The NoaFX IB Account

With a NoaFX IB account the commissions that you could earn are only limited by the number of referrals you make and the trading activity of these referrals. This account is for individuals who want to earn commissions whenever they refer friends to our company, and it is a win win situation. The referrals get access to all of the same great NoaFX benefits and advantages and you gain commissions from making referrals and from any trading activity of your referrals.

A NoaFX IB account allows you to create your own referral network, and we offer a multi level commission structure. When your referrals make referrals of their own you will get commissions from this second level. The more clients you bring NoaFX the higher your commissions could be. The potential is unlimited, and you decide how much you earn with your NoaFX IB account.

How Does a NoaFX IB Account Work?

When you open a NoaFX IB account you can start referring people and companies immediately. When you make a referral then you receive a commission for this once the person that you refer opens an account and starts trading with us. The best part is that the referral will be impressed and they will also start to refer people to NoaFX. You receive commissions on multiple tiers, so you benefit when someone you refer directs their friends and clients to us as well. Eventually you can have a considerable amount of passive income just for helping others. Your referrals will find the best trading platforms and resources at NoaFX.

Please click here to download NoaFX's IB agreement.

Please visit our sponsors

Results 51 to 60 of 148

-

22-04-2015, 04:28 PM #51Senior Member

- Join Date

- Feb 2015

- Posts

- 150

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

-

23-04-2015, 03:49 PM #52Senior Member

- Join Date

- Feb 2015

- Posts

- 150

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Why Noa?

We know that there are plenty of brokerage firms out there, vying to have your account opened with them.

Here are reasons why you don't want to risk your money anywhere else;

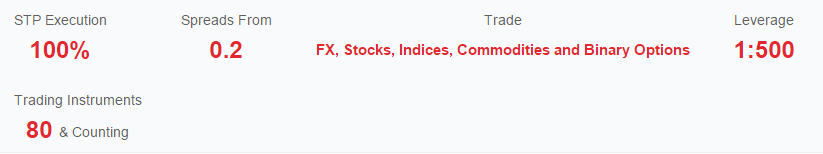

Technology

Superior Technology. Period.

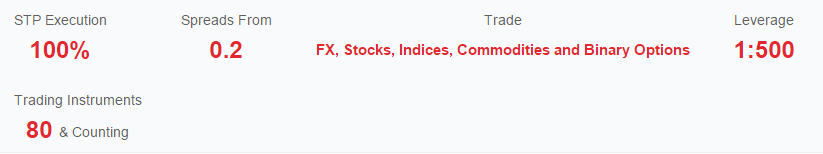

Our order clearance engine is far superior and has set standards that will revolutionize the FX industry. We are setting the standards for the fastest execution time and least number of requotes for a STP broker.

Fund Managers, First.

We know the games brokers play. Being fund managers, we have created this framework of impeccable standards with complete transparency. From technology, corporate governance to customer service standards, we want the best and we say it as it is.

Multi Platform Trading

We understand your need to access the markets on multiple platforms and when on the go.

It is your choice of platform when trading with us;

- Web Based Trading Platform MT4 MetaTrader

- Platform-Windows based

- IPhone Trader

- IPad Trader

- Android Trading Platform

Binary Options within MT4

Have the luxury and flexibility of trading Binary Options within your preferred MT4 platform itself! You no longer need to dabble with multiple platforms, maintain multiple margins and constantly worry about handling both accounts. Harness the power of our technology and take your trading to a whole new level!

-

26-04-2015, 04:47 PM #53Senior Member

- Join Date

- Feb 2015

- Posts

- 150

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

-

26-04-2015, 04:48 PM #54Senior Member

- Join Date

- Feb 2015

- Posts

- 150

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

NoaFx provide daily analysis is the sum of Market Insight in NoaFx in facebook NoaFx

Make sure we do trading with strong analytical provision so that we can get the maximum profit

-

28-04-2015, 05:37 PM #55Senior Member

- Join Date

- Feb 2015

- Posts

- 150

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

I Have already put in a withdrawal request. How long does it take before i receive my funds

Most withdrawals are processed within the same business day. Depending on the time of the day your request came in, you can expect the funds transfer to be issued out within 1 business day. Most deposits to your account should complete within 1-3 business days.

Do you allow high frequency trader, scalper

Yes, you are free to trade using any trading style, there are no limitations. In fact, we welcome trading styles with high frequencies of clearance as they are very well suited to our order clearance mechanism.

-

29-04-2015, 03:38 PM #56Senior Member

- Join Date

- Feb 2015

- Posts

- 150

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Since you are a ECN broker, do you charge any commissions

There is no commissions that we charge on all our orders. We pass the operational costs to you from our liquidity providers to you as spreads. That is all you "pay" to us.

What is the background of NoaFX

NoaFX is a retail spot FX brokerage arm of Capital Market Investments Limited(2011), Company registration number. 3693175.

We are licensed under the FMA and FSP regulatory bodies, under FSP License No. FSP284605

We are also a member of Financial Dispute Resolution Scheme (FDR), Membership No 276030, which is a non-profit arbitration body that handles customer disputes. This body is the first and most respected scheme under the External Dispute Resolution (EDR) scheme approved by the Minister for Consumer Affairs under the Financial Service Providers (Registration and Dispute Resolution) Act 2008.

-

01-05-2015, 04:25 PM #57Senior Member

- Join Date

- Feb 2015

- Posts

- 150

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

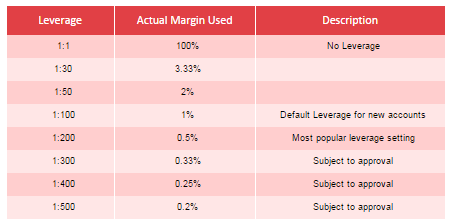

NoaFX Leverage Options

NoaFX Leverage Options

At NoaFX traders have a wide range of leverage options so that you can control your risk exposure. All of the NoaFX accounts are set at the default leverage setting of 1:100. The maximum leverage available for NoaFX traders is 1:500 when requested by the member. The various leverage settings that are available at NoaFX are:

Which NoaFX leverage setting should I pick?

All new NoaFX accounts start out with a default 1:100 setting. This is the recommended leverage setting if you are not completely sure what leverage will meet your trading system needs.

More leverage means a lower cost so why shouldn't I just pick the highest leverage amount?

Over leveraging has risks involved so effective risk management is crucial. A higher leverage is more affordable but if your account balance can not handle the positions that you take then you could risk a margin call, and possibly high losses. Make sure you understand all of the risks involved with over leveraging in order to manage your risks.

Can I start with one leverage amount and then change it later on?

Of course! When you are ready to change the leverage setting of your account make sure you do not have any open positions, and then send a request to [email protected]. We will change the leverage setting on your account on the same business day.

-

03-05-2015, 03:13 PM #58Senior Member

- Join Date

- Feb 2015

- Posts

- 150

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Advantages/Benefits of CFD Trading

Go Short or Go Long With CFD Trading

NoaFX CFD trading allows you to choose between going long (buying) or going short (selling), depending on how you think the market will react. If you expect the market to rise then you will buy, and if you expect it to fall then you will sell. When you trade CFDs then you can benefit no matter what direction the market moves if you predict these movements correctly. If you think a short term loss will occur for that market or investment vehicle then you will sell, and if the price falls then your profits will go up. If you predict wrong and the market moves against you then you will see bigger losses. CFDs offer flexibility that few other vehicles can provide.

Use CFDs as a Portfolio Hedge

If you think that your current portfolio may experience a loss in value then short selling by utilizing CFDs can help you offset any portfolio value losses. CFDs can be a great hedging tool for traders, and many individuals and organizations use these vehicles to hedge against portfolio losses. This is especially true when the markets are volatile. If you have $10,000 in XYZ company shares and you short sell this amount through a CFD trade then any portfolio loss is offset by the CFD gains that you will get.

Extended Trading Hours

NoaFX recognizes how important it is to access your account and trade when it is convenient for you, no matter where you may be. This is especially important when the markets are moving at a rapid pace. With NoaFX you have unrestricted access to your account 24/7. In addition a number of our markets operate up to 23 hours out of a 24 hour period, and these include major indices like Wall Street and the UK 100. This means CFDs can be traded even when the markets underlying them are closed.

High Levels of Leverage

Trading CFDs involves leverage, and this means that traders are only required to pay a fraction of the total value that the trade has in order to open a position. This is what margin is, and usually a small percentage of the full trade value is required up front. Leverage can help traders magnify any profits that they see, but it also means that any losses are also magnified as well. It is important that any trader understands the risks that margin and leverage entail before they take advantage of these. Independent advice should be sought if this is not the case.

-

03-05-2015, 03:14 PM #59Senior Member

- Join Date

- Feb 2015

- Posts

- 150

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Corporate Governance

Licensed in a reputable jurisdiction

NoaFX operates under Capital Market Investments Limited, incorporated, licensed and regulated in New Zealand. New Zealand is a highly developed country with strong economical and political stability. It also has a well enforced and regulated corporate culture and is one of the least corrupt nations in the world. This allows clients to have an assurance and confidence in the nation's practices for if there should be challenges, the country will have effective laws, enforcement and practices to serve to the best interests of the client.

Top Prime Banks as Deposit Custodians

Our banking services are with prime banks which are either Tier 1 banks globally or of the top 3 banks within that country itself.

Fund Segregation

Company funds and client funds are kept in two separate bank accounts and managed under different fiduciary controlling officers. This way, we ensure no one has the right to use clients' funds for any other reason than funding of clients' trades.

3rd Party Trustee Administered Deposit Facility

Our client deposits are held in a bank account held in a top prime bank in New Zealand. This bank account is also a trust facility, administered by a certified law firm. This ensures that we cannot solely transact on this bank account having your account funds. Every single transaction has to be dual approved by both the company and the trustee. You can assume that with each transaction that involves more work as such, our admin costs and transaction costs for the trustee's services too are increased. However, this is both a necessary and assuring measure to ensure safety of your funds.

Clients may choose to enjoy the safety of a trust facility, for a nominal fee. Trust facilities are usually only available for clients of high net worth and at an expensive cost to maintain.

NoaFX has heavily subsidized these costs, so as to give you a peace of mind. Regardless of account size, background or performance, your funds can be safekept in a trust facility.

By the way, we don't just say we have a trust facility for marketing purposes. When you wire your funds over, you will see the facility's details setup as such!

Insured Trust Deposits

All Client Deposits in the Trust Facility are covered by an insurance scheme that covers negligence or mishandling of funds. This insurance coverage, covers all claims that are held under the trust facility. As deposits kept in this account are off balance sheet, they cannot be held claimable by any debtors should the company be insolvent. Further, to protect any further risks, the insurance coverage provides a total peace of mind to ensure that no worst case scenario even can risk your deposits. The insurance policy is covered by AON Insurance(www.aon.com), a world leading insurance firm, having offices in more than 120 countries and a workforce of over 65,000 staffs.

Company Audited Financials

Each financial year, our financial statements and health is audited by top auditing firms to give you the confidence and assurance that you are in good hands. Auditing is an expensive and arduous process. We do it anyway to ensure your safety of funds and assure you that there is another firm ensuring it too.

-

05-05-2015, 05:52 PM #60Senior Member

- Join Date

- Feb 2015

- Posts

- 150

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Retail Forex trading offers many benefits. These include:

- A 24 Hour Market- The Forex market is the only market that operates on a continuous basis, because of the geographical dispersion between the various markets around the globe. Forex trading is not available on Saturdays and Sundays.

- Commission Free- Forex trading does not involve commissions. Traders pay for the spread involved, and this can be as small as 2 units at four decimal places.

- Recession Proof Market- Traders can make profitable trades on the Forex market regardless of whether there is a bull or a bear market trend. The market is bi-directional, and traders can buy and sell both.

- High Leverage- Forex brokers may offer traders 100 times leverage, or even more favorable credit terms, for every dollar invested. This can help keep contract costs down and potential profits higher. Traders who only have a small amount of capital can take advantage of this leverage to get more lucrative successful trades.

- Highest Market Trading Volume- The Forex market has the highest market trading volume out of all the markets. The daily volume can range from $4 trillion US dollars to $6 trillion US dollars. No other market can compete with this volume of trading.

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote