Japanese Yen Gains as Export Data Outperforms Forecasts

The Japanese Yen rose as the country’s exporting sector performed better than expected, weighing on the likelihood of near-term BOJ currency intervention.

THE TAKEAWAY: Merchandise Trade Balance rose to ¥ 32.9 Billion from -¥ 1476.9 Billion > Traders Bought Yen as the Chance for Further BOJ Inflationary Action in the FX Market Diminished > USDJPY Fell

Data released by the Ministry of Finance and the Customs Office showed that the merchandise trade balance in February rose to 32.9 billion Yenfrom -1476.9 billion Yen. The figure surpassed the -120 billion Yen deficit that analysts expected. Additionally, trade exports fell only 2.7 percent on the year, beating the 6.5 percent drop forecasted and improving upon the 9.3 percent decline the prior year.

The figures painted a rosier than expected picture of an export-dominated Japanese economy and jumped on bears who forecasted a larger drop in the country’s export sector. Though the data did not go as far as suggesting a warming exports industry, they did show the market that Japanese exporters were not faring as poorly as analysts thought. As exports performed better than expected, the likelihood declined that the Bank of Japan would infuse currency markets with more Yen anytime in the near future. As a result, traders positioned themselves closer to the Yen. In the minutes after the release, USDJPY fell from 83.440 to as low as 83.140.

Mar 22, 2012 00:49

OctaFX.Com News Updates

Please visit our sponsors

Results 31 to 40 of 769

-

22-03-2012, 02:07 PM #31Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

-

22-03-2012, 02:50 PM #32Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

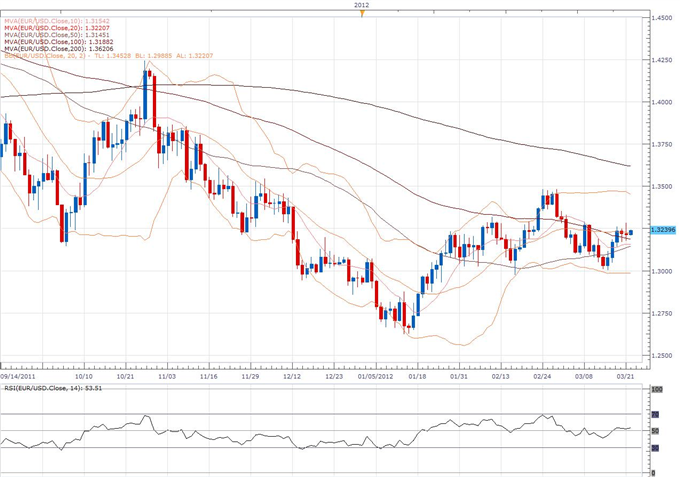

EUR/USD Classical Technical Report 03.22

EUR/USD: The market has been well supported on the latest dip towards key support at 1.2975 and the subsequent bounce back above 1.3100 delays bearish prospects and opens the door for additional consolidation over the coming days. The key levels to watch above and below come in by 1.3315 and 1.2975 respectively and a break and close above or below will be required for clearer directional bias. In the interim we remain sidelined.

Mar 22, 2012 00:49

OctaFX.Com News Updates

-

22-03-2012, 03:13 PM #33Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

USD Rises but Mounting Global Risks Keeps FX Pressured

With the U.S. dollar and the Japanese Yen being the best performing currencies this morning, it is clear that mounting risks in the financial markets has raised the level of fear. A series of negative economic reports overnight from China, the Eurozone and the U.K. was compounded by softer data from Canada. Retail sales rose 0.5 percent in January, which a marked an improvement from flat growth in December but was a major a disappointment compared to the market's 1.8 percent forecast. Excluding auto purchases, sales declined by 0.5 percent.

The U.S. only country that continues to print good news. Jobless claims dropped to its lowest level since February 2008. Weekly claims fell 5k to 348k after a downward revision to the prior's week report. The level of jobless claims is consistent with continued job growth in the U.S. economy and as long as claims remain below 375k on a weekly basis, there is no reason for the Fed to be overly concerned. The recovery is still "frustratingly slow" according to Bernanke but currency traders are satisfied that the U.S. economy is improving at all. U.S. leading indicators will be released later this morning and with claims falling and stocks rising, we expect another positive report.

The U.S. dollar is outperforming every major currency except for the Yen because better than expected U.S. data and risk aversion is a win win for the dollar. The string of weaker economic economic data outside of the U.S. has made America look a shining star to investors. Fed President Bullard's comment about the higher risk of inflation this year also helped to lift the greenback.

If bad news begets more bad news abroad, we could see greater demand for dollars. The Chinese government has officially come to terms with slower growth and while their economy may be able to handle it, the Australian and New Zealand economies may not. If Chinese demand pulls back more than it has already, the Reserve Bank of Australia may have to lower interest rates over the next few months and this risk has drive the Australian dollar sharply lower. At the same time, the Eurozone is suffering from weaker domestic and external demand. The sharp decline in the PMI reports flashes signs of a technical recession in the Eurozone. 48 hours ago, we penned a report talking about how the dollar can't lose because even if the U.S. recovery loses momentum, the outlook for other countries is even worse. In Europe, the rise in Italian and Spanish 10 year bond yields raises fresh concerns about the funding capacity of the Eurozone’s #3 and #4 economies. If the EUR/USD will have a very tough time recovering if European bond yields continue to rise.

Mar 22, 2012 00:49

OctaFX.Com News Updates

-

22-03-2012, 03:54 PM #34Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

Australian Dollar Sold as Dovish RBA Cuts Hopes for Future Rate Hike

LONDON (Reuters) - World stocks hit their lowest in over a week on Thursday and Wall Street was set open in the red as manufacturing slumps in China and the euro zone fuelled global growth concerns.

The downbeat data triggered flows back into safe-haven assets that boosted German government debt, while it also sent the euro lower and left the common currency looking vulnerable to further losses.

The HSBC flash Purchasing Managers' Index, the earliest indicator of China's industrial activity, fell to 48.1 in March from February's four-month high of 49.6.

The euro zone's leading economies Germany and France both reported an unexpected contraction in manufacturing activity. [nL9E7J203Z], sending Markit's Composite PMI for the region down to 48.7 in March from 49.3 in February.

Anything below 50 is viewed as a contraction.

"When you get numbers like this out of the euro zone it definitely puts the growth outlook into question and points to a mild recession," said Niels Christensen, currency strategist at Nordea in Copenhagen.

"There should be a widening of rate differentials in favor of the dollar, so a lower euro/dollar will be the result".

MSCI's main world equity index <.MIWD00000PUS> fell 0.4 percent to its lowest in eight days after hitting its highest level since August earlier in the week.

U.S. stock index futures <.NDc1> pointed to losses of 0.5-0.6 percent at the Wall Street open.

Recent comments by the U.S. Federal Reserve have cut expectations of further quantitative easing, or asset buying. Previous rounds of QE had supported risky assets.

"Everyone was so focused on Greece and the debt crisis is still on everyone's mind, but attention is focusing back on to fundamentals," said DZ Bank rate strategist Michael Leister.

"The PMIs alone don't make for such a big story but they fit into the bigger picture risk-off theme that we're seeing."

European stocks <.FTEU3> weakened for a fourth straight session, heading for their longest negative run in four months. They fell 1 percent to 10-day lows and emerging stocks <.MSCIEF> fell 0.4 percent to two-week lows.

The euro dropped 0.4 percent against the dollar to $1.3162 and 1 percent against the yen to 109.

The dollar lost 0.7 percent to 82.79 yen although it gained 0.2 percent against a basket of major currencies <.DXY>.

Brent crude oil was down 0.5 percent at $123.55 a barrel.

Mar 06, 2012 04:09

OctaFX.Com News Updates

-

23-03-2012, 07:27 PM #35Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

Stocks slip on growth worries, bonds rise

NEW YORK (Reuters) - World stocks drifted lower on Friday, pulled down by a decline in U.S. home sales as concerns about global growth cooled enthusiasm.

Commodity prices ticked higher on the belief the prior day's sell-off in risk assets was overdone.

The Commerce Department said sales of new single-family homes slipped 1.6 percent in February to a seasonally adjusted 313,000-unit annual rate. January's sales pace was revised down to 318,000 units from the previously reported 321,000 units.

U.S. government debt prices rose for the fourth day in a row, reversing more of last week's losses, as concerns about the economic picture in China and Europe competed with improved U.S. employment for investors' attention.

The benchmark 10-year U.S. Treasury note was up 18/32 in price to yield 2.21 percent.

Wall Street opened mixed, but then fell on the U.S. home sales. European and global stock indices were lower.

The belief that equity markets have gained to much in too short a time has dampened investor sentiment. The benchmark S&P 500, on track for its first weekly decline in six weeks, has gained more than 10 percent so far this year and almost 30 percent since its October lows.

"We are all looking for a correction in the markets and that is what we are getting at the moment," said Frank Lesh, a futures analyst and broker at FuturePath Trading LLC in Chicago.

"It's not a deep and serious correction, but we were a bit overbought and we could just move sideways to slightly lower to correct that, and it appears that is what we are doing."

The Dow Jones industrial average (DJI:DJI) was down 11.24 points, or 0.09 percent, at 13,034.90. The Standard & Poor's 500 Index (MXP:SPX) was down 1.68 points, or 0.12 percent, at 1,391.10. The Nasdaq Composite Index (NAS:COMP) was down 13.33 points, or 0.44 percent, at 3,049.99.

The MSCI world equity index <.MIWD00000PUS> was off 0.1 percent, while a measure of top European stocks <.FTEU3> lost 0.8 percent and emerging markets <.MSCIEF> fell 0.5 percent.

The dollar has been supported by an improving U.S. economic landscape that contrasts with the euro zone, where most economies are either teetering on the brink of or in recession.

The euro was up 0.37 percent at $1.3245, and the U.S. Dollar Index <.DXY> down 0.36 percent at 79.448.

The relationship between risk appetite and the dollar has become more complicated, according to Chris Fernandes, vice president, senior foreign exchange adviser for the capital markets division at Bank of the West in San Ramon, California.

"Whereas in the past the dollar would tend to fall as risk appetite was rising, the dollar is now benefiting from pro-risk developments, as U.S. economic data has generally bested expectations recently," he said.

Brent oil was up $1.84 at $124.98 a barrel, underpinned by worries that military conflict with Iran will hit supplies and create an oil price spike.

U.S. light sweet crude oil rose $1.30 to $106.65 a barrel. The Reuters/Jefferies CRB Index <.CRB> of leading commodity prices was up 0.6 percent at 314.04.

Mar 23, 2012 10:29

OctaFX.Com News Updates

-

23-03-2012, 08:19 PM #36Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

Euro zone seeks middle ground on rescue fund size

BRUSSELS (Reuters) - Euro zone finance ministers are moving closer to agreeing a combined rescue fund of around 700 billion euros ($924 billion) in Copenhagen next week and anything higher would probably be too ambitious, euro zone diplomats said on Friday.

The EU's top economic official, Olli Rehn, is pushing for a big fund capable of bailing out indebted euro zone countries such as Italy and Spain, should they be cut off from the markets, despite resistance in Germany, the bloc's paymaster.

So far, Germany has refused to countenance any combination of the various rescue funds.

In a final push to press Berlin and others to go further, the European Commission circulated a document to member states this week in Brussels, proposing an increase to as much as 940 billion euros.

But three diplomats said that was unrealistic, as the European Central Bank has already injected 1 trillion euros in stimulus to banks, and EU governments have committed to tough economic reform and fiscal discipline to calm financial markets.

"Officials are moving towards the middle ground of giving the combined fund a lending capacity of 700 billion," said one euro zone diplomat who had seen the Commission report that was also obtained by Reuters.

Finance ministers and central bankers will discuss the size of a bailout firewall in Copenhagen next Friday. That would likely be made up of the European Financial Stability Facility (EFSF) that had been due to be wound up next year, and the European Stability Mechanism (ESM) permanent fund that was set to replace it.

The 440 billion euro EFSF and the 500 billion euro ESM now have a combined lending ceiling of 500 billion euros, which means that in the 12 months from July, when they will co-exist, they would not be able to lend beyond that limit.

Last week, senior euro zone officials told Reuters that the 17-nation currency area is likely to agree on a combined fund of almost 700 billion euros in a trade-off between German opposition to more funds and the need to reassure investors.

"The signals we are getting is that Germans are going to come on board," said another diplomat.

WHAT BERLIN WANTS

Under the Commission's central proposal, the two funds would be allowed to add up to 940 billion euros, transferring the EFSF's remaining firepower into the ESM.

That means the lending capacity of the ESM would be 740 billion euros, taking out existing emergency loans to Portugal, Greece and Ireland.

"The markets would be most likely to consider the new lending capacity sufficient and the brunt of the stabilization effort would no longer fall on the ECB," the report said.

The Commission hopes that would help motivate other major global powers such as the United States and China to give more funds to the International Monetary Fund to deal with any further fallout from the debt crisis.

Two other proposals sketched out by the EU's executive include one that would allow the EFSF and ESM to operate independently of one another until the EFSF is wound down next year. That would also equate to a joint-lending capacity of 740 billion euros but only until the EFSF is closed.

A third alternative would be to disband the EFSF ahead of 2013, making the ESM responsible for all lending. This model would see total lending capacity at 500 billion euros.

"The question is what Germany might want in return to agreeing to a bigger firewall, be it more austerity from member states, or a German in one of the top posts soon to be vacant in the EU," said a third diplomat.

European governments are jostling for four coveted jobs, including the post of coordinating policy between euro zone finance ministers, known as the president of the Eurogroup.

Germany has put forward its finance minister, Wolfgang Schaeuble, for the influential post, sources told Reuters this month, although that move may also be a negotiating ploy.

Mar 22, 2012 00:49

OctaFX.Com News Updates

-

26-03-2012, 07:16 PM #37Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

Euro up versus dollar, yen as Bernanke fans QE hopes

NEW YORK (Reuters) - The euro advanced against the dollar and the yen on Monday as weaker-than-expected U.S. data and Federal Reserve Chairman Ben Bernanke's cautious comments on the job market spurred hopes for more easing ahead, boosting riskier assets.

The single currency hit a better than three-week high against the greenback and jumped more than 1 percent against the yen.

Bernanke's warning that the U.S. economy needs to grow faster to get the unemployment rate down boosted hopes early in the session that the bank could yet conduct another round of quantitative easing.

Disappointing home sales data reinforced that outlook later on Monday, with contracts to purchase previously owned U.S. homes unexpectedly falling in February.

"All this left the market with the nagging thought that the Fed is not quite done with economic stimulus," said Boris Schlossberg, director of FX Research at GFT in Jersey City, New Jersey. "I think they have not in any way, shape or form eliminated that possibility."

News from Europe also helped the single currency, with German Chancellor Angela Merkel giving veiled approval to an expected increase in the region's financial firewall this week, with finance ministers meeting in Copenhagen on March 30-31.

The euro advanced 0.41 percent to $1.3325 on Monday and touched its highest since March 1. Against the yen the single currency jumped as high as 110.54 yen before more recently trading at 110.37 yen, up 1.01 percent.

The dollar also slid against the Swiss franc, off 0.39 percent to 0.9042 francs.

Still, analysts said the region's debt crisis is far from over. A number of events this week could help clarify how well policymakers are managing those problems, including bond auctions in Italy and Spain's budget on Friday. Italy is seeking to raise up to 7.5 billion euros amid renewed pressure on peripheral euro zone debt.

Worries are also growing about Spain after a government setback in regional elections, making Prime Minister Mariano Rajoy's task of pushing through harsh spending cuts more difficult.

"Really we've made a big stride but we haven't actually solved the problems" in the euro zone, said Camilla Sutton, chief currency strategist at Scotia Capital. The euro could see recurring bouts of selling through the year as those worries persist, she added.

DOLLAR FIRMER AGAINST YEN

The dollar advanced against the Japanese currency, gaining 0.62 percent to 82.82 yen.

Traders said they would prefer to buy the dollar and sell the yen, with repatriation inflows ahead of the Japanese fiscal year-end on March 31 unlikely to change the bearish sentiment toward the Japanese currency over the medium term.

"We are expecting the dollar/yen pair to trade in a 80-85 yen range with a risk of an upside break. A lot will depend on whether the economies outside the U.S. also pick up," said Paul Robson, currency strategist at RBS Global Banking.

"As long as the U.S. economy shows signs of outperforming the others, the dollar would be supported."

The growth-linked Australian dollar was up 0.64 percent at $1.0525 after a fall last week.

Mar 22, 2012 00:49

OctaFX.Com News Updates

-

26-03-2012, 08:01 PM #38Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

Dollar falls against euro after Bernanke comments

Dollar falls against euro after Bernanke says US job market is still weak

NEW YORK (AP) -- The dollar fell sharply against the euro Monday after Federal Reserve Chairman Ben Bernanke said that the U.S. job market is still weak despite recent signs that it is improving.

Traders interpreted Bernanke's comments to mean that the Fed will keep interest rates near zero. Lower interest rates tend to weigh on a currency by reducing the returns investors get from holding it.

Bernanke's comments were made during a speech at the National Association for Business Economics.

The euro rose to $1.3333 in afternoon trading from $1.3263 late Friday.

The central bank has kept interest rates near zero since cutting them during the financial crisis in December 2008. The Fed keeps rates low in order to help the economy recover.

Despite improvements in the job market, Bernanke said that he doesn't expect the unemployment rate to keep falling. Employers added an average of 245,000 jobs a month from December through February. And the unemployment rate was at 8.3 percent in February, down from 9 percent during the same month a year ago.

In other trading, the British pound rose to $1.5926 from $1.5871. The dollar fell to 0.9034 Swiss franc from 0.9086 Swiss franc and to 99.22 Canadian cents from 99.85 Canadian cents.

The dollar rose to 82.77 Japanese yen from 82.49 yen.

Mar 26, 2012 15:49

OctaFX.Com News Updates

-

26-03-2012, 08:37 PM #39Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

Euro gains versus dollar, yen; Bernanke triggers new quantitative easing talk

NEW YORK (Reuters) - The euro advanced against the dollar and yen for a second straight day on Monday as weaker-than-expected U.S. data and Federal Reserve Chairman Ben Bernanke's cautious comments on the job market spurred expectations for more policy easing.

The single currency hit a better than three-week high against the greenback and jumped more than 1 percent against the yen. Still, analysts said the euro zone's debt crisis was far from over and the currency could come under pressure this week.

Bernanke's warning that the U.S. economy needs to grow faster to get unemployment down led investors to take on more risk on hopes the central bank could conduct another round of quantitative easing.

Disappointing home sales data reinforced that outlook later on Monday, with contracts to purchase previously owned U.S. homes unexpectedly falling in February.

"All this left the market with the nagging thought that the Fed is not quite done with economic stimulus," said Boris Schlossberg, director of FX Research at GFT in Jersey City, New Jersey. "I think they have not in any way, shape or form eliminated that possibility."

News from Europe also helped the single currency, with German Chancellor Angela Merkel giving veiled approval to an expected increase in the region's financial firewall this week, with finance ministers meeting in Copenhagen on March 30-31.

The euro advanced 0.5 percent to $1.3331 on Monday and touched its highest since March 1. Against the yen the single currency jumped as high as 110.54 yen before more recently trading at 110.44 yen, up 1.1 percent.

The dollar also slid against the Swiss franc, off 0.5 percent to 0.9035 francs. The dollar's session trough against the Swiss franc was the lowest since March 2, according to Reuters data

A number of events this week could help clarify how well policymakers are managing problems in the euro zone. They include bond auctions in Italy and Spain's budget on Friday. Italy hopes to raise up to 7.5 billion euros amid renewed pressure on peripheral euro zone debt.

Worries are also growing about Spain after a government setback in regional elections, making Prime Minister Mariano Rajoy's task of pushing through harsh spending cuts more difficult.

"Really we've made a big stride but we haven't actually solved the problems" in the euro zone, said Camilla Sutton, chief currency strategist at Scotia Capital. The euro could see recurring bouts of selling through the year as those worries persist, she added.

DOLLAR FIRMER AGAINST YEN

The dollar advanced against the Japanese currency, gaining 0.6 percent to 82.81 yen.

Traders said they would prefer to buy the dollar and sell the yen, with repatriation inflows ahead of the Japanese fiscal year-end on March 31 unlikely to change the bearish sentiment toward the Japanese currency over the medium term.

"We are expecting the dollar/yen pair to trade in a 80-85 yen range with a risk of an upside break. A lot will depend on whether the economies outside the U.S. also pick up," said Paul Robson, currency strategist at RBS Global Banking.

"As long as the U.S. economy shows signs of outperforming the others, the dollar would be supported."

The growth-linked Australian dollar was up 0.5 percent at $1.0514, recouping some of last week's 1.2 percent decline.

Mar 26, 2012 18:35

OctaFX.Com News Updates

-

27-03-2012, 03:05 PM #40Senior Investor

- Join Date

- Feb 2012

- Posts

- 1,727

- Feedback Score

- 0

- Thanks

- 0

- Thanked 36 Times in 27 Posts

OECD pushes for $1.3 trillion eurozone crisis fund

OECD head urges euro countries to boost crisis fund to $1.3 trillion-plus to aid growth

BRUSSELS (AP) -- The 17 countries that use the euro need to build a €1 trillion ($1.3 trillion) firewall to help the struggling currency union return to growth, the head of the Organization for Economic Cooperation and Development said Tuesday.

Angel Gurria, the secretary-general of the Paris-based international development body, said existing plans for a €500 billion ($664 billion) European rescue fund were not enough to restore market confidence in the eurozone.

"The mother of all firewalls should be in place," Gurria he told a news conference in Brussels, where he was flanked by Olli Rehn, the EU's economic affairs commissioner, who has also been pushing for a larger bailout fund.

A permanent bailout fund of at least €1 trillion would give governments the breathing space to focus on kickstarting growth and restoring the competitiveness of their economies, Gurria added.

As well as shoring up the financial defenses, the OECD chief pointed to a raft of economic reforms that individual countries should enact. According to the organization's annual report for the eurozone, which was released Tuesday, vulnerable states may need more than €1 trillion in aid over the coming two years and Gurria said eurozone finance ministers should take a decision to boost their bailout funds at their meeting in Copenhagen on Friday.

Germany, the bloc's largest economy, signaled on Monday that it would support an increase to around €700 billion ($929 billion), but only until some €200 billion in loans already promised to Greece, Ireland and Portugal have been paid back.

That falls below the recommendation of the International Monetary Fund and the European Commission, the European Union's executive. Both organizations believe a much bigger firewall will keep a lid on the pressure on Italy and Spain, the eurozone's third- and fourth-largest economies, which have a combined debt load of more than €2.5 trillion.

"I am of the view that when you are dealing with markets you should overshoot," Gurria said.

Germany's proposal may also not be enough to convince other large non-euro economies, such as China and the U.S., to give the IMF more resources, money that could be used to further protect Europe.

Asked about the chances that Gurria's €1 trillion goal could actually be achieved on Friday, Rehn declined to give a clear answer.

"I am confident that we can reach a convincing decision," he said, adding that discussions between euro states were still ongoing.

Countries like Germany fear that easy access to financial support could stop countries from implementing reforms. They also point to the recent stabilization in financial markets. Credit for that has been given to the European Central Bank, which has pumped more than €1 trillion in cheap long-term loans into European banks.

The OECD's Gurria warned of the perils of overconfidence.

"We can still clearly not draw too much comfort from these signs of healing," he said, noting that there had been other brief moments of respite in Europe's two-year-old debt crisis.

He warned that funding costs in several euro countries remain unsustainable, and — in what appeared to be a clear reference to Spain — have been creeping up again in recent weeks.

Gurria also suggested that the ECB could intervene more aggressively in the bond markets of struggling countries if market pressures resurface — a step that the central bank has been reluctant to take so far.

Mar 27, 2012 08:56

OctaFX.Com News Updates

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote