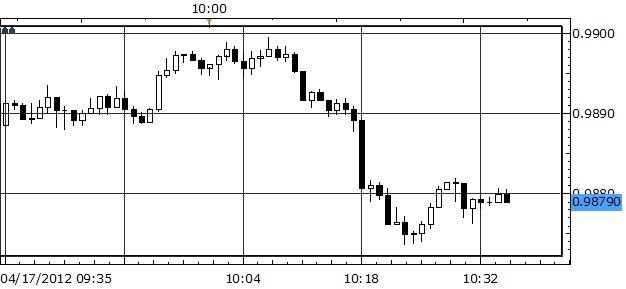

OctaFX.Com - EUR/USD Unmoved Following Positive Euro Industrial Production Data

THE TAKEAWAY: Eurozone industrial production rises 0.5% during February, beats analysts’ expectations -> Weak production in Germany outweighed by 13% increase in the Netherlands -> EUR/USD stays at the same level following the report

Eurozone industrial production rose by 0.5% for the month of February, led by France and the Netherlands. The actual production beat average estimates of a 0.2% decline. However, the numbers were 1.8% lower than February of the previous year, as expected by analysts.

The numbers can be seen as a sign of economic stabilization for the Eurozone; and a drop in industrial production in Germany and Spain was offset by improved production in France and the Netherlands. The weak German numbers that were released last week were not fully represented in today’s numbers as the slump in construction output was not included in the Eurozone survey.

EUR/USD did not react strongly to the better than expected data. The pair rose and fell following the release, but later settled back down to initial levels.

Apr 12, 2012 15:50

OctaFX.Com News Updates

Please visit our sponsors

Results 61 to 70 of 769

-

12-04-2012, 06:14 PM #61Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

-

13-04-2012, 07:43 PM #62Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFx - Euro down as Spain yields, China GDP worry

NEW YORK (Reuters) - Higher Spanish borrowing costs dragged the euro down on Friday, pulling the single currency to a second straight weekly loss against the dollar and the yen as the European debt crisis and slower-than-expected Chinese growth worried investors.

News that Spain's banks are virtually locked out of credit markets and relied heavily on cheap loans from the European Central Bank in March spooked investors, who then drove the cost of credit default swaps on Spanish debt to a record high.

The Spanish debt concerns stoked worries from earlier in the session, when data showed China's economy grew less than expected in the first quarter.

"The euro zone situation is slowly flaring up again, and that can have some people second-guessing how many euros they want to hold," said Sean Incremona, an economist at 4cast Ltd in New York.

"In the bigger picture, price action this week has been pretty inconsequential," he added. "We're pretty close to where it left off last week after the payroll action," when U.S. jobs data disappointed and the dollar sold off on views the U.S. Federal Reserve could ease policy further.

The single currency has been mostly range bound in recent weeks as investors look for a reason for large moves.

The euro fell 0.8 percent to $1.3080 on Friday, eroding what had previously been a slight advance for the week versus the dollar. The single currency was more recently off 0.16 percent against the greenback for the week.

Against the yen the euro was off 0.67 percent at 105.90 yen, for a fall of 0.815 percent this week.

The dollar's gains were broad-based, with the greenback rising 0.91 percent against the traditional safe-haven Swiss franc to 0.9192 francs. Against the yen, the dollar was up 0.09 percent at 80.95 yen.

"We are seeing the traditional reaction in that stocks are selling off, core bond markets are rallying, the dollar is rallying and commodities are getting hit," said George Davis, chief technical analyst at RBC Capital Markets in Toronto.

Investors could stay more pessimistic over the next few weeks, he said.

Uncertainty about the euro, however, has fallen as reflected in the options market, with three-month risk reversals in the euro/dollar still biased for euro puts, trading at -2.075 vols on Thursday, but improving from -3.5 vols in mid-February.

AUSSIE PRESSURED

The Australian dollar, which reacts strongly to Chinese data because Australia's commodity-driver economy relies heavily on Chinese demand, fell to as low as US$1.0352.

The Aussie had gained 1.2 percent on Thursday on a surprisingly strong local jobs report and solid bank lending data from China.

"We view yesterday's strong Australian employment and Chinese loan data as more important than the overnight Chinese Q1 GDP release and hence see the overnight sell-off in AUD as providing good levels to go long," Nomura analyst Geoff Kendrick said in a note.

Apr 13, 2012 12:50

OctaFX.Com News Updates

-

13-04-2012, 08:37 PM #63Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com - Gold eases below $1,670/oz as dollar recovers

LONDON (Reuters) - Gold prices slipped below $1,670 an ounce on Friday, pausing in their biggest one-week rally since late February as the dollar firmed against key currencies, with the euro falling out of favor due to worries over Spain's financial health.

Nominally higher risk assets, like stocks and commodities, also came under pressure after Chinese growth data released overnight failed to meet expectations.

Spot gold was down 0.4 percent at $1,668.66 an ounce at 1453 GMT, while U.S. gold futures for June delivery fell $10.20 an ounce to $1,670.40.

The metal is still on track to rise 2.4 percent this week after a soft U.S. jobs report last Friday stoked expectations for new quantitative easing measures. Ultra-loose U.S. monetary policy was a key driver of record gold prices last year.

However, a rebound in the dollar on Friday took the wind out of the precious metal's sails.

"Especially in the United States, the investment climate is very neutral towards gold at this stage. People really need to see a policy catalyst before they come back aggressively," Standard Bank analyst Walter de Wet said.

"On the physical side, from the end of this month there is really no seasonal demand coming until August," he added. "It is going to be difficult to break much higher if we don't have this physical buying supporting any investment demand coming through for the next two or three months."

The dollar was up 0.4 percent against the euro as Spanish bond yields rose on data showing the country's banks were relying heavily on ECB lending, and after Chinese growth data disappointed traders. (FRX/)

The single currency hit a session low after a report showed U.S. consumer sentiment slipped in early April.

A report released on Friday showed China's economy grew at its weakest pace in nearly three years in the first quarter, with annual rate of expansion easing to 8.1 percent from 8.9 percent in the previous three months.

European shares were on track for a fourth straight week of losses as renewed concerns about the rising cost of borrowing in some highly indebted euro zone countries dampening sentiment, while safe-haven German bund futures rose. (.EU) (GVD/EUR)

Gold is expected to remain closely tied to the dollar on Friday. A stronger dollar tends to weigh on gold, as it makes dollar-priced commodities more expensive for other currency holders, and curbs the metal's appeal as an alternative asset.

STRUGGLE FOR MOMENTUM

Gold is on track to rise nearly 7 percent this year but has struggled to gain momentum after a strong showing in January as expectations for a further round on monetary easing fluctuate.

A Reuters poll released Friday showed analysts are turning more cautious towards gold, with heady forecasts of $2,000 an ounce receding fast as the economy stabilizes. (PREC/POLL)

While the precious metal remains on course to rally through this year and into 2013, just one analyst of 33 polled expected it to average more than $2,000 an ounce this year, against five analyst of 45 in a similar poll in January.

"The last six months has seen an increase in correlation between gold and other risk assets," Schroders Private Banking head of asset allocation Robert Farago said on Friday. "While this is not readily explainable and therefore may be somewhat coincidental, it does reduce the metal's attraction as a portfolio diversifier."

"I am not convinced that a deflationary environment will prove favorable in the short term," he added. "This would produce a liquidity squeeze and gold may well prove a source of funds since almost all investors are sitting on profits."

Physical buying in Asia's bullion market slowed to a trickle on Friday, as higher prices pushed traders to the sidelines, but a gold-buying festival in India in late April is likely to help bring in some demand from the world's top consumer of the metal.

Silver was down 0.9 percent at $32.02 an ounce, spot platinum was down 0.5 percent at $1,590.75 an ounce and spot palladium was down 0.2 percent at $647.75 an ounce.

CME Group, the biggest operator of U.S. futures exchanges, said it will cut margins for COMEX silver futures for the second time since February in an attempt to boost liquidity after a narrow price range tempered trading interest.

Apr 13, 2012 15:19

OctaFX.Com News Updates

-

17-04-2012, 05:20 PM #64Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

Eurozone March inflation revised up to 2.7 percent

Eurozone inflation in March revised up to 2.7 percent; increase was unexpected

BRUSSELS (AP) -- Inflation in the 17 countries that use the euro was higher than predicted in March, largely because of higher energy and transport costs, official figures showed Tuesday.

Eurostat, the EU's statistics office, said eurozone consumer prices in the year to March rose by 2.7 percent, up from the initial prediction of 2.6 percent. March's rate was the same as the previous month's and indicates that price pressures remain despite mounting fears that the eurozone as a whole will fall back into recession.

The surprise increase in inflation has reined in expectations that the European Central Bank will cut interest rates again any time soon. The bank, which is tasked with keeping inflation just below 2 percent, last cut borrowing costs in December, taking its main rate down to the joint-record low of 1 percent.

With oil prices remaining elevated, analysts said inflation could well remain above target for a while yet, even though Europe's dim growth prospects could weigh on consumer demand and wage increases.

Gustavo Bagattini, European economist at RBC Capital Markets, said he expects inflation to start declining in the second quarter of the year but won't average anything below 2.5 percent.

"This is consistent with our 2012 average forecast of 2.4 percent, which is in line with the ECB's forecast, meaning that the governing council will continue to have to accept a higher rate of inflation temporarily," Bagattini said.

The euro pushed ahead after the figures from $1.3145 to a day's high of $1.3173.

Apr 17, 2012 09:06

OctaFX.Com News Updates

-

17-04-2012, 05:43 PM #65Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com - Canadian Dollar Soars on Hawkish BoC Comments

Currencies and equities are trading slightly higher this morning thanks to better than expected economic data from Europe and a relatively healthy Spanish bond auction. The EUR/USD is taking its cue from Spanish bond yields and the steep decline back below 6 percent encouraged investors to dip their toes back into euros. For the time being the 1.30 level continues to hold in the EUR/USD and even though we believe this level will be taken out eventually, a further rise in Spanish bond yields would be needed for that to happen. Mixed U.S. housing market numbers failed to have a lasting impact on the dollar. Housing starts fell for the second month in a row by 5.8 percent. This was the steepest slide in nearly a year and drove starts to a 5 month low. Building permits on the other hand continued to rise by 4.5 percent. Unlike starts, permits have gradually increased for the past 3 months and are now at its highest level since September 2008. The discrepancy between starts and permits is good news because it represents a tremendous amount of backlog and once the recovery gains momentum, housing starts will rise quickly because permits have already been attained by builders.

Meanwhile up North, the Bank of Canada is gearing up for a rate hike. According to the BoC, "removing stimulus may become appropriate." Unlike other parts of the world crippled by high debt levels and slowing growth, Canada has benefitted significantly from the improvement in the U.S. economy and the rise in oil prices. Business and consumer confidence in Canada improved to the point where the BoC felt comfortable enough to raise its 2012 growth forecast to 2.4 from 2 percent and its 2013 forecast from 2.4 to 2.8 percent. Most of Canadian growth is expected to come from domestic demand. Last month, Canada experienced its strongest pace of job growth since 2008 and this improvement in the labor market will translate into stronger consumption. In terms of external factors, the BoC is looking at it from a glass half full point of view - they expect Europe to rise from recession in the second half of the year and they view the U.S. economy has slightly stronger. If not for Europe's troubles, the BoC would have probably raised interest rates today. However don't interpret the BoC comments to mean that a rapid series of consecutive rate hikes will follow. The central bank will raise interest rates gradually to avoid over tightening in what can still be characterized as uncertain global economic conditions. The hawkish comments from the Bank of Canada drove USD/CAD to 0.99 and it should only be a matter of time before USD/CAD slips to a fresh 7 month low.

Apr 17, 2012 09:10

OctaFX.Com News Updates

-

17-04-2012, 05:58 PM #66Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com -Spanish bill sale, German ZEW support euro

LONDON (Reuters) - The euro rose against the dollar on Tuesday after Spanish bill sales went through smoothly and a survey showed a rise in German analyst and investor sentiment, easing some of the market's concerns over euro zone debt.

However, analysts said Spain's precarious fiscal position would remain a worry and the most important test would come with an auction of Spanish 10-year debt on Thursday, which could put the euro back under pressure.

Spanish 10-year government bond yields dipped below 6 percent after jumping on Monday on fears its deficit and weak economy may force it to seek international help. Analysts said these concerns would limit the euro's gains with most investors still bearish about the common currency.

"We shouldn't read too much into the Spanish bill auction or into the ZEW data - the German Ifo survey (on Friday) and Spanish 10-year auction will be more important,"

said Gavin Friend, currency strategist at nabCapital.

"The target for the euro is $1.32/$1.3225 but I don't see it much above there."

He said the euro would face further tests with the G20 and IMF meeting at the end of this week and the first round of the French presidential election on April 22.

The euro was last flat on the day at $1.3135, having earlier surpassed Monday's high to hit $1.3173, with traders saying stop-loss buy orders were triggered on the breaks above $1.3150-60. They said a U.S. bank and Swiss investors had bought euros.

More gains would see it target the 55-day moving average at $1.3204, with the euro also supported by the German ZEW survey which showed analyst sentiment in Europe's largest economy rising unexpectedly in April to its highest level since June 2010.

The common currency hit a low of $1.2995 on Monday before rebounding as investors who had earlier initiated bearish bets reversed those positions. Analysts said the bounce above $1.30 suggested that level was an important support that could be difficult to breach. Once below there, however, traders could focus on a move towards the January low of $1.2624.

"I think we'll see a test of $1.30 within the next week," said Niels Christensen, currency strategist at Nordea in Copenhagen, adding concerns about Spain's elevated debt, shrinking economy and high unemployment would keep the euro weak.

ANOTHER SPAIN TEST

Investors were relieved as Spain sold 3.2 billion euros of 12 and 18-month bills, although at much higher yields compared with a month ago. Thursday will see a far bigger test when Spain sells 10-year and two-year bonds.

Compounding Spain's fiscal woes, its banks borrowed a record 316.3 billion euros from the European Central Bank in March, almost double February's total, as they remained all but excluded from wholesale credit markets.

The euro was up 0.3 percent at 106.0 yen, recovering from a trough of 104.63 yen on Monday, a level not seen since mid-February.

The euro and other riskier currencies could be helped further if U.S. housing data and industrial output for March, due at 8:30 a.m. EDT (1230 GMT) and 1315 GMT come in on the stronger side of expectations.

The dollar rose 0.3 percent against the safe-haven yen to 80.64 yen, above a seven-week low of 80.29 hit on Monday.

The higher-yielding Australian dollar edged up 0.2 percent at $1.0370 as stock markets recovered. It cut earlier losses after Reserve Bank of Australia policy meeting minutes showed it would consider cutting interest rates in May if data confirmed a benign inflation outlook.

Apr 17, 2012 10:52

OctaFX.Com News Updates

-

17-04-2012, 06:25 PM #67Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com - Canadian Dollar Surges as Hawkish BoC Raises Rate Hike Expectations

Although the key rate was kept on hold at 1.00 percent, an increasingly hawkish Bank of Canada has sent the Canadian Dollar surging early in the North American trading session. The shift in rhetoric has boosted rate hike expectations, improving the yield outlook for the world’s tenth largest economy.

The Bank of Canada left key interest rate on hold at 1.00 percent for the thirteenth consecutive meeting today, but the real story lies within the central bank’s statement accompanying the release. The BoC said that higher rates “may become appropriate” in the future as actual economic growth and price pressures have exceeded economists’ forecasts.

Governor Mark Carney said that “In light of the reduced slack in the economy and firmer underlying inflation, some modest withdrawal of the present considerable monetary policy stimulus may become appropriate.” Governor Carney went on to say that “The timing and degree of any such withdrawal will be weighed carefully against domestic and global economic developments.” Market participants have taken this as a sign that the BoC will move to raise rates in the coming months, with the Credit Suisse Overnight Index Swaps now showing that 18.0-basis points are being priced in over the next 12-months (from 0.9-bps ahead of the meeting).

USDCAD 1-min Chart: April 17, 2012

Charts Created using Marketscope – Prepared by Christopher Vecchio

On the more hawkish than expected tone, as market participants have started to price in higher rates in the future, the Canadian Dollar has soared across the board, but most notably against the Euro and the Japanese Yen. The EURCAD has dropped over 95-pips on the rate decision (UPDATE: as of 14:28 GMT, the EURCAD was down over 110-pips post-rate decision). Similarly, the CADJPY jumped over 65-pips (UPDATE: as of 14:28 GMT, the CADJPY was up over 75-pips post-rate decision).

The USDCAD also traded lower, falling over 60-pips immediately (UPDATE: as of 14:28 GMT, the USDCAD was down over 70-pips post-rate decision).

Apr 17, 2012 14:28

OctaFX.Com News Updates

-

19-04-2012, 05:01 PM #68Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFx -Euro falls for 3rd day on nagging funding worries

NEW YORK (Reuters) - The euro fell for a third straight session against the U.S. dollar on Thursday despite a decent Spanish bond sale as investors remained skeptical about funding issues in the euro zone.

The euro also tracked the rise in credit default swaps and the widening of yield spreads between the safe-haven German bunds and peripheral fixed income debt, suggesting growing nervousness about liquidity in the financial system and sustainability of the region's debt.

"This is all emblematic of the fact that the market remains very nervous about the state of credit in the euro zone," said Boris Schlossberg, director of FX research at GFT Forex in Jersey City.

"Despite the fact that we had a decent Spanish bond auction, there is just basic skepticism not only about the sovereign debt market but also the health of the overall banking system, particularly in Spain."

Spain's Treasury issued 2.5 billion euros in two- and 10-year bonds, at the top end of the targeted amount. Yields on the key 10-year bond were higher, however, reflecting fears that Spain may miss budget deficit targets and about its banking sector.

The euro dropped 0.2 percent to $1.3087 after hitting a session low of $1.3068, reversing gains that took the single currency to $1.3164 following the Spanish auction.

Traders said they were inclined to sell into any euro rallies, with the rise in Spanish and Italian yields undermining any optimism from the auction. Market talk of a French downgrade also undermined sentiment towards the common currency.

The euro also modestly sold off after a report showed that U.S. initial jobless claims were weaker than expected, which slightly dampened risk appetite.

The euro held above strong chart support at $1.30. But an escalation of concerns about Spain's high level of debt, at a time when the economy is faltering, would put the euro back under pressure, potentially taking it towards the 2012 low of $1.2624.

"The market has come to realize that positive bond auctions are not Spain's salvation," said Neil Mellor, currency strategist at Bank of New York Mellon, adding it was only a matter of time before the euro broke below $1.30.

"There are too many negative elements in the euro zone. If $1.30 breaks, we have only got minor levels of support until the January lows. We cannot preclude a sudden move lower."

Many in the market said the euro would head lower in the medium term given the risks that budget and debt problems in Spain will worsen and uncertainty over the outcome of the French presidential election, which polls suggest will result in a leadership change.

Traders cited talk of hedge funds betting the euro will fall to $1.25 soon after the French poll concludes early next month.

The safe-haven Japanese yen, meanwhile, fell, as equities gained and after Bank of Japan Governor Masaaki Shirakawa stressed the central bank's commitment to powerful monetary easing.

The dollar rose 0.3 percent to 81.510 yen, triggering reported stop loss buy orders around 81.60 yen, with traders earlier citing flows related to the launch of a large investment trust by a Japanese investment bank.

The euro was up 0.1 percent at 106.79 yen, although resistance came in around its 50-day moving average at 107.44 yen.

The higher-yielding Australian dollar was steady against the U.S. dollar at US$1.0356.

Apr 19, 2012 10:53

OctaFX.Com News Updates

-

19-04-2012, 05:34 PM #69Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFX.Com -EUR/USD Classical Technical Report 04.19EUR/USD: The latest round of setbacks have stalled ahead of some key multi-week support by 1.3000 and from here we still can not rule out risks for additional consolidation above 1.3000, before considering bearish resumption. Ultimately, any rallies towards 1.3300 should be well capped, while a break and daily close back under 1.3000 would accelerate declines to the early 2012 lows at 1.2660.Apr 19, 2012 06:26OctaFX.Com News Updates

OctaFX.Com -EUR/USD Classical Technical Report 04.19EUR/USD: The latest round of setbacks have stalled ahead of some key multi-week support by 1.3000 and from here we still can not rule out risks for additional consolidation above 1.3000, before considering bearish resumption. Ultimately, any rallies towards 1.3300 should be well capped, while a break and daily close back under 1.3000 would accelerate declines to the early 2012 lows at 1.2660.Apr 19, 2012 06:26OctaFX.Com News Updates

-

20-04-2012, 03:59 PM #70Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OctaFx -AUD/USD Classical Technical Report 04.20

AUD/USD: Our bearish outlook in this market is being reaffirmed with the latest pullback from the mid-1.0400’s and we continue to project deeper setbacks over the coming days and weeks back below parity. A fresh lower top now looks to be carving by 1.0465 but only back above 1.0640 would delay and give reason for concern. From here, look for a break and close back below 1.0300 to open the next downside extension towards 1.0000 over the coming sessions.

Apr 20, 2012 06:44

OctaFX.Com News Updates

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote