Existing analytical skills must be able to be considered properly, this is done so that traders can be more leverage in getting maximum trading security and comfort like what I got from Tickmill.

Please visit our sponsors

Results 3,041 to 3,050 of 3458

Thread: Forex News from InstaForex

-

27-09-2022, 04:10 AM #3041

-

27-09-2022, 06:54 AM #3042

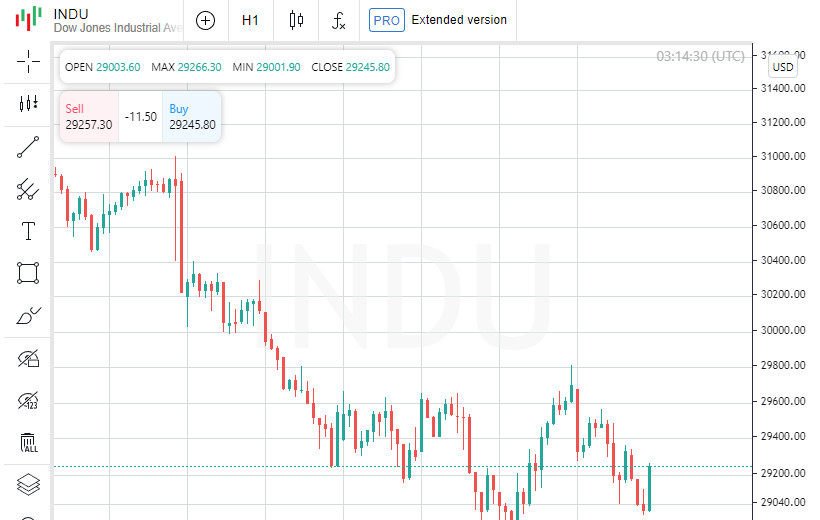

US stocks closed lower, Dow Jones down 1.11%

At the close in the New York Stock Exchange, the Dow Jones fell 1.11% to hit a 52-week low, the S&P 500 fell 1.03%, and the NASDAQ Composite fell 0.60%.

Walmart Inc was the top gainer among the components of the Dow Jones index today, up 1.25 points (0.96%) to close at 131.31. Apple Inc rose 0.34 points (0.23%) to close at 150.77. Procter & Gamble Company rose 0.13 points or 0.10% to close at 135.71.

The biggest losers were The Travelers Companies Inc, which shed 4.88 points or 3.14% to end the session at 150.60. Boeing Co was up 2.99% or 3.92 points to close at 127.34, while Chevron Corp was down 2.63% or 3.81 points to close at 140.96. .

Leading gainers among the components of the S&P 500 in today's trading were Wynn Resorts Limited, which rose 11.99% to 66.80, Las Vegas Sands Corp, which gained 11.81% to close at 39.66. as well as Costco Wholesale Corp, which rose 2.98% to end the session at 480.30.

The losers were DISH Network Corporation, which shed 6.12% to close at 14.27. Shares of The AES Corporation shed 5.48% to end the session at 22.96. Quotes of Halliburton Company decreased in price by 5.17% to 23.31.

Leading gainers among the components of the NASDAQ Composite in today's trading were LAVA Therapeutics NV, which rose 97.50% to 4.74, DIRTT Environmental Solutions Ltd, which gained 42.87% to close at 0.45. as well as shares of Panbela Therapeutics Inc, which rose 25.96% to close the session at 0.34.

The biggest losers were Powerbridge Technologies Co Ltd, which shed 68.57% to close at 0.50. Shares of Scienjoy Holding Corp lost 43.77% to end the session at 1.67. Quotes of Snow Lake Resources Ltd fell in price by 40.88% to 1.88.

On the New York Stock Exchange, the number of securities that fell in price (2652) exceeded the number of those that closed in positive territory (536), while quotes of 132 shares remained virtually unchanged. On the NASDAQ stock exchange, 2,592 stocks fell, 1,248 rose, and 275 remained at the previous close.

The CBOE Volatility Index, which is based on S&P 500 options trading, rose 7.82% to 32.26, hitting a new 3-month high.

Gold futures for December delivery lost 1.56%, or 25.90, to hit $1.00 a troy ounce. In other commodities, WTI crude for November delivery fell 2.82%, or 2.22, to $76.52 a barrel. Futures for Brent crude for December delivery fell 2.81%, or 2.39, to $82.64 a barrel.

Meanwhile, in the Forex market, EUR/USD fell 0.84% to hit 0.96, while USD/JPY edged up 0.94% to hit 144.66.

Futures on the USD index rose by 0.98% to 114.07.

News are provided by

InstaForex.

Read More

-

28-09-2022, 08:00 AM #3043

US stock market closed mixed, Dow Jones down 0.43%

At the close of the New York Stock Exchange, the Dow Jones fell 0.43% to hit a 52-week low, the S&P 500 index fell 0.21%, and the NASDAQ Composite index rose 0.25%.

The leading performer among the Dow Jones index components today was Salesforce Inc, which gained 2.57 points or 1.76% to close at 148.89. Quotes Dow Inc rose by 0.40 points (0.92%), ending trading at 43.79. Home Depot Inc rose 0.79% or 2.11 points to close at 268.69.

The losers were shares of McDonald's Corporation, which lost 7.06 points or 2.90% to end the session at 236.70. Procter & Gamble Company was up 2.75% or 3.73 points to close at 131.98 while Coca-Cola Co was down 2.57% or 1.49 points to close at mark 56.38.

Leading gainers among the S&P 500 index components in today's trading were CF Industries Holdings Inc, which rose 6.10% to hit 95.87, Mosaic Company, which gained 4.15% to close at 48.44, and also shares of Royal Caribbean Cruises Ltd, which rose 3.88% to end the session at 45.75.

The biggest losers were Digital Realty Trust Inc, which shed 3.98% to close at 97.73. Shares of Organon & Co shed 3.54% to end the session at 24.26. Quotes of Global Payments Inc decreased in price by 3.39% to 108.02.

Leading gainers among the components of the NASDAQ Composite in today's trading were Avenue Therapeutics Inc, which rose 106.25% to hit 7.26, Scienjoy Holding Corp, which gained 47.90% to close at 2.47, and also shares of X4 Pharmaceuticals Inc, which rose 40.18% to close the session at 1.25.

The drop leaders were NLS Pharmaceutics AG, which shed 25.07% to close at 0.72. Shares of Midatech Pharma PLC ADR lost 20.77% and ended the session at 2.06. Quotes of Fednat Holding Co decreased in price by 18.22% to 0.18.

On the New York Stock Exchange, the number of securities that fell in price (1634) exceeded the number of those that closed in positive territory (1527), while quotes of 136 shares remained virtually unchanged. On the NASDAQ stock exchange, 2048 companies rose in price, 1751 fell, and 295 remained at the level of the previous close.

The CBOE Volatility Index, which is based on S&P 500 options trading, rose 1.05% to 32.60, hitting a new 3-month high.

Gold Futures for December delivery added 0.18%, or 2.95, to $1.00 a troy ounce. In other commodities, WTI crude for November delivery rose 2.29%, or 1.76, to $78.47 a barrel. Futures for Brent crude for December delivery rose 2.35%, or 1.95, to $84.81 a barrel.

Meanwhile, in the Forex market, the EUR/USD pair remained unchanged 0.14% to 0.96, while USD/JPY rose 0.06% to hit 144.84.

Futures on the USD index rose by 0.09% to 114.12.

News are provided by

InstaForex.

Read More

-

29-09-2022, 05:01 AM #3044Senior Investor

- Join Date

- Jul 2011

- Location

- www.ArmadaMarkets.com

- Posts

- 4,135

- Feedback Score

- 0

- Thanks

- 0

- Thanked 2 Times in 2 Posts

Existing analytical skills must be able to be considered properly, this is done so that traders can be more leverage in getting maximum trading security and comfort like what I got from Tickmill.

-

29-09-2022, 10:09 AM #3045

USD/JPY: When will Groundhog Day end?

The USD/JPY pair continues to tread in the 144-145 range, in which it has been stuck since the beginning of the week. Consolidation is pretty boring for both bulls and bears, but there is no trigger on the horizon yet.

This year, the Japanese currency has fallen in price relative to its American counterpart by more than 20%. The reason for the weakening of the yen was the strong monetary divergence between the US and Japan.

Last week, the dollar-yen pair set another high-profile record. After the Federal Reserve raised rates again, and the Bank of Japan left the indicator unchanged, the quote jumped to a new 24-year high at 145.90.

The sharp fall of the yen forced the Japanese government to intervene in support of its national currency for the first time since 1998. As a result of the intervention, the USD/JPY pair went into a steep peak. However, the asset did not stay as a loser for long. It only took a couple of days for it to get back on track leading to the main goal for today – level 145.

Since the beginning of this week, the dollar-yen pair has already come close to the cherished mark several times, but each time it rolled back.

According to analysts, the main deterrent for dollar bulls at the moment is the risk of repeated currency intervention.

Given the huge number of warnings from the Japanese authorities, traders still prefer not to get into trouble. However, the situation may change dramatically if a particularly powerful trump card in favor of the dollar appears on the market.

You may ask: isn't it here now? Indeed, the dollar received strong support from the Fed last week. The US central bank not only raised rates, but also made it clear that it intends to tighten its monetary policy in the future.

This week, American politicians have further intensified hawkish rhetoric, which contributed to the explosive growth of the dollar. The greenback has reached a new 20-year high, showing impressive dynamics in almost all directions, but not paired with the yen.

The psychologically important 145 barrier still remains impregnable for the USD/JPY asset. This suggests that the market has already taken into account the further growth of discrepancies in the monetary policy of the Fed and the BOJ.

Now traders need specifics: how big the gap in US and Japanese interest rates can become.

If in the near future American officials again talk about raising the indicator by 100 bps, perhaps this will be the very impetus for the dollar, which will move it from the dead point.

– Of course, the Japanese Ministry of Finance is aware of the current vulnerability of the yen. Probably, the authorities will continue to intimidate traders with interventions to deter speculators, Rabobank analysts warn. – Nevertheless, we are still guided in our 3-month forecast for the USD/JPY pair to the level of 147.

As for the short-term dynamics of the asset, do not expect miracles in the coming days. Most experts believe that the dollar-yen pair will remain in the zone of broad consolidation.

The technical picture for the USD/JPY

200-day exponential moving average at 141.20 scales higher. This indicates that the long-term trend is still stable.

At the same time, the relative strength index (RSI) fluctuates in the range of 40.00-60.00, which indicates that the movement continues within the current range.

For a decisive bearish reversal, the asset needs to fall below the previous week's low at around 140.35.

Dollar bulls may push the pair higher after overcoming the previous week's high at 145.90.

This may lead the quote to the August 1998 high at 147.67. And its breakthrough will send the dollar even further upward – to psychological resistance in the area of 150.00.

News are provided by

InstaForex.

Read More

-

30-09-2022, 06:37 AM #3046

US stock market closed lower, Dow Jones down 1.54%

At the close in the New York Stock Exchange, the Dow Jones fell 1.54%, the S&P 500 fell 2.11% and the NASDAQ Composite fell 2.84%.

The leading gainers among the components of the Dow Jones index today were The Travelers Companies Inc, which gained 1.76 points (1.15%) to close at 154.68. Visa Inc Class A rose 0.88 points or 0.49% to close at 180.06. Merck & Company Inc shed 0.14 points or 0.16% to close at 86.64.

The losers were Boeing Co shares, which lost 8.11 points or 6.08% to end the session at 125.33. Walgreens Boots Alliance Inc was up 4.97% or 1.65 points to close at 31.55 while Apple Inc was down 4.91% or 7.36 points to end at 142. .48.

Among the S&P 500 index components gainers in today's trading were Everest Re Group Ltd, which rose 3.07% to 267.41, STERIS plc, which gained 2.76% to close at 167.29, and also shares of W. R. Berkley Corp, which rose 2.73% to end the session at 65.18.

The biggest losers were CarMax Inc, which shed 24.60% to close at 65.16. Shares of SolarEdge Technologies Inc lost 8.27% to end the session at 235.56. Quotes of Royal Caribbean Cruises Ltd decreased in price by 7.91% to 43.64.

Leading gainers among the components of the NASDAQ Composite in today's trading were Senti Biosciences Inc, which rose 50.71% to hit 2.11, Avalon Globocare Corp, which gained 25.85% to close at 0.70, and also shares of TuanChe ADR, which rose 25.31% to close the session at 3.07.

The biggest losers were Atlis Motor Vehicles Inc, which shed 54.82% to close at 33.95. Shares of Lion Group Holding Ltd lost 49.25% and ended the session at 1.01. Quotes of Twin Vee Powercats Co decreased in price by 29.01% to 2.52.

On the New York Stock Exchange, the number of securities that fell in price (2631) exceeded the number of those that closed in positive territory (530), while quotes of 112 shares remained virtually unchanged. On the NASDAQ stock exchange, 2,842 stocks fell, 956 rose, and 224 remained at the previous close.

The CBOE Volatility Index, which is based on S&P 500 options trading, rose 5.50% to 31.84.

Gold futures for December delivery lost 0.07%, or 1.20, to hit $1.00 a troy ounce. In other commodities, WTI crude for November delivery fell 0.55%, or 0.45, to $81.70 a barrel. Futures for Brent crude for December delivery fell 0.55%, or 0.48, to $87.57 a barrel.

Meanwhile, in the Forex market, EUR/USD rose 0.70% to hit 0.98, while USD/JPY edged up 0.21% to hit 144.46.

Futures on the USD index fell 0.36% to 112.11.

News are provided by

InstaForex.

Read More

-

03-10-2022, 03:31 AM #3047

The selection of the existing broker must be able to be considered carefully, this is done so that traders can be more leverage in getting the security and comfort of trading like what I got from Tickmill.

-

03-10-2022, 06:42 AM #3048

US stocks closed lower, Dow Jones down 1.71%

At the close of the New York Stock Exchange, the Dow Jones fell 1.71% to hit a 52-week low, the S&P 500 fell 1.51% and the NASDAQ Composite fell 1.51%.

Shares of UnitedHealth Group Incorporated were among the leaders of gains among the components of the Dow Jones index today, which lost 3.79 points (0.74%) to close at 505.04. Walgreens Boots Alliance Inc fell 0.15 points or 0.48% to close at 31.40. Dow Inc shed 0.23 points or 0.52% to close at 43.93.

The drop leaders were Nike Inc shares, which lost 12.21 points or 12.81% to end the session at 83.12. Boeing Co was up 3.39% or 4.25 points to close at 121.08, while Walt Disney Company was down 3.20% or 3.12 points to close at 94. 33.

Leading gainers among the S&P 500 index components in today's trading were Charles River Laboratories, which rose 3.57% to hit 196.80, Weyerhaeuser Company, which gained 2.92% to close at 28.56, and shares of Twitter Inc, which rose 2.74% to end the session at 43.91.

The losers were shares of Carnival Corporation, which fell 23.31% to close at 7.03. Shares of Norwegian Cruise Line Holdings Ltd lost 18.11% to end the session at 11.35. Quotes of Royal Caribbean Cruises Ltd decreased in price by 13.14% to 37.91.

Leading gainers among the components of the NASDAQ Composite in today's trading were FingerMotion Inc, which rose 82.16% to hit 3.37, SAITECH Global Corp, which gained 43.36% to close at 3.24, and shares of Avenue Therapeutics Inc, which rose 39.03% to end the session at 10.08.

The biggest losers were Atlis Motor Vehicles Inc, which shed 39.91% to close at 20.40. Shares of Aterian Inc lost 37.06% and ended the session at 1.24. Quotes of Edesa Biotech Inc decreased in price by 34.66% to 0.92.

On the New York Stock Exchange, the number of securities that fell in price (1,758) exceeded the number of those that closed in positive territory (1,354), while quotations of 117 shares remained virtually unchanged. On the NASDAQ stock exchange, 2,139 companies fell in price, 1,583 rose, and 228 remained at the level of the previous close.

The CBOE Volatility Index, which is based on S&P 500 options trading, fell 0.69% to 31.62.

Gold futures for December delivery added 0.11%, or 1.80, to $1.00 a troy ounce. In other commodities, WTI crude for November delivery fell 1.87%, or 1.52, to $79.71 a barrel. Futures for Brent crude for December delivery fell 2.13%, or 1.86, to $85.32 a barrel.

Meanwhile, in the Forex market, the EUR/USD pair remained unchanged 0.08% to 0.98, while USD/JPY advanced 0.23% to hit 144.77.

Futures on the USD index fell 0.09% to 112.10.

News are provided by

InstaForex.

Read More

-

04-10-2022, 04:08 AM #3049Senior Investor

- Join Date

- Jul 2011

- Location

- www.ArmadaMarkets.com

- Posts

- 4,135

- Feedback Score

- 0

- Thanks

- 0

- Thanked 2 Times in 2 Posts

Existing analytical skills must be able to be considered properly, this is done so that traders can be more leverage in getting maximum trading security and comfort like what I got from Tickmill.

-

04-10-2022, 10:03 AM #3050

USD/JPY: May the force be with you!

Yesterday, bulls again pushed the USD/JPY pair above the key 145 mark, but failed to gain a foothold there. The yen turned out to be a tough nut to crack, which is still too tough for the dollar bulls.

For a penny of ammunition, for a fragment of ambition

Trampling the USD/JPY pair, which lasted all last week, unexpectedly gave way to a decisive upward movement on Monday morning.

Lacking a new fundamental catalyst, the dollar miraculously managed to hit the 145 peak it tested in September again.

Recall that the last time this barrier was captured turned out to be a disaster for the greenback. In response to the strong fall of the yen, the Japanese authorities carried out the first intervention in 24 years to support their national currency.

Having touched a potentially dangerous line, this time the greenback was more cautious and without intervening in the market, it bounced back as if scalded.

This served as yet another confirmation that USD/JPY bulls are still wary of intervention and do not want to draw fire on themselves.

Of course, the dollar still has a strong amulet in its pocket that will almost save it from a steep plunge. We are talking about the growing monetary divergence between the US and Japan.

But the market is well aware that this is no longer enough for the USD to rise. With the Japanese government continuing to threaten to intervene again, the dollar needs a big boost in the form of strong economic data.

A strong US economy will definitely allow the Federal Reserve to satisfy all its hawkish ambitions, and weak macroeconomic statistics, on the contrary, will prevent this.

Recall that at the September meeting, the US central bank raised interest rates by 75 bps and reaffirmed its willingness to raise the rate more aggressively if inflation continues to be high.

Nevertheless, many analysts believe that the 75 bps step is the ceiling for the Fed. The US central bank is unlikely to decide on anything more, given the uneven economic data.

This opinion was supported by the latest index of business activity in the US manufacturing sector. The ISM reported a reading of 50.9 in September, lower than its forecast of 52.2.

After the release of pessimistic statistics, the yield on 10-year US bonds fell by 14 basis points to 3.66%, and the dollar significantly fell.

Flat may drag on

Today's portion of US economic data is also unlikely to please the USD/JPY bulls. Tuesday's key report will be the release of the index of business activity in the services sector from ISM.

Economists forecast a decline in September to 56 compared to the previous value of 56.9.

The data on the index of new orders for the last month may also turn out to be weak. The indicator is expected to fall to 58.9 against 61.8 recorded in August.

Preliminary estimates are putting significant pressure on the dollar-yen this morning as it struggles to break out of the consolidation phase to try again to break through the defenses at the psychologically important 145 mark.

At the time of release, the quote jumped almost 0.2% and traded around 144.80.

The trigger for the asset was a dovish statement by Japanese Prime Minister Fumio Kishida. The day before, the official said that the government will continue to stimulate the economy, while trying to make the most of the weak yen.

The geopolitical factor also provided significant support to the dollar - the escalation of tension between Japan and North Korea.

At the beginning of the day, it was reported that Pyongyang, which had already tested an unprecedented number of missiles this year, had fired another short-range ballistic projectile.

This time, the target of the North Korean military appeared to be the Hokkaido area, which is considered the second largest Japanese island.

In response to the missile launch over Japan, the Hokkaido authorities issued an air raid alert and urged the people of the region to take shelter.

Meanwhile, Japanese Defense Minister Yasukazu Hamada has signaled that Tokyo is considering all options for strengthening its defenses, including a counterattack.

If the conflict between the countries continues to escalate, the Japanese yen may weaken even more. In this case, bulls on the USD/JPY pair will finally have a real chance to settle above the 145 level.

However, we recommend that traders do not force things yet and be patient, especially since most forecasts for the USD/JPY pair point to further movement in the flat.

Most likely, in the coming days, the dollar and the yen will continue to pull the price rope in the 144-145 range.

Technical picture for the USD/JPY pair

The short-term trend is neutral, but has a tendency to the downside. As the quote fell below the 20-, 50- and 100-EMAs yesterday, this could spell further losses.

If the bears manage to take the asset below 144, this will open a fast route to 143.90.

News are provided by

InstaForex.

Read More

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote