Market updates on October 29

More at: http://bit.ly/36bkZXT

29.10.2019

On the H4 of EUR/GBP, we see that the price is testing the psychological level of 0.8612. The pair is consolidating, thus, the further direction will depend on the strength of the euro. If the pair falls below 0.8612, it will slide towards 0.8590. In the case of the reversal, the resistance is placed in the range of 0.8649-0.8663.

On the H4 of EUR/USD, we see a similar picture, indicating a bearish movement. The price may test the support range 1.1073-1.1061, 1.1038. If the pair sticks above 1.1085, we may see a rise to 1.1105.

Gold is on the sideways movement, indicating a potential for a rise. On the H1 chart of XAU/USD, it has already broken yesterdays’ resistance and is gradually climbing up towards the resistance levels at 1495.47, 1506.00 and 1514.47. For the market reversion, support levels may be set at 1488.83, 1484.14 and 1480.35.

Please visit our sponsors

Results 241 to 250 of 370

Thread: Forex daily News FBS

-

29-10-2019, 03:20 PM #241Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

-

30-10-2019, 08:08 PM #242Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

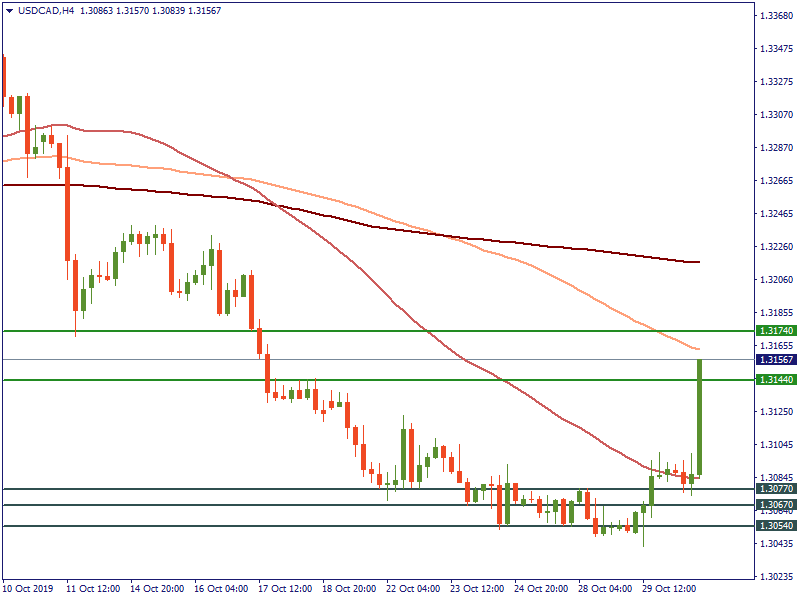

USD/CAD has risen by more than 60 pips

More at: http://bit.ly/36bkZXT

30.10.2019

The Canadian dollar weakened significantly after the monetary policy decision by the Bank of Canada. Bulls broke the resistance at 1.3144 on H4 and pushed the price above it towards the 100-period SMA and the 1.3174 level. From the downside, the key levels in bears’ focus will be at 1.3077, 1.3067 and 1.3054.

-

04-11-2019, 03:07 AM #243Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Market updates on October 31

Check the charts: http://bit.ly/2prnTaF

31.10.2019

European Quarterly GDP Growth Rate – 12:00 MT (10:00 GMT)

American Monthly Personal Income and Personal Spending Index – 14:30 MT (12:30 GMT)

The US Fed announced the interest rate cut to 1.75% on October 30. EUR/USD reacted by rising. On the H4 chart of EUR/USD, the day has started with the price inching into the resistance range of 1.1167 – 1.1177 and possibly aiming at another 3-months resistance level of 1.1217. The support levels of 1.1101 and 1.1076 remain valid unless a strong bearish movement appears on the chart.

While the Bank of Canada released the unchanged interest rate of 1.75% against the lowered rate of US Fed on October 30, the USD/CAD performed a sharp rise during the announcement. That was due to the negative tone the officials expressed in regards to the likely contractions within the investments, exports, employment growth and global economy slowdown pushing the Bank of Canada to implement monetary ease in the coming future. On the H1 chart of USD/CAD, the price bounced back from the newly formed local resistance level of 1.3180, testing the support level of 1.3152. If it is broken, we will have a range of 1.3120 – 1.3131, 1.3078 and 1.3049 as the support levels. Otherwise, the additional resistance level may be placed at 1.3208.

On the H4 chart of USD/JPY, the quote has dropped to the support level of 108.65. That was due to the unchanged Japanese interest rate (set at -0.1% as per October 31 release) against the lowered US Fed rate, which led to relative depreciation of the US dollar. However, the likelihood of the monetary ease in the future on behalf of the Bank of Japan keeps the Japanese yen dropping slowly, viewing the resistance levels of 108.99 and 109.254. The support level of 108.55 and the range of 108.34 – 108.41 remains valid.

-

04-11-2019, 03:13 AM #244Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Market updates: NFP edition

More at: http://bit.ly/2NAcSMd

01.11.2019

Key events ahead

Average hourly earnings – 14:30 MT (12:30 GMT)

Non-farm employment change – 14:30 MT (12:30 GMT)

Unemployment rate – 14:30 MT (12:30 GMT)

The main focus for today will be on the American jobs data at 14:30 MT. According to the forecasts, the level of non-farm payrolls will advance by 89 thousand. At the same time, average hourly earnings will show an increase of 0.3% and the unemployment rate will rise to 3.6%. If the actual levels of NFP and average hourly earnings are higher, and the unemployment rate is lower than the forecasts, the USD will strengthen. Let’s consider the most important pairs ahead of the event.

Bulls of EUR/USD have not overcome the 1.1166 resistance level on H4 after the Fed rate cut on Wednesday. If the level is broken right after the release, reaching the next resistance at 1.1180 may be possible. The further upside momentum will be limited by the 1.1194 level. On the other hand, if the actual figures come out optimistic for the USD, EUR/USD will reverse towards 1.1131. After the breakout, bears need to focus on the 1.1121 level. The break of that level will be placed at 1.1106.

USD/JPY has stuck below the 200-period SMA on the 4-hour chart after yesterday’s plunge. The USD needs to be boosted by the positive NFP figures to break the current resistance at 108.53 and move upwards to the 108.15, 108.24 and 108.41 levels. From the downside, the breakout of the 107.93 level will open the way for bears towards the 107.8 level. The next support will lie at 107.65. RSI oscillator is oversold, that is why the continuation of the downside momentum may be expected.

An upside momentum for the price of gold is the result of the mixed news concerning US-China trade truce and the weak USD. Currently, the price of the yellow metal is overbought on H4 according to RSI and testing the $1,514 resistance level. If the USD weakens on the job data, the breakout of that resistance will be inevitable. That kind of scenario may lead to the retest of the $1,518 level (high of October 25th). The next key level will be situated at $1,524. On the contrary, the first support will be placed at $1,509.2. The next one will lie at $1,504.

-

04-11-2019, 01:41 PM #245Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

5 important events this week will bring us

More at: http://bit.ly/36x6EW1

04.11.2019

RBA rate statement (Tue, 5:30 MT (3:30 GMT)) – According to forecasts, the interest rate will remain steady at 0.75%. We will keep an eye on the monetary policy statement, where the regulator may throw some hints on the possible changes to the monetary policy.

Canada’s trade balance (Tue, 15:30 MT (13:30 GMT)) – If the actual level of indicator is higher than the forecasts, the CAD will go up.

New Zealand’s employment change and unemployment rate (Tue, 23:45 MT (21:45 GMT)) – Analysts anticipate the employment change to increase by 0.2%. At the same time, the unemployment rate is forecast to rise to 4.1%. Higher-than-expected figures of employment change and lower level of the unemployment rate will be NZD-positive.

BOE monetary policy summary (Thu, 14:00 MT (12:00 GMT)) – The interest rate is expected to stay at 0.75%. The possible move for the British pound may come with the release of the monetary policy statement. Any hawkish comments concerning the bank’s policy amid the Brexit mess will support the British pound.

Canada’s employment change and unemployment rate (Fri, 15:30 MT (13:30 GMT)) – If the actual level of employment change is higher and the unemployment rate is lower than the forecasts, the Canadian dollar will get positive momentum.

Hot news:

During the ASEAN summit this weekend, Commerce Secretary Wilbur Ross expressed optimism that the US would reach a “phase one” trade deal with China this month and said licenses would be coming soon for American companies to sell components to Huawei Technologies Co. The news boosted the risk-on sentiment in the markets.

Christine Lagarde will make her first speech as a president of the European Central Bank this evening at 20:30 MT (18:30 GMT) time.

-

12-11-2019, 03:06 AM #246Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

5 important events this week will bring us

More at: http://bit.ly/2CzXEBJ

11.11.2019

British preliminary yearly GDP growth rate (Mon, 11:30 MT time (09:30 GMT)) – according to forecasts, the yearly GDP growth rate will be at 1.1% against the higher 1.3% previous mark. The GBP price shall not change much unless the release is higher than the expectation.

New Zealand’s interest rate statement (Wed, 06:00 MT time (04:00 GMT)) – The Reserve Bank of New Zealand may lower the interest rate to 0.75% on Wednesday form the current 1% if they decide that the economy needs monetary stimulus. If the rate stays at 1%, the NZD shall rise.

American Consumer Price Index (Wed, 18:30 MT time (16:30 GMT)) – The analysts anticipate the coming consumer price marks to be at 0.3% for the monthly CPI and 0.2% for the core monthly CPI. If the indicators are higher than the forecast, the USD shall gain strength.

Australian jobs data (Thu, 05:30 MT time (03:30 GMT)) – The forecasted employment change is 16.2K against the previous 14.7K, while the unemployment is expected to stay unchanged at 5.2% in Australia. If the readings are better than the forecast, the AUD will rise.

The quarterly European GDP growth rate (Thu, 12:00 MT time (10:00 GMT)) – The quarterly GDP growth rate is expected to stay unchanged at 0.2%. The price of the euro shall not be affected unless the release is different from the forecast.

Hot news:

During the weekend the US president Trump made another worrying statement advising that China may be interested in the trade deal more than he is; on Tuesday he shall give another speech to clarify the US-China trade war positioning

-

12-11-2019, 01:28 PM #247Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Market updates on November 12

Check the charts: http://bit.ly/34LUiaS

12.11.2019

Key events ahead

British Claimant Count Change – 11:30 MT time (09:30 GMT)

European ZEW Economic Sentiment Index – 12:00 MT time (10:00 GMT)

On Monday, GBPUSD rose to the resistance of 1.2873. Today, it has continued rising after a short correction. On the H4 chart of GBP/USD, the bulls may locate their additional resistance levels at 1.2873 and 1.2890 for the upward direction. The downward trend will have the possible support levels at 1.2806, 1.2790 and 1.2770.GBPUSDH4 November 12.png

The euro has also started the day rising against the USD. On the H1 chart of EUR/USD, the resistance level of 1.1038 is its closest mark for the bullish scenario. Otherwise, the support levels may be placed at 1.1027, 1.1025 and 1.1016.

The Australian dollar shows a very similar scenario in relation to the USD today. On the H1 chart of AUD/USD, after slumping down to 0.6837 it has risen back to the level of 0.6853. If it keeps the same upward direction, the bulls may locate their resistance levels in the range of 0.6857 – 0.6861. Otherwise, for the market reversal scenario, the support levels may be placed at 0.6848, 0.6845 and 0.6837.

-

15-11-2019, 04:45 AM #248Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Oil market updates on November 14

More at: http://bit.ly/32PlMuT

14.11.2019

Today, the oil prices may move on the release of crude oil inventories at 18:00 MT time. The analysts forecast the number of barrels held in the inventories of the American commercial firms to advance by 1.5 million.

If the actual number of barrels is higher than the expectations, the WTI and Brent prices will go down;

On the other hand, lower-than-expected figures will push the prices for crude higher.

What is the situation in the market right now?

The price for Brent is having a bullish session. On H4, it has been testing the highs above the resistance at $63.03. If the price is supported by the lower-than-expected release, the break of this level will happen. After that, bulls will focus on reaching the next target at $63.40. The next resistance will lie at $63.90. On the other hand, a higher-than-expected number of barrels will pull the price for Brent below the $62.53 level. The next support will be placed at $62.

As for WTI, its price has been testing the resistance at $57.7 on H4 since the start of the trading day. The breakout of this level will help bulls to push the price for crude upwards to the $58.08 level. As far as this level will be reached, bulls will try to reach the next one at $58.6. From the downside, it is recommended to keep an eye on the $57.3 level. The great increase in the number of barrels may help bears to overcome that level and focus on reaching the support at $56.8 (50-period SMA).

-

16-11-2019, 01:26 AM #249Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Market updates on November 15

Check the charts: http://bit.ly/2KqrRHL

15.11.2019

US retail sales and core retail sales – 15:30 MT time (12:30 GMT)

During the Asian trading session, the White House economic adviser Larry Kudlow announced the positive progress in phase one trade deal with China. It increased the risk-on sentiment in the market.

USD/JPY took advantage of the news and has risen higher. The pair has tested the 108.6 level on H4. If bulls manage to break this level, the next resistance will lie at 108.7. After that, reaching the 108.78 level (100-period SMA) will be possible. From the downside, bears will be looking for a breakout of the 108.51 level. If it happens, the chance of falling towards the 108.42 level will increase. The next support will lie at 108.28.

The price of gold has bounced from the 50-period SMA on H4 and moved lower. Since the beginning of the trading session, it has slid towards the support at $1,461. If this level is broken, the next support will be placed at $1,457.6. From the upside, if gold’s price rises above the $1,466, the next key level will lie at $1,471 (50-period SMA).

EUR/USD is awaiting the release of indicators of US headline and core retail sales. According to the forecasts, the former indicator will advance by 0.1%, while the latter is expected to increase by 0.3%. If the actual figures outperform the forecasts, the euro will fall below the 1.1015 level on H4 and will likely test the support at 1.1003. On the other hand, if the figures disappoint, the breakout of the current resistance at 1.1025 will occur and may drive EUR/USD up to the 1.1034 level.

-

16-11-2019, 01:30 AM #250Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

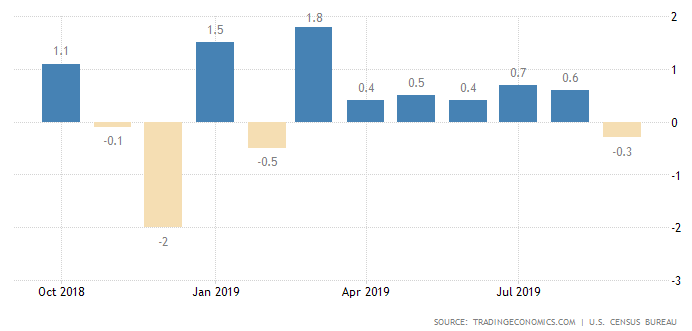

The United States will release the headline and core retail sales at 15:30 MT on November 15.

Check at: http://bit.ly/2qYhxzE

The indicators represent the change in the total value of sales at the retail level. The difference of the core indicator from the headline one is that the former excludes automobile sales due to their high volatility. Last time both of the indicators came out lower than the forecasts. While advance retail sales dropped by 0.3% (vs. the anticipated increase by 0.3%), the retail sales without autos fell by 0.1% (vs. +0.2% expected). The disappointing figures pulled the USD lower. Let’s see how the release affects the USD this time.

• If the indicators are greater than the forecasts, the USD will rise;

• If the indicators are weaker than the forecasts, the USD will fall

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Tags for this Thread

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

6Likes

6Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote