Huijin Investment announced it is expanding its investment in ETFs.

China's blue chips hit a five-year low last week amid a slowing economy, prompting state investors, known as the "national team," to step up purchases of ETFs tracking shares of leading companies to support the market.

News are provided by

InstaForex.

Read More

-

08-02-2024, 03:59 AM #3440

The selection of a broker must be carefully considered, as the broker serves as the bridge for traders to engage in forex trading. That's why I chose to join Tickmill broker, allowing me to trade comfortably and securely here.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote