Technical analysis of Bitcoin for 04.06.2019

Crypto Industry News:

The Japan House of Representatives officially approved a new bill to amend national laws regulating the cryptographic industry.

The draft law - prepared by the Japanese Financial Services Agency (FSA) and approved by the House in mid-March this year - was adopted by a majority of votes at the plenary session of the Chamber of Councilors, in accordance with the current update of the FSA on the official website.

The project is aimed at introducing changes to two national laws regarding cryptographic assets - the act on the settlement of funds and the law on financial instruments and exchange. Now that the bill has been adopted, the amended acts are expected to enter into force in April 2020.

The proposed changes to Japanese financial instruments and payment services will ostentatiously tighten the regulation of cryptocurrencies to promote user protection, more stringent regulation of trading in cryptographic instruments, mitigate industry risks, such as stock market busts, and the broad establishment of a more transparent legal framework for new asset classes.

According to earlier reports, the bill also introduces a legal change in the name of cryptocurrencies as "cryptographic assets", previously marked in the country as "virtual currencies". The draft also provides for stricter rules regarding trading in margins, limiting the leverage to double and four times the initial deposit.

Technical Market Overview:

The BTC/USD pair has made another wave to the downside as anticipated. This wave is a part of the wave 4 correction and so far reached the level of $7,739 after all the technical supports were violated. The next target for bulls is seen at the level of $7,484. This corrective cycle might evolve into an ABCDE Triangle pattern as well, so please keep an eye on the further developments.

Weekly Pivot Points:

WR3 - $10,284

WR2 - $9,622

WR1 - $9,121

Weekly Pivot - $8.545

WS1 - $8,037

WS2 - $7,438

WS3 - $6,960

Trading Recommendations:

The best strategy in the current market conditions is to trade in the direction of the main trend, which is still up. All the local bounces and correction should be treated as another opportunity to open the buy orders for a better price. Please notice, the larger time frame trend is up and there are no signs of any trend reversal.

Analysis are provided byInstaForex.

Please visit our sponsors

Results 2,791 to 2,800 of 4086

Thread: InstaForex Wave Analysis

-

04-06-2019, 06:12 AM #2791

-

07-06-2019, 02:34 AM #2792

EURUSD: ECB revised the interest rate forecast. Mario Draghi is pleased with the growth of the economy in the 1st quarter, but fears for its future

The euro ignored data on the growth of the eurozone economy in the 1st quarter of this year, as traders closely followed the ECB report. Even despite the fact that the expected dates for raising interest rates in the eurozone were shifted to the middle of next year, and Mario Draghi signaled a possible decrease in interest rates to a negative level if necessary, the euro held its position and even rose against the US dollar.

According to the report, a good increase in consumer spending in the euro area in the 1st quarter of this year contributed to accelerating economic growth. Export has also made a significant contribution.

According to the EU statistics agency, the eurozone economy grew by 0.4% in the 1st quarter of this year compared to the 4th quarter. Compared with the 1st quarter of 2018, the economy grew by 1.2%. In annual terms, an increase of 1.6%.

However, it is already known from the results of the latest reports that in the 2nd quarter of this year, GDP growth slows down, and, as many experts expect, growth will be the weakest since the beginning of economic recovery in 2014.

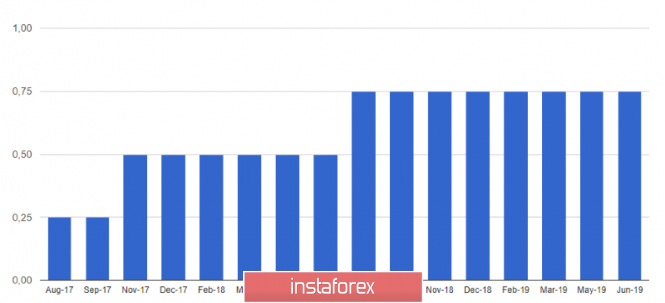

As I noted above, the attention of traders was focused on the ECB meeting, at which the regulator left the refinancing rate unchanged, at the level of 0.0%. The European Central Bank left the deposit rate unchanged at -0.40%.

The central bank revised its forecast, saying that rates would remain at current levels, at least until the end of the first half of 2020. The ECB will continue to completely reinvest the income from the QE program over a long period after the first rate increase.

A new TLTRO program was also announced, according to which targeted long-term loans for banks will be offered at a rate of 10 bp above the average refinancing rate.

The euro rose during the speech of the ECB President Mario Draghi, although the statements made by in principal were negative.

Draghi noted that he is closely following how monetary policy affects banks, and is ready to act. If necessary, the ECB will adjust monetary policy instruments. As for the extension of the forecast period of saving rates, it was quite expected due to the long-term uncertainty, which is now observed in the global economy. First of all, uncertainty is associated with conflicts in international trade and changes in the policies of central banks. Draghi also said that the ECB may lower interest rates if necessary.

As for the economy, the head of the ECB is confident that, despite the stronger growth in eurozone GDP in the 1st quarter of this year, the difficulties in the world still put pressure on the prospects for further growth, and the data indicate a slightly weaker growth in the economy 2nd and 3rd blocks.

ECB economists forecast GDP growth in 2019 by 1.2% against the previous forecast of growth of 1.1%, while in 2020 it is expected to grow by 1.4% against the previous forecast of growth by 1.6%.

The ECB president is confident that the increase in employment and wage growth will continue to support the eurozone economy, but the threat of protectionism and geopolitical factors will slow it down.

Analysis are provided byInstaForex.

-

11-06-2019, 06:08 AM #2793

USD/JPY to test resistance, a drop is possible!

USDJPY to test key resistance, a drop to 1st support is possible

Entry: 109.012

Why it's good : 61.8% Fibonacci extension, 23.6% Fibonacci retracement, horizontal pullback resistance

Stop Loss : 109.914

Why it's good :50% Fibonacci retracement,horizontal swing high resistance

Take Profit : 107.854

Why it's good: 61.8% Fibonacci retracement, 100% Fibonacci extension, horizontal swing low support

Analysis are provided byInstaForex.

-

13-06-2019, 06:16 AM #2794

GBP/USD near support, a bounce is possible!

GBPUSD is near support, a bounce to 1st resistance is possible

Entry: 1.2844

Why it's good : 100% Fibonacci extension, 38.2% & 23.6% Fibonacci retracement, horizontal swing low support

Stop Loss : 1.1256

Why it's good :38.2% & 61.8% Fibonacci retracement,100% Fibonacci extension, horizontal swing low support

Take Profit : 1.1342

Why it's good: 100% Fibonacci extension, horizontal swing high resistance

Analysis are provided byInstaForex.

-

14-06-2019, 06:50 AM #2795

Technical analysis of GBP/USD for 14/06/2019:

Technical Market Overview:

After two Pin Bar like candlestick formation around the upper consolidation boundary, the GBP/USD pair keeps trading close to the support zone located between the levels of 1.2652 - 1.2668. The momentum is barely holding the neutral fifty level and it looks like is about to go lower as well. The stochastic is in the middle of the range now, so all sum up there is no direct signal regarding the future price move now, but the support zone is tempting to be violated. In this scenario, the next target for bears is seen at level 1.2605.

Weekly Pivot Points:

WR3 - 1.2954

WR2 - 1.2856

WR1 - 1.2800

Weekly Pivot Point: 1.2708

WS1 - 1.2658

WS2 - 1.2549

WS3 - 1.1502

Trading Recommendations:

The best strategy in the current market conditions is to trade in the direction of the main trend, which is still down. All the local bounces and correction should be treated as another opportunity to open the sell orders for a better price. Please notice, the larger time frame trend is down and there are no signs of any trend reversal.

Analysis are provided byInstaForex.

-

17-06-2019, 04:46 AM #2796

USD/CAD approaching resistance, potential reversal!

Price is approaching its resistance where we expect to see a reversal.

Entry : 1.3437

Why it's good : 61.8% Fibonacci retracement, 100% Fibonacci extension, horizontal pullback resistance

Stop Loss : 1.3499

Why it's good : 78.6% Fibonacci retracement

Take Profit : 1.3364

Why it's good : Horizontal pullback support, 38.2% Fibonacci retracement

Analysis are provided byInstaForex.

-

18-06-2019, 05:52 AM #2797

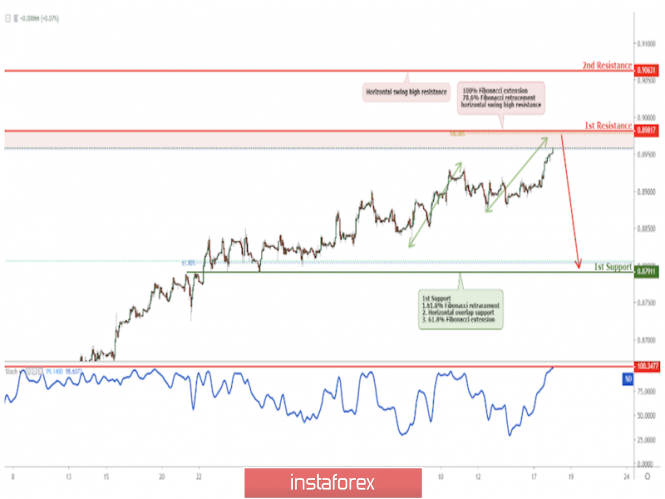

EUR/GBP near resistance, a drop is possible!

EURGBP is near resistance, a drop to 1st support is possible

Entry: 0.8982

Why it's good : 100% Fibonacci extension, 78.6% Fibonacci retracement, horizontal swing high resistance

Stop Loss : 0.9063

Why it's good :horizontal swing high resistance

Take Profit : 0.8791

Why it's good: 61.8% Fibonacci extension, horizontal overlap support, 61.8% Fibonacci retracement

Analysis are provided byInstaForex.

-

19-06-2019, 06:20 AM #2798

GBP/USD near resistance, a drop is possible!

GBPUSD is near resistance, a drop to 1st support is possible

Entry: 1.2564

Why it's good : 61.8% Fibonacci extension, 23.6% Fibonacci retracement, horizontal pullback resistance

Stop Loss : 1.2660

Why it's good :horizontal pullback resistance, 61.8% Fibonacci retracement, 61.8% Fibonacci extension

Take Profit : 1.2462

Why it's good: 100% Fibonacci extension

Analysis are provided byInstaForex.

-

20-06-2019, 05:34 AM #2799

USD/JPY approaching support, possible bounce!

Price is approaching its support where it could potentially bounce up to its resistance at 108.161

Entry : 107.492

Why it's good : 61.8% Fibonacci extension

Take Profit : 108.161

Why it's good : 50% Fibonacci retracement, horizontal pullback resistance, 61.8% Fibonacci extension

Analysis are provided byInstaForex.

-

21-06-2019, 05:34 AM #2800

GBPUSD: The pound is growing after the Bank of England's decision not to change the monetary policy

The British pound continued its growth against the US dollar, completely ignoring the weak report on retail sales. The demand for the pound has been observed since the beginning of the week, when it became clear that the monetary policies of the Bank of England and the US Federal Reserve may begin to diverge in different directions. In other words, the central bank of England will not lower interest rates, while the Fed intends to do this, which, although indirectly, was mentioned at Fed Chairman Jerome Powell's press conference yesterday.

As I noted above, retail sales in the UK fell in May of this year, and one of the main reasons are adverse weather conditions, which negatively affected the demand for summer wardrobe items. This once again confirms the fact that the UK economy is unlikely to show good growth rates in the 2nd quarter of this year and, at best, will only keep them.

According to the UK National Bureau of Statistics, retail sales in the UK fell by 0.5% in May compared with April. Fall is observed for the second month in a row. Between March and May, UK retail sales rose by only 1.6%, after rising 1.7% between February and April.

Economists had expected a similar decline in retail sales, which also kept pressure on the British pound before the publication of the Bank of England report on interest rates.

According to the data, the Bank of England left the key interest rate at the level of 0.75%, and the decision to keep the key rate at the same level was made at a ratio of 9 to 0.

The central bank noted that downside risks for GDP growth have increased, and therefore GDP growth will remain unchanged in the 2nd quarter. The regulator also expects that this year inflation will be below the target level of 2%, which will "slow down" with a further increase in interest rates in the context of growing uncertainty with Brexit.

Let me remind you that today Boris Johnson, who is the most likely successor of Theresa May as prime minister, moved ahead in the fourth round of voting with 157 votes. Johnson is a hard advocate of Brexit, which in the future could create serious problems for the economy.

The Bank of England expects a limited and gradual increase in interest rates in the event of a smooth Brexit.

As for the technical picture of the GBPUSD pair, growth was restrained by a large resistance level around 1.2730, and currently there is some downward correction in the support area of 1.2640, which will make it possible for large buyers to build the lower boundary of the new upward channel capable of continuing the current trend. The main weekly goal of the bulls will be a high in the area of 1.2760.

Analysis are provided byInstaForex.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 4 users browsing this thread. (0 members and 4 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote