World stock indices received support from the recovery in oil prices

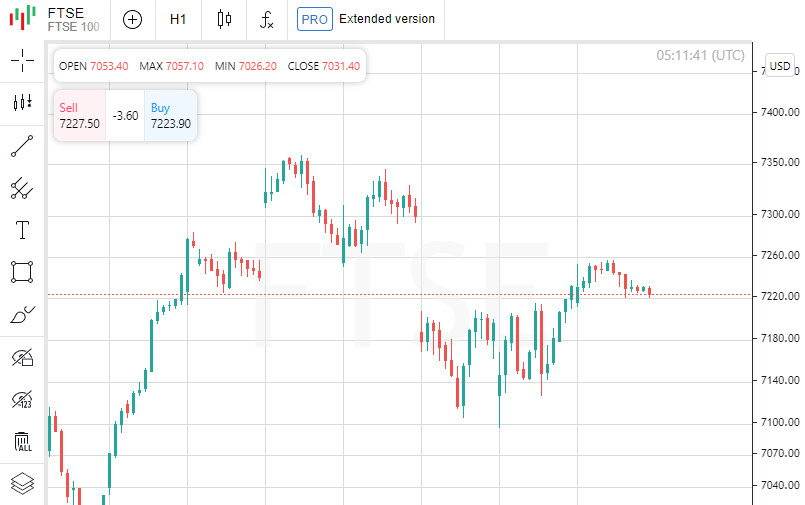

The European equity markets index rose 0.8%, while the UK FTSE index climbed more than 1%, helped by gains in oil and gas stocks.

Oil fell $1 a barrel earlier on Monday on worries about the global economic outlook, but declines in production from the Organization of the Petroleum Exporting Countries (OPEC), unrest in Libya and sanctions on Russia outweighed those concerns.

Ecuador's oil production has been hit lately by civil unrest, and a strike in Norway could cut supplies this week.

Steven Brennock, a spokesman for oil broker PVM, said the growing supply disruption was exacerbated by a possible shortage of spare capacity from Middle Eastern oil producers. Prices will continue to rise unless new oil hits the markets soon.

A survey of analysts on Friday showed that production of 10 OPEC countries in June fell by 100,000 barrels per day to 28.52 million barrels per day. In the meantime, they promised to increase it by about 275,000 barrels.

Brent crude rose 1.25% to $113.02, while WTI rose 1.2% to $109.76 a barrel.

The MSCI World Markets Index rose 0.38%, while it lost 2.3% last week.

In June, global equity markets hit 18-month lows amid worries about rising inflation and higher interest rates, but have rallied slightly since then.

The broadest MSCI index for Asia-Pacific countries excluding Japan rose by 0.34%.

The Chinese Blue Chip Index finished the day up 0.7% on the back of a 4.65% gain in the sub-index of medical stocks. Cities in eastern China tightened COVID-19 restrictions on Sunday amid new coronavirus outbreaks.

The Japanese Nikkei added 0.84%.

US S&P 500 and Nasdaq futures shed 0.4% and 0.5%, respectively, as recent weak US data suggests a weaker data in the June jobs report due on Friday. American stock markets are closed today.

The Atlanta Fed's long-awaited Q2 GDP outlook has dropped to -2.1% year-on-year, meaning the country is already in a technical recession.

The jobs report is forecast to point to a slowdown in June job growth to 270,000, with median wage growth declining to 5.0%.

The minutes of the Fed's June meeting, which will be released on Wednesday, are expected to indicate the central bank's inclination to decisively tighten policy. Earlier, the Open Market Committee decided to raise rates by 75 basis points.

The likelihood of another 75 basis point rate hike this month and a rate hike to 3.25%-3.5% by the end of the year is estimated by the market at about 85%.

The US Treasury market is closed today, but their futures market is open and continued to rise. Judging by it, the yield of 10-year bonds is kept at the level of 2.88%; it has fallen 61 basis points since its June peak.

The yield on German 10-year government bonds, the eurozone benchmark, rose 10 basis points to 1.328%. Last week it was falling as investors began to buy protective bonds.

The US dollar slipped 0.06% to 104.99 against a basket of currencies, rebounding from recent 20-year highs driven by its defensive-currency status.

The euro rose 0.13% to 1.0442, off a recent five-year low of 1.0349. The European Central Bank is expected to raise interest rates this month for the first time in a decade, and the euro could be supported if the central bank decides to raise it by half a point at once.

The Japanese yen also attracted defence-currency buyers late last week, pushing the dollar back to 135.48 yen from a 24-year high of 137.01, though it still gained 0.3% on the day.

A strong dollar and rising interest rates weigh on gold, which traded down 0.15% to $1,808 an ounce. It hit a six-month low of $1,784 last week.

News are provided by

InstaForex.

Read More

Please visit our sponsors

Results 2,961 to 2,970 of 3458

Thread: Forex News from InstaForex

-

05-07-2022, 09:17 AM #2961

-

06-07-2022, 11:46 AM #2962

Zimbabwe's gold standard.

At the end of this month, to try to tame inflation, the Reserve Bank of Zimbabwe will begin selling gold coins, thus providing a store of value for the country's declining currency and an alternative to the US dollar for the public.

The gold coin weighing 22 carats in one troy ounce will be called Mosi-oa-Tunya and will already be available from July 25.

Each coin will be assigned a serial number. After the purchase, the buyer takes possession of the coin and receives a certificate of ownership to the bearer. The buyer or the holder of the coin can transfer it to the bankers of his/her choice for safekeeping, and in this case a certificate of safe storage or a receipt will be issued.

According to the governor of the central bank, John Mangudya, gold coins can be bought for local currency, the US dollar and other foreign currencies.

The price will be set based on the international gold price and production costs.

Owners of gold coins will be able to exchange them for cash. Gold coins can also be used for transactional purposes and as collateral for loans.

According to the press release, the coins will be sold by Fidelity Gold Refinery, Aurex and local banks.

Rising inflation and currency devaluation have made life difficult for the Zimbabwean population. Annual inflation in the country was almost 192% in June.

The central bank of Zimbabwe was forced to more than double the discount rate from 80% to 200%, which was a new record.

Zimbabwe also announced plans to adopt the US dollar as legal tender for the next five years to stabilize the country's exchange rate. This is the second time in more than a decade that Zimbabwe has legalized the US dollar as legal tender.

According to the country's Finance Minister Mthuli Ncube: the government has announced its intention to maintain a multi-currency system based on the dual use of the US dollar and the Zimbabwean dollar.

News are provided by

InstaForex.

https://www.instaforex.com/forex_analysis/315389"]Read More [/url]

-

07-07-2022, 02:00 PM #2963

[b]China and the USA [b/]

[img]https://forex-images.ifxdb.com/userfiles/20220706/analytics62c5b88ae8a96_source!.jpg[img/]

The confrontation between countries with the first and second economies of the world lasts for years and runs along a variety of lines – from trade to intellectual property rights. Now Western sanctions against Russia have been added here, and Washington has directly warned Beijing about the consequences if they are violated. The United States has already blacklisted five Chinese companies last week, accusing them of supporting the Russian military-industrial base. However, at the same time, the American authorities say that China generally complies with the sanctions restrictions. The situation is quite slippery, especially amid statements about US President Joe Biden's plans to lift some restrictions on trade with China (introduced under Donald Trump). In addition, Beijing itself may fall under sanctions for aggression against fr. Taiwan, which China considers its territory. The relevant bill has already been submitted to the US Senate.

[b]China and Investment [b/]

[img]https://forex-images.ifxdb.com/userfiles/20220706/analytics62c5ba1818760_source!.jpg[img/]

For more than four months, global markets have been operating in a changed reality and new standards. As the history of the last hundred days has shown, geopolitical events can become a threat to investments and indices, and very quickly. By the way, China has faced negative market movements and capital outflows before. In total (according to the Institute of International Finance, IIF), from January to March 2022, investors have already withdrawn more than $30 billion from China.

The main reasons for the outflow of capital were:

lockdowns due to COVID-19;

problems in the Chinese real estate sector;

rising yields on US Treasury bonds.

Moreover, according to the same IIF, there is "a perceived risk of investing in countries whose relations with the West are difficult." How much are investors willing to invest in stocks that may not be able to get out quickly if necessary?

[b]China and COVID[b/]

[img]https://forex-images.ifxdb.com/userfiles/20220706/analytics62c5b964e7f11_source!.jpg[img/]

In addition to fears of becoming a pariah of world markets in the event of political conflicts, the Chinese market is also under pressure from a zero tolerance policy for COVID. Lockdowns, testing and other restrictive measures have been introduced in Shanghai for several months now (after a new outbreak of the disease) and then in Beijing. As a result, many production processes and the operation of the world's largest port have slowed down. The real estate market is still depressed, consumer spending is weak, and businesses do not want to hire employees and invest because of COVID.

The quarantine also affected the work of shopping and entertainment centers, restaurants, etc. Last week, some breaks were introduced for residents and tourists, but on Tuesday Beijing again announced mass testing of most of its residents after an outbreak in a karaoke hall. Chinese President Xi Jinping said that it is better to bear the "temporary" economic costs of the "wartime" state than to "harm people's lives and health".

[b]China and the world market[b/]

[img]https://forex-images.ifxdb.com/userfiles/20220706/analytics62c5b98f9ee69_source!.jpg[img/]

Meanwhile, many market experts believe that even in the event of political negativity, sanctions against China will be unlikely. The fact is that the size of its economy and markets is so large that it will cause much more harm to the West than, for example, the restrictions imposed on Russia.

For comparison:

China accounts for 40% of emerging market stock indices;

Before February 24, Russia accounted for 6.1% of benchmark debt.

The impact of sanctions against China on global financial markets will also be much greater.

[b]China and economic growth [b/]

[img]https://forex-images.ifxdb.com/userfiles/20220706/analytics62c5b9ed5e1ef_source!.jpg[img/]

And although analysts believe that a precedent has already been set for restrictive and punitive sanctions, such a move against China looks more far-fetched than realistically feasible. However, even this risk deters investors. But not everyone. Last month alone, net inflows into China-listed equities totaled $11 billion. "Playing" on the side of China:

the size of its economy;

a huge amount of foreign money invested in Chinese enterprises.

Particularly contrasting amid recession fears in the West is that China is the only major economy in the world that promises a recovery in growth this year. In addition, according to some sources, to revive its economy, China is preparing to create a state infrastructure fund worth $74.69 billion in the third quarter.

-

12-07-2022, 01:50 AM #2964

Major European stocks rise mostly by 0.10-1.34%

Major European stocks rose mostly by 0.10-1.34%. Only the Spanish IBEX 35 declined by 0.27%. All other indices increased. The British FTSE 100 gained the least. It went up only 0.1%. Germany's DAX is the top gainer, adding 1.34%. France's CAC 40 advanced by 0.44% and Italy's FTSE MIB rose by 1%. The STOXX Europe 600 index was up 0.51%, ending positive for the third consecutive session.

Strong data on US unemployment partly contributed to investors' positive sentiment. According to this data, the US economy is on the verge of recession. It added 372,000 jobs in June. Meanwhile, analysts forecasted that the number of jobs would grow by 265,000-268,000. The unemployment rate remained unchanged at 3.6% compared to May.

European stock indices advanced despite traders' growing concerns about a possible economic downturn due to severe measures of global central banks to combat inflation.

Nevertheless, the latest statistical data show that the EU economic situation is deteriorating. The key reason for it is a sharp increase in energy prices, gas in particular, due to the reduction in Russia's energy supplies.

An economic slowdown is most likely amid the ECB's plans to raise interest rates. Moreover, the economic slowdown may last for several months.

Next week, US and EU companies will publish their corporate reports for the second quarter of 2022. However, many economists predict that they will worsen their outlook on major indexes.

Shares of Commerzbank AG (+ 7.9%), Societe Generale (+ 2.4%), Deutsche Bank (+ 2.7%), as well as Credit Agricole (+2.1%) and BNP Paribas (+2%) were among the major gainers of the STOXX Europe 600 index.

Volkswagen AG announced that it would plan to invest more than 20 billion euros in a new program to manufacture batteries for electric cars by 2030. Later, its shares rose by 5.1%. Porsche Automobil Holding SE stocks also went up, gaining 6.1%.

Shares of Electricite de France SA added 5.6% after the announcement of the company's nationalization and the suitable candidate for the position of CEO.

The major reason why Uniper shares rose by 0.6% was the company's call for aid to the German government.

Moreover, shares of oil and gas companies gained: OMV AG added 6.6% and Orron Energy AB went up 6.4%.

News are provided by

InstaForex.

https://ifxpr.com/3c6rAdv"]Read More [/url]

-

12-07-2022, 04:12 AM #2965Senior Investor

- Join Date

- Jul 2011

- Location

- www.ArmadaMarkets.com

- Posts

- 4,127

- Feedback Score

- 0

- Thanks

- 0

- Thanked 2 Times in 2 Posts

The selection of the existing broker must be able to be considered carefully, this is done so that traders can become better and can be more leverage in getting maximum trading security and comfort like what I got from Tickmill.

-

13-07-2022, 02:36 AM #2966

The euro is in a deep depression. Is it a dead end?

The European currency is frantically looking for a way out of the current situation, when the decline persists, and parity with the dollar looms on the horizon. At the same time, the US currency remains in an upward trend, fueled by the interest of investors seeking to withdraw into the USD amid the possible onset of a recession.

At the beginning of trading on Tuesday, July 12, the euro was balancing near a 20-year low, steadily approaching parity with the dollar. Experts believe that the main reason for this phenomenon is the growing fears about the energy crisis, which can plunge Europe into recession. Against this background, the actions of the Federal Reserve, which continues to aggressively tighten the monetary policy in order to curb inflation, contrast sharply with the indecisiveness of the European Central Bank.

According to Trading Economics analysts, the euro has updated its low against the greenback over the past 20 years. The single currency lost about 1.2% on Monday, July 11, dropping to 1.0067. In the future, the fall continued. On the morning of Tuesday, July 12, the EUR/USD pair was trading at 1.0011, breaking another anti-record.

The euro reached new lows on Monday, remaining under pressure against the dollar. According to preliminary estimates, the strengthening of the euro is unlikely in the second half of 2022, since the European economy may suffer a technical recession. According to analysts of the National Bank of Canada, in the near future, the euro will remain "at a level close to the bottom."

The improvement of the situation for EUR is possible with the stabilization of energy prices, experts are certain. Currently, the single currency is suffering from a sharp rise in energy prices. The situation is complicated by the geopolitical conflict in Eastern Europe and rising inflation in the eurozone. These factors are steadily pushing the euro to parity with the dollar, that is, to the level of 1.0100.

The second half of 2022 does not imply the formation of conditions suitable for strengthening the euro. According to experts, the European economy is closer than ever to a burst of technical recession. In the near future, the EUR will remain at a low level, analysts summarize.

Against this background, the US currency is strengthening its position, overtaking its rival in the EUR/USD pair and bringing the probability of parity closer. On Wednesday, July 13, the markets are expecting reports for June on inflation in the US and Germany. According to analysts, annual inflation in Germany slowed to 7.6% in June (from the previous 7.9%). As for the preliminary calculations about the United States, last month consumer prices increased by 8.8% year-on-year. Recall that this figure was 8.6% in May.

Confirmation of this scenario means that inflation in the US remains at the highest level in the last 40 years. At the same time, a weaker consumer price index will slow down the potential fall of the EUR/USD pair to parity. However, a postponement is possible only until the European Central Bank decides on the rate, that is, until the meeting next Thursday, July 21.

Most analysts agree that further acceleration of inflation contributes to an increase in the key rate in the United States (by another 75 bps). At the same time, decisive action is also likely from the ECB, which is prone to procrastination in this matter. The course of tightening monetary policy taken by the Fed will provide additional support to the greenback and increase pressure on the euro.

News are provided by

InstaForex.

Read More

-

14-07-2022, 02:18 AM #2967

Asian markets advance slightly on Wednesday

Asian stock indexes increased slightly on Wednesday. The S&P/ASX 200 edged up by 0.05%, while the Shenzhen Composite rose by 0.95%. The Shanghai Composite and the Nikkei 225 gained 0.36% and 0.41% respectively. The Hang Seng Index advanced by 0.71%, while the KOSPI increased by 0.73%.

Indexes in the Asia-Pacific region entered a slight correction following an earlier slump triggered by fears of a new wave of COVID-19 in the region. China has re-imposed quarantine measures, while South Korea reports an increase in coronavirus infections.

New lockdowns could weigh down on Asia-Pacific economic growth.

Traders also noted policy decisions by the main central banks, which are striving to bring soaring inflation under control. The Bank of Korea has increased the interest rate by 50 basis points to 2.25% from 1.75%, matching market expectations. Economists see the South Korean regulator hike the rate further in the near future.

South Korean stocks increased slightly, with LG Electronics, Inc. and Samsung Electronics, Co. gaining 0.7% and 0.5% respectively.

On the S&P/ASX 200, the best performing stock was Megaport, Ltd, which jumped by 6.5%. St. Barbara, Ltd. rose by 4.7%, while Pointsbet Holdings, Ltd. increased by 5%.

Investors also awaited the release of US CPI data. Inflation in the US was projected to increase to 8.8% in June, up from 8.6% in May.

Rising inflation would boost expectations of further monetary tightening by the Fed. However, it can also indicate that inflation has peaked amid falling crude oil prices. Market players are wary of higher interest rates weighing down on the global economy.

According to the latest statistic data, China's exports increased by 13.2% year-on-year over the past 6 months. Imports rose by 4.8%.

On the Hang Seng Index, Haidilao International Holding, Ltd. increased by 6%, while JD.com, Inc. and Sands China, Ltd. rose by 4.6% and 3.8% respectively. Shares of Tianqi Lithium, Corp. dived by 10% in their market debut.

On the Nikkei 225, the best-performing stock was Toho, Co., which climbed by 6.1%. The movie theater company's net revenue surged by 72% in the first quarter thanks to a rise in theater visitors.

Tokyo Electric Power Co Holdings Inc. increased by 5.6%, Recruit Holdings Co., Ltd. gained 2.9%, Honda Motor Co., Ltd. rose by 2.6%, and SoftBank Group, Corp. advanced by 2.4%.

News are provided by

InstaForex.

Read More

-

14-07-2022, 04:10 AM #2968

The selection of the existing broker must be able to be considered carefully, this is done so that traders can be more leverage in getting maximum trading security and comfort like what I got from Tickmill.

-

15-07-2022, 02:59 AM #2969

Dollar: fireworks of growth and inflationary confrontation

The US currency once again took advantage of rising inflation, soaring after the release of the consumer data index (CPI) in the US. However, "skimming the cream" after an inflationary turn, the dollar risks sinking in the medium and long-term planning horizons.

According to reports from the US Department of Labor, the inflation rate measured by the consumer price index (CPI) has soared to the highest in four decades. By the end of June, it reached 9.1% year-on-year, demonstrating the most significant increase since 1981. Recall that this indicator did not exceed 8.6% in May. At the same time, the expanded inflation indicator in the United States increased by 1.3%, which is the highest level since 2005. This indicator reflects the increase in prices for gasoline, housing and food.

Against this background, the US currency showed an incredible rise, sharply overtaking the euro in the EUR/USD pair. In the current situation, the euro sank by 0.3%, reaching 1.0004. As a result, the dollar, having tested another high, returned to parity with the euro after a short-term breakthrough. On Wednesday, July 13, the single currency fell to the level of 0.9998 for the first time since December 2002. Then the euro fell by 0.39% on the morning of Thursday, July 14, reaching 1.0020. Later, the EUR/USD pair traded at 0.0023, unsuccessfully trying to get out of the price hole.

The sharp spurt of the dollar amid the rise in consumer prices was accompanied by a violation of parity on the part of the euro. After the release of US inflation data, the euro slipped below the parity level in the EUR/USD pair. According to analysts at Commonwealth Bank of Australia, the parity of both currencies, settled at 0.9900, remains the lower limit for the EUR/USD pair. In the future, currency strategists expect consolidation to come in tandem.

Movements in the EUR/USD pair are taking place amid rapidly growing inflation, which has accelerated significantly after reaching a high over the past 40 years. Further strengthening of inflation increases the risk of an aggressive rate hike by the Federal Reserve. According to analysts, this will trigger a recession in the near future. At the same time, concerns about the recession provide significant support to the greenback.

According to Rafael Bostic, president of the Atlanta Fed, extremely high inflation leaves the US central bank no choice in raising interest rates, which is likely to be resolved positively. This statement was supplemented by Wells Fargo analysts, explaining that the Fed will need several monthly inflation indicators to make a final decision on the rate. Regarding the June consumer price index (CPI), experts expected that it "will be hot, but this report just burns." Recall that consumer price inflation in the United States outstripped already inflated expectations, soaring by 1.3%. In annual terms, prices rose by 9.1%, which is a new cyclical high.

According to experts, a steady increase in prices for basic goods, recorded for two months, is extremely undesirable for the Fed. The central bank seeks to weaken core inflation in the consumer goods segment amid a rapid rise in the cost of food and energy. However, progress in this matter is minimal so far.

In such a situation, the greenback was the winner, drawing strength from the unwinding of the inflationary spiral. However, there is a walk on thin ice here: in the long term, the USD risks to sink significantly. At the moment, the dollar feels confident, demonstrating its importance to the world. The recent aggressive USD rally indicates that the US currency acted as a shield for the population of the United States suffering from extremely high inflation.

In the current situation, the purchasing power of American imports is increasing. Note that a strong dollar provides protection from inflation in the form of cheaper imports. However, Morgan Stanley analysts believe that the strengthening USD adds risks for the Fed, as a strong national currency makes it difficult for the central bank to cool demand. Such a situation provokes further tightening of the monetary policy or leads to stagflation. Recall that with stagflation, high inflation persists, but economic growth slows down significantly.

Another important factor undermining the strength of the dollar in the EUR/USD pair remains the cardinal difference in the monetary strategies of the Fed and the European Central Bank. This year, the US central bank has raised rates by 1.50%, and the European one is still in thought, although inflation in the eurozone is also breaking records. The gap between the Fed and ECB rates will grow after the June consumer price index in the United States showed a new 40-year high. At the same time, experts do not rule out that this month the ECB will begin its rate hike cycle, but with a smaller step – 0.25%.

In the long term, the strengthening of the greenback will contribute to further tightening of financial conditions. Against this background, the Fed continues to reduce its balance sheet, Morgan Stanley emphasizes. As a result, a strong dollar increases the risk of a recession in the United States, which many investors consider inevitable.

News are provided by

InstaForex.

Read More

-

15-07-2022, 10:20 AM #2970

Gold cannot withstand the onslaught of a strong dollar

Gold is falling in price on Thursday amid a rising dollar. Judging by the rise in US currency quotes, investors reacted with enthusiasm to record inflation data in the US.

So, in the morning hours of the European trading session, the price of the August gold futures on the New York Comex exchange fell by 0.52% to $1,726.45 per troy ounce. By 14:50 GMT, the quotes had already fallen by 2.23% to $1,696.85. Silver by this time managed to decline by 5.61%, to $18,117.

At one point the August gold futures were at $1,704.28.

The dollar index, or its exchange rate against a basket of six other currencies, rose 0.96% today, reaching 109.03 points. A stronger dollar makes gold less affordable when buying in a different currency. The yield on 10-year US Treasury bonds is 2.982%. The yield curve of 2-year and 10-year Treasury bonds remains inverted and the most inverted over the past 22 years. This indicates an approaching economic recession.

In addition, another inflation report was published on Thursday, which made a lot of noise and caused a storm of emotions among traders. According to the data, in June, annual inflation in the United States rose to 9.1% in annual terms (it was at the level of 8.6% in May). This June figure was the highest in the United States since November 1981.

Obviously, in this scenario, the Federal Reserve is forced to keep its finger on the pulse of aggressive tightening of monetary policy. According to the CME Group, almost 82% of analysts are confident that at the July Fed meeting the discount rate will be significantly increased – immediately by 100 basis points, that is, to the level of 2.5-2.75%. By the way, before these data were released, about 91% predicted a rate increase of only 75 basis points. It just so happened that the increase in the US rate (and even expectations of its increase) has a very beneficial effect on the exchange rate of the US national currency, but for the demand for gold, this news can be called negative.

A significant difference in interest rates in large countries (they are higher in the US) leads to the spread of the so-called Carry Trade, when international traders and institutions exchange their own currencies for possession of the US dollar. As history shows, this phenomenon can persist for quite a long time, which once again will only strengthen the dollar.

The strong drop in crude oil futures prices this week is also a factor reducing the prospects for gold. NYMEX futures dropped overnight to the lowest level in the last three months – $93.24 per barrel. January crude oil futures are trading at $84 per barrel. This indicates that the market is confident that crude oil prices will decline in the coming months. The fall in the cost of crude oil contributes to a decrease in the value of assets in other commodity markets. Such a noticeable weakening of the commodity sector is an important early sign that inflationary pressure has already reached its peak.

So, we are seeing an increase in bond yields, a rise in the dollar, while a noticeable drop in crude oil prices. Obviously, these are all clearly bearish elements that are working against bulls in the metals market today. In addition, investors' fears about the recession in the United States are growing stronger and there is a decline in consumer and commercial demand for metals.

News are provided by

InstaForex.

Read More

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote