Existing analytical skills must be able to be considered properly, this is done so that traders can be more leverage in getting maximum trading security and comfort like what I got from Tickmill.

Please visit our sponsors

Results 3,031 to 3,040 of 3458

Thread: Forex News from InstaForex

-

16-09-2022, 04:30 AM #3031

-

16-09-2022, 07:02 AM #3032

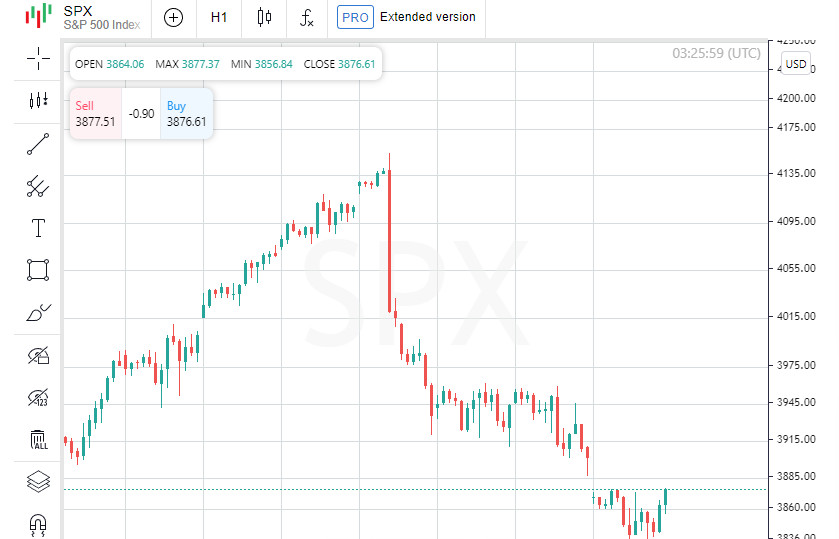

US stocks closed lower, Dow Jones down 0.56%

At the close of the New York Stock Exchange, the Dow Jones fell 0.56% to a one-month low, the S&P 500 fell 1.13% and the NASDAQ Composite fell 1.43%.

UnitedHealth Group Incorporated was the top performer in the Dow Jones Index today, up 13.14 points or 2.58% to close at 522.91. JPMorgan Chase & Co rose 1.75 points or 1.51% to close at 117.87. Goldman Sachs Group Inc rose 4.36 points or 1.33% to close at 331.62.

The losers were Salesforce Inc, which shed 5.50 points or 3.43% to end the session at 154.78. Microsoft Corporation was up 2.71% or 6.84 points to close at 245.38, while Visa Inc Class A was down 2.03% or 4.04 points to close at 195. .37.

Leading gainers among the S&P 500 index components in today's trading were Humana Inc, which rose 8.37% to 497.24, Wynn Resorts Limited, which gained 7.48% to close at 65.23, and shares of Paramount Global Class B, which rose 5.16% to close the session at 23.05.

The losers were Adobe Systems Incorporated, which shed 16.79% to close at 309.13. Shares of Albemarle Corp shed 6.49% to end the session at 286.75. West Pharmaceutical Services Inc lost 5.91% to 273.63.

Leading gainers among the components of the NASDAQ Composite in today's trading were Heartbeam Inc, which rose 85.60% to hit 2.32, Neurobo Pharmaceuticals Inc, which gained 47.21% to close at 24.82, and shares of Nabriva Therapeutics AG, which rose 40.65% to end the session at 0.27.

The drop leaders were Shuttle Pharmaceuticals Inc, which shed 55.65% to close at 16.63. Shares of Eloxx Pharmaceuticals Inc lost 40.97% to end the session at 0.22. Quotes Color Star Technology Co Ltd fell in price by 39.54% to 0.07.

On the New York Stock Exchange, the number of securities that fell in price (2188) exceeded the number of those that closed in positive territory (909), and quotes of 125 shares remained virtually unchanged. On the NASDAQ stock exchange, 1991 stocks fell, 1759 rose, and 265 remained at the previous close.

The CBOE Volatility Index, which is based on S&P 500 options trading, rose 0.42% to 26.27.

Gold futures for December delivery lost 2.08%, or 35.55, to hit $1.00 a troy ounce. In other commodities, WTI October futures fell 3.84%, or 3.40, to $85.08 a barrel. Brent oil futures for November delivery fell 3.56%, or 3.35, to $90.75 a barrel.

Meanwhile, in the Forex market, the EUR/USD pair was unchanged 0.20% to 1.00, while USD/JPY was up 0.23% to hit 143.48.

Futures on the USD index rose by 0.06% to 109.44.

News are provided by

InstaForex.

Read More

-

19-09-2022, 06:39 AM #3033

US stocks closed lower, Dow Jones down 0.45%

At the close on the New York Stock Exchange, the Dow Jones fell 0.45% to hit a monthly low, the S&P 500 index fell 0.72%, and the NASDAQ Composite index fell 0.90%.

The leading performer among the components of the Dow Jones index today was Home Depot Inc, which gained 4.43 points (1.63%) to close at 275.97. Amgen Inc rose 3.48 points or 1.53% to close at 231.14. Johnson & Johnson rose 2.52 points or 1.53% to close at 167.60.

The losers were Boeing Co shares, which fell 5.49 points or 3.67% to end the session at 144.29. Chevron Corp was up 2.60% or 4.17 points to close at 156.45, while Walt Disney Company was down 2.28% or 2.52 points to close at 108. 25.

Leading gainers among the S&P 500 index components in today's trading were Iron Mountain Incorporated, which rose 3.35% to hit 55.29, Newmont Goldcorp Corp, which gained 3.09% to close at 43.71, and also Dollar Tree Inc, which rose 2.89% to end the session at 141.92.

The biggest losers were FedEx Corporation, which shed 21.40% to close at 161.02. Shares of WestRock Co lost 11.48% to end the session at 34.15. Quotes of International Paper fell in price by 11.21% to 35.23.

Leading gainers among the components of the NASDAQ Composite in today's trading were Panbela Therapeutics Inc, which rose 53.06% to hit 0.58, Applied Opt, which gained 50.40% to close at 3.76, and shares of Axcella Health Inc, which rose 29.57% to end the session at 2.41.

The biggest losers were Aditx Therapeutics Inc, which shed 58.52% to close at 4.31. Shares of Esports Entertainment Group Inc lost 46.15% and ended the session at 0.18. Shuttle Pharmaceuticals Inc lost 45.94% to 8.99.

On the New York Stock Exchange, the number of securities that fell in price (2294) exceeded the number of those that closed in positive territory (816), and quotes of 121 shares remained virtually unchanged. On the NASDAQ stock exchange, 2,586 stocks fell, 1,158 rose, and 233 remained at the previous close.

The CBOE Volatility Index, which is based on S&P 500 options trading, rose 0.11% to 26.30.

Gold Futures for December delivery added 0.38%, or 6.35, to hit $1.00 a troy ounce. In other commodities, WTI October futures rose 0.29%, or 0.25, to $85.35 a barrel. Brent oil futures for November delivery rose 0.81%, or 0.74, to $91.58 a barrel.

Meanwhile, in the forex market, the EUR/USD pair remained unchanged 0.10% to 1.00, while USD/JPY fell 0.40% to hit 142.95.

Futures on the USD index fell 0.02% to 109.43.

News are provided by

InstaForex.

Read More

-

20-09-2022, 11:01 AM #3034

Wave your hand to the yen: the dollar is preparing to take off

This week, traders' nerves are stretched to the limit. Everyone is waiting for the Fed's verdict on interest rates and the next jump in the dollar. According to forecasts, it will grow the most against the yen. The divergence in the monetary policy of the US Federal Reserve and the Bank of Japan was the main reason for the weakening of the yen this year.

Due to the large difference in interest rates, the JPY has fallen by more than 20% against the dollar since January. This is the strongest annual decline in the Japanese currency in the entire history of observations.

Nevertheless, many analysts believe that the yen has not yet reached the bottom. Since everything now points to a further increase in monetary divergence, new anti-records are predicted for the yen.

According to experts, the JPY may test another 24-year low against the dollar in the coming days. Two factors will contribute to the sharp fall of the yen.

Firstly, this is the fifth increase in interest rates in America this year. And secondly, the BOJ's confirmation of its depth of strategy.

The degree of nervousness is increased by the fact that the Fed and the BOJ will announce their decisions on interest rates with a difference of only a few hours.

In light of the latest US inflation data, which turned out to be worse than forecasts, the market expects the Fed to raise the indicator by 75 or 100 bps.

Such a hawkish scenario can provide a powerful momentum for the dollar and a strong tailwind for the USD/JPY pair. And the speech of the head of the BOJ will disperse the asset even more.

Goldman Sachs analysts are confident that this week BOJ Governor Haruhiko Kuroda will again leave all the parameters of the monetary policy unchanged: yield curve control, asset purchase program and interest rate recommendations.

According to experts, the BOJ is unlikely to get off its dovish route, even despite signs of increased price pressure.

Statistics on inflation in Japan for August were released this morning. As the report showed, the core consumer price index exceeded the growth forecast on an annualized basis and reached 2.8%.

Thus, inflation in the country exceeded the BOJ's target, which is at the level of 2%, for the past five consecutive months.

This significantly increases concerns that the price pressure may last much longer than the BOJ expects. But it is not worth speculating about the possible capitulation of the BOJ yet.

The news about the acceleration of inflation on the eve of the next meeting of the Japanese central bank really puts Kuroda in a difficult position.

He will have to try hard to give a logical explanation for the need to continue monetary incentives when price growth has significantly overtaken the 2% target.

However, it is unlikely that the current inflation, which remains relatively low compared to other countries, will force the head of the BOJ to change shoes abruptly.

Earlier, Kuroda has repeatedly stated that the central bank will keep interest rates at extremely low levels until solid wage growth makes inflation more stable.

The firm determination of Japanese politicians to adhere to the dovish strategy is also evidenced by today's decision of the government.

On Tuesday, Japan's finance ministry said it would spend 3.48 trillion yen ($24 billion) from budget reserves to cope with the continued price increases.

The decision was made at a meeting of the cabinet of Prime Minister Fumio Kishida, whose approval rating has recently dropped significantly.

In order to regain the favor of the Japanese suffering from the rising cost of living, the official is ready to provide a new package of financial assistance, i.e. to eliminate the symptom, not the cause of the disease.

As you can see, Japan is not going to deploy an anti-inflationary company yet, as other countries do. However, the status of an outsider does not bode well for its national currency.

The US Fed is not the only one who is going to raise interest rates this week, but also the Bank of England and the Swiss National Bank. This will further aggravate the situation of the yen, analysts believe.

But the main beneficiary of the isolated BOJ position will still be the USD/JPY pair. According to forecasts, it will break through the key threshold of 145 if the Fed's actions turn out to be even more hawkish this time.

News are provided by

InstaForex.

Read More

-

21-09-2022, 03:47 AM #3035Senior Investor

- Join Date

- Jul 2011

- Location

- www.ArmadaMarkets.com

- Posts

- 4,135

- Feedback Score

- 0

- Thanks

- 0

- Thanked 2 Times in 2 Posts

Existing analytical skills must be able to be considered properly, this is done so that traders can be more leverage in getting maximum trading security and comfort like what I got from Tickmill.

-

21-09-2022, 06:11 AM #3036

US stock market closed lower, Dow Jones down 1.01%

At the close of the New York Stock Exchange, the Dow Jones fell 1.01% to a one-month low, the S&P 500 index fell 1.13%, and the NASDAQ Composite fell 0.95%. The leading performer among the components of the Dow Jones index today was Apple Inc, which gained 2.42 points (1.57%) to close at 156.90. Quotes Boeing Co rose by 1.06 points (0.73%), ending trading at 145.94. 3M Company lost 0.12 points or 0.10% to close at 116.52.

The biggest losers were Nike Inc, which shed 4.79 points or 4.47% to end the session at 102.42. Caterpillar Inc was up 2.26% or 4.12 points to close at 177.99, while Home Depot Inc was down 2.23% or 6.25 points to close at 274. 17.

Leading gainers among the components of the S&P 500 in today's trading were Wynn Resorts Limited, which rose 2.90% to hit 67.80, Valero Energy Corporation, which gained 2.63% to close at 107.42, and also shares of Expedia Inc, which rose 2.09% to end the session at 104.63.

The fallers were shares of Ford Motor Company, which fell 12.32% to close at 13.09. Shares of Iron Mountain Incorporated shed 9.84% to end the session at 50.65. Quotes of Generac Holdings Inc decreased in price by 6.99% to 183.49.

The leading gainers among the components of the NASDAQ Composite in today's trading were Sobr Safe Inc, which rose 234.98% to 3.05, Powerbridge Technologies Co Ltd, which gained 60.62% to close at 2.20. as well as Neurobo Pharmaceuticals Inc, which rose 42.40% to end the session at 20.79.

The biggest losers were Virios Therapeutics Llc, which shed 75.50% to close at 0.49. Pagaya shares shed 67.24% to end the session at 2.29. Quotes of Integrated Media Technology Ltd decreased in price by 46.07% to 1.03.

On the New York Stock Exchange, the number of securities that fell in price (2599) exceeded the number of those that closed in positive territory (546), while quotes of 129 shares remained virtually unchanged. On the NASDAQ stock exchange, 2,705 companies fell in price, 1,091 rose, and 227 remained at the level of the previous close.

The CBOE Volatility Index, which is based on S&P 500 options trading, rose 5.43% to 27.16.

Gold futures for December delivery shed 0.29% or 4.80 to hit $1.00 a troy ounce. In other commodities, WTI crude for November delivery fell 1.19%, or 1.02, to $84.34 a barrel. Brent oil futures for November delivery fell 1.14%, or 1.05, to $90.95 a barrel.

Meanwhile, in the Forex market, EUR/USD was flat at 0.49% at 1.00, while USD/JPY edged up 0.35% to hit 143.71.

Futures on the USD index rose 0.39% to 109.89.

News are provided by

InstaForex.

Read More

-

22-09-2022, 04:14 AM #3037

the funds and risks that exist must indeed be able to be considered properly, this is done so that traders can be more leverage in getting maximum trading security and comfort like what I got from Tickmill.

-

22-09-2022, 06:57 AM #3038

BTC quotes unexpectedly turned to growth

Bitcoin began to rise on Wednesday morning, when this article was written, its price had reached $19,123.

According to virtual asset price tracking website CoinMarketCap, over the past 24 hours, the highest value of bitcoin reached $19,548, and the lowest was $18,813.

As a result of the past 24 hours, the price of bitcoin rose by 2.8% and closed the session at about $19,000.

Over the past seven days, bitcoin has fallen in price by 16%. The main reason for the confident decline of the first cryptocurrency in recent days, experts call a protracted fall in key US stock indices, as well as fresh data from the US Department of Labor, according to which the August inflation rate in the country decreased to only 8.3% from 8.5% in July.

The results of the September meeting of the US Federal Reserve on the next increase in the key interest rate will be made public on Wednesday. During this meeting, the central bank carefully assessed the final inflation rate. Analysts are sure that amid a slight decrease in the consumer price index, the US central bank will not refuse another rate hike by 75 basis points. So, last week, Fed Chairman Jerome Powell announced the central bank's readiness to "act decisively" in order to combat record levels of consumer prices in the country.

To date, approximately 82% of the market is confident that the Fed will increase the base interest rate by 75 basis points. At the same time, 18% is set aside for a possible rate increase of 100 basis points. As a result, the central bank's interest rate could rise to 300-325 bps or 325-350 bps, respectively.

Recall that in March 2022, the US central bank already raised its key rate by 25 basis points, in May - by 50, and in June - by 75.

By the way, recently experts from the analytical company Kaiko reported that the volatility of BTC significantly depends on the results of the meetings of the Fed.

According to analysts from Kaiko, a high correlation of bitcoin with the decisions of the Fed was recorded in the summer of 2021, which indicates that the cryptocurrency market has long been influenced by key macroeconomic indicators.

So, when in May 2022 the Fed increased the rate range to 0.75-1% per annum, the cost of the first cryptocurrency sharply overcame the level of $40,000, but on the same day it fell below $36,000, starting the process of a protracted correction.

In June this year, when the US central bank raised its key rate to 1.5-1.75%, bitcoin immediately reacted with spectacular growth.

Experts are confident that in the coming months, the digital asset market will respond even more strongly to the speeches of world central banks, because often, an increase in the interest rate dramatically reduces the ability of investors to invest in risky assets such as virtual currency.

The weak results of the last trading session on the US stock market also became an important factor in pressure on the BTC on Wednesday. So, on Tuesday, the Dow Jones Industrial Average fell 1.01%, the S&P 500 plunged 1.13%, and the NASDAQ Composite fell 0.95%.

Since the beginning of 2022, analysts have increasingly begun to emphasize the high level of correlation between the US securities market and virtual assets amid intense anticipation by both of the consequences of the geopolitical conflict in Eastern Europe and further steps by the Fed.

Earlier, experts from the investment company Arcane Research have already stated that the correlation of BTC and technology securities has reached its peak since July 2020.

The current situation looks rather ironic, because since the advent of cryptocurrency, it has been positioned as the main tool for protecting against inflation and price volatility in traditional markets. However, in recent months, digital assets have been increasingly correlated with stock markets, which casts doubt on the success of virtual coins.

Altcoin Market

Ethereum, the main competitor of bitcoin, also started the trading session on Wednesday with a rise and by the time of this writing it has reached $1,343.

Over the past seven days, the value of the altcoin has fallen by 17%. At the same time, the key reason for such a sharp drop in ETH was the most long-awaited event of the current year for cryptocurrency fans.

So, on the morning of September 15, the Ethereum network successfully migrated from the Proof-of-Work (PoW) algorithm to Proof-of-Stake (PoS), which does not require mining. The migration happened as part of a major update to The Merge.

At first, the quotes of bitcoin's main competitor reacted to positive news with growth, but later fell sharply by 8.2%.

As for cryptocurrencies from the top 10 by capitalization, within the past 24 hours, the best results were recorded by XRP (+8.05%), and the worst by BTC (-2.8%).

According to the results of the past week, in the top ten of the strongest digital assets, the fall list was headed by the Ethereum cryptocurrency (-15.60%), and the highest results were recorded by XRP (+22.06%).

According to CoinGecko, the world's largest virtual asset data aggregator, Cosmos (-9.87%) took the first place in the drop list among the top 100 most capitalized digital assets over the past 24 hours (-9.87%).

According to the results of the past week, the digital asset Ravencoin (-39.14%) showed the worst results among the top hundred strongest digital assets.

In the past 24 hours, the total market capitalization of cryptocurrencies has dropped to $920 billion, according to CoinGecko.

Since last November, when this figure exceeded the $3 trillion mark, it has more than tripled.

Crypto Expert Predictions

The unpredictable behavior of the digital coin market forces analysts to make the most unexpected predictions about its future. The CEO of Dogifox Nicholas Merten said that BTC is waiting for a collapse to $14,000.

The crypto expert came to this conclusion due to technical and macroeconomic factors. So, Merten is sure, the recent exchange rate movement of digital gold may signal the end of a 10-year bullish cycle, after which the coin will cease to be a key asset compared to other commodities and stocks.

An important macroeconomic incentive to reduce the cost of the first cryptocurrency, the crypto expert believes, may also be the Fed's decision. Despite the potential dangers for the global economy, the US central bank is likely to continue raising interest rates until the record inflation is completely defeated.

The combination of all the above technical and macroeconomic factors, the Dogifox CEO believes, will soon push bitcoin to the price bottom at $14,000. If the coin collapses to these values, its correction will be 80% of the historical record of $69,000.

As for the near future of bitcoin's main competitor, the altcoin Ethereum, Merten suggests that the cryptocurrency will retest the $800-$1,000 range, and in the worst case, quotes will fall even lower.

However, there are those who hold more positive views regarding the future of key players in the cryptocurrency market. So, recently the former top manager of the financial conglomerate Goldman Sachs, and now the CEO of Real Vision, Raoul Pal, said that digital assets will grow steadily in the coming year.

The analyst explains his optimism about the cryptocurrency market in the long term by the global economic crisis and the merger of Ethereum.

So, Pal is sure that against the background of ETH migration to the Proof-of-Stake algorithm, miners who sell altcoins every day will leave the market. As a result, there will be a decrease in the volume of offers and $6 billion in Ethereum will disappear from monthly sales. In this case, the main competitor of bitcoin will be less prone to inflation.

In addition, the CEO of Real Vision believes that, thanks to the constantly growing demand, the decrease in the supply of ETH and the environmental problems of BTC, 2023 can be very successful for Ethereum.

News are provided by

InstaForex.

Read More

-

23-09-2022, 05:08 AM #3039

US stocks closed lower, Dow Jones down 0.35%

At the close of the New York Stock Exchange, the Dow Jones fell 0.35% to a 3-month low, the S&P 500 fell 0.84%, and the NASDAQ Composite fell 1.37%.

Merck & Company Inc was the top performer among the components of the Dow Jones in today's trading, up 2.98 points or 3.53% to close at 87.51. Quotes Johnson & Johnson rose by 2.90 points (1.78%), ending trading at 166.18. Salesforce Inc rose 2.52 points or 1.71% to close at 150.15.

Shares of American Express Company were the leaders of the fall, the price of which fell by 5.68 points (3.82%), ending the session at 143.03. Boeing Co was up 3.20% or 4.58 points to close at 138.71, while Goldman Sachs Group Inc was down 2.43% or 7.79 points to close at 312. .92.

Among the S&P 500 index components gainers today were Eli Lilly and Company, which rose 4.85% to 310.87, Merck & Company Inc, which gained 3.53% to close at 87.51. , as well as shares of Bristol-Myers Squibb Company, which rose 2.63% to end the session at 71.29.

The biggest losers were Caesars Entertainment Corporation, which shed 9.44% to close at 37.62. Shares of Ball Corporation lost 8.66% to end the session at 49.23. FactSet Research Systems Inc dropped 8.29% to 394.75.

Leading gainers among the components of the NASDAQ Composite in today's trading were Spero Therapeutics Inc, which rose 167.74% to hit 2.20, Avenue Therapeutics Inc, which gained 105.90% to close at 0.44, and also shares of Panbela Therapeutics Inc, which rose 46.39% to end the session at 0.35.

Top Ships Inc. was the biggest loser, shedding 44.06% to close at 0.12. Shares of Ecmoho Ltd lost 42.72% and ended the session at 0.10. Quotes of Pintec Technology Holdings Ltd decreased in price by 28.80% to 0.42.

On the New York Stock Exchange, the number of securities that fell in price (2596) exceeded the number of those that closed in positive territory (546), while quotes of 120 shares remained virtually unchanged. On the NASDAQ stock exchange, 3,011 stocks fell, 765 rose, and 257 remained at the previous close.

The CBOE Volatility Index, which is based on S&P 500 options trading, fell 2.29% to 27.35.

Gold futures for December delivery added 0.24%, or 4.00, to $1.00 a troy ounce. In other commodities, WTI crude for November delivery rose 0.54%, or 0.45, to $83.39 a barrel. Brent oil futures for November delivery rose 0.50%, or 0.45, to $90.28 a barrel.

Meanwhile, in the Forex market, the EUR/USD pair remained unchanged 0.04% to 0.98, while USD/JPY fell 1.14% to hit 142.40.

Futures on the USD index rose by 0.65% to 111.07.

News are provided by

InstaForex.

Read More

-

26-09-2022, 08:09 AM #3040

GBP/USD. The pound is on the path of a great crisis. Will there be parity?

How low can the exchange rate fall? Will the Bank of England take measures to support the pound? At the end of last week, bearish positions on the British pound sharply intensified. Traders seem to have tried to resist such a powerful downward movement until the last moment, but it did not work out. Events are developing in such a way that the pound in the future can not only update distant historical lows, but also risks setting a new anti-record. The BoE's decision on the rate and the announcement of the interim budget, to put it mildly, did not impress the markets. The central bank raised the rate by only 50 bps, accumulating a backlog from the Federal Reserve. The new economic plan failed to allay investors' concerns about the approaching recession in the country. The collapsed economic indicators were also another reason for short positions. The GfK consumer confidence indicator plunged to -49 from -41, updating the historical record. The last time such figures could be seen was in 1974. The CBI retail activity indicator fell to -20 in September from 37 in August. Preliminary PMI estimates could not act as a kind of reassurance for the market. The composite index fell to 48.4 from 49.6 due to the deterioration in the service sector, where the corresponding indicator fell to 49.2 from 50.9. At first, the GBP/USD pair fell to the area of 1.1020, which is the low since 1985. Then shorts intensified and the quote easily broke down the 1.0900 mark.

Since the beginning of the year, GBP/USD has lost approximately 20%. Given inflation of 10%, nervousness should be not only among market players, but primarily among the government and the BoE. If officials do step up their efforts to maintain the pound, volatility in the foreign exchange market risks being prohibitive or getting out of control.

What's Wrong with Government Measures?

The pound was mostly brought down by new government measures. The authorities have announced significant tax cuts since 1972 in an attempt to push the country's economic growth to 2.5%.

At least some, but actions and in theory, and even according to the government's plan, it was supposed to support the mood. However, investors have their own vision of the situation and they did not believe that the British authorities, led by Liz Truss, would be able to finance these measures without hindrance.

Radical changes to the tax code imply a reduction in the basic income tax rate from 20p to 19p from April 2023. The highest income tax rate has been reduced from 45p to 40p, while the increase in national insurance contributions this year will be canceled in November.

In addition, the planned increase in corporate tax has been postponed indefinitely. At the same time, Brits buying housing for the first time will be able to see a noticeable weakening of the state fee. The cost of all the announced tax cuts, according to the authorities, is 45 billion pounds.

At the same time, the government's decision to limit electricity bills will cost much more, approximately 130 billion pounds.

In general, this means that the British government will need to borrow more, increasing the supply of gold on the market.

What will Happen to the Pound?

The panic selling of the pound made many think about the future prospects of the British currency. What is it: a temporary turbidity and an excessively strong and completely unreasonable reaction of worried investors, or is the pound really on the path of a great crisis? Will there be parity with the dollar for the first time in history?

Indeed, the pound is now under the strongest pressure, including due to the incessant advance of the dollar. The fall of the pound coincides with the time when there was a significant sell-off on world markets. Even in normal times, this creates obstacles for the national currency of Britain.

Parity with the dollar is considered by analysts as an extreme measure, which is still far from reality. At the same time, new record lows are quite possible.

It is unlikely that government measures will lead to a collapse of the pound or create problems when selling gold coins.

"Given that the economy is flirting with recession, tax cuts supporting demand are not necessarily a bad idea. But this tax cut should be permanent, not temporary," Oxford Economics believes.

The pound is expected to continue to decline to about 1.0500 against the dollar in the short term. Meanwhile, the BoE will have no choice but to raise the size of the rate hike. At the November meeting, the central bank should increase the rate by 75 bps. Thus, the markets will raise the forecast for the maximum bank rate from 3% to 4%.

News are provided by

InstaForex.

Read More

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote