European stocks decline in the face of trade tensions

http://bit.ly/2DXJEmo

09.05.2019

On Thursday, European stocks headed south broadly due to the fact market participants had risky assets shunned, while willing to see whether China and America manage to dodge a trade conflict that would damage the world economy.

Eventually, the pan-European STOXX 600 index had slumped by nearly 0.7%, hitting a fresh four-week minimum.

On Wednesday, American leader told that China had the deal broken it had reached in trade negotiations with America, and vowed not to back down on slapping fresh levies on China’s goods.

As the world's leading economies proceed with their two-day trade negotiations in Washington on Thursday, traders were willing to know if a last-minute truce could prevent a steep increase of levies on $200 billion worth of China’s exports on Friday.

Over seven key sectors lost nearly 1%. Additionally, tariff-exposed auto shares went down by nearly 1.6%, while semiconductor shares lost ground too.

Banco BPM, Italy's number three lender went down by 6% having posted a halving of loan-loss provisions for the first quarter.

In addition to this, the country's leading financial institution by assets UniCredit went down even after it repeated its 2019 objectives and reported a net gain above analyst hopes.

Among the top divers were stocks of ArcelorMittal after the world's number one steelmaker cut demand estimate for its major markets and told it was facing the tough challenges of lower steel prices as well as reduced consumption in the European Union.

As for German wholesaler Metro, it headed south having posted another quarter of diving sales at its Russian business as well as its Real hypermarkets that the company is actually in the process of selling.

Please visit our sponsors

Results 141 to 150 of 370

Thread: Forex daily News FBS

-

09-05-2019, 09:09 PM #141Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

-

13-05-2019, 08:11 PM #142Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

5 important events this week will bring us!

More at: http://bit.ly/2JgFjyV

13.05.2019

British average earning index (Tue, 11:30 MT) – According to the forecasts, the indicator will reach 3.4%. If the actual figures are higher, the GBP will be supported.

Canadian CPI (Wed, 15:30 MT) – Higher than expected level of consumer inflation will be positive for the loonie.

US retail sales and core retail sales (Wed, 15:30 MT) – Analysts anticipate the headline retail sales to advance by 0.2%. As for its core level, it will likely increase by 0.7%. As usual, higher figures will be appreciated by the USD bulls.

Australian jobs report (Thu, 4:30 MT) – The level of employment change is expected to rise by 15,200 jobs. At the same time, the level of the unemployment rate is forecast to remain at the same level of 5%. If the actual level of employment change is higher and the unemployment rate is lower than the expectations, the AUD will be supported.

Speech by the BOC governor Stephen Poloz (Thu, 18:15 MT) – The Bank of Canada’s governor will be holding a press conference in Ottawa. He may provide some supportive comment for the Canadian dollar.

Hot news:

During the weekend, the US president Donald Trump continued to pressure China after the US raised tariffs on $200 billion of Chinese goods on Friday. He said that the deal would be far worse for China is his second term. The Chinese side said that it "deeply regrets" the US decision to hike tariffs and will apply countermeasures. As a result, the risky assets fell down. At the same time, the USD/CNH pair has jumped to its highest level since January. However, the trade negotiations keep going. The presidents of the two leading economies are expected to meet during the G20 summit, but now we may only wonder how many surprises the sides will bring to the market until then.

The Saudi energy minister said that two of its vessels were targeted in an attack on Sunday.

The ministers of the British Cabinet want the Prime Minister Theresa May to stop the cross-party talks and start indicative votes in the Parliament.

The bullish market is confirmed: Bitcoin has risen above $7,000 during the weekend. The total market capitalization reached $200 billion. Analysts see one of the main reasons in Fidelity, the famous financial institution, buying and selling Bitcoin.

-

14-05-2019, 09:35 PM #143Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

American import prices rally a bit

More at: http://bit.ly/2Vkidcd

14.05.2019

In April, American import prices surged less than anticipated in April due to the fact that jumps in the cost of food and petroleum were tamed by the largest tumble in the price of capital goods for a decade, dropping a hint at the fact that inflation could stay moderate for a while.

Tuesday’s the report from the Labor Department on Tuesday followed the previous week’s data, which indicated mild producer as well as consumer price jumps in April that underscored the Fed’s projection of no further interest rate hikes in 2019. Financial analysts state that inflation is also not too low for the major US financial institution to cut rates in 2019.

Early in May, the Federal Reserve kept rates intact and indicated little inclination to have its monetary policy adjusted anytime soon.

As a matter of fact, import prices tacked on by 0.2% in April after an unrevised 0.6% ascend in March. Financial analysts had hopes import prices would rally by 0.7% last month.

For the 12 months through April, import prices headed south by 0.2% having ascended by 0.1% in March.

Prices of American Treasuries rallied following the publication of the data. Amerian stock index futures surged and the evergreen buck jumped versus a basket of currencies.

Inflation could be spurred by the previous week's move by American leader to have levies lifted on $200 billion worth of Chinese exports to from 10% to 25%. Market experts estimate the latest tariffs could add up to two-tenths of a percentage point to inflation.

In April, prices for imported fuels as well as lubricants headed north by 2.5% having rallied by up to 6.9% in the previous month.

-

15-05-2019, 01:12 PM #144Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

The jobs data may support the AUD

The Australian jobs data will be out on May 16, at 4:30 MT. The indicator of employment change demonstrates how many people were employed during the previous month. Analysts anticipate it to advance by 15,200 people this time. As for the unemployment rate, it is anticipated to remain at the same level of 5%. The indicators may bring positive momentum to the AUD, which is struggling amid the trade tensions.

http://bit.ly/2LTiTGi

------------------------------------------------------------------------

-

16-05-2019, 04:25 PM #145Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

Weaker risk sentiment pulls the AUD to its lowest levels since January

http://bit.ly/2VqQSoY

15.05.2019

AUD/USD continues to move within the downward channel. At the moment, the aussie is testing the support at 0.6917. This is the lowest level for the pair since the flash crash at the beginning of January. The next support lies at 0.6871. The bearish weakness may help bears to push the Australian dollar back to the resistance at 0.6957. If this level is broken, the next resistance will lie at 0.7. RSI is currently testing the oversold zone, while the Stochastic indicator is already moving within this zone.

-

20-05-2019, 02:31 PM #146Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

5 important events this week will bring us!

Read at fbs : http://bit.ly/2YCASlE

20.05.2019

Speech by the Fed Chair Jerome Powell (Tue, 02:00 MT) – The Fed chair is due to speak during the Financial markets conference in Florida. His comments may shake the USD.

British CPI (Wed, 11:30 MT) – The level of the consumer price index is forecast to reach 2.2%. Higher figures will support the British pound amid the Brexit pressure.

Canadian core retail sales (Wed, 15:30 MT) – The indicator is expected to advance by 0.8%. If its actual level is higher, the loonie will rise.

Eurozone PMIs (Thu, 10:15-11:00 MT) – If the indicators are higher than the forecasts, the EUR will go up.

UK retail sales (Fri, 11:30 MT) – Positive release of the indicator of retail sales will be good for the GBP.

Hot news:

During the Asian session, the market sentiment was softer. However, at the start of the European trading session, the US-China trade tensions have started over again as China warned about the countermeasures on Huawei case. The US president Donald Trump and his administration banned Huawei and other telecommunication firms from doing business with American companies last week. Fresh uncertainties increase fears in the markets.

Also, the People's Bank of China announced that it would continue to keep the yuan stable within the balanced range. It strengthened the Chinese currency.

The unexpected victory for conservative Prime Minister Scott Morrison pushed the Australian dollar higher. He promised to simplify the tax system and introduce a tax cut.

The Brazilian real continues to weaken due to the protests against the freeze to the education budget and lower growth forecasts for Brazil from BNP and Goldman Sachs. Moreover, as an emerging markets currency, it keeps being affected by the trade tension between the US and China.

Europe anticipates the elections on May 23-25. During these elections, the citizens of the 28 countries will vote in a new European parliament Analysts anticipate Eurosceptic and anti-immigration parties to gain a lot due to the Brexit and global uncertainties. We need to pay attention to the parties from the UK. If the conservative party of Theresa May gains fewer votes, than others, it will increase the pressure on the current prime minister to resign. Also, keep an eye on the comments by the Italian Deputy Prime Minister Matteo Salvini. He said that Italy could break the EU budget rules on debt levels if necessary to raise the level of employment. If his party succeeds, the fears in the market may weaken the euro.

During the OPEC+ meeting this weekend, the members agreed to maintain the production cuts. It pushed the prices for crude higher.

-

21-05-2019, 10:17 PM #147Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

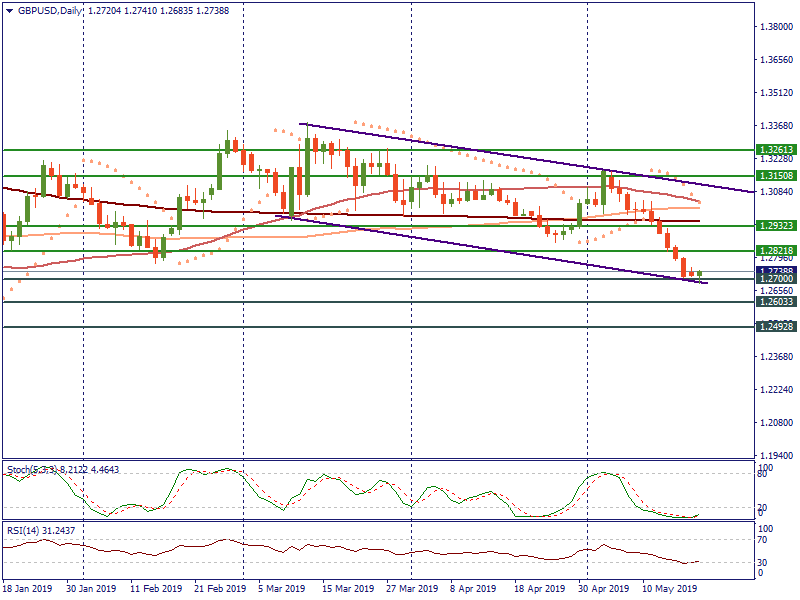

Does the British pound have any chance?

More at: http://bit.ly/2wbF53o

21.05.2019

As the Brexit situation does not become any brighter, the British pound suffers, too. The British Prime Minister Theresa May is expected to step down from her post by the end of June. This fact does not reduce the risks of a no-deal Brexit due to the lack of certainty in the final divorce deal with the EU.

However, today the GBP may be supported. The news that Theresa May will make the proposal for her deal at 17:00 MT has pushed the cable to the resistance at 1.2822. If she announces significant changes today, it will rise higher. On the other hand, if she fails again it will slide below the 1.27 level. The next support will lie at 1.2603.

The stochastic indicator has formed a crossover in the oversold and RSI has tested the border of the oversold zone.

-

22-05-2019, 08:38 PM #148Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

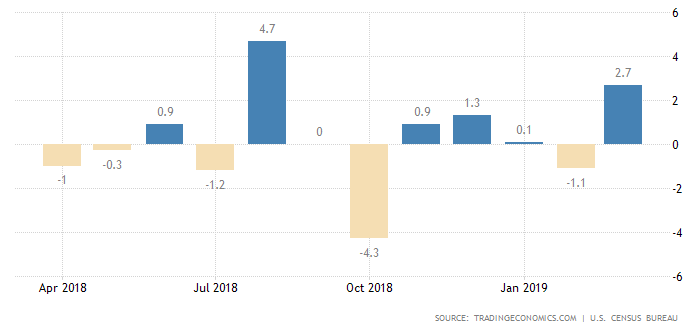

The USD may be supported by the releases

Read at: http://bit.ly/2Qmi8nG

22.05.2019

The United States anticipates the release of headline and core durable goods orders on May 24, at 15:30 MT time. The indicator represents the change in the total value of new purchase orders for durable goods. Its core level excludes transportation orders due to their high volatility. Rising purchase orders signal that manufacturers will increase their activity. This fact demonstrates the importance of the indicator. Last time the actual level of the headline indicator came out significantly higher than the forecasts (2.7% vs. 0.7%). The core indicator also advanced by 0.4% If the situation repeats itself, the USD will get positive momentum.

• If the actual levels of indicators are higher than the forecasts, the USD will rise;

• If the actual levels of indicators are lower than the forecasts, the USD will fall.

-

23-05-2019, 03:18 PM #149Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

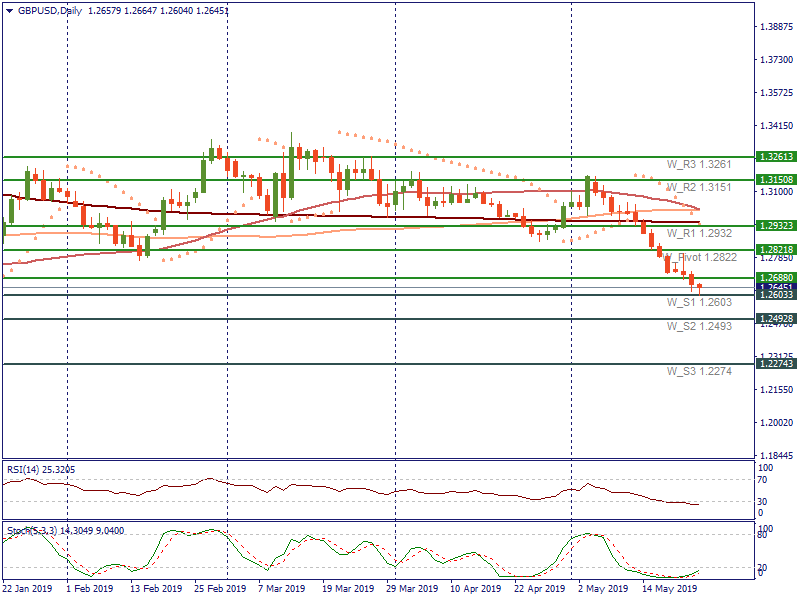

The British pound continues to go down as political risks intensify.

More at: http://bit.ly/2YMTjEu

23.05.2019

A lot of political uncertainties are driving the British pound down. The main of them is, of course, connected with the question: "How long Theresa May will stay a prime minister?"

Her proposal to publish a new withdrawal agreement bill (WAB) this Friday was not welcomed by her colleagues. The new agreement suggests the possibility of the second referendum and the customs union.

Reportedly, Theresa May will face another non-confidence vote tomorrow, if she does not announce the date of her departure.

What may be a game changer today?

Theresa May will meet with the ministers today;

The Cabinet will try to find a solution on delivering Brexit no matter what.

Technical levels for GBP/USD

The pair is testing the significant support level at 1.2603. If today's talks do not result in any breakthrough, the pair will fall further to the last December's lows. The next support will be placed at 1.2493. If the pair is supported today, it will rise to the resistance at 1.26882.

RSI is moving within the oversold zone and Stochastic formed a crossover within this zone, which may signal a possible buying opportunity.

-

24-05-2019, 06:28 PM #150Senior Investor

- Join Date

- Apr 2018

- Posts

- 509

- Feedback Score

- 0

- Thanks

- 0

- Thanked 0 Times in 0 Posts

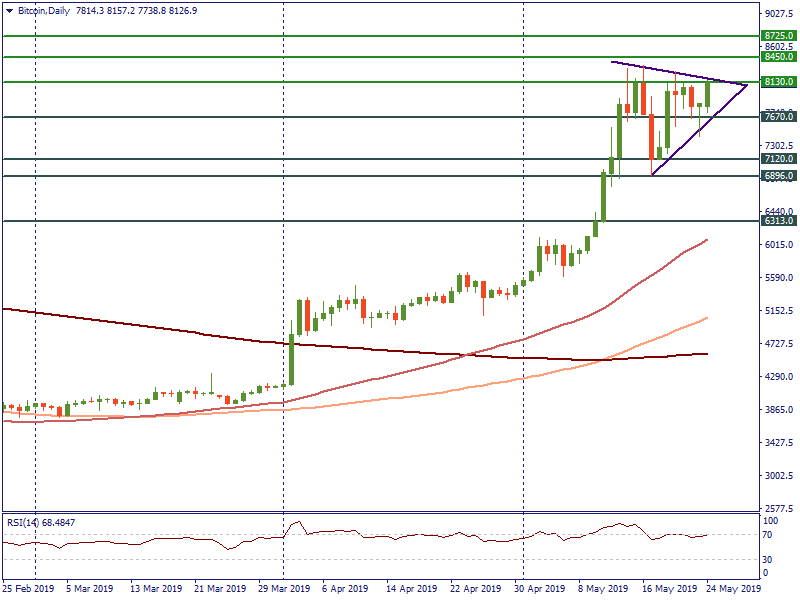

Weekly Cryptonews

More at: http://bit.ly/2QmZiN8

24.05.2019

Jeff Adams, the Senior Sales Manager for Huobi Global: “We see a lot of appetites out there from players in more established financial markets when it comes to digital assets but many are still uncomfortable jumping into unregulated trading environments…”

The price for Bitcoin keeps trading near the strong resistance at $8,130. If bullish pressure in the market increases, the next resistance will lie at $8,450. If it weakens, bears will meet the first support at $7,670. In case of the fall, the next key level will lie at $7,120. The price for the oldest cryptocurrency formed a symmetrical triangle pattern, as a result, the break may be either up or down. RSI is moving close to the overbought zone.

What news has been happening in the crypto market this week?

New releases:

WhatsApp messenger launched a bot which allows sending BTC, ETH, LTC and ZTX token to other users.

According to the investigation by the Block, Tether invested in different fiat assets and bitcoin. It means, that USDT is backed by BTC.

Ethereum foundation will invest $19 million to the development of Ethereum 2.0 and $8 million to the support of the current blockchain of ETH.

Grayscale Investments got the approval from the FINRA regulator on listing shares of the Ethereum-trust in the non-exchange market. Its price will depend on the market value of the ETH.

AT&T, the world’s largest telecommunications company, became the first major U.S. mobile carrier to accept Bitcoin for payment.

Regulations:

US Security and Exchange Commission once again postponed the approval of Bitcoin-ETF by VanEck and SolidX. At the same time, the NYSE Arca stock exchanged applied for the launch of Bitcoin-ETF, too.

US tax regulator is working on the new rules on paying taxes from crypto assets.

During the crypto fraud case, the court approved that Chinese citizens may own and exchange Bitcoin.

Are you kidding?

Craig Wright, the famous Faketoshi, registered the rights on White Paper and the code of Bitcoin. However, this fact does not make him the creator of BTC, as it has not been checked.

Current prices (last update 19:20 MT time):

Bitcoin: $8,187

DASH: $162.05

Litecoin: $103.35

Ethereum: $256.16

-

Sponsored Links

Thread Information

Users Browsing this Thread

There are currently 1 users browsing this thread. (0 members and 1 guests)

Tags for this Thread

24 Hour Gold

Advertising

- Over 20.000 UNIQUE Daily!

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

- Get Maximum Exposure For Your Site!

- Get QUALITY Converting Traffic!

- Advertise Here Today!

Out Of Billions Of Website's Online.

Members Are Online From.

6Likes

6Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote