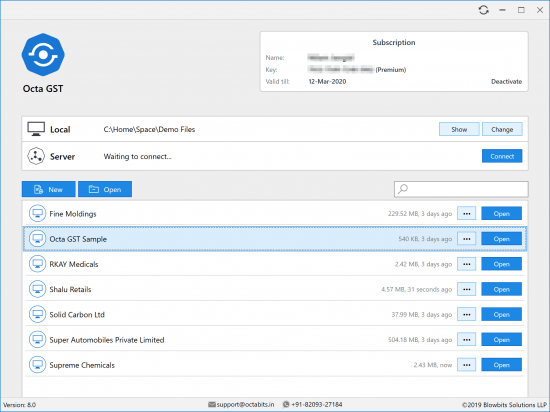

OCTA GST 10.19 | File Size: 11 MB

Octa GST. Private, Efficient & Accurate. The GST compliance experience you deserve!

GSTR-2A & Purchase Reconciliation

Unmatched high performance & smart reconciliation

Supplier level (party-wise) or invoice level reconciliation

Reconcile for month, quarter, financial year or all transactions

Option to include/exclude reverse charge invoices

Option to ignore the small differences to focus on significant differences only.

Smart linking of invoices based on invoice number patterns. Link and compare invoices even if invoice numbers does not match.

Export mismatch report in Excel format. Include or exclude the invoices based on mismatch status.

GST Returns Annual Report

Simple and comparative summary of GST returns

Single consolidated Excel report

Month-wise consolidated report of GSTR-1, GSTR-2A and GSTR-3B

Month-wise comparison report of GSTR-3B vs GSTR-1 and GSTR-3B vs GSTR-2A

Seperate heads of different tax types

Seperate heads depending on nature of transactions

Process lakhs of transactions in seconds

Prepare Accurate GST Returns

Auto-generate GST returns, apply validations, keep history

Data import from multiple sources

Auto-calculates the return data from sales/purchase transactions

Full support of amendments in GSTR-1

Run validation rules before return preparation to avoid mistakes in filing

ITC claim reminder/notification

Return preview and analysis

Generate Excel report to share with clients/other users

Release Notes

Added the facility to start trial from with-in the application. This helps new users get started with application trial quickly.

Updated GSTR-4A JSON schema as per latest GSTN specification.

Homepage

DOWNLOADCode:http://https://octa.in/

(Buy premium account for maximum speed and resuming ability)

Please visit our sponsors

Results 1 to 1 of 1

Thread: Octa gst 10.19

-

24-06-2021, 10:20 PM #1Senior Investor

- Join Date

- Feb 2016

- Posts

- 7,613

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Octa gst 10.19

Octa gst 10.19

-

Sponsored Links

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Tags for this Thread

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote