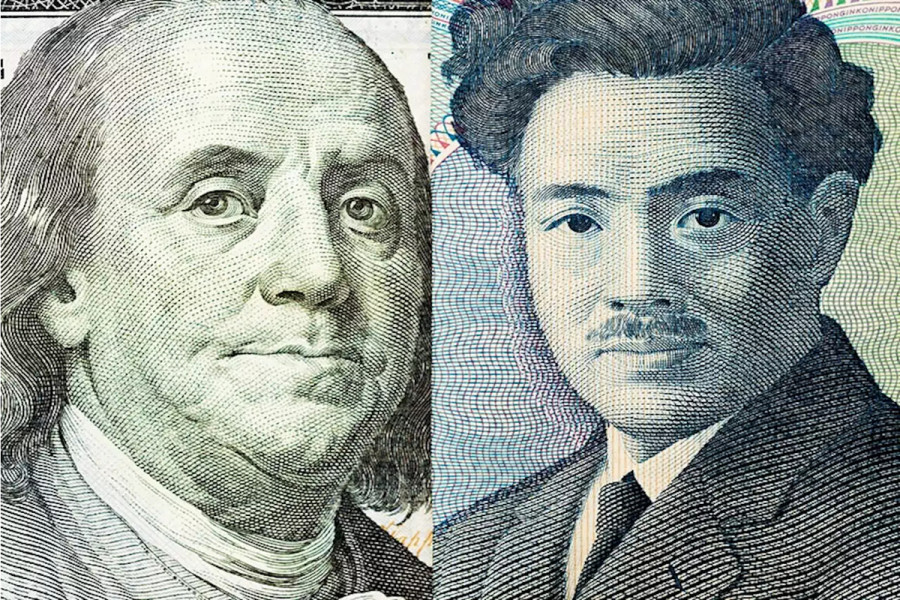

USD/JPY: Calm before the storm ahead of Jackson Hole symposium

As we embark on a new trading week, the USD/JPY currency pair has taken a neutral stance, signaling a cautious sentiment among investors ahead of the Federal Reserve symposium in Jackson Hole scheduled for August 24-26. All eyes are on the Federal Reserve's Chairman, Jerome Powell, whose speech will likely be a pivotal factor affecting the USD/JPY's trajectory. What can we expect from Powell's statement and how might it sway the greenback?

USD/JPY trapped in a sideways channel

The onset of Monday saw the USD/JPY pair settle into a neutral zone, with both currencies evenly matched and displaying little momentum.

Several factors currently serve as drivers for the yen:

Rising expectations of a potential change in the monetary policy of the Bank of Japan, propelled by July's unexpectedly high inflation figures. Last month, the Consumer Price Index (CPI) surged to an annualized 3.3%, surpassing the forecast of 2.5%. Traders' worries about Tokyo's intervention in the market, given that USD/JPY consistently trades above the significant 145.00 threshold, a level where intervention happened last year.

Looming fears of a global recession, compounded by China's stuttering economic growth. Further fiscal stimuli from Beijing might boost the yen, given its export-dependent nature.

Worries about decelerating global growth also buoy the US dollar, given its reputation as a haven asset. Yet, the central divergence in the monetary policies of the Fed and the Bank of Japan (BOJ) remains the strongest catalyst influencing the greenback's movements against the yen.

Speculations have long surrounded the BOJ's monetary approach. Still, the regulator sticks to its dovish strategy, hinting that no change is coming anytime soon.

Regarding the Federal Reserve, most investors anticipate a pause in its rate-hiking cycle in September. Yet, there's growing chatter about another tightening episode by year-end.

The recently released minutes from the FOMC's July meeting suggest that a significant chunk of Fed officials perceive an escalation in inflation risks, potentially warranting more hawkish measures.

Strong US macroeconomic indicators further underscore the robustness of its economy. A consensus among experts posits that these factors might allow the Federal Reserve to maintain its hawkish stance longer than was previously expected.

The burning question traders grapple with is the time the Federal Reserve will need to sustain elevated rates. Until a clear answer emerges, the greenback's consolidation phase is likely to persist.

Forecasts suggest that significant volatility in the USD majors, including the USD/JPY pair, is expected this Friday following Jerome Powell's speech at the Jackson Hole symposium. The direction the US currency takes will largely depend on Powell's tone. If the market interprets his speech as hawkish, the dollar might receive a boost.

On the other hand, a dovish tone from the Fed Chair could send the greenback tumbling across the board, including against the yen.

What's the likely scenario?

The majority of economists surveyed by Bloomberg believe Powell won't declare the Fed's anti-inflation mission as accomplished on Friday.

Nearly 80% of respondents asserted that US consumer price growth will remain above target levels in the coming years, necessitating the Fed to maintain its hawkish stance, which typically implies higher interest rates.

Analyst Jerome Schneider believes that persistent inflation will leave the Federal Reserve with no choice but to keep rates above the 5% mark for several months to come. He predicts the regulator might only commence rate reductions around mid-2024 or later.

It's probable that Powell won't specify any exact timelines during his Jackson Hole symposium speech. However, he might subtly indicate that the Fed's tightening cycle is far from over.

"We expect the Fed Chair to strike a more balanced tone in Wyoming. He'll likely hint at the end of the tightening cycle but emphasize the need to keep interest rates elevated for longer," commented Anna Wong for Bloomberg Economics.

If investors receive compelling evidence suggesting prolonged high interest rates in the US, the dollar could gain strength across all fronts, with USD/JPY being the main winner.

In an optimistic scenario, the greenback might strengthen against the yen to 147 by the week's end, provided there's no intervention warning from the Japanese government.

Technical outlook

The daily chart reveals a bullish exhaustion for the USD/JPY pair. The fading momentum is evident in the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) indicator.

However, the pair remains above the 20-, 100-, and 200-day simple moving averages, indicating that buyers still dominate the market on a broader scale.

The most crucial zones to monitor now are support levels at 145.00, 144.00, and 143.20, and resistance levels at 145.50, 146.00, and 146.30.

News are provided by

InstaForex.

Read More

Please visit our sponsors

Results 3,311 to 3,320 of 3458

Thread: Forex News from InstaForex

-

21-08-2023, 02:50 PM #3311

-

22-08-2023, 07:24 AM #3312

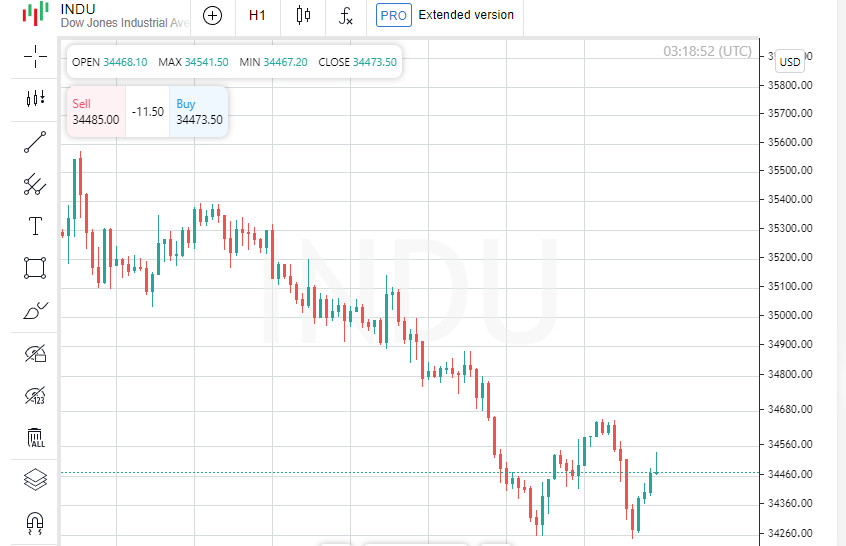

Changes on the Horizon: Nasdaq Surges Thanks to Nvidia and Tech Giants, Investors' Eyes on Jackson Hole

GS is considering a move to sell a business segment for affluent clients. Palo Alto Networks is on the rise amid positive expectations. Indices: Dow dipped by 0.1%, S&P 500 rose by 0.7%, and Nasdaq soared by 1.6%. The week started strong for Nasdaq and S&P 500. Nvidia shares provided a significant boost, attracting optimistic investor outlooks. As other tech stocks have shown, interest in them is growing.

But not everything is rosy: the Dow Jones industrial index slightly conceded its position. Investors are closely monitoring the yield of 10-year treasury bonds, which has reached a level last seen during the Great Financial Crisis of 2007. All eyes are on the meeting of the heads of the world's central banks in Jackson Hole. On the agenda? Jerome Powell's statement on Friday.

The technology sector drives the most significant growth of the S&P 500 and Nasdaq. Nvidia shares rocketed 8.5%, primarily due to HSBC, which set a target share price of $780 - one of the highest on Wall Street.

Nvidia, the AI market star this year, is forecasted to exceed analysts' quarterly income predictions. The company's shares have shot up 220% over the year, with Nasdaq maintaining a 29% growth rate.

In a nutshell about Nvidia: "Nvidia is top-tier artificial intelligence," says Quincy Crosby from LPL Financial. "It'll be interesting to see if they meet their set targets... Nvidia might become the main player this week."

And don't forget to pay attention to the US Federal Reserve: its leaders will gather for an essential annual symposium in Jackson Hole.

Everyone is awaiting Powell's speech to gauge the pulse of the economy and understand the next steps regarding rates. This anticipation is particularly heightened after recent central bank data made many ponder the possibility of inflation growth.

And what about the stock market? Dow Jones slightly decreased, losing 36.97 points. But stay optimistic, as both the S&P 500 and Nasdaq moved upwards, gaining 30.06 and 206.81 points, respectively.

Regarding company news, Johnson & Johnson shares dropped by 3%. Why? They expect to retain about 9.5% in their new Kenvue division. And yes, Goldman Sachs also took a slight hit, contemplating the sale of part of its assets.

Meanwhile, in the tech world, Palo Alto Networks shares are thriving, showing a 14.8% growth! Their latest report, with strong quarterly data and forecasts, has convinced many of their stability. VMware hasn't been left out either; their shares jumped by 4.9% following the approval of a deal with Broadcom, which, by the way, is also up by 4.8%.

Activity on the U.S. stock exchanges was below average. A total of 9.75 billion shares were traded, less than the standard of 10.99 billion looking at the past 20 trading days.

When it comes to individual stocks, the situation was more complex. On the NYSE, declining stocks outnumbered the advancing ones at a ratio of 1.44 to 1. As for Nasdaq, the advantage was with the declining stocks, with a ratio of 1.08 to 1.

An interesting fact: The S&P 500 presented itself rather ambiguously, showing 3 new annual highs and a whole 18 lows. And Nasdaq? There was even greater volatility there, with 36 new highs and a staggering 214 new lows. This indicates that investors are currently on their toes, evaluating a plethora of factors before making buy or sell decisions.

News are provided by

InstaForex.

Read More

-

23-08-2023, 05:58 AM #3313

EUROPEAN ECONOMIC NEWS PREVIEW: EUROZONE FLASH PMI DATA DUE

Purchasing Managers' survey results from the euro area and the UK are the top economic news due on Wednesday.

At 3.15 am ET, France's flash composite Purchasing Managers' survey results are due. The composite index is forecast to rise to 47.5 in August from 46.6 in the previous month. At 3.30 am ET, S&P Global is scheduled to release Germany's composite PMI survey results. The composite output index is expected to fall to 48.3 in August from 48.5 a month ago.

At 4.00 am ET, Eurozone flash PMI survey data is due. Economists expect the composite indicator to ease to 48.5 in August from 48.6 in the previous month.

Half an hour later, UK S&P/CIPS composite PMI survey results are due. The composite index is seen at 50.3 in August compared to 50.8 a month ago.

News are provided by

InstaForex.

Read More

-

24-08-2023, 06:13 AM #3314

EUROPEAN ECONOMIC NEWS PREVIEW: FRANCE BUSINESS CONFIDENCE DATA DUE

Business sentiment survey data from France is the top economic news due on Thursday, headlining a light day for the European economic news.

At 2.45 am ET, France's statistical office INSEE releases monthly business confidence survey data. The business sentiment index is forecast to fall to 99 in August from 100 in July.

At 3.00 am ET, business sentiment survey data is due from the Czech Republic.

At 4.00 am ET, Statistics Poland is slated to release unemployment data for July. The jobless rate is seen unchanged at 5.00 percent.

At 6.00 am ET, the Confederation of British Industry publishes Distributive Trades survey data for August.

News are provided by

InstaForex.

Read More

-

25-08-2023, 09:26 AM #3315

GERMAN ECONOMY STABILIZES AS ESTIMATED IN Q2

Germany's economy stabilized as estimated in the second quarter as weak foreign demand offset the strength in government spending and investment, latest data from Destatis showed Friday.

Gross domestic product posted nil growth in the second quarter after a 0.1 percent fall in the first quarter and a 0.4 percent decline in the fourth quarter of 2022.

With the latest flat growth, the biggest euro area economy ended a short period of recession.

The statistical office confirmed the preliminary estimate published on July 28.

"After slight declines in the previous two quarters, the German economy stabilized in spring," Destatis President Ruth Brand said.

"We continue to see the German economy being stuck in the twilight zone between stagnation and recession," ING economist Carsten Brzeski said.

In the latest World Economic Outlook, the International Monetary Fund projected the German economy to shrink 0.3 percent this year before rebounding 1.3 percent in 2024.

On a yearly basis, the price-adjusted GDP dropped 0.6 percent in contrast to the 0.1 percent rise a quarter ago. Calendar-adjusted GDP fell 0.2 percent, the same rate of decline as reported in the first quarter.

Both price-adjusted and calendar-adjusted growth figures were confirmed. The expenditure-side of GDP showed that household spending remained unchanged in the second quarter and government spending rebounded 0.1 percent following a 1.9 percent fall a quarter ago.

Gross fixed capital formation gained 2.1 percent, reversing a 1.7 percent fall in the preceding period.

Data showed that exports slid 1.1 percent, offsetting the 0.4 percent rise in the first quarter. By contrast, imports stabilized after a 1.5 percent decrease.

News are provided by

InstaForex.

Read More

-

28-08-2023, 07:53 AM #3316

JAPAN LEADING INDEX FALLS AS ESTIMATED

Japan's leading index weakened as initially estimated at the end of the second quarter, the latest data from the Cabinet Office showed on Monday.

The leading index, which measures future economic activity, dropped to 108.9 in June from a six-month high of 109.1 in May. That was in line with the flash data published on August 7.

The coincident index that measures the current economic situation rose to a 10-month high of 115.1 in June from 114.3 in the previous month, as estimated.

Data showed that the lagging index rose somewhat to 107.3 from 107.2 in the previous month. The reading was the strongest since January 2020

News are provided by

InstaForex.

Read More

-

29-08-2023, 04:41 AM #3317

JAPAN JOBLESS RATE RISES TO 2.7% IN JULY

The unemployment rate in Japan came in at a seasonally adjusted 2.7 percent in July, the Ministry of Internal Affairs and Communications said on Tuesday.

That exceeded expectations for 2.5 percent, which would have been unchanged from the June reading.

The jobs-to-applicant ratio ticked down to 1.29, shy of forecasts for 1.30, which again would have been unchanged.

The participation rate was 63.1 percent, matching forecasts and steady from the June level.

News are provided by

InstaForex.

Read More

-

30-08-2023, 05:35 AM #3318

AUSTRALIA CONSTRUCTION WORK DONE ADDS 0.4% IN Q2

The value of total construction work done in Australia was up a seasonally adjusted 0.4 percent on quarter in the second quarter of 2023, the Australian Bureau of Statistics said on Wednesday - coming in at A$59.010 billion.

That missed forecasts for an increase of 1.0 percent following the 1.8 percent gain in the three months prior.

The increase was driven by engineering work, which rose 0.7 percent in the June quarter and is 15.5 percent higher than the same time last year. Building work done rose 0.2 percent and is 4.3 percent higher than the same time last year.

The value of building work done rose 0.2 percent in the June quarter.

News are provided by

InstaForex.

Read More

-

31-08-2023, 01:48 AM #3319

JAPAN RETAIL SALES JUMP 6.8% ON YEAR IN JULY

The total value of retail sales in Japan was up 6.8 percent on year in July, the Ministry of Economy, Trade and Industry said on Thursday - coming in at 13.924 trillion yen.

That beat forecasts for an increase of 5.4 percent following the downwardly revised 5.6 percent gain in June (originally 5.9 percent).

On a monthly basis, retail sales advanced 2.1 percent after slipping 0.6 percent in June.

Sales from large retailers improved an annual 6.0 percent, up from 4.0 percent a month earlier.

Wholesale sales were down 0.7 percent on year and up 1.3 percent on month at 35.638 trillion yen, while commercial sales rose 1.3 percent on year and 1.5 percent on month to 49.562 trillion yen.

News are provided by

InstaForex.

Read More

-

01-09-2023, 05:44 AM #3320

CHINA MANUFACTURING SECTOR PIVOTS TO EXPANSION - CAIXIN

The manufacturing sector in China climbed into expansion territory in August, the latest survey from Caixin revealed on Friday with a manufacturing PMI score of 51.0.

That's up from 49.2 in July and it moves above the boom-or-bust line of 50 that separates expansion from contraction.

Supporting the improvement in overall business conditions was a renewed increase in new order intakes. Companies indicated that firmer underlying market conditions had helped to boost client spending. The modest upturn in overall sales occurred despite a further drop in new business from abroad in August, suggesting that stronger domestic demand was the main source of growth.

The downturn in new export orders did ease compared to July, however, and was only mild. Companies responded to greater amounts of new work by expanding production during August. Though modest, the rate of output growth was among the best seen over the past year.

News are provided by

InstaForex.

Read More

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote